Market Momentum: Your Weekly Financial Forecast & Market Prep

Issue 19 / What to expect Oct 28, 2024 thru Nov 01, 2024

Last Week: Insights & Trends

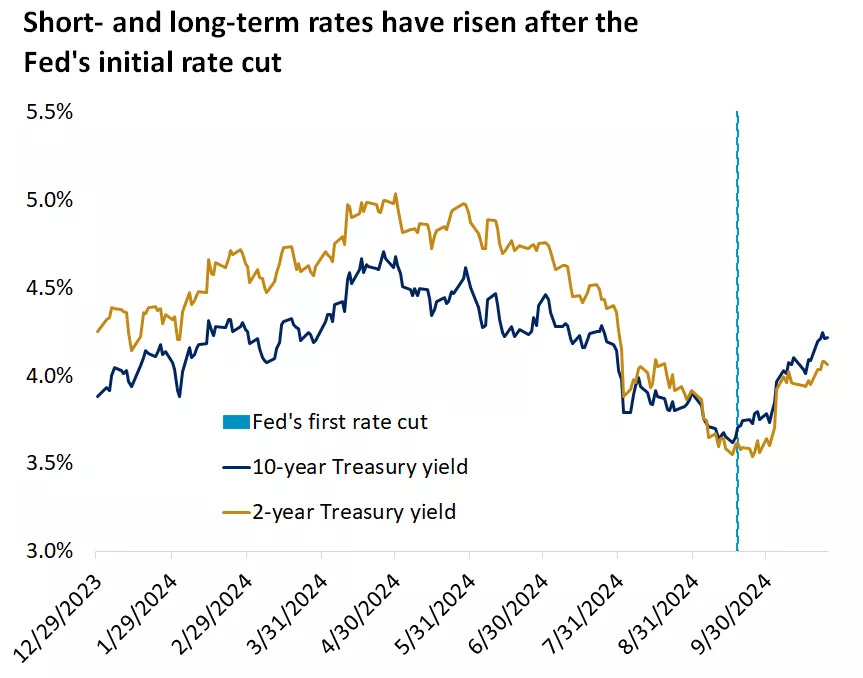

The week in U.S. markets was marked by rising yields, fluctuating equity prices, and mixed economic indicators, all while investor focus remained on evolving Federal Reserve policy and upcoming election implications. Since the Fed's recent rate cuts, the market has experienced a notable increase in bond yields, with 2- and 10-year Treasury yields climbing amid strong economic and inflation data. This trend continued last week, interrupting a six-week winning streak for the stock market and bringing the future direction of yields into focus. Below is a detailed analysis of these market movements, the underlying factors, and what lies ahead for equities, fixed income, and investor sentiment.

Rising Yields: Causes and Implications

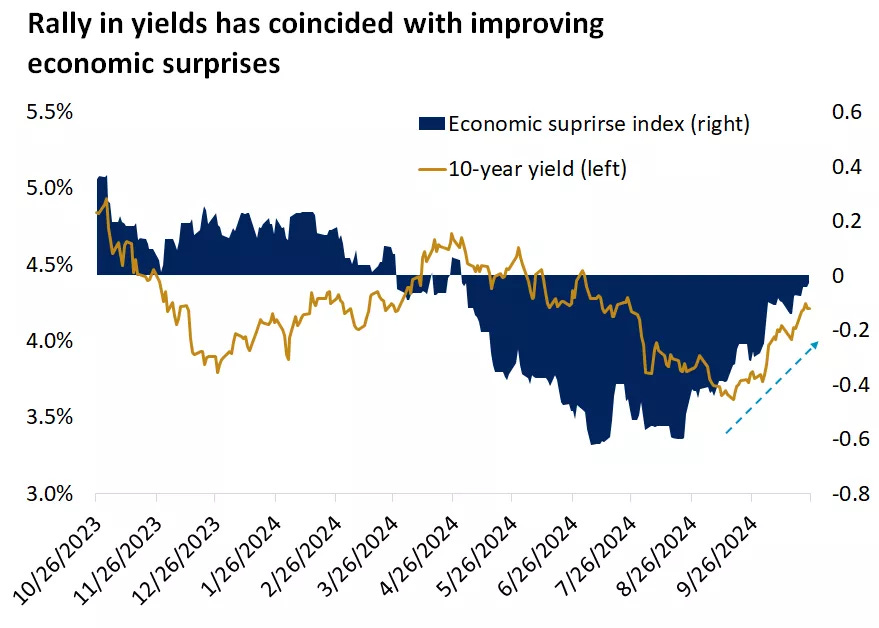

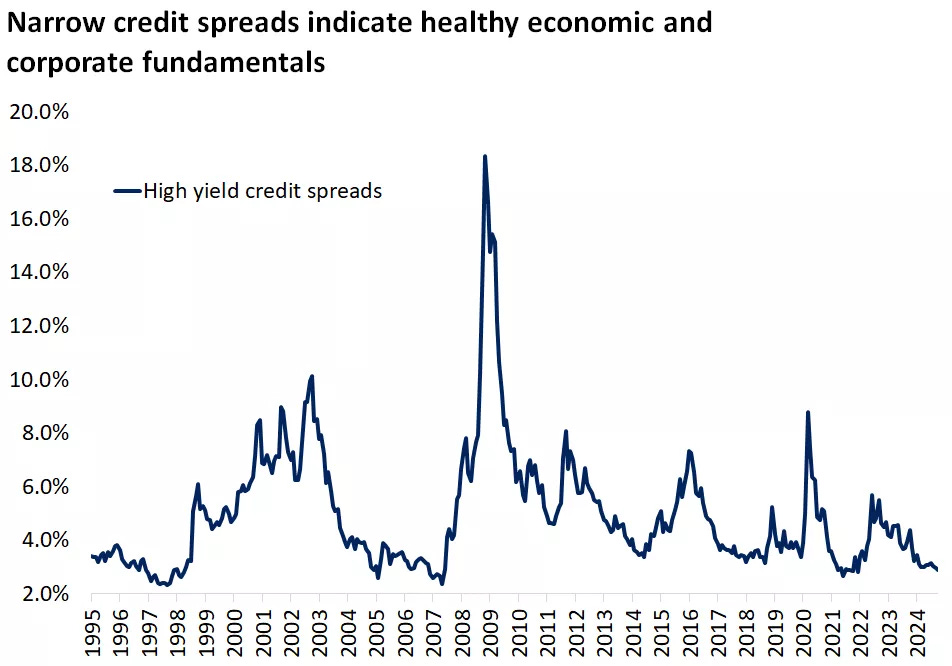

The upward pressure on yields reflects a combination of stronger-than-anticipated economic data, a gradual shift in Fed expectations, and lingering concerns around U.S. fiscal health and political uncertainty. In the wake of the Fed’s initial rate cut, both short- and long-term bond yields have risen, fueled by robust September job numbers and an unexpected bump in inflation. The 10-year Treasury yield rose to 4.24% by Friday, the fifth increase in six weeks and significantly higher than its September low of 3.62%. Analysts are split on whether yields will sustain this rise or cool as we enter the election period.

Economic Strength Defies Slowdown Forecasts

Stronger-than-expected retail sales and job market data have bolstered the case for a resilient U.S. economy. September’s job gains were the most robust in six months, with the unemployment rate dipping, alleviating fears of a recession in the near term. The third-quarter GDP, anticipated to be around 3.4%, would indicate consecutive quarters of above-average growth, further supporting this outlook. This resiliency has led to upward adjustments in GDP growth projections, driven in part by heightened consumer spending and a boost in productivity, with technological advancements such as artificial intelligence (AI) playing a significant role.

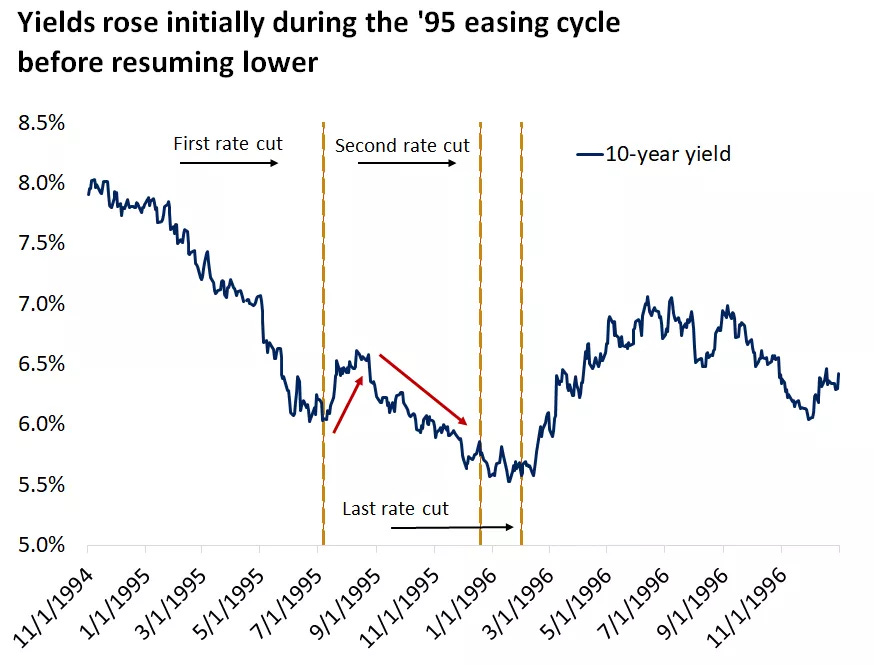

Shift in Federal Reserve Policy Expectations

Despite initial expectations of a swift easing cycle, recent data has led the Fed and markets to recalibrate expectations. After a half-point cut, bond markets now anticipate a shallower, more gradual rate reduction path, adjusting the anticipated policy rate to around 3.5% by the end of 2025, up from a prior projection of 2.9%. These adjustments have tempered the likelihood of any further outsized cuts, underscoring the Fed’s cautious stance amid sustained inflationary pressures and durable economic momentum.

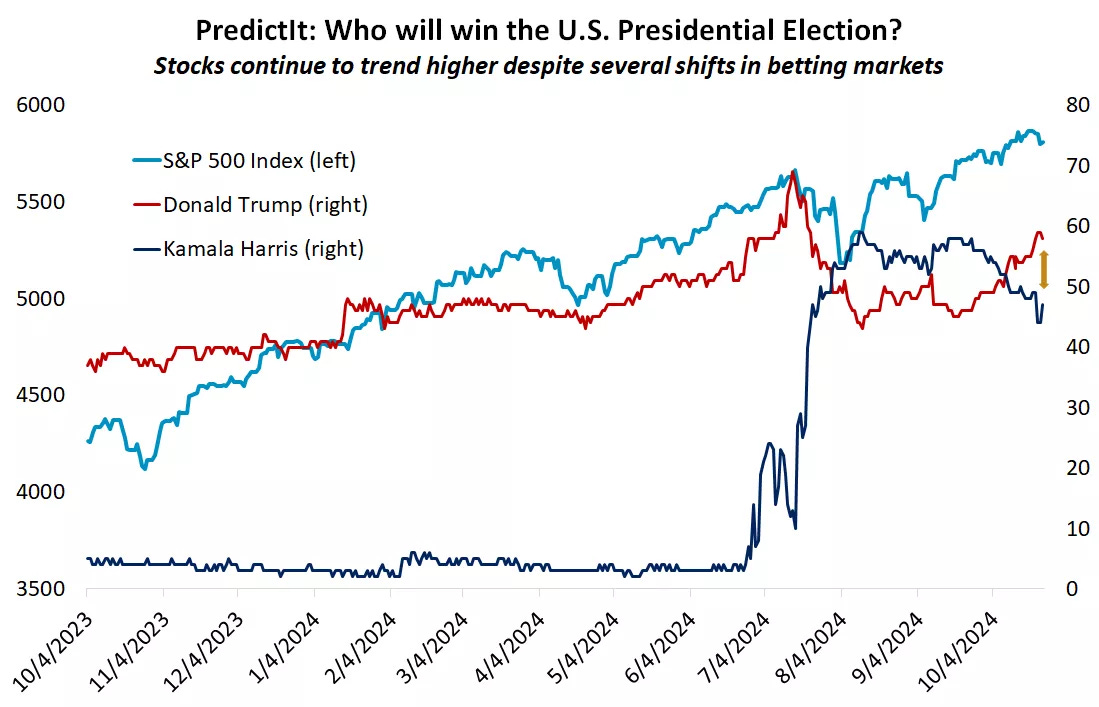

The U.S. Election and Fiscal Concerns

With the November 5 presidential election looming, the potential fiscal trajectory of the country has added another layer of complexity. Analysts at the Committee for a Responsible Federal Budget estimate substantial increases in the national debt, with plans from both leading candidates contributing trillions to the deficit over the coming decade. The potential fiscal stimulus, in the form of increased government spending or tax cuts, could pressure the Fed to maintain higher interest rates to counteract inflation. In addition, the issuance of new Treasury bonds to fund spending could push yields even higher, particularly if debt loads climb more sharply than anticipated. This could make Treasury yields less stable in the medium term, introducing further volatility into the bond market.

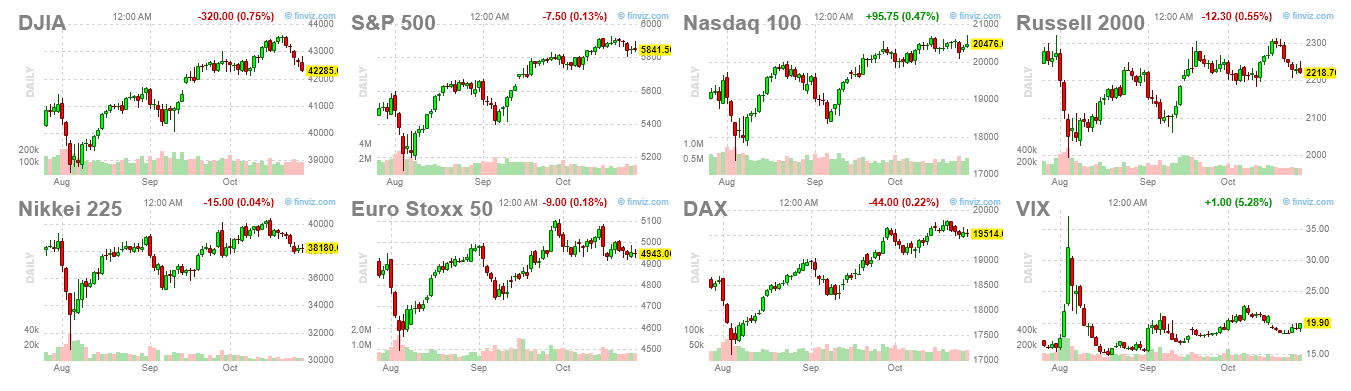

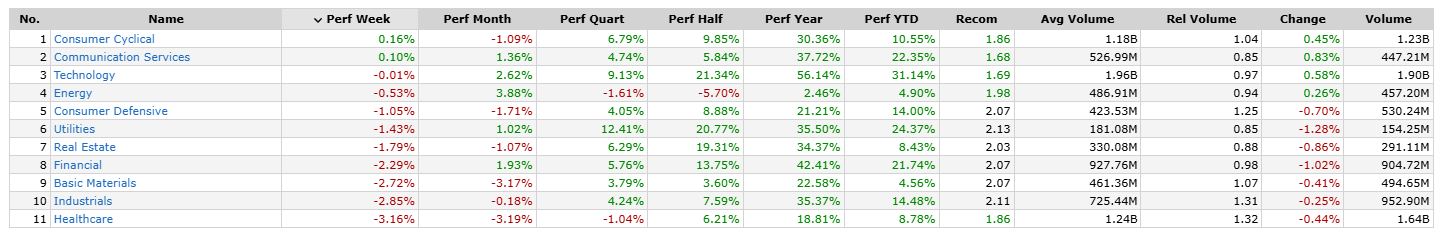

Equity Market Impact: A Cooling Rally and Earnings Season

The stock market’s rally has hit a pause, with the Dow and S&P 500 seeing declines of about 3% and 1%, respectively, snapping a six-week winning streak. The NASDAQ managed a slight gain, buoyed by resilient tech stocks, but an early rally fizzled as bond yields turned upward. Analysts suggest that these rising yields are beginning to siphon investment away from equities, especially in interest-rate-sensitive sectors like industrials, materials, and utilities, which led the declines last week.

Mega-Cap Earnings Bolster Tech

Technology stocks have been a bright spot, with the so-called “Magnificent Seven” expected to contribute significant earnings growth this season, led by companies like Tesla, General Motors, Texas Instruments, and Lam Research. By mid-week, around 37% of S&P 500 companies had reported earnings, with 75% surpassing analyst expectations. However, overall growth for the S&P 500 remains moderate, with a 3.6% growth forecast, down from 4.3% at the start of earnings season.

Consumer Sentiment and Spending Patterns

Consumer sentiment reached a six-month high, as reported by the University of Michigan, with the index climbing to 70.5, an increase that highlights the underlying strength in consumer confidence despite rising costs. Strong durable goods orders and upward revisions in GDP estimates have also pointed to continued resilience in business investment, although the housing market remains a notable weak spot. Data showed a slight dip in home sales for September, illustrating ongoing challenges in real estate.

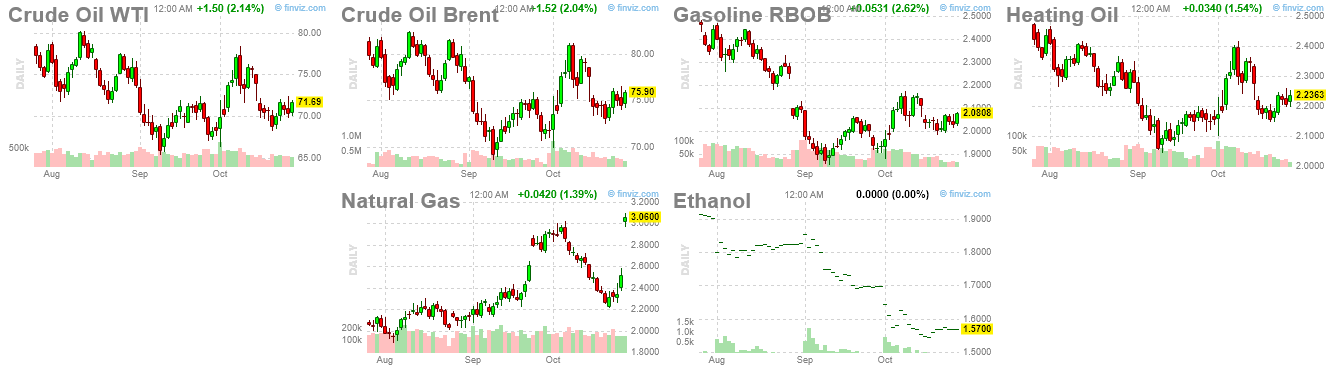

Oil Volatility and Inflationary Pressures

U.S. crude oil prices rebounded by nearly 5% over the week, closing at around $72 per barrel, yet still below summer highs. Persistent oil price volatility adds another inflationary risk, further complicating the Fed’s calculus as it navigates rate adjustments.

The Week Ahead: Key Indicators on the Horizon

This upcoming week holds several important economic releases, including the October nonfarm payrolls report and the Fed's favored inflation measure, the Personal Consumption Expenditures (PCE) price index. Both releases will be closely watched for signs of cooling in employment and inflation, which could impact the Fed’s policy stance and provide additional clarity on the broader economic outlook.

Bottom Line: Navigating Market Volatility

The rise in yields, while unsettling to some equity investors, is driven by favorable underlying economic conditions. Market participants are encouraged to consider intermediate and long-term bonds to secure yields at current levels. Meanwhile, equity investors may find attractive buying opportunities during market dips, given the resilience of consumer and business sentiment and the U.S. economy’s competitive strength globally. As the week unfolds, election-related volatility and fresh economic data will likely steer the market narrative, keeping investors vigilant in their pursuit of stable returns in a dynamic environment.

