Market Momentum: Your Weekly Financial Forecast & Market Prep

Issue 24 / What to expect Dec 09, 2024 thru Dec 13, 2024

In This Issue

Market-On-Close: All of last week’s market-moving news and macro context in under 5 minutes + futures-snapshots

Special Coverage: Bitcoin: Breakout or Bubble?

The Latest Investor Sentiment Readings

Institutional Support & Resistance Levels For Major Indices: Exactly where to look for a turn in markets this week in SPY, QQQ, IWM & DIA

Institutional Activity By Sector: Institutional flow by sector including the top names institutionally-backed names in those sectors

Top Institutional Orderflow In Individual Names: All of the largest sweeps and trade blocks on lit exchanges and dark pools

Investments In Focus: Bull vs Bear arguments for FDX, LULU, TGT, ALT, FIS, TSM, GFS

Top Institutionally-Backed Gainers & Losers: An explosive watchlist for day traders seeking high-volatility

Normalized Performance By Thematics YTD (Sector, Industry, Factor, Energy, Metals, Currencies, and more): which corners of the markets are beating benchmarks, which ones are overlooked and which ones are over-crowded

Key Econ Events and Earnings On-Deck For This Week

Market-On-Close

As the year concludes and the holiday season envelops us, investors find much to celebrate. The financial markets have climbed to unprecedented heights, with record-breaking stock performances and favorable bond yields reflecting a buoyant economic landscape. Underpinning this strength is a U.S. economy that continues to grow at or above trend, defying predictions of recession.

This resilience has been a hallmark of 2024, supported by a robust labor market, strong consumer spending, and sector-specific expansions. However, looming challenges—from policy shifts to global uncertainties—pose significant hurdles. Let’s take a brief look into the economic and market dynamics of the past year, highlighting key drivers of growth, areas of concern, and potential paths forward for 2025.

Consumer Spending: The Bedrock of Growth

The U.S. economy, with consumer spending accounting for approximately 70% of GDP, has proven its resilience despite challenges such as elevated inflation and higher interest rates. A significant dichotomy has emerged within consumer behavior, with middle- and upper-income groups maintaining robust spending due to wealth effects from higher stock market valuations and stable real estate prices.

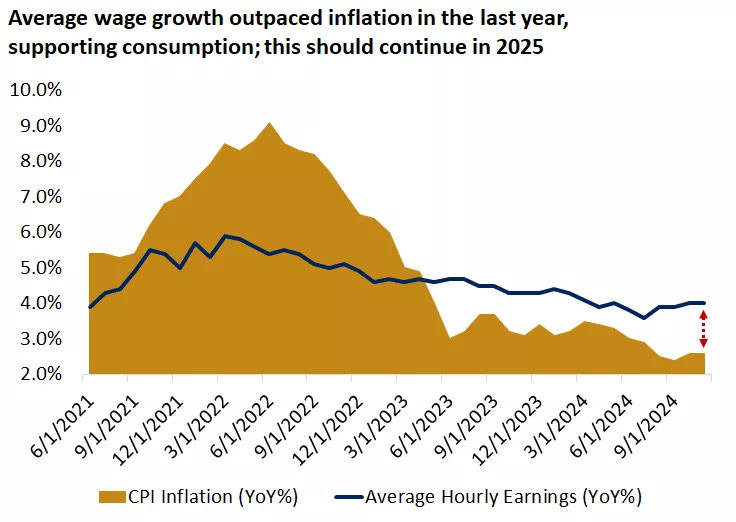

Real wage gains across households have further supported consumer confidence. Wage growth has consistently outpaced inflation, a trend expected to persist into 2025 as inflation moderates to the 2%-3% range. These dynamics have particularly bolstered service-oriented sectors, including leisure, hospitality, and dining, which have seen strong demand. The consumer's resilience remains a cornerstone of economic stability, providing a vital buffer against external shocks.

