📈Top 5 Over 30📈

Here are this week’s top 5 prints over the past 30 days for the major indices. These levels represent the top institutional presence in indices and tend to be natural magnets for prices, often acting as support or resistance. If you trade the corresponding futures products, you’ll find these useful as well. Mark these on your charts to stay on the right side of prices this week.

Last week we noted that it felt like we were “in the nosebleeds” but longs still controlled all the technicals. Our plan was to seek a two-way tape and fade edges until Weds. The read was good and we got to work the rangebound activity as sellers dipped toes into the 1.79M print and couldn’t follow through and buyers hesitated to push further north until getting inflation readings and hearing from the Fed. Short positioning was quickly unwound Weds leading to a large gap up. Gaps are a form of imbalance and a demonstration of strength and/or urgency. I wouldn’t personally seek a counter-trend position until we see that gap filled. Of special note is the volume being done here at the highs, seen in the volume profile (always anchored to the oldest of the 5 prints). When you’re institutional-sized, you only care about one thing - finding liquidity. You have to seek out counter-parties with whom you can move size and I think the profile is telling us they’re still finding people to do business with. In an auction, price moves down to attract buyers; likewise, price moves up to attract sellers. Have we moved up enough? I think there was enough mixed-news this past week for markets to think about where value should be and we’re going to see some more 2-way trade (I think). [VL Link To SPY Chart]

As part of my weekly prep, I also like taking a look at the TPO chart. You can manipulate price, you can fake volume but time, of the 3 auction building blocks, is the immutable component. (If you’re interested in learning more about TPO, there’s a 6-part study guide published by the CBOT that is widely circulated but also made available in the “reading-materials” channel in the VL Discord. ) I have no idea what I’ll be doing 6 days from now, so I sure as hell can’t tell you what something as complex as the markets will be doing. With that said, in the absence of anything exogenous, I see a good opportunity to balance and develop this area because:

We’ve just been on an absolute tear. 7 of the past 8 weeks have been green for the S&P and NASDAQ and the ranges haven’t been trivial .

We’ve got poor structure at the highs and lows that both have a high likelihood to be revisited and that the auction will naturally seek to repair

Contract rolls are happening and that can often lead to some significant chop

Friday closed inside on the daily. Typically you follow the break of the highs or lows but we’ve already got pretty good balance in the 3 profiles above the gap and I think we just see the edges developed more with price mean-reverting to the center to do more business.

Inflation showing signs of cooling, consumer sentiment was in the gutter and the Fed backing off from 3 to maybe 1 rate cut now…this mixed bag is going to lead to a little price discovery

The gap and the singles print suggest longs are favored and until those are neutralized, I have to agree. I also want to draw your attention to a phenomena about markets that I’m trying to make clear with the green, numbered boxes below and that is that price has a tendency to move in extensions. I’ll talk more about price extensions in future stacks, but suffice it to say for now that I think these are where the battle lines are being drawn and we’ll want to pay attention to price as it tests into and perhaps accepts into lower auction zones. Your pass/fail levels are still the prints which have good confluence with the assumed auction zones and where we’ve seen business transacted by virtue of the volume profile. [VL Link To SPY Chart]