Futures Markets: Indices

Futures Markets: Bonds

Futures Markets: Energy

Futures Markets: Metals

Futures Markets: Currencies

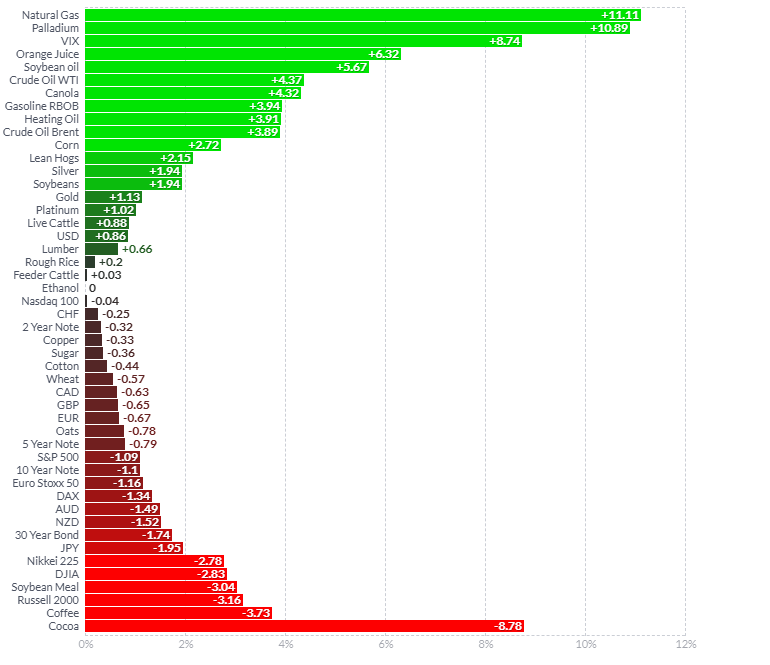

Futures Markets: 1-Week Performance

S&P 500: By Size & Sector

S&P 500: Sectors Scorecard

US Investor Sentiment

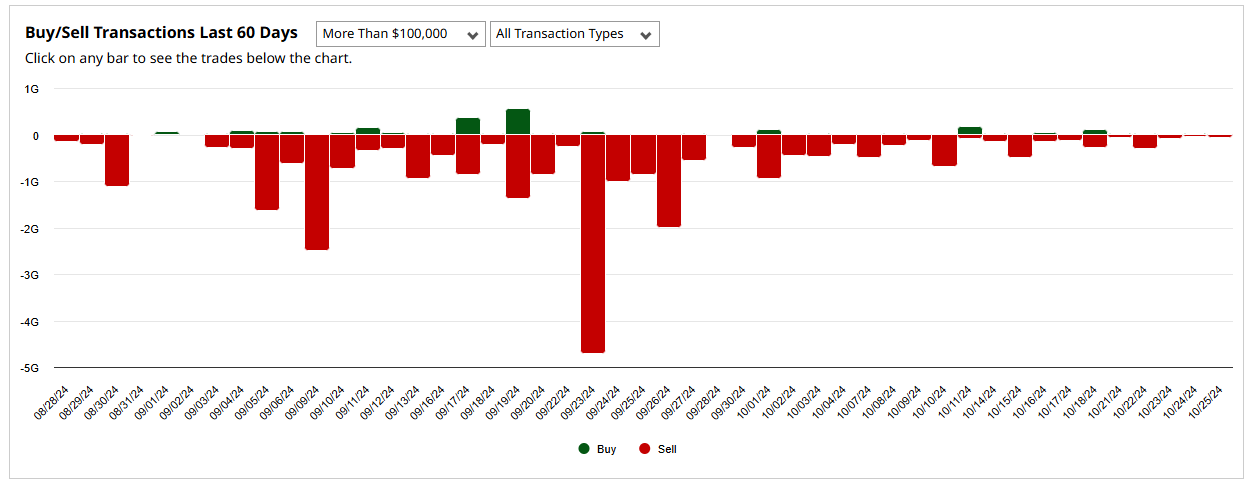

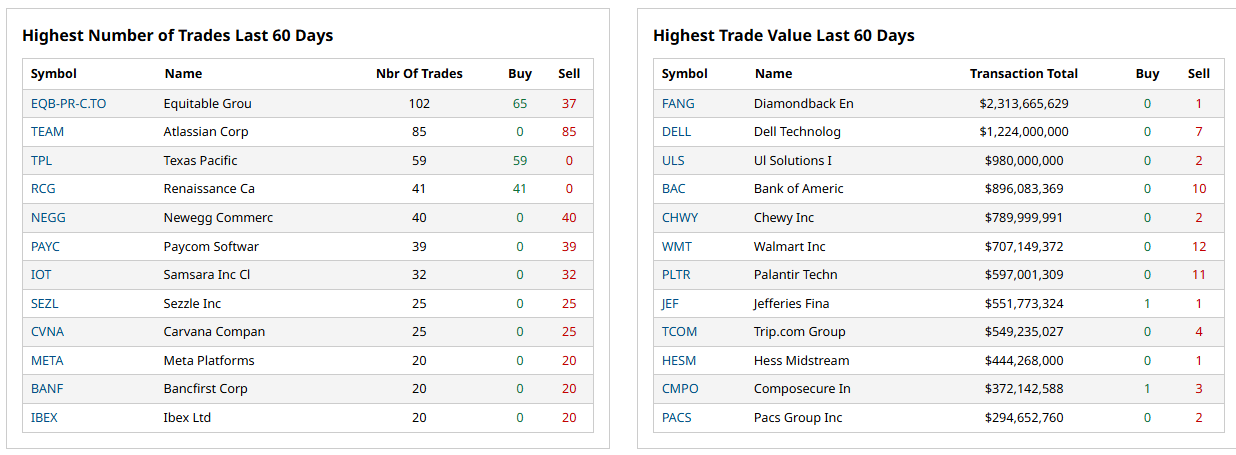

Insider Trading

Insider trading occurs when a company’s leaders or major shareholders trade stock based on non-public information. Tracking these trades can reveal insider expectations about the company’s future. For example, large purchases before an earnings report or drug trial results might indicate confidence in upcoming good news.

Last Week’s Insider Transactions Over $5M

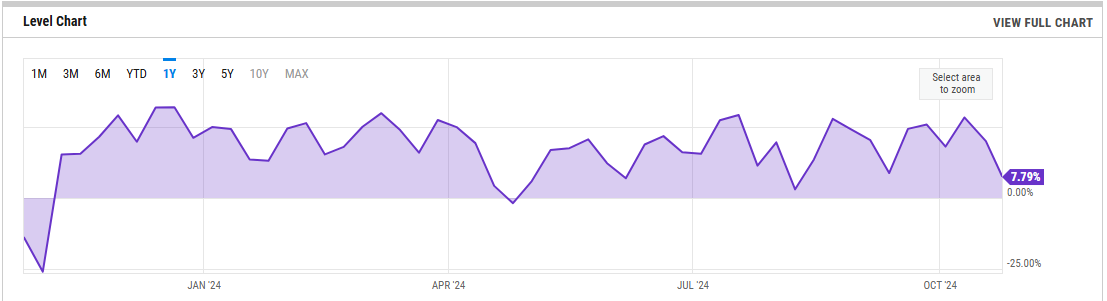

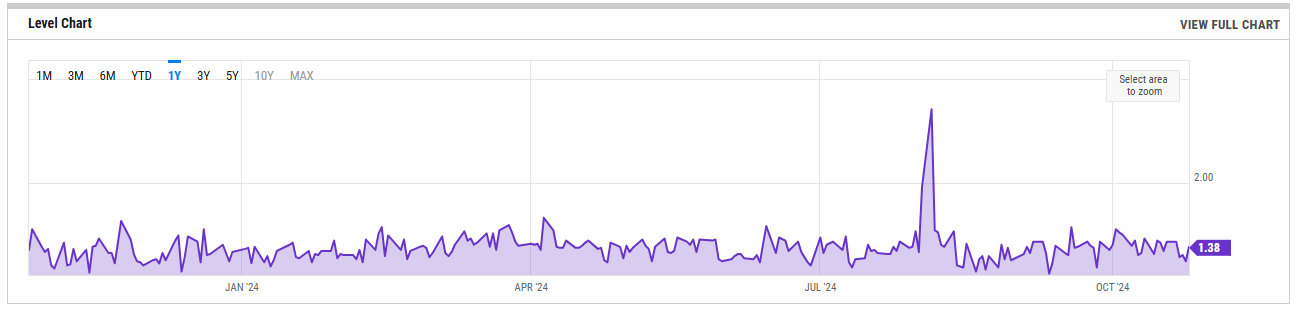

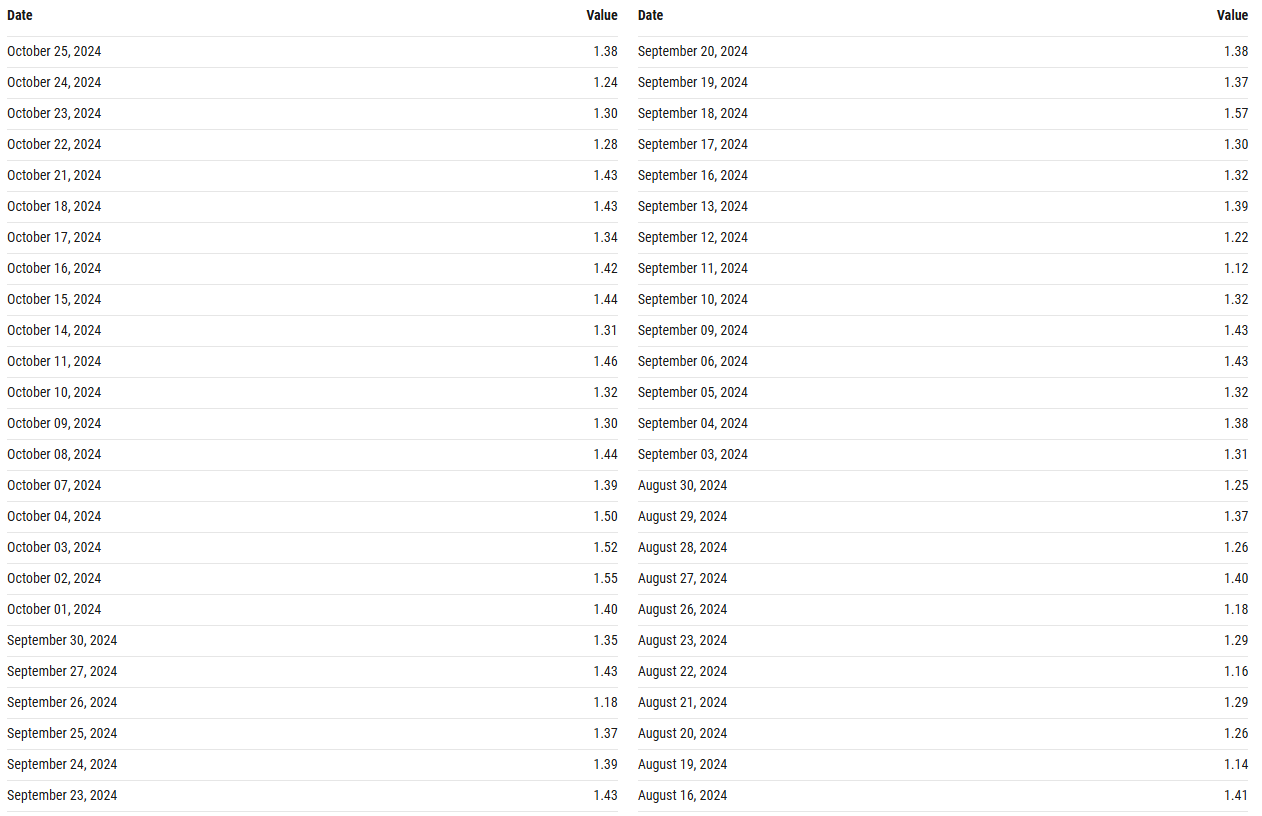

%Bull-Bear Spread

The %Bull-Bear Spread chart is a sentiment indicator that shows the difference between the percentage of bullish and bearish investors, often derived from surveys or sentiment data, such as the AAII (American Association of Individual Investors) sentiment survey. This spread tells investors about the prevailing mood in the market and can provide insights into market extremes and potential turning points.

Bullish or Bearish Sentiment:

When the spread is positive, it means more investors are bullish than bearish, indicating optimism about the market’s direction.

A negative spread indicates more bearish sentiment, meaning more investors expect the market to decline.

Contrarian Indicator:

The %Bull-Bear Spread is often used as a contrarian indicator. For example, extremely high levels of bullish sentiment might suggest that the market is overly optimistic and could be due for a correction.

Similarly, when bearish sentiment is extremely high, it might indicate that the market is overly pessimistic, and a rally could be on the horizon.

Market Extremes and Reversals:

Historically, extreme values of the spread (both positive and negative) can signal turning points in the market. A very high positive spread can signal market exuberance, while a very low or negative spread may indicate fear or capitulation.

1-Year View

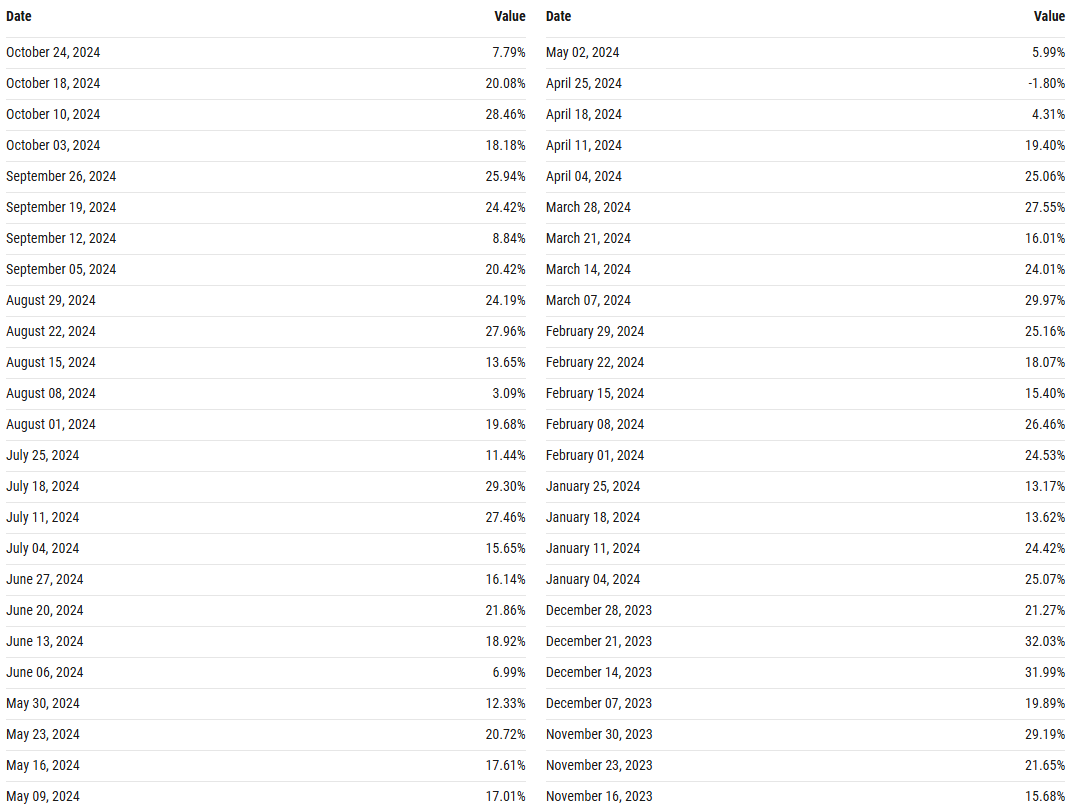

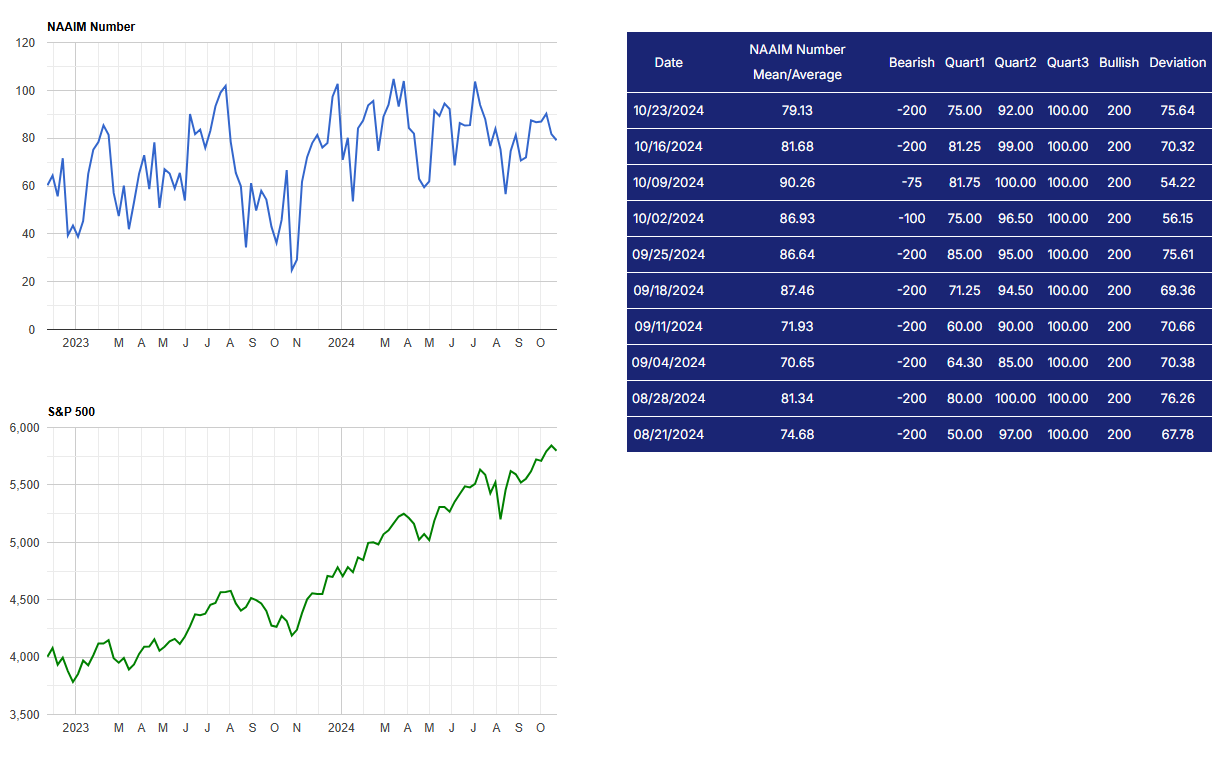

NAAIM Exposure Index

The NAAIM Exposure Index (National Association of Active Investment Managers Exposure Index) measures the average exposure to U.S. equity markets as reported by its member firms. These are typically active money managers who provide their equity exposure levels weekly. The index offers insight into how much these managers are investing in equities at any given time, ranging from being fully short (-100%) to leveraged long (up to +200%).

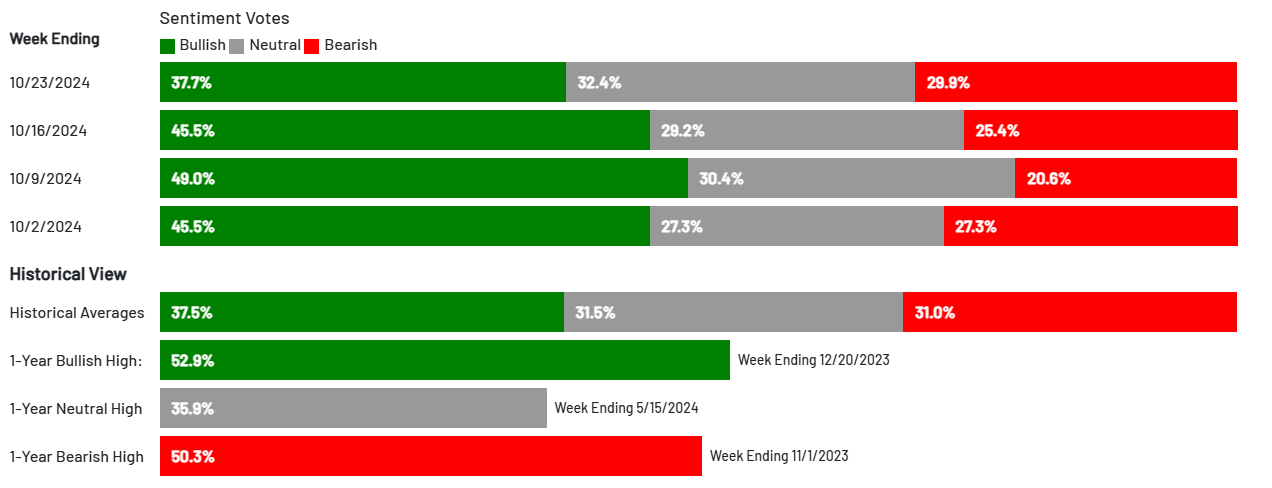

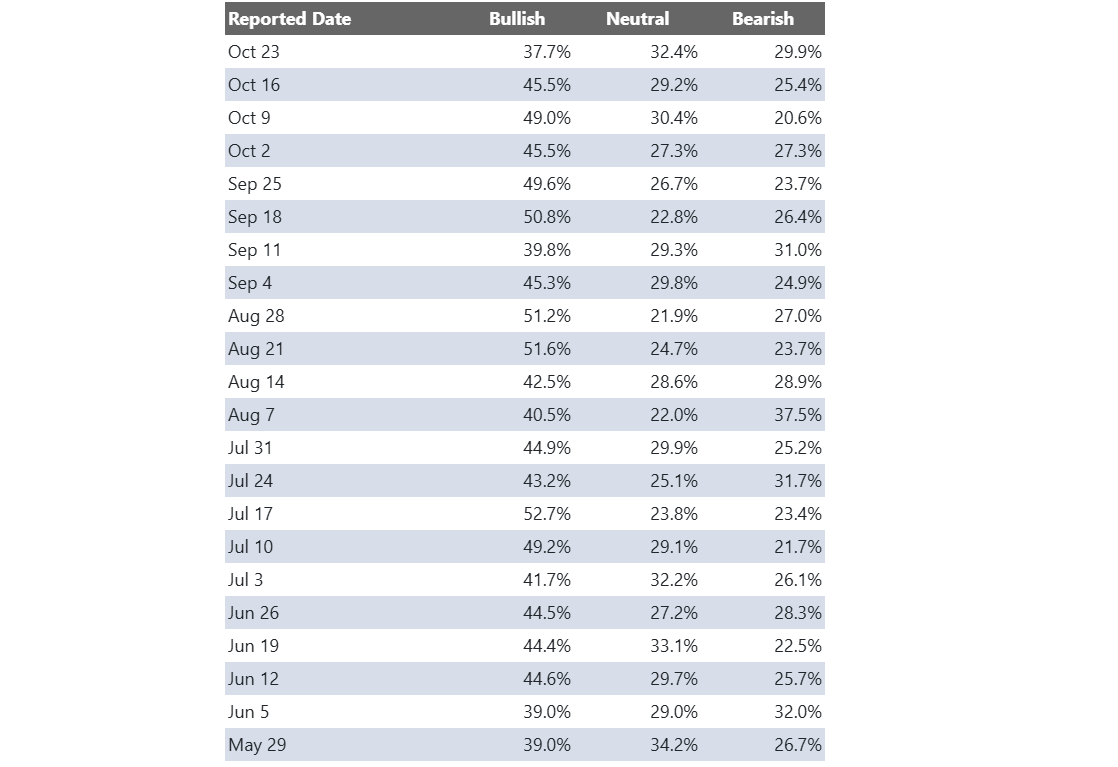

AAII Investor Sentiment Survey

The AAII Investor Sentiment Survey is a weekly survey conducted by the American Association of Individual Investors (AAII) to gauge the mood of individual investors regarding the direction of the stock market over the next six months. It provides insights into whether investors are feeling bullish (expecting the market to rise), bearish (expecting the market to fall), or neutral (expecting the market to stay about the same).

Key Points:

Bullish Sentiment: Reflects the percentage of investors who believe the stock market will rise in the next six months.

Bearish Sentiment: Represents those who expect a decline.

Neutral Sentiment: Reflects investors who anticipate little to no market movement.

The survey is widely followed as a contrarian indicator, meaning that extreme levels of bullishness or bearishness can sometimes signal market turning points. For example, when a large number of investors are overly optimistic (high bullish sentiment), it could suggest a market top, while excessive pessimism (high bearish sentiment) may indicate a market bottom is near.

