Market Momentum: Your Weekly Financial Forecast & Market Prep

Issue 32 / What to expect Feb 10, 2025 thru Feb 14, 2025

In This Issue

Market-On-Close: All of last week’s market-moving news and macro context in under 5 minutes + futures-snapshots

Special Coverage: Tough Tariff Talk: What It Means for Investors & the U.S. Stock Market

The Latest Investor Sentiment Readings

Institutional Support & Resistance Levels For Major Indices: Exactly where to look for support and resistance this week in SPY, QQQ, IWM & DIA

Institutional Activity By Sector: Institutional order flow by sector including the top institutionally-backed names in those sectors. We break it all down and provide the key insights and take-aways you need to navigate institutional positioning this week.

Top Institutional Order Flow In Individual Names: All of the largest sweeps and blocks on lit exchanges and hidden dark pools

Investments In Focus: Bull vs Bear arguments for CART, MCD, ASTS

Top Institutionally-Backed Gainers & Losers: An explosive watchlist for day traders seeking high-volatility

Normalized Performance By Thematics YTD (Sector, Industry, Factor, Energy, Metals, Currencies, and more): which corners of the markets are beating benchmarks, which ones are overlooked and which ones are over-crowded

Key Econ Events and Earnings On-Deck For This Week

Market-On-Close

The first week of February 2025 brought significant challenges to U.S. financial markets as multiple headwinds converged to pressure equity indices. The S&P 500 demonstrated relative resilience with a modest decline of 0.95%, while the Dow Jones Industrial Average fell 0.99% and the Nasdaq 100 experienced a more pronounced drop of 1.30%. These movements came amid a complex interplay of economic data, policy developments, and corporate earnings releases that shaped market sentiment throughout the week.

The week's trading narrative was dramatically altered by President Trump's announcement regarding new tariff implementations. The declaration of potential reciprocal tariffs sent immediate ripples through the market, though some pressure was alleviated when tariffs on Mexico and Canada were subsequently postponed for 30 days. This development injected a new element of uncertainty into market dynamics, particularly affecting sectors with significant international exposure.

January's employment data presented market participants with a nuanced picture of labor market conditions. While the headline nonfarm payrolls figure of 143,000 fell short of the anticipated 175,000, the December figures received a substantial upward revision to 307,000 from the previously reported 256,000. More notably, the unemployment rate unexpectedly decreased to 4.0%, marking an eight-month low and suggesting continued labor market strength. Wage growth also exceeded expectations, with average hourly earnings rising 0.5% month-over-month and 4.1% year-over-year, surpassing projected increases of 0.3% and 3.8% respectively.

Consumer sentiment data raised some concerns as the University of Michigan's February index unexpectedly declined to 67.8, its lowest level in seven months. The reading came in well below expectations of 71.8, reflecting growing consumer anxiety about potential inflationary pressures from trade policies. Adding to these concerns, inflation expectations showed marked increases, with the one-year outlook jumping to 4.3% and the five-to-ten-year projection reaching 3.3%, representing fifteen-month and sixteen-year highs respectively.

The ongoing fourth-quarter earnings season has largely exceeded initial expectations, with companies reporting an average growth rate of 7.5% year-over-year. Corporate performance, however, showed significant divergence across sectors. Amazon.com declined more than 4% after providing weaker-than-expected guidance, while Expedia Group surged over 17% following strong quarterly results. The technology sector displayed particular sensitivity to interest rate movements, with chip makers experiencing broad declines as bond yields advanced.

In the fixed income markets, March 10-year T-notes closed down by eleven ticks, with the yield rising 4.9 basis points to 4.483%. The trading session saw notable volatility as notes initially spiked to a one-and-a-half month high before retreating, with the yield rebounding from a low of 4.380%. These movements were largely driven by the employment data and inflation expectations, though some recovery occurred as equity market weakness increased demand for safe-haven assets.

Manufacturing sector data provided a bright spot in the economic landscape, as January marked the first expansion in activity since 2022. This development carries particular significance given the sector's previous extended contraction, though concerns about the impact of potential tariffs on the manufacturing recovery persist. German economic data meanwhile showed mixed signals, with December industrial production falling 2.4% month-over-month while exports unexpectedly rose 2.9%.