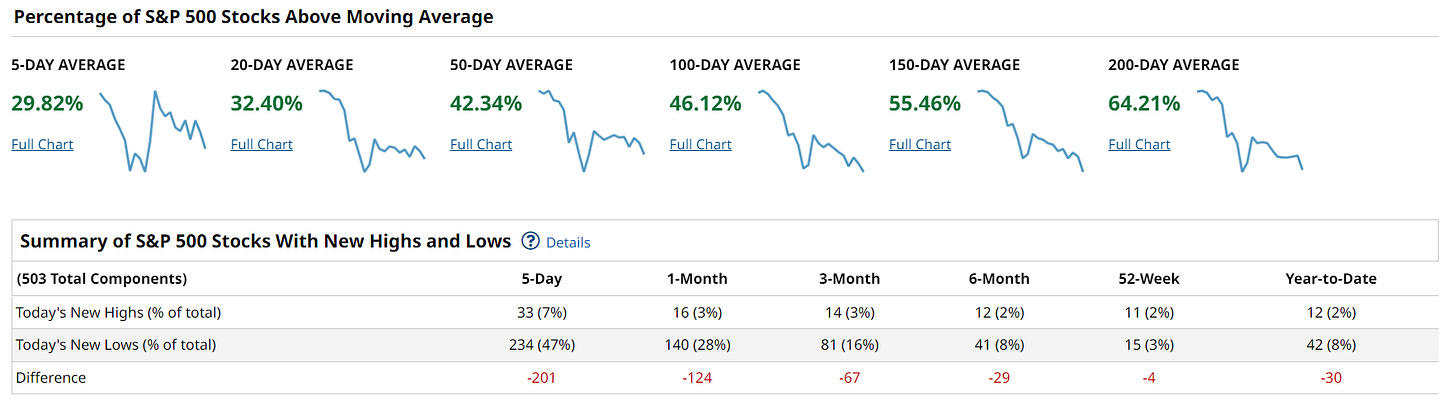

Lastly, I know you’re looking at it and wondering wtf is going on: breadth. It has just been abysmal. Is it a warning sign: maybe. But Mr. Market’s playbook of late has been to let the Mag7 lift indices under deteriorating breadth conditions and then let the Mag7 consolidate while the rest of the market goes through a period of improving breadth conditions. It’s all weird and that’s what it is until it isn’t. I think I’ll share breadth stats on an on-going basis because it is am important market-health-metric even if the market isn’t paying attention to it right now.

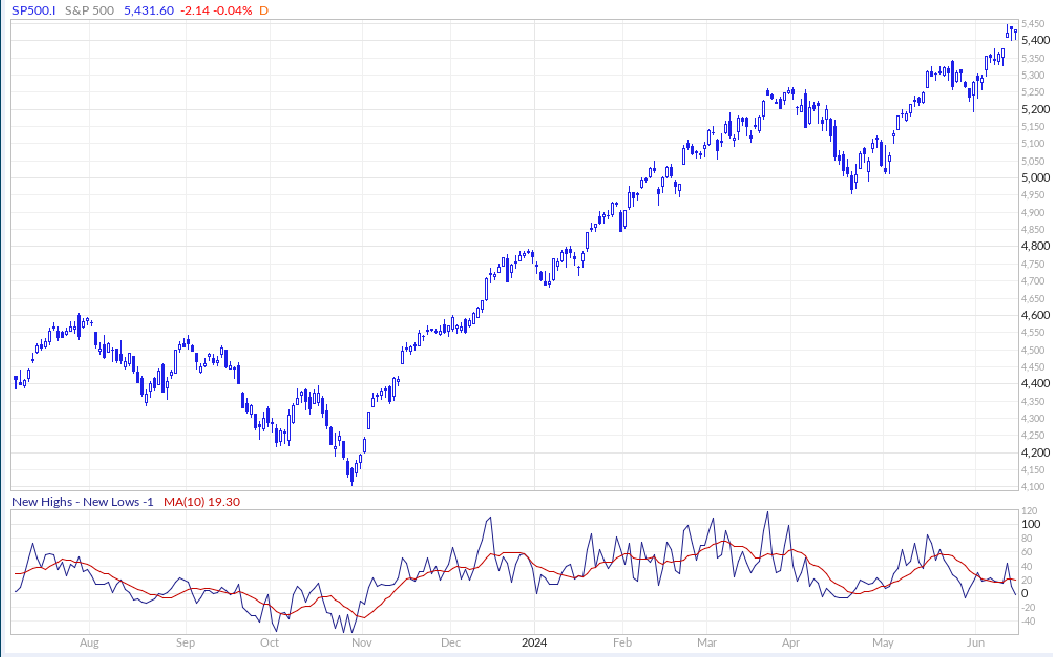

Here, we highlight another breadth metric: New Highs minus New Lows which highlights the daily difference between the number of stocks reaching new 52-week highs and the number of stocks reaching new 52-week lows. Above 0 confirms bulls in control, below 0 confirms bears in control and bullish/bearish divergences can be observed like many other oscillator-indicators. As of the close on Fri, it just ticked under 0 to -1. It’s not time for big gulps, but this doesn’t exactly inspire confidence.

