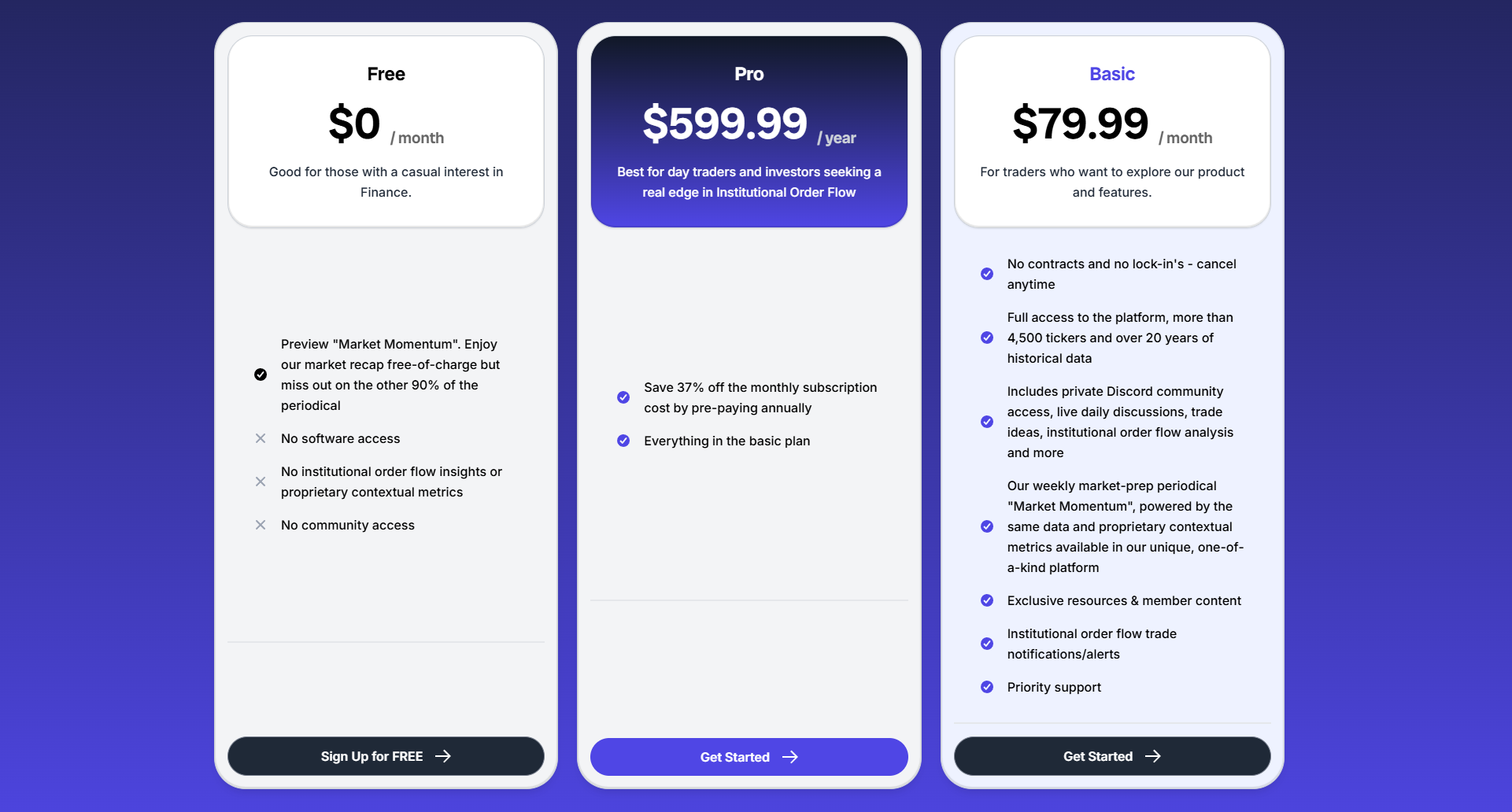

Market Momentum: Your Weekly Financial Forecast & Market Prep

Issue 40 / What to expect April 07, 2025 thru April 11, 2025

In This Issue

Market-On-Close: All of last week’s market-moving news and macro context in under 5 minutes + futures-at-a-glance

The Latest Investor Sentiment Readings

Institutional Support & Resistance Levels For Major Indices: Exactly where to look for support and resistance this week in SPY, QQQ, IWM & DIA

Institutional Activity By Sector: Institutional order flow by sector including the top institutionally-backed names in those sectors. We break it all down and provide the key insights and take-aways you need to navigate institutional positioning this week.