The Labor Market: A Pillar of Strength

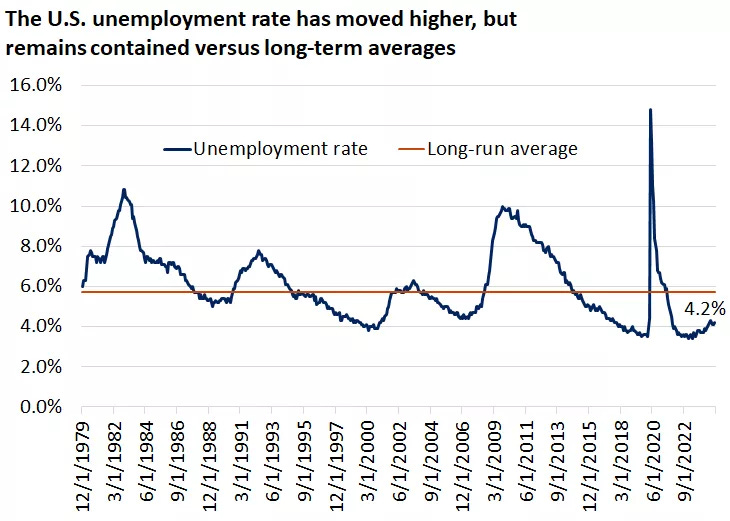

Employment trends in 2024 showcased a labor market adjusting to post-pandemic normalization. November's addition of 227,000 new jobs surpassed expectations, underscoring a rebound from October's weather-impacted figures. The average monthly job creation of 180,000, while below 2023 levels, remains above historical norms.

The unemployment rate, ticking slightly higher to 4.2%, reflects a balancing act rather than underlying weakness. Broader labor market metrics, including wage growth and job openings, point to sustained strength. Employment in manufacturing, healthcare, and leisure sectors has been particularly robust, with manufacturing showing signs of recovery from earlier contractions.

As interest rates trend downward and corporate earnings improve, the labor market is positioned for potential reacceleration in late 2025. Pro-growth policies could further drive hiring, contributing to economic momentum.

Sectoral Dynamics: Services Lead, Manufacturing Stabilizes

The services sector, constituting 70% of U.S. GDP, has been the economy's mainstay in 2024. Financial services, transportation, and leisure industries have exhibited steady growth, supported by resilient consumer demand. The ISM services index consistently signaled expansion, reflecting the sector's vitality.

Manufacturing, on the other hand, faced headwinds for much of the year, grappling with supply chain disruptions and global uncertainties. However, recent ISM data indicates a potential turnaround, with new orders for both services and manufacturing showing expansion. If sustained, this trend could herald broader industrial stabilization, complementing the strength of the services sector.

Navigating the Challenges: New “Walls of Worry”