QQQ doesn’t have prints at the highs like SPY but everything else bears a strong resemblance - large bullish gap, good development in the profile at the highs and price action that even has bulls crying for a pullback. We’ve also got, what I think, are clear auction extensions. To find auction extensions, I first look for an area of consolidation - bonus points if it contains a print (spoiler, we got one here). I then draw a box around the consolidative price action and copy-paste those boxes one on top of the other. You can also set your Fib tool to multiples of 100% to do the same equidistant projections. In the absence of prints, this gives me clear areas to look for strength/weakness and define risk against. [VL Link To QQQ Chart]

From a TPO perspective, we don’t have as much structure needing repair. We do have gaps and single prints but there is one area marked in red I want to call attention to that is of particular interest to me: the naked POC at $461 circled in red. It was at one point resistive but when price popped over, we could never get back to that fair-price to check it. We’ve now got a lot of price action that has developed on top. There’s nothing actionable about it right now and I’m not targeting it until I see sellers holding lower highs and lower lows in some form. I’ve just got it marked-up on my charts as an AOI - Area of Interest.

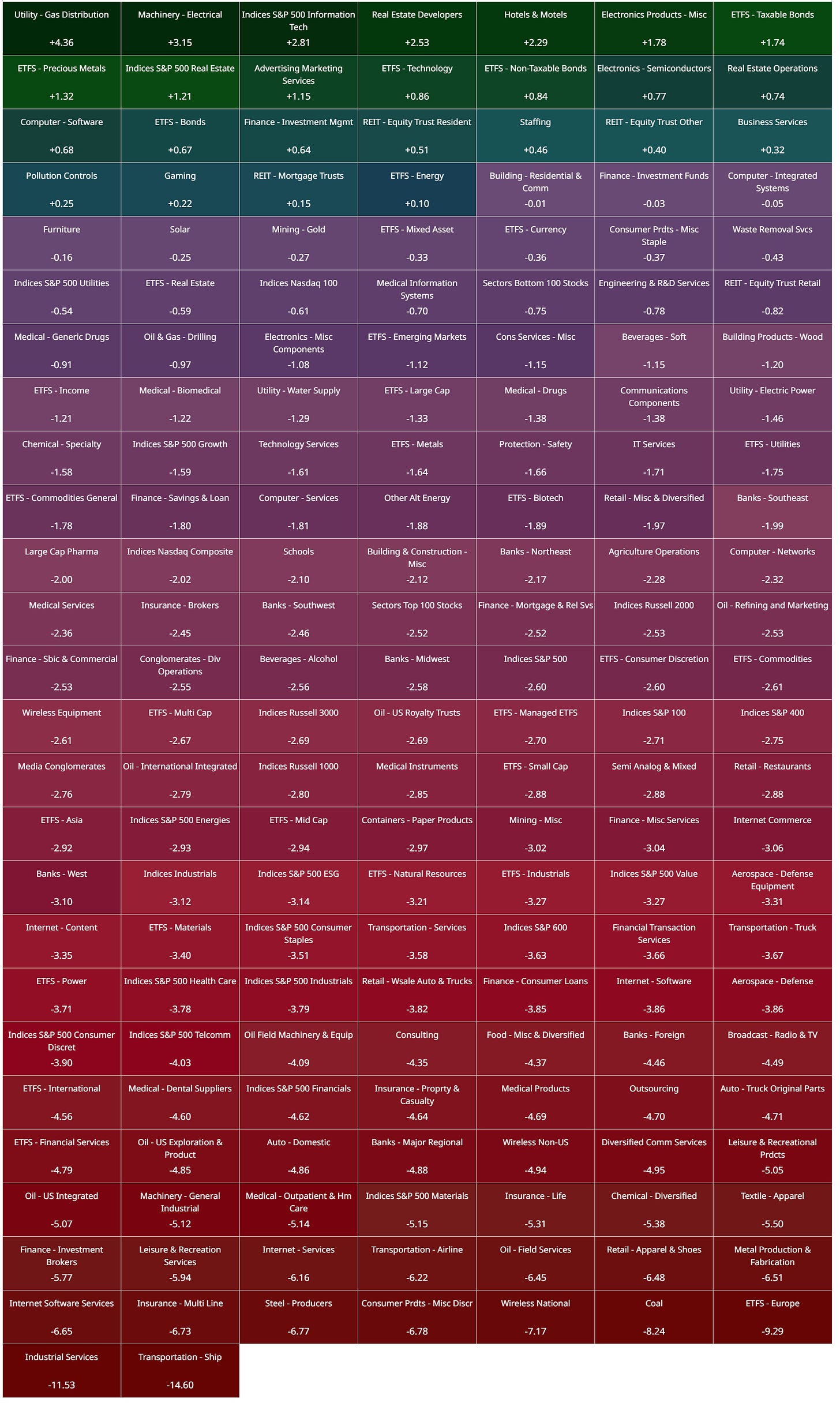

As mentioned above, large-cap growth has been the primary driver of late, grossly outperforming value over any period in recent history.

And a different visualization of the same, capturing just this past week’s winners:

Small-caps still looking for a heartbeat here. Last week we saw 4 of the 5 largest prints over the past 30 days tested and bulls unable to hold a single one as IWM closed well below all of them. [VL Link To IWM Chart]

On the TPO chart, there isn’t much to lean on and right now we expect to sell rips when given the chance.

If your holding periods are greater than intraday, you’ll likely have noticed that IWM has been an absolute chopfest. Whenever I find myself getting chopped, I like to zoom out to higher timeframes and see if I’m trading something rangebound or something consolidating - look for boxes and inside bars. When I look at the daily over the past several weeks, I noticed that we’re definitely consolidating. The wedge pattern is clear and this has left last month an inside month with this month, thus far, also inside making it a double inside month…a larger imbal move is potentially brewing!

