Market Momentum: Your Weekly Financial Forecast & Market Prep

Issue 26 / What to expect Dec 23, 2024 thru Dec 27, 2024

In This Issue

Market-On-Close: All of last week’s market-moving news and macro context in under 5 minutes + futures-snapshots

Special Coverage: From AI to Sustainability: 10 Investment Themes for 2025 to Keep on Your Radar

The Latest Investor Sentiment Readings

Institutional Support & Resistance Levels For Major Indices: Exactly where to look for a turn in markets this week in SPY, QQQ, IWM & DIA

Institutional Activity By Sector: Institutional flow by sector including the top names institutionally-backed names in those sectors

Top Institutional Orderflow In Individual Names: All of the largest sweeps and trade blocks on lit exchanges and dark pools

Investments In Focus: Bull vs Bear arguments for META, AVGO, PLTR, ULTA, TPR, GMED, APO

Top Institutionally-Backed Gainers & Losers: An explosive watchlist for day traders seeking high-volatility

Normalized Performance By Thematics YTD (Sector, Industry, Factor, Energy, Metals, Currencies, and more): which corners of the markets are beating benchmarks, which ones are overlooked and which ones are over-crowded

Key Econ Events and Earnings On-Deck For This Week

Market-On-Close

A Modest Rate Cut with a Hawkish Twist

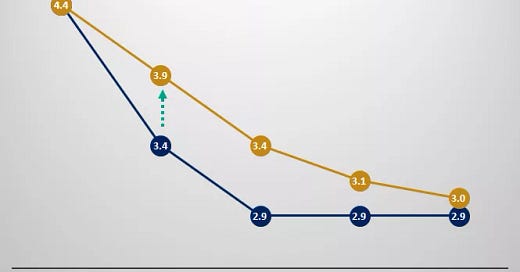

The Fed delivered a widely expected quarter-point rate cut at its December meeting, lowering the federal funds rate to a target range of 4.25%–4.5%. This marked the culmination of a year-long cycle of monetary easing that has reduced rates by a full percentage point from their September peak of 5.5%. However, it was the Fed’s projections for 2025 that captured market attention and sparked volatility.

The updated dot plot revealed a scaled-back pace of rate cuts, with only two reductions expected in 2025 compared to the four outlined in September. This cautious outlook reflected concerns about lingering inflation and uncertainty surrounding tariff policies, both of which could shape the trajectory of the economy in the coming year. Powell underscored these factors, noting that while inflation has moderated significantly from its pandemic-era highs, it remains above the Fed’s 2% target. Core personal consumption expenditure (PCE) inflation is now projected to reach 2% only by 2027, suggesting a long runway for achieving price stability.

Adding to the uncertainty are potential changes in trade and tariff policies under the incoming administration. Powell acknowledged these policy shifts could have meaningful, though difficult-to-predict, effects on inflation and economic activity.

Markets React: Bond Yields Rise, Stocks Stumble

Markets were swift in their response to the Fed’s updated projections. Bond yields climbed sharply, with the 10-year Treasury yield rising above 4.5%, reflecting reduced expectations for aggressive rate cuts. The yield increase also mirrored stronger economic growth and persistent inflation prospects. Equities, meanwhile, faced a sell-off, with the S&P 500 experiencing its second-worst day of the year, declining nearly 3% following the Fed’s announcement.

Market breadth—a measure of the proportion of stocks trading above their 50-day moving averages—deteriorated sharply during the week. By Thursday, just 21% of S&P 500 components traded above this threshold, down from 70% at the end of November. This decline in breadth underscores the outsized influence of a handful of mega-cap stocks, particularly in the technology, communication services, and consumer discretionary sectors, on recent market gains.

The hawkish tone of the Fed’s December meeting served as a reset for market expectations, bringing them more in line with the Fed’s cautious outlook. According to the CME FedWatch Tool, markets are now pricing in just one rate cut for 2025, leaving room for potential surprises should the Fed adopt a more accommodative stance.