Top Institutional Order Flow In Individual Names: All of the largest sweeps and blocks on lit exchanges and hidden dark pools

Investments In Focus: Bull vs Bear arguments for PYCR, SARO, GBX

Top Institutionally-Backed Gainers & Losers: An explosive watchlist for day traders seeking high-volatility

Normalized Performance By Thematics YTD (Sector, Industry, Factor, Energy, Metals, Currencies, and more): which corners of the markets are beating benchmarks, which ones are overlooked and which ones are over-crowded

Key Econ Events and Earnings On-Deck For This Week

Market-On-Close

Market Turbulence: Analyzing the Impact of Trade Policy on Global Financial Markets

Introduction

The financial markets experienced extraordinary volatility last week, culminating in the steepest weekly decline in five years. Investors watched with growing concern as major indices plummeted in response to unexpected trade policy announcements from the Trump administration. The S&P 500 shed nearly 6% in a single day, while the technology-heavy Nasdaq 100 suffered even steeper losses. This market reaction represents more than typical short-term volatility—it signals deep investor anxiety about potential economic disruption and global trade conflicts that could fundamentally alter the economic landscape.

The catalyst for this market turbulence was President Trump's April 2nd announcement of sweeping tariffs that exceeded market expectations in both scope and magnitude. What made this policy particularly impactful was its broad application across virtually all trading partners and its potential to raise effective tariff rates to levels not seen in over a century. While markets had been anticipating some form of protectionist measures, the comprehensive nature of these tariffs—coupled with China's swift retaliatory response—sent shockwaves through global financial systems.

The Tariff Announcement: A Policy Earthquake

On April 2nd, President Donald Trump unveiled a comprehensive tariff framework that immediately altered market expectations. The announcement outlined a minimum 10% tariff on virtually all countries, scheduled to take effect on April 5th, with significantly higher rates targeted at nations with which the United States maintains substantial trade deficits. The magnitude of these tariffs stunned market participants, who had anticipated more moderate and targeted measures.

The most severe tariffs were directed at China, with a 34% reciprocal tariff rate that, when combined with existing duties, brings the total tariff burden on Chinese imports to a staggering 67%. Other major trading partners faced substantial increases as well: the European Union received a 20% reciprocal tariff (bringing their total to 39%), while Japan was assigned a 24% reciprocal tariff (raising their total to 46%). Notably, Canada and Mexico were exempted from these new reciprocal tariffs, though they remain subject to previously announced 25% tariffs on certain goods.

What makes these tariffs particularly significant is their historical context. From 2000 to 2024, the average U.S. tariff rate on imports hovered around a modest 1.7%. The new measures are projected to raise the effective tariff rate to between 20% and 25%—the highest level in at least a century. Given that the United States imported approximately $3.3 trillion of goods in 2024, these tariffs could generate revenue of roughly $660 billion, equivalent to about 2.3% of GDP. The sheer scale of this policy shift represents a fundamental reorientation of U.S. trade strategy.

The market had barely begun processing these announcements when China delivered its counterpunch. On Friday, Beijing announced it would impose matching 34% tariffs on all U.S. imports beginning April 10th. This swift retaliation validated market fears about an escalating trade conflict and further intensified the sell-off in global equity markets.

Market Reaction: A Global Risk-Off Environment

The market response to these trade policy developments was swift and severe. By Friday's close, the S&P 500 had fallen 5.97%, the Dow Jones Industrial Average had dropped 5.50%, and the Nasdaq 100 had plunged 6.07%. The weekly performance was even more striking, with the S&P 500 down 7.1% and the Nasdaq down 8.2%—marking the worst weekly performance for these indices in over five years. The Russell 2000, representing smaller companies, suffered disproportionately, losing approximately 10% for the week and ending more than 30% below its all-time high.

