Market Momentum: Your Weekly Financial Forecast & Market Prep

Issue 49 / What to expect June 16, 2025 thru June 20, 2025

NOTE: This weekly periodical is too large for Substack to deliver in its entirety via email - you will only see a portion of this great content if you read from your email client. Click the header/title at the top to read the full article!

In This Issue

[Free For Everyone]

Weekly Market-On-Close Report: All the macro moves, market drivers, and must-know narratives—covered in less than five minutes.

Weekly Benchmark Breakdown: Our weekly intelligence report on major indices cuts through the index-level noise to uncover participation, momentum, and structural integrity and tell you whether markets are rising on solid ground or skating on thin breadth. This is where bull markets prove themselves—or quietly start to unravel.

The Latest Investor Sentiment Readings: Track the emotional pulse of the market with our curated dashboard of sentiment indicators. From fear-fueled flight to euphoric overreach, this week's readings reveal whether investors are cautiously creeping in—or stampeding toward the exits.

Special Coverage Report: Seeing the Full Picture: How Bank of America Uses 20 Valuation Metrics to Evaluate Equity Worth

Institutional Support & Resistance Levels For Major Indices: Exactly where to look for support and resistance this coming week in SPY, QQQ, IWM & DIA

Normalized Performance By Thematics YTD: Which corners of the markets are beating benchmarks, which are overlooked and which ones are over-crowded!

Key Econ Events & Earnings On-Deck For This Coming Week

[Only For Subs]

This Week’s Institutional Activity In Equities: Track the real money. This section breaks down where institutions are placing their bets—and pulling their chips. You'll get a sector-by-sector view of equity flows, highlighting the most active names attracting large-scale buying or selling. We go beyond the headlines and into the tape, surfacing the week’s most notable block trades and sweep orders, both on lit exchanges and hidden dark pools. Whether you're following momentum or fading crowded trades, this is your map to where size is moving and why it matters.

Institutional Activity By Day (rolling 6-months)

Institutional Activity By Sector By Week (rolling 6-months)

This Week’s Institutional Activity In ETFs: Follow the flows that shape the market. This section uncovers where institutions are deploying capital across the ETF landscape, broken down by sector and fund. We highlight the largest block trades and aggressive sweeps—both visible on lit exchanges and hidden in dark pools—to reveal how the smart money is positioning. Whether they’re rotating risk, hedging exposure, or scaling into themes, this is your lens into the ETF vehicles driving institutional intent.

Statistical Analysis and Insights From This Week’s Top Prints: we run the numbers on the most significant institutional trades of the week—those outsized prints that stand apart from the noise. Through statistical analysis and pattern recognition, we decode what these moves may signal about future price action. Whether it's the start of accumulation, a stealthy unwind, or a shift in market regime, this is where data meets intent. These are the trades that matter—and the stories they may be telling.

Weekly Market-On-Close Report

Geopolitical Tensions Drive Volatility Amid Economic Resilience

Financial markets concluded the trading week under significant pressure as escalating Middle Eastern tensions overshadowed otherwise constructive economic fundamentals. Major equity indices posted meaningful declines on Friday, with the S&P 500 retreating 1.13%, the Dow Jones Industrial Average declining 1.79%, and the Nasdaq 100 falling 1.29%. The selloff was precipitated by Israeli military operations targeting Iranian nuclear infrastructure, prompting a classic risk-off response across asset classes and commodity markets.

Despite geopolitical headwinds, underlying economic indicators continued to demonstrate resilience. Consumer price inflation moderated below expectations in May, consumer sentiment registered its first improvement in six months, and preliminary trade framework discussions between the United States and China yielded encouraging developments. These crosscurrents highlight the complex dynamics facing investors as they navigate between solid fundamental conditions and heightened geopolitical uncertainty.

Market Performance and Index Analysis

Equity Market Dynamics

The week's trading patterns exemplified the market's sensitivity to geopolitical developments, with indices exhibiting strength through Thursday before deteriorating sharply on Friday. The S&P 500's 1.13% decline brought weekly performance into negative territory despite earlier gains, while futures contracts for June E-mini S&P (ESM25) fell 1.06%, indicating continued pressure in extended trading sessions.

Mid-cap and small-cap segments faced more pronounced headwinds, with the S&P MidCap 400 declining 1.46% and the Russell 2000 dropping 1.49%. This differential performance reflects the market's preference for large-cap stability during periods of uncertainty, as smaller companies typically exhibit higher volatility sensitivity to macro developments.

The Nasdaq 100's 1.29% retreat, while significant, demonstrated relative resilience compared to broader market indices. However, June E-mini Nasdaq futures (NQM25) extended losses to 1.20%, suggesting continued technology sector pressure into the following session.

International Market Performance

Global equity markets mirrored domestic weakness, with European indices posting comparable declines. The Euro Stoxx 50 closed down 1.31%, reflecting similar risk-off sentiment across developed markets. Asian markets also participated in the broader selloff, with China's Shanghai Composite declining 0.75% and Japan's Nikkei Stock 225 falling 0.89%.

The synchronized global equity decline underscores the interconnected nature of modern financial markets and the rapid transmission of geopolitical risk across international boundaries. The relative magnitude of losses suggests that while regional factors play a role, global risk appetite remains the dominant driver of cross-border equity flows.

Geopolitical Catalyst Analysis

Middle East Conflict Escalation

The primary market catalyst emerged from Israeli military operations targeting approximately 100 Iranian facilities, including nuclear infrastructure and ballistic missile programs. The strikes, which reportedly eliminated senior Iranian military commanders and nuclear scientists, represented a significant escalation in regional tensions that had been simmering for months.

Iran's retaliatory response, launching dozens of ballistic missiles into Israeli territory, virtually guaranteed continued military engagement and elevated the conflict to a new phase of intensity. Israeli Prime Minister Netanyahu's commitment to continue strikes "for as many days as it takes to remove this threat" signals a prolonged period of regional instability.

The conflict's market implications extend beyond immediate risk-off sentiment. President Trump's characterization of the situation as requiring Iran to make a nuclear deal "before it is too late," coupled with warnings of "even more brutal" future attacks, introduces additional policy uncertainty. While the administration emphasized non-involvement in the military strikes, the potential for expanded U.S. engagement remains if Iran attempts to block the Strait of Hormuz or attacks American assets in the region.

Commodity Market Response

Oil markets experienced dramatic volatility, with crude prices surging over 7% on Friday to reach four-month highs near $73 per barrel. The weekly gain of nearly 12% reflects market concerns about potential supply disruptions through critical shipping channels, particularly the Strait of Hormuz, through which approximately 20% of global oil supplies transit.

The energy market response highlights the continued strategic importance of Middle Eastern production capacity despite increased U.S. domestic output. While America has achieved net petroleum exporter status, global price dynamics remain sensitive to supply disruption risks in the region.

Gold markets demonstrated their traditional safe-haven characteristics, with precious metals advancing 1.50% as investors sought refuge from geopolitical uncertainty. The rally brought gold to new record highs near $3,450 per ounce, eclipsing previous peaks established in late April and early May. The metal's performance, up from approximately $2,600 at year-end, reflects both geopolitical premium and broader monetary policy considerations.

Economic Fundamentals Assessment

Inflation Dynamics

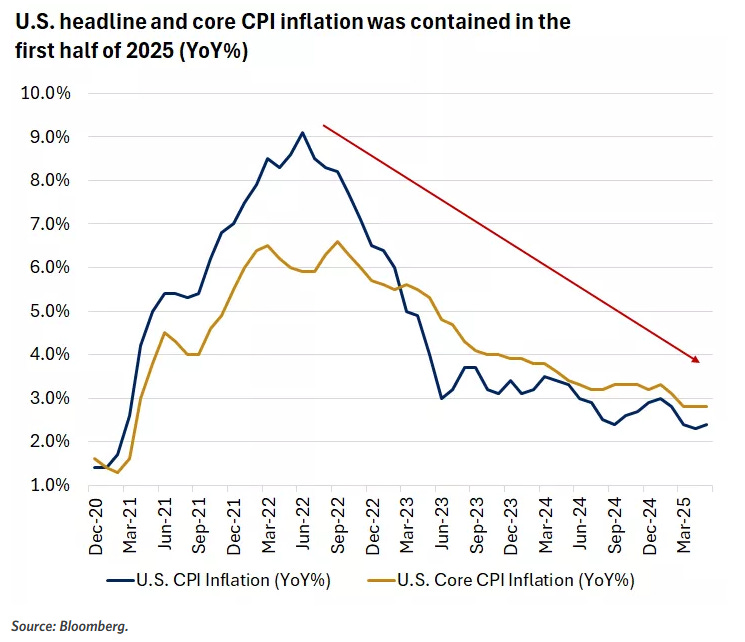

Despite geopolitical turmoil, domestic inflation metrics delivered encouraging signals for monetary policy normalization. The Bureau of Labor Statistics reported May Consumer Price Index growth of just 0.1% month-over-month, significantly below consensus expectations of 0.3% and down from April's 0.2% reading.

Annual headline inflation registered 2.4%, modestly above April's four-year low of 2.3% but below forecasted 2.5%. More importantly, core CPI excluding volatile food and energy components remained stable at 2.8% year-over-year, slightly below anticipated 2.9% and demonstrating continued disinflationary momentum in services sectors.

Producer price inflation at the wholesale level similarly undershot expectations, rising only 0.1% monthly after April's modest decline. This reading, below consensus forecasts of 0.2%, suggests that tariff impacts thus far have been more contained than many market participants anticipated, possibly due to inventory build-ahead strategies by importers.

The inflation data's significance extends beyond immediate monetary policy implications. The moderation occurs against a backdrop of elevated tariff uncertainty, suggesting that supply chain adaptations and inventory management strategies may be effectively mitigating some inflationary pressures from trade policy changes.

Consumer Sentiment Recovery

Consumer confidence metrics provided additional evidence of economic resilience, with the University of Michigan's preliminary June Consumer Sentiment Index surging to 60.5 from May's 52.2 reading. The 8.3-point improvement represented the first positive movement in six months and significantly exceeded consensus expectations of 53.6.

Perhaps more significantly, one-year inflation expectations plummeted to 5.1% from May's elevated 6.6% level, a decline substantially larger than forecasted retreat to 6.4%. Five-to-ten-year inflation expectations moderated slightly to 4.1% from 4.2%, aligning with market projections and suggesting longer-term price stability expectations remain anchored.

According to survey analysis, consumers appear to have "settled somewhat from the shock of the extremely high tariffs announced in April and the policy volatility seen in the weeks that followed." This adaptation suggests that while initial tariff announcements created significant uncertainty, households are beginning to adjust expectations as policy implementation details emerge.

Labor Market Dynamics

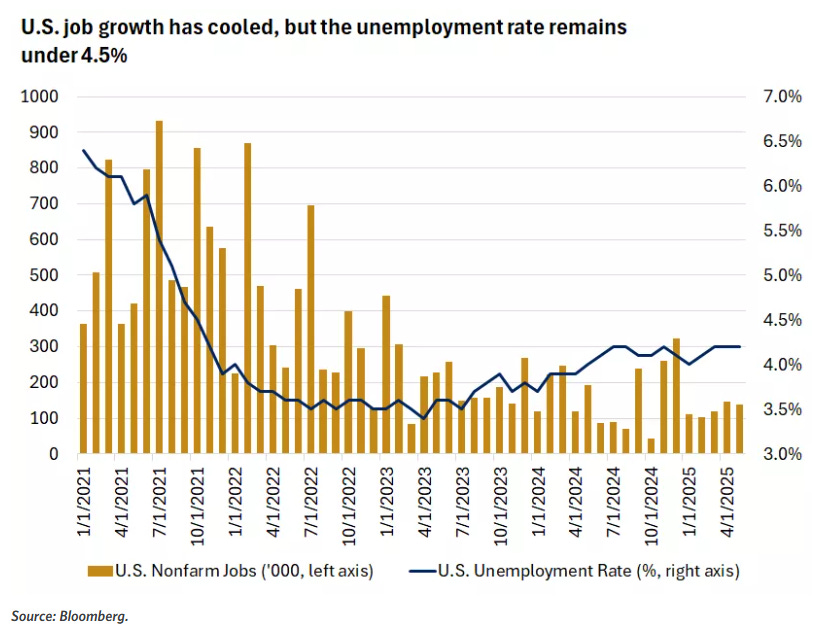

The employment landscape continues demonstrating remarkable stability despite broader economic uncertainties. Current unemployment rates hover near 4.2%, substantially below the long-term historical average of approximately 5.5%, indicating continued labor market tightness.