Economic Fundamentals Remain Resilient

Amid the volatility, the Fed offered a reassuring view of the economy’s health. Updated projections pointed to better-than-expected growth and a robust labor market. U.S. GDP is now forecasted to grow by 2.1% in 2025, up from 2.0% in the September projection, while the unemployment rate is expected to edge lower to 4.3% from the prior estimate of 4.4%. These figures reflect a resilient consumer and a labor market that has weathered the Fed’s restrictive policy stance.

Recent economic data reinforce this narrative. Third-quarter GDP growth was revised upward to an annualized 3.1%, driven by robust consumer spending, which grew at a healthy 3.7% pace. The Fed’s GDP-Now forecast suggests fourth-quarter growth will remain strong at approximately 3.2% annualized, well above the historical trend range of 1.5%–2.0%. Retail sales figures for November also exceeded expectations, rising 0.7% after a 0.5% gain in October, signaling continued consumer strength.

Inflation: Progress with Persistent Challenges

Inflation continues to be a central focus for policymakers. While recent data suggest progress, core PCE inflation remains elevated at 2.8% year-over-year, slightly below consensus expectations but still above the Fed’s long-term goal. Headline PCE inflation, which includes food and energy prices, also rose 2.4%, below the Fed’s 2025 forecast of 2.5%.

Notably, the inflationary dynamics are shifting. Goods inflation showed signs of cooling, with a month-over-month decline in prices. However, services inflation remains the primary driver of PCE, underscoring the challenge of achieving a broad-based disinflationary trend. Powell emphasized that the Fed will remain cautious as it assesses incoming data, balancing the risks of entrenched inflation with the need to support economic growth.

Political Uncertainty Clouds the Outlook

Complicating the economic picture is the looming threat of a government shutdown. As Congress struggled to pass a temporary funding measure, investor sentiment wavered. While shutdowns have historically had limited market impact, prolonged disruptions could weigh on sectors reliant on federal spending, such as defense contractors and insurers. Moreover, political gridlock may pose challenges to the incoming administration’s pro-growth agenda, particularly on issues such as tax reform and infrastructure investment.

Opportunities Amid Volatility

Despite the market turbulence following the Fed’s hawkish pivot, long-term investors have reason to remain optimistic. The underlying drivers of the ongoing bull market—strong corporate earnings, resilient consumer spending, and innovation-led growth—remain intact. With the S&P 500 up approximately 24% year-to-date and the Dow Jones Industrial Average posting a 14% gain, markets have delivered robust returns in 2024, even after factoring in the recent pullback.

Bond markets, too, present opportunities. Elevated yields in the investment-grade bond market, particularly in the seven- to 10-year segment, offer attractive entry points for balanced investors looking to reallocate cash holdings. The combination of higher yields and moderated rate-cut expectations could provide a favorable environment for fixed-income strategies in 2025.

Looking Ahead: A Year of Transition

As the Fed navigates its dual mandate of price stability and full employment, 2025 is shaping up to be a year of transition. While the direction of interest rates is clear—lower in the medium term—the pace and magnitude of cuts will depend on the interplay of inflation, economic growth, and policy uncertainty. For investors, this evolving landscape underscores the importance of diversification, discipline, and a long-term perspective.

Market volatility, though unsettling in the short term, can create opportunities to rebalance portfolios, add quality investments, and position for growth in the years ahead. As Powell aptly noted, the U.S. economy remains “in a really good place,” providing a solid foundation for navigating the challenges and opportunities of the year to come.