Volatility, as measured by the CBOE Volatility Index (VIX), spiked dramatically from 20 to over 45 before settling at 39.63—levels not seen since the market turbulence of early 2020. This surge in the "fear index" reflected profound uncertainty about the economic implications of these trade policies and their potential to disrupt global supply chains.

The selloff was not limited to U.S. markets. International equities also suffered substantial losses, with the Euro Stoxx 50 falling to a 3.5-month low and closing down 4.60%. Japan's Nikkei Stock 225 sank to a 7.75-month low, closing down 2.75%. The global nature of this market reaction underscores the interconnectedness of the modern economy and the far-reaching implications of U.S. trade policy.

Within equity markets, sector performance revealed interesting patterns that reflected investor assessments of tariff exposure. The "Magnificent Seven" technology stocks, which had been market leaders for much of the past few years, experienced particularly steep declines. Tesla fell more than 10%, while Nvidia and Apple dropped more than 7%. The semiconductor industry, with its heavy exposure to global supply chains and the Chinese market, suffered even more pronounced losses, with companies like Micron Technology falling more than 12% and Intel declining more than 11%.

Energy stocks also faced severe pressure as crude oil prices plummeted to four-year lows, with WTI crude falling more than 7%. Companies like APA Corp and Baker Hughes saw their shares drop more than 13%. Mining stocks similarly tumbled as commodity prices weakened, with Freeport-McMoRan falling more than 12%.

However, not all sectors suffered equally. Homebuilders showed relative strength, with companies like DR Horton gaining more than 4% as investors anticipated that lower Treasury yields would put downward pressure on mortgage rates, potentially supporting housing demand. Companies with substantial manufacturing operations in Vietnam, such as Nike and Lululemon Athletica, also performed relatively well after President Trump indicated that Vietnam was willing to negotiate to avoid new U.S. tariffs.

The risk-off sentiment extended beyond equity markets, triggering significant moves in fixed income and commodities. Investors sought safety in government bonds, pushing the yield on the 10-year Treasury note down 31 basis points for the week to 3.93%, with intraday lows reaching 3.856%—a six-month low. European government bond yields similarly declined, with the German 10-year bund yield falling to a one-month low of 2.479%.

In commodities markets, gold briefly touched another all-time high at $3,134 per ounce before settling at $3,022, reflecting its traditional role as a safe-haven asset during periods of market stress. Conversely, oil prices collapsed under the weight of concerns about global economic growth, with West Texas Intermediate crude falling 13.75% to $61.66 per barrel, its lowest level in four years.

Currency markets also reflected shifting economic expectations, with the dollar index (DXY) falling 1.66% for the week to its lowest level since October, effectively erasing all post-election gains. This dollar weakness came despite the traditional role of the U.S. currency as a safe haven during periods of market stress, suggesting that investors were reassessing the impact of trade policies on U.S. economic prospects.

Economic Implications: Growth, Inflation, and Monetary Policy

The market reaction to the tariff announcements reflects deep concern about their potential economic impact. Tariffs represent a complex economic intervention with multifaceted effects on growth, inflation, corporate margins, and household spending power.

The immediate economic concern is the potential impact on growth. Tariffs can pressure corporate profit margins through higher input costs, potentially leading to reduced investment and hiring. They can also weigh on household spending by increasing the cost of imported goods and reducing real purchasing power. Additionally, retaliatory measures from trading partners can harm U.S. exporters, further dampening economic activity.

These growth concerns were somewhat tempered by Friday's employment report, which showed that U.S. employers added 228,000 jobs in March—significantly above expectations of 140,000. This strong labor market data suggests that the U.S. economy entered this period of trade uncertainty from a position of relative strength. However, the unemployment rate did tick up slightly to 4.2% from 4.1%, indicating some potential softening in labor market conditions.