The horizontal lines in the chart above are actually from an even more zoomed out view of IWM where I’ve applied the principle of price extensions:

Maybe this resonates with you, maybe it doesn’t. I do believe we often see what we want when looking at charts. Financial data is noisy as hell and our job is to extract the signals from that noise. I only offer this as a way to reduce noise and improve focus by isolating areas we want to potentially trade in, just like VL prints, your favorite SMA or any number of perfectly valid ways to interpret this mess. Last week I mentioned that price may be trying to balance against roughly $188 and that would actually put us right at the bottom of the current price extension/zone. Not a prediction, just an idea; zone-to-zone; the consolidation here is the potential fly in the ointment - do we go imbal up to test the top of the zone again or imbal down and finish the range-bound trade?

We’ve got a small shift in positioning as prints that dominated the prior week’s chart have been replaced with positioning closer to the mid of the balance box. I think we’re seeing the mean-reversion trade play out here with another test into the lows due in the short-term especially as the largest institutional block is still looming at the highs. Price faced another rejection at the yellow box (which denotes an LVN from a larger composite profile) and I’ll be looking for more development around $381 and larger renewed institutional interest at the lows of the box. [VL Link To DIA Chart]

TPO has some good targets to observe for reactions. The h-pattern developing in price reaffirms the short-term $381 target but if the auction decide to repair structure, we’ve got multiple lows underneath that may get a look

🏃🏽Summary Of Sector Performance🏃🏽

VL provides a lot of great ways to drill into/filter for thematics. A sector performance overview is provided here only for inspiration for trade ideas. Consider targeting leaders and/or laggards in the best and worst sectors, for example.

1-Yr S&P Sector Performance vs SPY (benchmark)

S&P Sector Breadth

5-Day Sector Performance Heatmap

🏆Top Aggregate & Individual Flow Summary🏆

There are often great trades ideas or sources for inspiration in these prints. Only the top 30 of each group are shown but the full results are available in VL for you to browse at your leisure and setup real-time alerts on.

