Market Momentum: Your Weekly Financial Forecast

Issue 11 / What to expect Sept 2, 2024 thru Sept 6, 2024

Weekly Wrap-Up

August was a month marked by significant volatility in financial markets, starting with sharp declines and culminating in a remarkable recovery. This period was characterized by economic resilience, shifting market leadership, and evolving expectations regarding monetary policy. The market’s trajectory in August offers crucial insights into broader economic trends, investor sentiment, and the potential outlook for the coming months.

Market Overview: A Rollercoaster Ride

The month began with substantial corrections in major stock indices, spurred by recession fears and disappointing job data. The S&P 500, for instance, experienced a near 10% decline from its mid-July peak, hitting three-month lows on August 5. Despite these early losses, the market quickly rebounded as economic indicators improved, and investor confidence was bolstered by expectations of a rate cut by the Federal Reserve.

By the end of August, the S&P 500 and Dow Jones Industrial Average (DJIA) had recovered their losses, with the DJIA posting a series of new all-time highs. The Nasdaq, though lagging slightly behind, also ended the month higher, reflecting a broad-based recovery that extended beyond the technology sector.

Shifts in Market Leadership

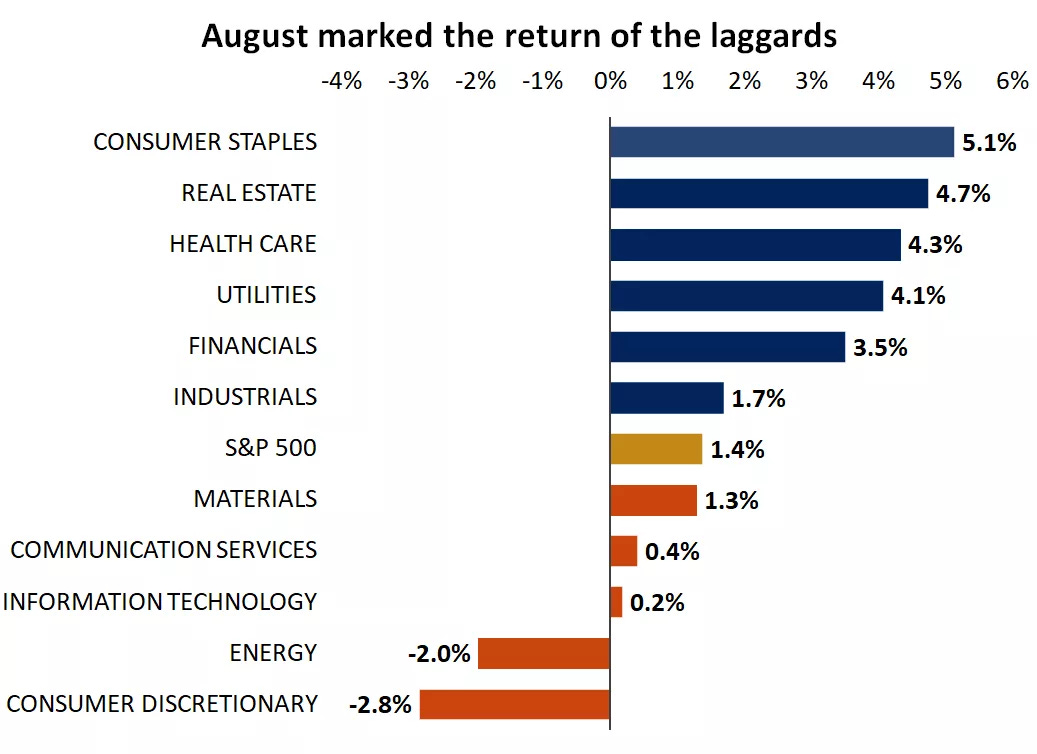

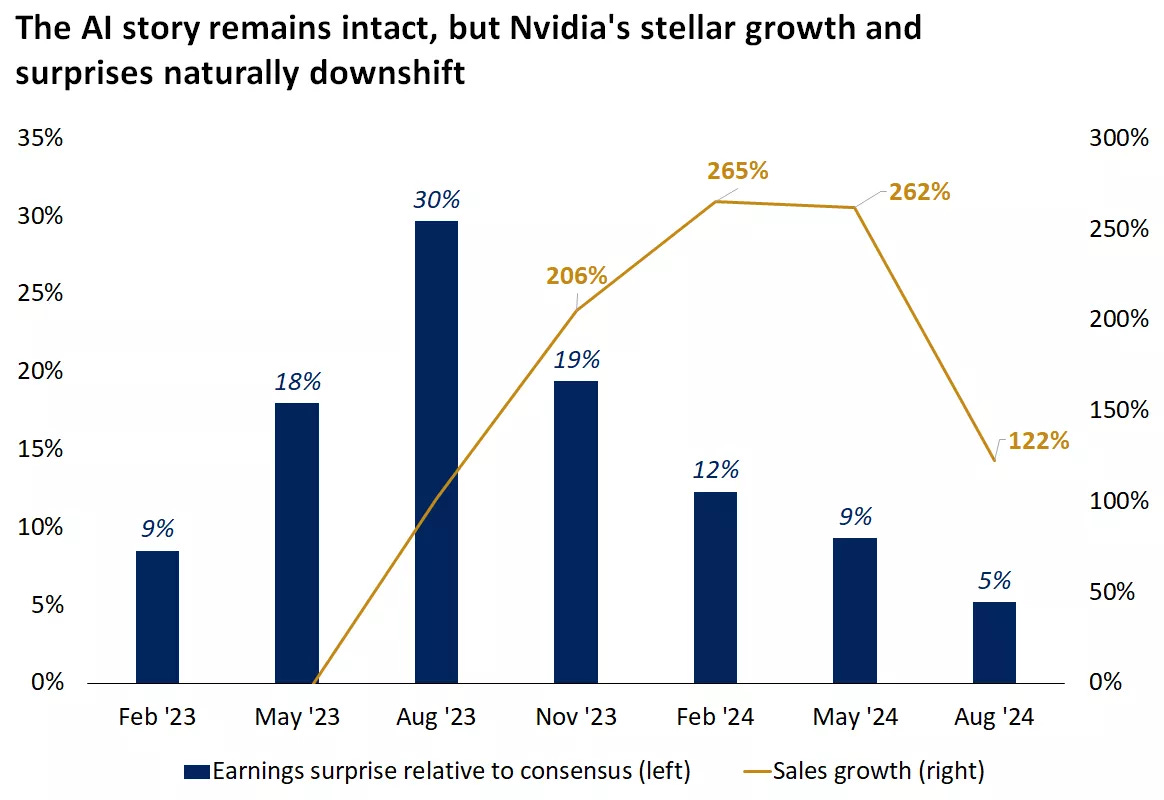

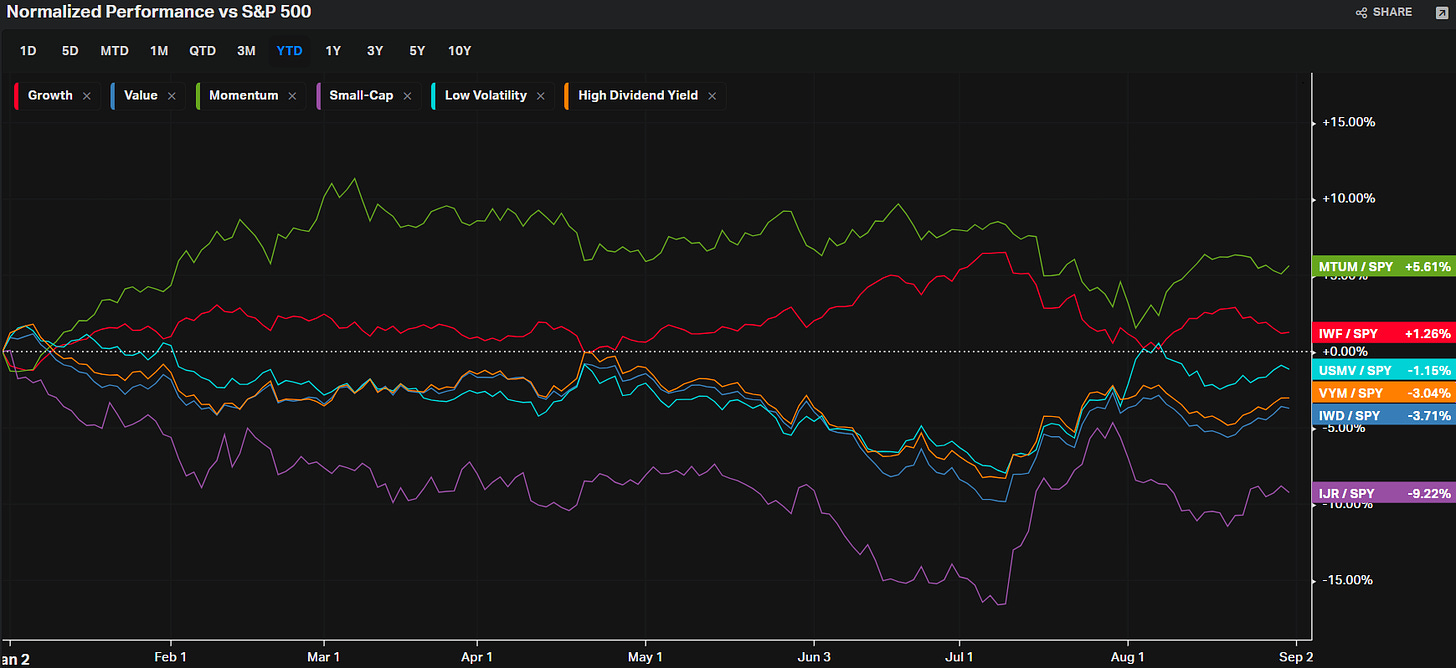

One of the most notable developments in August was the shift in market leadership. Throughout much of 2024, mega-cap technology stocks, including the so-called “Magnificent 7,” dominated the market, driven by enthusiasm for artificial intelligence (AI) and strong earnings growth. However, August saw these tech giants losing some of their momentum, partly due to high valuations and tough year-over-year comparisons.

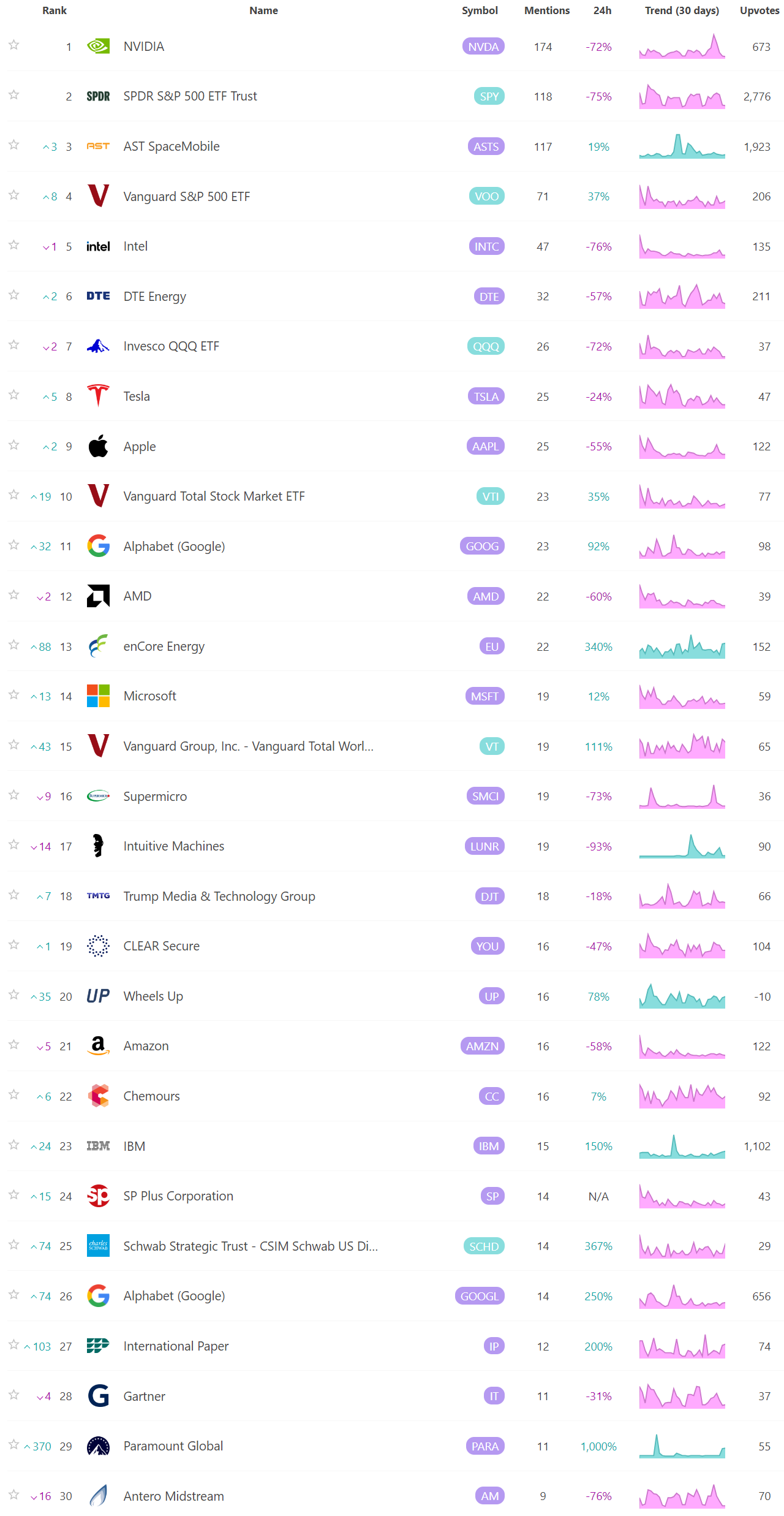

NVIDIA, a leader in AI development, exemplified this trend. While the company reported strong earnings, with 122% sales growth, the figures did not surpass expectations to the extent seen in previous quarters. This moderation in growth signaled that the era of outsized gains for tech heavyweights might be slowing down, leading to a broader range of sectors contributing to market gains.

Broadening Earnings Growth

The broadening of earnings growth was another critical theme in August. Unlike the first half of the year, where a few tech giants drove most of the market’s gains, August saw a wider array of sectors and stocks contributing to the rally. The equal-weight index of the S&P 500 hit new highs, indicating that smaller and mid-sized companies were also benefiting from the economic recovery.

Nine of the eleven sectors in the S&P 500 posted positive earnings growth, with notable contributions from financials, healthcare, and utilities. This diversification of earnings sources suggests that the market is becoming more balanced, which could support sustained gains in the final months of the year.

The Federal Reserve and Monetary Policy

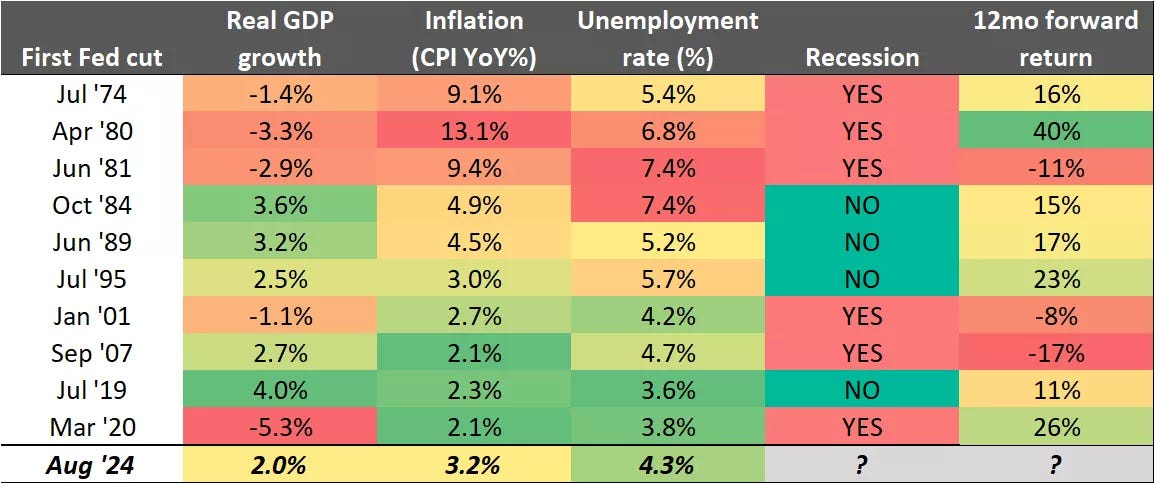

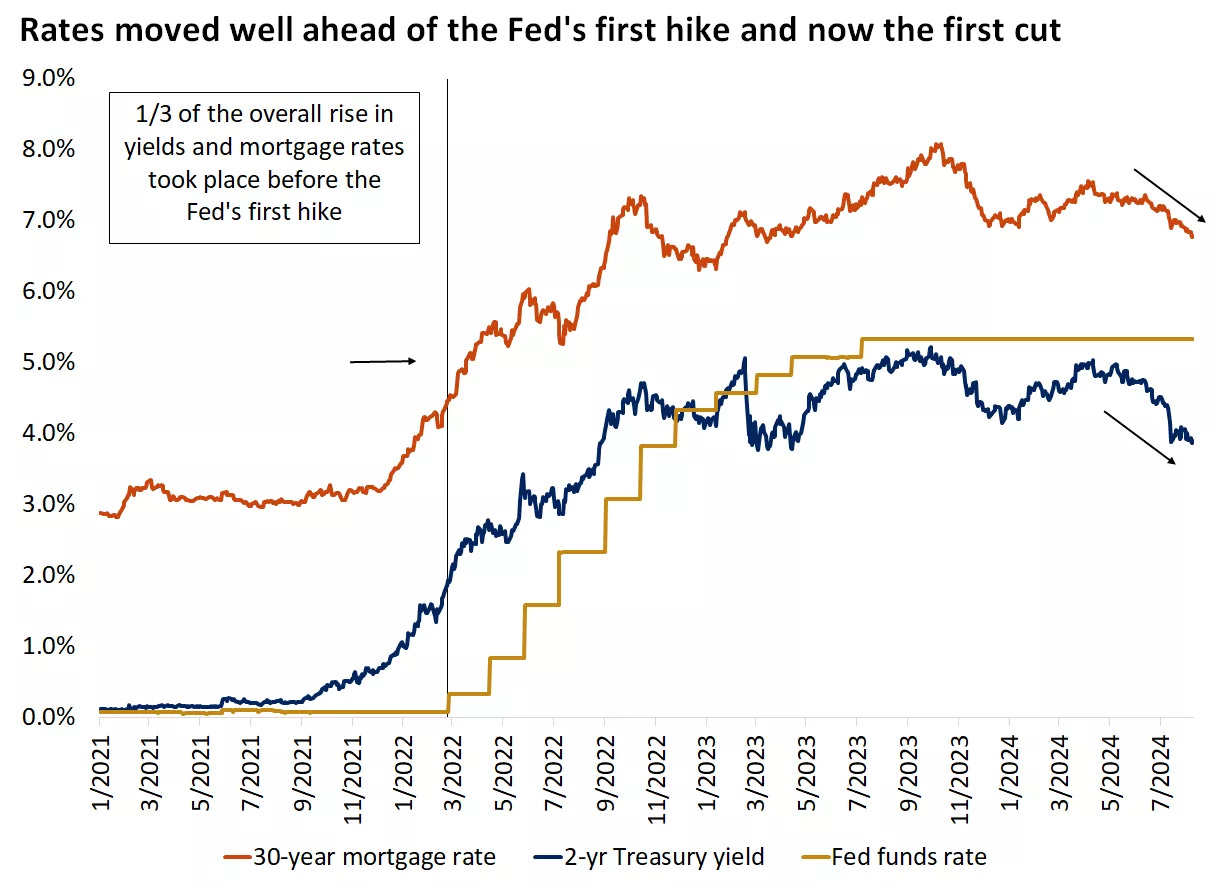

Monetary policy remained a central focus in August, with the Federal Reserve signaling that it was preparing to shift from a tightening stance to a more accommodative approach. At the annual Jackson Hole symposium, Fed officials indicated that the time had come to adjust policy, with rate cuts likely to begin in September.