The current environment can be characterized as featuring "low hiring but also low firing," as corporations prioritize talent retention amid uncertain business conditions. This dynamic supports wage growth, with increases of approximately 3.9% continuing to outpace inflation rates, providing consumers with positive real wage gains.

This wage-inflation differential represents a critical support mechanism for consumer spending patterns. Historical analysis suggests that consumers demonstrate greatest spending confidence when employment security coincides with real wage growth, both conditions currently present in the domestic economy.

GDP Growth Trajectory

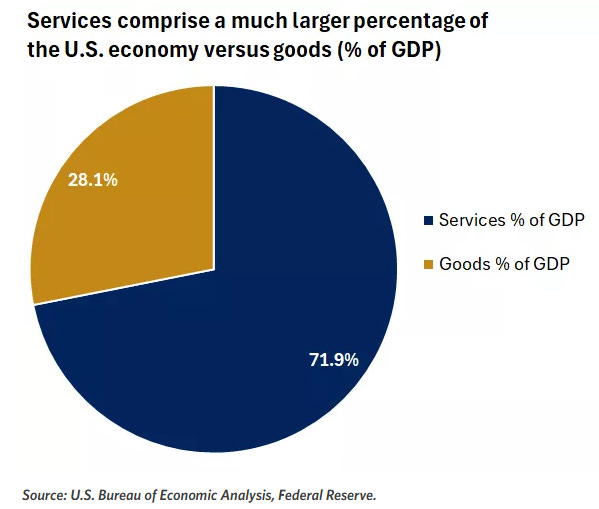

Economic growth metrics continue exceeding trend rates despite first-quarter softness attributed primarily to inventory accumulation patterns. Second-quarter GDP tracking estimates suggest growth rates may exceed 3%, driven by household consumption projections of approximately 1.7% annually.

The consumption resilience appears particularly noteworthy given persistent weak consumer sentiment readings prior to recent improvements. This divergence between sentiment and actual spending behavior suggests that objective economic conditions may be providing sufficient support for discretionary expenditures despite subjective uncertainty.

Trade Policy Developments

China-United States Framework Progress

Bilateral trade discussions yielded meaningful progress during the week, with both American and Chinese officials reporting establishment of a preliminary trading framework. The proposed structure includes significant tariff modifications, with Chinese export levies potentially declining from current 145% levels to 55%, comprising reciprocal 10% tariffs, 20% fentanyl-related penalties, and existing 25% China-specific duties.

Conversely, tariffs on American exports to China would be maintained at 10% levels under the framework. Beyond tariff adjustments, the agreement addresses critical non-tariff barriers, particularly concerning Chinese rare-earth mineral exports essential for American manufacturing operations.

China has agreed to temporarily restore rare-earth export licenses to U.S. manufacturers for six-month periods, while America will ease restrictions on Chinese jet engine components and related aerospace parts. While representing constructive progress, the preliminary nature of these arrangements requires presidential approval from both nations before implementation.

Multilateral Trade Timeline Considerations

The July 9 deadline for the conclusion of the 90-day tariff pause on non-Chinese trading partners approaches rapidly, creating additional policy uncertainty. Treasury Secretary Bessent's recent comments suggest potential deadline extensions for partners demonstrating "good faith" in ongoing negotiations, acknowledging the complex timeline requirements for comprehensive trade agreement development.

Current elevated 10% tariff rates on these partners during the pause period continue imposing economic costs, though substantially below the higher rates initially contemplated. The administration's apparent flexibility on timing suggests recognition that sustainable trade agreements require adequate development time rather than artificial deadline pressures.

United Kingdom Trade Agreement Progress

Bilateral discussions with the United Kingdom yielded encouraging developments, with Prime Minister Starmer indicating removal of remaining obstacles to finalizing a comprehensive trade agreement. The potential conclusion of U.S.-UK trade negotiations represents a significant diplomatic achievement and could provide a template for broader multilateral engagement.

Federal Reserve Policy Implications

Interest Rate Environment

Current federal funds rates of 4.25%-4.5% maintain significant elevation above prevailing inflation rates of 2.5%-3.5%, providing the Federal Reserve considerable accommodation flexibility should economic conditions warrant intervention. Futures markets are discounting minimal 3% probability of 25 basis point reduction at the June 17-18 Federal Open Market Committee meeting, suggesting near-term policy stability expectations.

However, market pricing implies expectations for one to two rate cuts during 2025's second half, contingent upon economic data evolution and trade policy clarity. The Fed's current wait-and-see posture reflects prudent assessment of competing inflationary and deflationary forces, particularly given ongoing tariff uncertainty and geopolitical developments.

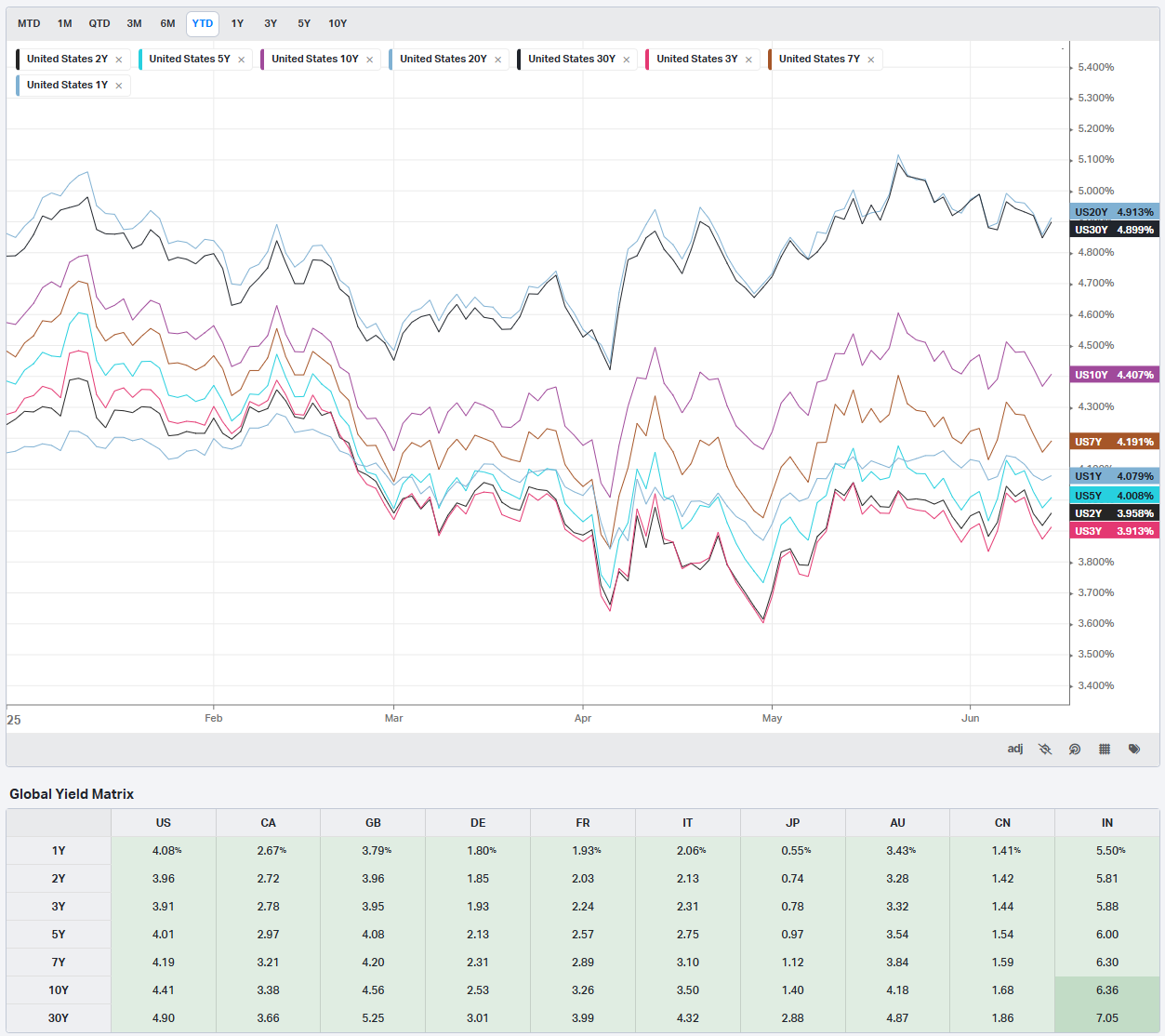

Fixed Income Market Dynamics

Treasury markets experienced meaningful volatility throughout the week, with September 10-year notes (ZNU25) declining 14.5 ticks on Friday. The 10-year yield advanced 5.1 basis points to 4.411%, primarily reflecting inflationary concerns from energy price increases rather than fundamental monetary policy shifts.

Ten-year breakeven inflation expectations rose 2.2 basis points to 2.291%, recovering from early week five-week lows and suggesting market recognition of potential commodity-driven price pressures. Notably, Treasuries failed to generate meaningful safe-haven demand despite geopolitical tensions, indicating investor focus on inflation implications rather than flight-to-quality dynamics.

European government bond yields demonstrated similar patterns, with German 10-year bund yields advancing 5.8 basis points to 2.535% and UK gilt yields rising 7.3 basis points to 4.550%. Swap markets are pricing 11% probability of 25 basis point European Central Bank rate reduction at the July 24 policy meeting.

A successful 30-year Treasury auction during the week generated stronger-than-expected demand, with yields of 4.84% coming below Wednesday's 4.91% closing level. This outcome helped alleviate recent concerns about diminished Treasury market attractiveness and potential financing difficulties for government operations.

Sector-Specific Performance Analysis

Energy Sector Leadership

Geopolitical tensions provided significant tailwinds for energy sector equities, with major integrated oil companies posting notable gains. Exxon Mobil ( XOM 0.00%↑ ) advanced 2.1% while Chevron ( CVX 0.00%↑ ) gained 0.7%, reflecting both higher commodity prices and expectations for improved operational margins.

The sector's outperformance extends beyond immediate price benefits, as sustained higher oil prices improve the economics of domestic production operations and enhance cash flow generation capabilities for capital allocation and shareholder returns.

Defense Contractor Rally

Military escalation in the Middle East drove substantial gains across defense industry stocks, with major contractors experiencing significant premium expansion. Lockheed Martin ( LMT 0.00%↑ ) surged 3.7%, Northrop Grumman ( NOC 0.00%↑ ) gained 4.0%, and RTX Corporation ( RTX 0.00%↑ ) advanced 3.6%.

The defense sector rally reflects both immediate procurement expectations and longer-term geopolitical tension implications for military spending priorities. Sustained regional conflict could drive enhanced defense budget allocations and accelerated equipment replacement cycles.

Travel and Hospitality Pressure

Tourism-related equities faced significant headwinds from conflict escalation, as extended Middle Eastern warfare could substantially impact international travel patterns. Booking Holdings ( BKNG 0.00%↑ ), Expedia Group ( EXPE 0.00%↑ ), Hilton Worldwide Holdings ( HLT 0.00%↑), and Marriott International (MAR 0.00%↑) all posted losses averaging approximately 3%.

The sector's vulnerability extends beyond direct regional exposure, as heightened security concerns and elevated energy costs can depress broader travel demand patterns and reduce discretionary spending on leisure activities.

Airline Industry Challenges

Commercial aviation stocks experienced particularly acute pressure from dual headwinds of elevated fuel costs and weakening pricing power. Higher oil prices directly impact operational expenses, while recent inflation data showing airfares declining 2.7% month-over-month for the fourth consecutive month suggests limited ability to pass through cost increases.

American Airlines Group ( AAL 0.00%↑ ) and United Airlines Holdings (UAL 0.00%↑) declined over 4%, while Delta Air Lines ( DAL 0.00%↑ ) fell 3.8% and Southwest Airlines ( LUV 0.00%↑ ) dropped 2.7%. The sector's performance reflects the challenging operational environment of squeezed margins from both input cost inflation and pricing pressure.