👆🏽Top %Price Change This Week👇🏽

Winners

Losers

💰Mag7 MoneyFlow💰

When we look at moneyflow charts, we’re visualizing the aggregate institutional activity by price for a given period. The benefit of moneyflow charts is that you have an apples-to-apples comparison of institutional involvement across the entire market because everything is measured by the same yardstick: dollars. If you are familiar with auction mechanics and volume profiling, you can apply the same principles here; large bars are magnets and show where business is being done and you can expect positioning to be defended; narrow bars represent little interest or less-success in doing business at that price and work as pass/fail levels to position and define risk against. A final note: the gradient in color represents the age of positioning; the darkest colors are roughly 3 weeks old and the lightest are the most recent week.

💵Institutional Dollar Index💵

The Institutional Dollar Index measure the percent of volume generated by institutional activity vs all other volume on a given day. High values mean large institutional involvement and may suggest a directional commitment by larger players; low values mean low institutional involvement and suggest a continuation of current conditions. Like all institutional flow we look at, the direction can’t be known by this data itself; what is most important is the subsequent reaction to liquidity when it shows relatively high readings.

💡Ticker Spotlight💡

Each week we’ll try to highlight something that caught our eyes at VL. This week we’re taking a look at a pair of tickers that showed robust institutional activity and potentially have broader ramifications for the market as they are related to index activity and not a smaller, more specific segment of the market.

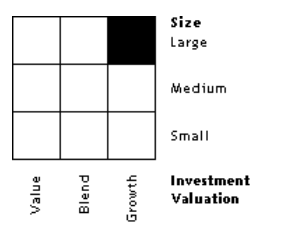

As you may well know, this ticker provides 3X daily leveraged exposure to the S&P500 index. The Morningstar Style Box is consistent with the breadth theme we discussed above

It’s because of it’s investment objectives and the alignment with the breadth theme that we want to call special attention to some large prints that came in at the highs:

We’ve got roughly 7.6M across 3 prints underneath and just this past week about 5M at the highs. Does this suggest the ride is almost over? Maybe. Does this mean we leverage ourselves into shorts? Definitely not. There are always 3 possible outcomes: up, down, or sideways and we want to be reactive instead of predictive. How price behaves to this liquidity is what we’re watching. We have, in the past, seen institutions participate in what appear to be tops, only to subsequently find out (sometimes painfully), that they were doubling down at what turned out to be the mid or a larger imbalance move! Even if these 2 ranked prints (#2-ranked and #5-ranked) suggest the 3x bull ride is over, there is still the possibility that we rather uneventfully consolidate sideways. Last week’s inflation reading showed some possible slowing but the latest Fed projections are now suggesting maybe only one rate cut instead of the 3 they hinted at earlier. In addition, consumer sentiment also came in a miss last week, showing the most sour reading in 7 months. A mixed bag of signals to process here at local highs. To add some additional color, last Thurs, VL alerted #1, #2, #3, #9 and #10 ranked prints for VOO 0.00%↑ all coming at the highs as well. VOO is also categorized by Morningstar as Large-Cap Growth, the same as SPXL. The confluence of trades across multiple tickers belonging to a thematic opined upon in this Stack multiple times is probably not a coincidence. More importantly, if we look at the historical correlation between these 2 tickers and SPY, we know that even if the prints themselves aren’t predictive, staying on the right side of them will protect our PnL.

If you’re trading higher timeframes with longer term investment horizons, it may be time to consider putting on some protection and possibly locking in some profits by overwriting inventory you’re a little overweight on. If you’re David-Hunter-Uber-Melt-Up-SPX-To-7000 bullish, well, you’ve been right so far and you’ve been having an easier go at these markets than me and these confluent prints may be a gift from the stock market gods for you. I’ll be watching for reactions and positioning if given the opportunity on re-tests. The market has been characterized by large, directional moves that have been unforgiving to scale traders who are trying to build positions over ranges. Whether it’s due to liquidity conditions or something else, you’re going to be way better off watching a move that you wished you were in rather than being positioned in a move you wished you weren’t.

🗓️Econ Events On Deck This Week🗓️

Here are key economic events happening this week that have the potential to cause outsized moves in the market or heightened short-term volatility.

Love this broad market summary with deeper dives into specific indexes and signals. Cheers!

Thks.