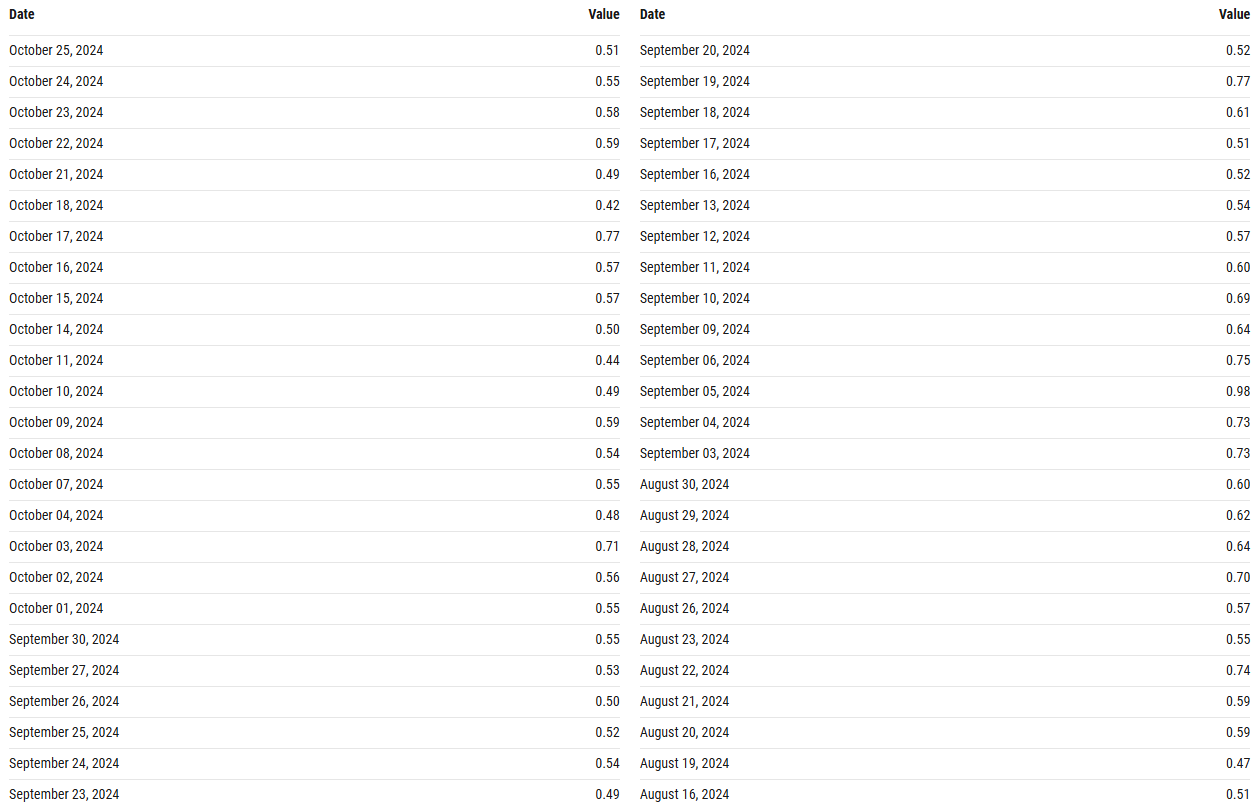

SPX Put/Call Ratio

The SPX Put/Call Ratio is an indicator that is used to gauge market sentiment. This is calculated as the ratio between trading S&P 500 put options and S&P call options. A high put/call ratio can indicate fear in the markets, while a low ratio indicates confidence. For example, in 2015, the Put-Call ratio was as high as 3.77 because of market fears stemming from various global economic issues like a GDP growth slowdown in China and a Greek debt default.

1-Year View

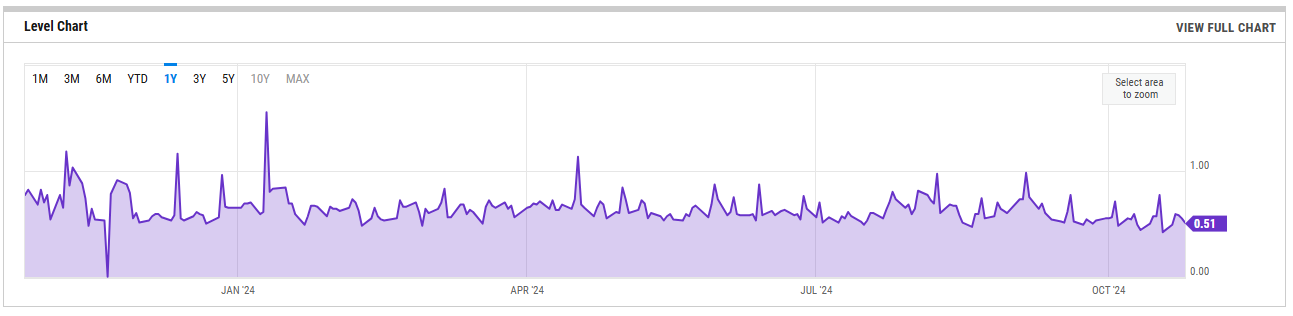

CBOE Equity Put/Call Ratio

1-Year View

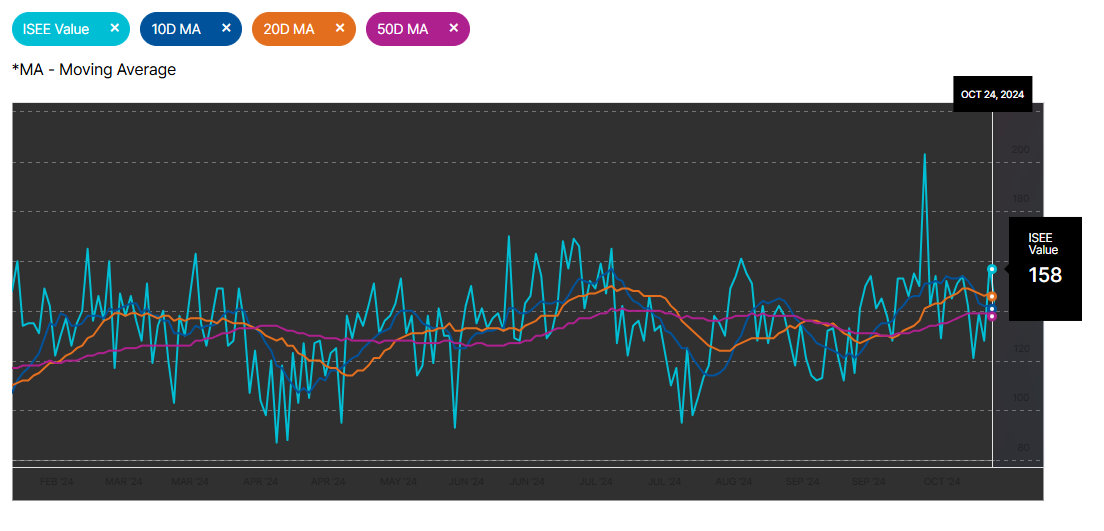

ISEE Sentiment Index

The ISEE (International Securities Exchange Sentiment) Index is a measure of investor sentiment derived from options trading. Unlike traditional put/call ratios, the ISEE Index focuses only on opening long customer transactions and is adjusted to remove market-maker and firm trades, providing a purer sentiment reading.

The ISEE Index typically ranges from 0 to 200, with readings above 100 indicating more call options being bought relative to put options, suggesting bullish sentiment. Conversely, readings below 100 suggest bearish sentiment, with more puts being purchased relative to calls.

(Sorry, they still haven’t fixed the dark background which makes it hard to read axis values)

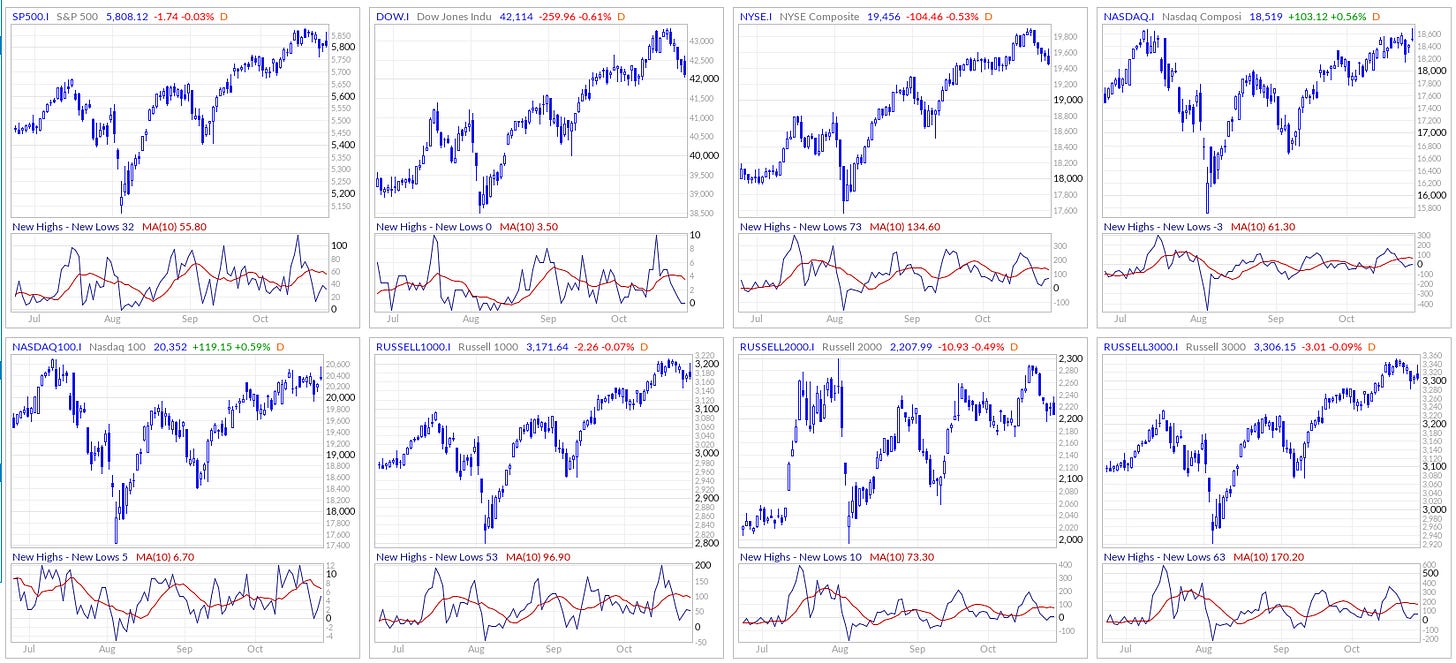

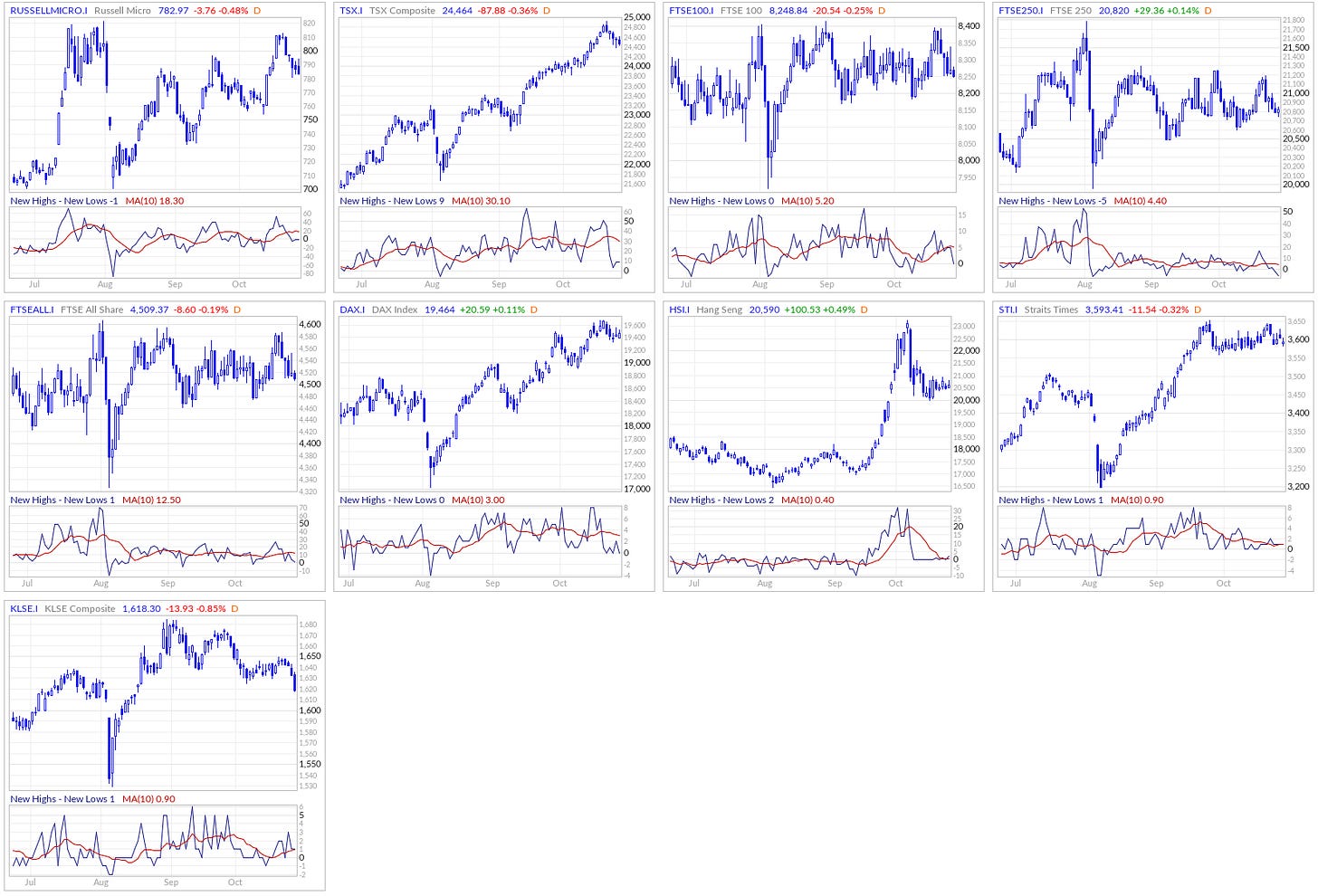

New Highs - New Lows

The New Highs - New Lows indicator (NH-NL) displays the daily difference between the number of stocks reaching new 52-week highs and the number of stocks reaching new 52-week lows. The NH-NL indicator generally reaches its extreme lows slightly before a major market bottom. As the market then turns up from the major bottom, the indicator jumps up rapidly. During this period, many new stocks are making new highs because it's easy to make a new high when prices have been depressed for a long time. The NH-NL indicator oscillates around zero. If the indicator is positive, the bulls are in control. If it is negative, the bears are in control. As the cycle matures, a divergence often occurs as fewer and fewer stocks are making new highs (the indicator falls), yet the market indices continue to reach new highs. This is a classic bearish divergence that indicates that the current upward trend is weak and may reverse.

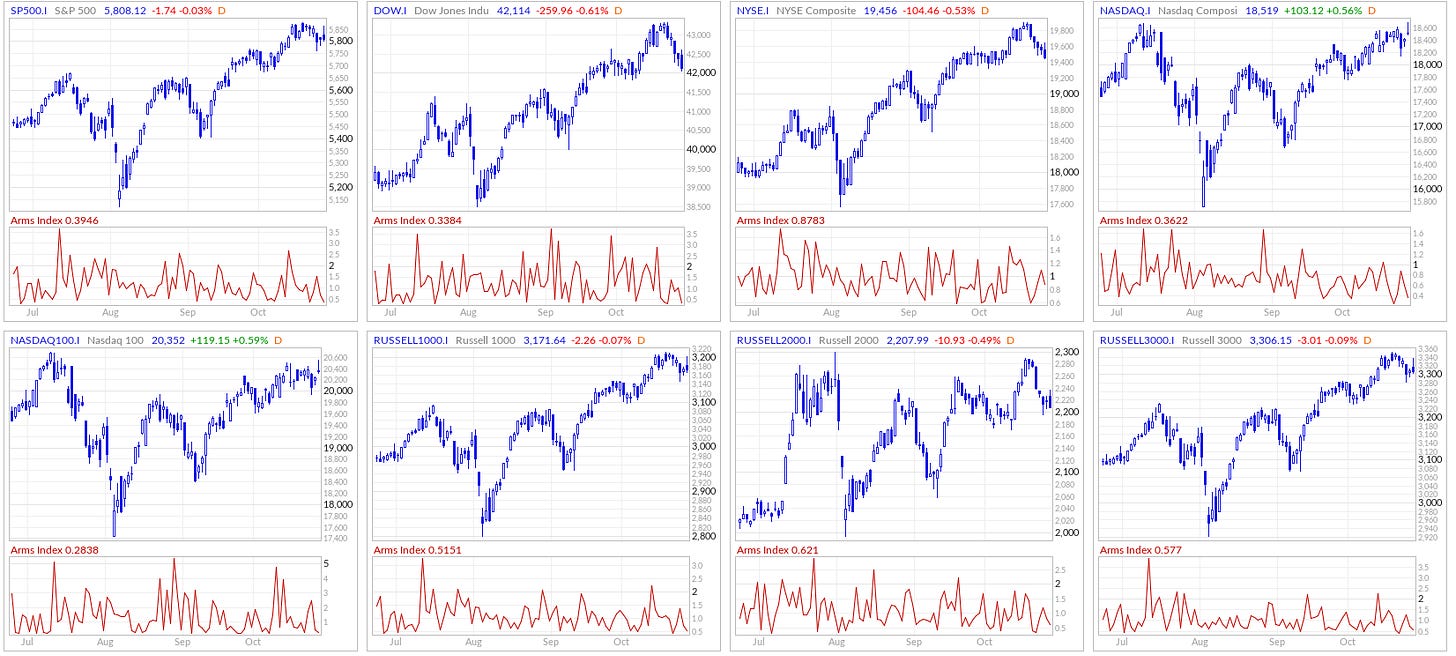

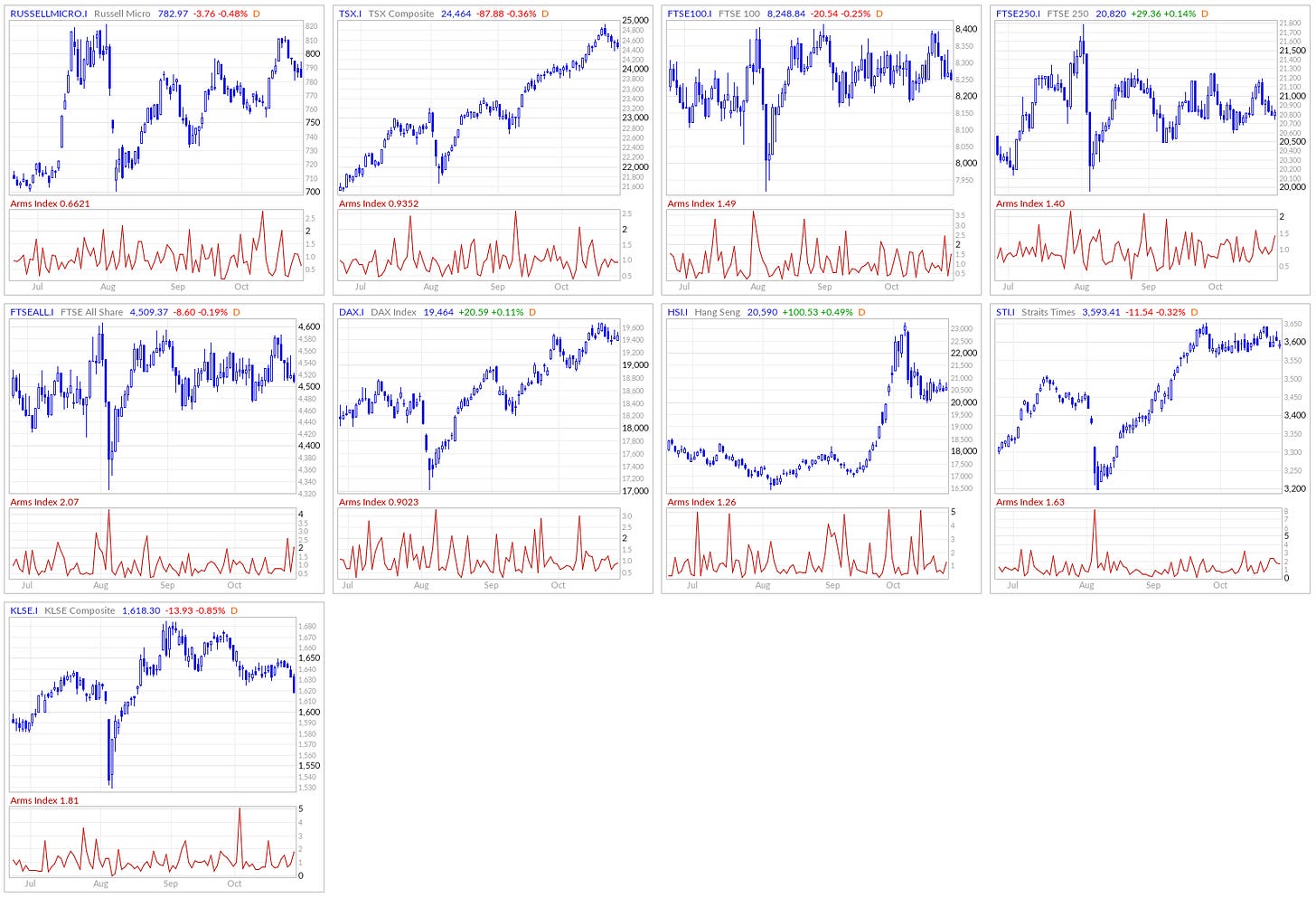

ARMS Index

The Arms Index, also known as the TRIN (Short-Term TRading INdex), was developed by Richard Arms in the 1960s. It is calculated by dividing the ratio of advancing stocks to declining stocks by the ratio of advancing volume to declining volume. Interpreting the Arms Index involves looking at its value in relation to certain thresholds. A value below "1" is considered bullish, indicating that advancing stocks and volume dominate the market. Conversely, a value above "1" is considered bearish, suggesting that declining stocks and volume are more prevalent. Extremely low values (below 0.5) or high values (above 2) are often seen as potential reversal signals.