The homebuilding sector faced significant pressure as rising yields and deteriorating consumer sentiment weighed on housing demand prospects. Companies like Toll Brothers and DR Horton experienced notable declines, with the sector's weakness reflecting broader concerns about interest rate sensitivity in the current market environment.

Commodity markets saw notable movements, with gold setting new record highs above $2,900 per ounce before settling around $2,890. Oil prices continued their recent decline, trading around $71 per barrel amid concerns about demand implications from trade tensions. Copper prices showed strength, rising more than 3% to reach a four-month high.

Current economic indicators suggest the U.S. economy remains on a solid growth trajectory. Fourth-quarter GDP growth came in at 2.3% annualized, contributing to full-year 2024 growth of 2.8%. Consumer spending has maintained robust momentum, with fourth-quarter consumption growing at 4.2%, well above long-term averages of approximately 3%. This strength in consumption, which accounts for roughly 68% of GDP, provides important support for continued economic expansion.

The Federal Reserve's policy trajectory has become increasingly complex given recent data. Markets are currently pricing just a 10% probability of a rate cut at the March FOMC meeting. Fed officials have provided mixed signals, with Minneapolis Fed President Kashkari suggesting inflation's continued moderation could allow for modest rate cuts by year-end, while Dallas Fed President Logan indicated rates might already be near neutral levels.

Looking ahead, market participants must navigate several key variables. The implementation and scope of trade policies remain a significant source of uncertainty, with potential implications for both economic growth and inflation. These policies could particularly impact sectors with high international exposure, as Mexico, Canada, and China collectively account for approximately 42% of total U.S. trade, representing over $2 trillion in value.

Historical precedent suggests meaningful economic impact from trade actions, with Fed research indicating that U.S. tariffs during 2018-2019 contributed to a 0.1%-0.3% increase in inflation while reducing economic growth by 0.3%-0.5%. The current situation could potentially have larger effects given the broader scope of proposed trade actions.

Corporate earnings will continue to influence market direction, with current results suggesting resilient profit growth. Among S&P 500 companies reporting thus far, 77% have exceeded earnings expectations and 63% have surpassed sales forecasts. This performance supports the narrative of underlying corporate strength, though guidance and outlook statements suggest increasing caution about potential headwinds.

The market environment heading into the remainder of 2025 suggests a period of potentially increased volatility following two years of solid gains and relatively low market fluctuations. While fundamental supports remain in place, including above-trend economic growth and strong corporate profits, the intersection of trade policy uncertainty, inflation concerns, and Federal Reserve policy adjustments creates a more complex trading landscape. The upcoming Consumer Price Index report will provide another important data point for assessing inflation trends, with particular attention to whether the recent pattern of slightly hotter-than-expected readings continued into January.

This evolving market environment underscores the importance of maintaining a balanced approach to risk management while remaining attuned to shifting sector dynamics and correlation patterns. The interaction between trade policy developments, monetary policy expectations, and underlying economic fundamentals suggests a trading environment that will reward careful analysis and robust risk management practices.

5-Day Futures Performance Leaders

S&P 500 Sector Insights

Sector Overview With Individual Names By Market Cap

Sector 5-Day Leaderboard

Sector Sinkers vs Swimmers

ETF Insights

Reviewing a heatmap like this weekly can be incredibly helpful for investors as it provides a quick and visual summary of market performance across various sectors, asset classes, and geographies.

1. Sector and Asset Class Trends

Identify Strong and Weak Sectors: Investors can quickly spot which sectors (e.g., technology, energy, healthcare) are performing well or underperforming.

Asset Class Diversification: Seeing how commodities, fixed income, equities, and cryptocurrencies performed helps assess diversification.

2. Market Sentiment

Risk-On or Risk-Off: A green-dominated map suggests bullish sentiment, while red indicates bearish sentiment. Investors can align their strategies accordingly.

Volatility Indicators: Observing movements in volatility indices (e.g., VIX) can highlight changing market dynamics.

3. Regional Analysis

Global Insights: Performance in developed and emerging markets (e.g., Europe, China, Asia-Pacific) helps in gauging international investment opportunities or risks.

Currency Impacts: Movements in forex or country-specific ETFs can indicate currency-driven market trends.

4. Thematic Trends

Growth vs. Value: Comparing the performance of growth ETFs (e.g., VUG) versus value ETFs (e.g., VTV) reveals the prevailing market preference.