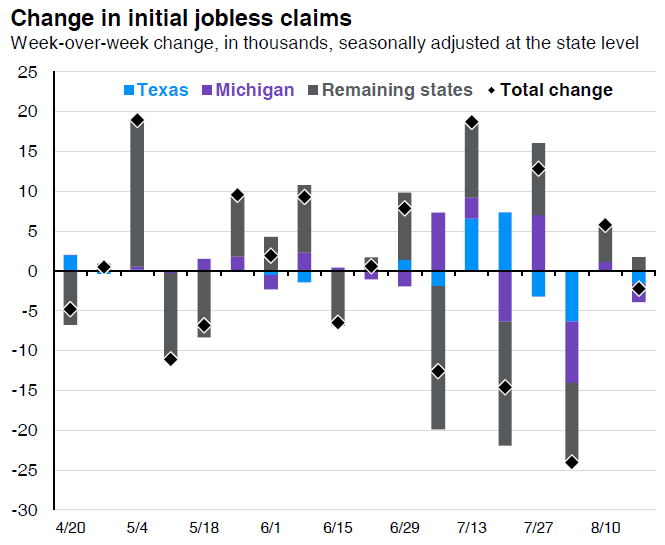

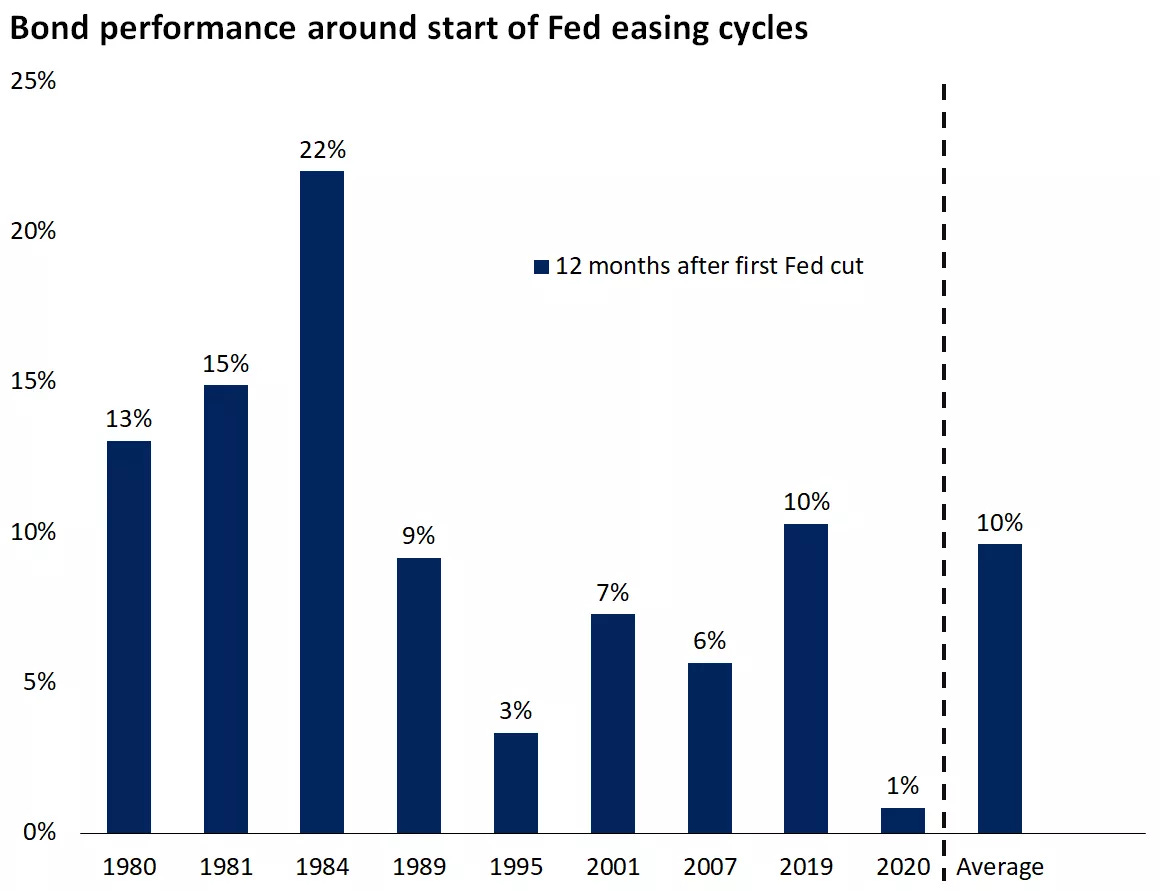

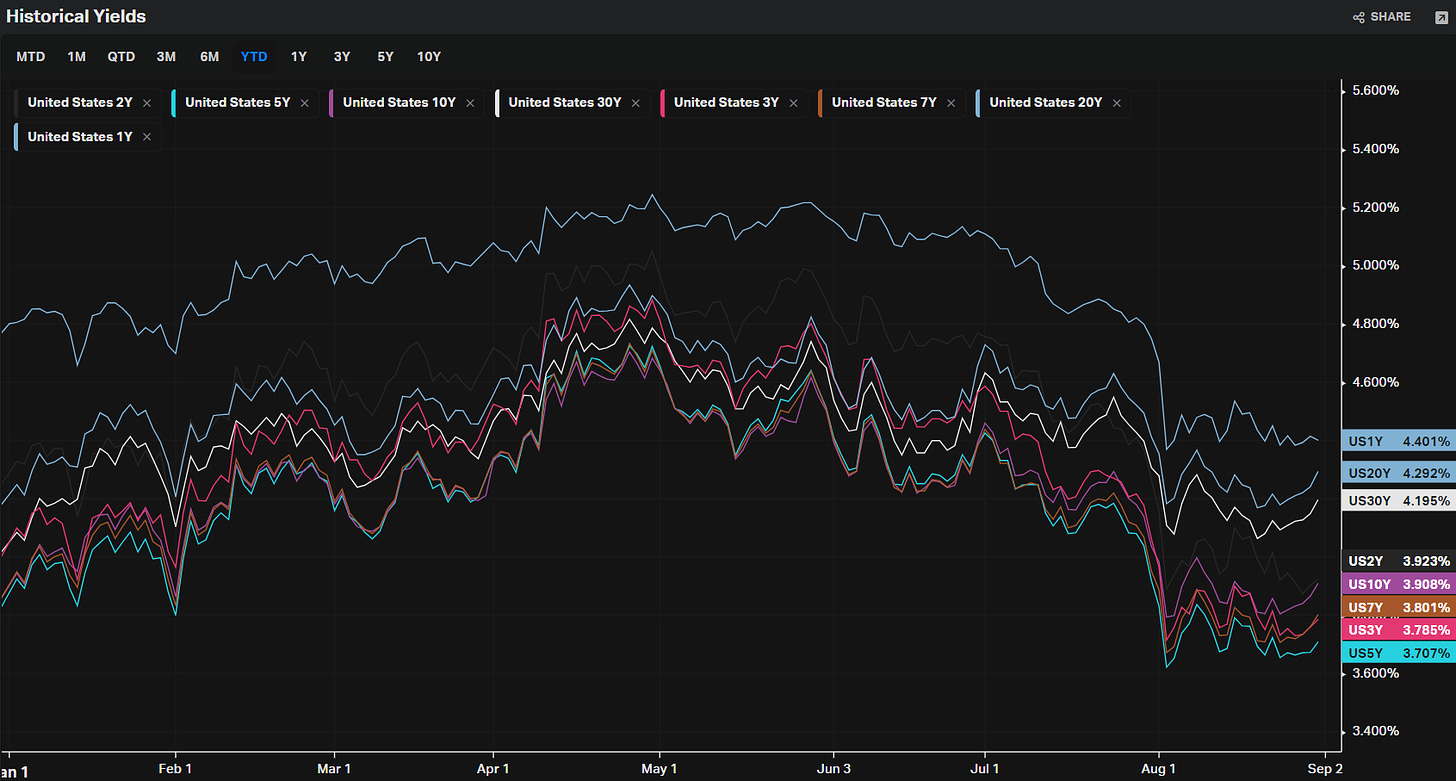

This shift was prompted by progress in bringing inflation closer to the Fed’s 2% target, coupled with a slowing labor market that raised concerns about future economic growth. The anticipation of rate cuts led to a decline in bond yields, with the market pricing in a significant reduction in the Fed funds rate by the end of 2024.

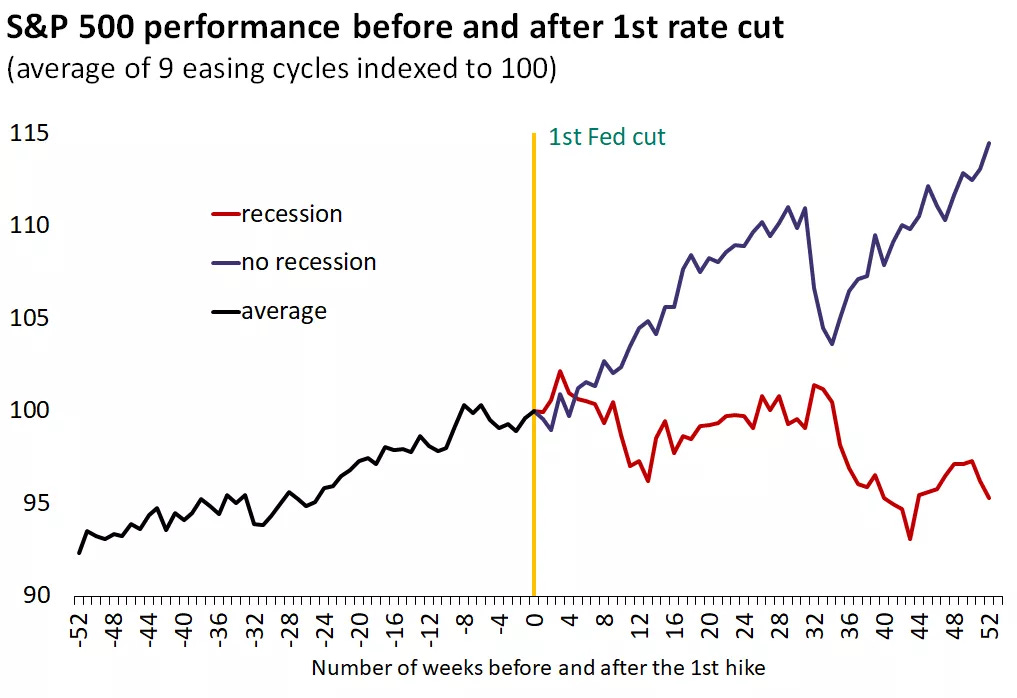

Investors reacted positively to the prospect of easier monetary policy, as rate cuts historically support equity markets, particularly when the economy is not in a recession. However, there was also caution about the potential for increased market volatility during the transition period.

Economic Indicators: Growth and Inflation Dynamics

Economic data released in August painted a mixed picture. On the one hand, the U.S. economy showed resilience, with GDP growth for the second quarter being revised upwards to 3.0%, driven by strong consumer spending. This robust growth supported the narrative of a soft landing, where the economy slows down without tipping into a recession.

On the other hand, inflation continued to ease, with the Personal Consumption Expenditures (PCE) Price Index rising by 0.2% month-over-month in July. Core PCE, which excludes food and energy prices, also showed moderation, coming in below expectations. This decline in inflation further reinforced the case for the Fed to begin cutting rates.

Market Sentiment and Investor Behavior

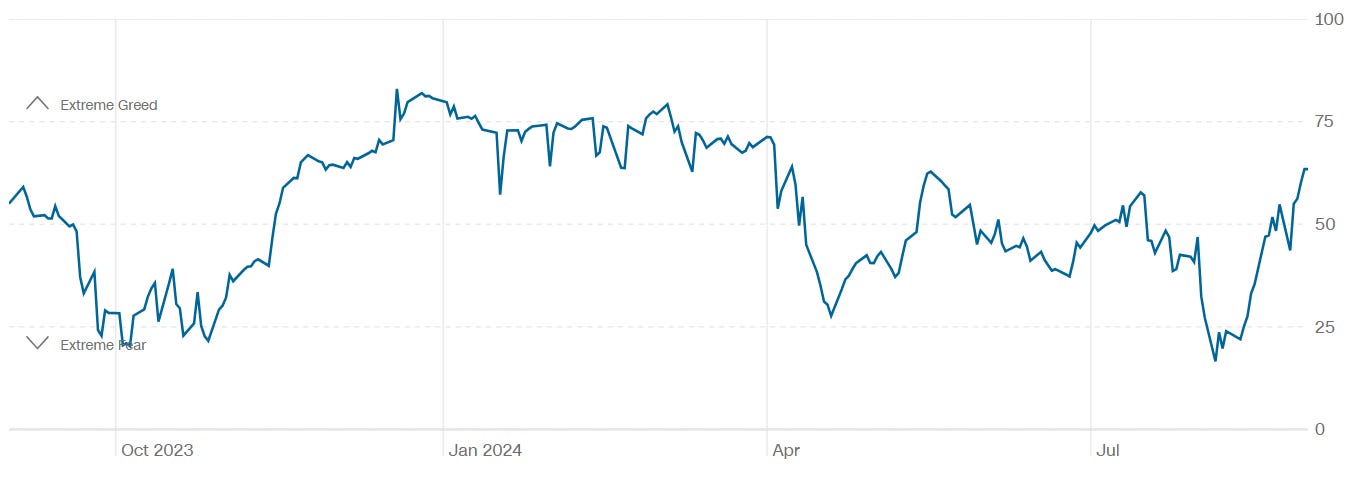

Investor sentiment fluctuated throughout August, reflecting the tension between economic optimism and concerns about potential risks. The early-month correction was driven by fears of a recession, exacerbated by disappointing jobs data. However, as economic indicators improved, sentiment became more positive, with the market rallying in the latter half of the month.

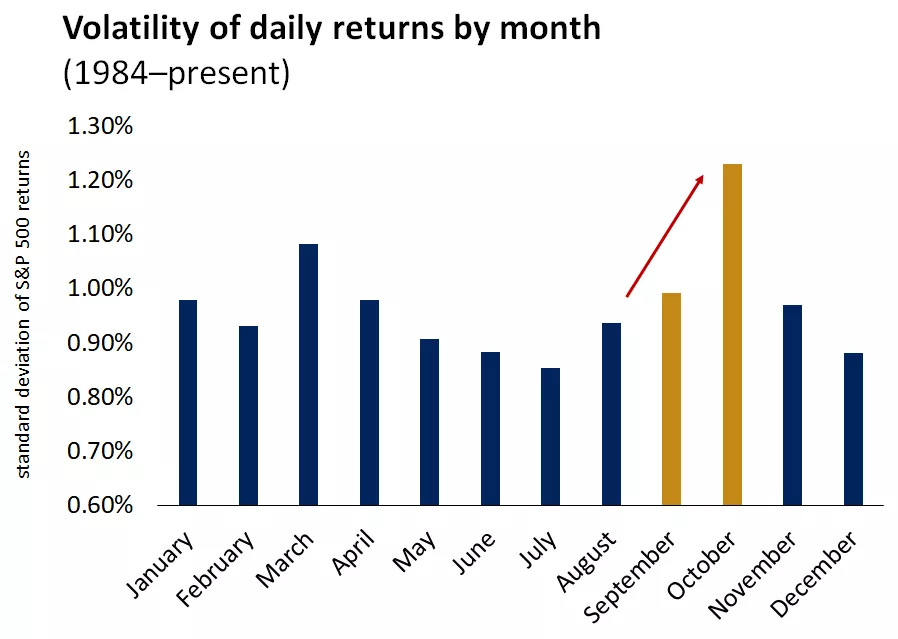

Despite the recovery, there were signs of consolidation towards the end of August, with some investors questioning whether the positive momentum was fully priced in. Additionally, the historical trend of increased volatility in September added to the cautious tone, as the market braced for potentially choppy trading ahead.

Sector Performance and Stock Movements

The performance of different sectors varied widely in August, reflecting the broader shifts in market dynamics. Real estate, materials, and industrials led the market, benefiting from the broadening of earnings growth and the anticipation of lower interest rates. In contrast, energy and communication services lagged, with energy stocks particularly affected by falling oil prices.

Several individual stocks also saw significant movements during the month. For example, Dell Technologies and Marvell Technology both posted strong earnings, driven by demand for AI-related products. Meanwhile, Intel’s stock surged on reports that the company was considering strategic changes to its business model, including separating its product design and foundry operations.

Looking Ahead: Preparing for the Fall

As the market heads into the final months of 2024, several factors are likely to influence its trajectory. The upcoming Federal Reserve meeting in September will be closely watched, as investors look for confirmation of the expected rate cuts. Additionally, the economic data releases, particularly on jobs and inflation, will play a crucial role in shaping market expectations.

Historically, the period leading up to the November elections has been challenging for stocks, with increased volatility and lower returns. Investors may need to exercise caution and ensure that their portfolios are appropriately diversified across asset classes and sectors to navigate potential turbulence.

Conclusion

August 2024 was a month of contrasts in the financial markets, marked by a fierce start and a more subdued finish. While the market experienced significant volatility, the overall trend was positive, supported by a resilient economy, broadening earnings growth, and the prospect of easier monetary policy. As the focus shifts from inflation to growth, and with the Fed poised to begin cutting rates, the outlook for the remainder of the year remains cautiously optimistic, albeit with an awareness of the potential challenges ahead.