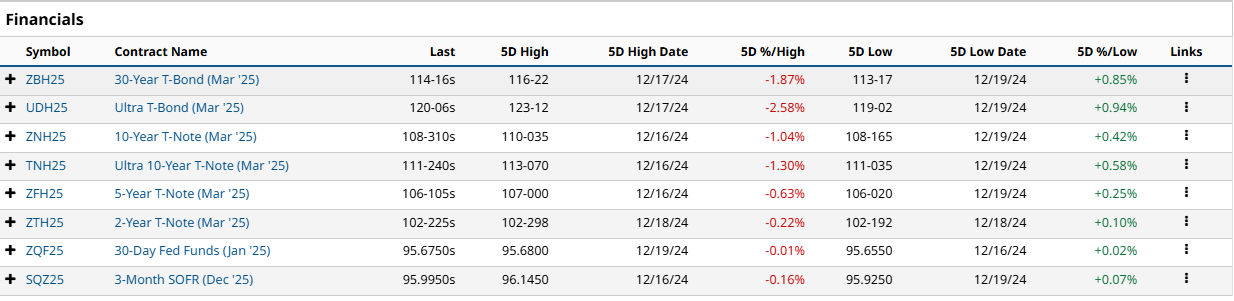

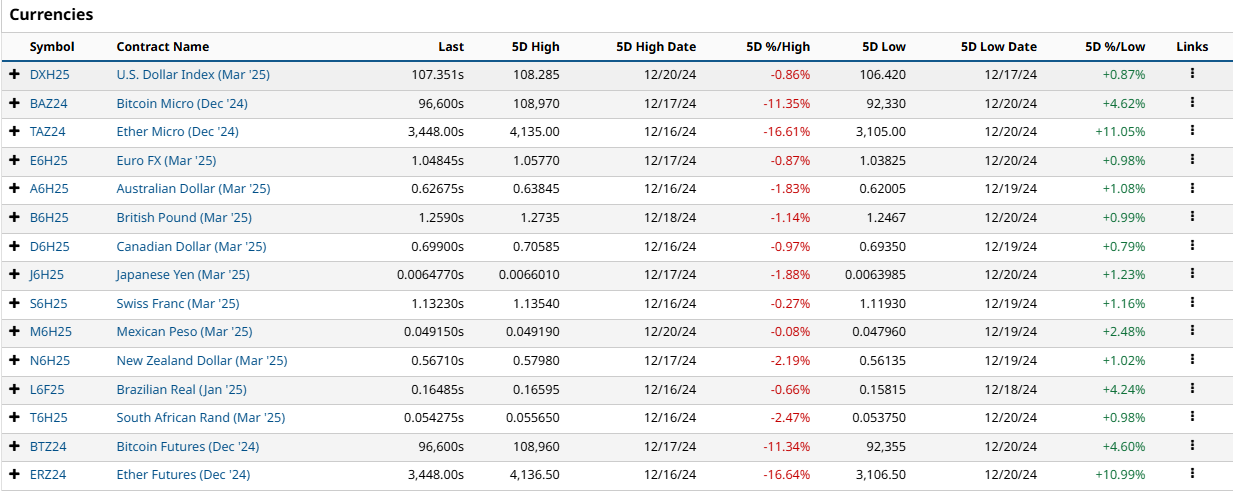

Futures Markets Snapshots

S&P 500: Sector Insights

Technology

The technology sector was mostly down this week, with declines driven by concerns over high valuations and macroeconomic headwinds like rising interest rates.

Microsoft (MSFT, -2.39%) declined as the market recalibrated valuations across the sector following Fed Chair Jerome Powell's commentary suggesting rates may stay higher for longer.

Nvidia (NVDA, +0.34%) managed to eke out a small gain, buoyed by reports that it remains a leader in AI chip demand despite emerging competition.

Consumer Discretionary

Consumer discretionary stocks showed mixed results. Home improvement stocks struggled due to weak housing data, while auto manufacturers faced pressure from competition concerns.

Tesla (TSLA, -3.48%) fell after pricing concerns in its EV segment gained traction, with analysts highlighting aggressive discounting strategies impacting profitability.

Home Depot (HD, -5.85%) saw declines tied to reports of falling housing activity amid high mortgage rates, which dampened home improvement spending.

Communication Services

The sector exhibited a mixed performance, with internet content outperforming telecoms.

Alphabet (GOOGL, +0.84%) gained slightly, helped by continued growth in its cloud and ad businesses.

Meta Platforms (META, -5.66%) slid as investors took profits following a strong run earlier in the year and raised concerns about digital ad growth amid economic uncertainty.