While growth concerns dominated market sentiment, inflation risks also factored into investor calculations. Tariffs essentially function as a tax on imports, and some portion of these costs will likely be passed on to consumers, potentially pushing prices higher. Evidence of this inflationary pressure was already visible in the ISM manufacturing survey, which showed that the prices index jumped seven percentage points to 69.4% in March, largely due to the impact of tariffs. Similarly, the ISM services survey indicated that the prices index remained firmly in expansion territory at 60.9%, with respondents specifically citing tariff activity as a driver of cost increases.

These conflicting growth and inflation signals create a challenging environment for monetary policy. Federal Reserve Chair Jerome Powell acknowledged these complexities in a speech on Friday, noting that the economic impact of new tariffs is likely to be "significantly larger than expected" and may lead to "slower growth and higher inflation." However, Powell also indicated that the Fed was "well-positioned to wait" before adjusting monetary policy, suggesting that the central bank wanted more clarity on the economic effects before committing to interest rate cuts.

Despite Powell's measured stance, market expectations for Fed policy shifted dramatically in response to the tariff announcements. Interest rate futures now reflect expectations for multiple rate cuts in 2025, as investors anticipate that the negative growth effects from trade policies will force the Fed to ease monetary policy to support the labor market and stimulate economic activity. The markets are currently discounting the chances at 34% for a 25 basis point rate cut after the May 6-7 FOMC meeting.

International Dimensions: Global Response and Supply Chain Implications

The global nature of modern supply chains means that tariff policies have complex international ramifications. China's swift retaliatory tariffs represent just the beginning of what could become a broader international response. European officials have already begun advocating for a forceful retaliation to President Trump's measures, potentially targeting U.S. technology and service companies, as well as U.S. banks.

For China specifically, economists estimate that the higher U.S. tariffs could reduce China's 2025 GDP growth by 1% to 2.4%, potentially prompting additional stimulus measures from Beijing. These might include increased fiscal spending, special sovereign bond issuances, and adjustments to monetary policy such as cuts in the reserve requirement ratio for banks.

The United Kingdom is taking a slightly different approach, with Trade Secretary Jonathan Reynolds expressing confidence in the ability to negotiate a reduction in the new 10% tariff imposed on the country's exports. However, British officials are also consulting businesses about potential retaliatory tariffs if negotiations fail to yield results.

These international responses highlight the potential for cascading effects across the global economy. As countries adjust their trade policies in response to U.S. actions, new patterns of international commerce may emerge, with significant implications for global supply chains and investment flows.

Corporate Impact: Winners and Losers in a Shifting Trade Landscape

Beyond broad market movements, the tariff announcements have created distinct winners and losers at the corporate level. Companies deeply embedded in global supply chains or with significant exposure to affected markets face potential disruption to their business models and profit margins.

The technology sector, particularly semiconductor companies, appears especially vulnerable. The potential disruption to the semiconductor supply chain is illustrated by reports that Intel Corp. and Taiwan Semiconductor Manufacturing Co. (TSMC) have tentatively agreed to a joint venture to operate Intel's manufacturing plants. Under this arrangement, TSMC would receive a 20% stake in exchange for sharing its manufacturing techniques, reflecting strategic adjustments to a changing trade environment.

Social media companies also face uncertainty. President Trump has indicated that the U.S. is close to unveiling a plan to spare TikTok from a U.S. ban, with a proposal that would see new outside investors owning 50% of TikTok's U.S. business and ByteDance's stake falling below 20%. However, a broader measure of social media stocks ended the week down nearly 7%, reflecting investor concern about potential regulatory challenges in a more protectionist environment.

Some companies face direct regulatory threats from China. GE HealthCare Technologies saw its shares fall more than 15% after China initiated an anti-dumping investigation into imports of medical X-ray tubes from the U.S. Similarly, DuPont de Nemours dropped more than 12% after China's market regulator announced an investigation into alleged antitrust violations by the company.