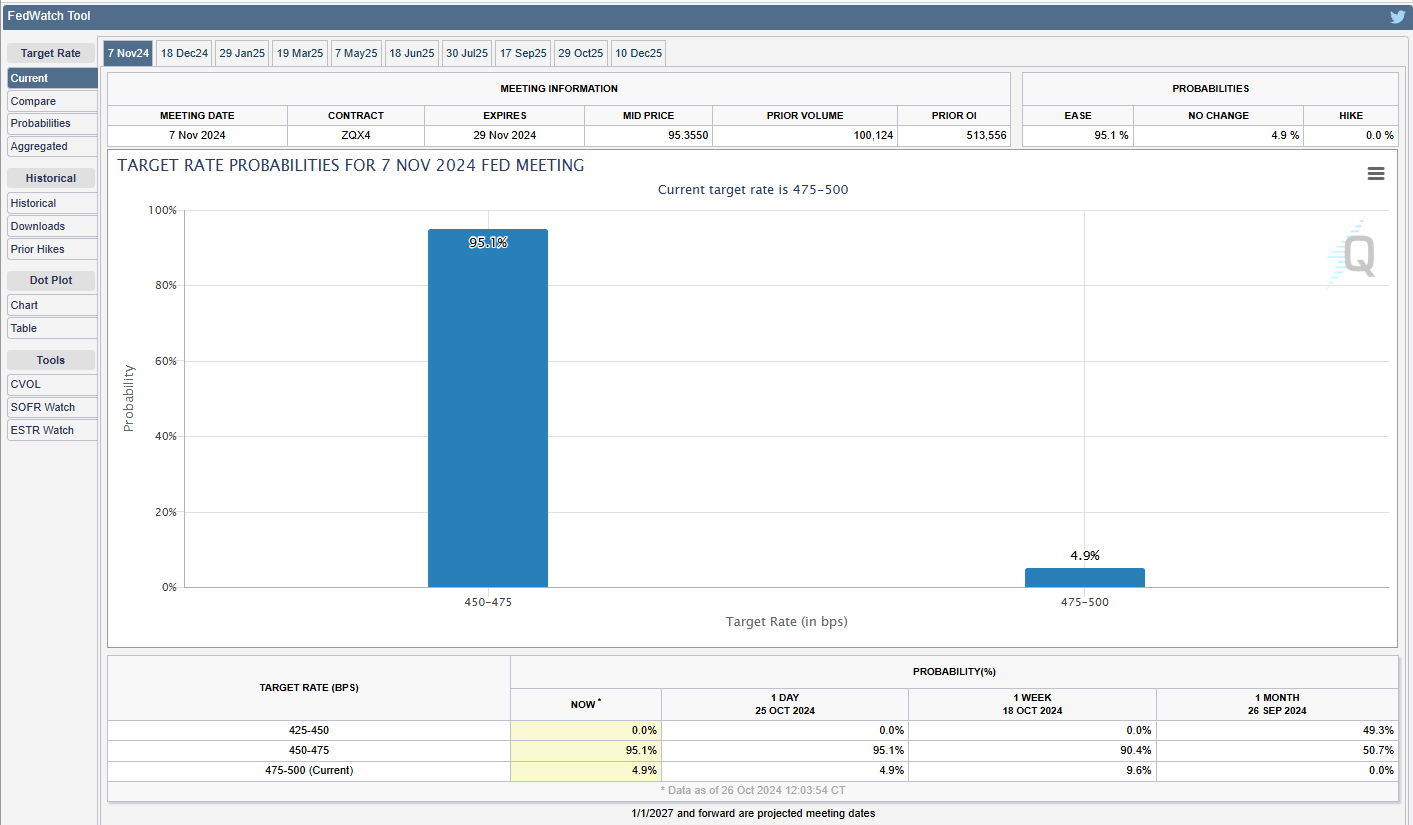

CME Fedwatch

What is the likelihood that the Fed will change the Federal target rate at upcoming FOMC meetings, according to interest rate traders? Use CME FedWatch to track the probabilities of changes to the Fed rate, as implied by 30-Day Fed Funds futures prices.

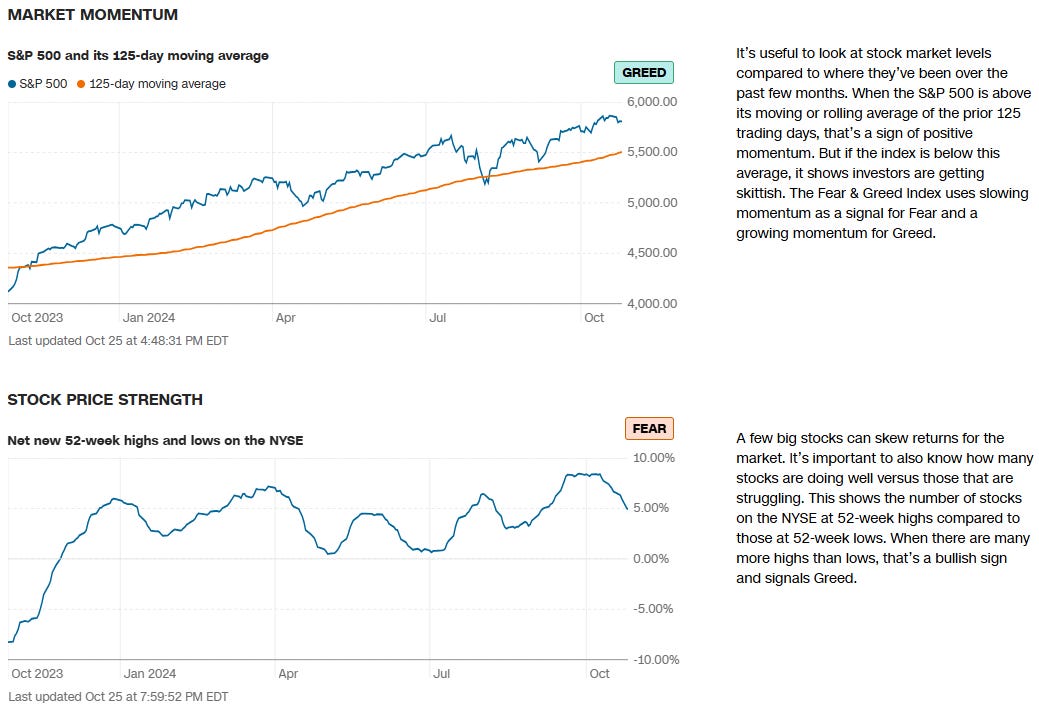

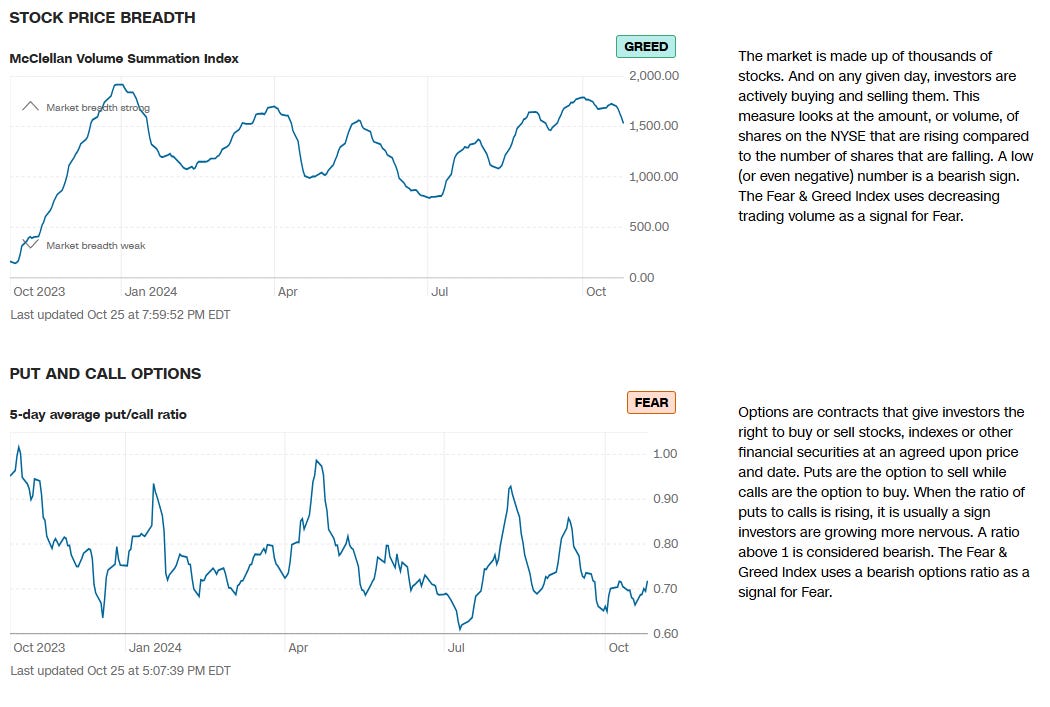

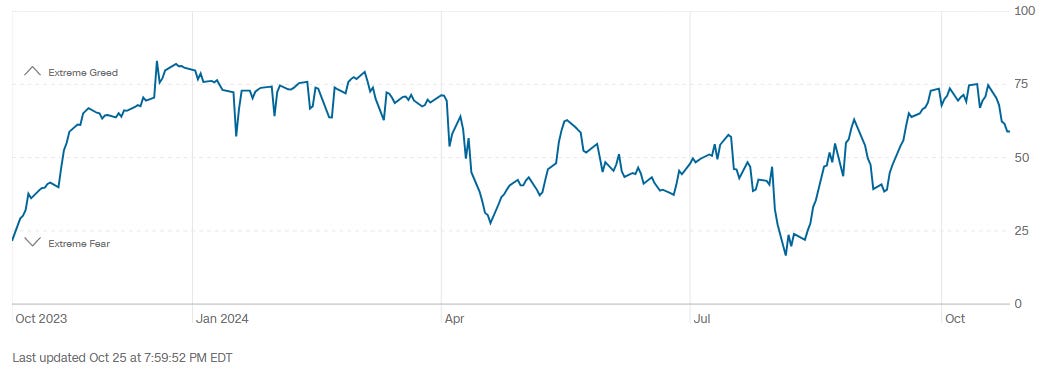

CNN 7 Fear & Greed Constituent Data Points + Composite Index

Final Composite Fear & Greed Index Reading

Institutional S/R Levels for Major Indices

When you’re a large institutional player, your primary goal is to find liquidity - places to do a ton of business with the least amount of slippage possible. VolumeLeaders.com automatically identifies and visually plots the exact spots where institutions are doing business and where they are likely to return for more. It’s one of the primary reasons “support” and “resistance” concepts work and truly one of the reasons “price has memory”.

Levels from the VolumeLeaders.com platform can help you formulate trades theses about:

Where to add or take profit

Where to de-risk or hedge

What strikes to target for options

Where to expect support or resistance

And this is just a small sample; there are countless ways to leverage this information into trades that express your views on the market. The platform covers thousands of tickers on multiple timeframes to accommodate all types of traders. Observe for yourself how accurate the levels are by marking-up your charts with the information in the “Trade Levels” boxes I’m giving for free below and play-along in real-time this week. These charts cover recent sessions, but subs will get new levels as they develop, see the latest trades and institutional positioning, have access to levels from other time frames and so much more. When you watch these levels this week, I’m confident you’ll see how clear, intuitive and actionable this information is for yourself.

SPY 0.00%↑

Key Observations from the Chart:

1. Largest Trades (Blue Circles)

First Cluster (Sept 30 - Oct 3): Large trades occurred around $571 to $573, with relative sizes (RS) up to 135.67%. This price level, particularly $571.82 and $573.76, saw heavy institutional accumulation, indicating this area could serve as a support zone. The largest trade in this range ($1.86B on Sept 30) highlights strong buying interest.

Additional Clusters (Oct 16, Oct 23): Trades around $579 to $584 exhibit a notable resistance zone. These trades, with RS values from 84% to 98%, indicate institutional selling or distribution, suggesting a barrier for further upward movement unless SPY can sustain above these levels.

2. Key Institutional Activity Price Levels (Dashed Blue Lines)

$567.90: This level witnessed the highest cumulative activity, with $9.08B in trades. Given its volume and high relative size, it is a critical support level.

$579.60 and $584.10: These levels saw strong resistance clusters, with substantial activity around $6.59B and $5.34B, respectively. If SPY moves into this range, it will likely face resistance unless there is a sustained breakout.

3. Volume and Relative Size (RS)

Largest Trade on Sept 30: At $571.82 with an RS of 135.67%, this represents a significant accumulation point. The multiple large trades around $571-$573 further confirm this area as a likely support zone for future price action.

Consistent High RS on October 16 and 23: Institutional activity remained strong around the $579 to $584 range, with RS values around 84-98%, showing that large players were actively involved in distributing shares, marking this as a resistance level.

4. Support and Resistance Zones

Support Levels:

$567.90: This level, backed by the highest notional volume, is the primary support zone. Any retracement toward this area is likely to find institutional buying interest.

$571.82 - $573.76: These prices also serve as strong support levels due to significant institutional activity.

Resistance Levels:

$579.60 - $584.10: Strong resistance exists in this range, with multiple high-volume trades and relative sizes marking this area as challenging for price action. Breaking above this range with substantial volume would indicate a possible continuation to the upside.

Conclusion:

Bullish Bias Within a Range: The recent large institutional trades suggest that SPY is supported around $567-$573, but faces significant resistance in the $579-$584 range. If SPY breaks above $584 with sustained buying, we could see further upward movement. Conversely, if it fails to clear this resistance, a pullback to the $567-$573 support zone is likely.

Key Levels to Watch: $567.90 and $571.82 on the downside as support, and $579.60 to $584.10 on the upside as resistance.

QQQ 0.00%↑

Key Observations from the Chart:

1. Largest Trades (Blue Circles)

Blue Circles (Sept 25 - Oct 10): These represent clusters of significant institutional trades around $485 to $490. The largest relative size (RS) in this period was 72.54% on Sept 25 at $485.80, indicating strong buying interest. The other large trades in this zone with RS values between 61% and 69% show that this area is a key support zone.

Higher-Level Trades (Oct 14 - Oct 23): Additional large trades took place around $493 to $497, indicating that this range is likely acting as resistance. Notable RS values between 63% and 72% in this zone reinforce this resistance level.

2. Key Institutional Activity Price Levels (Dashed Blue Lines)

$481.30 and $482.40: These levels are heavily traded support zones, with significant volume concentrated here. The activity at these levels, especially $481.30 with $4.24B in trades, suggests strong support.

$494.60 - $497.06: These levels represent the highest recent prices with large institutional trades, making this range a resistance zone that QQQ has struggled to break above consistently.

3. Volume and Relative Size (RS)

Largest Trade on Sept 25: This trade at $485.80 with an RS of 72.54% indicates strong institutional buying interest. Given the high RS, this price is likely to act as a key support level if QQQ retraces.

Consistent RS Values Above $490: The trades in the $493 to $497 range have RS values between 61% and 69%, showing that institutions were active here, likely representing a distribution phase, making this area a potential resistance zone.

4. Support and Resistance Zones

Support Levels:

$481.30 - $485.80: These levels saw significant institutional activity and will likely serve as a strong support zone if QQQ declines. Multiple trades at this range further support the idea of institutional accumulation here.

Resistance Levels:

$493 - $497: This is the current resistance zone backed by high-volume trades. To move higher, QQQ would need to break above this range with sustained volume, which would signal bullish strength.

Conclusion:

Bullish Within Range, Testing Resistance: The chart indicates that QQQ has strong institutional support around $481-$486 but faces resistance in the $493-$497 range. A successful break above $497 could indicate a bullish breakout, while failure to do so might see QQQ consolidating or pulling back to support levels.

Key Levels to Watch: The support around $481-$485 and the resistance at $493-$497 are critical for QQQ's near-term direction.

IWM 0.00%↑

Key Observations from the Chart:

1. Largest Trades (Colored Circles)

Orange Circles (Sept 27 - Oct 10): Large institutional trades occurred around the $220-$226 range, particularly $220.89 and $226.76, with relative sizes (RS) ranging from 27.38% to 32.63%. These high RS values indicate substantial institutional activity, suggesting this area is a critical resistance zone. The largest trade on Sept 30 at $220.89 with an RS of 32.63% shows significant selling pressure.

Blue Circle (Oct 25): Another large trade occurred recently around $218.89 with a relative size of 31.66%. This trade suggests potential support as institutions are stepping in to buy at lower levels after a pullback.

2. Key Institutional Activity Price Levels (Dashed Blue Lines)

$222.50: This level saw the highest cumulative activity, with $5.6B in trades and a high relative size of 2.55x. Given the volume here, this price serves as a primary resistance level that IWM needs to break for further upside.

$217.60 - $221.70: There was substantial institutional activity in this range, with values between $4.59B and $5.48B. This range is likely to act as support during pullbacks.

3. Volume and Relative Size (RS)

Largest Trade on Sept 30: The trade at $220.89 with an RS of 32.63% is notable, as it represents strong resistance at this price level.

Consistent RS in Recent Trades: The large trade on Oct 25 with an RS of 31.66% around $218.89 shows institutional interest at lower prices, which may provide a support base around this level.

4. Support and Resistance Levels

Support Levels:

$217.60 - $221.70: This zone, with consistent institutional support, is critical for IWM to maintain upward momentum. If it holds, it could provide a strong base for a rebound.

Resistance Levels:

$222.50 - $226.76: These levels serve as significant resistance. The recent large trades around these prices suggest that breaking above $226 will require strong buying momentum to overcome institutional selling pressure.

Conclusion:

Bearish Bias in the Short Term: The recent large trades around $218.89 suggest that institutions are accumulating near this level, likely as support. However, the resistance at $222.50 to $226.76 will be challenging to break without strong bullish momentum.

Key Levels to Watch: Support around $217.60 - $221.70 and resistance at $222.50 - $226.76 will define the near-term direction for IWM.

DIA 0.00%↑

Key Observations from the Chart:

1. Largest Trades (Orange Circles)

Clusters in Early October: Large trades occurred around $421.32 and $423.00 on Sept 26-27 and early October. These trades, with relative sizes (RS) between 5.70% and 11.11%, indicate substantial institutional activity at this price level, suggesting support in this area.

Higher-Level Trades (Oct 17 - Oct 23): Additional significant trades occurred at $429.30 and $432.60, likely marking this range as resistance due to institutional selling. The RS values here, such as 5.09% and 6.01%, highlight a level of distribution near recent highs.

2. Key Institutional Activity Price Levels (Dashed Blue Lines)

$421.40: This level saw the largest amount of activity, with $314M in trades and an RS of 1.60x. Given the trading volume and relative size here, it serves as a critical support level.

$429.30 and $432.60: These levels represent significant resistance points, reinforced by large recent trades. The $429.30 level, in particular, saw a strong concentration of activity, with $268M traded.

3. Volume and Relative Size (RS)

Largest Trade on Oct 1 at $421.40: The trade with an RS of 11.11% shows significant institutional accumulation at this level, solidifying $421.40 as strong support.

Consistent Resistance around $429 - $432: The trades at $429.30 and $432.60 show institutional selling, confirming this range as a likely resistance zone.

4. Support and Resistance Zones

Support Levels:

$421.40: This is the primary support level, heavily supported by institutional activity. If the price drops to this level, it is likely to encounter strong buying interest.

$423.00: Another support area based on consistent institutional trades in this range.

Resistance Levels:

$429.30 - $432.60: This range serves as a significant resistance zone. The volume and distribution seen at these levels indicate that breaking above this area would require strong bullish momentum.

Conclusion:

Neutral to Bearish Bias in the Short Term: The recent institutional trades highlight resistance around $429-$432, making it challenging for DIA to continue upward without significant volume. Support around $421.40 should provide a floor, but any break below this level could signal further downside.

Key Levels to Watch: $421.40 as support and $429.30 - $432.60 as resistance. A break above $432.60 would suggest bullish momentum, while a drop below $421.40 may indicate further bearish pressure.