Healthcare

The healthcare sector was one of the weakest performers, dragged down by concerns over drug pricing and regulatory risks.

Eli Lilly (LLY, -2.71%) and UnitedHealth (UNH, -3.91%) dropped amid broader pressure on healthcare plans and pharmaceuticals.

Industrials

Industrials showed resilience, bolstered by strong performance in aerospace and defense.

Boeing (BA, +4.54%) stood out, driven by strong aircraft delivery data and optimism around defense contracts, as geopolitical tensions remain elevated.

Financials

The financial sector declined, with regional banks leading the losses due to rising funding costs and credit quality concerns.

U.S. Bancorp (USB, -4.16%) and other regional banks struggled as bond yields surged, increasing borrowing costs and compressing margins.

Energy

The energy sector underperformed as oil prices softened during the week.

Chevron (CVX, -7.16%) and ExxonMobil (XOM, -4.48%) faced sharp declines amid weakening crude oil demand expectations and worries about oversupply in global markets.

Consumer Staples

The sector edged lower as defensive names fell out of favor with rising bond yields, which make dividend-paying stocks less attractive.

Procter & Gamble (PG, -1.75%) declined as consumer defensives faced reduced demand from investors rotating into higher-yielding assets.

Utilities

Utilities faced steep losses as higher bond yields diminished their appeal. Rising interest rates made dividend yields less competitive compared to safer alternatives like Treasuries.

Duke Energy (DUK, -4.43%) was among the laggards in the group.

Key Takeaway

This week’s sector performance reflects heightened sensitivity to interest rates and macroeconomic developments. Standout movements were tied to housing weakness (e.g., Home Depot), EV pricing strategies (Tesla), and resilience in aerospace and defense (Boeing). Broader market sentiment remains cautious, driven by concerns about growth and monetary policy.

ETF Insights

US Large Cap

SPY (-2.16%) and QQQ (-2.24%): The broader market pulled back sharply, with technology and growth-focused names leading declines, reflecting ongoing concerns about the Federal Reserve's monetary policy stance.

RSP (-3.02%): Equal-weighted ETFs underperformed as market breadth weakened, with few sectors providing support.

US Sector ETFs

Technology (XLK, -1.29%): Technology ETFs underperformed, with heavyweights like Microsoft and Nvidia contributing to losses. However, leveraged ETF SOXS (+10.52%) surged as bearish bets on semiconductors paid off amidst concerns about slowing demand.

Energy (XLE, -5.69%): Energy ETFs were the hardest hit this week, reflecting a sharp drop in crude oil prices. XOP (-7.13%), representing oil and gas exploration, suffered on weaker demand forecasts and oversupply fears.

Consumer Discretionary (XLY, -2.79%): Declines in this sector were tied to underperformance in homebuilders like ITB (-7.33%), reflecting a housing market slowdown amidst rising mortgage rates.

Healthcare (XLV, -2.12%): Weakness in healthcare ETFs like XBI (-2.27%) highlighted concerns about pricing pressures and reduced investor interest in defensive sectors.

Utilities (XLU, -2.51%): Utilities fell as rising bond yields made their defensive appeal less attractive.

Style-Based ETFs

Value (VTWV, -4.15%) vs. Growth (VUG, -1.40%): Value stocks significantly underperformed growth, reflecting investor preference for more defensive and growth-oriented names amidst economic uncertainty.

Mid-Cap (IJH, -4.98%) and Small-Cap (IWM, -4.15%): Smaller-cap stocks saw outsized losses, driven by rising borrowing costs and weaker economic outlooks.

Leverage and Inverse ETFs

SOXL (-11.07%) vs. SOXS (+10.52%): Leveraged semiconductor ETFs showed opposing trends as bearish bets surged on declining semiconductor stock performance.

TZA (+13.63%): A standout performer, this small-cap bear ETF soared, reflecting steep declines in small-cap stocks as rising interest rates squeezed growth prospects.

SPXL (-6.19%): Leveraged large-cap bullish ETFs saw significant losses as broader markets retreated.

Global and International ETFs

Developed Markets (EFA, -4.80%) and Emerging Markets (EEM, -4.00%): Both suffered from concerns about global economic growth, a stronger dollar, and geopolitical tensions.

China (FXI, -2.19%): Chinese ETFs continued to decline despite Beijing's efforts to stimulate the economy.

Brazil (EWZ, -8.55%): The sharp decline reflected political and economic instability, combined with weaker commodity prices.

Fixed Income

TLT (-2.04%) and IEF (-0.83%): Long-duration Treasuries fell as yields rose on expectations of prolonged monetary tightening.

TMF (-5.66%): The leveraged long Treasury ETF suffered significantly due to its sensitivity to rising yields.

AGG (-0.98%): Broad-based bond ETFs declined modestly, tracking the rising rate environment.

Commodities and Cryptocurrencies

Gold (GLD, -0.90%) and Silver (SLV, -2.99%): Precious metals weakened slightly, weighed down by a stronger dollar and higher real yields.

Bitcoin ETFs (BITO, -5.25%) and GBTC (-5.27%): Crypto ETFs declined amidst regulatory uncertainty and profit-taking following recent rallies.

Key Takeaways

Energy and Small Caps Suffered: Energy and small-cap-focused ETFs were the weakest performers due to rising rates, weaker oil prices, and economic uncertainties.

Leverage Paid Off for Bears: Inverse and bear-leveraged ETFs like SOXS and TZA capitalized on market weakness.

Global Markets Struggled: International ETFs reflected a challenging environment, with Europe, emerging markets, and Brazil experiencing sharp declines.

Fixed Income and Defensives Weakened: Rising yields pressured Treasuries and defensive sectors like utilities, diminishing their appeal.

This week's performance highlights the market's sensitivity to higher yields, tighter monetary policy, and a slowing global economy. Defensive plays and bearish strategies outperformed amidst a broad risk-off sentiment.

[Special Coverage] From AI to Sustainability: 10 Investment Themes for 2025 to Keep on Your Radar

As we move into 2025, global investment opportunities are increasingly shaped by technological advancements, environmental imperatives, and shifting geopolitical landscapes. Below is a detailed analysis of the top 10 investable themes that hold promise for the upcoming year.

1. Artificial Intelligence (AI) & Automation

Artificial Intelligence continues to redefine the boundaries of innovation. In 2025, its applications will further integrate into diverse industries, transforming everything from healthcare diagnostics to supply chain logistics. Generative AI is expected to see exponential growth, driving efficiencies in creative processes, customer service, and product design. Companies developing AI hardware accelerators, such as GPUs and TPUs, are poised for gains as demand for computational power increases. Robotics and robotic process automation (RPA) will see heightened adoption in manufacturing and customer support, addressing labor shortages and driving cost efficiencies.

Investment Opportunities:

AI software platforms and cloud computing providers.

Robotics companies specializing in automation for industrial and service sectors.

Companies creating AI chips and edge-computing devices.

Relevant Tickers:

Current Market Leaders: NVDA 0.00%↑ (NVIDIA), MSFT 0.00%↑ (Microsoft), GOOG 0.00%↑ (Alphabet), AMZN 0.00%↑ (Amazon)

Challengers: PATH 0.00%↑ (UiPath), AI 0.00%↑ (C3.ai), GFS 0.00%↑ (GlobalFoundries)

Pre-Public Companies to Watch: Anthropic, OpenAI, DeepMind

2. Clean Energy Transition

The shift toward renewable energy sources is accelerating, fueled by government incentives, corporate sustainability goals, and public demand for carbon neutrality. Solar, wind, and hydroelectric projects are scaling globally, while advancements in battery technology are enhancing energy storage capabilities. Green hydrogen is emerging as a potential game-changer for hard-to-decarbonize sectors such as shipping and aviation. The ongoing energy crisis has reinforced the need for diversified energy portfolios, increasing investment in clean energy infrastructure.

Investment Opportunities:

Renewable energy providers and energy storage innovators.

Companies developing green hydrogen production technologies.

Electric grid modernization and infrastructure upgrades.

Relevant Tickers:

Current Market Leaders: TSLA 0.00%↑ (Tesla), ENPH 0.00%↑ (Enphase Energy), NEE 0.00%↑ (NextEra Energy), BE 0.00%↑ (Bloom Energy)

Challengers: PLUG 0.00%↑ (Plug Power), BLDP 0.00%↑ (Ballard Power Systems), FREY 0.00%↑ (FREYR Battery)

Pre-Public Companies to Watch: Heliogen, Commonwealth Fusion Systems

3. Space Economy

The commercial space industry is set to soar in 2025, driven by advancements in satellite technology and reduced launch costs. Companies are capitalizing on satellite-based internet services to bridge digital divides, while space tourism captures public imagination. Additionally, the potential for asteroid mining and lunar exploration has attracted attention, positioning early movers for exponential growth.

Investment Opportunities:

Satellite manufacturers and launch service providers.

Firms specializing in space tourism and infrastructure.

Early-stage companies exploring resource extraction from celestial bodies.

Relevant Tickers:

Current Market Leaders: SPCE 0.00%↑ (Virgin Galactic), RKLB 0.00%↑ (Rocket Lab), MAXR 0.00%↑ (Maxar Technologies)

Challengers: ASTS 0.00%↑ (AST SpaceMobile), RDW 0.00%↑ (Redwire Corporation)

Pre-Public Companies to Watch: SpaceX, Blue Origin, Relativity Space

4. HealthTech & Precision Medicine

The healthcare industry is undergoing a technological renaissance. Precision medicine, fueled by advancements in genomics and AI-driven drug discovery, is enabling personalized treatments. HealthTech companies are integrating telemedicine and wearable technologies into mainstream healthcare, offering real-time monitoring and proactive care. These innovations aim to enhance outcomes while reducing costs, making healthcare more accessible.

Investment Opportunities:

Biotech firms engaged in gene-editing technologies.

Companies offering telehealth platforms and wearable health devices.

AI startups focused on drug discovery and healthcare data analytics.

Relevant Tickers:

Current Market Leaders: TDOC 0.00%↑ (Teladoc Health), ILMN 0.00%↑ (Illumina), ISRG 0.00%↑ (Intuitive Surgical), REGN 0.00%↑ (Regeneron Pharmaceuticals)

Challengers: CRSP 0.00%↑ (CRISPR Therapeutics), EXAS 0.00%↑ (Exact Sciences), DNA 0.00%↑ (Ginkgo Bioworks)

Pre-Public Companies to Watch: Grail, Tempus Labs

5. Cybersecurity

As the world becomes increasingly digital, the need for robust cybersecurity solutions grows. High-profile breaches and escalating cyber threats have made data security a top priority for governments and corporations alike. The advent of quantum computing adds complexity to encryption methods, requiring companies to innovate rapidly.

Investment Opportunities:

Cybersecurity software and service providers.

Firms specializing in cloud and endpoint security.

Startups developing post-quantum cryptography solutions.

Relevant Tickers:

Current Market Leaders: PANW 0.00%↑ (Palo Alto Networks), FTNT 0.00%↑ (Fortinet), CRWD 0.00%↑ (CrowdStrike), ZS 0.00%↑ (Zscaler)

Challengers: S 0.00%↑ (SentinelOne), OKTA 0.00%↑ (Okta), TENB 0.00%↑ (Tenable Holdings)

Pre-Public Companies to Watch: Post-Quantum, Arqit Quantum

6. Reshoring & Regionalization

Global supply chain disruptions have spurred a movement toward reshoring and regionalization. Governments and companies are investing in domestic manufacturing and regional supply chains to reduce reliance on distant sources. Advanced manufacturing technologies, such as 3D printing and IoT, are playing pivotal roles in reshoring efforts.

Investment Opportunities:

Domestic manufacturing and logistics companies.

Infrastructure firms focusing on industrial revitalization.

Advanced manufacturing technology providers.

Relevant Tickers:

Current Market Leaders: CAT 0.00%↑ (Caterpillar), HON 0.00%↑ (Honeywell), UPS 0.00%↑ (United Parcel Service)

Challengers: DM 0.00%↑ (Desktop Metal), MKFG 0.00%↑ (Markforged Holding), GNRC 0.00%↑ (Generac Holdings)

Pre-Public Companies to Watch: Velo3D, Carbon 3D

7. Sustainable Consumer Products

Consumer preferences are shifting toward sustainability, with demand rising for eco-friendly and ethically produced goods. Regulatory measures targeting single-use plastics and carbon-intensive products are reinforcing this trend. Innovations in biodegradable materials and sustainable supply chains are becoming competitive differentiators.

Investment Opportunities:

Companies offering sustainable packaging solutions.

Brands focused on circular fashion and recycled materials.

Firms involved in plant-based and lab-grown food production.

Relevant Tickers:

Current Market Leaders: PEP 0.00%↑ (PepsiCo), BYND 0.00%↑ (Beyond Meat), TSN 0.00%↑ (Tyson Foods), UL 0.00%↑ (Unilever)

Challengers: DNMR 0.00%↑ (Danimer Scientific), $MYLK (The Planting Hope Company)

Pre-Public Companies to Watch: Perfect Day, NotCo

8. Digital Payment Ecosystems

The digital payment ecosystem is expanding rapidly, driven by e-commerce growth, blockchain adoption, and financial inclusion in emerging markets. Cryptocurrencies and decentralized finance (DeFi) platforms are reshaping how money is transferred and stored. Traditional payment processors are investing in innovations to stay competitive.

Investment Opportunities:

Mobile payment platforms and e-wallet providers.

Blockchain technology and DeFi startups.

Financial services targeting underbanked populations.

Relevant Tickers:

Current Market Leaders: SQ 0.00%↑ (Block), PYPL 0.00%↑ (PayPal), V 0.00%↑ (Visa), MA 0.00%↑ (Mastercard)

Challengers: AFRM 0.00%↑ (Affirm Holdings), SOFI 0.00%↑ (SoFi Technologies)

Pre-Public Companies to Watch: Stripe, Chime

9. Aging Population & Longevity

The global aging population is creating new demand for products and services tailored to senior citizens. Anti-aging research and technologies are becoming mainstream, while robotics and IoT solutions offer enhanced elder care. Companies that cater to this demographic with innovative solutions are well-positioned for growth.

Investment Opportunities:

Senior housing and long-term care facilities.

Robotics for elder care and health monitoring devices.

Biotech firms researching anti-aging treatments.

Relevant Tickers:

Current Market Leaders: WELL 0.00%↑ (Welltower), NVCR 0.00%↑ (NovoCure), MDT 0.00%↑ (Medtronic)

Challengers: CYCN 0.00%↑ (Cyclerion Therapeutics), RCEL 0.00%↑ (AVITA Medical)

Pre-Public Companies to Watch: Unity Biotechnology, Juvenescence

10. Climate Resilience Infrastructure

The increasing frequency of extreme weather events has highlighted the need for resilient infrastructure. Investments in water management, flood prevention, and climate-adaptive urban planning are becoming essential. Governments and private enterprises are allocating significant resources to mitigate the impacts of climate change.

Investment Opportunities:

Companies developing flood prevention and water management solutions.

Providers of resilient construction materials.

Firms specializing in green urban planning and smart cities.

Relevant Tickers:

Current Market Leaders: ECL 0.00%↑ (Ecolab), AWK 0.00%↑ (American Water Works), ACM 0.00%↑ (AECOM)

Challengers: PHO 0.00%↑ (Invesco Water Resources ETF), TTEK 0.00%↑ (Tetra Tech)

Pre-Public Companies to Watch: FloodMapp, Climate Adaptive Infrastructure

Conclusion

The themes outlined above represent not only the challenges but also the opportunities of our times. By aligning investment strategies with these transformative trends, investors can position themselves to capture significant growth while contributing to a sustainable and innovative future. Each theme offers distinct avenues for capital allocation, making 2025 a year of promising possibilities across various sectors and geographies.