On the positive side, companies with less exposure to international trade or those positioned to benefit from shifts in supply chains may find opportunities in this changing landscape. Consumer staples companies that import relatively few of their products, such as Dollar General, have seen stronger performance. Additionally, there appears to be a rotation into traditionally defensive sectors like food producers and utilities, reflecting investor preference for businesses less exposed to global trade disruptions.

Investment Implications: Navigating Uncertainty

For investors, the current market environment presents significant challenges. The combination of heightened volatility, policy uncertainty, and potential economic disruption demands a thoughtful investment approach focused on long-term objectives rather than short-term market movements.

History suggests that market reactions to policy shocks often involve overshooting, followed by adjustment as the actual economic impacts become clearer. While the magnitude of the current tariff proposals is unprecedented in recent decades, certain investment principles remain relevant for navigating this uncertainty.

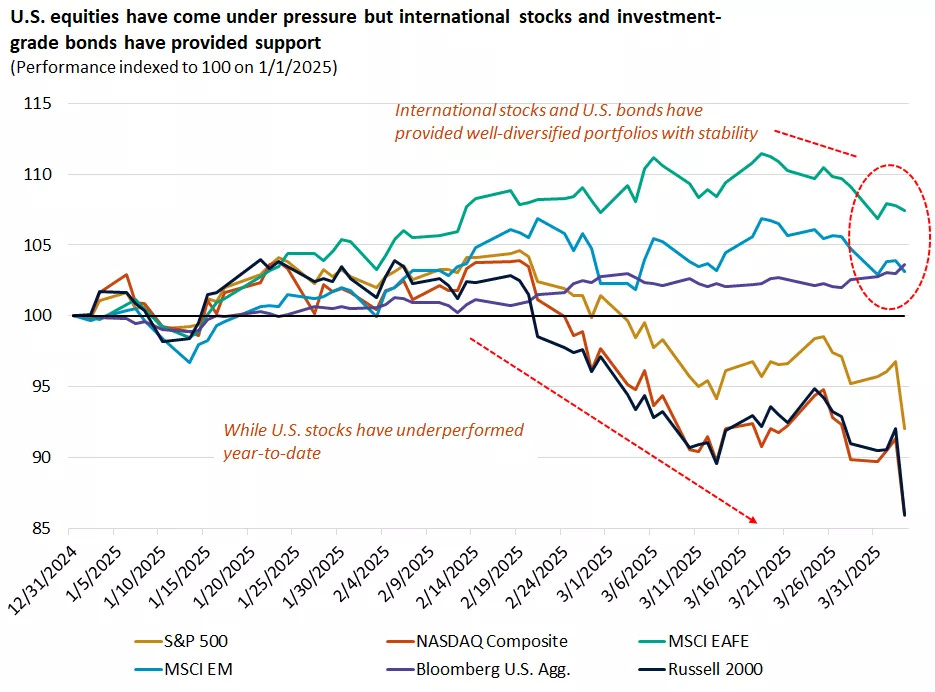

First, diversification has demonstrated its value in 2025. Despite volatility in U.S. equity markets, international stocks and U.S. investment-grade bonds have posted positive returns year-to-date, helping to offset the impact of U.S. stock underperformance for investors with well-diversified portfolios. This pattern underscores the importance of maintaining exposure to a variety of asset classes to smooth periods of volatility and benefit from rotating market leadership.

Second, within U.S. equities, a balanced approach between growth and value investments may provide resilience. Sectors like healthcare and financials, which potentially have less direct exposure to tariffs, may offer relatively attractive opportunities. Additionally, maintaining a strategic allocation to U.S. investment-grade bonds, which have served as a safe haven during market volatility, could provide portfolio stability during turbulent periods.