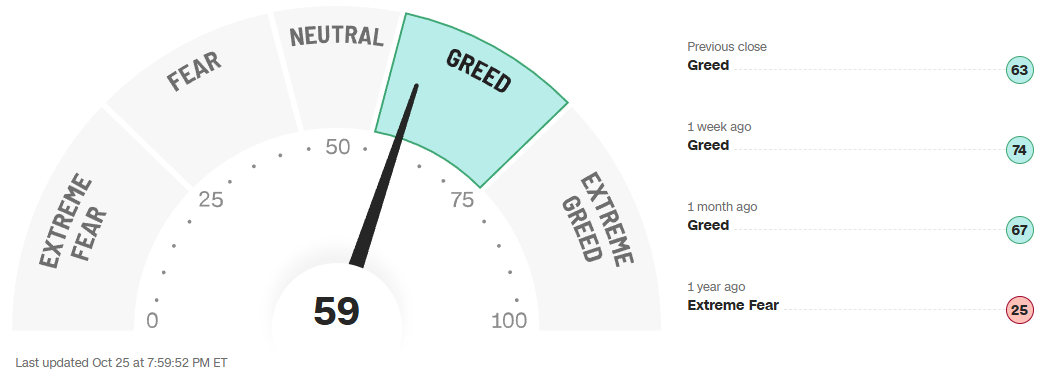

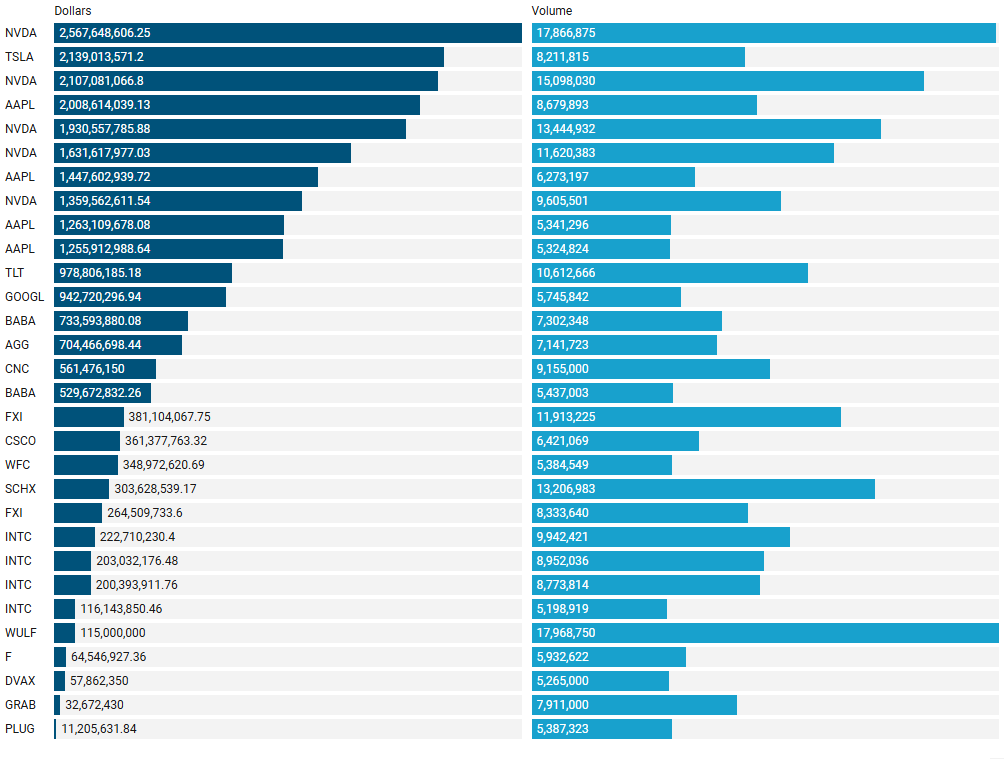

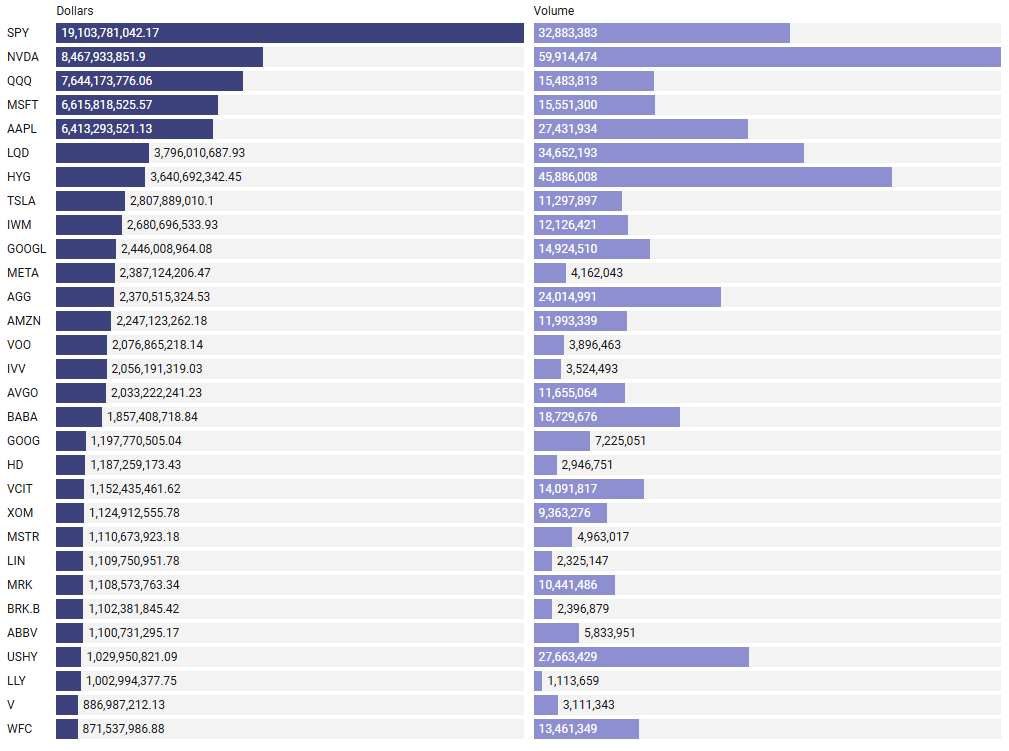

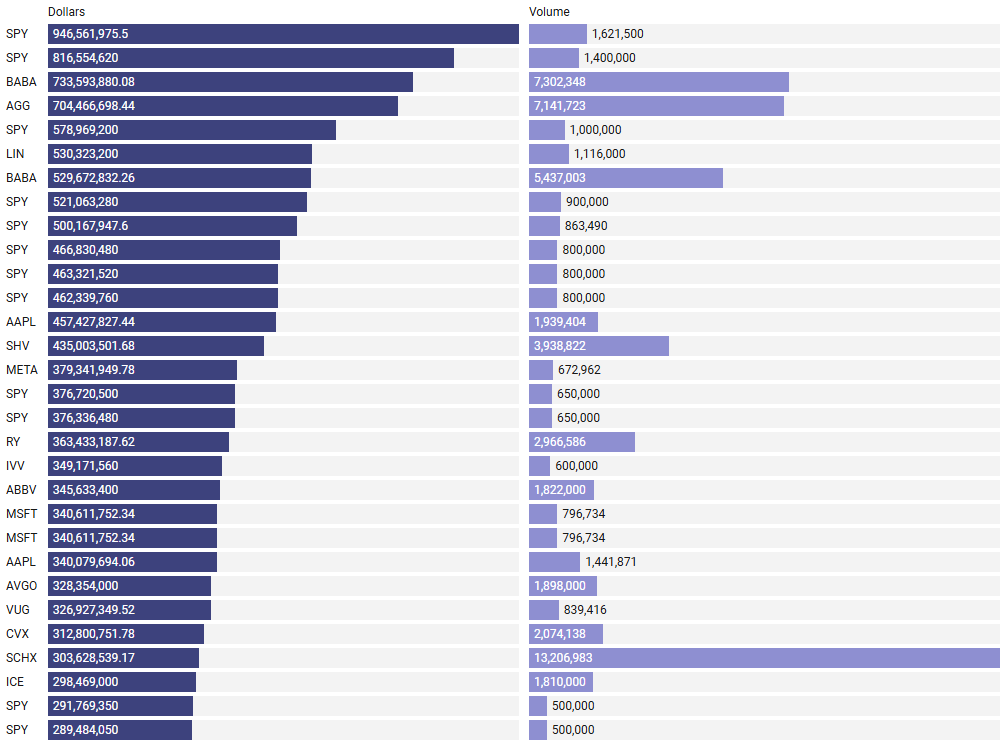

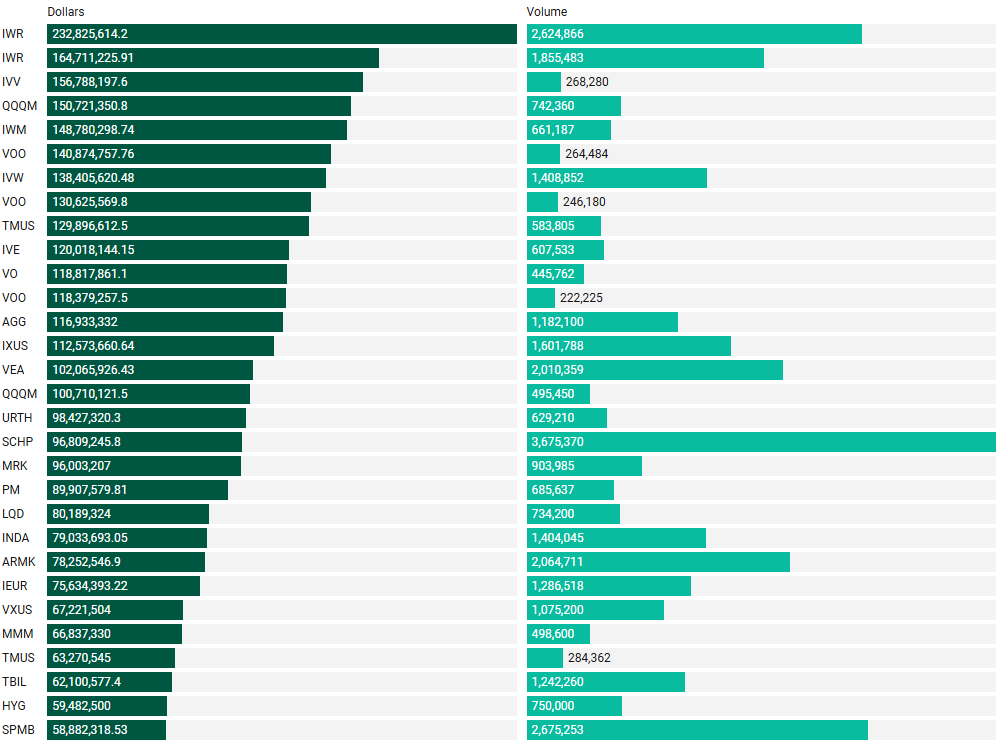

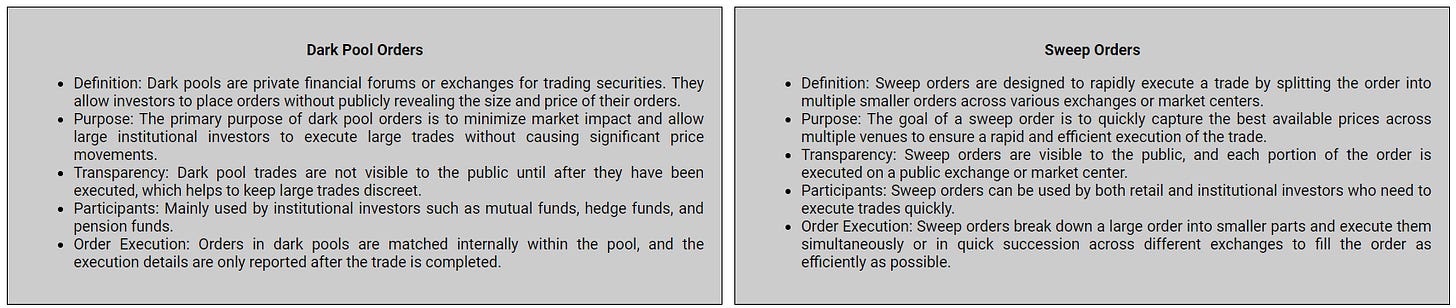

Top Institutional Order Flow

Many excellent trade ideas and sources of inspiration can be found in these prints. While only the top 30 from each group are displayed, the complete results are accessible in VolumeLeaders.com for your convenience to explore at any time. Remember to configure trade alerts within the platform to ensure you never overlook institutional order flows that capture your interest or are significant to you. The blue charts encompass all types of trades, including blocks on lit exchanges; the purple charts exclusively depict dark pool trades; and the green charts represent sweeps only.

Top Aggregate Dollars Transacted by Ticker

Largest Individual Trades by Dollars Transacted

Top Aggregate Dark Pool Activity by Ticker

Largest Individual Dark Pool Blocks by Dollars

Top Aggregate Sweeps by Ticker

Top Individual Sweeps by Dollars Transacted

Investments In Focus: Bull vs Bear Arguments

Please read “Institutional S/R Levels For Major Indices” at the top of this stack to understand the nature and importance of what we’re looking at here visually. Institutions leave footprints that VolumeLeaders.com can illustrate for you while providing context to assess things like institutional conviction and urgency. Theses and data given below are not financial advice, just personal observations that may be wrong; consult a certified financial advisor before making any investment decisions.

BABA 0.00%↑

🐂 Bull Thesis for BABA 0.00%↑ 🐂

Robust E-commerce Presence: Alibaba dominates the e-commerce market in China through platforms like Taobao and Tmall, with a substantial market share and a massive, loyal user base. This entrenched position provides a strong revenue base and growth opportunities in e-commerce.

Cloud Computing Growth: Alibaba Cloud is a leader in Asia’s cloud market, and despite competition, it continues to expand its market share and revenue. The company’s cloud division is positioned to benefit from the global shift towards digital transformation, providing a promising long-term growth catalyst.

Domestic Consumption Trends: China's government has been encouraging domestic consumption and economic independence, which could boost demand on Alibaba’s platforms. With a strong presence in the local market, Alibaba is well-positioned to capitalize on this trend.

International Expansion: Alibaba’s efforts to expand internationally, particularly in Southeast Asia with Lazada, position the company to capture growing digital markets outside of China. Success in these regions could help diversify revenue and reduce reliance on the domestic market.

Strong Financial Position: Alibaba’s solid balance sheet and cash reserves provide it with the flexibility to make strategic investments, innovate, and withstand economic or regulatory pressures while maintaining growth in core areas.

🐻 Bear Thesis for BABA 0.00%↑ 🐻

Regulatory Risks: Alibaba continues to face significant regulatory pressures from Chinese authorities, including antitrust scrutiny and data privacy concerns. These challenges could impact its growth, increase compliance costs, and limit its market dominance.

Intense Competition: Rival companies like JD.com, Pinduoduo, and even ByteDance’s e-commerce ventures are rapidly gaining market share. Heightened competition could pressure Alibaba’s margins, especially in the face of aggressive pricing and customer acquisition strategies by competitors.

Slowing Economic Growth in China: China’s economic slowdown and fluctuating consumer confidence can impact consumer spending, affecting Alibaba’s core e-commerce business. Reduced consumer spending could lead to slower growth in its key domestic market.

Dependence on China’s Market: Alibaba’s reliance on the Chinese economy and domestic market limits its revenue diversification. Economic or political changes within China directly impact the company’s operations and revenue streams.

Investment in Non-Core Businesses: Alibaba’s extensive investments in less profitable businesses, such as media and entertainment, have yet to deliver meaningful returns. This capital allocation strategy raises concerns about profitability and could weigh on the company’s overall financial performance.

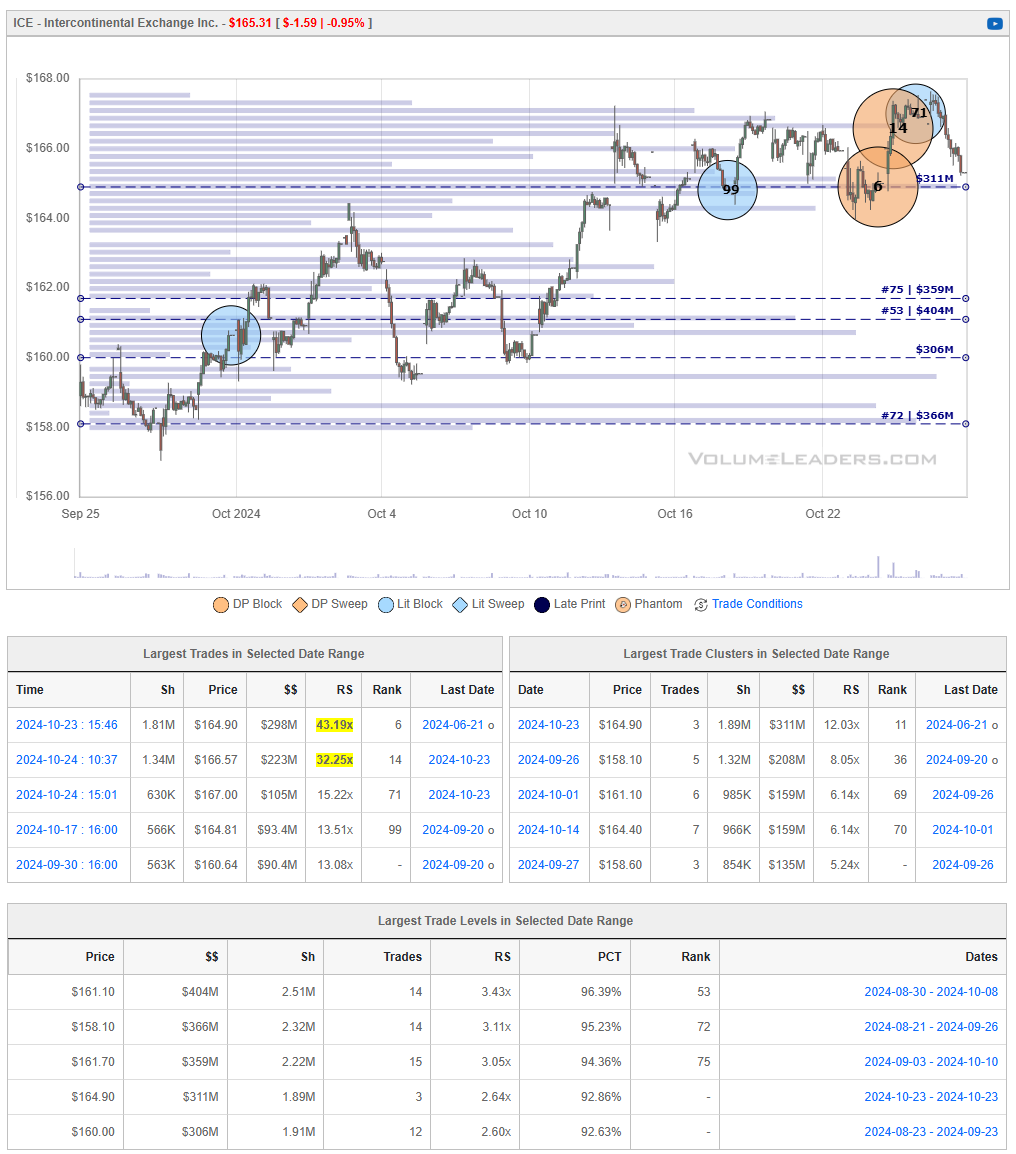

ICE 0.00%↑

🐂 Bull Thesis for ICE 0.00%↑ 🐂

Diverse Revenue Streams: ICE has a diversified business model across data services, exchanges, and mortgage technology, which helps mitigate risks from any single segment. This multi-pronged approach also provides steady growth and revenue stability.

Growing Demand for Data Services: With the increasing importance of data in financial markets, ICE’s robust data and analytics services are in high demand. This segment is a major growth driver, especially as more institutions prioritize data-driven strategies.

Mortgage Technology Expansion: ICE’s acquisition of Ellie Mae has strengthened its mortgage technology arm, giving it a foothold in the digital mortgage ecosystem. The continued shift toward digital mortgage solutions presents significant growth potential in the coming years.

Strategic Acquisitions: ICE has a strong track record of acquisitions that strategically enhance its capabilities and market share, such as the New York Stock Exchange. These acquisitions add both scale and scope, giving ICE an edge in various financial services.

Resilience in Economic Downturns: As a global exchange operator, ICE benefits from high trading volumes and market activity, even in volatile markets, providing a degree of recession resilience due to increased trading demand during downturns.

🐻 Bear Thesis for ICE 0.00%↑ 🐻

Heavy Dependence on Market Volatility: A significant portion of ICE’s revenue is generated through trading activity, which can fluctuate based on market conditions. Lower volatility periods could impact revenue negatively if trading volumes decrease.

Regulatory Pressures: ICE operates in a highly regulated industry, and potential changes in financial regulations, particularly around trading and clearinghouses, could limit its business operations or increase compliance costs.

Mortgage Market Risks: While mortgage technology is a growth area, ICE’s exposure to the mortgage industry poses a risk during periods of economic downturn or rising interest rates, which can reduce mortgage origination volumes and impact revenue from this segment.

Intense Competition in Data Services: ICE’s data services face competition from major players like Bloomberg and Refinitiv, which have strong footholds in financial data. This competition could lead to margin pressure or limit ICE’s growth in the data services space.

Execution Risks with Acquisitions: While acquisitions have been a strength for ICE, the risk of overpaying or failing to integrate these assets remains. Any missteps in its acquisition strategy, particularly in the mortgage technology space, could negatively impact its financial performance.

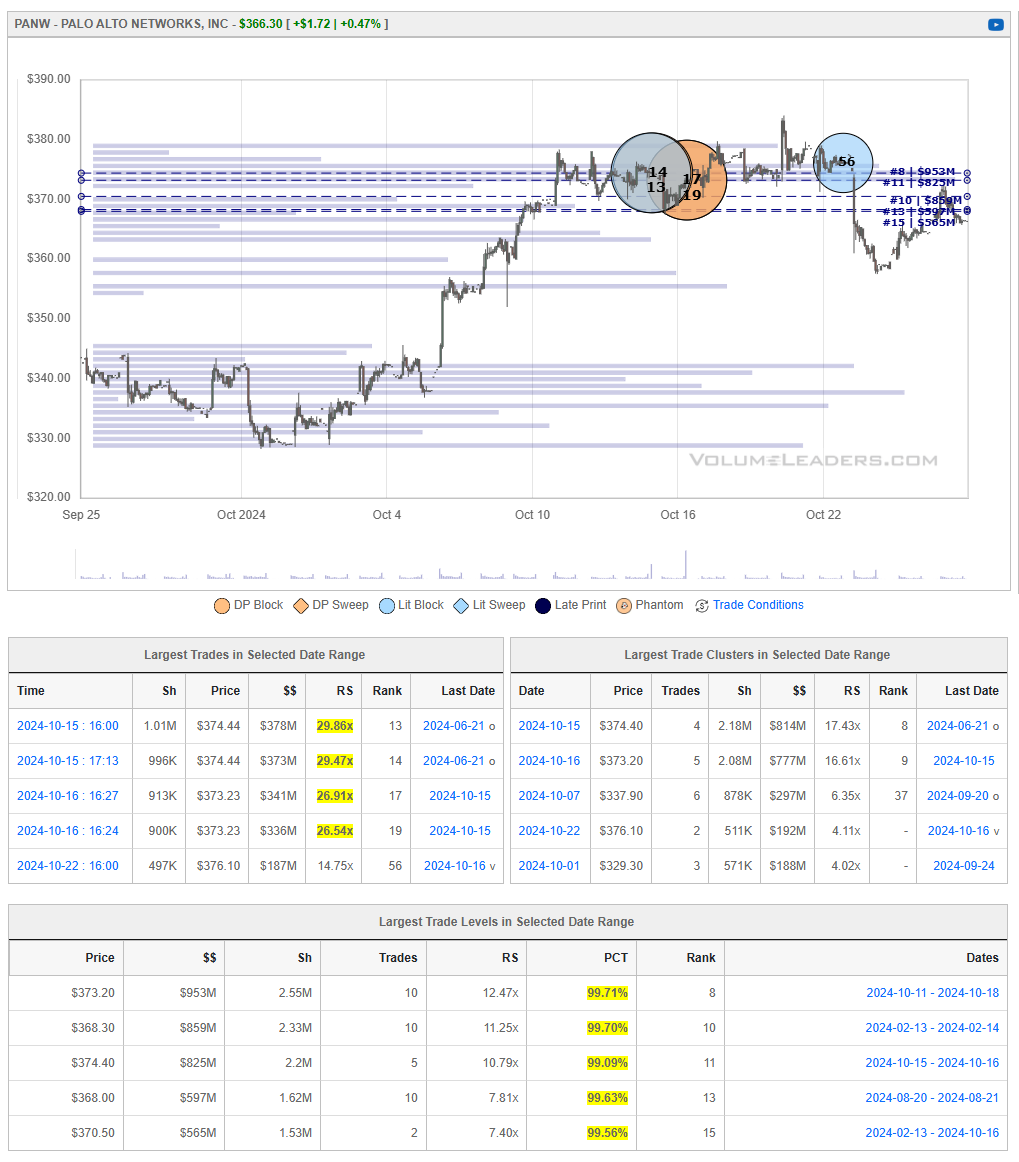

PANW 0.00%↑

🐂 Bull Thesis for PANW 0.00%↑ 🐂

Leading Position in Cybersecurity: Palo Alto Networks is a market leader in cybersecurity, with a broad portfolio of products covering network security, cloud security, and endpoint protection. This dominant position supports strong brand recognition and market trust.