This Week’s Snapshots

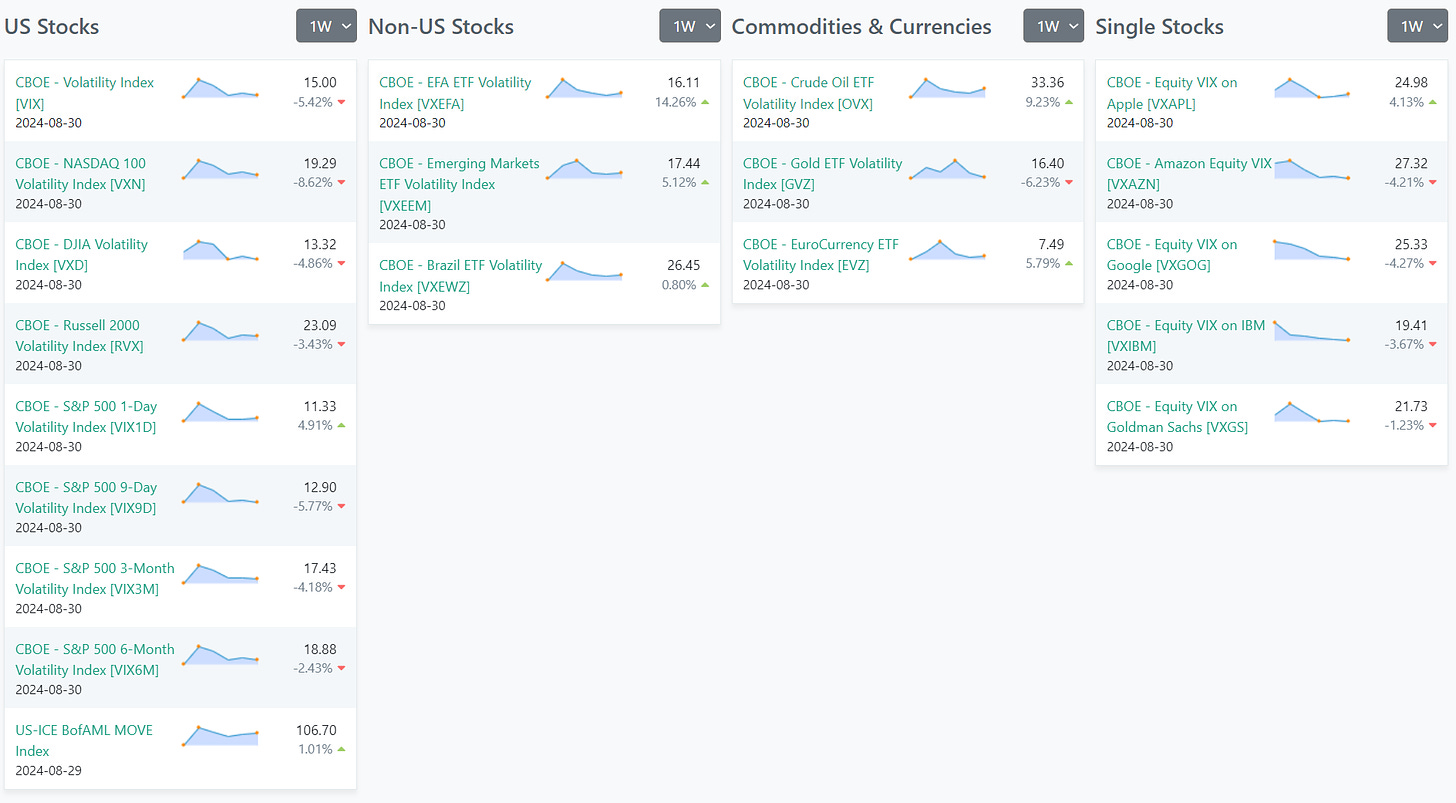

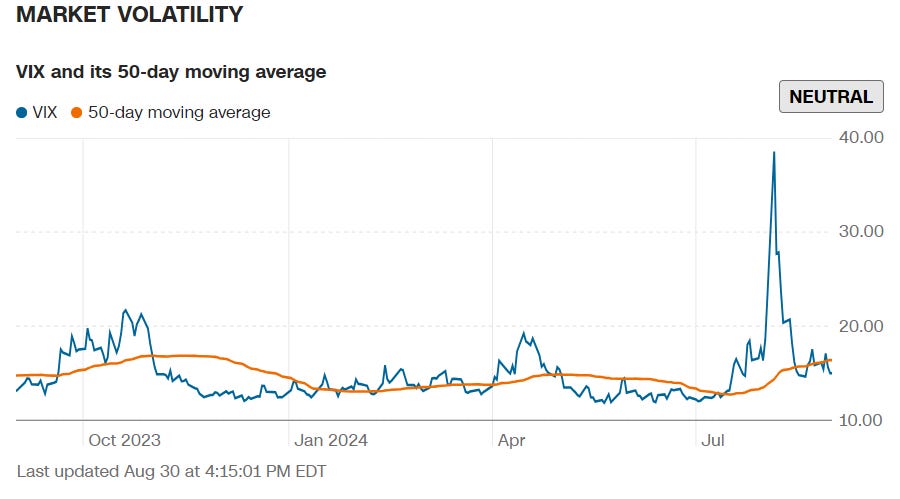

Volatility

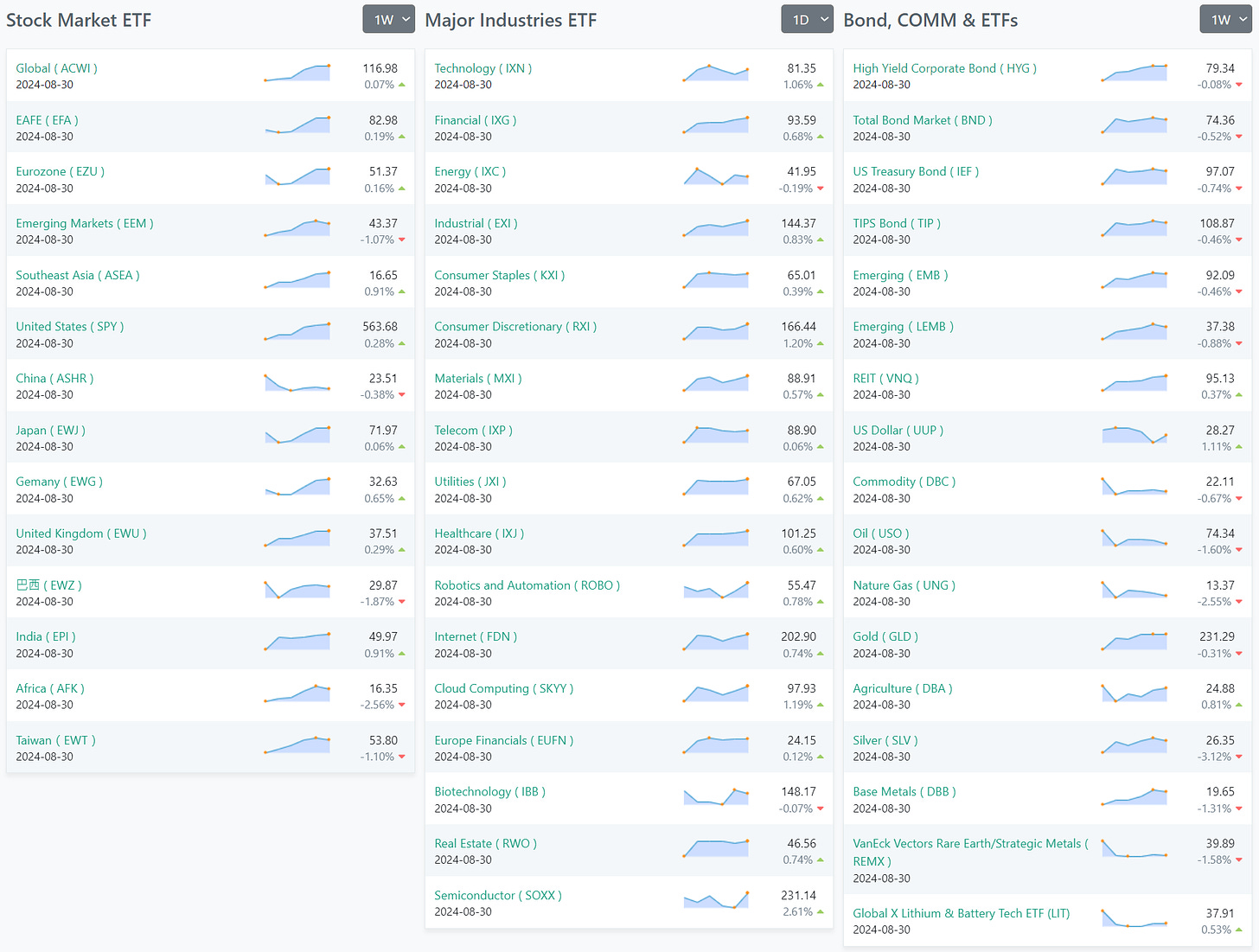

ETFs

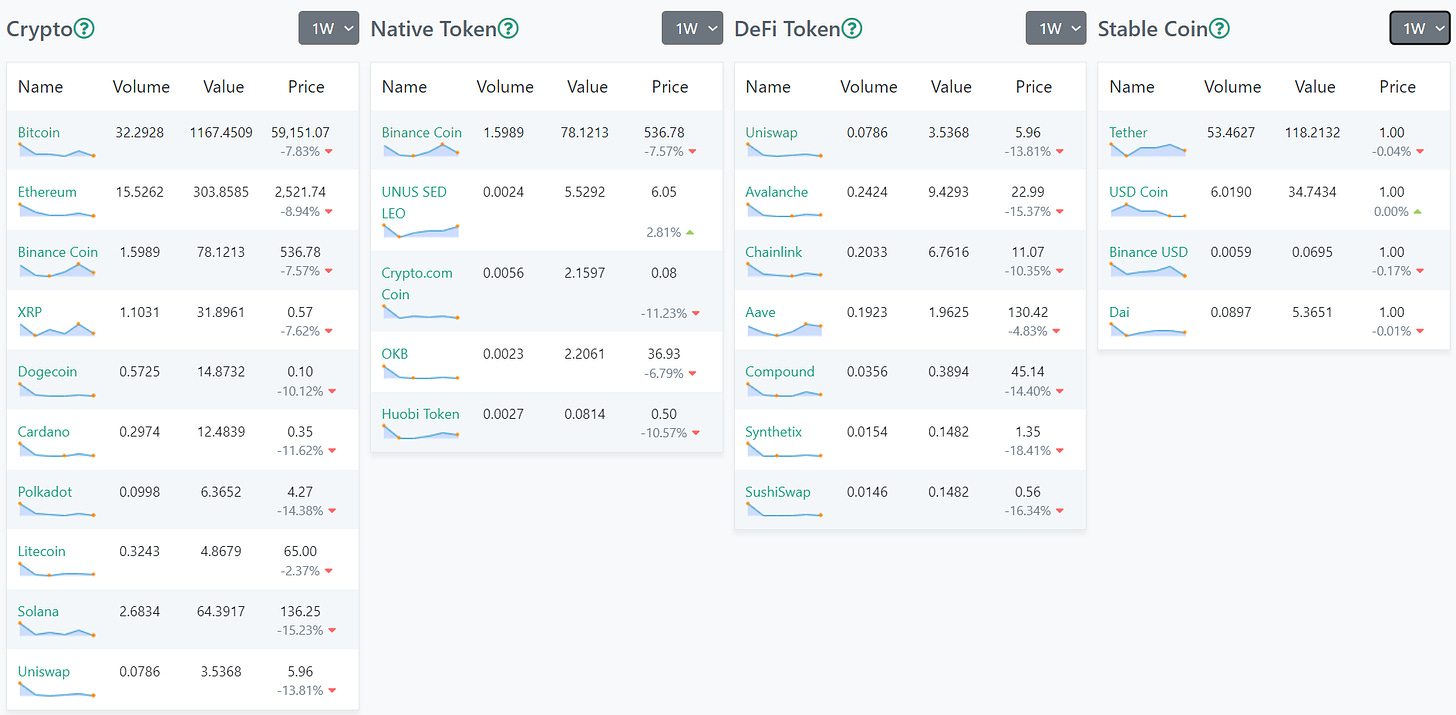

Crypto

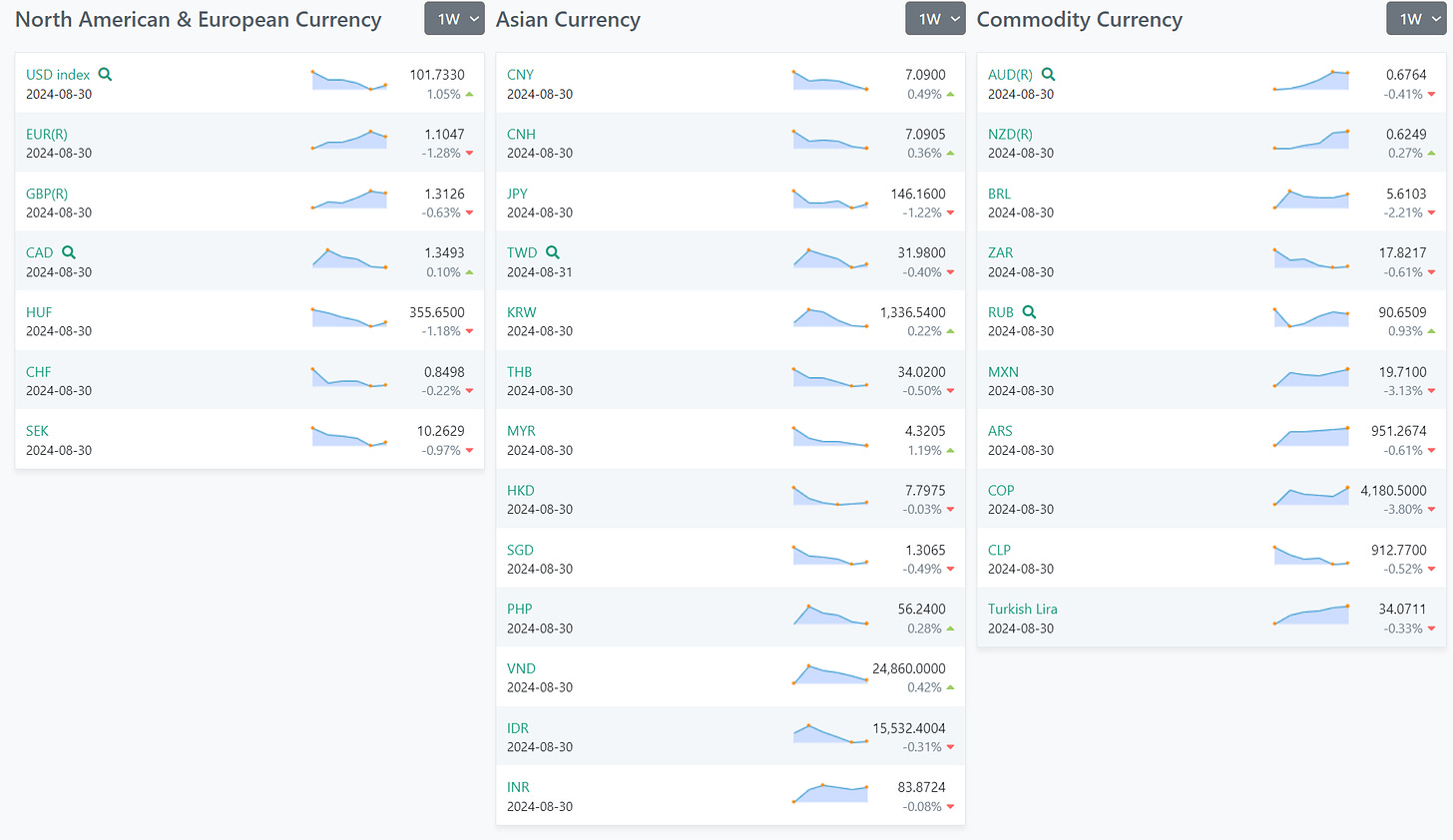

Forex

US Investor Sentiment

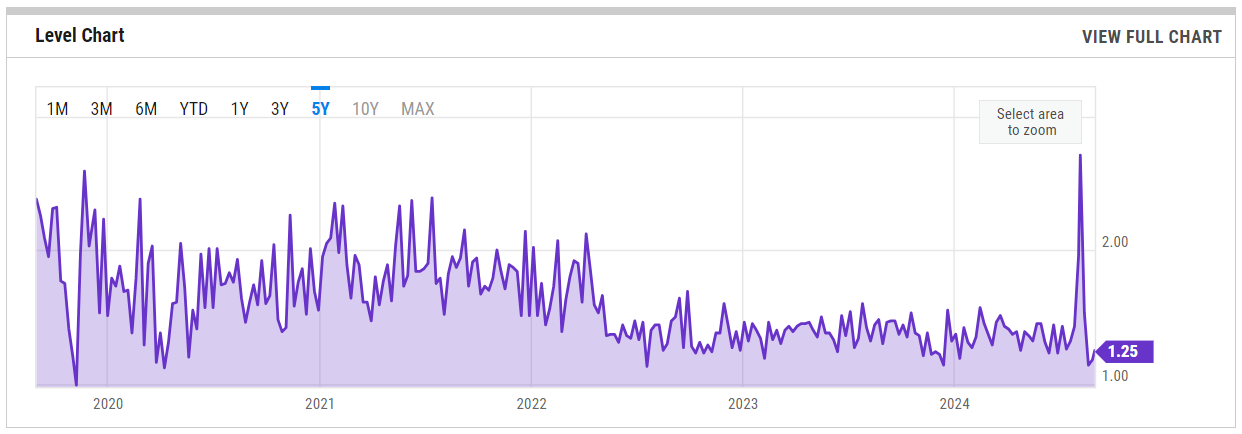

%Bull-Bear Spread

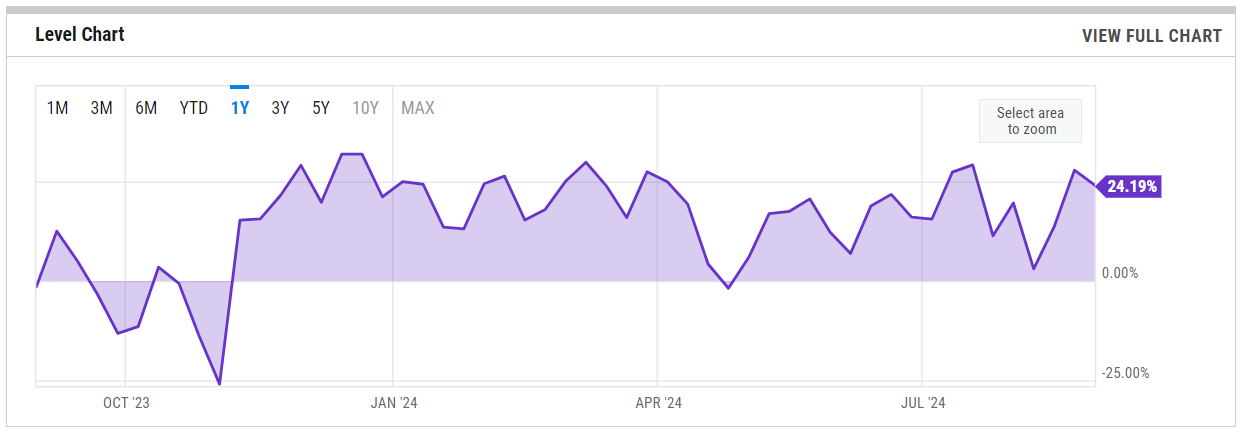

US Investor Sentiment, % Bull-Bear Spread is at 24.19%, compared to 27.96% last week and -3.66% last year. This is higher than the long-term average of 6.68%.

1-Year View

5-Year View

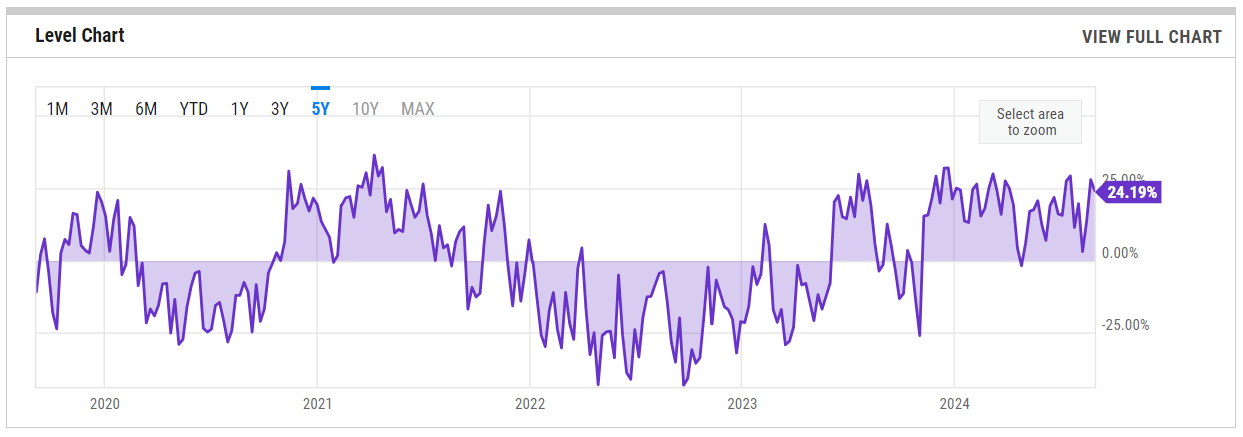

NAAIM Exposure Index

The NAAIM Exposure Index rose to 81.34, a significant increase of 8.92% from the previous week. This marked a notable recovery in sentiment among active managers, as they increased their exposure to U.S. equities. This uptick reflects growing confidence in the market as economic indicators suggested resilience despite earlier concerns.