Technology Sector Divergence

The Magnificent 7 technology stocks demonstrated mixed performance amid broader risk-off sentiment, with Tesla ( TSLA 0.00%↑ ) managing a 2% gain while most peers posted losses. Nvidia ( NVDA 0.00%↑ ) led declines with a 2.1% drop, while Apple ( AAPL 0.00%↑ ) and Meta Platforms ( META 0.00%↑ ) each lost over 1%.

Tesla's outperformance may reflect its relative insulation from immediate geopolitical impacts and continued investor confidence in electric vehicle market penetration. Conversely, semiconductor and technology hardware companies face greater supply chain vulnerability from international tensions.

Financial Services Disruption

Payment processing companies faced unique pressures from reports of major retailers investigating stablecoin adoption to bypass traditional credit card transaction fees. Visa ( V 0.00%↑ ) and Mastercard ( MA 0.00%↑ ) both declined over 4% on Wall Street Journal reports that Amazon and Walmart are exploring alternative payment mechanisms.

This development represents a potentially transformative threat to traditional payment processing business models, as cryptocurrency-based transactions could significantly reduce merchant processing costs while maintaining transaction security and efficiency.

Individual Equity Highlights

Industrial Sector Developments

US Steel ( X 0.00%↑ ) declined 2.6% following reports that Nippon Steel's planned acquisition may face delays if management freedom requirements are not adequately addressed. The transaction's uncertainty reflects broader concerns about foreign acquisition approvals in strategic industrial sectors.

Boeing ( BA 0.00%↑ ) continued facing headwinds from the aftermath of the Indian 787 Dreamliner crash that resulted in over 240 fatalities. The stock fell nearly 2% on Friday, adding to Thursday's 5.14% decline as safety concerns continue impacting the aerospace manufacturer's reputation and order flow.

Technology Earnings Impact

Adobe ( ADBE 0.00%↑ ) experienced over 5% decline despite reporting second-quarter results that exceeded analyst expectations. The negative reaction reflects persistent investor concerns about artificial intelligence's potential impact on Adobe's creative software revenue streams, despite management's attempts to address competitive positioning.

The Adobe reaction exemplifies broader market concerns about AI disruption across traditional software sectors, with investors requiring increasingly compelling evidence of competitive moat sustainability against rapidly evolving technological capabilities.

Consumer Discretionary Adjustments

McDonald's ( MCD 0.00%↑ ) declined 0.4% following Argus Research's downgrade from buy to hold rating. The adjustment reflects analyst concerns about sustained consumer discretionary spending patterns amid economic uncertainty and potential margin pressure from operational cost inflation.

Market Outlook and Investment Implications

Volatility Expectations

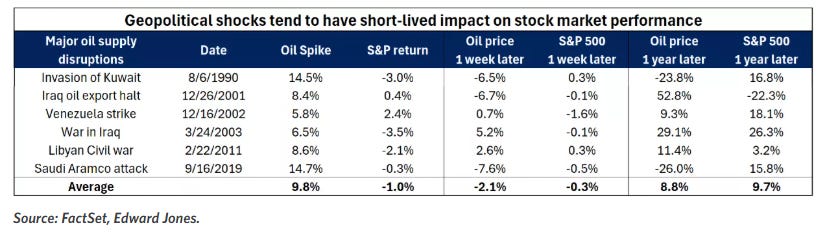

The convergence of geopolitical tensions, trade policy uncertainty, and evolving monetary policy conditions suggests continued elevated volatility levels in the near term. Historical analysis indicates that geopolitical tensions typically generate short-lived market impacts, though commodity price effects can persist longer.

The current environment's complexity, combining multiple uncertainty sources, may extend typical volatility duration patterns. Investors should anticipate continued choppy market conditions until greater clarity emerges regarding Middle Eastern conflict resolution and trade policy implementation.

Sectoral Positioning Considerations

Current market dynamics favor defensive positioning with selective growth exposure. Energy and defense sectors appear well-positioned for continued geopolitical tension environments, while travel and transportation sectors face sustained headwinds from both conflict and elevated commodity costs.

Technology sector performance likely depends on geopolitical development trajectories, with semiconductor and hardware companies facing greater supply chain vulnerability than software and services providers. Financial services companies may benefit from potential interest rate stability but face headwinds from payment processing disruption risks.

Fixed Income Strategy Implications

Treasury positioning requires balancing safe-haven demand against inflation risk considerations. While geopolitical tensions typically support government bond demand, elevated commodity prices and potential supply chain disruption could maintain inflation pressure and limit bond rally potential.

Corporate credit markets may experience differentiated performance based on sector exposure to geopolitical and commodity price risks. Energy sector credit should benefit from improved cash flow generation, while transportation and consumer discretionary credits may face margin pressure.

International Exposure Assessment

Global market integration suggests that U.S. investors cannot entirely insulate portfolios from international developments through domestic positioning alone. However, American market relative insulation from direct trade and energy dependencies provides some defensive characteristics compared to international alternatives.

Emerging market exposure requires careful consideration of individual country geopolitical alignments and commodity dependencies. Markets with significant Middle Eastern exposure or energy import dependencies may face sustained pressure until conflict resolution.

Economic Policy Monitoring

Fiscal Policy Developments

Congressional tax policy discussions continue progressing toward July 4 deadlines, with Senate negotiations focusing primarily on Tax Cuts and Jobs Act extensions rather than dramatically stimulative new measures. While the impact may be largely status quo maintenance, potential accelerated capital expenditure deductions and deregulation measures could provide modest economic support.

The fiscal policy impact timing suggests greater influence during 2026 as provisions take effect, rather than immediate economic acceleration. This timing may prove beneficial by providing economic support if current growth momentum moderates naturally through normal cyclical patterns.

Regulatory Environment Evolution

Potential deregulation across multiple sectors could provide medium-term economic support through reduced compliance costs and enhanced operational flexibility. Financial services, energy, and healthcare sectors appear most likely to benefit from regulatory streamlining initiatives.

However, the implementation timeline and scope of regulatory changes remain uncertain, requiring careful monitoring of administrative actions and congressional support for broader deregulatory initiatives.

Risk Assessment and Scenario Analysis

Upside Scenario Considerations

Optimistic outcomes could emerge from successful Middle Eastern conflict de-escalation, comprehensive U.S.-China trade agreement conclusion, and continued economic resilience despite external pressures. Such developments could drive meaningful equity market recovery and commodity price normalization.

Federal Reserve rate reduction implementation could provide additional market support, particularly for interest-sensitive sectors including real estate, utilities, and growth-oriented technology companies. Combined with fiscal policy support, this monetary accommodation could extend the current economic expansion cycle.

Downside Risk Evaluation

Adverse scenarios include sustained Middle Eastern conflict escalation, potential U.S. military involvement, and significant commodity price increases driving renewed inflation pressure. Such developments could force Federal Reserve policy reconsideration and potentially trigger economic growth deceleration.

Trade policy negotiations failure and return to elevated tariff levels could create sustained inflationary pressure while simultaneously reducing economic growth through higher consumer costs and business investment uncertainty.

Base Case Projection

The most probable outcome involves continued near-term volatility with gradual resolution of current uncertainty sources over the coming quarters. Economic fundamentals appear sufficiently robust to withstand moderate external pressures, while policy flexibility remains available for more severe scenarios.

Markets likely continue experiencing elevated volatility until geopolitical and trade policy clarity improves, with selective sector outperformance based on individual exposure to prevailing uncertainty sources.

Conclusion and Strategic Recommendations

Current market conditions reflect the complex interaction between solid underlying economic fundamentals and elevated external uncertainty from geopolitical and trade policy sources. While near-term volatility appears likely to persist, the domestic economy's resilience provides a foundation for eventual market stabilization.

Investors should maintain diversified positioning with tactical adjustments for current uncertainty sources. Energy and defense sector exposure provides geopolitical tension hedging, while maintaining technology and healthcare allocations captures longer-term growth potential.

Fixed income positioning should balance safe-haven benefits against inflation risk considerations, with intermediate-duration Treasuries potentially offering optimal risk-adjusted returns in the current environment. Corporate credit requires careful sector selection based on individual vulnerability to prevailing risk factors.

The market's response to this week's developments demonstrates continued sensitivity to external shocks despite improving fundamental conditions. This dynamic suggests that patient, diversified investment approaches with tactical flexibility will likely outperform more concentrated strategies during the current uncertainty period.

As clarity emerges regarding trade policy implementation and geopolitical developments, markets should eventually reflect underlying economic strength and corporate earnings growth potential. Until such clarity arrives, maintaining defensive positioning with selective growth exposure appears prudent for navigating the complex current environment.

Weekly Benchmark Breakdown

S&P 500 Index

The S&P 500 closed at 5,976.97, down -1.13% on the week—marking a modest pullback from recent highs. However, under the surface, the picture reveals a sharper deterioration in internal breadth than the index-level move alone would suggest. The rally’s foundation has clearly weakened this week, as short-term momentum collapsed and new lows sharply outpaced new highs.

Breadth Metrics: Significant Short-Term Deterioration

Short-term momentum has broken down:

Just 24.80% of components are above the 5-day moving average—down from over 70% last week.

Only 38.29% remain above the 20-day MA.

Intermediate trend remains somewhat intact:

69.44% of components still above 50-day MA, but this is now likely at risk if weakness persists.

Longer-term trend alignment is showing initial cracks:

100-day MA: 50.99%

150-day MA: 48.21%

200-day MA: 46.82%

The index remains technically long-term healthy, but deterioration is creeping into intermediate and long-term structures.

New Highs vs. New Lows: Bearish Reversal

97 new 5-day highs (19%), versus 242 new lows (48%) → net -145.

The most negative breadth print in weeks—this is a clear reversal of bullish leadership.

New lows dominate even out to 1-month and beyond:

1-month net: -4

3-month net: +6 (still positive, but fading)

6-month, 52-week, YTD also beginning to tilt toward neutral.

Interpretation

The S&P 500 breadth structure has sharply deteriorated. The short-term reversal in momentum and the large surge in new lows signal that the rally has lost steam—at least for now. Intermediate trend breadth (50-day MA) remains strong but will likely weaken quickly if downside pressure persists.

At the same time, longer-term structures are still intact, but leadership is no longer broad-based. Institutional activity appears to be rotating out of weaker names, causing a bifurcated market beneath the surface.

Conclusion

This was a breadth breakdown week for the S&P 500. Short-term momentum has collapsed, and leadership is now decisively skewed to the downside. While long-term trend structures have not yet broken, they are vulnerable if current weakness deepens.

Unless short-term breadth rebounds quickly, the market risks transitioning into a corrective phase. For now, the tape favors caution and selectivity, with defensive positioning warranted until participation improves. This is no longer a "fully confirmed rally" — breadth has flipped to fragile and vulnerable.

Dow Jones Index

The Dow Jones Industrial Average closed at 42,197.79, down -1.79% on the week, marking a sharp reversal after weeks of steady grinding higher. Internally, the picture has clearly deteriorated at the short- and intermediate-term levels, though long-term structure remains relatively stable for now.

Breadth Metrics: Short-Term Breakdown, Long-Term Still Holding

Short-term momentum has weakened materially:

Just 20.00% of components are above their 5-day moving average.

40.00% remain above the 20-day MA—both readings sharply lower from recent highs.

Intermediate-term trend holding for now:

63.33% of components are still above the 50-day MA—resilient, but vulnerable if selling persists.

Long-term structure remains strong:

100-day MA: 60.00%

150-day MA: 63.33%

200-day MA: 63.33%

Long-term participation is still healthy, though leadership is thinning at the edges.

New Highs vs. New Lows: Weakening Leadership

4 new 5-day highs (13%), versus 14 new lows (47%) → net -10.

Leadership is clearly thinning:

1-month net: -1

No 3-month, 6-month, 52-week, or YTD new highs reported this week.

New low count is not overwhelming, but the absence of new highs is a yellow flag.

Interpretation

The Dow’s internals this week reflect a clear loss of momentum and growing internal fragility. While the longer-term structure (100-, 150-, 200-day MAs) remains intact, the collapse in short-term momentum and the negative new high/new low spread signals that buyers have stepped aside, at least for now.

Leadership is becoming narrow, and downside pressure is picking up. The fact that long-term breadth is holding means this is not yet a major breakdown, but the index is vulnerable to further pullback if short-term breadth does not stabilize soon.

Conclusion

The Dow is moving into a short-term corrective phase after a very strong prior run. The deterioration in 5-day and 20-day breadth, coupled with thinning leadership, points to fading upside momentum. The long-term trend remains technically sound, but unless participation rebounds in the coming week, further weakness is likely.