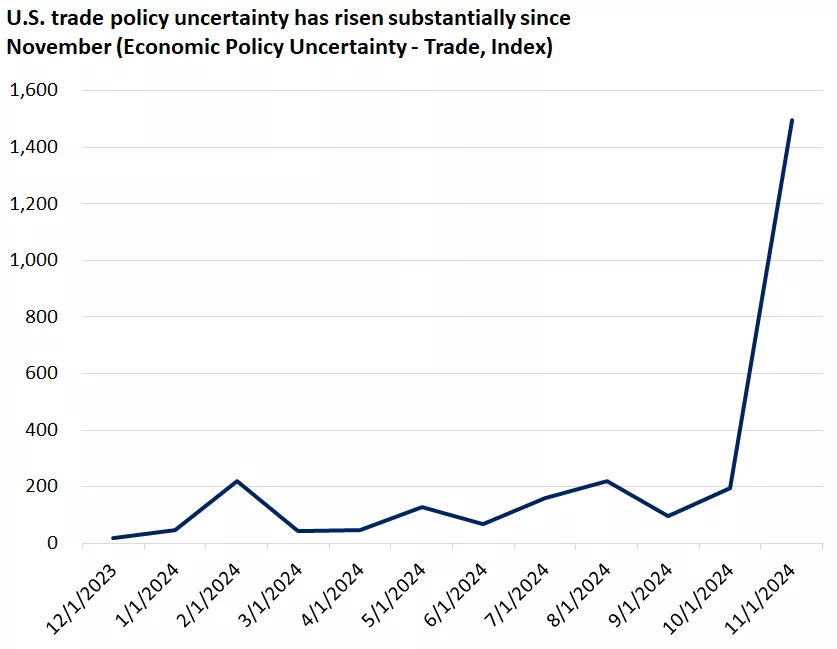

Despite the rosy backdrop, 2025 presents its own set of challenges. Policy uncertainties, particularly under a new White House administration, could impact trade, tariffs, and immigration. Escalations in trade tensions could weigh on consumer confidence and inflation, introducing volatility into otherwise stable markets. However, the likelihood of extreme policy measures appears low, with potential disruptions expected to be contained.

Federal Reserve policy represents another critical variable. While rate cuts are anticipated, robust economic growth or re-emergent inflation could lead to a more cautious approach from the Fed, potentially tempering market enthusiasm. Nonetheless, the prevailing trajectory suggests lower rates, supportive of consumer spending and corporate investments.

Market Strategies: Turning Volatility into Opportunity

Increased uncertainty should not dissuade investors but instead serve as an opportunity to reassess portfolios. Pullbacks in markets can provide strategic entry points, particularly given the underlying strength of the economy. Diversification remains a key theme, with a balanced allocation across large- and mid-cap stocks and a mix of growth and value sectors.

The bond market also offers opportunities. While short-duration bonds and cash-like instruments have provided stability, a gradual shift toward intermediate maturity bonds could lock-in attractive yields amidst a declining rate environment. Strategic allocation between equities and bonds can help investors navigate the complexities of 2025.

Conclusion: Poised for a Soft Landing

The U.S. economy's performance in 2024 has been nothing short of remarkable. With resilient consumer spending, a robust labor market, and sectoral strength, it stands poised to achieve the elusive "soft landing"—a modest slowdown without tipping into recession. While challenges loom, from policy shifts to market volatility, the fundamental backdrop remains favorable.

As we transition into 2025, the focus should be on maintaining diversification, capitalizing on market opportunities, and navigating uncertainties with strategic foresight. With the U.S. economy on firm footing and no downturn in sight, the coming year offers a landscape ripe for growth and investment. Investors, armed with insights and a long-term perspective, can look forward to navigating this promising yet complex terrain.