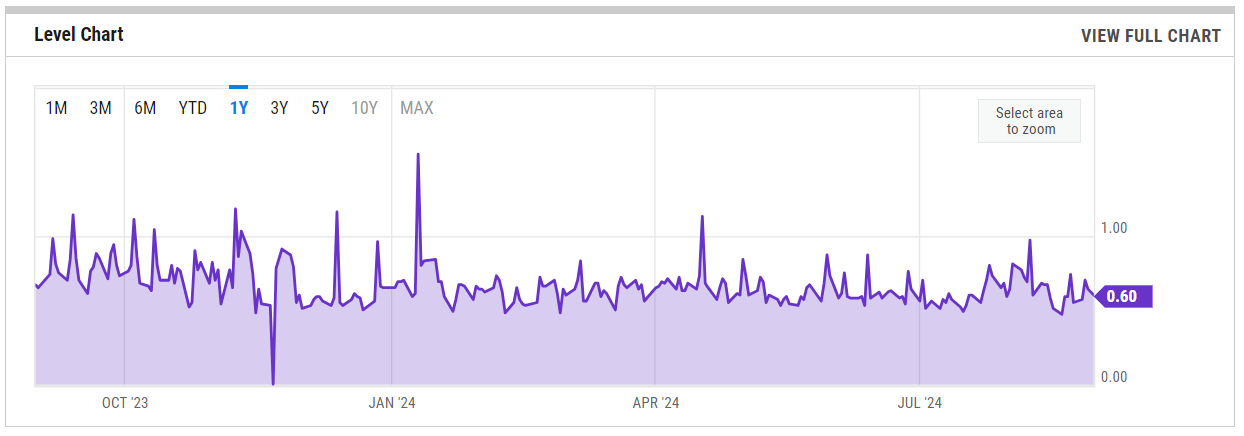

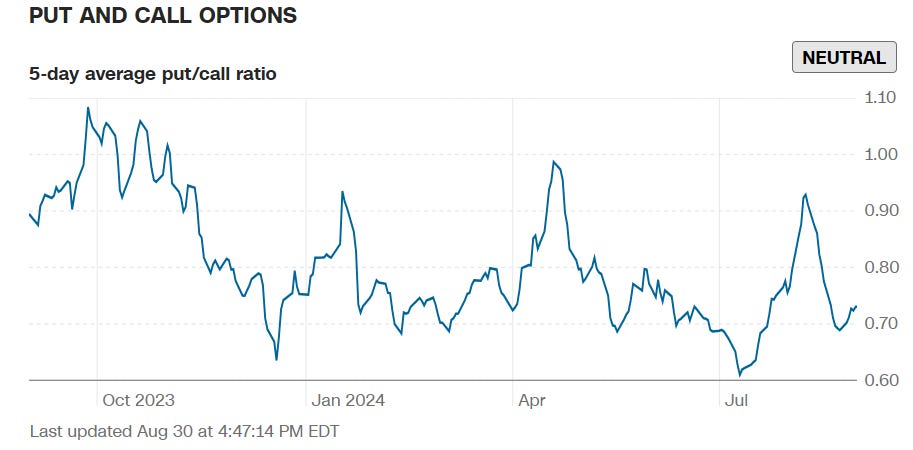

SPX Put/Call Ratio

1-Year View

5-Year View

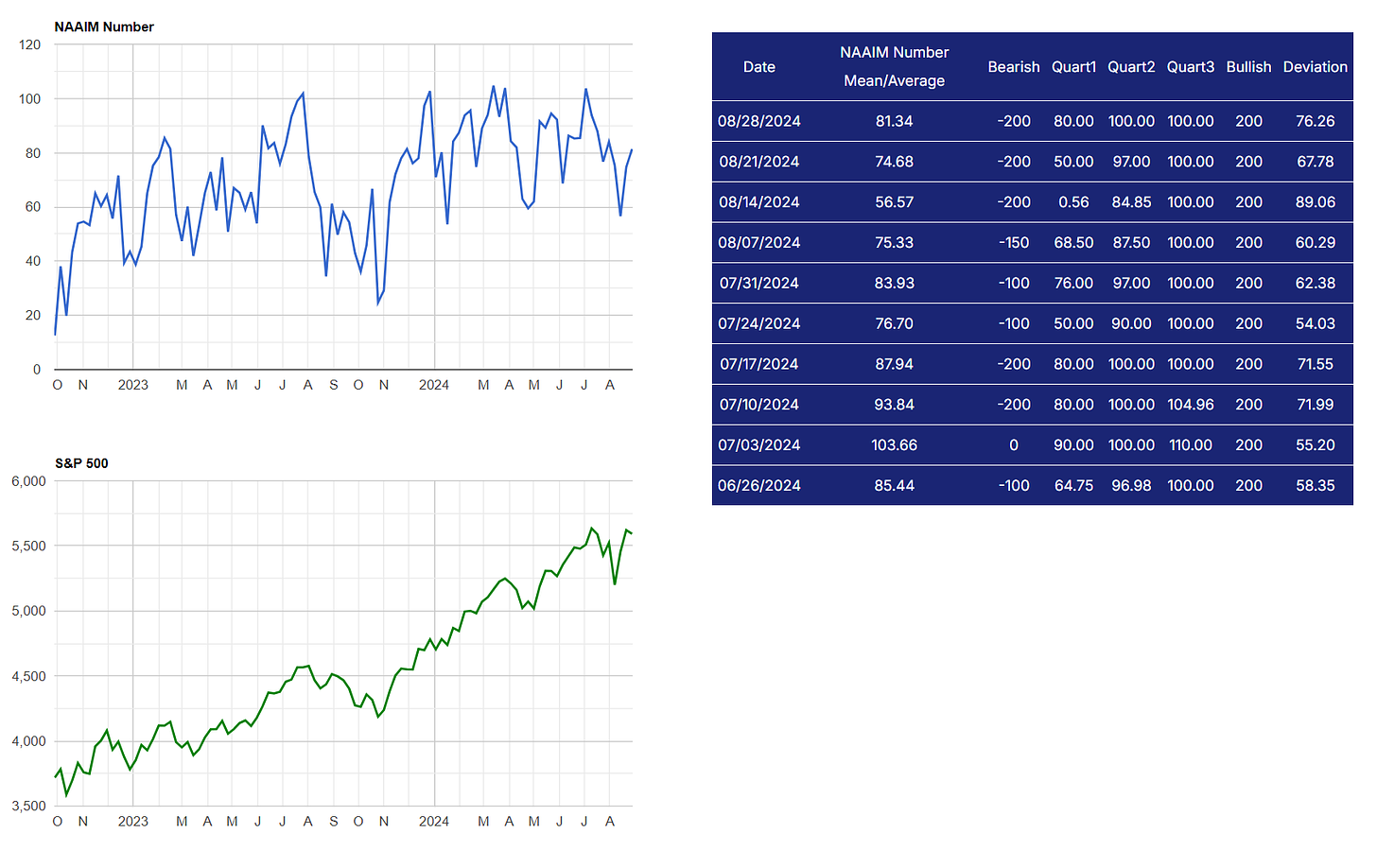

CBOE Equity Put/Call Ratio

1-Year View

5-Year View

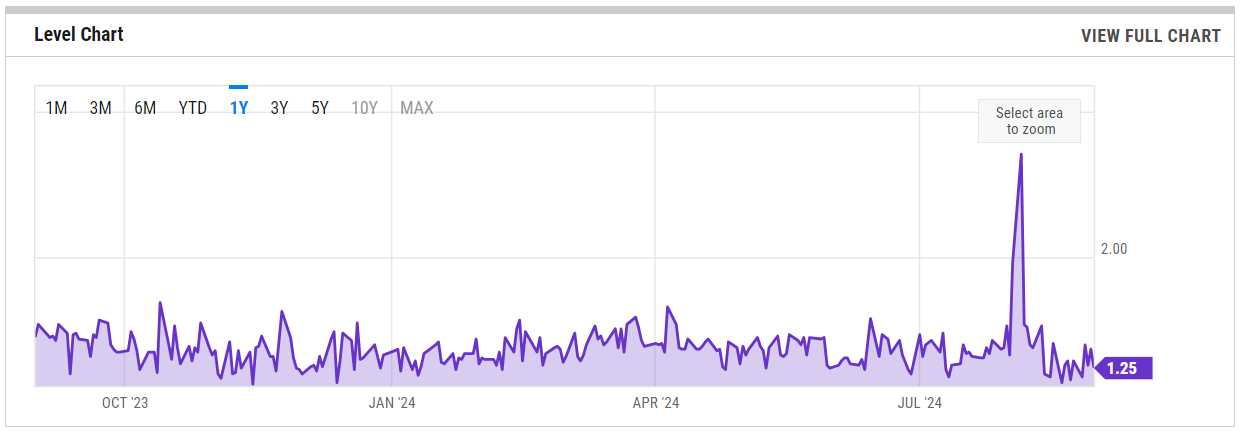

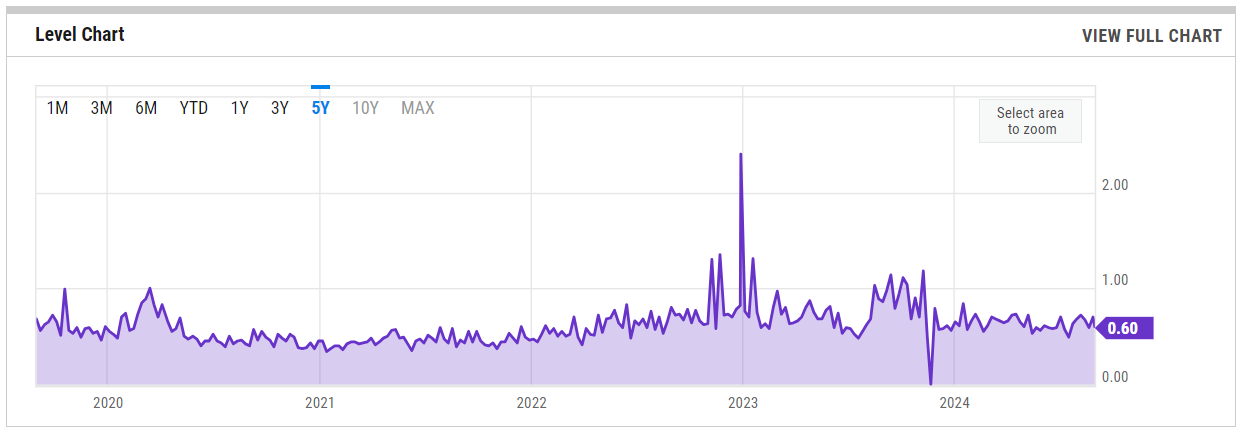

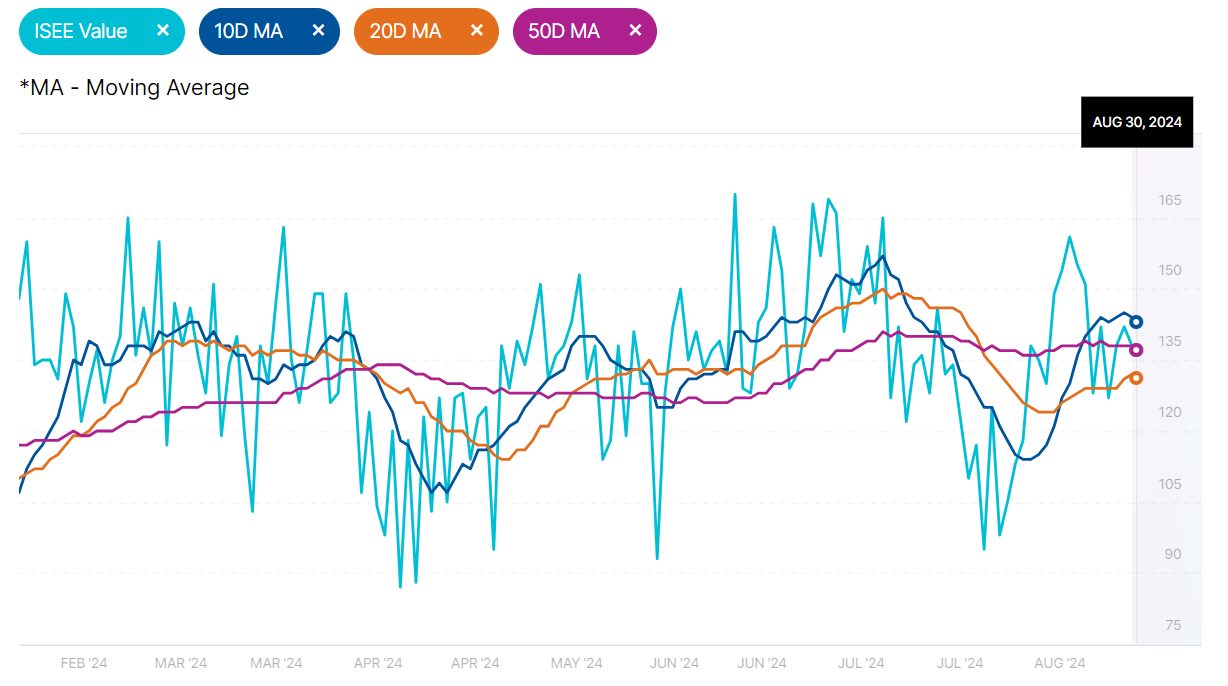

ISEE Sentiment Index

The ISEE (International Securities Exchange Sentiment) Index is a measure of investor sentiment derived from options trading. Unlike traditional put/call ratios, the ISEE Index focuses only on opening long customer transactions and is adjusted to remove market-maker and firm trades, providing a purer sentiment reading.

The ISEE Index typically ranges from 0 to 200, with readings above 100 indicating more call options being bought relative to put options, suggesting bullish sentiment. Conversely, readings below 100 suggest bearish sentiment, with more puts being purchased relative to calls.

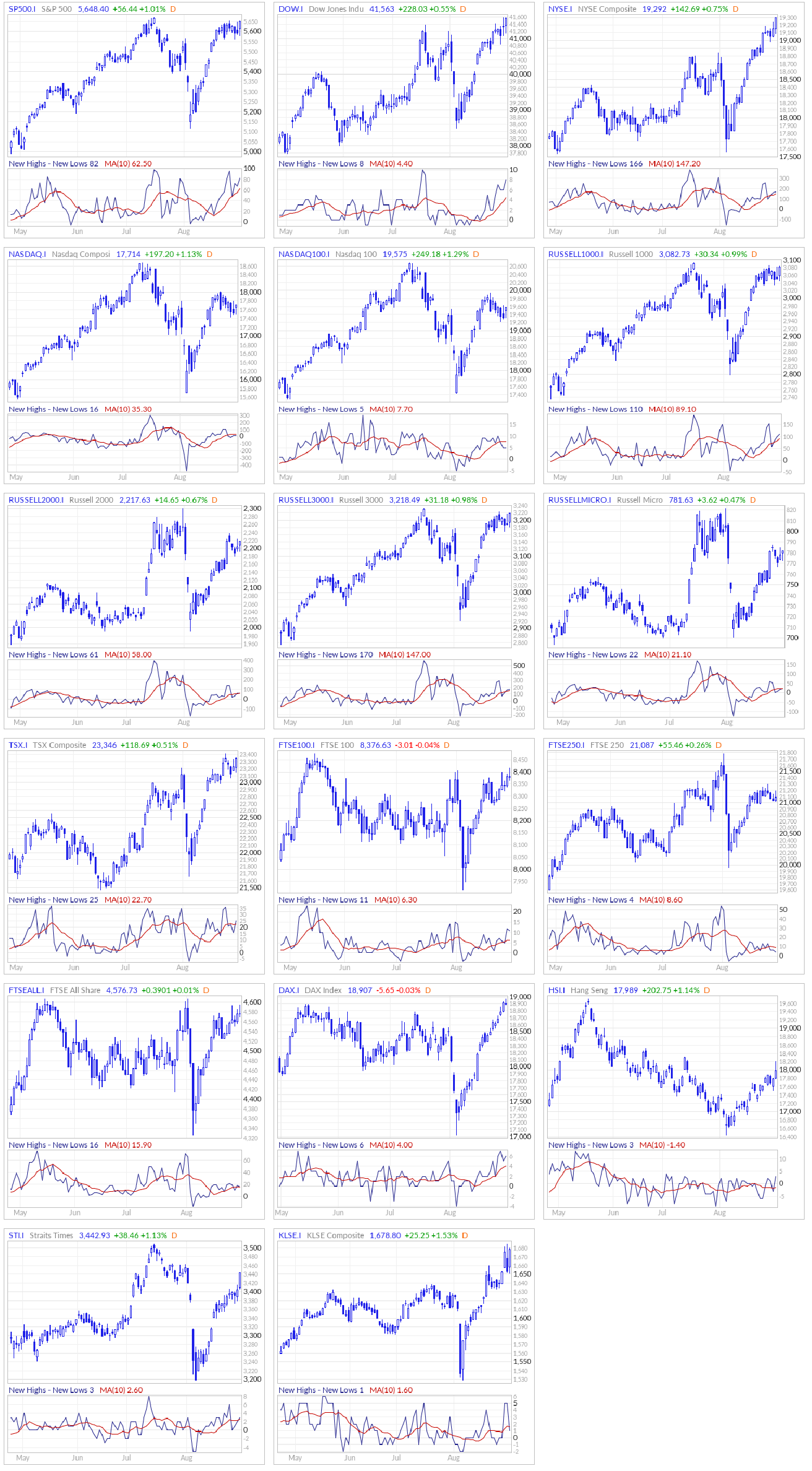

New Highs - New Lows

The New Highs - New Lows indicator (NH-NL) displays the daily difference between the number of stocks reaching new 52-week highs and the number of stocks reaching new 52-week lows. The NH-NL indicator generally reaches its extreme lows slightly before a major market bottom. As the market then turns up from the major bottom, the indicator jumps up rapidly. During this period, many new stocks are making new highs because it's easy to make a new high when prices have been depressed for a long time. The NH-NL indicator oscillates around zero. If the indicator is positive, the bulls are in control. If it is negative, the bears are in control. As the cycle matures, a divergence often occurs as fewer and fewer stocks are making new highs (the indicator falls), yet the market indices continue to reach new highs. This is a classic bearish divergence that indicates that the current upward trend is weak and may reverse.

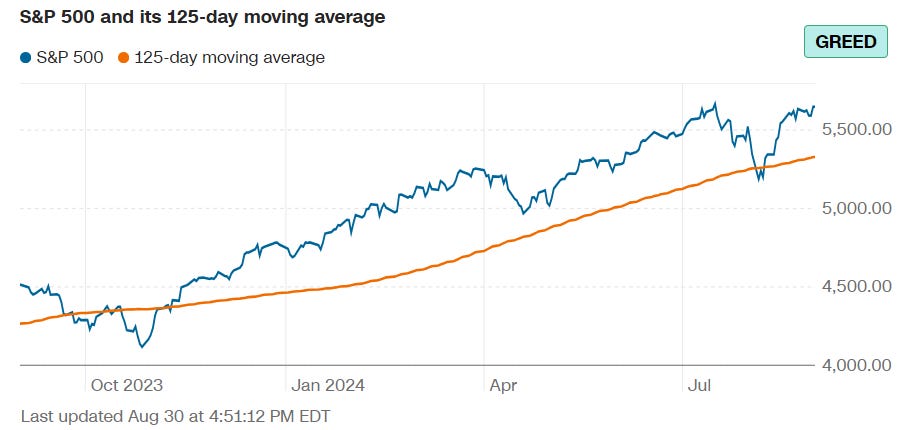

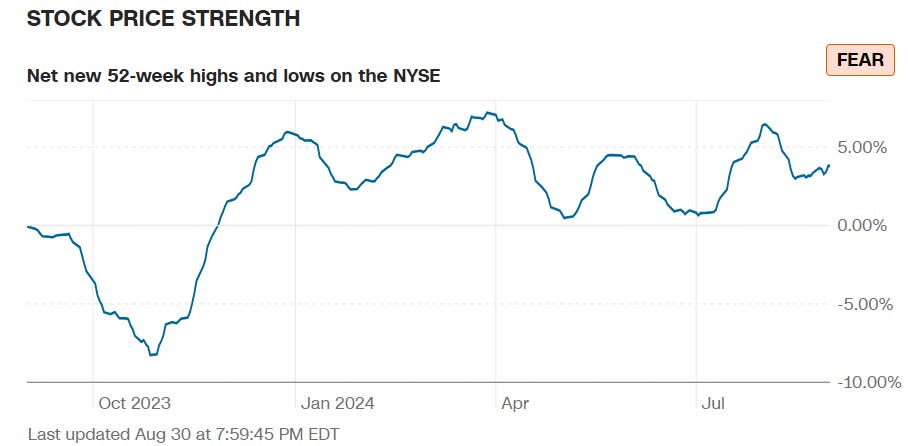

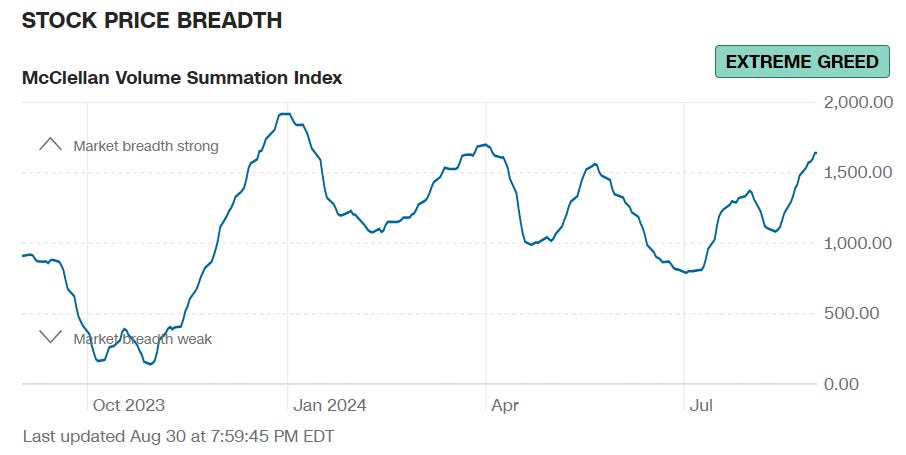

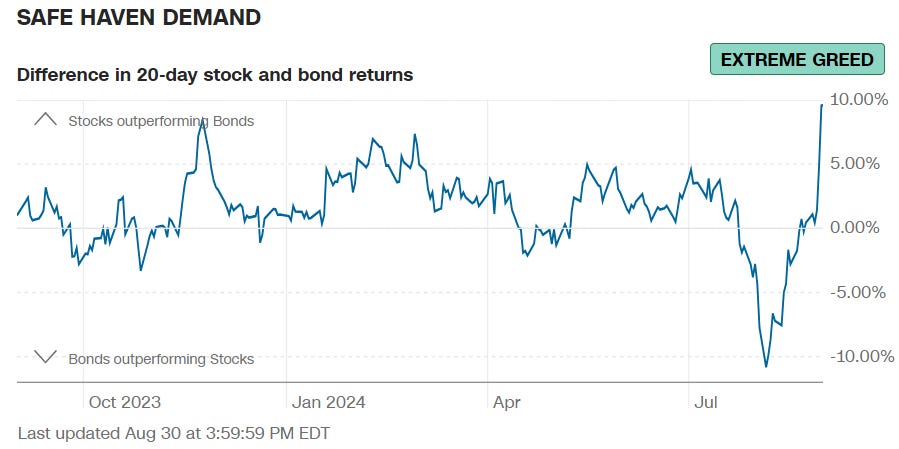

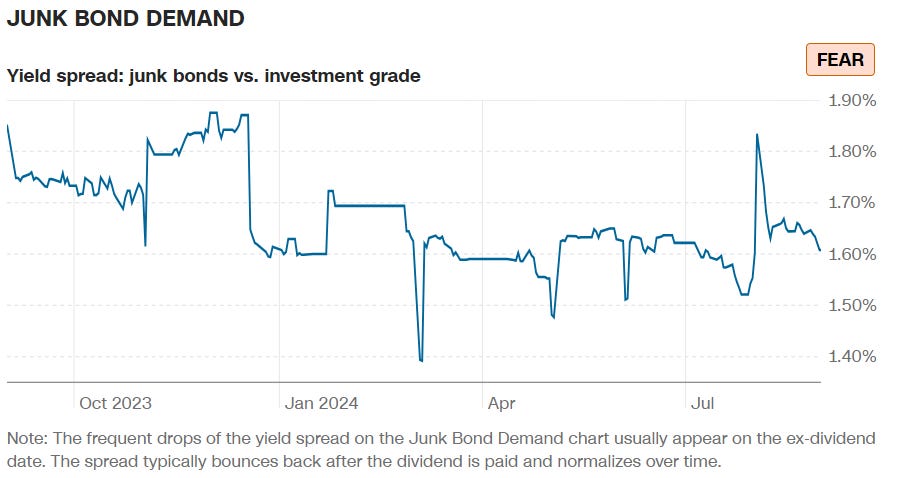

CNN 7 Fear & Greed Constituent Data Points + Composite Index

Final Composite Fear & Greed Index Reading

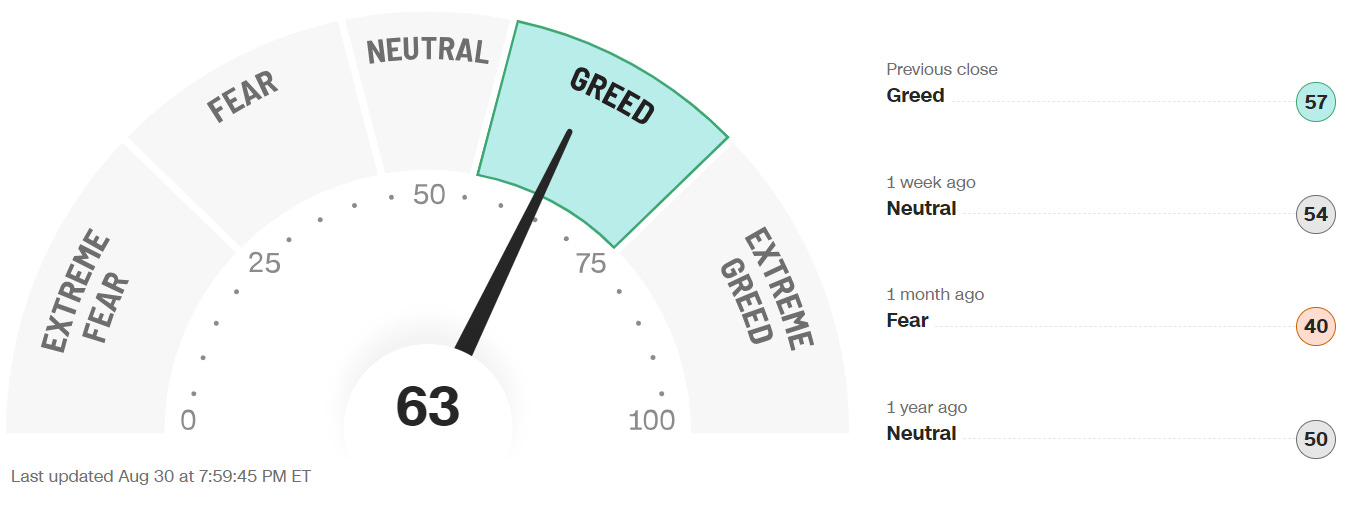

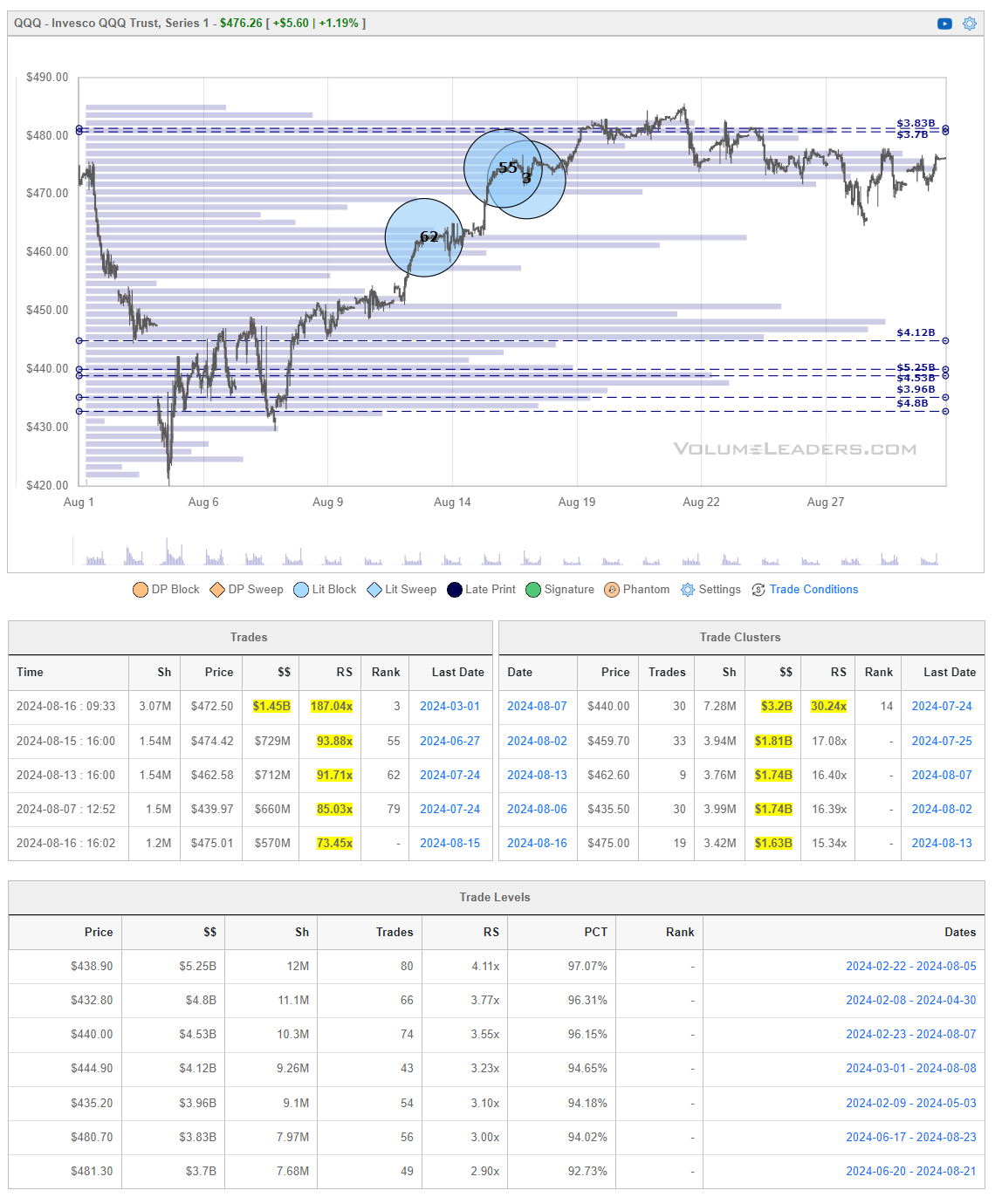

Institutional S/R Levels for Major Indices

When you’re a large institutional player, your primary goal is to find liquidity - places to do a ton of business with the least amount of slippage possible. VolumeLeaders.com automatically identifies and visually plots the exact spots where institutions are doing business and where they are likely to return for more. It’s one of the primary reasons “support” and “resistance” concepts work and truly one of the reasons “price has memory”.

Levels from the VolumeLeaders.com platform can help you formulate trades theses about:

Where to add or take profit

Where to de-risk or hedge

What strikes to target for options

Where to expect support or resistance

This is just a small sample; there are countless ways to leverage this information into trades that express your views on the market. The platform covers thousands of tickers on multiple timeframes to accommodate all types of traders. Observe for yourself how accurate the levels are by marking-up your charts with the information in the “Trade Levels” boxes I’m giving for free below and play-along in real-time this week. These charts cover the past 7 or so sessions but subs will get new levels as they develop in real-time and have access to levels from other time frames. I’m confident you’ll see how clear-cut, intuitive and actionable this information is for yourself.