For now, this is a market to approach with caution—selectivity and risk management take priority until we see breadth stabilization and a new wave of leadership emerge.

NASDAQ 100 Index

The Nasdaq 100 closed at 21,631.04, down -1.29% on the week—a meaningful pullback from recent highs. The index is still within striking distance of its 52-week high, but breadth has materially deteriorated under the surface, with notable short-term weakness and declining leadership.

Breadth Metrics: Short-Term Weakness Emerging

Short-term momentum has broken down sharply:

Only 22.77% of components remain above their 5-day moving average—down from the 70–80% zone seen in recent weeks.

49.50% remain above their 20-day MA—a major drop from prior strength.

Intermediate-term trend holding for now:

76.23% of components still above 50-day MA—off highs, but still providing a cushion.

Long-term structure remains healthy but at risk:

100-day MA: 63.36%

150-day MA: 62.37%

200-day MA: 60.39%

These long-term readings indicate the uptrend remains intact, but short-term breadth is flashing caution.

New Highs vs. New Lows: Clear Deterioration in Leadership

11 new 5-day highs (11%), versus 43 new lows (43%) → net -32.

Breadth deterioration is also showing at longer timeframes:

1-month net: -4

3-month net: -1

6-month, 52-week, YTD: flat

Leadership has thinned dramatically, and weakness is broadening across components.

Interpretation

The Nasdaq 100 is showing a classic short-term breadth breakdown after a strong run. While long-term trend structure remains technically sound, short- and intermediate-term participation has weakened materially.

This is a rotation and risk-management phase, not a structural breakdown—yet. However, the combination of falling short-term breadth and a negative new high/new low spread indicates that buyers have stepped aside temporarily, leaving the index vulnerable to further mean reversion.

Conclusion

The Nasdaq 100 has entered a short-term corrective phase, with breadth now signaling caution. While the longer-term uptrend is still intact, the current deterioration in participation and leadership suggests a period of consolidation or deeper pullback may be required to reset internals.

For now, this is a market where selectivity is key—focus on relative strength names, manage risk, and watch for signs of breadth stabilization before re-engaging aggressively. Short-term caution is warranted until momentum and leadership rebuild.

Russel 1000

The Russell 1000 closed at 327.83, down -1.15% on the week, showing a sharp pullback from its recent strong run. Underneath the surface, market breadth has deteriorated significantly, with short-term momentum collapsing and new lows now dominating across nearly all timeframes.

Breadth Metrics: Momentum Cracking Hard

Short-term momentum has broken down sharply:

Only 21.05% of components are above their 5-day moving average—a complete reversal from the >75% zone seen just two weeks ago.

38.22% remain above the 20-day MA—also a steep drop.

Intermediate-term participation weakening:

68.16% still above 50-day MA—but this is now vulnerable given the sharp deterioration in short-term momentum.

Longer-term structure slipping:

100-day MA: 48.10%

150-day MA: 43.51%

200-day MA: 42.91%

The long-term trend structure is moving back below the key 50% participation threshold—a risk factor going forward.

New Highs vs. New Lows: Negative Breadth Dominates

144 new 5-day highs (14%), versus 544 new lows (54%) → net -400 — the worst breadth print of the four major indices this week.

Longer-term net new highs/lows remain negative:

1-month net: -66

3-month net: +11 (barely positive, at risk of flipping)

6-month, 52-week, YTD: flat

The sheer scale of 544 new lows is a clear sign that selling is widespread across the index.

Interpretation

The Russell 1000 has shifted into a broad internal correction. Short-term breadth and leadership have completely collapsed, and the dominance of new lows across nearly all windows signals institutional rotation out of weaker names.

The fact that the 50-day MA still holds at 68% is somewhat supportive, but given the magnitude of short-term deterioration, this cushion may erode quickly if downside momentum persists. The trend of the past few weeks—catch-up rally in breadth and new highs—has now been decisively reversed.

Conclusion

The Russell 1000 is now the weakest of the four major indices in internal structure this week. The combination of collapsing short-term momentum, overwhelming new lows, and falling long-term participation is a clear warning flag.

This is a market in active correction beneath the surface, and risk management is warranted until we see breadth stabilize and downside leadership abate. Expect further mean reversion and potential leadership rotation in coming sessions—defensive positioning is favored until participation rebuilds.

Major Indices Insights & Summary

Market internals across all four major U.S. indices have meaningfully deteriorated this week, shifting from broad-based strength to a fragile state dominated by short-term momentum collapse and an overwhelming surge in new lows. While prices remain elevated near recent highs, breadth tells a sharply different story: buyers have stepped aside, and defensive selling is gaining traction.

The deterioration is broad:

The S&P 500 saw its 5-day breadth plunge to 24.8%, with new lows outpacing new highs by -145—a sharp reversal from prior strength.

The Dow Jones breadth also collapsed, with only 20% of components above the 5-day MA and new highs vs. lows net -10.

The Nasdaq 100, while technically the strongest long-term, also saw short-term breadth collapse to 22.8%, with new lows outpacing highs by -32.

The Russell 1000 posted the most dramatic internal damage, with 544 new lows vs. 144 new highs (-400), and just 21% of components above the 5-day MA—the most severe breakdown among the major indices.

Longer-term structures (150- and 200-day MAs) remain intact across the board for now, but are increasingly vulnerable if selling continues. This is not a healthy tape beneath the surface, despite relatively small price pullbacks in the indices.

Bottom line: The rally’s internal foundation has cracked. Without a swift and decisive breadth rebound, the risk of a deeper corrective phase is now front and center.

VL Indices Market Score: 52 / 100 ( -38 WoW )

Our Market Score plunged this week as internal momentum flipped negative across all major indices. While long-term structures are still technically intact, short-term deterioration and the surge in new lows argue for caution.

1. Leadership Has Vanished

S&P 500: +97 highs vs. 242 lows → net -145

Dow Jones: +4 highs vs. 14 lows → net -10

Nasdaq 100: +11 highs vs. 43 lows → net -32

Russell 1000: +144 highs vs. 544 lows → net -400

Buyers are no longer in control. Leadership is retreating across all timeframes.

2. Participation Collapse Across the Board

5-day % of stocks above MA:

S&P 500: 24.8%

Dow Jones: 20.0%

Nasdaq 100: 22.8%

Russell 1000: 21.0%

20-day % of stocks above MA:

S&P 500: 38.3%

Dow Jones: 40.0%

Nasdaq 100: 49.5%

Russell 1000: 38.2%

Momentum is breaking down at a rapid pace. The rotation out of previously strong participation is swift and decisive.

3. Long-Term Structures Still Intact (For Now)

S&P 500: ~48–50% above 150/200 MA

Dow Jones: ~63% above 150/200 MA

Nasdaq 100: ~60–62% above 150/200 MA

Russell 1000: ~43–42% above 150/200 MA

This remains the last line of defense. If these long-term readings begin to fall meaningfully in the coming week, the risk of a more prolonged correction rises sharply.

4. Market Tone Has Shifted

Unlike prior weeks, where dips were shallow and quickly bought, this week’s action signals distribution rather than orderly rotation. Short-term breadth collapse and broad new low expansion are classic markers of institutional risk-off behavior.

This does not yet constitute a structural bear phase—but the internal shift is undeniable. Defensive positioning and risk management are now warranted.

5. Conclusion

The market has entered a fragile and vulnerable state. Breadth is deteriorating across all major indices, leadership has vanished, and the internal momentum that supported the prior rally has decisively reversed.

Unless we see a sharp rebound in breadth participation and leadership in the next 1–2 weeks, the risk of an intermediate-term correction grows substantially. We downgrade our outlook from confirmed rally to corrective risk-on alert — watch breadth metrics closely in the days ahead.

US Investor Sentiment Report

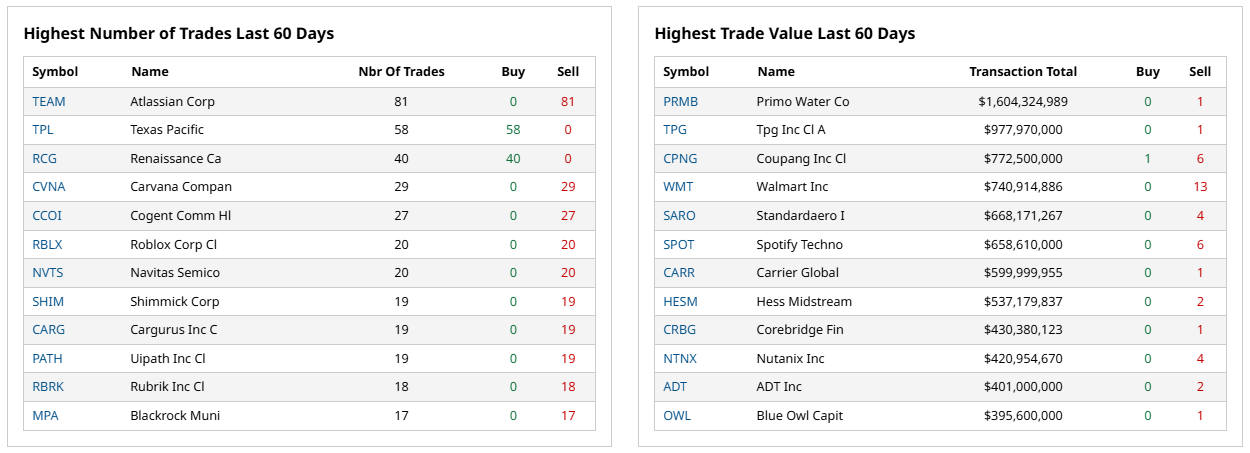

Insider Trading

Insider trading occurs when a company’s leaders or major shareholders trade stock based on non-public information. Tracking these trades can reveal insider expectations about the company’s future. For example, large purchases before an earnings report or drug trial results might indicate confidence in upcoming good news.

%Bull-Bear Spread

The %Bull-Bear Spread chart is a sentiment indicator that shows the difference between the percentage of bullish and bearish investors, often derived from surveys or sentiment data, such as the AAII (American Association of Individual Investors) sentiment survey. This spread tells investors about the prevailing mood in the market and can provide insights into market extremes and potential turning points.

Bullish or Bearish Sentiment:

When the spread is positive, it means more investors are bullish than bearish, indicating optimism about the market’s direction.

A negative spread indicates more bearish sentiment, meaning more investors expect the market to decline.

Contrarian Indicator:

The %Bull-Bear Spread is often used as a contrarian indicator. For example, extremely high levels of bullish sentiment might suggest that the market is overly optimistic and could be due for a correction.

Similarly, when bearish sentiment is extremely high, it might indicate that the market is overly pessimistic, and a rally could be on the horizon.

Market Extremes and Reversals:

Historically, extreme values of the spread (both positive and negative) can signal turning points in the market. A very high positive spread can signal market exuberance, while a very low or negative spread may indicate fear or capitulation.

NAAIM Exposure Index

The NAAIM Exposure Index (National Association of Active Investment Managers Exposure Index) measures the average exposure to U.S. equity markets as reported by its member firms. These are typically active money managers who provide their equity exposure levels weekly. The index offers insight into how much these managers are investing in equities at any given time, ranging from being fully short (-100%) to leveraged long (up to +200%).

CBOE Total Put/Call Ratio

CBOE's total put/call ratio includes index options and equity options. It's a popular indicator for market sentiment. A high put/call ratio suggests that the market is overly bearish and stocks might rebound. A low put/call ratio suggests that market exuberance could result in a sharp fall.