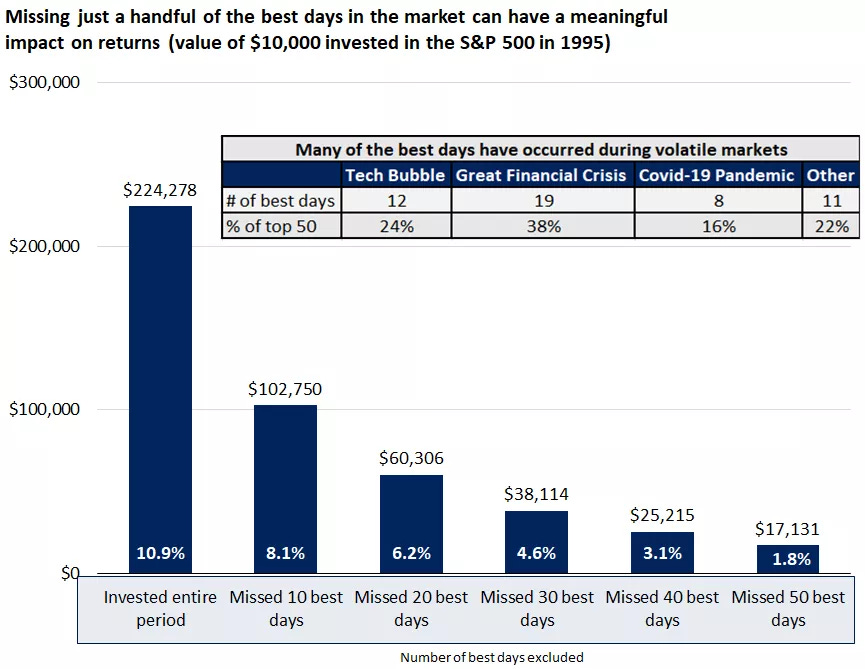

Third, maintaining a long-term perspective remains essential. Market timing—attempting to exit the market before declines and re-enter before recoveries—has consistently proven difficult to execute successfully. Missing just the best few trading days over a multi-year period can significantly reduce overall returns, and many of the strongest market days occur during periods of heightened volatility. For instance, an investment of $10,000 in the S&P 500 from 1995 to 2024 would have grown substantially more if fully invested throughout the period compared to missing even a handful of the best market days.

Fourth, quality and resilience should be emphasized in investment selection. Companies with strong balance sheets, pricing power, and adaptable business models may be better positioned to navigate the challenges of a more protectionist trade environment. Additionally, businesses with predominantly domestic operations might face fewer disruptions from international trade tensions.

Looking Ahead

The market turmoil of the past week represents more than a typical correction—it signals a potential inflection point in global trade relations with far-reaching implications for economic growth, inflation, and investment returns. While the immediate market reaction has been severe, the longer-term impact will depend on multiple factors, including the implementation details of the tariff policies, international responses, and the adaptability of businesses and supply chains.

For now, significant uncertainty remains. President Trump has suggested openness to tariff reductions if foreign nations offer "phenomenal" concessions, indicating some potential flexibility in the U.S. position. Additionally, the actual economic impact of these policies may differ from initial market fears as businesses adjust strategies and supply chains evolve.

What seems clear is that volatility is likely to remain elevated in the near term as markets digest these policy changes and assess their implications. For investors, this environment demands patience, discipline, and a focus on long-term financial objectives rather than short-term market movements.

The coming weeks will be critical in determining whether this market correction represents a temporary disruption or the beginning of a more prolonged adjustment to a fundamentally different trade landscape. Either way, the events of the past week have served as a powerful reminder of how quickly market conditions can change and the importance of maintaining a resilient investment approach capable of weathering periods of heightened uncertainty.

Range, Breadth, New Highs & Lows By Index

S&P Indices

Dow Jones Indices

NASDAQ 100 Indices

Russel 1000

5-Day Futures Performance Leaders

Market Intelligence Report: An Insider Preview of This Week's Top Institutional Trades

Breaking Down This Week's $42+ Billion In Institutional Trading Activity

Our exclusive data captures 758 institutional trades worth over $42.75 billion across 469 unique tickers, revealing how professional investors are positioning capital in today's complex market environment. These aren't casual retail trades—these represent significant institutional conviction, both bullish and bearish.

Mega Movers: The Largest Capital Deployments

Microsoft (MSFT) leads with a massive $3.28 billion position showing extraordinary relative size (307.97x)—the largest single institutional trade this week. This positioning comes amid crucial AI developments, huge international headlines and a blowback in markets that has seen little in terms of relief. Are there still bullish expansion opportunities for this giant or lingering concerns about valuation after recent rallies?