1. Price Action and Trade Levels:

Current Price: SPY is currently at $563.68, up 0.95%.

Key Support Levels:

$512.90 is a significant support level with a high volume of trades ($17B).

$522.10 is another critical support, representing a substantial price concentration.

Resistance Levels:

$563.68 is the most recent high and a resistance level, with significant trade activity as indicated by the most recent large volume ($1.45B).

$546.90 and $553.10 have shown to be previous areas of resistance as the price has struggled to maintain above these levels in past attempts.

2. Volume Analysis:

The chart highlights significant volume clusters:

Around $530: A critical area where the price experienced significant trading activity, potentially serving as a support zone.

$563.68: This level is where the price currently sits, with the largest volume of the day. This suggests a crucial decision point where SPY may either break out or face resistance.

The volume profiles indicate that the market has seen strong institutional participation at these levels, which could lead to either consolidation or reversal depending on the market sentiment.

3. Trade Clusters:

The Trade Clusters show that the most significant recent trades occurred around $563.68 and $553.10. This indicates that these levels are being closely watched and could be pivotal for future price movements.

The trades around $517.20 and $522.50 also show notable institutional activity, which may act as support if the price pulls back.

4. Relative Size (RS):

The RS figures in the Trade Levels table indicate that $563.68 has the highest RS (109.85%), showing strong resistance but also the potential for a breakout if the price manages to sustain above this level.

$530.65 and $553.10 also show high RS values, indicating these levels are key to watch for either support or resistance.

5. Price Movement Insights:

The price has been in a general uptrend since early August, with significant pullbacks around $530 before resuming the upward movement.

The current level of $563.68 is crucial. If the price fails to break above this level, we could see a pullback to lower support levels, such as $553.10 or $542.00.

If the price can break and hold above $563.68, it may continue its upward trend, with $573 - $580 being potential target levels based on previous price actions.

6. General Market Sentiment:

The recent price increase and high trading volume at the current level suggest bullish sentiment, but the market is at a critical juncture.

If the price breaks above $563.68 with sustained volume, it could signal further bullish momentum.

7. Conclusion:

Short-term: The price is at a key resistance level. Watch for a breakout above $563.68 or a pullback to support levels around $553.10 or $542.00.

Medium-term: If the price holds above $563.68, there is potential for continued upward movement.

Long-term: The overall trend appears bullish, but the price action at this level will determine the next significant move.

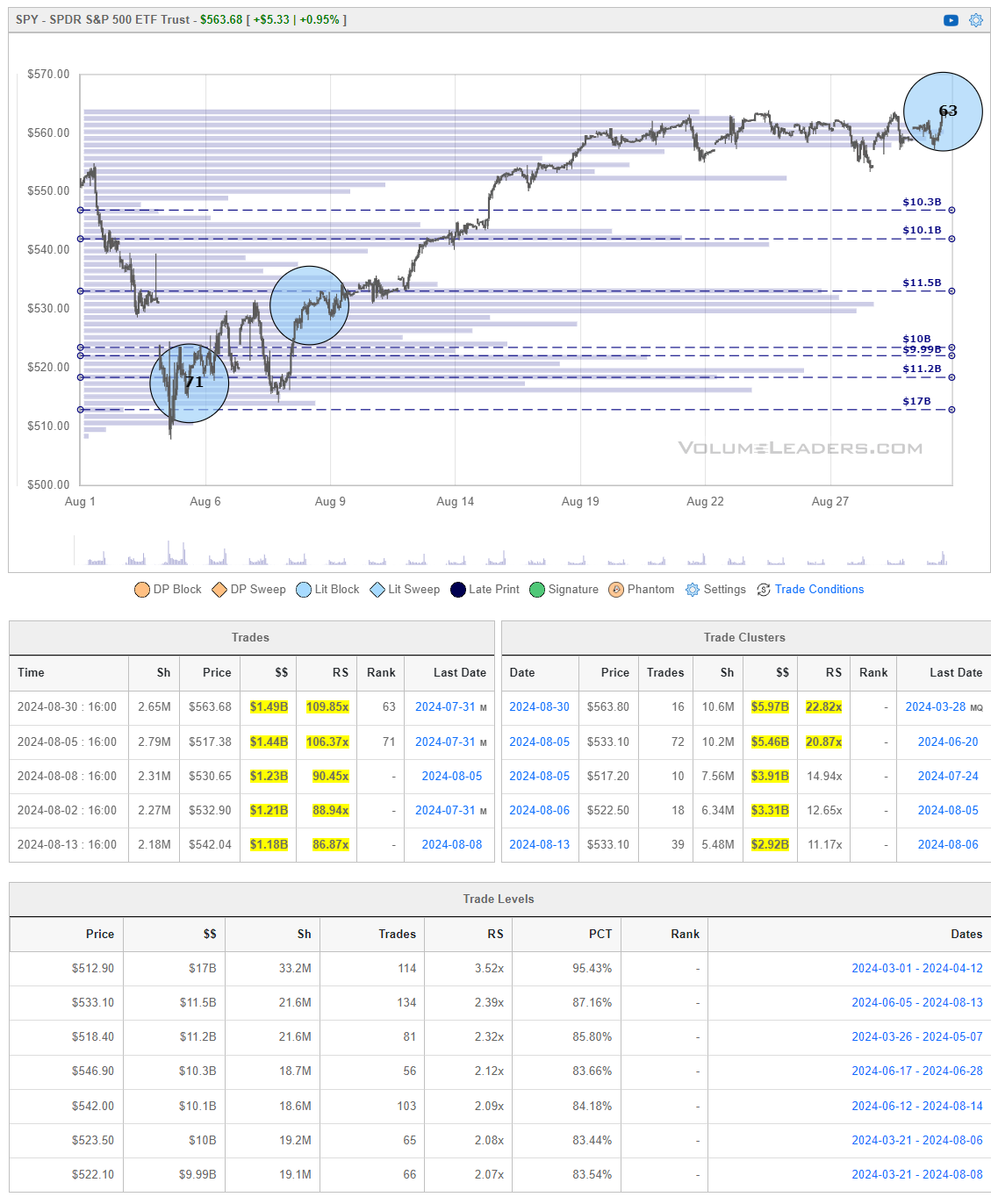

1. Price Action and Trade Levels:

Current Price: QQQ is trading at $476.26, up 1.19% from the previous level.

Key Support Levels:

$438.90 is a significant support level with a high concentration of trades ($5.25B), and an RS of 4.11x, indicating strong buying interest at this level.

$444.90 also represents a support level with $4.12B traded, suggesting that it could serve as a secondary support if the price pulls back.

Resistance Levels:

$481.30 is currently one of the higher resistance levels, with $3.7B traded, indicating that this level could be a potential barrier for further upward movement.

$480.70 has similar characteristics, acting as a short-term resistance that QQQ may need to overcome for continued bullish momentum.

2. Volume Analysis:

The blue circles on the chart highlight significant volume clusters around critical price levels:

$462 - $474: This area saw a lot of trading activity, particularly around $472.50, with a massive $1.45B traded, and the highest RS value of 187.04x. This indicates strong institutional involvement, which could act as either a strong support or resistance level depending on future price movements.

$440 - $460: The chart shows a concentration of trades around this range, with significant volume in areas such as $462.58 and $439.97, making these key levels to monitor for potential support.

3. Trade Clusters:

The Trade Clusters section highlights areas where large blocks of trades occurred:

$440.00: A significant amount of trading occurred here with $3.32B and an RS of 30.24x, suggesting that this level has historically been a key area of support.

$462.60 and $475.00 also saw notable trade volumes, which could indicate key levels to watch if the price tests these areas again.

4. Relative Size (RS):

The RS metric is particularly important in this analysis.

$472.50 has the highest RS at 187.04x, making it a crucial level for both potential resistance and future price action. The significant volume here suggests that a break above this level could lead to further bullish momentum.

Other high RS levels include $474.42 (93.88x) and $462.58 (91.71x), indicating that these levels have seen substantial interest and could act as pivot points for the price.

5. Price Movement Insights:

Uptrend Continuation: The price has been in an uptrend since early August, with a significant pullback around the $472.50 area. The current price near $476.26 suggests that QQQ is testing resistance levels, and if it can break above $481.30, it could lead to a continuation of the upward trend.

Potential Pullback: If the price fails to break above the current resistance, it may pull back to lower levels like $462.58 or $444.90, which have shown strong support in the past.

6. General Market Sentiment:

The chart suggests a bullish sentiment, especially with the recent price increase and the high RS at key resistance levels. However, the market is likely at a critical juncture where either a breakout or a consolidation phase could occur.

7. Conclusion:

Short-term: Watch the $476.26 level closely as it tests resistance. A break above $481.30 could indicate further bullish momentum.

Medium-term: If QQQ fails to break resistance, a pullback to support levels around $462.58 or $444.90 could occur.

Long-term: The overall trend remains bullish, but the next few trading sessions will be critical in determining whether QQQ can sustain its upward movement.

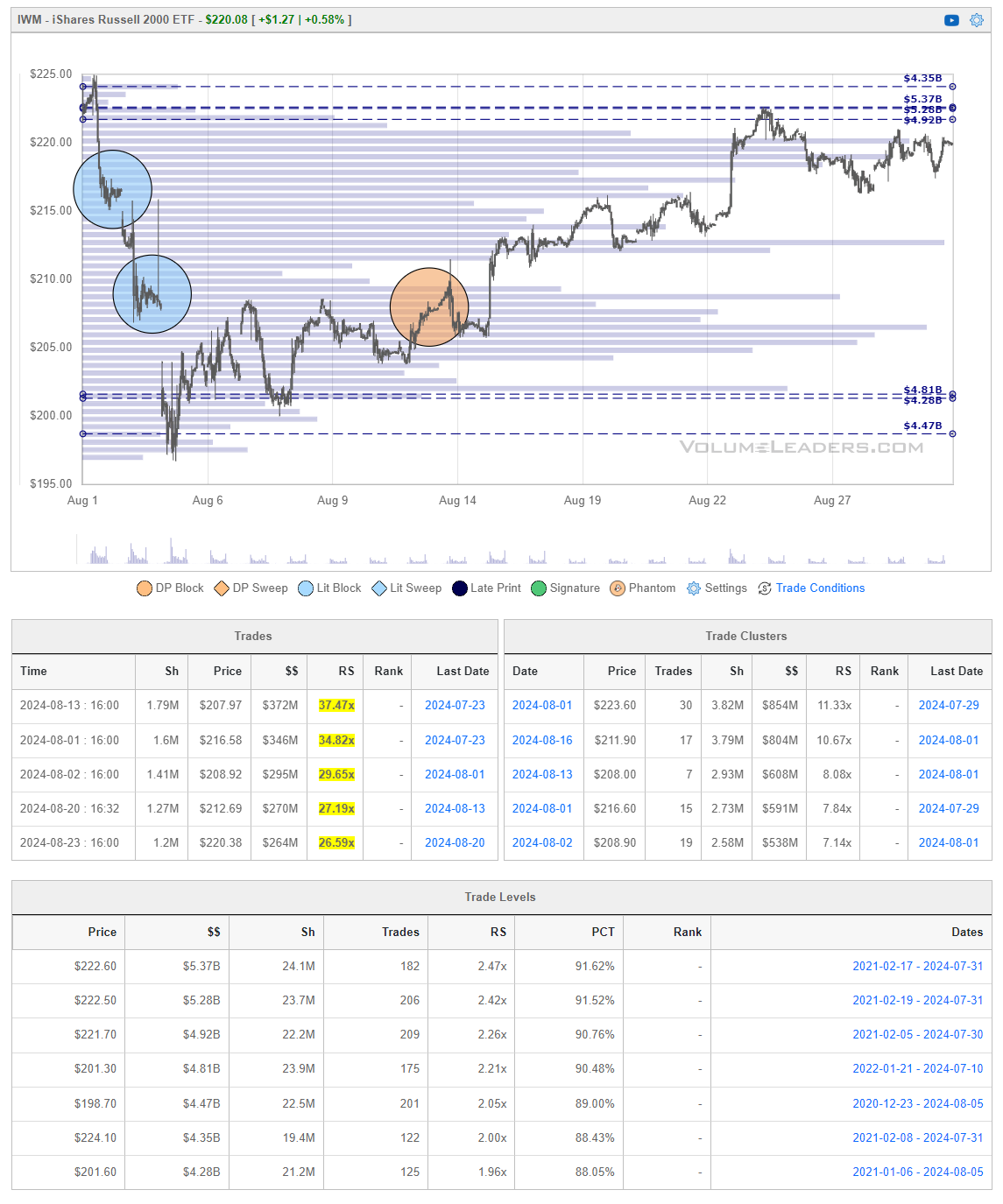

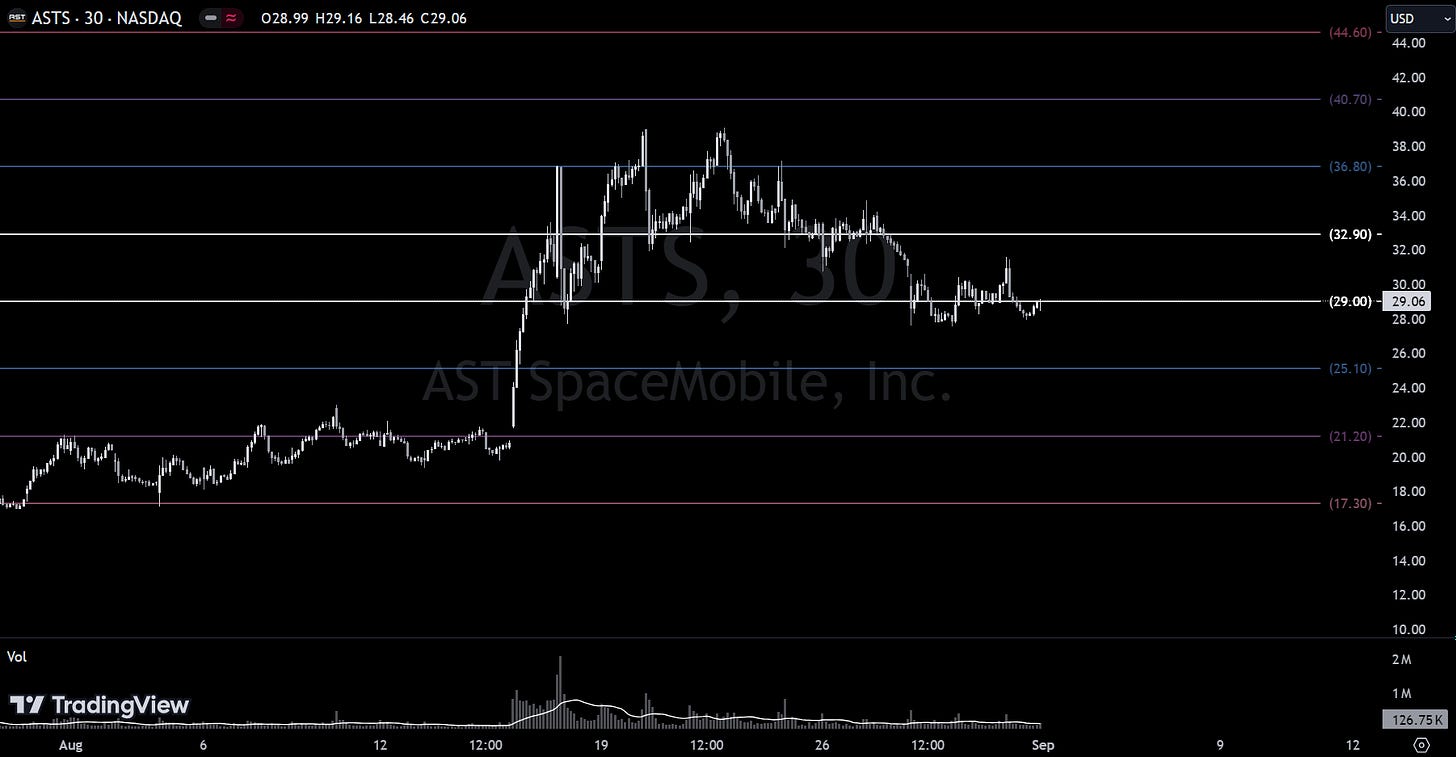

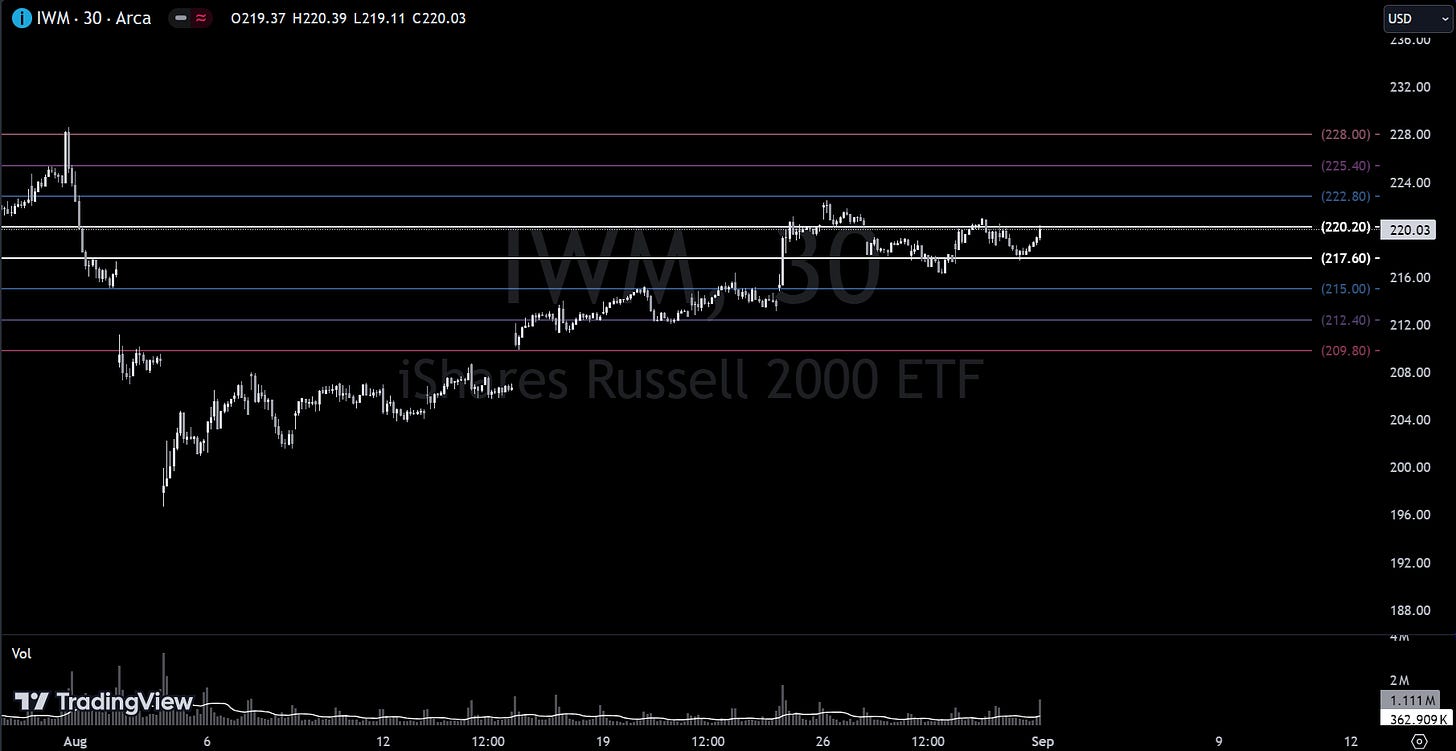

1. Price Action and Trade Levels:

Current Price: IWM is trading at $220.08, up 0.58% from the previous level.

Key Support Levels:

$201.60 is a significant support level with $4.81B traded, suggesting strong buying interest at this level.

$210.30 also represents a support level with $4.82B traded, making it an important level to monitor if the price pulls back.

Resistance Levels:

$222.60 and $222.50 are the primary resistance levels, with large trade volumes of $5.37B and $5.28B, respectively, indicating these are critical barriers for further upward movement.

2. Volume Analysis:

The chart highlights significant volume clusters:

$207.97 - $215.86: The blue circles highlight strong institutional activity in this range, with significant trades around $207.97 (RS of 37.47x) and $208.92 (RS of 29.65x). This suggests these levels are key support areas.

$212.69: This level has also seen significant trading with an RS of 27.19x, indicating that it could act as a resistance level if the price revisits this area.

3. Trade Clusters:

The Trade Clusters section highlights where large blocks of trades occurred:

$223.60: A significant amount of trading occurred here with $854M and an RS of 11.33x, suggesting this level is a key resistance point.

$211.90 and $216.90 also saw notable trade volumes, making these levels critical for future price action if the price tests these areas again.

4. Relative Size (RS):

The RS metric provides insights into the relative significance of price levels based on trading volume.

$207.97 has the highest RS at 37.47x, making it a crucial level for support. The significant volume here suggests strong buying interest at this level.

$215.86 also has a high RS of 34.82x, indicating that this level is another critical area to watch for potential resistance or support.

5. Price Movement Insights:

Uptrend Continuation: The price has been in an uptrend since early August, with a significant pullback around the $208.92 area. The current price near $220.08 suggests that IWM is testing resistance levels, and if it can break above $222.60, it could lead to further bullish momentum.

Potential Pullback: If the price fails to break above the current resistance, it may pull back to lower levels like $215.86 or $212.69, which have shown strong support in the past.

6. General Market Sentiment:

The chart suggests a cautiously bullish sentiment, with the recent price increase and the high RS at key resistance levels indicating potential for a breakout. However, the market is at a critical juncture where either a continuation of the uptrend or a consolidation phase could occur.

7. Conclusion:

Short-term: Watch the $220.08 level closely as it tests resistance. A break above $222.60 could indicate further bullish momentum.

Medium-term: If IWM fails to break resistance, a pullback to support levels around $215.86 or $212.69 could occur.

Long-term: The overall trend remains cautiously bullish, but the next few trading sessions will be critical in determining whether IWM can sustain its upward movement.