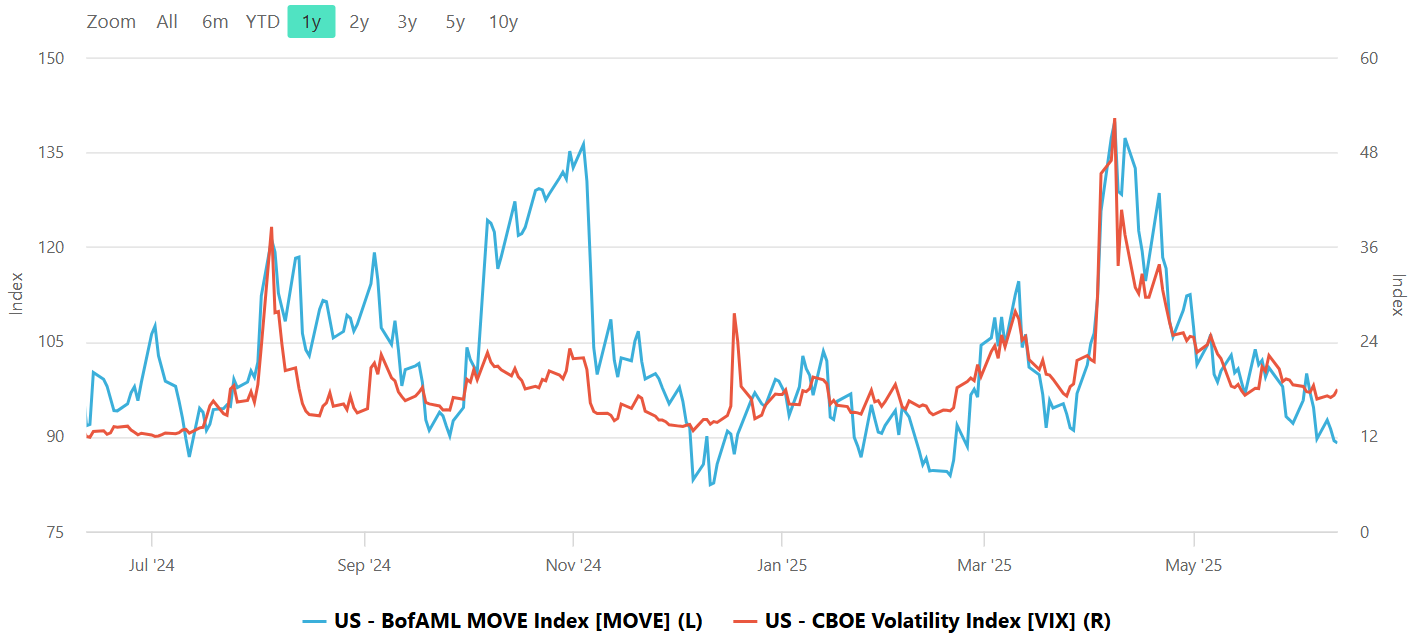

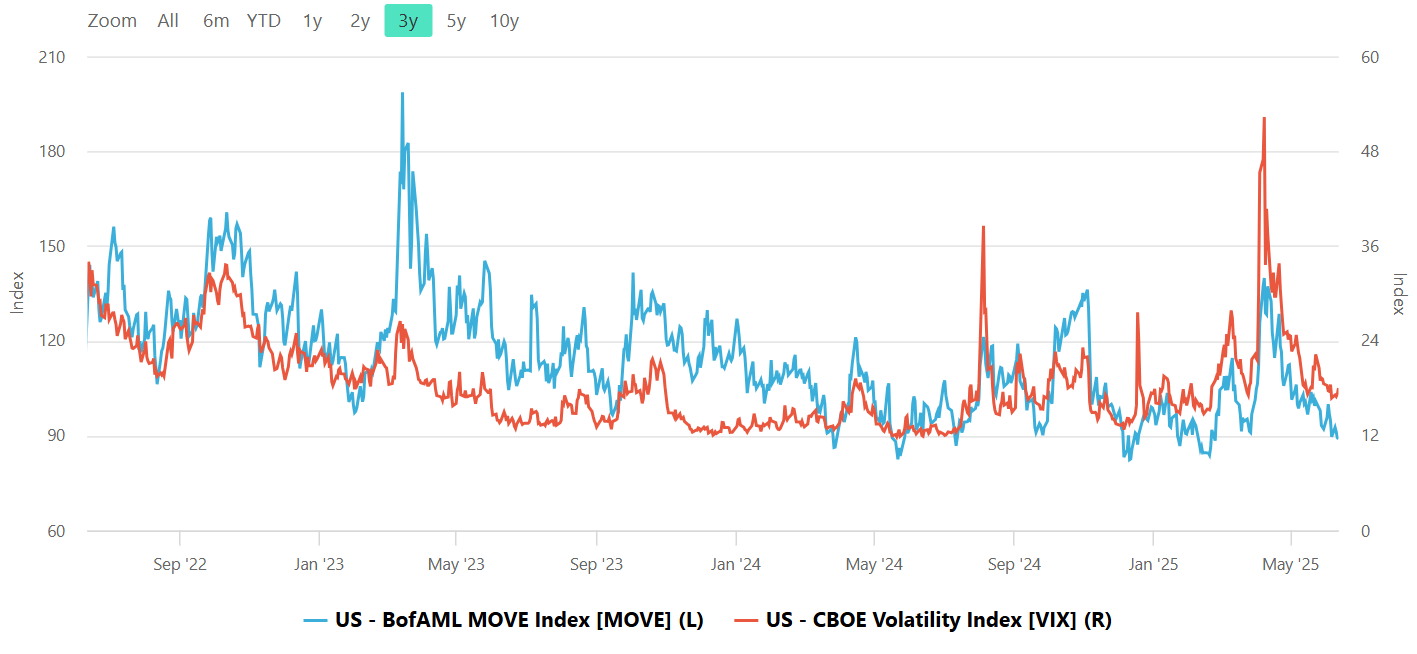

Equity vs Bond Volatility

The Merrill Lynch Option Volatility Estimate [MOVE] Index from BofAML and the CBOE Volatility Index [VIX] respectively represent market volatility of U.S. Treasury futures and the S&P 500 index. They typically move in tandem but when they diverge, an opportunity can emerge from one having to “catch-up” to the other.

CNN Fear & Greed Constituent Data Points & Composite Index

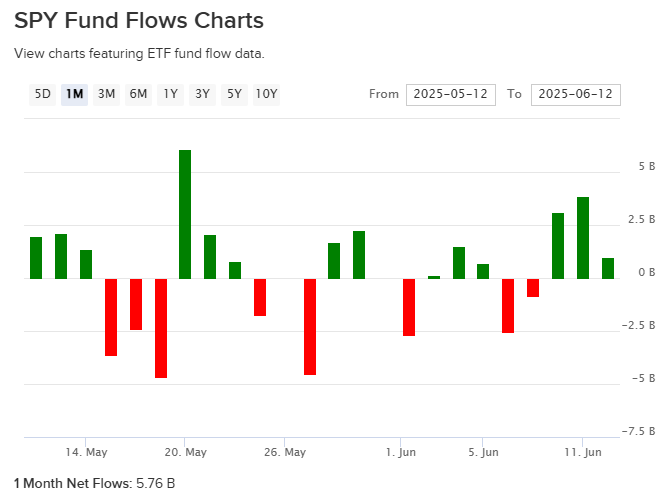

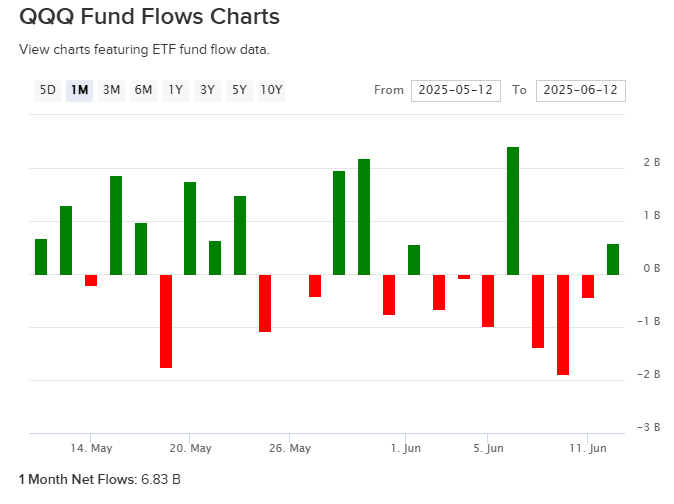

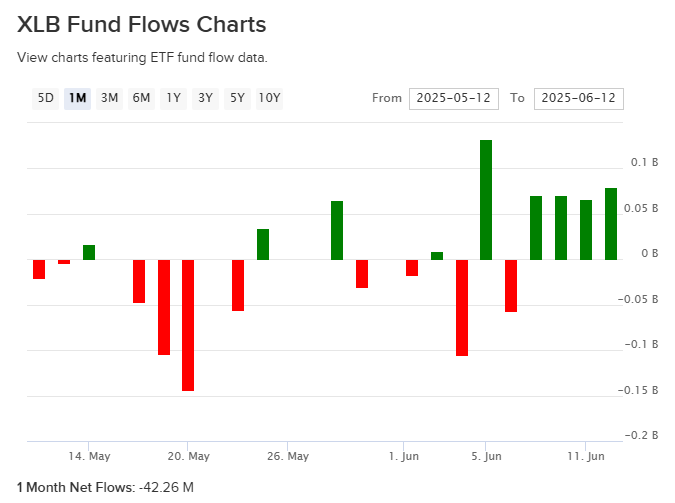

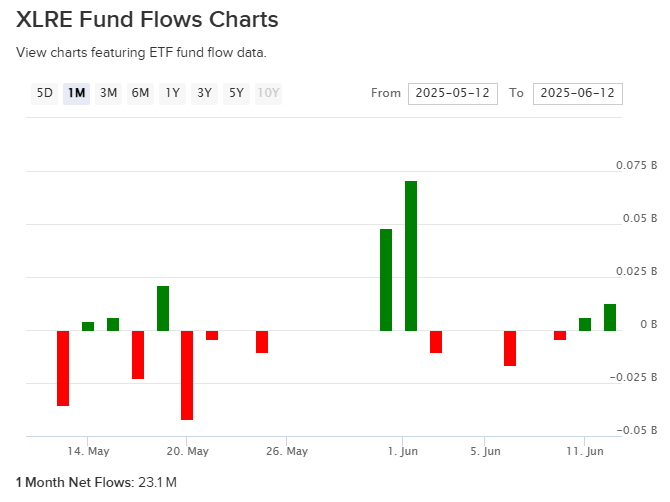

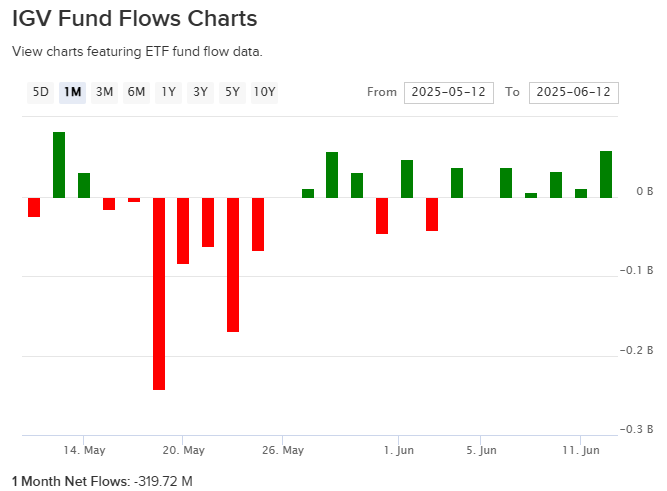

Fund Flows Snapshot

How to Read Fund Flows

Fund flows track the net movement of money into or out of ETFs over a given time period. Positive flows mean investors are adding money to that ETF; negative flows mean they are pulling money out. Fund flows provide insight into where capital is moving, which sectors or themes are being favored, and how market participants are positioning themselves.

Why Fund Flows Matter

Flows often tell us what’s happening beneath the surface of price action:

When flows align with a trend, they can confirm its strength.

When flows diverge from price (price rising but outflows), they can signal potential exhaustion or false moves.

Tracking sector rotation via flows helps identify where institutional money is moving — often ahead of retail.

Flows into defensive assets (utilities, staples, gold) can warn of rising risk aversion, while inflows into growth sectors or high-yield credit signal a more risk-on environment.

How to Use This Section

When reviewing the 1-month trailing fund flows:

Look for which sectors/themes are seeing inflows vs outflows — rotation can often precede price leadership.

Watch for flows into safe-haven assets — growing fear or hedging activity.

Pay attention to flow divergences — if flows contradict recent price moves, it may signal changing market dynamics.

Use flow trends as a lens for market risk appetite — is capital positioning for expansion, protection, or reversal?

What to Look For

Strong inflows → Sector/theme gaining institutional sponsorship — potential leadership emerging.

Consistent outflows → Sector/theme falling out of favor — headwind to price.

Sudden flow reversals → Shifts in market regime or sentiment — time to investigate.

Flows into defensive sectors + out of cyclicals → Broad de-risking underway.

Flows into growth & cyclicals → Confidence in the market’s forward outlook.

Bottom line: Fund flows give you an edge in tracking where the market is positioning next — often before it shows up in price.

This section helps you see what’s moving behind the scenes so you can align your trades and investments accordingly.

Pro Tips

When flows go into cyclical sectors + out of defensives → risk-on.

When flows go into defensives + credit ETFs + gold → risk-off or caution.

When flow divergence happens (e.g. price rising but XLF or XLI flows negative) → be alert for reversals.

When flows surge into money market funds → risk aversion peaking → contrarian bullish if combined with price washout.

When flows chase hot sectors late in a rally (high trailing flows in XLK, XLY, SMH after extended runs) → watch for potential crowding and reversal risk.

When broad market flows (SPY, QQQ) are flat or negative but sector flows are positive → market is entering a stock-picker’s tape — be selective, not broad beta.

When flows move sharply into bond proxies (XLU, XLRE, XLP) → rate expectations shifting → monitor yields and Fed signals.

When HYG / JNK flows flip strongly negative → rising credit stress → equities vulnerable to volatility spike.

When flows into small caps (IWM) surge after underperformance → reflation expectations building → often signals early phase of macro turn.

When global ETF flows (EEM, EFA) sharply diverge from US flows → macro capital rotation underway — useful for FX and commodities positioning.

Core S&P 500 Sector ETFs

Popular Thematic / Subsector ETFs to Watch

Fixed Income / Credit ETFs

Social Media Favs

Analyzing social sentiment can provide valuable insights for investment strategies by offering a pulse on public perception, mood, and market sentiment that traditional financial indicators might not capture. Here’s how social sentiment analysis can enhance investment decisions:

Market Momentum: Positive or negative social sentiment can signal impending momentum shifts. When public opinion on a stock, sector, or asset class changes sharply, it can create buying or selling pressure, especially if that sentiment becomes widespread.

Early Detection of Trends: Social sentiment data can help investors spot trends before they show up in technical or fundamental data. For example, increased positive chatter around a particular company or sector might indicate growing interest or excitement, which could lead to price appreciation.

Gauge Retail Investor Impact: With the rise of retail investor platforms, collective sentiment on social media can lead to significant price movements (e.g., meme stocks). Understanding how retail investors view certain stocks can help in identifying high-volatility opportunities.

Event Reaction Monitoring: Social sentiment can provide real-time reactions to news events, product releases, or earnings reports. Investors can use this information to gauge market reaction quickly and adjust their strategies accordingly.

Complementing Quantitative Models: By adding a social sentiment layer to quantitative models, investors can enhance predictions. For example, a model that tracks historical price and volume data might perform even better when factoring in sentiment trends as a measure of market psychology.

Risk Management: Negative sentiment spikes can be a signal of potential downturns or increased volatility. By monitoring sentiment, investors might avoid or hedge against investments in companies experiencing a public relations crisis or facing negative perceptions.

Long-Term Sentiment Trends: Sustained sentiment trends, whether positive or negative, often mirror longer-term market cycles. Tracking sentiment trends over time can help identify shifts in investor psychology that could affect longer-term investments or sector rotations.

For these reasons, sentiment analysis, when combined with other tools, can provide a comprehensive view of both immediate market reactions and underlying investor attitudes, helping investors position themselves strategically across various time frames. Here are the most mentioned/discussed tickers on Reddit from some of the most active Subreddits for trading:

Special Coverage Report

Seeing the Full Picture: How Bank of America Uses 20 Valuation Metrics to Evaluate Equity Worth

I. The Myth of the One True Metric

In the chaotic chorus of modern markets, there is an enduring temptation to distill investment decisions into a single, elegant number. For decades, the Price-to-Earnings ratio (P/E) has been the go-to shortcut for investors of all stripes — from portfolio managers to the weekend warrior managing a Roth IRA between coffee breaks. It’s a comforting figure: easy to calculate, easy to compare, easy to misinterpret.

But Bank of America, one of the largest and most influential financial institutions in the world, rejects that simplicity. Behind the curtain of its research desks and global strategy teams lies a valuation engine that runs not on a single signal but on a chorus of 20 distinct valuation metrics. These range from traditional ratios like P/B and EV/EBITDA to more nuanced indicators of cash flow, profitability, and capital structure. Together, they form a comprehensive mosaic — a layered approach that resists the allure of shortcuts and embraces complexity.

This is not merely an academic exercise or a tool of redundancy. BoA’s analysts believe valuation is too important — and too subtle — to leave in the hands of a single metric. By evaluating assets across multiple financial lenses, they are able to detect inconsistencies, identify traps, and more accurately value opportunity amid noise. This report explores how and why that 20-metric framework was built — and why it matters more than ever in today’s fractured markets.

II. The Philosophy Behind the 20-Metric Framework

To understand the why of this approach, we must first grapple with the core philosophical idea underpinning BoA’s strategy: valuation is probabilistic, not deterministic. There is no single formula that guarantees value. Rather, value exists in the interplay of expectations, fundamentals, capital structure, cash flow dynamics, and market sentiment. It is revealed over time — often only in hindsight — and is constantly distorted by narratives, liquidity, and macroeconomic regimes.

BoA’s 20-metric framework is built to see through that distortion. It exists to triangulate — to confirm or contradict the signals that any one metric might flash. For example, a low P/E might suggest a bargain, but if that company is hemorrhaging cash or weighed down by debt, the true value may be far less than the earnings multiple implies.

This mosaic approach also reflects sectoral nuance. What counts as a high P/B ratio for a bank may be par for the course for a biotech firm. Similarly, capital-intensive industries may look unattractive on net margin but shine on EBITDA or asset turnover. The 20-metric framework accounts for these divergences. It doesn't seek universal truth — it seeks contextual clarity.

III. Price-Based and Earnings Metrics: The Old Standbys

Let’s begin with the most familiar territory: price-based and earnings-based metrics. These include:

P/E Ratio (Trailing 12 Months)

Forward P/E

PEG Ratio (Price/Earnings-to-Growth)

Price to Book (P/B)

Price to Sales (P/S)

These are what most investors would recognize from a finance textbook or brokerage dashboard. They provide a surface-level view of what you’re paying for an asset, relative to what it’s earning, owning, or selling.

But surface-level does not mean irrelevant. BoA still relies heavily on these traditional metrics, particularly for screening large universes of stocks. P/E and Forward P/E are used to identify outliers, detect regime shifts, and quickly scan sectoral valuation dispersion. PEG adds a growth dimension to the equation — often helping analysts determine whether a high P/E is justified.

Price to Book (P/B) shines especially in asset-heavy sectors — like financials and industrials — where tangible equity plays a significant role in valuation. Meanwhile, P/S is often a go-to when earnings are negative or distorted, as in early-stage tech or healthcare plays.

These five metrics are the starting point in the 20-metric ensemble, but never the endpoint. They are the front door — inviting but incomplete.

IV. The Rise of Cash Flow and Enterprise Value Metrics

Valuation evolves with the market, and nowhere is that clearer than in the growing dominance of cash flow and EV-based metrics. These include:

Price to Free Cash Flow (P/FCF)

EV/EBITDA

EV/EBIT

EV/Sales

EV/Free Cash Flow

Why the pivot? In short: cash doesn’t lie.

Earnings can be manipulated through accounting assumptions, but cash flow reveals operational health. BoA leans heavily on P/FCF to assess whether a company is generating real value that can be reinvested or returned to shareholders. This is especially important in mature industries, where earnings growth may be modest but cash generation is strong.

Enterprise Value (EV) introduces a broader lens. It accounts not just for market cap but also for debt and cash — the entire capital structure. That’s where EV/EBITDA and EV/EBIT come in. These metrics allow for cross-company comparisons regardless of leverage levels, a critical distinction in industries like telecom, energy, and utilities where debt is a structural feature.

EV/Sales is particularly useful when a company has negative earnings but strong revenue momentum — common in high-growth tech. And EV/FCF is the holy grail for many analysts, combining the breadth of enterprise value with the purity of free cash flow.

BoA’s analysts often consider these metrics to be "truth-tellers" in an otherwise noisy environment. They cut through GAAP smoke and mirror games and expose what the business is really worth to an acquirer or long-term investor.

V. Profitability & Quality Metrics: Cutting Through the Noise

Not all valuation is about price. Some of it is about what the business does with its resources. This brings us to the profitability and quality cluster:

Earnings Yield

Operating Margin

Net Profit Margin

Return on Equity (ROE)

Return on Assets (ROA)

Return on Invested Capital (ROIC)

These metrics help BoA distinguish between cheap and good. A low P/E stock may seem like a value buy — until you realize the company earns just a sliver of profit on every dollar of revenue. In contrast, a high-margin, high-ROIC business with strong returns on capital might be a far better long-term investment even if it appears expensive on traditional metrics.

ROE and ROIC, in particular, are signals of a business’s ability to reinvest profitably. They are key indicators in BoA’s quality-factor screens and often guide the team’s thinking when constructing durability-focused portfolios.

Margins (operating and net) help isolate cost control and pricing power — key traits in an inflationary or recessionary environment. Earnings yield, the inverse of P/E, is often used as a relative value tool in asset allocation decisions — especially when comparing equities to bonds.

VI. Growth Metrics: The Path Forward

Valuation, in isolation, is meaningless without growth. A company trading at 50x earnings might still be cheap if those earnings are about to triple. That’s why BoA factors in:

Earnings Growth Rate (3- or 5-year CAGR)

Revenue Growth Rate

Growth metrics are notoriously volatile — subject to macro conditions, management changes, or secular disruption — but BoA uses them to contextualize multiples. A PEG ratio (P/E to Growth) under 1 might indicate that growth is underappreciated. Conversely, a high-growth stock with decelerating revenue should raise red flags.

The bank’s analysts cross-reference growth expectations with valuation and profitability. A high-growth name that also generates FCF and high ROIC? That’s gold. A fast grower burning cash and taking on debt? Tread carefully.

Growth is also central to thematic investing. Whether it’s AI, green energy, or semiconductors, BoA’s strategists use historical and forecasted CAGR data to filter and prioritize among peers.

VII. Risk & Balance Sheet Strength

No valuation framework is complete without a serious look at financial risk. BoA tracks:

Debt to Equity Ratio

Interest Coverage Ratio

These help the bank assess whether a company’s capital structure is sustainable — especially in rising rate environments or periods of credit tightening. Debt/Equity flags over-leveraged firms vulnerable to refinancing risk. Interest coverage gauges how comfortably a company can service its obligations.

These metrics also inform dividend sustainability and M&A potential. A low-leverage firm with strong coverage ratios might be a safer play in defensive rotations. Conversely, a highly leveraged company might be a risky — but high-reward — turnaround candidate.

BoA doesn’t use these metrics just to avoid downside. They’re also used to identify opportunities during dislocation — when credit fears overshoot the fundamentals.

VIII. How These Metrics Interact: Building a Composite View

The real power of BoA’s valuation model lies not in the metrics themselves, but in how they interact.

For example:

A stock with a low Forward P/E but negative FCF and deteriorating margins? That’s a value trap.

A stock with high EV/EBITDA but massive revenue growth and improving ROIC? That might be a misunderstood growth story.

BoA’s analysts weigh these factors depending on sector, stage of the business cycle, and macro regime. The bank rarely gives equal importance to all 20 metrics. Instead, they use them to tell a cohesive story — and to check whether that story holds up under multiple lenses.

It’s a bit like flying a plane with multiple instruments. You wouldn’t want to rely on just your altimeter. You need airspeed, direction, fuel level, and wind readings. The same goes for valuation.

IX. The Quant Layer: Scorecards, Factor Models & Screening

BoA doesn’t stop at interpretation. These metrics feed into quantitative models, scorecards, and ranking systems. The bank runs factor-based screens, where these metrics are weighted and scored to build custom portfolios.

Value Factors: P/E, P/B, EV/EBITDA

Quality Factors: ROE, ROIC, margins

Growth Factors: Earnings/revenue CAGR

Risk Factors: Debt ratios, interest coverage

This systematic layer powers smart beta products, sector rotation strategies, and risk overlays. It also forms the basis for tactical research notes sent to institutional clients — especially in volatile markets.

These screens can also flag stocks that may be poised to re-rate — either upward due to improving fundamentals or downward due to deteriorating quality.

X. Closing Thoughts: Seeing Like a Research Desk

If this all sounds exhaustive, that’s because it is. BoA’s 20-metric framework isn’t just about being thorough — it’s about being conviction-driven in a world addicted to noise.

In a time when headlines, sentiment shifts, and AI-generated news cycles can move billions in minutes, valuation discipline is more critical than ever. The point isn’t to be perfect — it's to be less wrong, more often.

Investors can’t always predict the future. But by using a wide lens, they can better understand the present — and make more grounded assumptions about what comes next. Whether you’re an institutional allocator or an individual stock picker, the lesson is clear: trust no single signal.

A stock, like a person, is too complex to judge on one dimension.

Institutional S/R Levels for Major Indices

When you’re a large institutional player, your primary goal is to find liquidity - places to do a ton of business with the least amount of slippage possible. VolumeLeaders.com automatically identifies and visually plots the exact spots where institutions are doing business and where they are likely to return for more. It’s one of the primary reasons “support” and “resistance” concepts work and truly one of the reasons “price has memory” - take a look at the dashed lines in the images below that the platform plots for you automatically; these are the areas institutions constantly revisit to do more business.

Levels from the VolumeLeaders.com platform can help you formulate trades theses about:

Where to add or take profit

Where to de-risk or hedge

What strikes to target for options

Where to expect support or resistance

And this is just a small sample; there are countless ways to leverage this information into trades that express your views on the market. The platform covers thousands of tickers on multiple timeframes to accommodate all types of traders.

SPY

QQQ

IWM

DIA

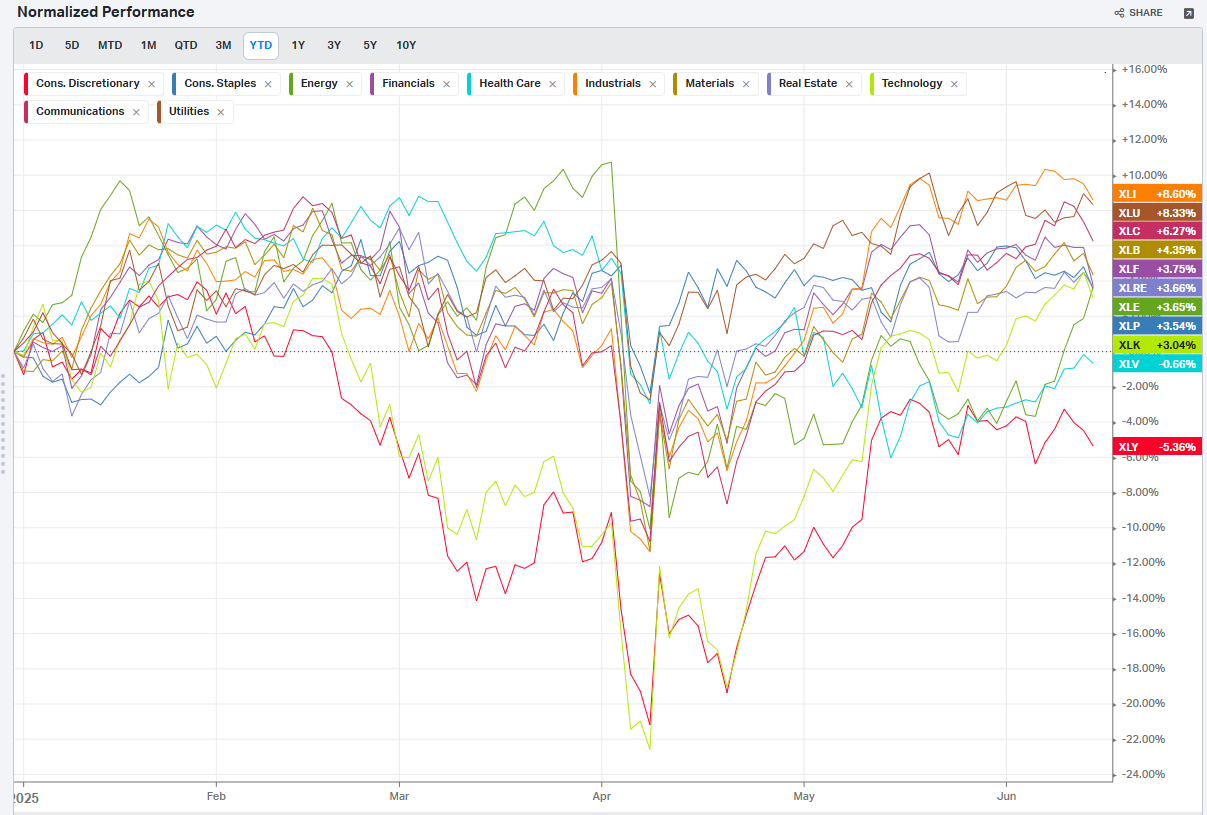

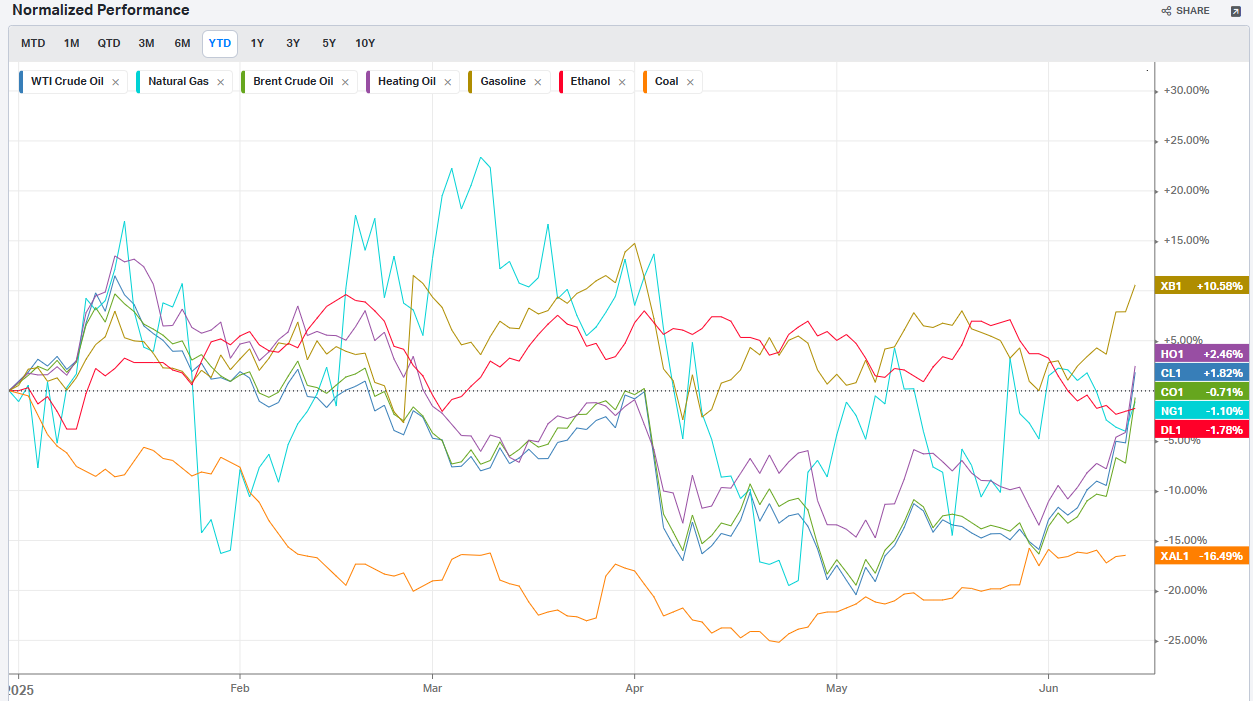

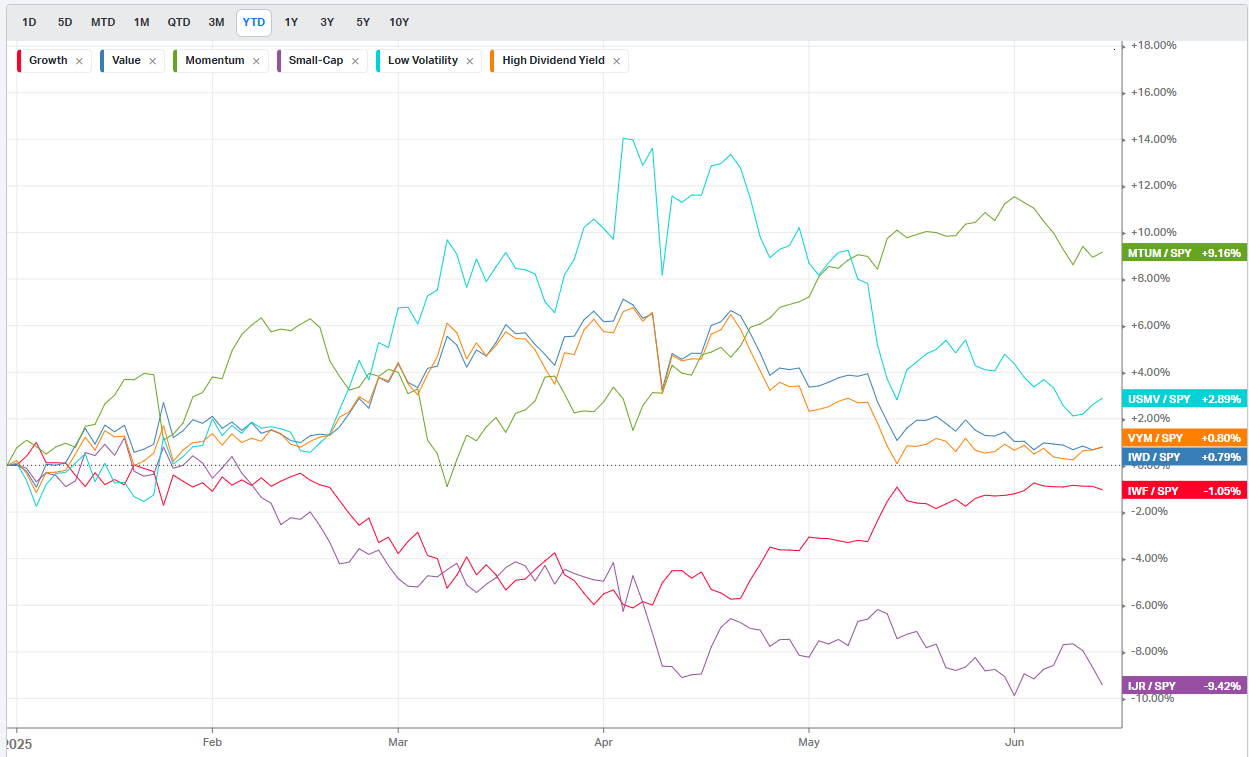

Summary Of Thematic Performance YTD

VolumeLeaders.com offers a robust set of pre-built thematic filters, allowing you to instantly explore specific market segments. These performance snapshots are provided purely for context and inspiration—think about zeroing in on the leaders and laggards within the strongest and weakest sectors, for example.

S&P By Sector

S&P By Industry

Commodities: Energy

Commodities: Metals

Commodities: Agriculture

Country ETFs

Currencies

Global Yields

Factors: Style

Factors: Size vs Value

Factors: Qualitative

Events On Deck This Week

Here are key events happening this week that have the potential to cause outsized moves in the market or heightened short-term volatility.

Econ Events By Day of Week

Anticipated Earnings By Day of Week

Market Intelligence Report

(Free Preview)

Institutional Trading Intelligence: High-Conviction Signals from Wall Street's Largest Players

This week's institutional trading data exposes remarkable concentration in specific themes that sophisticated investors are positioning for aggressively. With cybersecurity leader Rubrik ( RBRK 0.00%↑ ) commanding $247.7 million in rank-1 institutional positioning following stellar Q1 2026 earnings that prompted widespread analyst upgrades, including Wells Fargo raising their price target from $80 to $125, the data signals institutional conviction in next-generation infrastructure plays.

The analysis of 614 institutional trades reveals three dominant investment narratives: continued nuclear renaissance positioning from initial mentioning a couple of weeks ago, cybersecurity infrastructure buildout, and strategic large-cap concentration amid market uncertainty. Most striking is the emergence of relative size indicators exceeding 199%, suggesting institutions are making their largest bets in specific securities relative to historical norms.

Nuclear Energy: The Ultimate Contrarian Convergence Play

Oklo ( $OKLO) again emerges as a standout with $134.5 million in rank-1 institutional positioning and an extraordinary 85.05 relative size ratio, occurring precisely as the company advances toward its 2025 license application resubmission and secures Air Force pilot reactor agreements. The timing coincides with Oklo's $400 million secondary offering led by Goldman Sachs, indicating institutional appetite for nuclear infrastructure exposure ahead of regulatory catalysts.

The nuclear positioning extends beyond individual securities. Sam Altman's recent resignation as Oklo chairman specifically to facilitate supply discussions between OpenAI and the nuclear startup underscores the AI-energy nexus that institutions appear to be anticipating. The data reveals concentrated exposure to 2x leveraged nuclear positions alongside direct equity stakes, suggesting a multi-layered approach to the sector's potential acceleration.

What makes this positioning particularly compelling is the regulatory backdrop. Trump's directive for the NRC to issue licenses within 18 months creates a defined catalyst timeline that sophisticated investors are clearly positioning ahead of. The institutional concentration in OKLO coinciding with these developments suggests informed positioning for potential regulatory breakthrough moments.

Cybersecurity Infrastructure: Post-Earnings Momentum with Strategic Depth

Rubrik's institutional positioning reaches $247.7 million at rank-1 status following Q1 2026 earnings that significantly exceeded expectations, with the company posting strong momentum in its Zero Trust Data Security platform and identity business segments. The positioning coincides with widespread analyst upgrades, including Wedbush raising their target from $80 to $120 and KeyBanc increasing to $113 from $98.

The cybersecurity thesis extends beyond individual company performance. Rubrik's partnership with Google Agentspace for secure AI data management and the company's expansion of AMD EPYC processor deployment across cloud platforms positions the company at the intersection of AI infrastructure and cybersecurity—two themes receiving substantial institutional attention in the broader dataset.

The relative size metric of 53.12 for RBRK suggests institutions are significantly overweighting cybersecurity infrastructure relative to historical allocations. This positioning appears prescient given escalating geopolitical tensions and the increasing priority of data protection in enterprise IT spending.

Large-Cap Concentration: Defensive Positioning with Aggressive Sizing

The most substantial institutional positioning appears in SPLG 0.00%↑ (SPDR Portfolio S&P 500 ETF), with $798.4 million at rank-1 status and an unprecedented 199.89 relative size ratio. This extraordinary concentration in large-cap exposure suggests institutions are making their largest defensive positioning in decades while maintaining aggressive size parameters.

The positioning coincides with Bank of America's analysis showing the S&P 500 expensive on all 20 valuation metrics, yet strategists maintaining bullish outlooks due to structural advantages including energy independence, dollar reserve status, and technology sector leadership. SPLG's ultra-low cost structure makes it an optimal vehicle for institutions seeking core large-cap exposure without fee drag.

The concentration in SPLG alongside significant positioning in bond ETFs (VCSH with $751 million and 126.07 relative size) suggests institutional portfolio construction for both offensive and defensive scenarios. This barbell approach indicates sophisticated positioning for multiple market outcomes.

Precious Metals: Inflation Hedge with Geopolitical Premium

Royal Gold ( RGLD 0.00%↑ ) commands $221.4 million in rank-1 institutional positioning with a 59.94 relative size ratio, occurring as gold reaches new record highs near $3,450 per ounce amid Middle Eastern tensions and inflation concerns. The positioning extends to Agnico Eagle Mines ( AEM 0.00%↑ ) with $205.7 million and an 84.21 relative size ratio, suggesting broad institutional conviction in precious metals exposure.

The gold mining concentration appears strategically timed for both inflation protection and geopolitical uncertainty hedging. The relative size metrics suggest institutions are making their largest precious metals bets in years, potentially anticipating sustained commodity price elevation beyond current levels.

Technology Hardware: Supply Chain Resilience and AI Infrastructure

Technology sector positioning reveals focus on infrastructure components rather than consumer-facing applications. Seagate Technology ( STX 0.00%↑ ) receives $143.2 million in institutional positioning with a 55.24 relative size ratio, while Western Digital ( WDC 0.00%↑ ) garners $123.7 million with a 36.76 relative size ratio. This concentration in data storage infrastructure aligns with AI workload requirements and enterprise data protection needs.

The storage infrastructure theme intersects with cybersecurity positioning through companies like Rubrik, suggesting institutions are building comprehensive exposure to data protection and management ecosystems rather than single-point solutions.

Cryptocurrency Infrastructure: Institutional Adoption Acceleration

Bitcoin ETF positioning reaches significant levels with IBIT 0.00%↑ showing multiple entries exceeding 122% relative size ratios, while crypto-focused CRCL 0.00%↑ commands $257.5 million with a 54.79 relative size ratio. The positioning suggests institutional crypto adoption beyond experimental allocations.

The cryptocurrency positioning coincides with traditional payment disruption themes, as evidenced by pressure on Visa and Mastercard from stablecoin adoption initiatives by major retailers. Institutional positioning appears to anticipate structural shifts in payment processing infrastructure.

Financial Services: Operational Leverage and Specialty Focus

Brown & Brown ( BRO 0.00%↑ ) receives $290 million in institutional positioning with a 70.07 relative size ratio, suggesting conviction in insurance brokerage consolidation themes. The positioning in specialized financial services companies indicates institutional preference for operational leverage plays over traditional banking exposure.

The financial services positioning complements defensive large-cap exposure while maintaining growth characteristics through specialty market leadership positions.

Investment Implications: Thematic Convergence and Catalyst Timing

The institutional trading data reveals convergence around several key themes:

Nuclear-AI Infrastructure Nexus: The combination of nuclear energy positioning with AI infrastructure investments suggests institutions anticipate significant energy demand from artificial intelligence workloads, creating sustained demand for clean baseload power generation.

Cybersecurity-Data Management Integration: Positioning in both cybersecurity platforms and data storage infrastructure indicates institutional recognition of integrated data protection ecosystems as enterprise requirements rather than standalone solutions.

Defensive Positioning with Growth Overlays: The combination of large-cap concentration with growth theme exposure suggests institutional portfolio construction for multiple scenarios while maintaining aggressive position sizing in high-conviction areas.

Geopolitical Hedge Integration: Precious metals positioning alongside energy and defense exposure indicates comprehensive geopolitical risk hedging beyond traditional safe-haven allocation models.

Relative Size Analysis: Unprecedented Concentration Signals

The relative size metrics reveal institutional positioning intensity unprecedented in recent periods:

SPLG at 199.89: Largest relative large-cap positioning in dataset

VCSH at 126.07: Maximum institutional bond positioning relative to history

IBIT above 122: Crypto infrastructure at institutional adoption inflection

OKLO at 85.05: Nuclear infrastructure at maximum relative sizing

These metrics suggest institutions are making their largest sectoral bets in years, indicating high conviction in specific investment themes rather than broad market participation.

Conclusion: Smart Money Positioning for Structural Transitions

The institutional trading data exposes sophisticated positioning for multiple structural market transitions occurring simultaneously. The combination of nuclear energy renaissance, cybersecurity infrastructure acceleration, and geopolitical uncertainty hedging suggests institutions are positioning for significant economic and technological shifts.

The unprecedented relative sizing in specific themes indicates institutional conviction levels that typically precede major market developments. For individual investors, the data provides insight into where the most sophisticated market participants are concentrating their largest relative bets, potentially offering early signals for emerging investment opportunities.

The convergence of AI infrastructure needs, geopolitical uncertainty, and technological innovation creates a unique environment where multiple investment themes intersect, potentially amplifying returns for correctly positioned assets. The institutional positioning data suggests these convergences are not theoretical but actively being monetized by the market's most informed participants.

Unlock the Full Intelligence Briefing

You’ve just read the free preview—the institutional breadcrumbs. What you haven’t seen yet is where those trails lead:

✅ The full list of tickers institutions are concentrating in right now—with exact dollar amounts, timestamps, and sizing metrics

✅ The entry zones based on real trade data—not opinion. You’ll get the exact prices to mark up on your charts to make sure you stay on the right side of institutional positioning

✅ Access to the trades watchlist that updates all day, everyday, built entirely from high-conviction institutional flow

✅ And a members-only community of sharp, data-driven traders decoding the market in real time

If you're serious about getting ahead of Wall Street’s next big move—not chasing it—this is your edge.

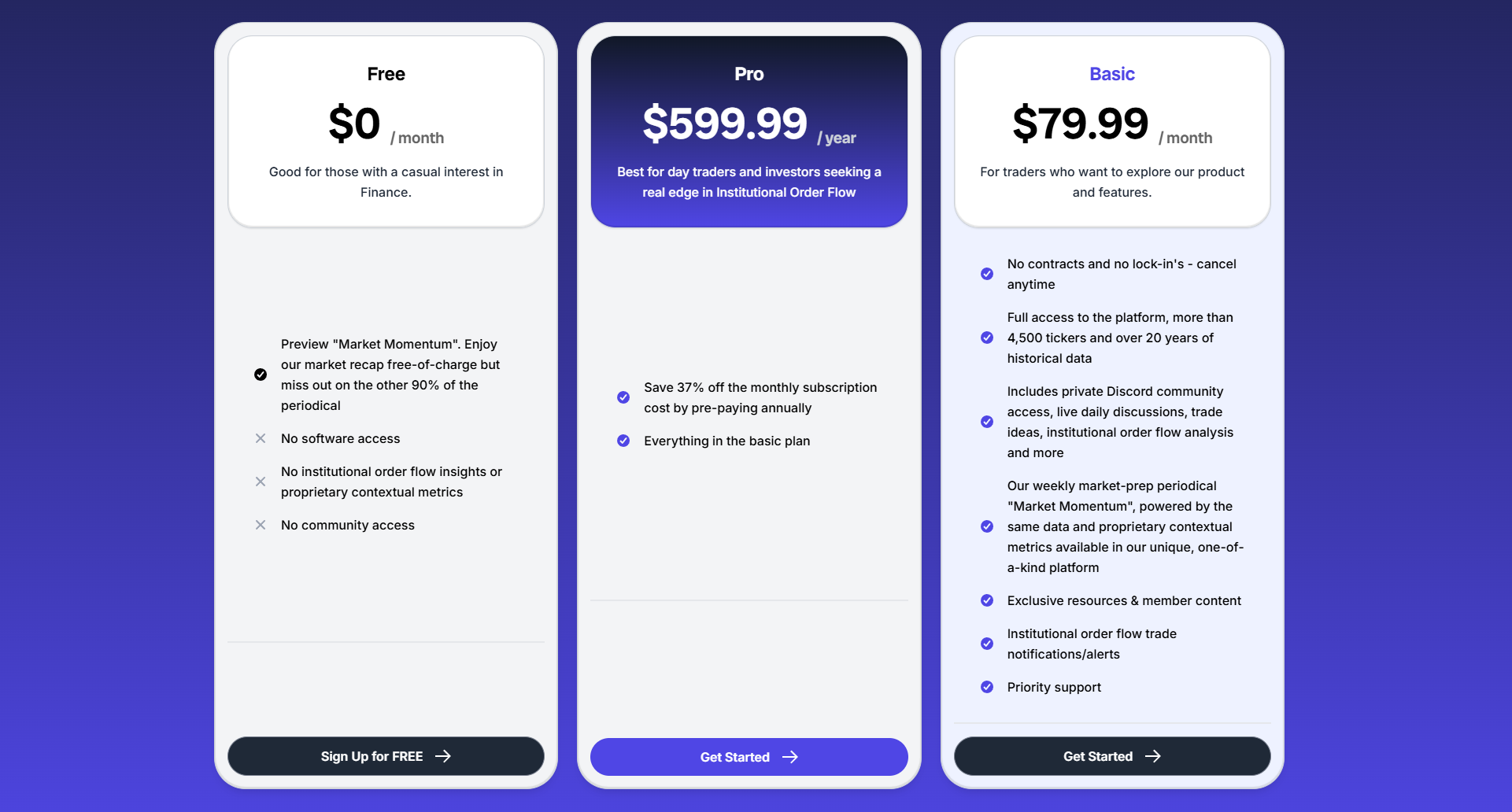

All of this, for less than the cost of your daily caffeine habit: $1.64/day.

👇👇👇 Join us inside. Your portfolio will thank you. 👇👇👇