Industry Leadership: Highlighting leadership within industries (e.g., gold miners, semiconductors) can inform thematic plays.

5. Monitoring Investments

Portfolio Alignment: Investors can track how their existing investments or watchlist align with broader market trends.

Rotation Signals: Seeing week-over-week changes in sector dominance may signal sector rotation opportunities.

6. Risk Management

Recognizing Overbought/Oversold Conditions: Consistent underperformance or overperformance in specific areas may indicate potential mean-reversion trades.

Correlation Awareness: By observing how different asset classes move, investors can manage portfolio correlation and risk.

7. Decision Support

Identify Outperformers/Underperformers: ETFs, sectors, or indices that repeatedly outperform or underperform can help refine trading or investment strategies.

Macro Perspective: Weekly trends highlight macroeconomic or geopolitical influences affecting markets.

Regularly reviewing a heatmap like this is a strategic practice that supports data-driven decision-making while fostering a holistic understanding of market dynamics.

Global Overview

Reviewing a global heatmap like this weekly is valuable for investors because it offers insights into international markets, helping to:

Identify Global Trends: Spot which regions or countries are performing well or underperforming.

Assess Sector and Regional Performance: Understand how industries are faring across different regions.

Diversify Portfolios: Uncover opportunities in emerging or developed markets for greater diversification.

Gauge Global Sentiment: Recognize the impact of macroeconomic events on specific regions.

Align with Global Strategies: Refine investment strategies based on regional strengths or weaknesses.

This overview ensures investors stay informed about global opportunities and risks, complementing their domestic market analysis.

Special Coverage

Tough Tariff Talk: What It Means for Investors & the U.S. Stock Market

The U.S. equity market has been caught in a peculiar state of suspended animation. Despite maintaining levels near all-time highs, beneath the surface, crosscurrents of uncertainty are roiling individual sectors and creating notable divergences that sophisticated investors can't afford to ignore. The catalyst? A renewed wave of tariff rhetoric that's forcing traders to recalibrate their positioning across asset classes.