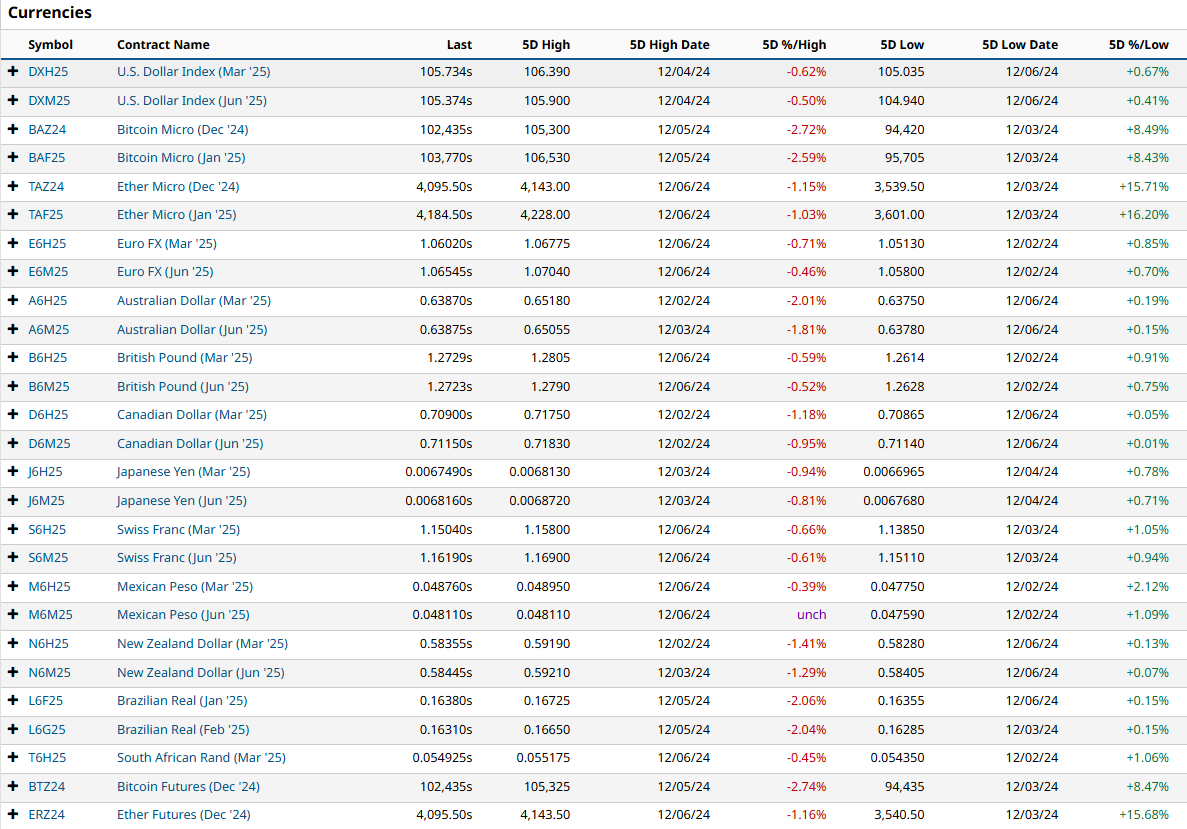

Futures Markets Snapshots

S&P 500: Sector Insights

Technology Sector:

Microsoft (MSFT): Shares rose by approximately 4.75%, closing at $443.57. The company continues to benefit from its strong position in cloud computing and AI services, maintaining investor confidence.

Apple (AAPL): The stock increased by about 2.32%, ending at $242.84. Apple's consistent product demand and services revenue contribute to its steady performance.

NVIDIA (NVDA): Shares surged by 10.77%, reaching $142.44. NVIDIA's dominance in AI hardware and software, along with its recent inclusion in the Dow Jones Industrial Average, has bolstered investor sentiment.

Broadcom (AVGO): The stock climbed by 10.77%, closing at $179.53. Broadcom's role in AI infrastructure and strong financial performance have attracted investor interest.

Consumer Discretionary:

Tesla (TSLA): Shares jumped by 12.77%, ending at $389.22. The rise follows the settlement of a lawsuit with JPMorgan Chase, removing legal uncertainties.

Amazon (AMZN): The stock increased by 9.21%, closing at $227.03. Amazon's announcement of a supercomputer using its Trainium chips for AI startup Anthropic positions it competitively in the AI chip market.

Communication Services:

Meta Platforms (META): Shares rose by 8.61%, reaching $623.77. Meta's advancements in AI and strategic investments have strengthened its market position.

Alphabet (GOOGL): The stock increased by 3.41%, closing at $174.71. Alphabet's continuous innovation in AI and digital advertising supports its growth.

Healthcare:

Eli Lilly (LLY): Shares rose by 3.94%, ending at $826.71. The company's strong product pipeline and positive clinical trial results have enhanced investor confidence.

UnitedHealth Group (UNH): The stock declined by 9.93%, closing at $549.62. The recent tragic death of CEO Brian Thompson has raised concerns about leadership stability.

Financials:

JPMorgan Chase (JPM): Shares fell by 0.94%, ending at $247.36. The settlement of the lawsuit with Tesla may have impacted investor sentiment.

Berkshire Hathaway (BRK.B): The stock decreased by 2.59%, closing at $470.50. Market fluctuations and portfolio performance may have influenced the decline.