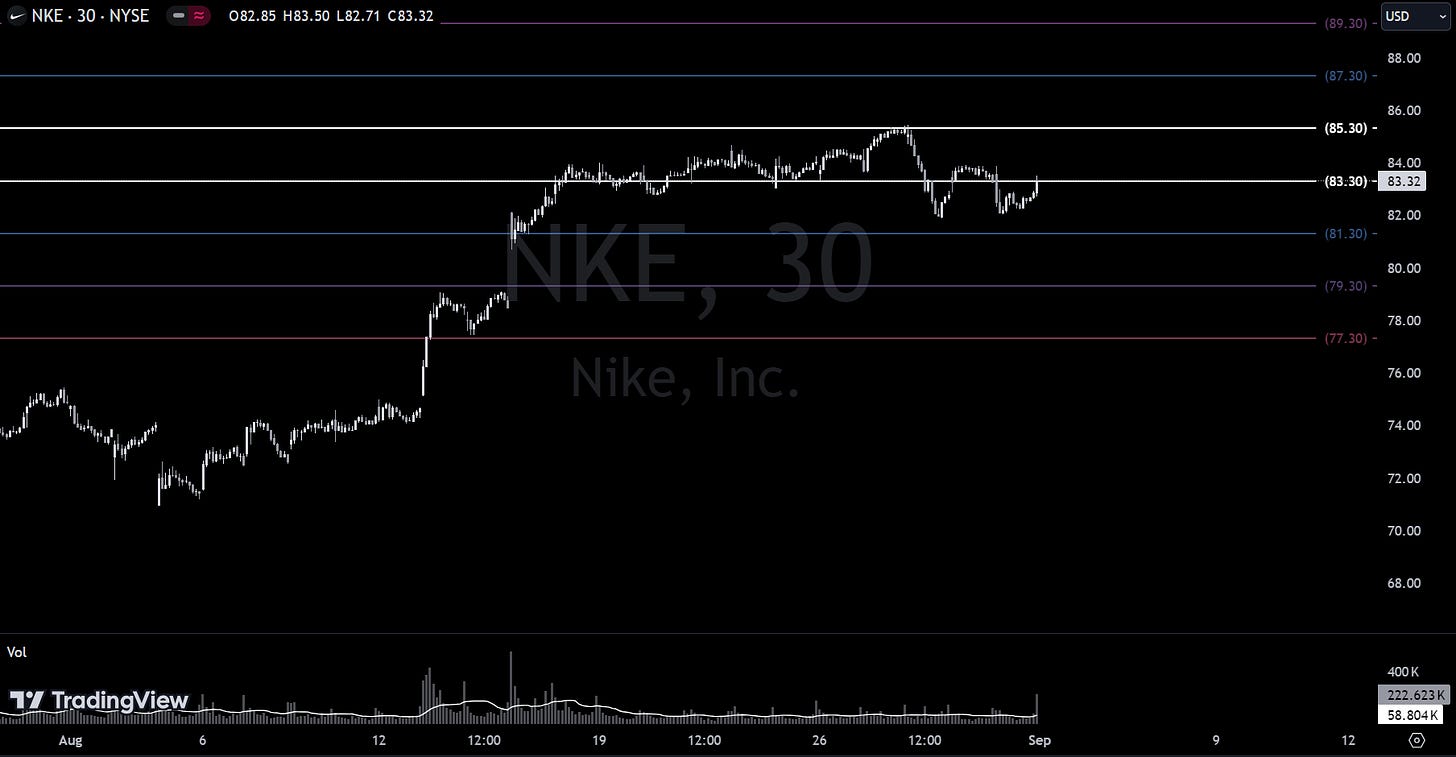

1. Price Action and Trade Levels:

Current Price: DIA is trading at $416.21, up 0.56%.

Key Support Levels:

$387.40 is a critical support level, with $728M traded and an RS of 3.68x. This level is crucial for maintaining bullish momentum.

$393.00 has significant trading volume ($504M) and an RS of 2.48x, making it an important support area if the price declines.

Resistance Levels:

$407.40 is currently the most immediate resistance level, with $373M traded and an RS of 1.83x. If DIA breaks above this, it may continue its upward trend.

$403.48 is another resistance area that has been tested previously, with $550M traded and an RS of 5.37x, indicating strong seller interest at this level.

2. Volume Analysis:

The chart highlights significant volume clusters:

$397.13 - $407.40: The green circles indicate strong institutional activity in this range, particularly around $403.48 and $407.40. These levels are key resistance points where selling pressure has previously emerged.

$393.00: This level has also seen substantial trading, making it a potential support level if the price starts to pull back.

3. Trade Clusters:

The Trade Clusters section highlights where large blocks of trades occurred:

$397.40: A significant amount of trading occurred here with $814M and an RS of 4.00x, suggesting this level is a critical support point.

$403.48 and $387.70 also saw substantial trade volumes, making these levels crucial for future price action.

4. Relative Size (RS):

The RS metric helps identify the relative significance of price levels based on trading volume:

$397.13 has the highest RS at 5.79x, indicating strong activity at this level. This is an important area for support if the price pulls back.

$403.48 with an RS of 5.37x is a critical resistance level that the price needs to overcome for continued bullish movement.

5. Price Movement Insights:

Uptrend Continuation: The price has been in an uptrend since early August, with significant pullbacks around the $393.00 and $397.40 areas. The current price near $416.21 suggests that DIA is testing previous highs. If it can break above the $407.40 resistance level, it could signal further bullish momentum.

Potential Pullback: If the price fails to break above the current resistance, it may pull back to lower levels like $403.48 or $393.00, which have shown strong support in the past.

6. General Market Sentiment:

The chart suggests a bullish sentiment, with the recent price increase and the high RS at key resistance levels indicating potential for a breakout. However, DIA is near significant resistance levels, so careful monitoring is necessary.

7. Conclusion:

Short-term: Watch the $416.21 level closely as it tests resistance. A break above $407.40 could indicate further bullish momentum.

Medium-term: If DIA fails to break resistance, a pullback to support levels around $403.48 or $393.00 could occur.

Long-term: The overall trend remains bullish, but the next few trading sessions will be critical in determining whether DIA can sustain its upward movement.