Market Technicals: Reading Between the Lines

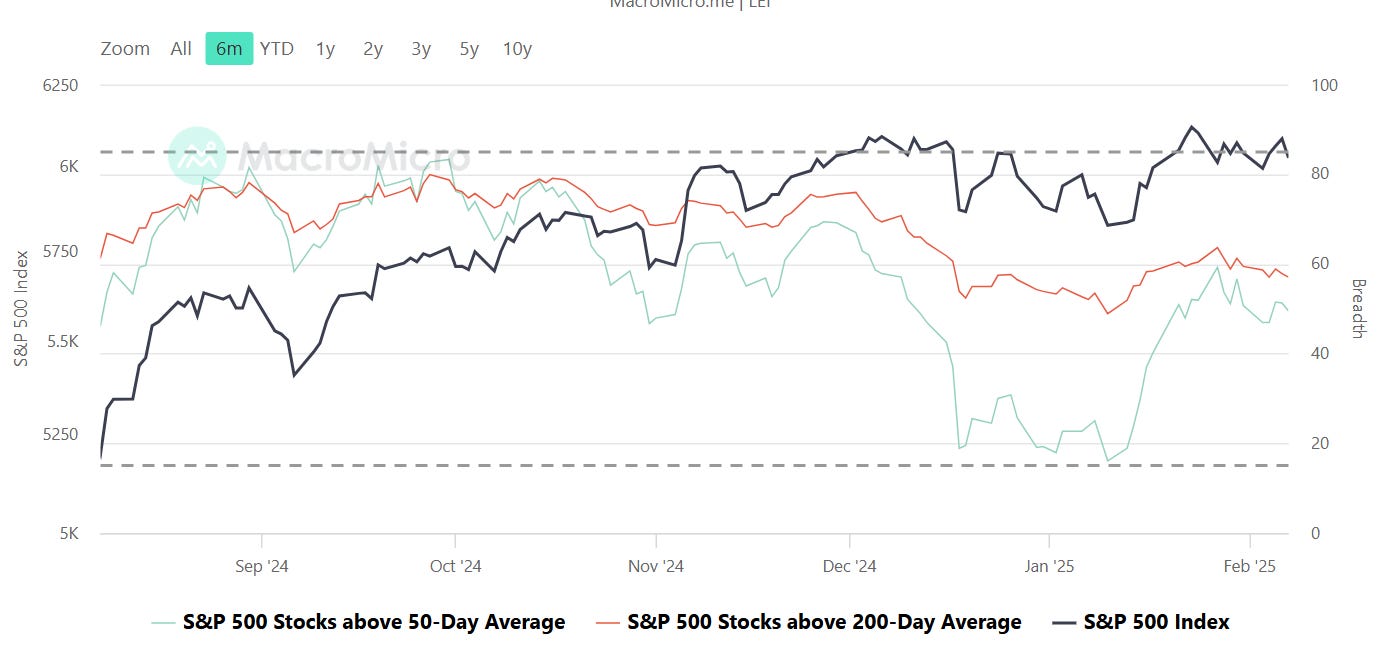

The S&P 500's apparent calm – trading within a mere 3% band since the U.S. election – masks significant rotation beneath the surface.

Technical analysts at Strategas Research highlight a troubling development: the percentage of large-cap stocks maintaining their uptrends has slipped below 60%, marking the lowest reading in over a year. This deterioration in market breadth typically serves as an early warning signal for institutional investors.

The index's stubborn persistence near the 6,000 level speaks more to the market's sophisticated game of musical chairs than genuine strength. As one sector falters, another rises to take its place, creating what veteran traders call a "rolling correction" rather than a traditional broad-based selloff.

The Magnificent Seven: A Changing of the Guard?

Perhaps most telling is the recent underperformance of the market's longtime leaders. The vaunted Magnificent Seven tech giants have lagged the broader S&P 500 by six percentage points since the Federal Reserve's December 19th meeting – a meaningful divergence that's catching the attention of quantitative strategists.

The weakness became particularly apparent last week when both Alphabet and Amazon posted ostensibly solid results. Yet the market's reaction proved brutal: Alphabet shares plunged 9% while Amazon shed 4%. The culprit? Forward guidance and capital expenditure plans that suggested peak margins might be in the rearview mirror. For momentum traders who had grown accustomed to these stocks being a one-way bet, the shift in narrative is forcing a wholesale reassessment of positioning.

Retail Traders: The New Market Force

While institutional investors may be growing cautious, the retail trading community is showing no such restraint. JPMorgan's equity desk reported that retail sentiment hit all-time highs last week, exceeding even the famous meme stock mania of 2021. This exuberance is most visible in names like Palantir Technologies, which saw its dollar trading volume on Friday handily exceed that of Apple – a company with 13 times its market capitalization.

The JPMorgan analysis comes with an important caveat for short-term traders: historically, such extreme readings in retail participation have correlated with positive returns over the subsequent two weeks. However, the signal's predictive value dissipates beyond that timeframe, suggesting tactical traders should remain nimble.

The Tariff Timeline: Understanding the Latest Developments

President Trump's latest salvo in the trade wars has introduced a new level of complexity for market participants. The announcement of impending "reciprocal tariffs" represents a significant escalation from previous measures. Unlike targeted actions against specific countries or sectors, this approach threatens to reshape the entire global trading landscape.

The mechanics of these proposed tariffs are straightforward in theory but complex in execution: if a foreign nation imposes a 100% tariff on American goods, the U.S. would respond with an identical 100% duty on their products. The implications for supply chains, inflation, and corporate margins are profound.

Sector Implications: Winners and Losers

The industrial sector, once a darling of the "Trump trade," has notably underperformed the broader market as tariff concerns mount. The Russell 2000 small-cap index has retreated to mid-October levels, suggesting traders are reducing exposure to companies with primarily domestic revenue streams – a striking reversal from the conventional wisdom that small-caps offer a haven during trade disputes.

The automotive sector faces particular scrutiny. European automakers like Stellantis and Volkswagen saw their shares drop more than 7% on initial tariff headlines before recovering on news of potential negotiations. Ford's CEO has publicly acknowledged that while the company could weather brief tariff disruptions, sustained 25% duties on Mexican and Canadian imports would "wipe out billions in industry profits."

Global Currency Markets: The First Line of Response

Currency traders have been quick to price in the tariff threats, with notable volatility in the Canadian dollar and Mexican peso. The loonie briefly touched 20-year lows before rebounding on news of a temporary tariff delay, while the peso has swung between gains of 3.5% and losses of 2.2% year-to-date.