Energy:

Exxon Mobil (XOM): Shares dropped by 3.72%, ending at $113.57. Fluctuating oil prices and market dynamics have affected the stock.

Chevron (CVX): The stock fell by 4.13%, closing at $155.24. Similar to Exxon Mobil, Chevron faces challenges from volatile energy markets.

Consumer Staples:

Walmart (WMT): Shares rose by 3.46%, reaching $95.70. Strong sales performance and strategic initiatives have contributed to the gain.

Procter & Gamble (PG): The stock declined by 3.04%, ending at $173.82. Market competition and cost pressures may have impacted the stock.

Industrials:

General Electric (GE): Shares fell by 3.61%, closing at $175.58. The company continues to navigate challenges in its industrial segments.

Boeing (BA): The stock decreased by 2.70%, ending at $153.93. Ongoing issues in production and regulatory scrutiny may have affected investor confidence.

Overall, the technology and consumer discretionary sectors have shown robust performance, driven by advancements in AI and strategic corporate developments. In contrast, the healthcare, financial, and energy sectors faced challenges due to leadership changes, legal matters, and market volatility.

ETF Insights

Major Index ETFs

SPY (+0.87%): The S&P 500 ETF had a modest gain, reflecting a generally positive week for large-cap stocks.

QQQ (+3.28%): Nasdaq's tech-heavy ETF significantly outperformed, driven by strong gains in technology and growth stocks.

DIA (-0.65%): The Dow ETF underperformed, indicating a relative lag in blue-chip industrials.

IWM (-1.22%): Small-cap stocks, represented by the Russell 2000 ETF, faced notable weakness, signaling a risk-off sentiment in smaller companies.

Growth vs. Value

IWF (+3.62%) and VUG (+3.45%): Growth ETFs outperformed significantly, supported by the rally in tech and consumer cyclical sectors.

IWD (-1.94%) and VTV (-1.96%): Value ETFs declined, highlighting weakness in financials, energy, and other traditionally value-oriented sectors.

Sector Highlights

Technology (XLK, +3.04%): Continued strength in tech, supported by outperformers like Microsoft, NVIDIA, and Apple.

Consumer Discretionary (XLY, +4.72%): Tesla and Amazon drove gains, with strong consumer sentiment in select areas.

Energy (XLE, -4.72%) and XOP (-6.64%): Energy ETFs plummeted due to weak oil prices and mixed demand outlooks.

Healthcare (XLV, -2.12%): Weakness in healthcare, led by declines in managed care and biotech.

Leverage and Inverse ETFs:

TQQQ (+9.83%): The leveraged Nasdaq ETF amplified the QQQ’s gains, benefiting from tech momentum.

SOXX (+5.35%): Semiconductor ETFs mirrored the strong tech performance, with NVIDIA and Broadcom leading.

SOXS (-6.92%): Inverse semiconductor ETFs fell sharply, reflecting the bullish momentum in semiconductors.

SQQQ (-9.18%): Bearish leveraged Nasdaq ETFs declined as growth stocks surged.

International Markets:

EFA (+1.41%) and IEFA (+1.30%): Developed market ETFs posted gains, driven by improving global sentiment.

EM (+1.36%): Emerging markets ETFs rose modestly, supported by stronger performance in Asia.

YINN (+4.43%): Leveraged China ETFs saw strong gains, likely reflecting optimism around policy easing or economic recovery.

Commodities:

GLD (-1.07%) and SLV (+1.18%): Gold saw modest losses, while silver gained, reflecting divergent moves in precious metals.

USO (-1.91%) and UNG (-7.35%): Oil and natural gas ETFs struggled, driven by oversupply concerns and weaker demand forecasts.

Fixed Income:

TLT (+0.45%): Long-term Treasury ETFs gained slightly, reflecting easing yields as investors sought safe-haven assets.

SHY (-0.26%): Short-term Treasuries showed slight losses, aligning with rate hike expectations.