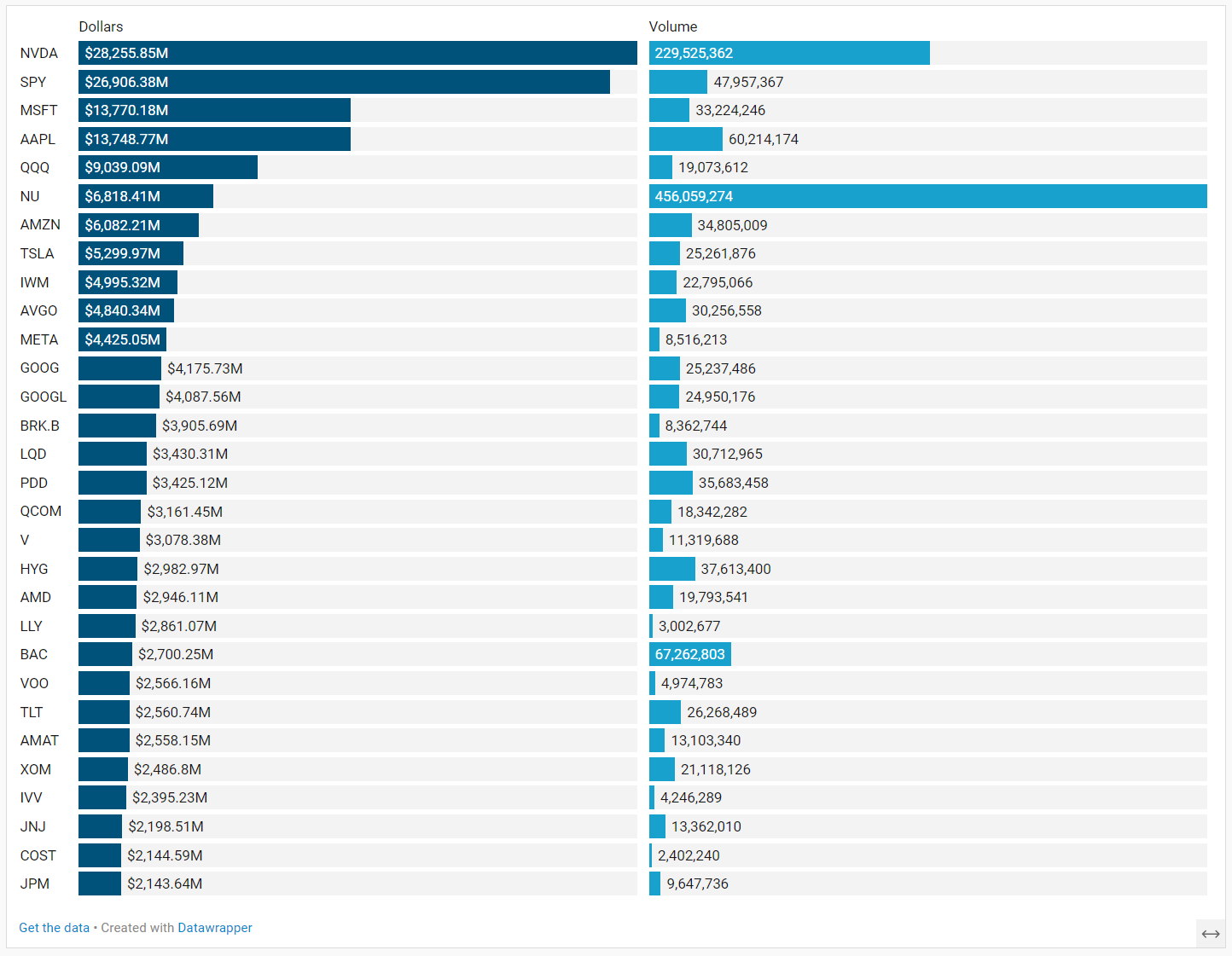

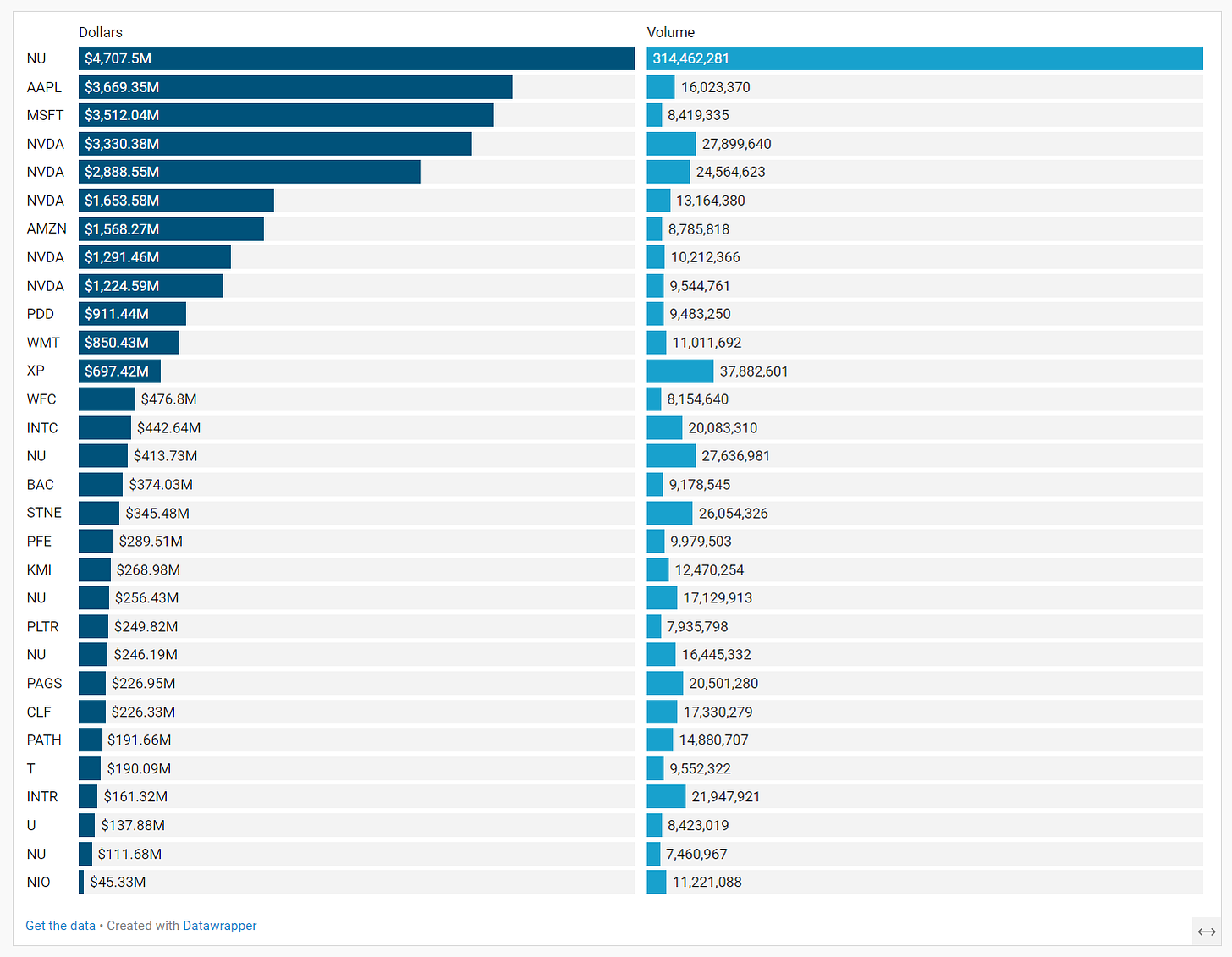

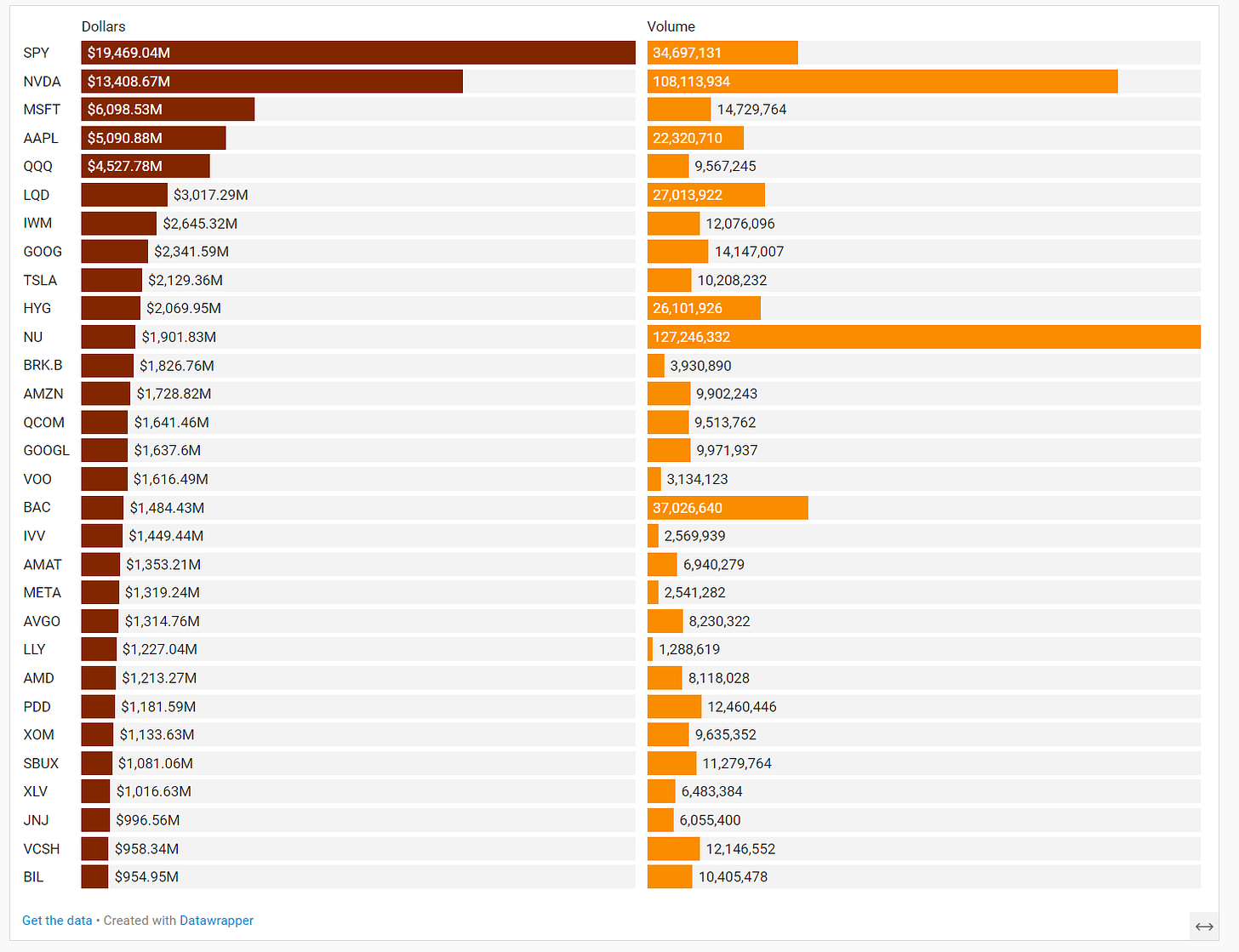

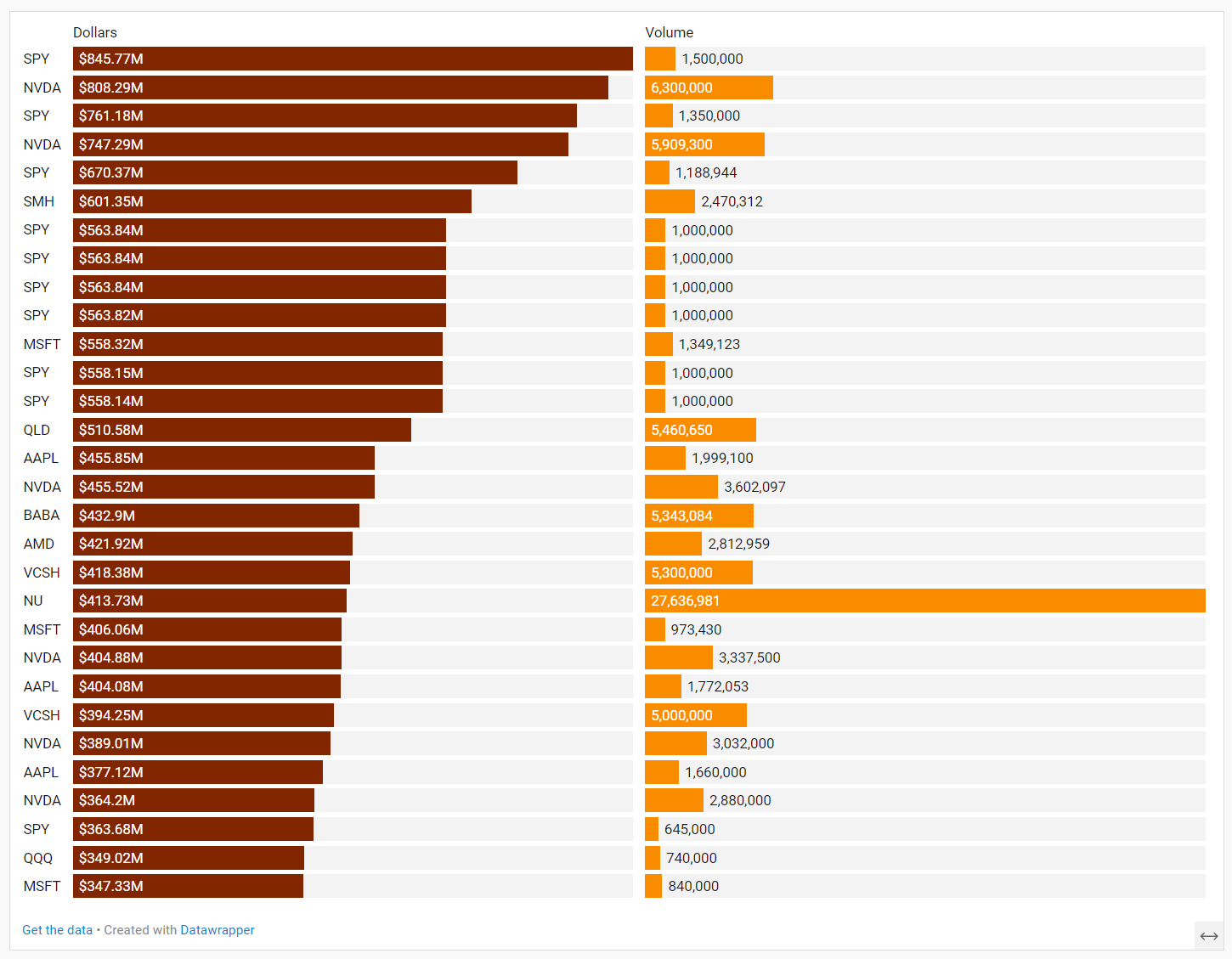

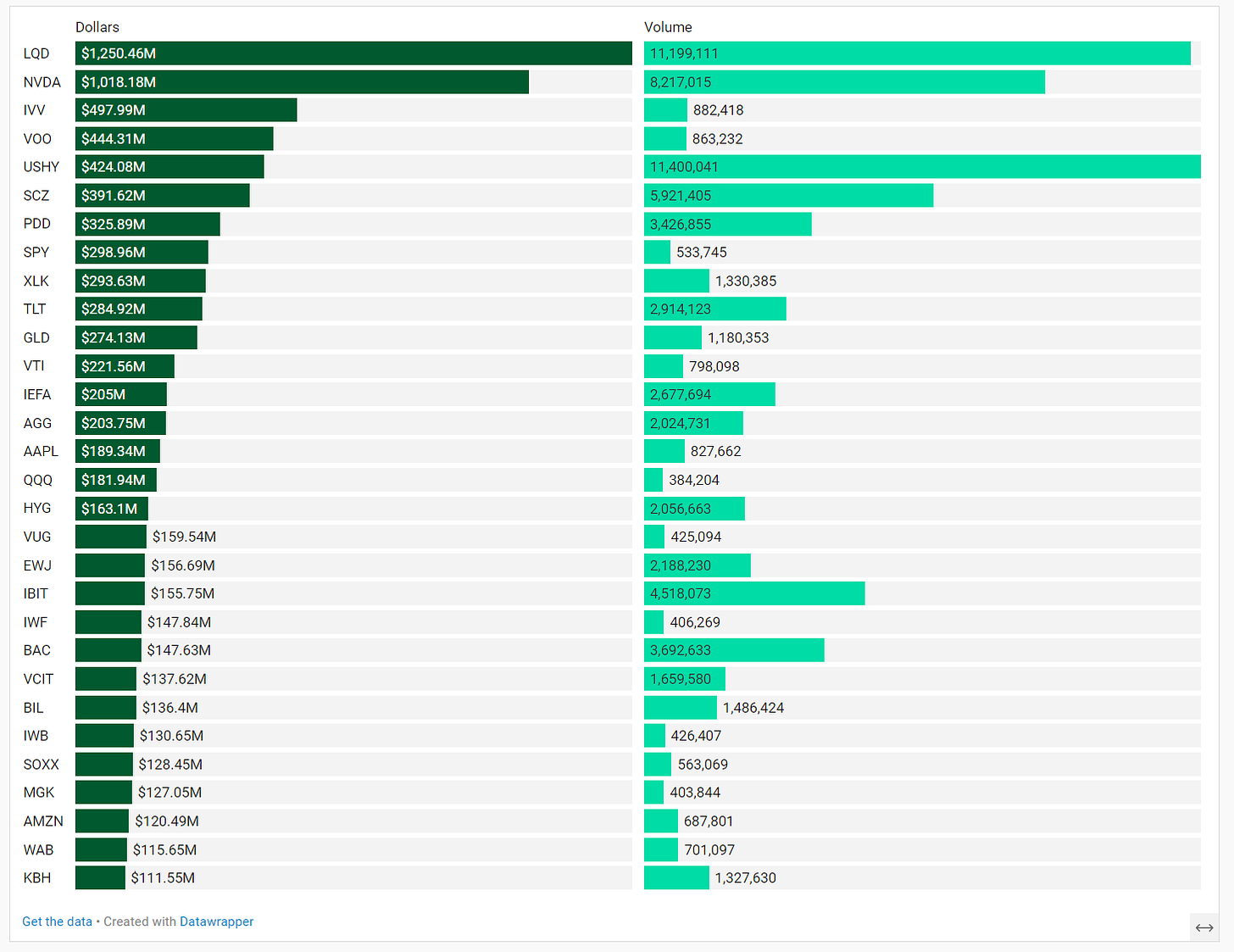

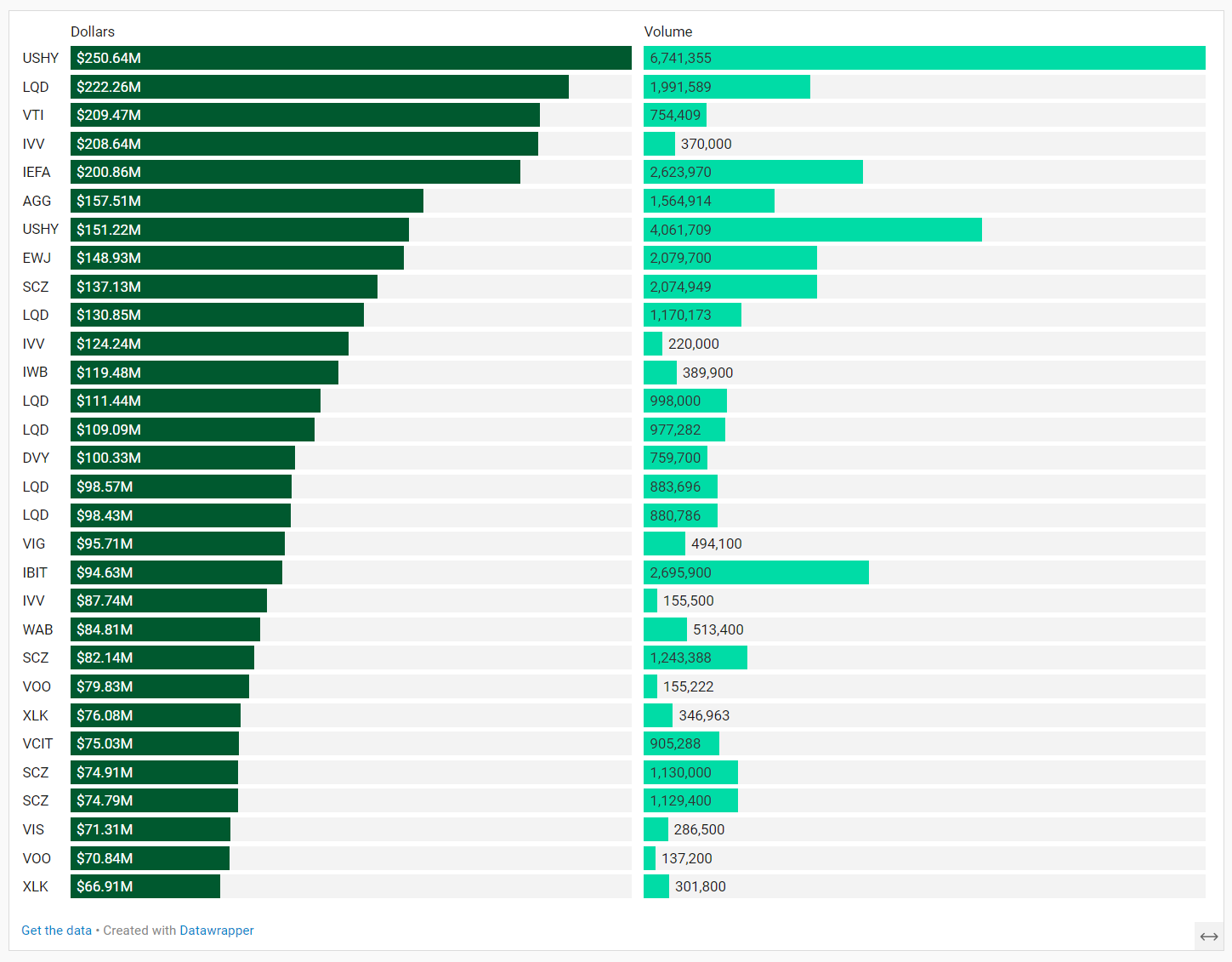

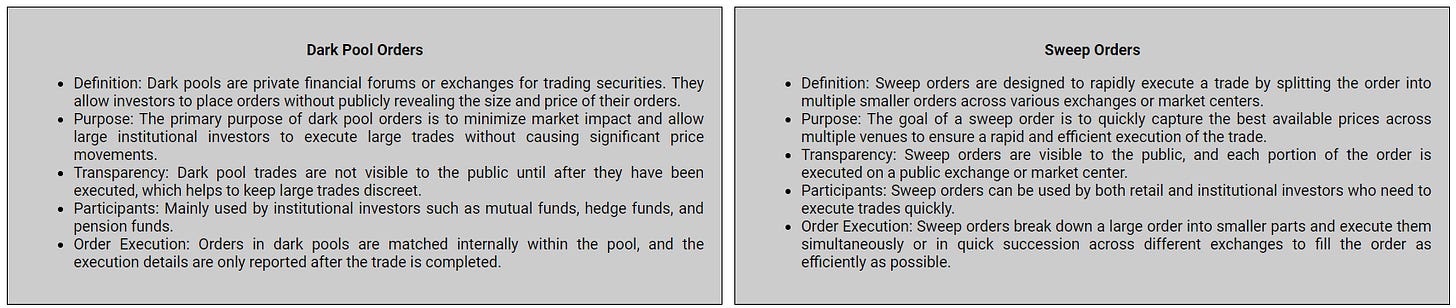

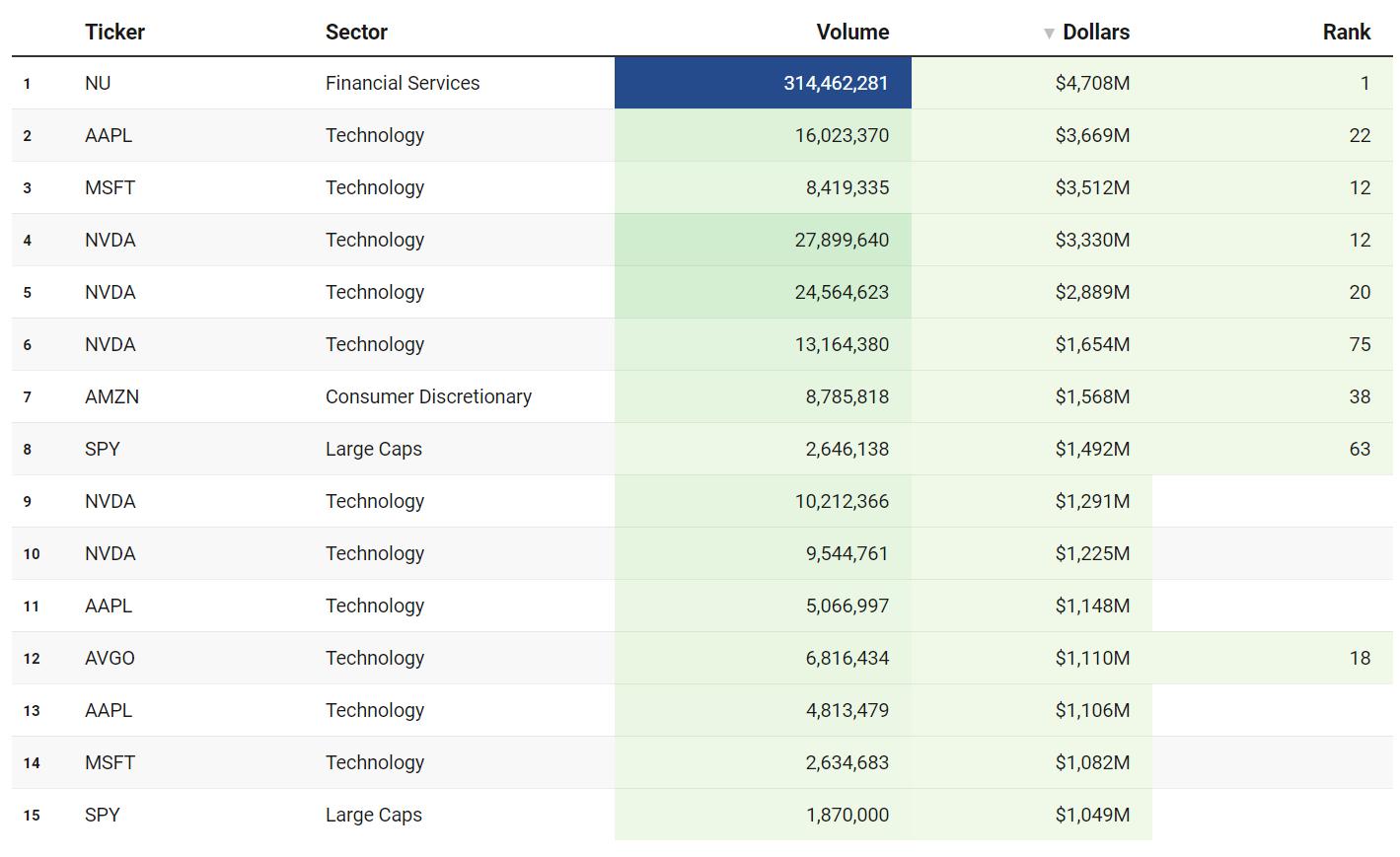

Top Institutional Order Flow

There are often great trades ideas or sources for inspiration in these prints. Only the top 30 of each group are shown but the full results are available in VL for you to browse at your leisure. Don’t forget to set up trade alerts inside the platform so you never miss institutional order flow that piques your interest or is otherwise important to you. Blue charts include all trade types including blocks on lit exchanges; red/orange charts are dark pool only trades; green charts are sweeps only.

Top Aggregate Dollars Transacted by Ticker

Largest Individual Trades by Dollars Transacted

Top Aggregate Dark Pool Activity by Ticker

Largest Individual Dark Pool Blocks by Dollars

Top Aggregate Sweeps by Ticker

Top Individual Sweeps by Dollars Transacted

Institutional S/R Levels for Individual Tickers

Please read “Institutional S/R Levels For Major Indices” at the top of this stack to understand the nature and importance of what we’re looking at here visually. Institutions leave footprints that VL can illustrate for you while providing context to assess things like institutional conviction and urgency.

Over the past week, PDD Holdings (PDD) experienced significant market activity primarily driven by its second-quarter earnings report, which led to a sharp decline in its stock price. The company reported earnings that missed revenue expectations, which, coupled with a muted outlook, caused its shares to drop nearly 30%. This decline was exacerbated by broader concerns about the Chinese economy, including weak economic data, slowing consumer income growth, and increased competition in the e-commerce sector.

Before this drop, PDD shares had gained around 20% since late July, but the earnings miss and cautious forward guidance led to a dramatic reversal. The market's reaction was swift, reflecting investor concerns about PDD's ability to maintain its growth trajectory in a challenging environment.

The ticker TSLT refers to the T-REX 2X Long Tesla Daily Target ETF, an exchange-traded fund that is designed to provide 2x leveraged exposure to the daily price movements of Tesla, Inc. (TSLA). This means that if Tesla's stock price increases by a certain percentage on a given day, the TSLT ETF aims to deliver approximately twice that percentage increase, minus fees and expenses. Conversely, if Tesla's stock price decreases, the ETF would aim to deliver twice the percentage loss.

Key Features of TSLT:

Leverage: TSLT uses financial instruments like swap agreements to achieve its 2x leverage, making it a highly volatile and risky investment option.

Investment Objective: The fund is intended for short-term trading strategies, particularly for those who want to capitalize on daily price movements of Tesla stock. It's not meant for long-term holding due to the risks associated with daily compounding.

Management: The ETF is managed by Tuttle Capital Management, which specializes in niche and innovative ETFs.

Expenses: The ETF has a relatively high expense ratio of 1.05%, reflecting the costs associated with managing a leveraged product.

Performance:

Volatility: Due to its leverage, TSLT is significantly more volatile than the underlying Tesla stock. While it offers the potential for amplified gains, it also poses the risk of amplified losses.

Trading Volume: The ETF typically experiences high trading volumes, indicative of its popularity among active traders.

TSLT clocked a #1 all-time trade at the end of the month with a significant amount of institutional positioning underneath. This 30-day profile shows a high-degree of balance and from balance we can, at some point, expect imbalance; a move is clearly building and this is worth watching.

VL Precision Swings

This week we’re featuring additional screened trade ideas from one of our backtested proprietary signals for tactical swings called IBB - Institutional Breakout Boxes. The IBB Setup identifies an area of significant institutional positioning within a tight, concentrated price range, forming what we call a breakout box. This setup captures the potential energy built up as large players accumulate or distribute positions, creating a high-probability opportunity for explosive moves once the price breaks out of this zone. The precision of this setup allows traders to capitalize on the momentum generated by institutional forces, with clearly defined risk and reward parameters.

Note, these are shared for educational and entertainment purposes only and do not constitute financial advice.Here’s an example from XLRE:

Let’s see how last week’s setups played out. If you took any of these yourself, let us know in the comments!

AEP: triggered long, +1.78%, all 3 targets met

AIG: triggered long, currently +1.41%, no targets yet met

BAC: triggered long, +2.1%, first profit target met

BIDU: triggered short, + 3.6%, second profit target met

DKNG: triggered short, +4.95%, first profit target met

EWZ: triggered short, -.56%, no targets yet met

JBL: triggered long, +.56%, no targets yet met

KMI: triggered long, +1.34, no targets yet met

NVDL: triggered short, +16.5%, all targets met

ORCL: triggered short for +1.2% into the T1 and is now triggered long +1.24%, first target met on the long side

STNG: triggered short, stopped for -1.4%, no targets met. Setup is still valid to play

XOP: triggered short, -.59%, no targets yet met

Some losers, more winners and a couple are still playing out. Here are some of the Precision Swings we’re watching this week:

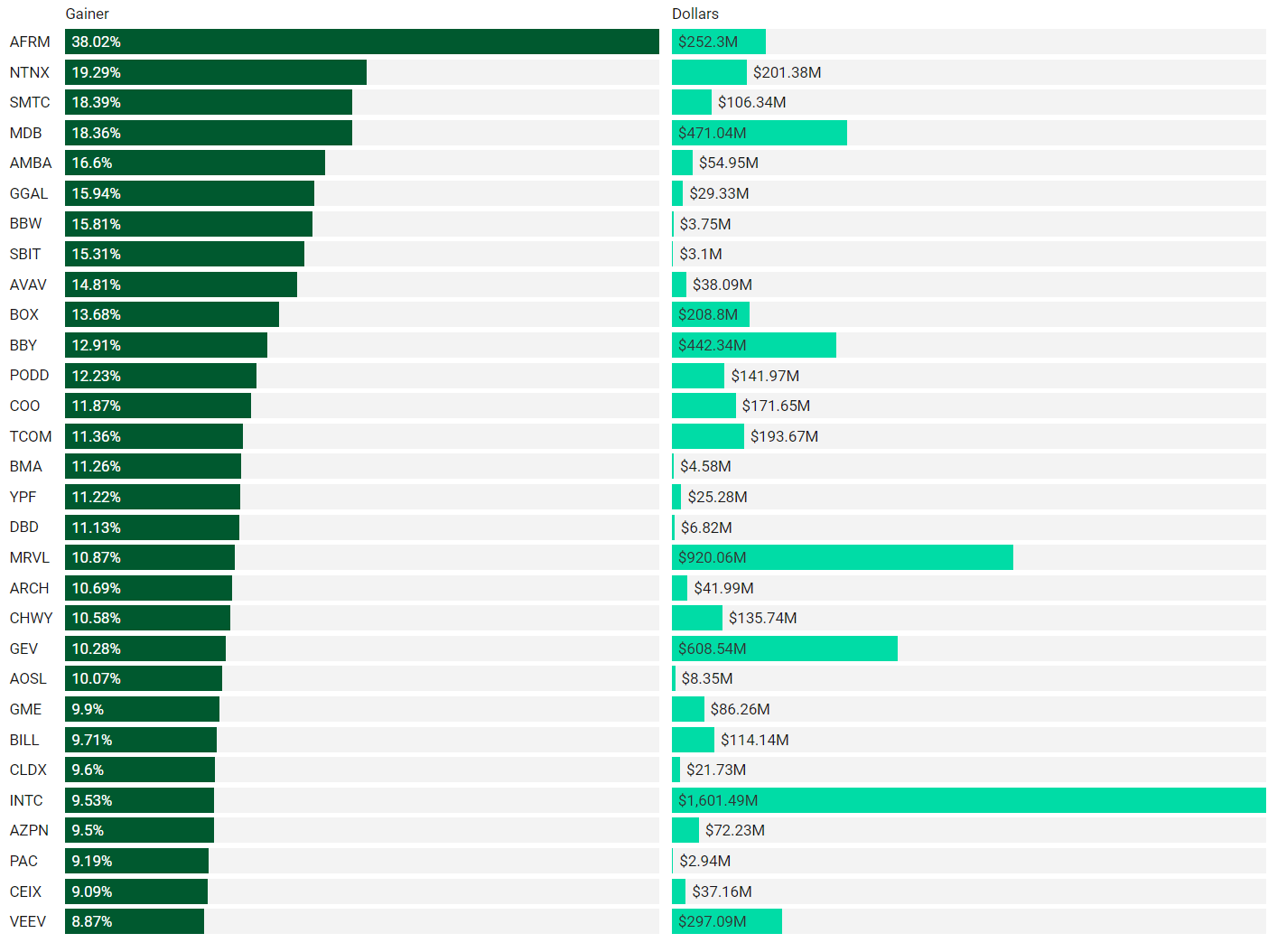

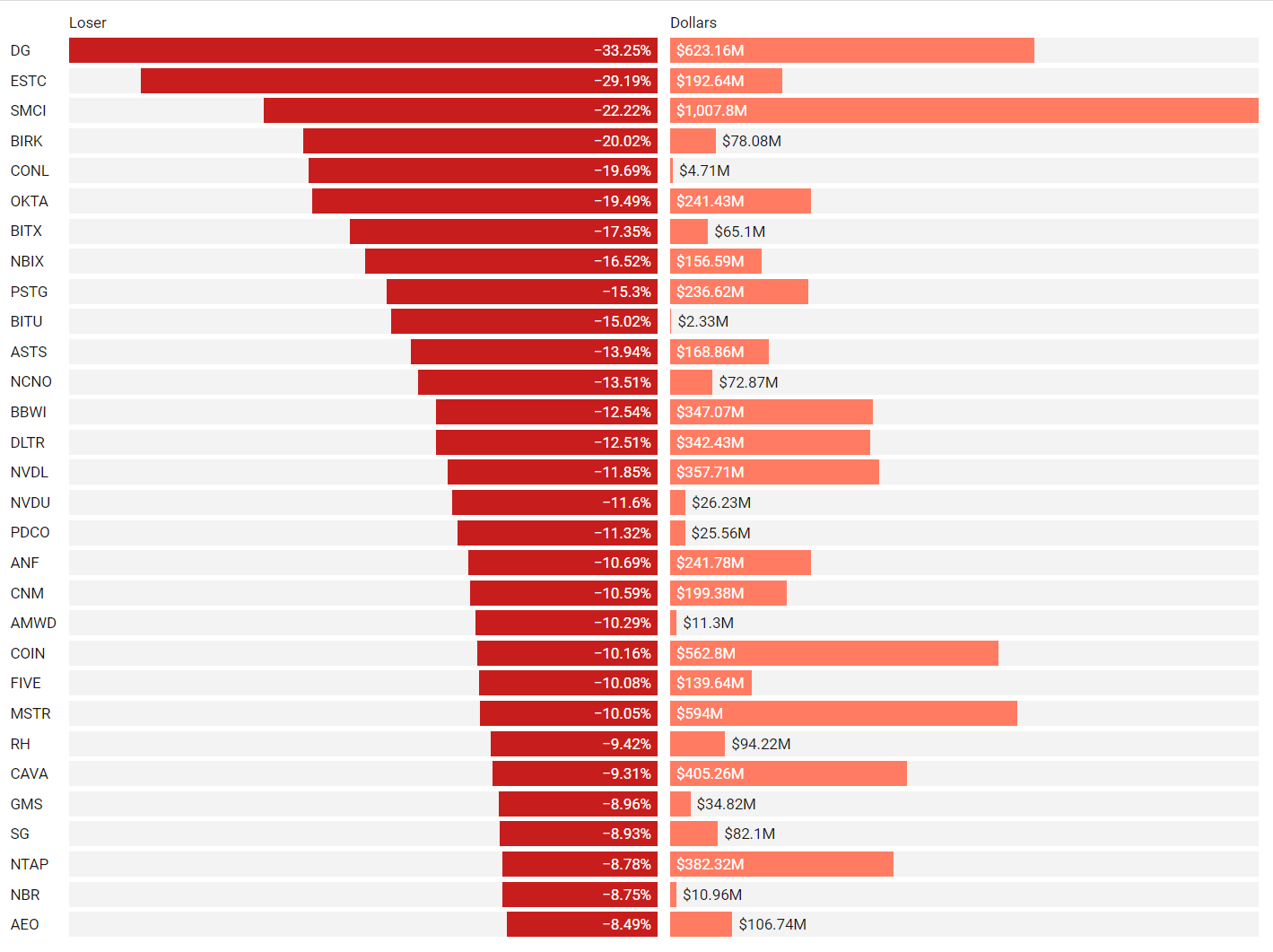

Institutionally-Backed Gainers & Losers

If you’re going to bet on a horse, consider one that is officially endorsed by an institution! These are the top percent gainers (green) and percent losers (red) from this week’s open-to-close that had a trade price greater than $20 and institutional involvement. Continue watching tickers from prior stacks as these frequently turn into multi-leg trades with a lot of movement!

Top Institutionally Backed Gainers

Top Institutionally Backed Losers

Billionaire Boys Club

Tickers that printed a trade worth at least $1B last week get a special shout-out… Welcome to the club. Subs should login to VL to get the exact trade price and relevant institutional levels around the trade - these are massive commitments by institutions that should not be ignored.

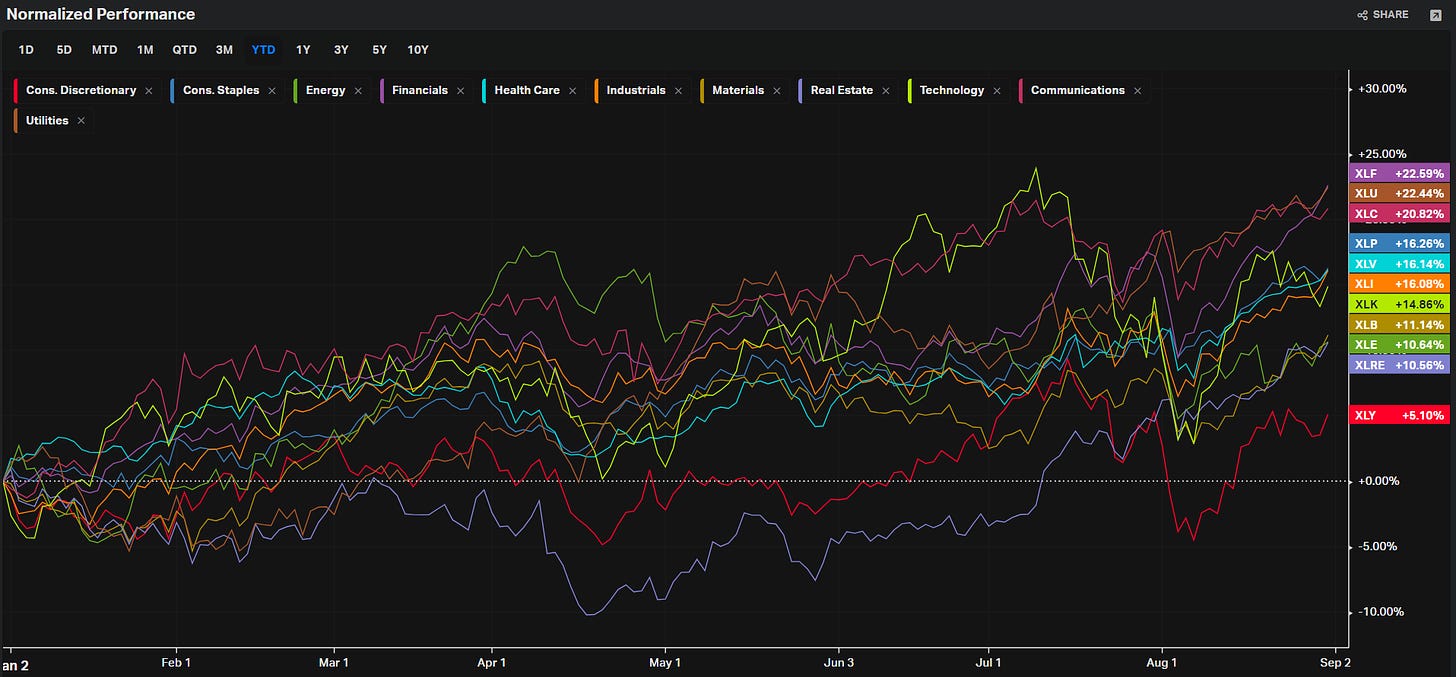

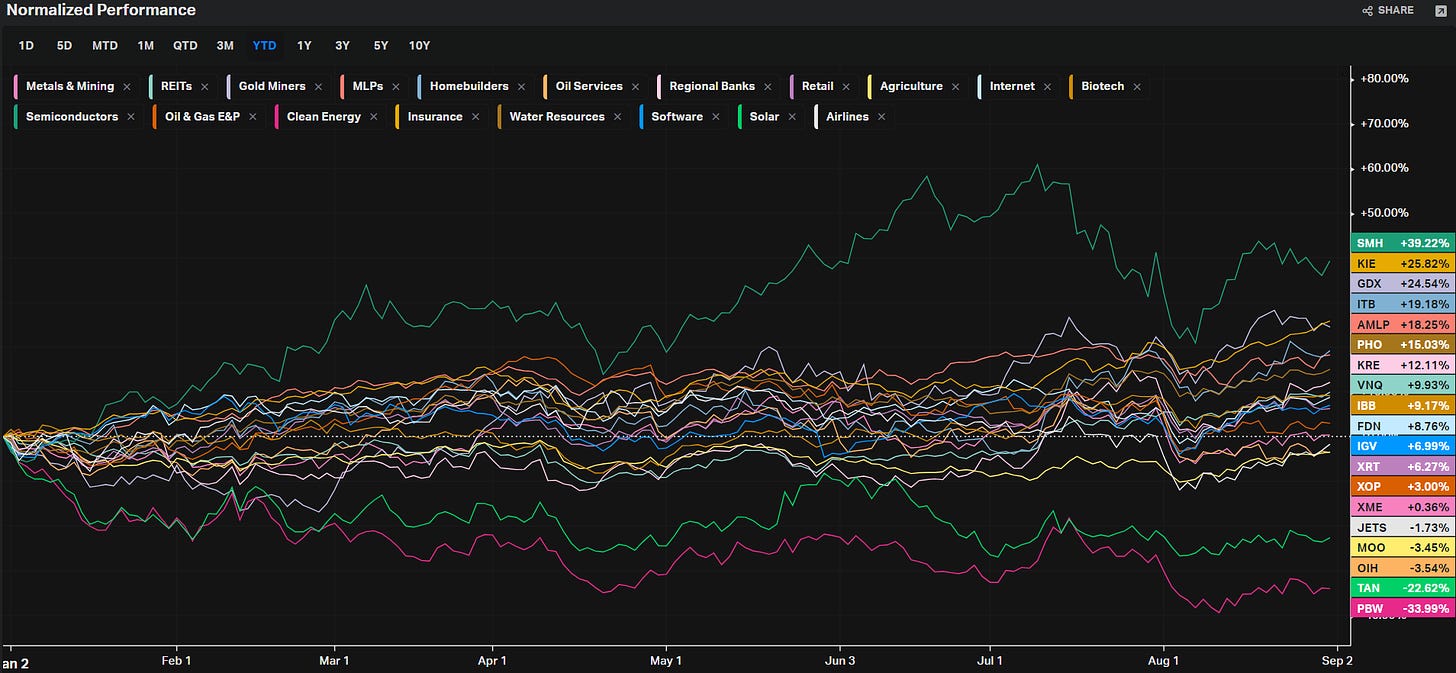

Summary Of Thematic Performance YTD

VL provides a lot of pre-built filters for thematics so that you can quickly dive into specific areas of the market. These performance overviews are provided here only for inspiration. Consider targeting leaders and/or laggards in the best and worst sectors, for example.

We’re now half-way through the year so we’re offering our semi-annual recap of what we’re seeing YTD in each theme. The next detailed wrap-up of thematics will come at the end of the year. If we missed something important, sound-off in the comments!

S&P By Sector

S&P By Industry

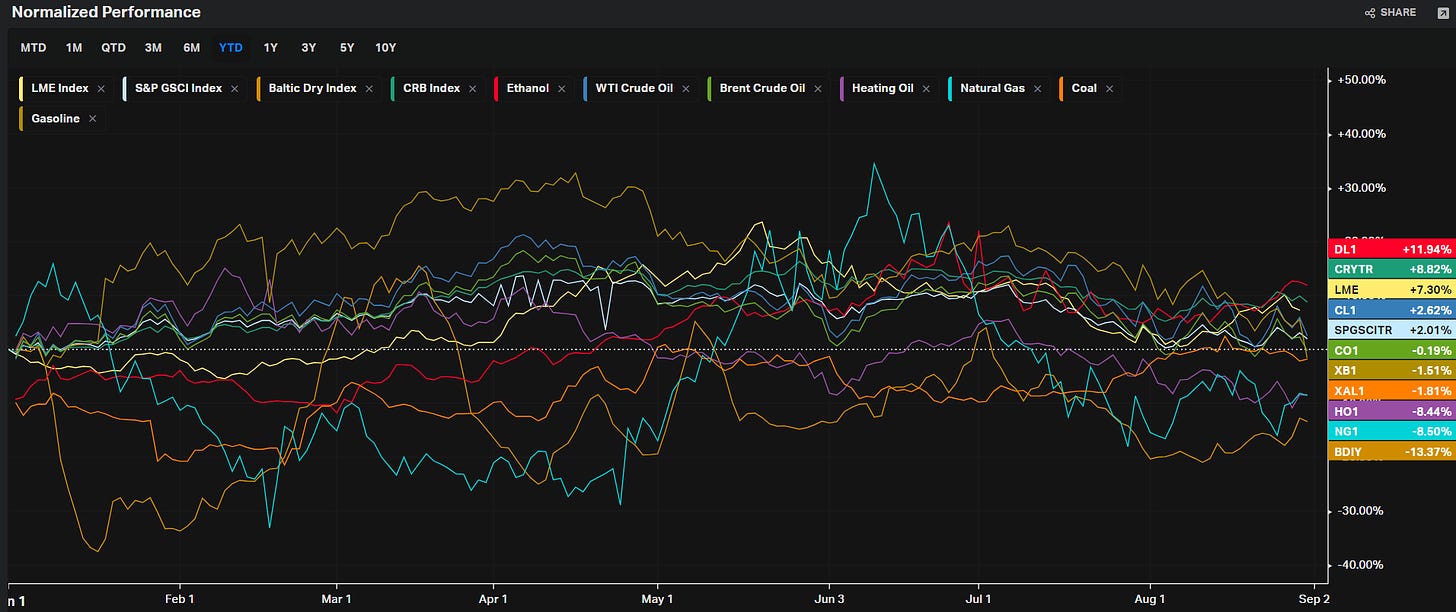

Energy

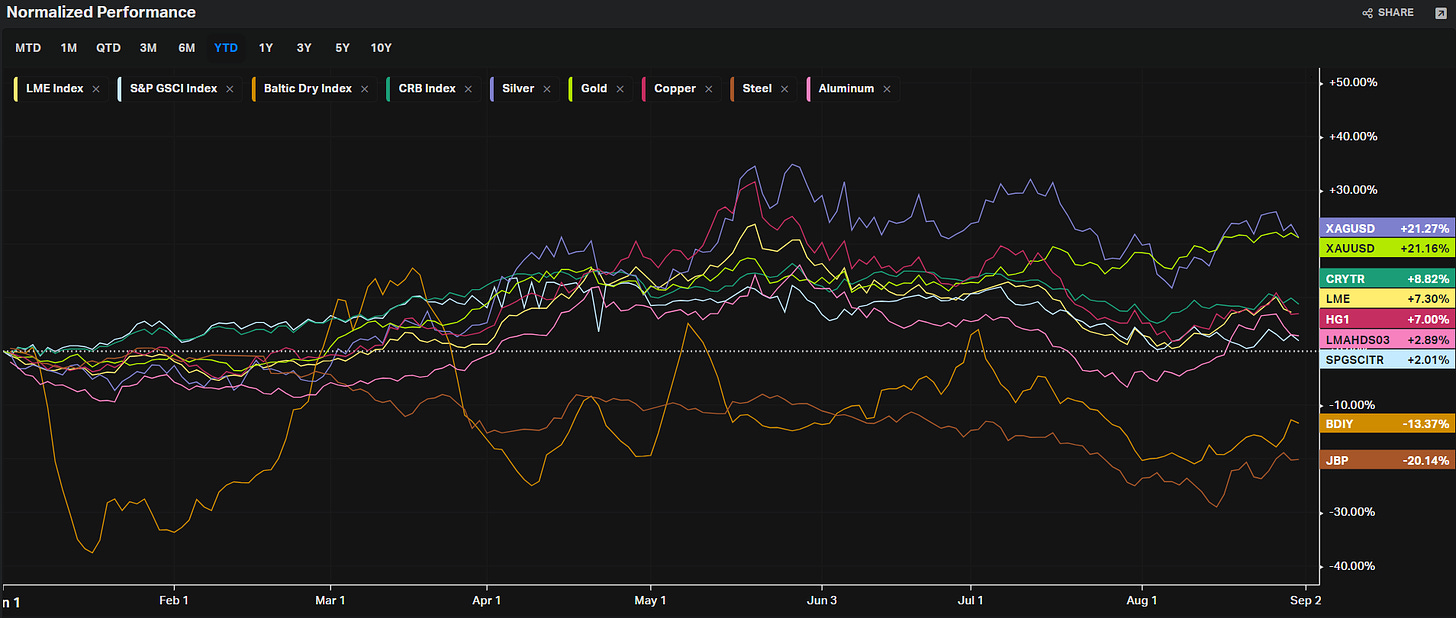

Metals

Agriculture

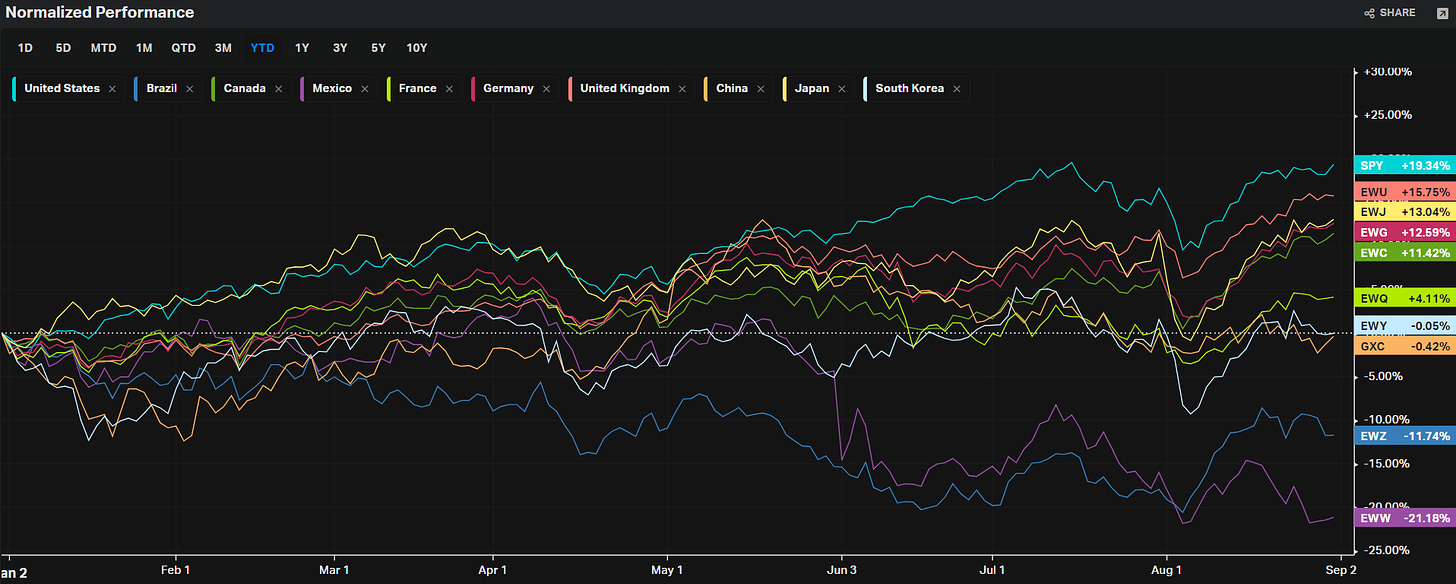

Country ETFs

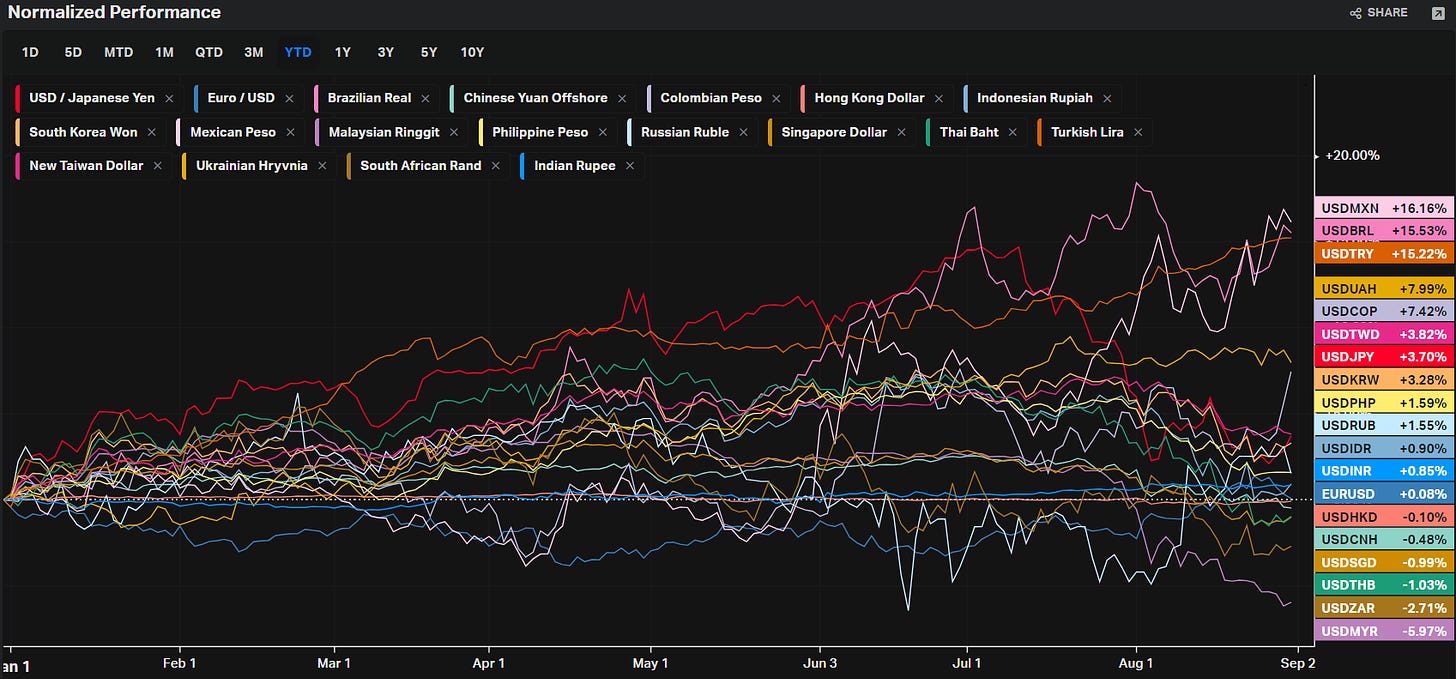

Currencies

Yields

Factors: Size vs Value

Factors: Style

Social Media Favs

Most mentioned/discussed tickers on Reddit from some of the most active Subreddits for trading:

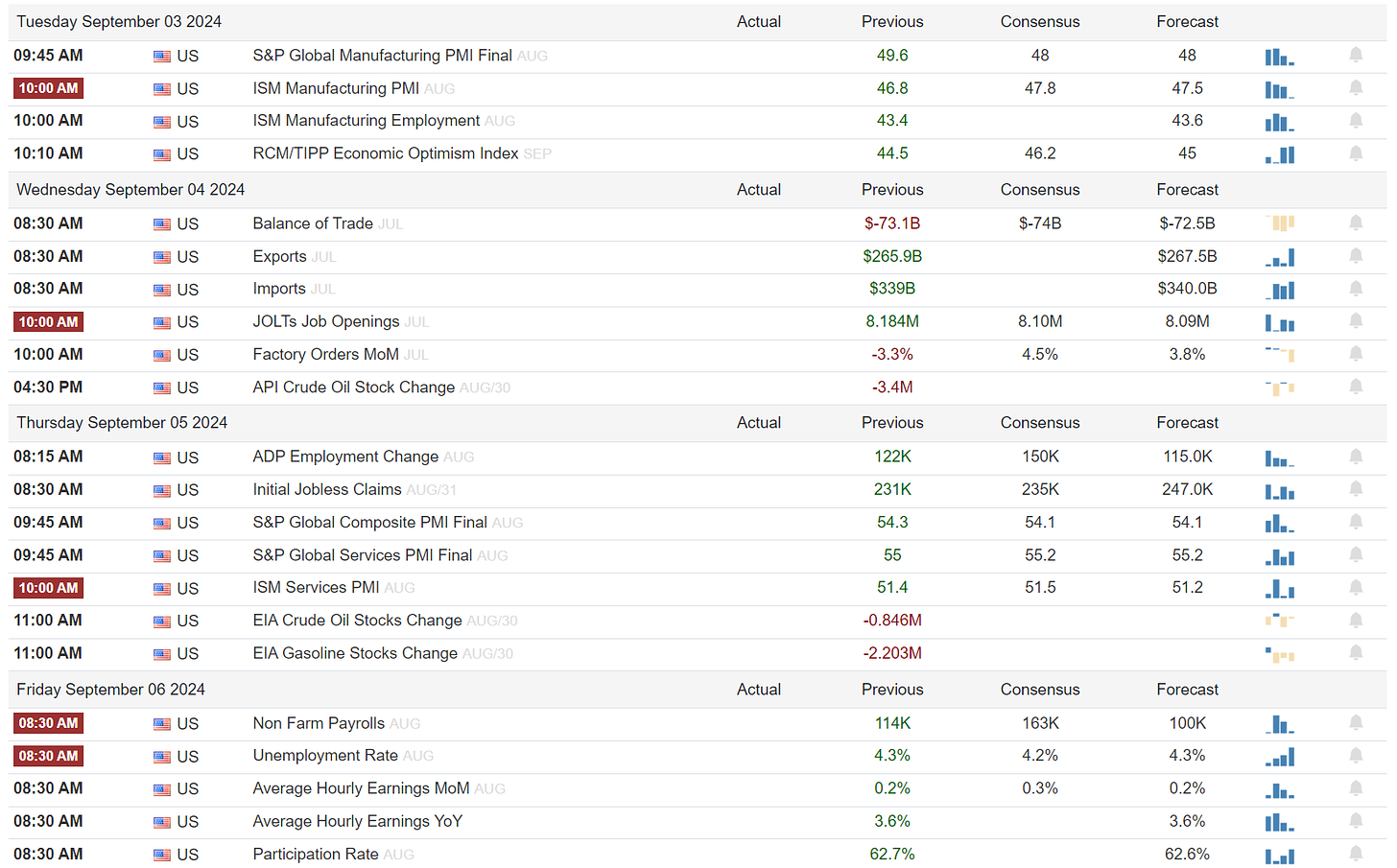

Events On Deck This Week

Here are key events happening this week that have the potential to cause outsized moves in the market or heightened short-term volatility.

Econ

Earnings

A Final Word

Thank you for reading this week's edition of Market Momentum. If you found value in this content, please consider sharing it with a friend or colleague, in a Discord or a Tweet. This small favor helps keep this stack free for you! Please check out VolumeLeaders.com for your own free trial of the platform that brings you the data powering this stack. Wishing you all a green week ahead filled with many bags ❤️💰.

Your weekly column has become one of my weekend must-reads