The euro hasn't escaped unscathed either, sliding 5% since the U.S. election and briefly touching $1.0125 – levels not seen since late 2022. Nearly one-third of currency strategists now project the euro could reach parity with the dollar within a year, citing the combination of trade uncertainty and divergent monetary policy expectations.

The China Factor: A Calculated Response

While much attention focuses on North American and European trading partners, China's response to the tariff threats has been notably measured. The yuan remains slightly stronger than its pre-Trump administration levels, while both mainland and Hong Kong equity indices have posted gains.

Bank of Singapore's chief economist Mansoor Mohi-uddin suggests this restraint may be strategic. China's initial retaliatory tariffs affected just $14 billion in U.S. exports, potentially leaving room for negotiation. Moreover, Beijing has resisted the temptation to weaken its currency significantly, prioritizing financial stability and relationships with other trading partners over short-term export advantages.

Economic Implications: Threading the Needle

The timing of these tariff threats adds another layer of complexity to the Federal Reserve's decision-making process. Friday's jobs report showed nonfarm payrolls increasing by 143,000 in January, with upward revisions to previous months painting a picture of a moderating but still healthy labor market. However, the 0.5% increase in hourly wages, combined with elevated inflation expectations in the University of Michigan consumer survey, suggests price pressures remain stubborn.

Economists at the Peterson Institute for International Economics estimate that the proposed tariffs on China, Mexico, and Canada alone could drive inflation higher by 0.6% in the near term while creating a 0.2% drag on real GDP growth. This stagflationary combination complicates the Fed's ability to deliver the rate cuts markets have been eagerly anticipating.

Trading Strategies: Navigating Uncertain Waters

For active investors, the current environment demands a more nuanced approach than the "buy-the-dip" mentality that dominated recent years. Several strategies warrant consideration:

Quality Over Momentum: With market breadth deteriorating, emphasis should shift toward companies with strong balance sheets and pricing power rather than those merely benefiting from momentum flows.

Options Protection: The CBOE Volatility Index (VIX) testing its floor near 15 provides relatively inexpensive opportunities to add portfolio protection through put options.

Sector Rotation: The market's clockwork rotations suggest opportunities for tactical traders willing to monitor relative strength carefully and adjust positions accordingly.

Currency Hedging: For investors with significant international exposure, the elevated volatility in currency markets may justify the cost of hedging positions, particularly in Canadian and Mexican assets.

Legal and Political Considerations

While the president has broad authority to negotiate changes in U.S. trade policy, legal experts note that sweeping tariff changes may face challenges. Previous tariff actions have been justified under national security provisions, particularly citing the fentanyl crisis for measures against Mexico, China, and Canada. Extending this argument to a broader set of trading partners may prove more difficult.

International trade lawyer Laura Siegel Rabinowitz of Greenberg Traurig expects legal challenges to emerge, particularly regarding WTO compliance. While she believes the targeted measures against China, Canada, and Mexico may withstand scrutiny due to the national emergency argument, broader reciprocal tariffs could face stronger headwinds.

Looking Ahead: Key Signposts for Investors

Markets will be closely monitoring several developments in the coming weeks:

The specific details of the reciprocal tariff program, expected to be announced next week

Potential negotiations with the European Union, particularly regarding auto tariffs

The Federal Reserve's response to potentially higher inflation readings

Corporate guidance during the remainder of earnings season, especially regarding margin pressures

Technical levels around S&P 500 6,100, which has emerged as significant resistance

Conclusion: Maintaining Perspective

While the market's resilience in the face of mounting uncertainties is impressive, investors would be wise to remember that periods of low volatility often precede significant moves. The combination of aggressive retail positioning, deteriorating market breadth, and potential policy shocks suggests heightened risk of market discontinuities.

For long-term investors, however, it's worth noting that previous rounds of tariff threats have ultimately led to negotiations rather than sustained trade wars. The key will be maintaining discipline during periods of elevated volatility while remaining alert for opportunities that arise from any market dislocations.

As we navigate these challenges, the words of veteran traders ring true: the market can remain irrational longer than you can stay solvent. In the current environment, preparation, agility and vigilance remain the watchwords for successful investment strategies.

Want to keep reading? Interested in finally knowing when institutions are positioning for a move and where they are? Sign-up today for the only platform delivering the institutional context you need to develop an edge over the markets 👇👇👇

If you’re already a subscriber, click here to access the latest issue of Market Momentum