TMF (+2.37%): Leveraged Treasury ETFs outperformed as bond markets stabilized.

Cryptocurrency:

BITO (+0.08%) and GBTC (+4.68%): Bitcoin-related ETFs showed resilience, reflecting continued interest in digital assets amid regulatory clarity.

Sector and Strategy Insights

Tech Leadership: Growth and tech-focused ETFs drove market performance, benefiting from optimism around AI, semiconductors, and cloud computing.

Energy Weakness: Declines in energy ETFs highlight ongoing challenges in the oil and gas sectors, including demand uncertainty and pricing pressures.

Divergent Fixed Income Performance: Long-term bonds saw some gains, possibly indicating investor hedging, while shorter durations were more muted.

Crypto Stability: Positive movement in cryptocurrency ETFs suggests improving sentiment, possibly tied to ETF approval optimism or macroeconomic factors.

This performance highlights a continued "risk-on" trade for growth and technology, while value sectors such as energy and financials remain under pressure.

[Special Coverage] Bitcoin: Breakout or Bubble?

Over the past decade, Bitcoin has evolved from an obscure digital experiment into a household name, inspiring fierce debate among economists, investors, and technologists. Lauded by some as the future of finance and dismissed by others as a speculative fad, Bitcoin sits at the intersection of innovation and speculation, begging a crucial question: is it a breakout technology poised to redefine global markets, or a bubble destined to burst, leaving chaos in its wake?

A Brief History of Bitcoin

Bitcoin’s genesis lies in the aftermath of the 2008 financial crisis, a period marked by widespread distrust of traditional financial institutions. Introduced in 2009 by the pseudonymous Satoshi Nakamoto, Bitcoin presented a radical alternative: a decentralized digital currency powered by blockchain technology. By enabling peer-to-peer transactions without intermediaries, Bitcoin aimed to provide financial sovereignty to individuals.

Initially dismissed as niche, Bitcoin began to garner attention as its value steadily climbed. Early adopters saw it as a hedge against inflation and currency devaluation, particularly in countries with unstable economies. By 2021, Bitcoin had reached an all-time high of nearly $69,000 per coin, cementing its status as a serious contender in the financial world. Yet, with dramatic price swings and periodic crashes, skepticism abounds.

The Case for a Breakout

Advocates of Bitcoin argue that it represents a paradigm shift in how we think about money. Unlike traditional currencies, Bitcoin operates on a decentralized network, making it resistant to government manipulation and censorship. This quality has proven especially attractive to individuals in authoritarian regimes or nations grappling with hyperinflation.

Moreover, Bitcoin’s supply cap of 21 million coins ensures scarcity, akin to gold. This “digital gold” narrative has driven its adoption as a store of value. Major institutions, including TSLA 0.00%↑ , MSTR 0.00%↑ , and SQ 0.00%↑ have added Bitcoin to their balance sheets, signaling growing mainstream acceptance.

Technological advancements also bolster Bitcoin’s case. The Lightning Network, a second-layer solution, aims to make Bitcoin transactions faster and more cost-effective, addressing criticisms of scalability. Additionally, developments in regulatory frameworks hint at a future where Bitcoin operates within a structured, less volatile environment.

For proponents, Bitcoin’s decentralized nature, scarcity, and technological evolution position it as a breakout asset capable of disrupting traditional financial systems. As younger, tech-savvy generations embrace digital assets, Bitcoin could well become the cornerstone of a new financial era.

The Case for a Bubble

Despite its promise, Bitcoin faces significant headwinds that suggest its valuation may be inflated. Skeptics point to its extreme volatility, which undermines its utility as a currency or store of value. Bitcoin’s price has often been driven by speculation rather than intrinsic value, leading to dramatic booms and busts.

Moreover, Bitcoin’s reliance on energy-intensive mining has sparked criticism from environmentalists. The process of validating transactions and securing the network consumes vast amounts of electricity, often sourced from fossil fuels. As governments and corporations prioritize sustainability, Bitcoin’s environmental impact could limit its growth.