Growing Demand for Cybersecurity Solutions: With increasing cyber threats and regulations worldwide, demand for cybersecurity solutions continues to rise. Palo Alto is well-positioned to benefit from heightened cybersecurity spending by governments and enterprises alike.

Strong Focus on Cloud and AI Integration: PANW’s Prisma Cloud and Cortex platforms leverage AI to enhance threat detection and response. These innovations keep Palo Alto Networks competitive in a rapidly evolving field, where cloud-native and AI-based solutions are increasingly valued.

Recurring Revenue Model: The company’s focus on subscription-based services has led to a higher proportion of recurring revenue, which provides cash flow stability and increases customer retention.

Aggressive M&A Strategy: PANW’s strategy of acquiring innovative startups has expanded its product portfolio and strengthened its market presence in high-growth areas like cloud security, endpoint protection, and artificial intelligence.

🐻 Bear Thesis for PANW 0.00%↑ 🐻

High Valuation and Growth Expectations: PANW trades at a high valuation relative to its peers, largely based on expected growth. If it fails to meet these growth expectations, there is a risk of a significant stock price correction.

Intense Competition in Cybersecurity: The cybersecurity market is highly competitive, with players like CrowdStrike, Fortinet, and Cisco competing for market share. Increased competition could pressure margins and reduce PANW’s market share over time.

Dependence on Acquisitions for Growth: While acquisitions have fueled growth, reliance on M&A for expansion carries integration risks and can dilute shareholder value if acquisitions do not deliver expected synergies or financial returns.

Macroeconomic Sensitivity: The tightening of enterprise budgets during economic downturns could reduce spending on cybersecurity, affecting PANW’s revenue. Companies may delay upgrades or expansions in challenging economic climates.

Complex Product Portfolio Integration: PANW’s broad product portfolio, while advantageous, can be challenging to integrate into seamless solutions for clients. This complexity could impact client satisfaction, retention, and the effectiveness of the solutions provided.

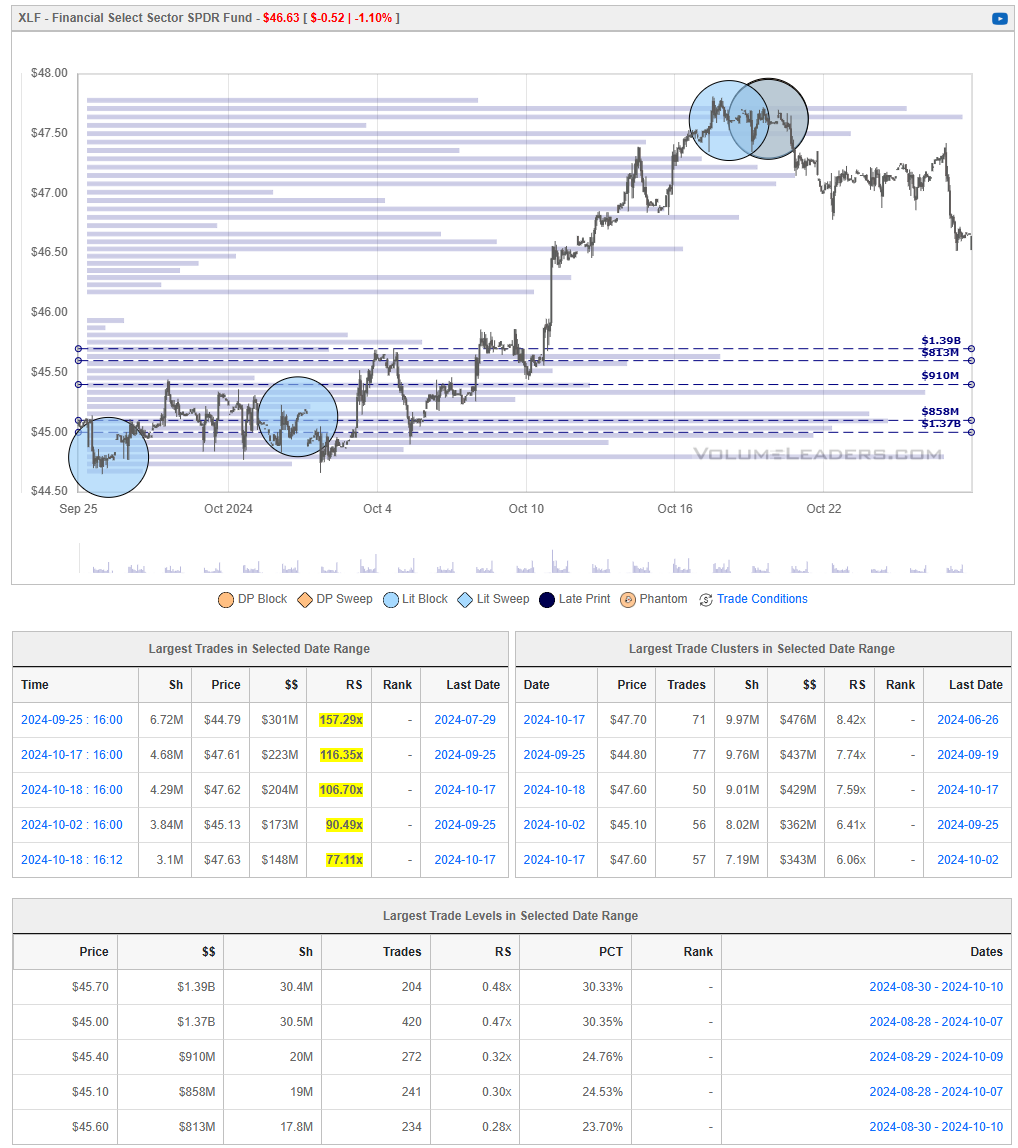

XLF 0.00%↑

🐂 Bull Thesis for XLF 0.00%↑ 🐂

Interest Rate Tailwinds: Financial institutions, especially banks, benefit from rising interest rates, which improve net interest margins and profitability. Higher rates could boost earnings across the sector, benefitting XLF’s holdings.

Economic Recovery Potential: XLF’s performance is closely tied to the broader economy. Economic growth and recovery post-recessionary pressures could lead to increased lending, capital market activity, and improved profitability for financial companies in the fund.

Diverse Holdings Across Financial Services: XLF includes major banks, insurance companies, asset managers, and other financial firms, providing diversified exposure to different financial services segments and reducing the risk associated with individual stocks.

Dividend Payouts: Many financial institutions pay steady dividends, which can be attractive to income-focused investors, especially in a fund like XLF. This dividend income can provide a buffer during periods of market volatility.

Resilience to Market Volatility: Financial institutions often see increased trading volumes during periods of volatility, which can boost trading revenue for investment banks, a component of XLF’s holdings.

🐻 Bear Thesis for XLF 0.00%↑ 🐻

Recession Risk: The financial sector is highly cyclical and can be vulnerable during economic downturns. A recession or economic slowdown could lead to reduced loan demand, higher credit losses, and declining asset values for banks and insurers in the fund.

Exposure to Regulatory Pressures: Financial institutions are subject to heavy regulatory scrutiny, which can limit profit potential and increase compliance costs. New regulations or increased oversight could particularly impact large banks within XLF.

Interest Rate Sensitivity: While rising rates can boost margins, rapid or unexpected rate hikes could also dampen loan demand and lead to higher default rates. Additionally, declining rates would hurt net interest margins, impacting profits for core holdings like banks.

Banking Sector Competition and Margin Pressure: With the rise of fintech and digital-only financial services, traditional financial institutions are facing increased competition, potentially pressuring fees and reducing revenue growth.

Potential Credit and Default Risks: Higher rates and economic uncertainty can lead to an increase in non-performing loans and defaults. This credit risk could adversely affect banks and other financial institutions in XLF, especially if consumer or corporate debt levels become unsustainable.

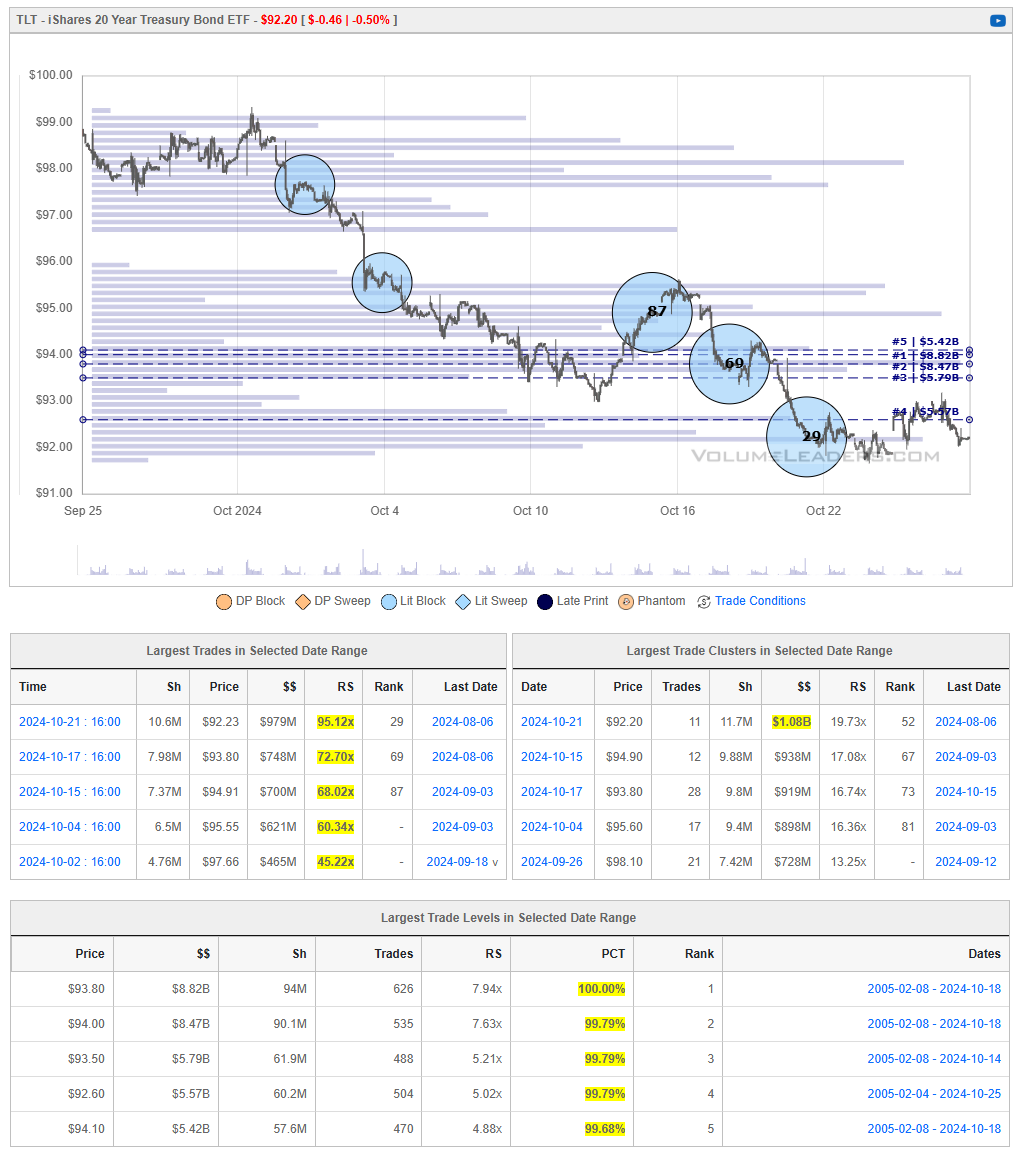

TLT 0.00%↑

🐂 Bull Thesis for TLT 0.00%↑ 🐂

Safe-Haven Appeal: TLT provides exposure to long-term U.S. Treasuries, which are often seen as a safe-haven asset. During periods of economic uncertainty or market volatility, demand for long-term Treasuries tends to increase, driving bond prices higher.

Rate Cut Potential: If the Federal Reserve begins cutting interest rates to stimulate the economy, long-term Treasury bond prices typically rise, which would positively impact TLT. The fund benefits from an inverse relationship between bond prices and interest rates.

Diversification Benefit: TLT offers diversification within a portfolio, as long-term Treasuries often have a low or negative correlation with stocks. This feature can help reduce overall portfolio risk and volatility, particularly during stock market downturns.

Yield Curve Benefits in Recessions: In a recessionary environment, the yield curve often inverts, making longer-term bonds more attractive relative to shorter-term bonds. This situation can increase demand for long-duration Treasury exposure, benefiting TLT.

Attractive for Income Investors: TLT provides a relatively stable income through its exposure to U.S. government bonds, appealing to income-focused investors looking for safe yield sources outside of equities.

🐻 Bear Thesis for TLT 0.00%↑ 🐻

Interest Rate Sensitivity: TLT is highly sensitive to changes in interest rates. If the Federal Reserve continues to raise rates or if inflation remains high, long-term bond prices could fall, negatively impacting the ETF's performance.

Inflation Risk: Rising inflation erodes the purchasing power of fixed-income returns, making long-term Treasuries less attractive. If inflation remains elevated, real returns for investors in TLT could be negative, reducing the fund’s appeal.

Opportunity Cost with Higher-Yield Alternatives: As rates rise, other fixed-income assets or shorter-duration bonds may offer competitive or better yields than long-term Treasuries, which could lead investors to rotate out of TLT.

Duration Risk: TLT’s focus on long-term bonds means it has a high duration, making it highly sensitive to even minor changes in interest rates. This high duration amplifies losses when rates increase, adding significant risk for investors.

Deficit and Debt Concerns: Increasing U.S. government debt and deficits could pressure Treasury prices if investors begin to demand higher yields for long-term bonds to compensate for rising debt levels. This scenario could impact TLT’s performance if bond yields increase to reflect higher credit risk.

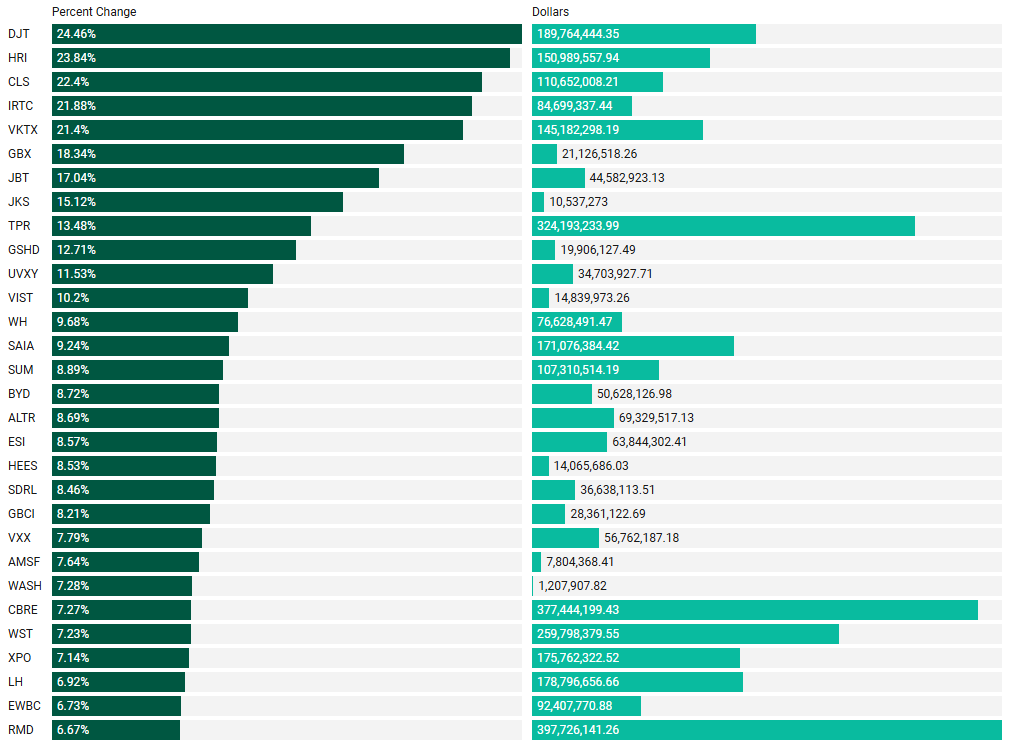

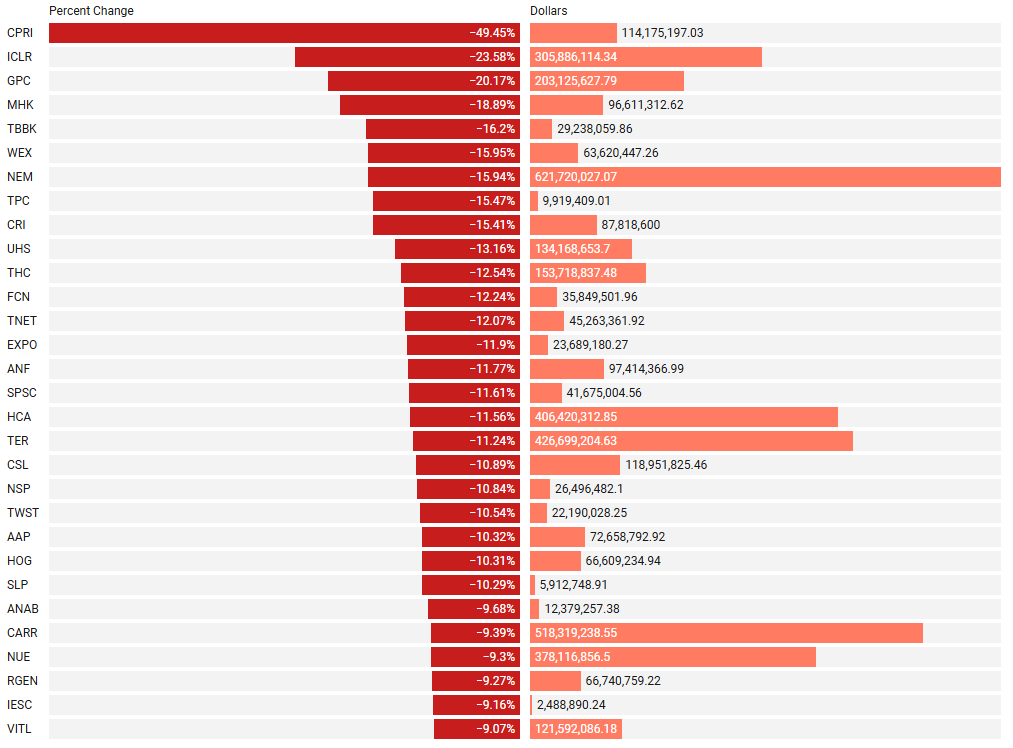

Institutionally-Backed Gainers & Losers

If you’re going to bet on a horse, consider one that is officially endorsed by an institution! These are the top percent gainers (green) and percent losers (red) from this week’s open-to-close that had a trade price greater than $20 and institutional involvement. Continue watching tickers from prior stacks as these frequently turn into multi-leg trades with a lot of movement!

Top Institutionally Backed Gainers

Top Institutionally Backed Losers

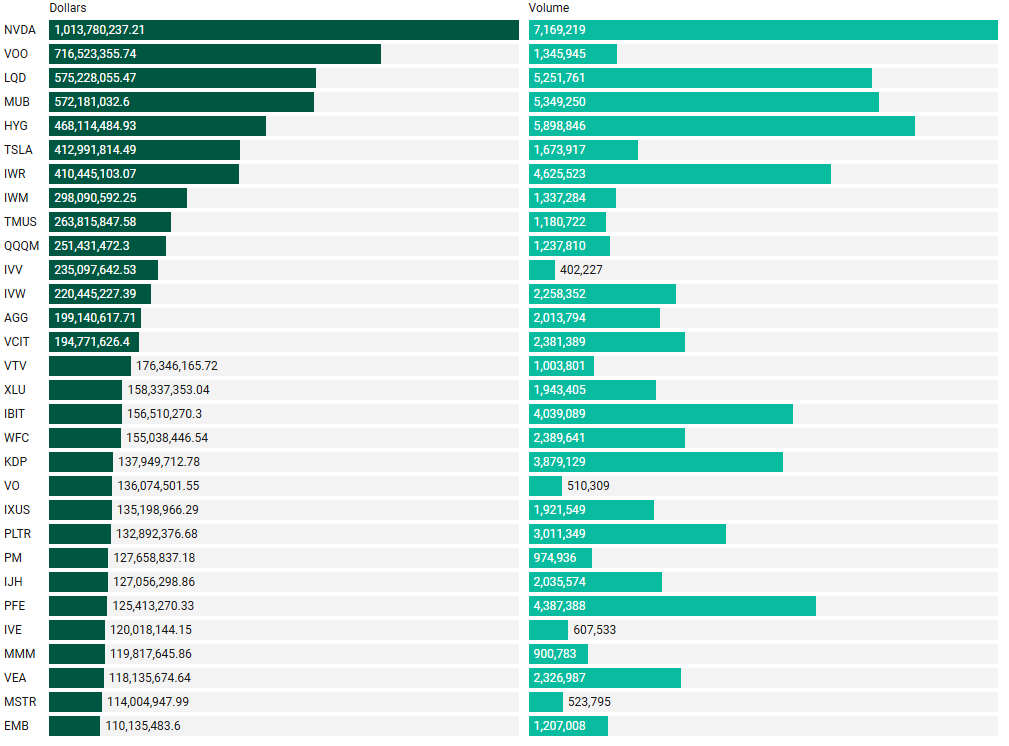

Billion Dollar Prints

Tickers that printed a trade worth at least $1B last week get a special shout-out… Welcome to the club. Subs should login to VolumeLeaders.com to get the exact trade price and relevant institutional levels around the trade - these are massive commitments by institutions that should not be ignored.

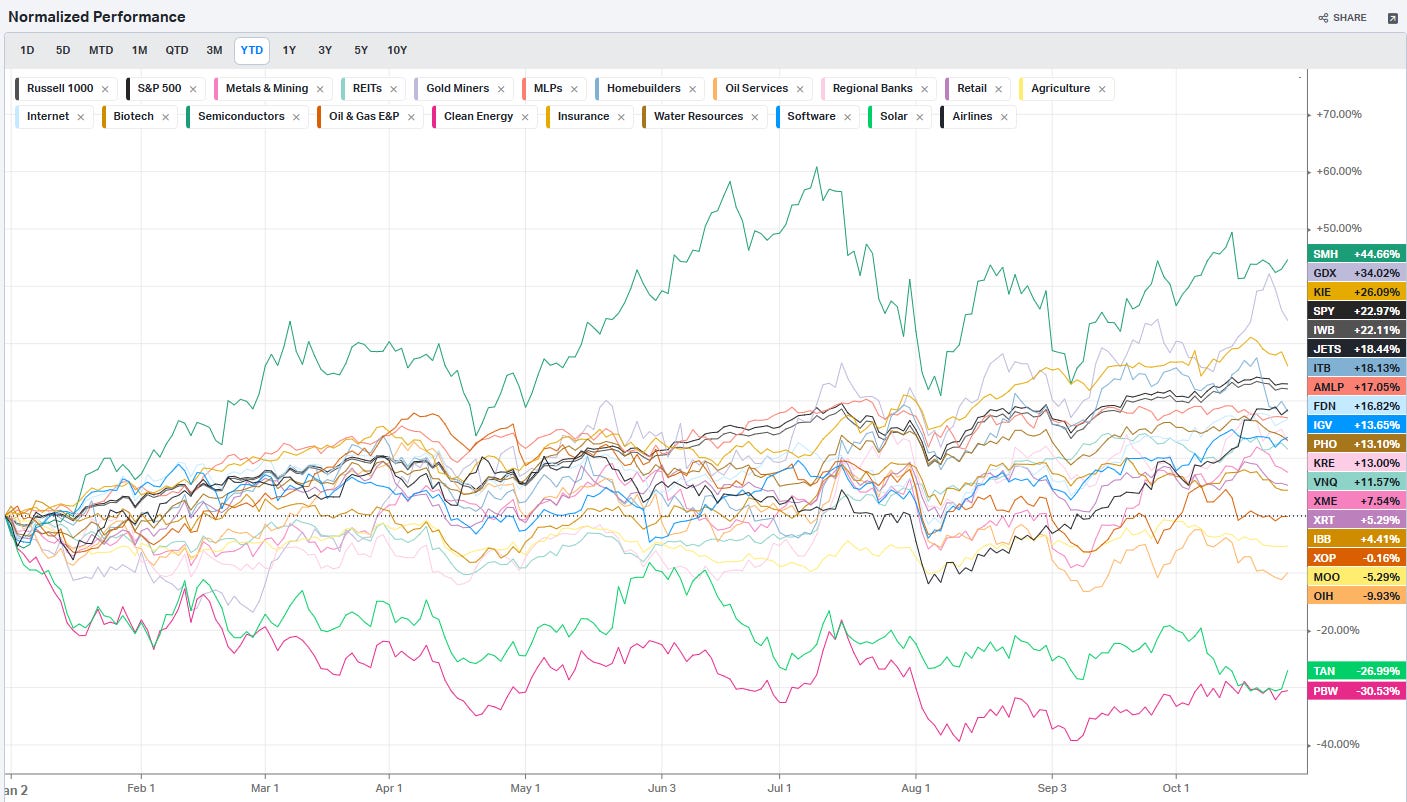

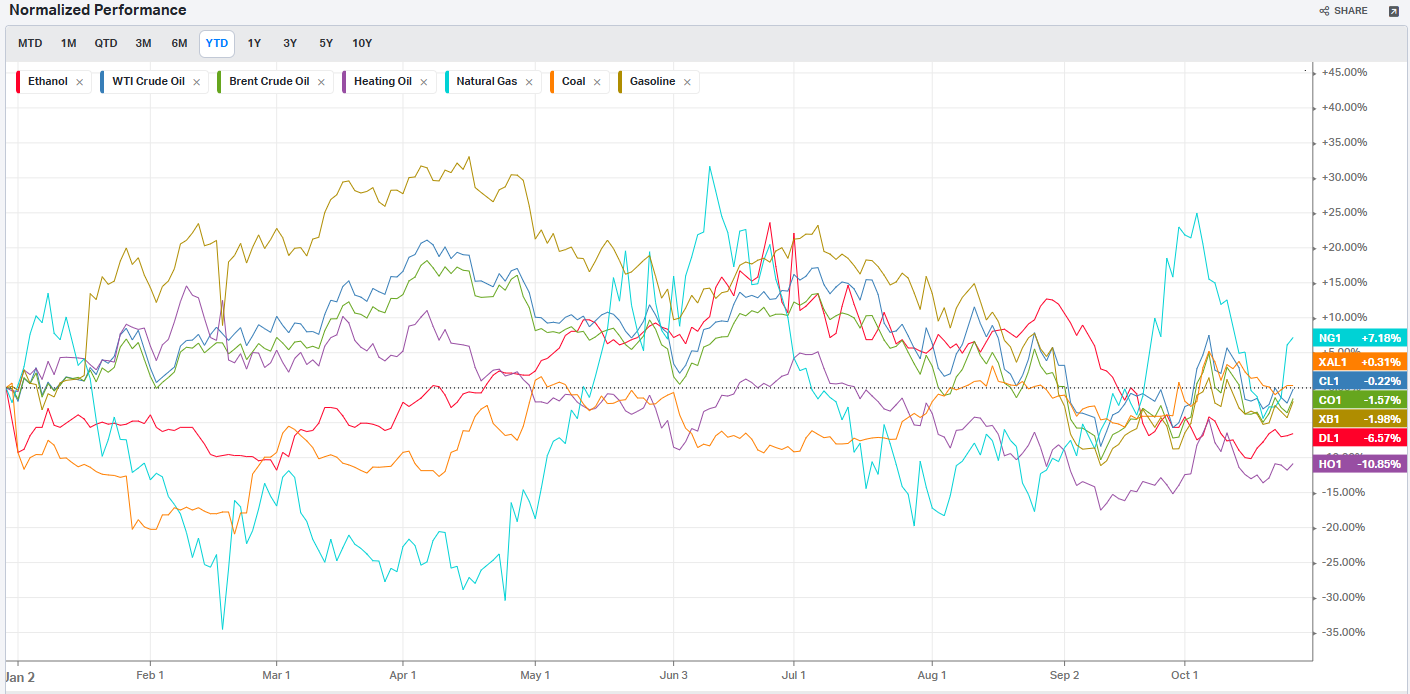

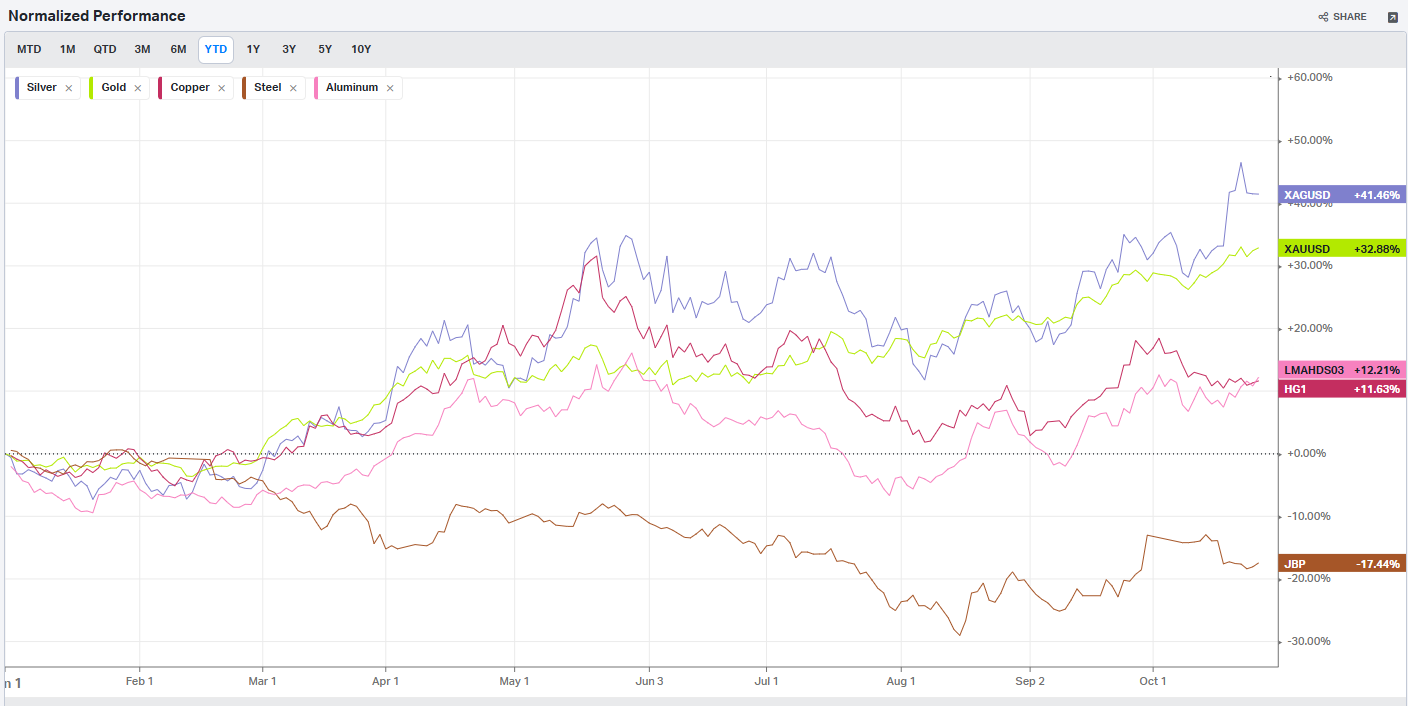

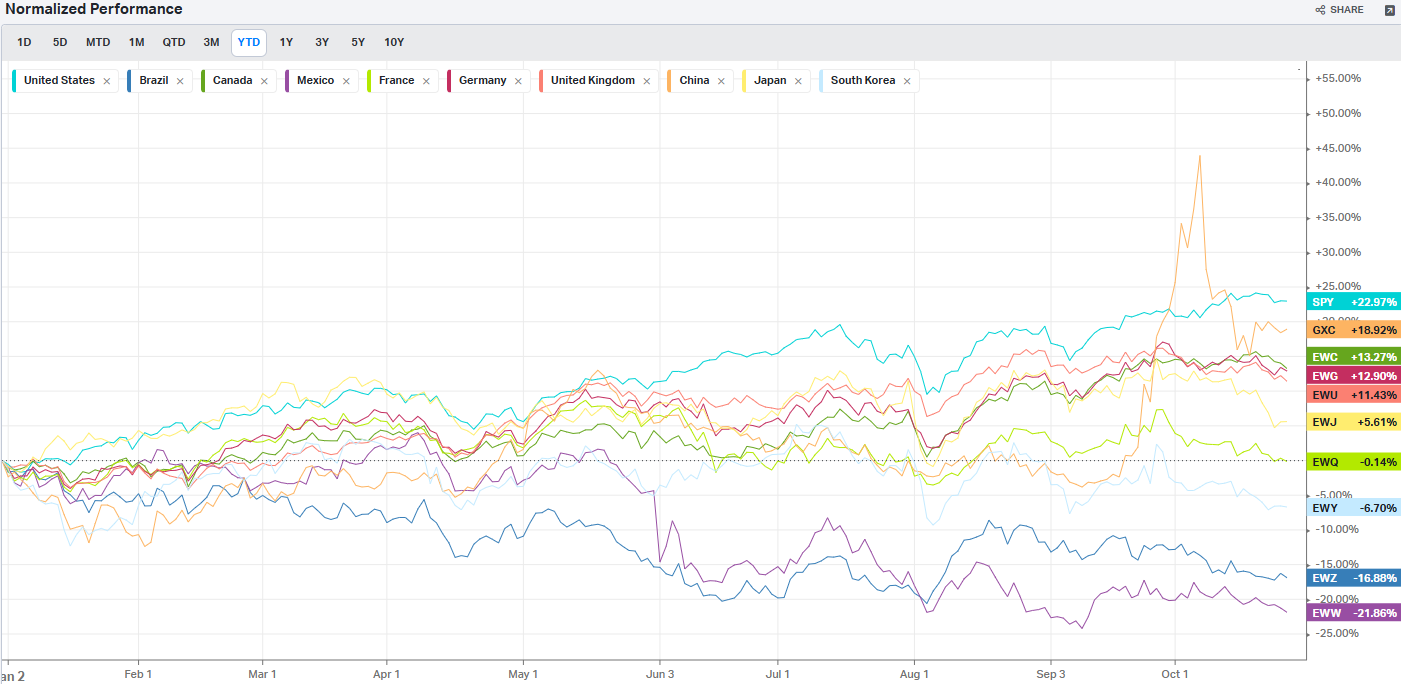

Summary Of Thematic Performance YTD

VolumeLeaders.com provides a lot of pre-built filters for thematics so that you can quickly dive into specific areas of the market. These performance overviews are provided here only for inspiration. Consider targeting leaders and/or laggards in the best and worst sectors, for example.

S&P By Sector

S&P By Industry

Commodities: Energy

Commodities: Metals

Commodities: Agriculture

Country ETFs

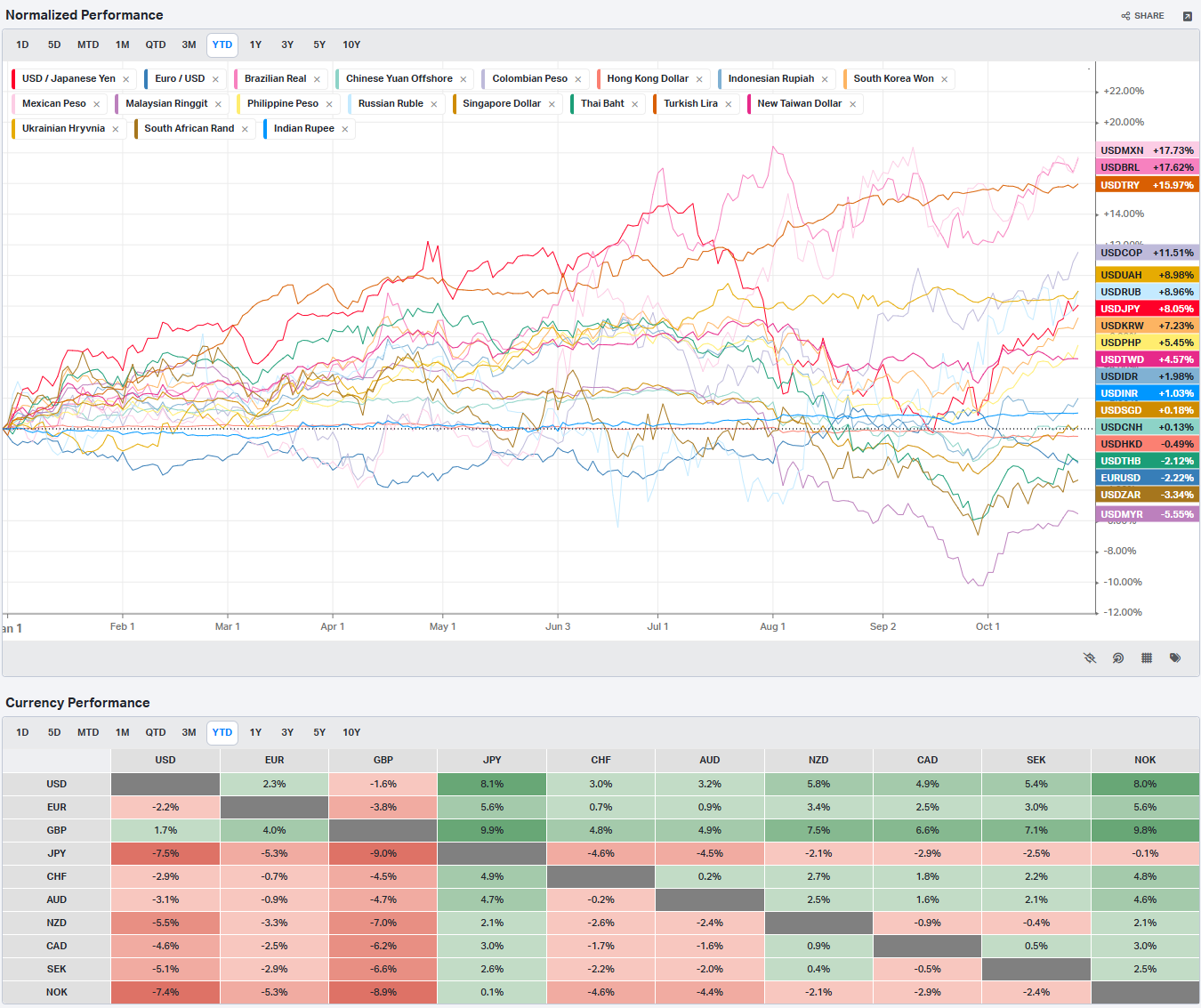

Currencies

Global Yields

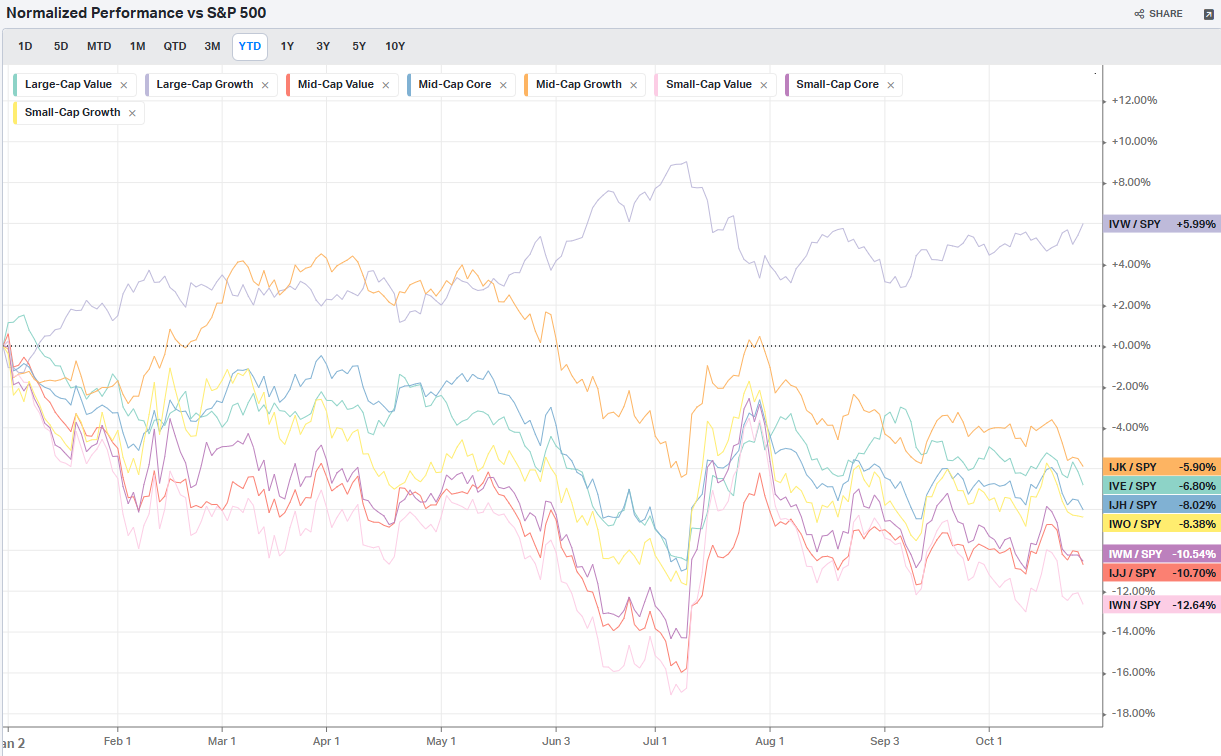

Factors: Size vs Value

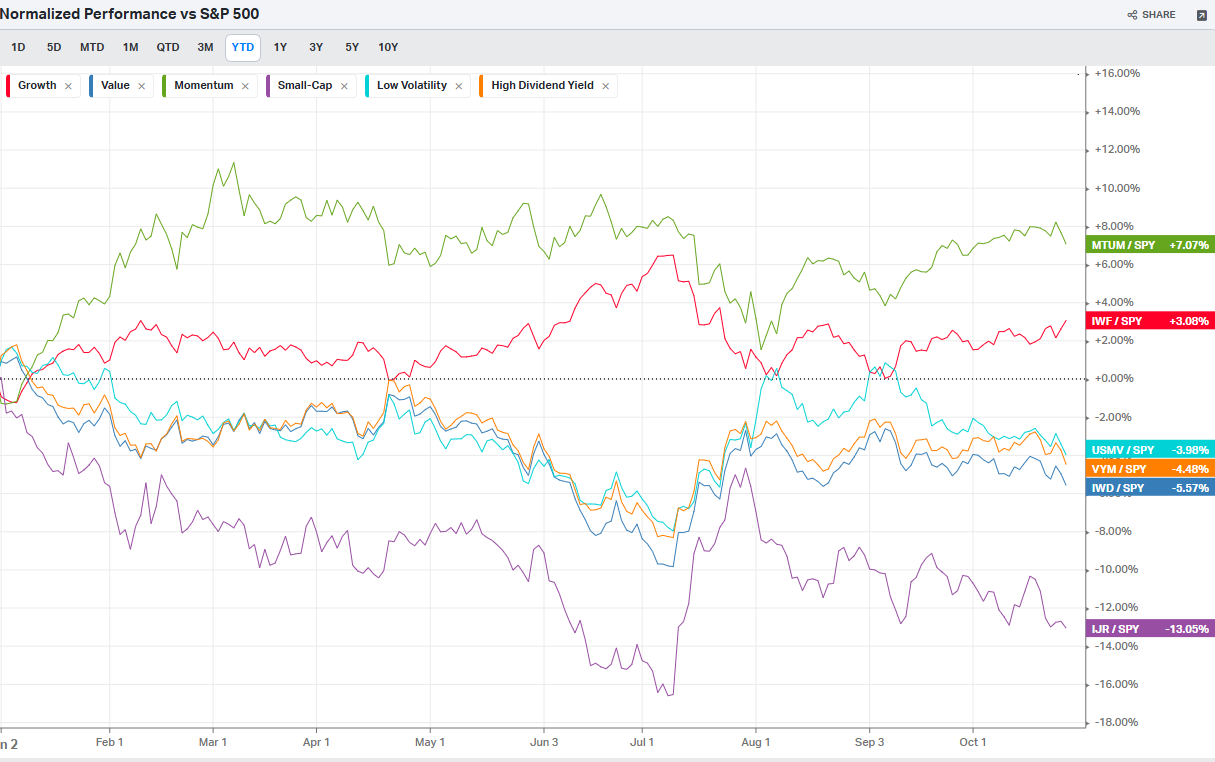

Factors: Style

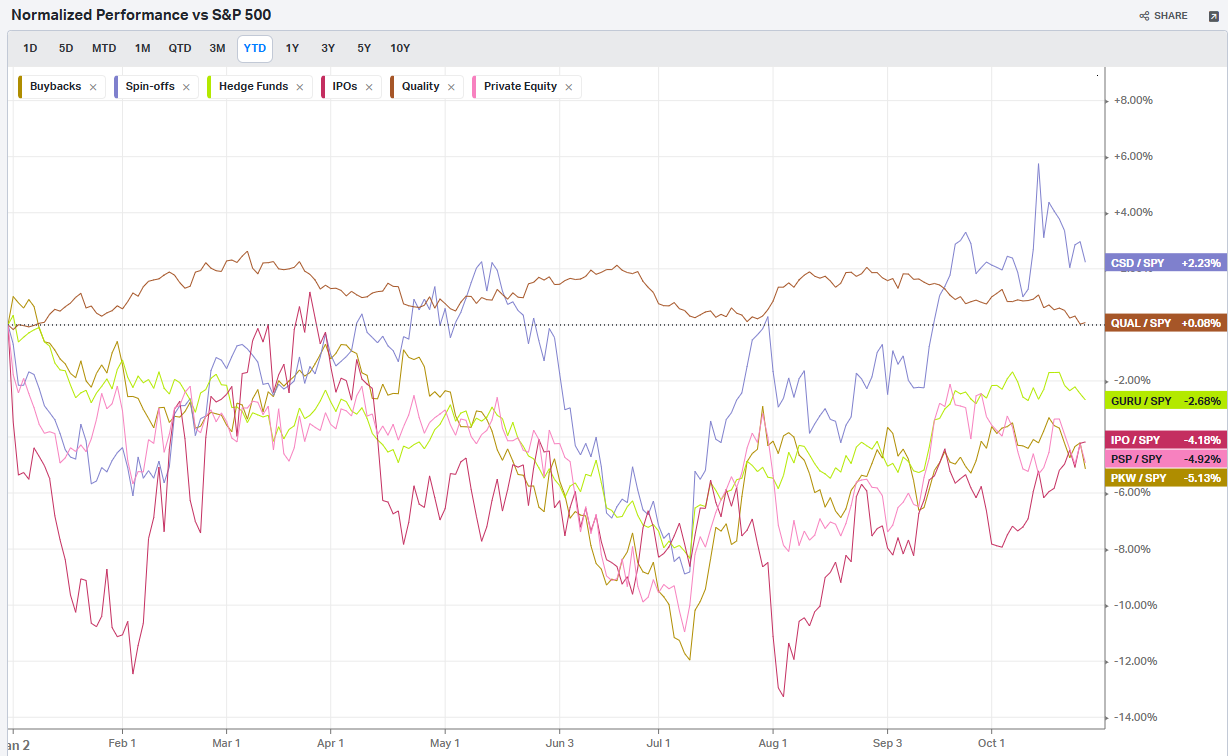

Factors: Qualitative

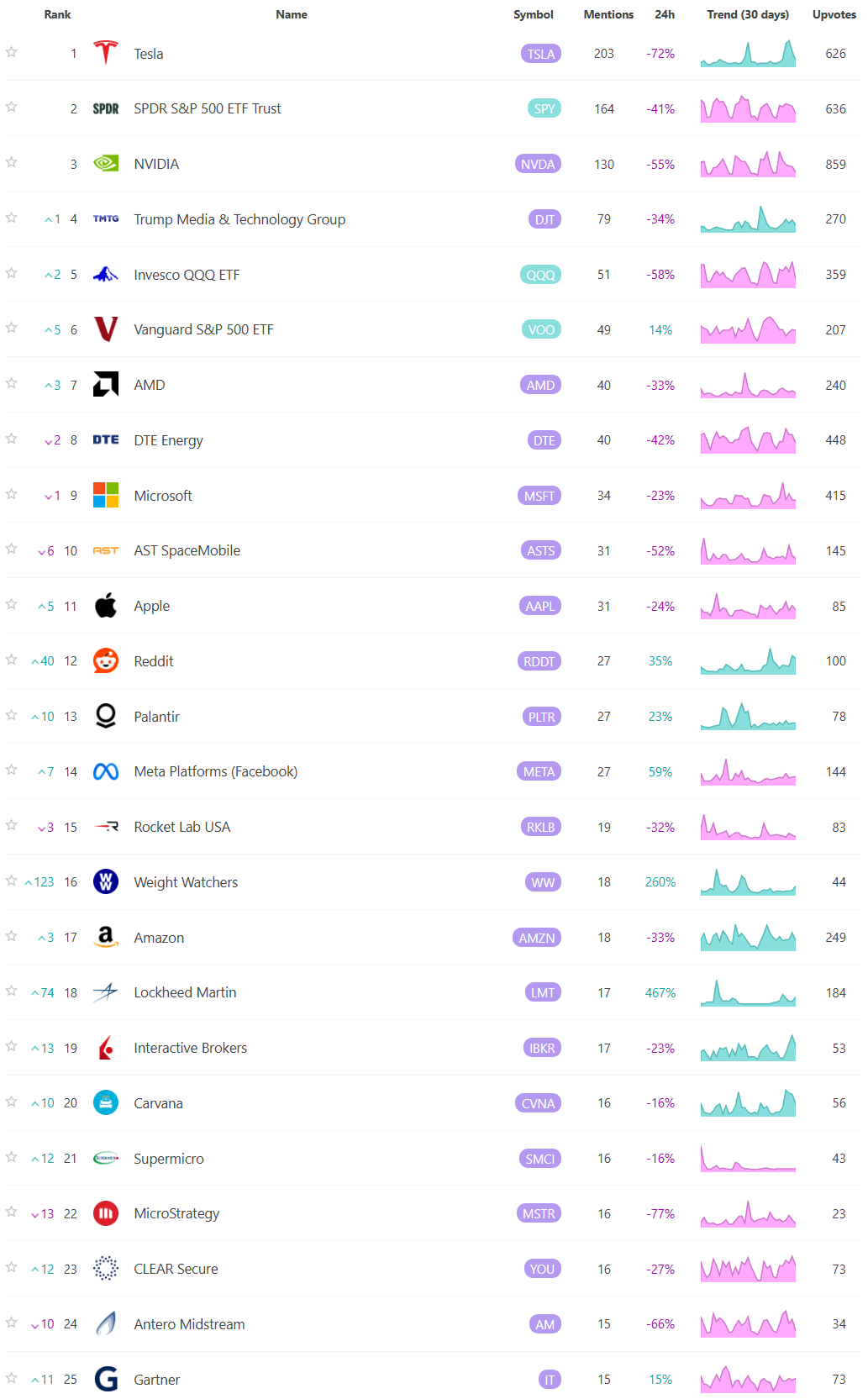

Social Media Favs

Most mentioned/discussed tickers on Reddit from some of the most active Subreddits for trading:

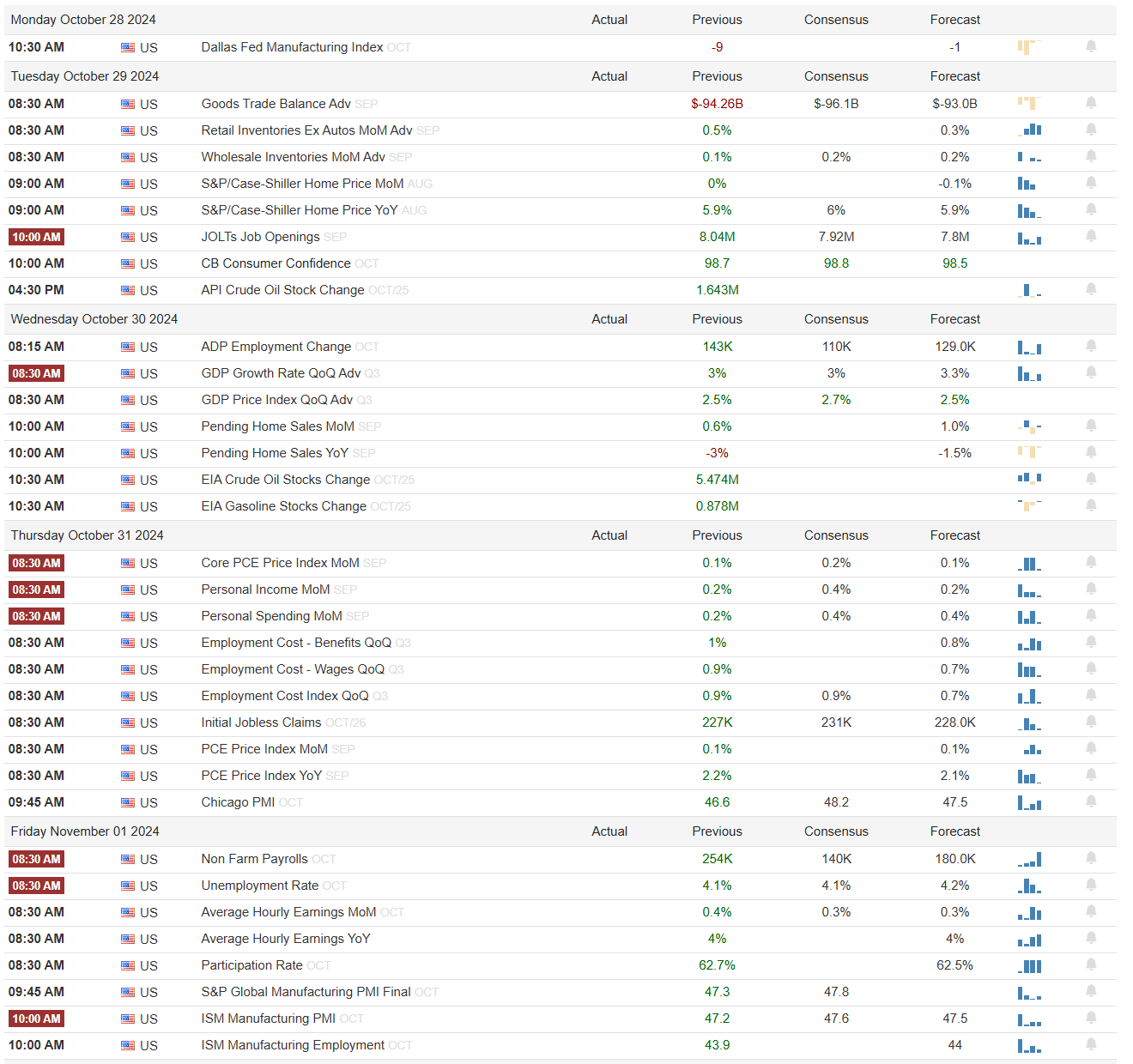

Events On Deck This Week

Here are key events happening this week that have the potential to cause outsized moves in the market or heightened short-term volatility.

Econ Events By Day of Week

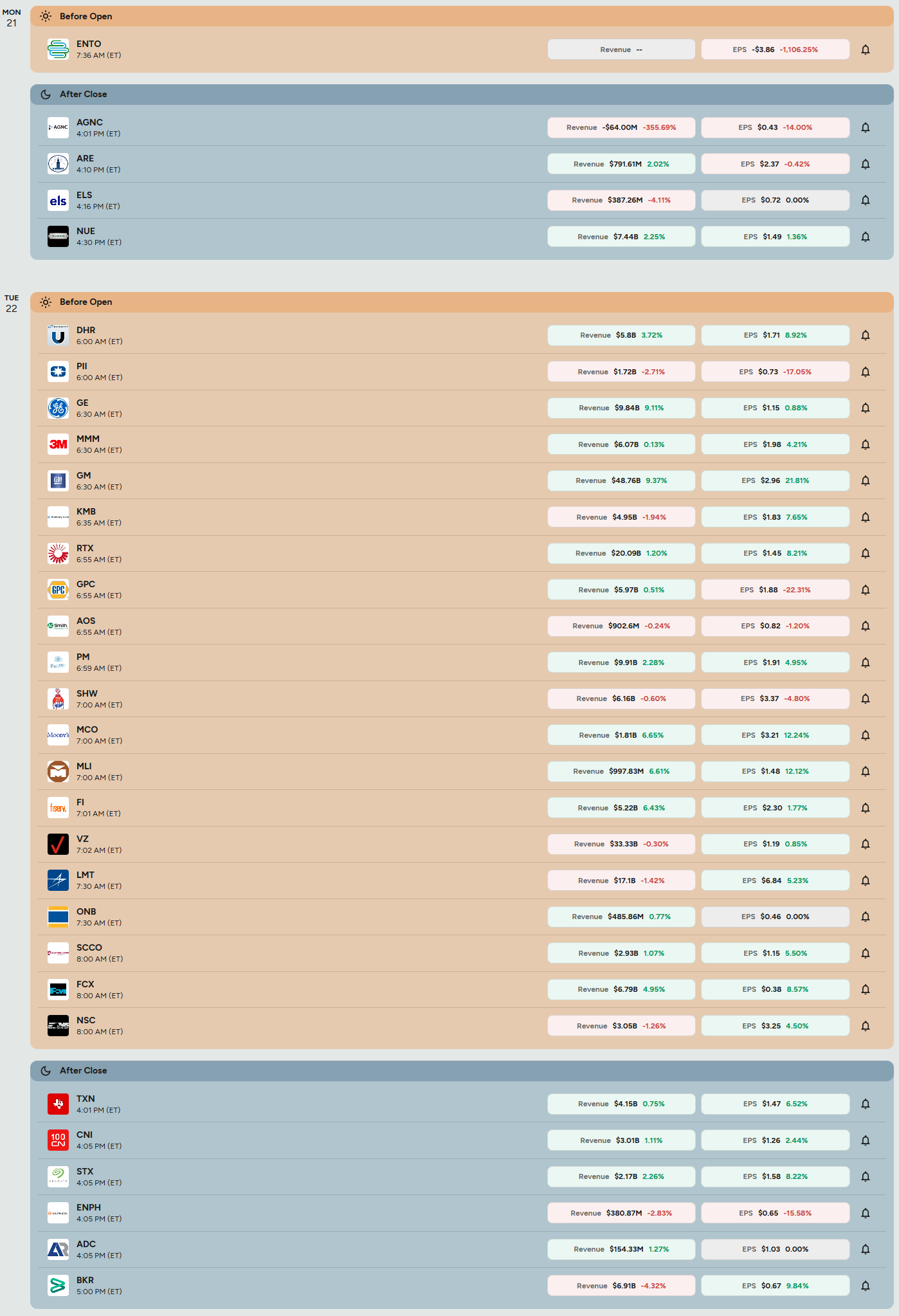

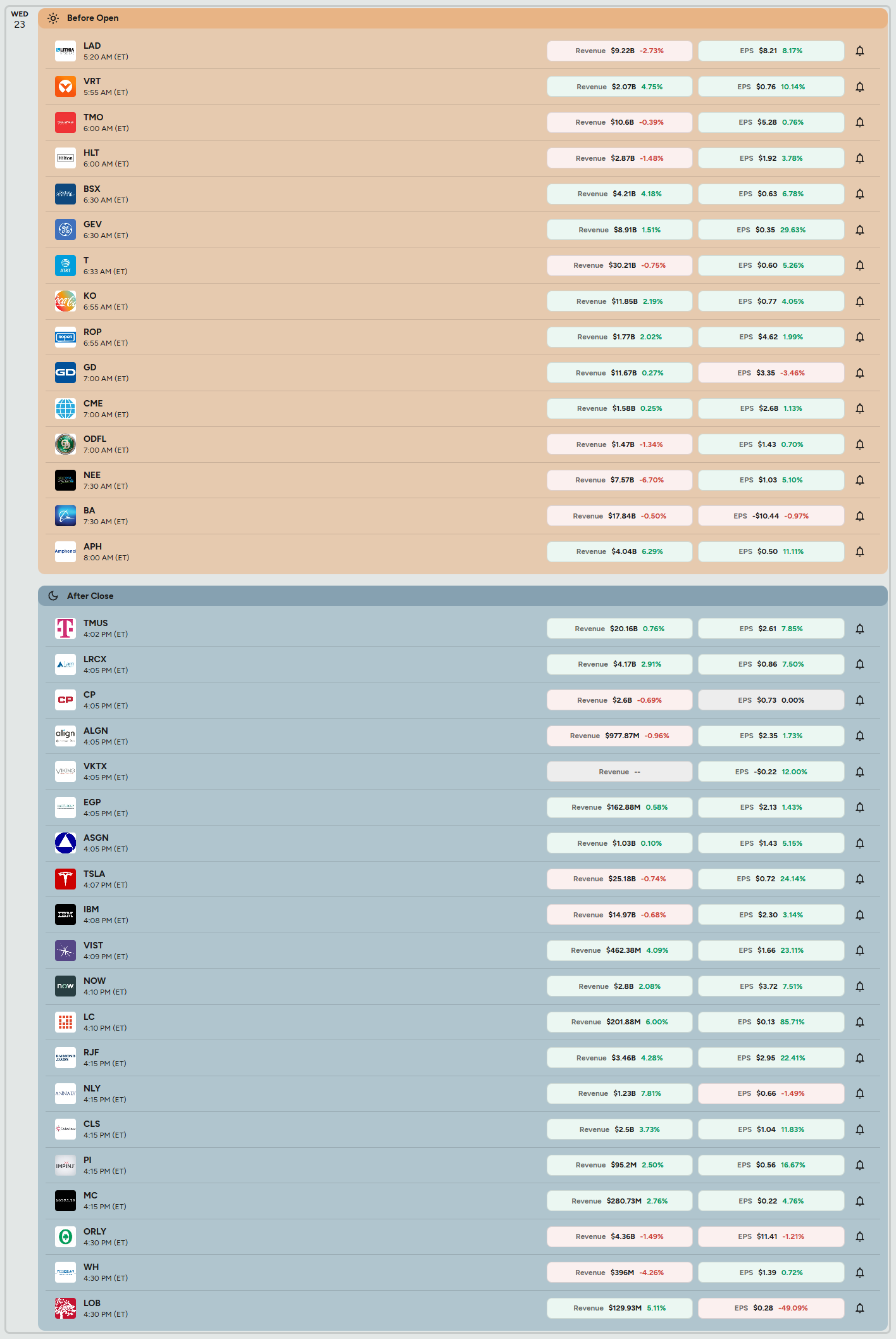

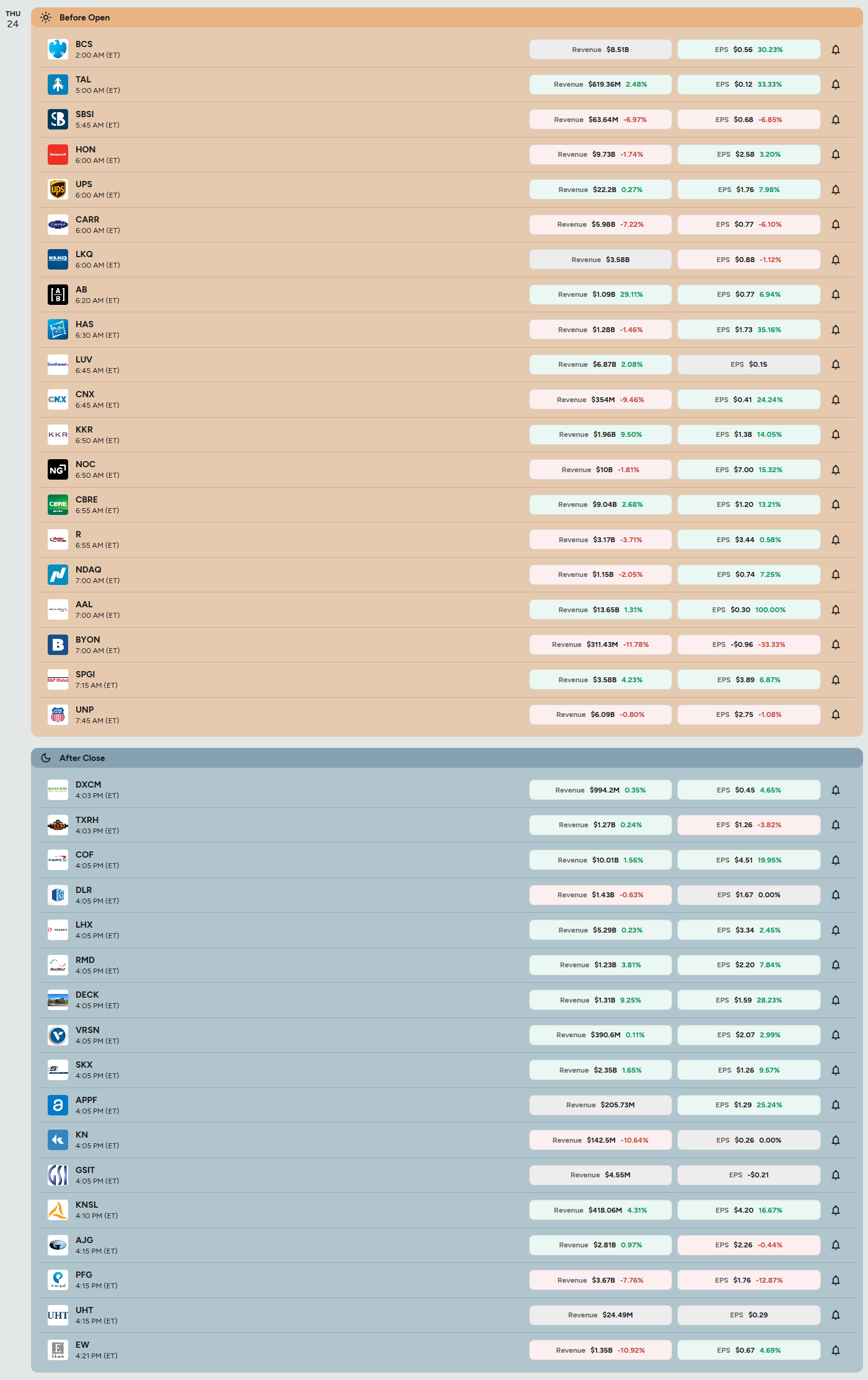

Anticipated Earnings By Day of Week

A Final Word

Thank you for reading this week's edition of Market Momentum. If you found value in this content, please consider sharing it with a friend or colleague, in a Discord or a Tweet. This small favor helps keep this stack free for you! Please check out VolumeLeaders.com for your own free trial of the platform that brings you the data powering this stack. Wishing you all a green week ahead filled with many bags ❤️💰.

I imagine the time and effort it takes for you to publish these reports every weekend is substantial. With appreciation and respect, thank you.