S&P 500 Index ( SPY 0.00%↑ ) attracted multiple billion-dollar trades totaling $6.03 billion, reflecting intense institutional focus on broad market direction. With two SPY trades alone exceeding $3.2 billion and $2.8 billion respectively, institutions are taking decisive macro positions as market uncertainty persists.

Communication Services Under Scrutiny: Meta Platforms ( META 0.00%↑ ) and Alphabet ( GOOGL 0.00%↑ ) each saw institutional positions exceeding $1.4 billion, representing major bets on the future of digital advertising and AI competition within the space.

📈 Sector Positioning: The Institutional Battlegrounds

Large Caps Dominance: This sector attracted $11.23 billion across 58 trades with an average position size of $193.6 million—significantly higher than any other sector. The notable 20.7% of trades with top-tier rankings (1-5) indicates strong institutional conviction despite potential downside risks.

Communication Services Divergence: Institutions deployed $6.68 billion with an average relative size of 17.37x suggests conflicting institutional viewpoints on digital media and telecom prospects.

Bonds Strategic Positioning: With the second-highest average relative size (22.81x) across 48 trades worth $4.1 billion, fixed income is seeing institutional attention ahead of potential policy shifts. High-yield bonds attracted $988 million with unusually strong conviction (25% are top-ranked trades).

Utilities' Surprising Strength: Though modest in total value ($447.6 million), utilities show the best average rank (9.83) of any major sector. Are institutions ready to double-down in defensives or start putting money back to work in other sectors?

🎯 Hidden Intelligence: Revealing Institutional Conviction

Industry Leadership Rotation: Software ($3.39B), Interactive Media ($3.33B), and Entertainment ($2.06B) are seeing the highest institutional capital flows, but Entertainment shows dramatically stronger conviction with 40% of trades receiving top rankings versus 0% for Software and Interactive Media.

Broadcasting Signals: NMAX 0.00%↑ leads all stocks with 25 separate institutional trades including a top-ranked position, suggesting intense institutional focus on this communications player. After running up this name over 1700% only to give most of it back, you’re going to want to have a look at the data to see where institutions staked-out positions.

Aerospace & Defense Focus: This industry attracted $651 million across 16 trades, with particularly strong activity in SARO 0.00%↑ (6 trades totaling $152 million). This concentrated positioning comes amid escalating global tensions and defense spending increases.

Software Infrastructure Battleground: CRWV 0.00%↑ saw 22 institutional trades totaling $318 million, placing it among the most actively traded stocks by frequency. Our data shows you where institutions are positioned so you can figure out if you’re on the right side of their trade.

💎 Under-the-Radar Opportunities

Beacon Roofing Supply ( BECN 0.00%↑ ): This industrial distributor captured an institutional position with remarkable relative size (111.46x) and a #1 rank—the highest-conviction trade among non-index tickers. At $243 million, this position represents substantial institutional confidence in the housing and construction materials sector.

Live Nation Entertainment ( LYV 0.00%↑ ): A #2 ranked $362 million position with 98.64x relative size indicates major institutional positioning in the live events space. Is someone anticipating post-pandemic growth acceleration or industry consolidation?

Omnicom Group ( OMC 0.00%↑ ): This media agency attracted a $304 million position with 86.98x relative size and a high #6 rank, suggesting institutional expectations for significant movements in advertising spend allocation and the name itself.

🧠 The Bottom Line

The institutional capital is deploying with remarkable precision across both broad market exposures and targeted sector plays. The concentration in large caps ($11.2B) alongside significant communication services positioning ($6.7B) reveals institutional investors positioning for continued market leadership from mega-caps while hedging with selective bond exposure ($4.1B).

What's particularly telling is the divergence between total capital deployed and conviction metrics—sectors receiving the most dollars aren't necessarily showing the strongest conviction signals. This suggests institutional investors are maintaining core large-cap exposure while building conviction positions in specific utilities, energy, and materials names.