Regulatory uncertainty poses another challenge. While some countries have embraced Bitcoin, others have imposed outright bans or severe restrictions. In 2021, China’s crackdown on cryptocurrency mining and trading sent shockwaves through the market. Future regulatory actions in major economies could stifle adoption and erode investor confidence.

Critics also question Bitcoin’s scalability. While the Lightning Network offers potential solutions, it remains in its infancy, and Bitcoin’s base layer struggles to handle high transaction volumes. Competing cryptocurrencies, such as Ethereum, offer more versatile platforms for decentralized applications, potentially diminishing Bitcoin’s dominance.

The Middle Ground: Bitcoin as an Asset Class

While the debate between breakout and bubble rages on, an emerging perspective positions Bitcoin as a new asset class. Neither destined to replace fiat currencies nor collapse entirely, Bitcoin could find its niche as a speculative investment akin to commodities or high-risk equities.

This view is supported by the growing infrastructure around Bitcoin. From regulated futures markets to Bitcoin exchange-traded funds (ETFs), financial instruments have emerged to facilitate institutional and retail participation. These developments suggest that Bitcoin is maturing, even if its path to mass adoption remains uncertain.

Bitcoin’s role as a portfolio diversifier is also gaining traction. Its lack of correlation with traditional assets makes it appealing to investors seeking to hedge against market downturns. While not without risks, Bitcoin’s inclusion in a diversified portfolio could offer asymmetric returns, balancing its volatility with its potential for outsized gains.

Lessons from History

Bitcoin’s trajectory bears striking similarities to past financial innovations. The dot-com bubble of the late 1990s, for example, saw astronomical valuations for internet companies, many of which ultimately failed. Yet, the underlying technology—the internet—revolutionized the world. Bitcoin could follow a similar pattern: a speculative phase marked by wild swings, followed by stabilization and integration into the broader economy.

Another historical parallel is the emergence of gold as a store of value. Gold’s journey from ornamental metal to financial cornerstone took centuries, shaped by cultural, economic, and technological factors. Bitcoin, still in its infancy, may require similar time and adaptability to cement its role.

The Path Forward

For Bitcoin to transcend its current volatility and skepticism, several developments are essential:

Regulatory Clarity: Clear, consistent regulations will provide the framework needed for broader adoption. Governments must strike a balance between fostering innovation and protecting consumers.

Technological Maturation: Scalability solutions like the Lightning Network must prove reliable, enabling Bitcoin to handle increased demand without compromising security.

Environmental Sustainability: Transitioning to renewable energy sources for mining operations could mitigate environmental concerns and enhance Bitcoin’s reputation.

Education and Awareness: Public understanding of Bitcoin’s utility and risks remains limited. Comprehensive education initiatives can empower individuals to make informed decisions.

Conclusion

Bitcoin embodies both the promise and peril of financial innovation. As a breakout technology, it challenges the status quo, offering a decentralized alternative to traditional finance. Yet, its volatility, environmental impact, and regulatory uncertainty underscore its speculative nature, raising legitimate concerns about its long-term viability.

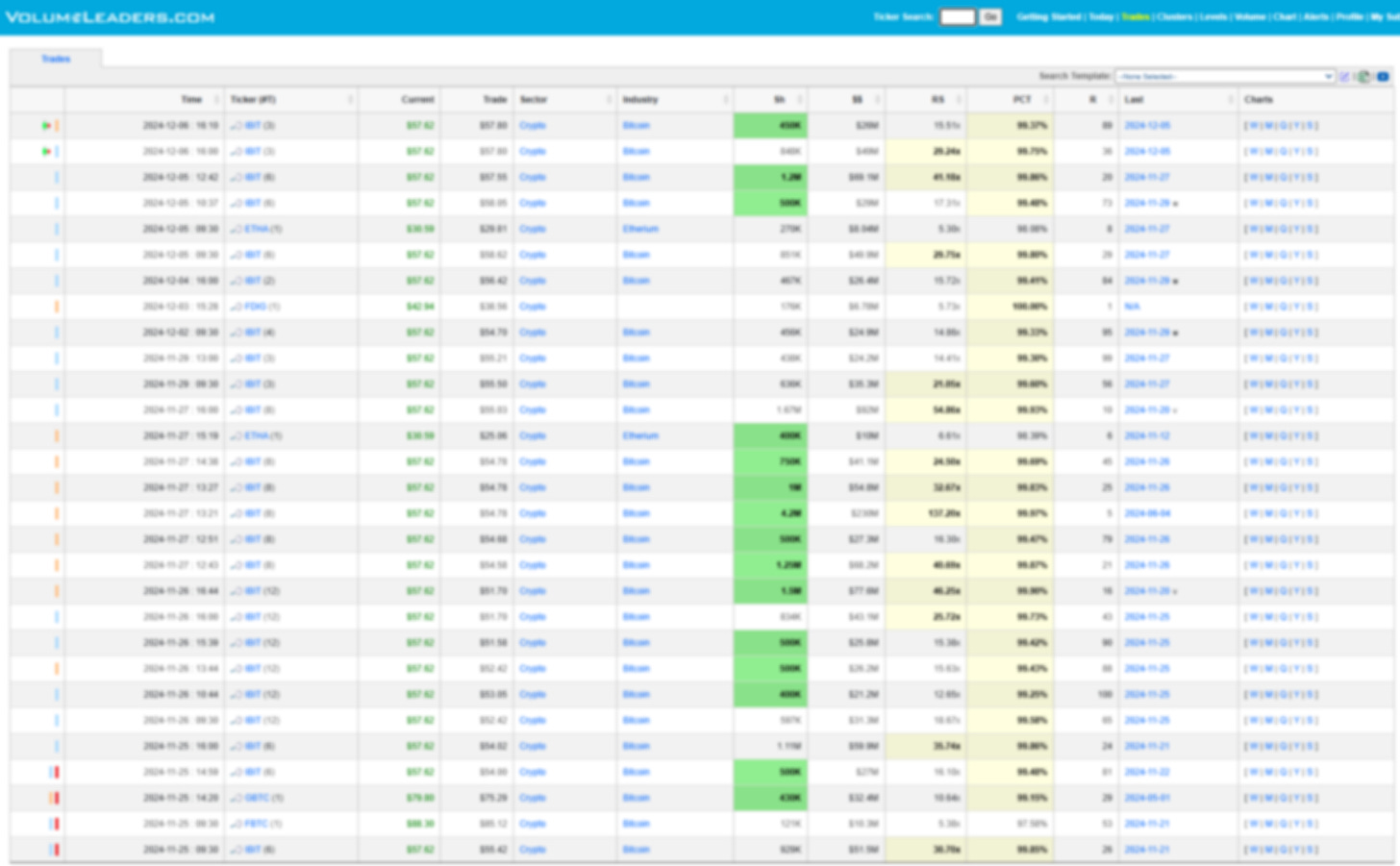

Whether Bitcoin proves to be a transformative breakthrough or a fleeting bubble will depend on how it navigates these challenges. In the meantime, it remains a fascinating experiment at the frontier of technology and finance, reflecting humanity’s enduring quest for progress and freedom. As the world watches and debates, one thing is certain: Bitcoin’s story is far from over. If you’re a VL subscriber, use the built-in search template to quickly see all of the institutional positioning in your favorite crypto tickers.

Whether you’re watching crypto-related tickers like COIN 0.00%↑ MSTR 0.00%↑ or RIOT 0.00%↑ or you’re seeking more direct exposure through ETFs like IBIT 0.00%↑ BITX 0.00%↑ and GBTC 0.00%↑ you’re going to want to login and see where institutions are positioned because there have been absolutely no shortages of prints since Thanksgiving: