Market Momentum: Your Weekly Financial Forecast

Issue 12 / What to expect Sept 9, 2024 thru Sept 13, 2024

Weekly Wrap-Up

Economic Data:

JOLTS (Job Openings): Job openings fell by 237,000 to 7.673 million in July 2024, the lowest since January 2021 and below forecasts. Declines were seen in health care, government, and transportation sectors, while openings rose in professional services and the federal government. Hires and separations remained steady, but job quits dropped to their lowest level since September 2020.

PMIs (Purchasing Managers' Index): The ISM Manufacturing PMI rose slightly to 47.2 in August 2024, but missed expectations, marking the 21st contraction in 22 months. New orders and production fell, and employment declined for the third straight month, reflecting ongoing challenges from high interest rates. Meanwhile, costs rose faster than expected, complicating the Fed's disinflation efforts.

Nonfarm Payrolls: The US economy added 142,000 jobs in August 2024, up from a revised 89,000 in July but below the 160,000 forecast. Gains were seen in construction, health care, and government, while manufacturing lost 24,000 jobs. Job growth was slower compared to the average 202,000 monthly gains over the past year, with previous months’ figures also revised lower.

Labor Market Softening:

The recent nonfarm payroll report confirmed a weakening U.S. labor market. Job gains were below expectations, and downward revisions were made for previous months. However, despite this softening, the labor market is not collapsing.

The unemployment rate ticked down from 4.3% to 4.2%, and job growth in sectors like leisure and hospitality was weaker than in the previous year.

Market Reactions:

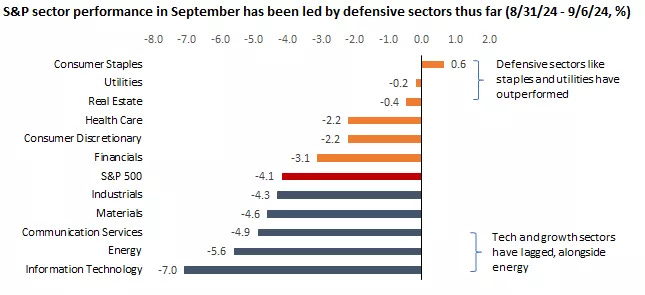

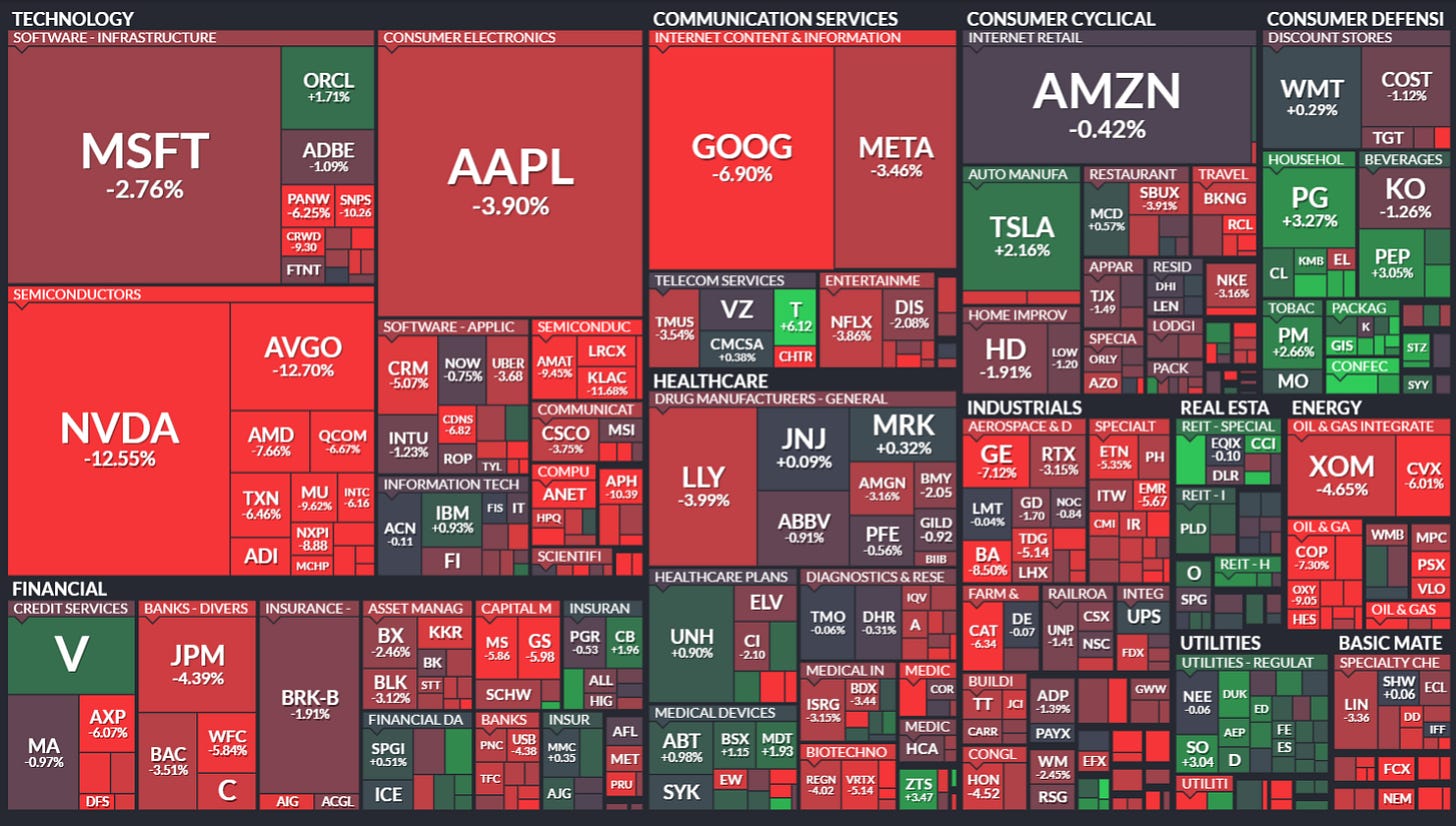

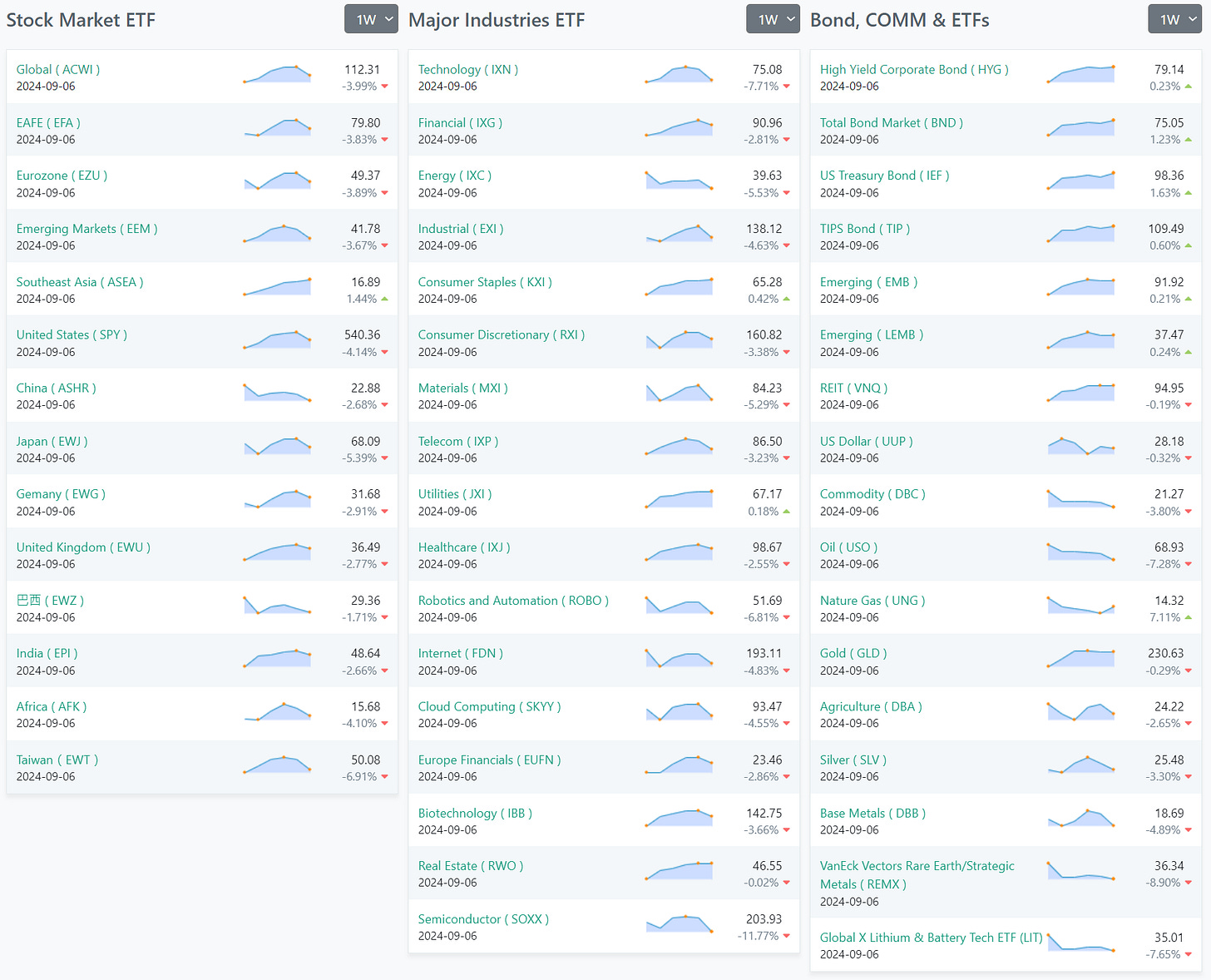

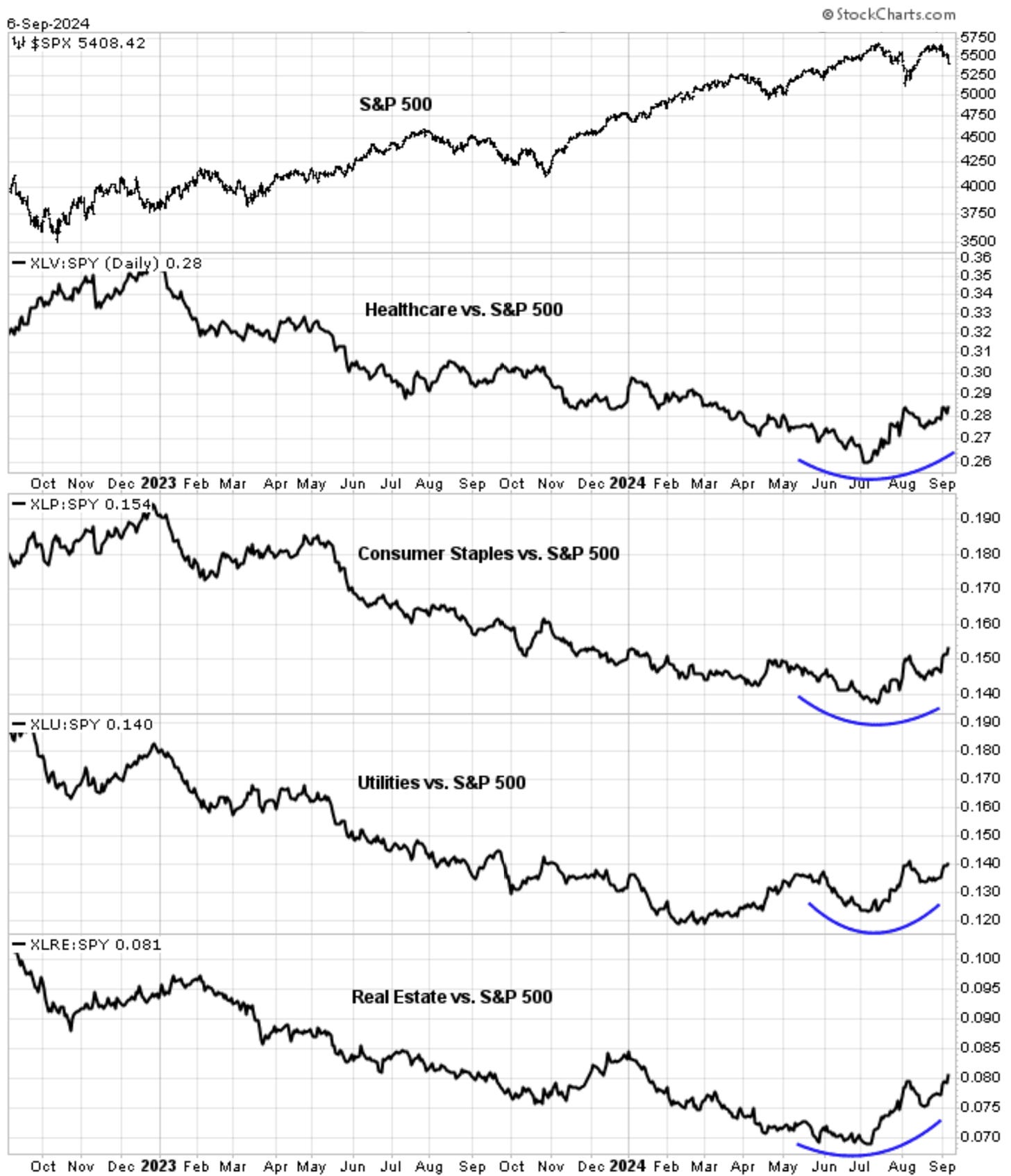

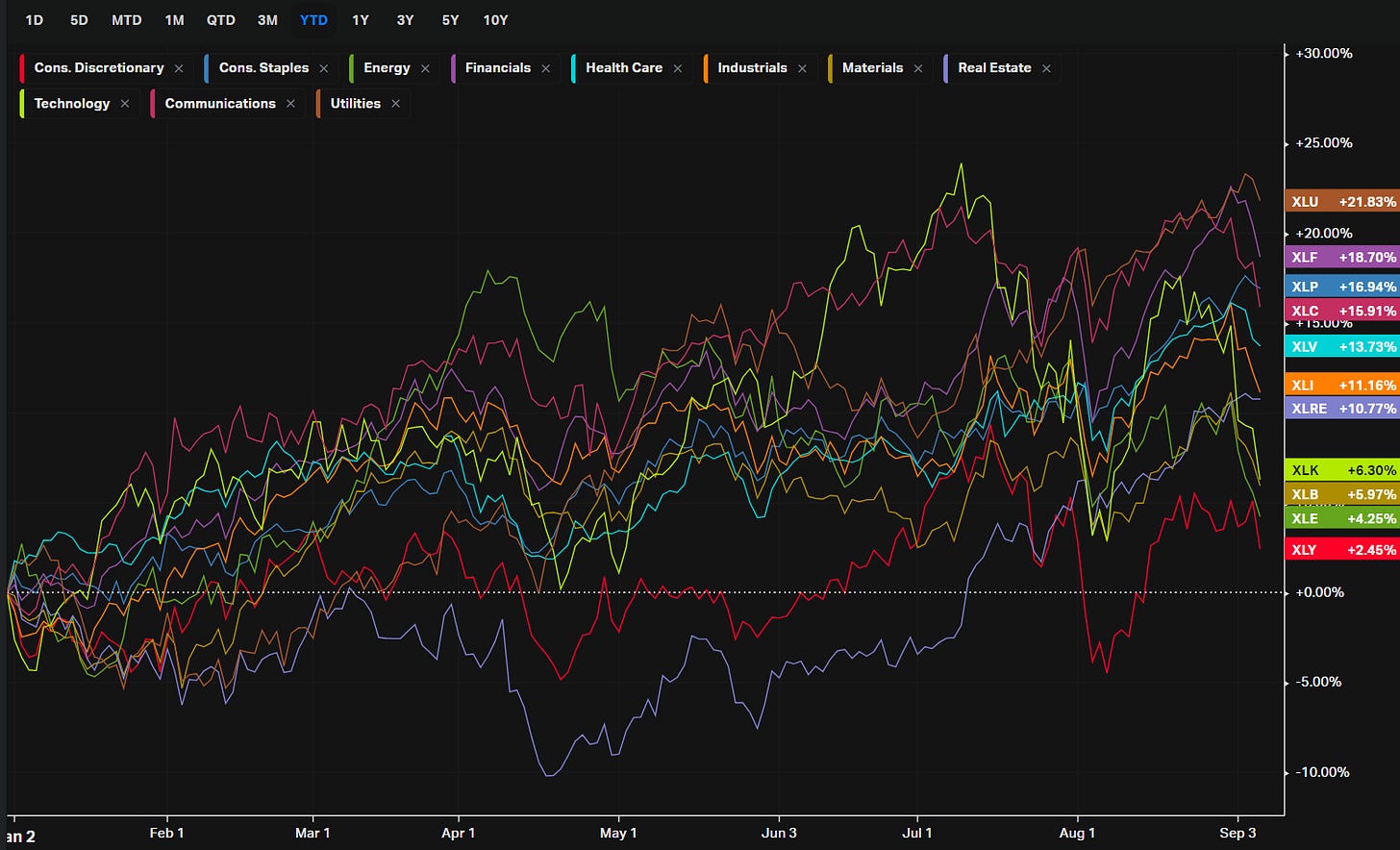

Markets have turned defensive in September, with sectors like consumer staples and utilities outperforming. The S&P 500 is down about 4% from recent highs, and the semiconductor sector saw significant declines.

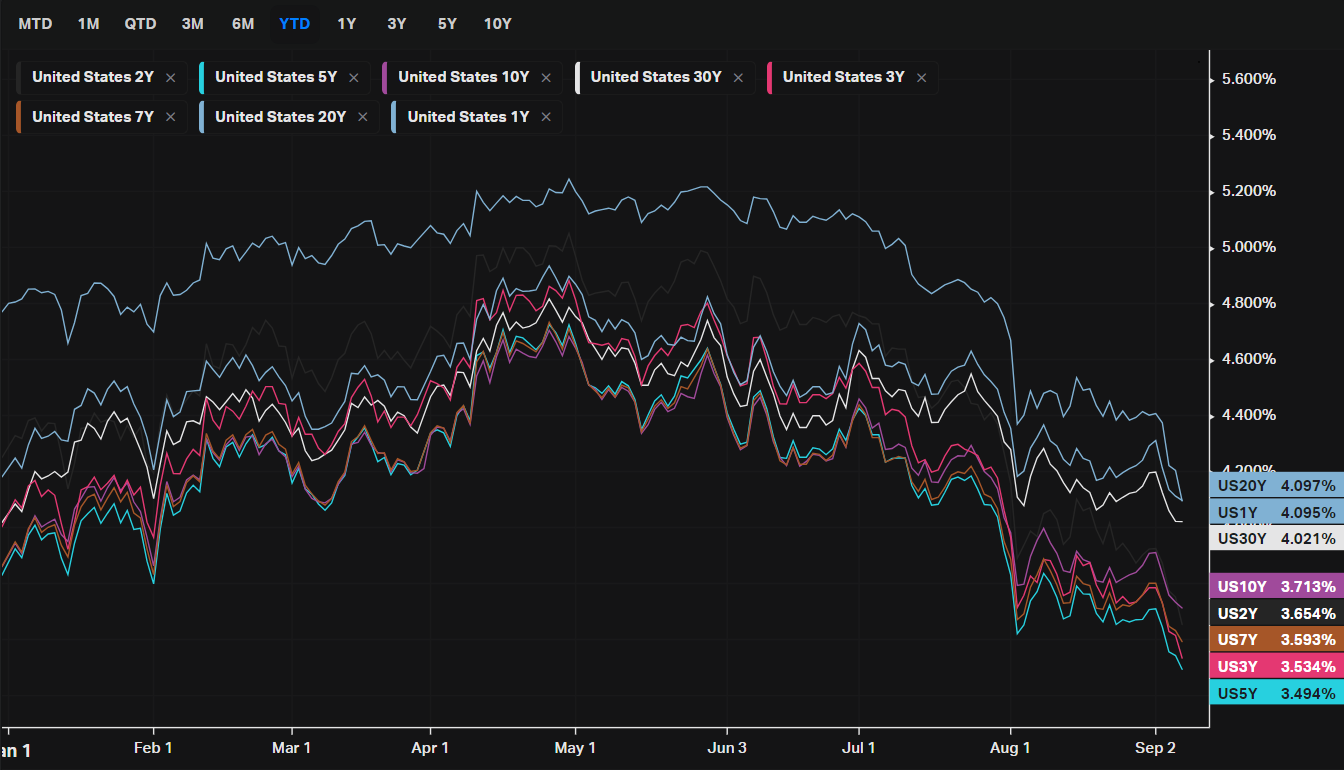

Treasury yields have fallen, reflecting expectations of Federal Reserve rate cuts, while crude oil prices dropped to a 14-month low due to demand concerns, especially from China.

Federal Reserve Outlook:

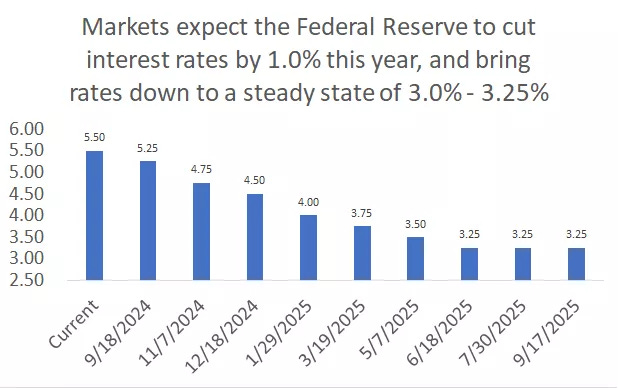

The Fed is expected to begin cutting rates at the September 18 FOMC meeting, with a potential 0.25% or 0.50% cut in response to the softening labor market and inflation moderating. These cuts could signal the Fed’s support for the labor market and economic growth.

Stock Market Volatility:

Stock indexes posted steep declines, with the NASDAQ down nearly 6% and the S&P 500 down over 4% for the week. Investors are cautious about rising economic uncertainty, particularly with U.S. elections approaching.

Recommendations for Investors:

Despite the market volatility and weaker economic data, long-term investors are encouraged to lean into market weakness, diversify portfolios, and consider adding quality investments at better prices as interest rates fall and economic growth could reaccelerate in the coming months. VolumeLeaders.com is the perfect platform in a stock-picker’s market, giving you valuable insights into which corners of the market institutions are invested in.

This Week’s Snapshots

Volatility

ETFs

Crypto

Forex

US Investor Sentiment

%Bull-Bear Spread

US Investor Sentiment, % Bull-Bear Spread is at 20.42%, compared to 24.19% last week and -1.44% last year. This is higher than the long-term average of 6.69%.

1-Year View

5-Year View

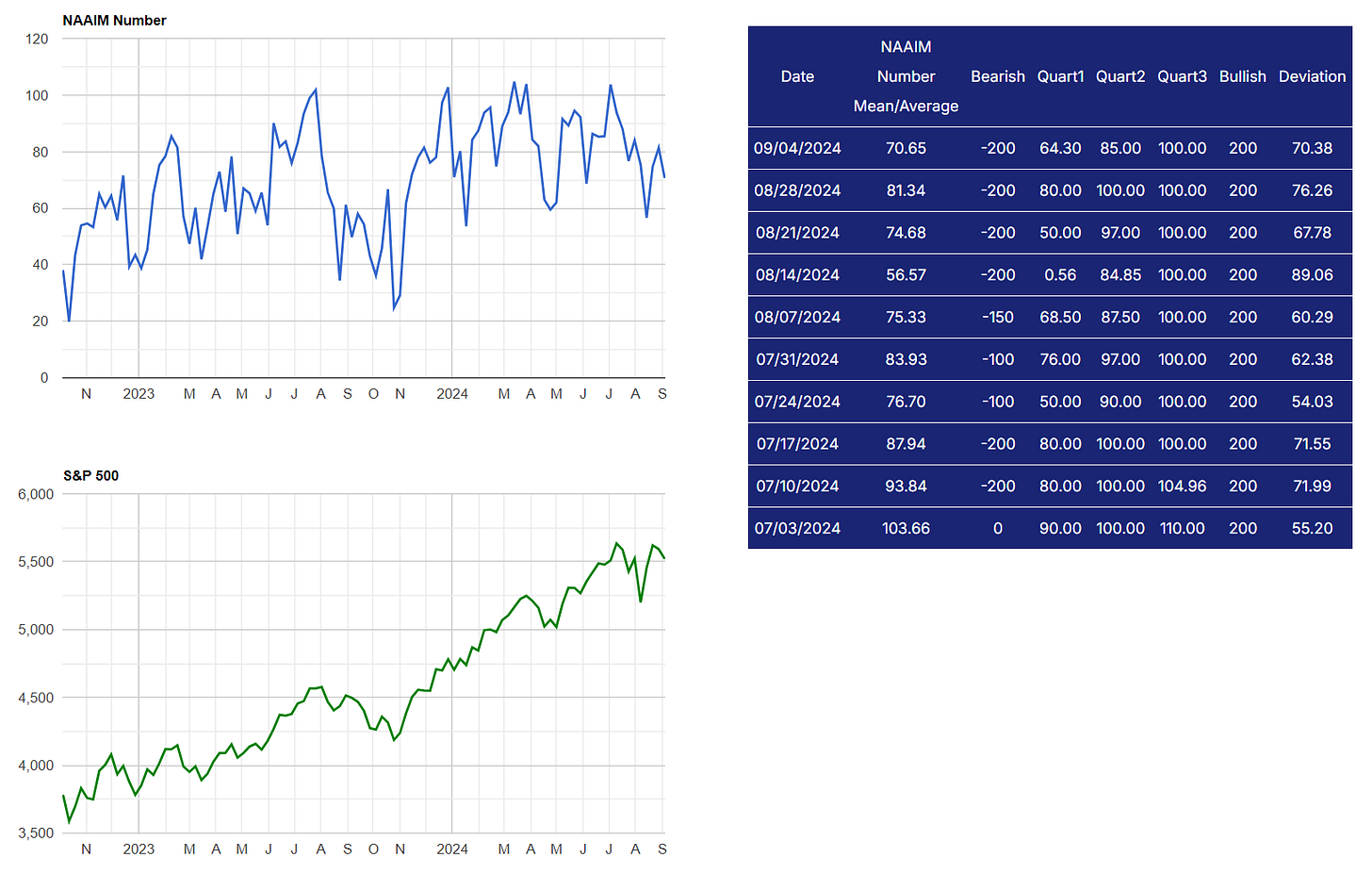

NAAIM Exposure Index

The NAAIM number decreased from the previous week's 81.34, indicating a more cautious outlook from active managers, with average exposure to equities declining.

AAII Investor Sentiment Survey

The AAII Investor Sentiment Survey is a weekly survey conducted by the American Association of Individual Investors (AAII) to gauge the mood of individual investors regarding the direction of the stock market over the next six months. It provides insights into whether investors are feeling bullish (expecting the market to rise), bearish (expecting the market to fall), or neutral (expecting the market to stay about the same).

Key Points:

Bullish Sentiment: Reflects the percentage of investors who believe the stock market will rise in the next six months.

Bearish Sentiment: Represents those who expect a decline.

Neutral Sentiment: Reflects investors who anticipate little to no market movement.

The survey is widely followed as a contrarian indicator, meaning that extreme levels of bullishness or bearishness can sometimes signal market turning points. For example, when a large number of investors are overly optimistic (high bullish sentiment), it could suggest a market top, while excessive pessimism (high bearish sentiment) may indicate a market bottom is near.

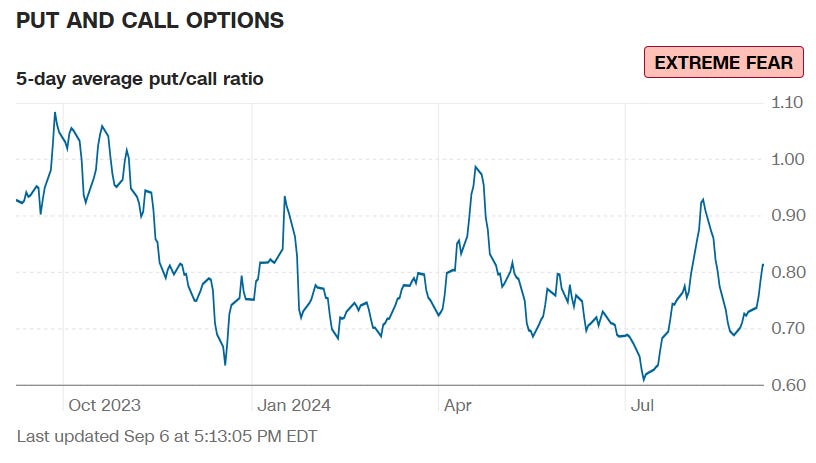

SPX Put/Call Ratio

1-Year View

5-Year View

CBOE Equity Put/Call Ratio

1-Year View

5-Year View

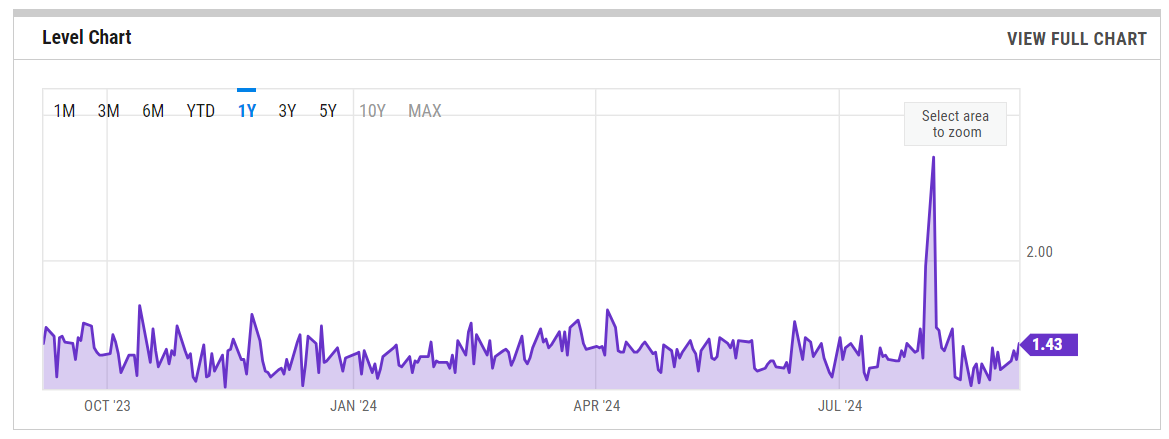

ISEE Sentiment Index

The ISEE (International Securities Exchange Sentiment) Index is a measure of investor sentiment derived from options trading. Unlike traditional put/call ratios, the ISEE Index focuses only on opening long customer transactions and is adjusted to remove market-maker and firm trades, providing a purer sentiment reading.

The ISEE Index typically ranges from 0 to 200, with readings above 100 indicating more call options being bought relative to put options, suggesting bullish sentiment. Conversely, readings below 100 suggest bearish sentiment, with more puts being purchased relative to calls.

New Highs - New Lows

The New Highs - New Lows indicator (NH-NL) displays the daily difference between the number of stocks reaching new 52-week highs and the number of stocks reaching new 52-week lows. The NH-NL indicator generally reaches its extreme lows slightly before a major market bottom. As the market then turns up from the major bottom, the indicator jumps up rapidly. During this period, many new stocks are making new highs because it's easy to make a new high when prices have been depressed for a long time. The NH-NL indicator oscillates around zero. If the indicator is positive, the bulls are in control. If it is negative, the bears are in control. As the cycle matures, a divergence often occurs as fewer and fewer stocks are making new highs (the indicator falls), yet the market indices continue to reach new highs. This is a classic bearish divergence that indicates that the current upward trend is weak and may reverse.

CME Fedwatch

What is the likelihood that the Fed will change the Federal target rate at upcoming FOMC meetings, according to interest rate traders? Use CME FedWatch to track the probabilities of changes to the Fed rate, as implied by 30-Day Fed Funds futures prices.

CNN 7 Fear & Greed Constituent Data Points + Composite Index

Final Composite Fear & Greed Index Reading

Institutional S/R Levels for Major Indices

When you’re a large institutional player, your primary goal is to find liquidity - places to do a ton of business with the least amount of slippage possible. VolumeLeaders.com automatically identifies and visually plots the exact spots where institutions are doing business and where they are likely to return for more. It’s one of the primary reasons “support” and “resistance” concepts work and truly one of the reasons “price has memory”.

Levels from the VolumeLeaders.com platform can help you formulate trades theses about:

Where to add or take profit

Where to de-risk or hedge

What strikes to target for options

Where to expect support or resistance

This is just a small sample; there are countless ways to leverage this information into trades that express your views on the market. The platform covers thousands of tickers on multiple timeframes to accommodate all types of traders. Observe for yourself how accurate the levels are by marking-up your charts with the information in the “Trade Levels” boxes I’m giving for free below and play-along in real-time this week. These charts cover the past 7 or so sessions but subs will get new levels as they develop in real-time and have access to levels from other time frames. I’m confident you’ll see how clear-cut, intuitive and actionable this information is for yourself.

Price Action

Trend Overview:

SPY’s downward trend started in late August 2024, where the price fell from around $560 to approximately $540.

There are noticeable peaks and pullbacks, but the overall direction remains bearish as the price continued to break support levels shown on the chart.

Support and Resistance:

Key support levels at $533.00 and a larger cluster of institutional positioning around $523.00, derived from the horizontal lines on the chart.

Resistance levels appear around $542 and $546.90, currently above price and also derived from the horizontal lines on the chart.

Large Trades:

Large blue circles highlight large trades, which signify areas where a high volume of trading occurred, often acting as pivotal points for reversals. These trades often signal strong institutional commitment to a position.

Price clusters in the chart around mid-August (around $540 to $560) show repeated failed attempts to break above resistance, eventually resulting in further liquidation.

Trade Clusters (Volume and RS):

There were significant trades on August 30th ($563.80), August 29th ($560.90), and August 24th ($553.10), each with a large Relative Size (RS). These highlight the importance of these prices as potential reversal or confirmation points.

On August 30th, for example, a trade of 10.6M shares at $563.80 with an RS of 22.82x shows an unusually large volume, suggesting a major shift or confirmation of the downtrend starting at that level.

Trade Levels and Volume Analysis:

Relative Size (RS):

RS measures the size of trades relative to average trade sizes. High RS values (e.g., 22.82x on 08/30 or 109.7x on 08/30) indicate institutional-level trades, potentially marking significant market shifts.

For example, the 1.49B transaction on August 30th at $563.63 suggests strong bearish activity, as the price continued its downtrend after this large transaction.

Volume and Price Correlation:

The volumes at lower levels like $533.10, $518.40, and $522.50 suggest strong institutional interest around those support levels. These levels could become pivotal in the future for potential rebounds or further declines, depending on the volume and price action at these points.

Significant Trade Levels:

The support level of $533.10 is important, with 21.6M shares traded at this level.

The $546.90 price level saw $10.3B traded, reflecting high institutional interest and a potential pivot point for future resistance.

Conclusion:

The chart and data indicate a bearish trend, with large institutional trades (as seen by high RS values) confirming the downtrend.

Key support levels to watch are $533.10 and $518.40, which may act as stopping points for further declines or potential reversal zones depending on future market sentiment.

The significant trades at $563.80 and $546.90 are likely resistance points if there is a retracement, making it harder for the price to break upward.

Price Action

Downtrend Continuation:

QQQ shows a downtrend from mid-August through early September 2024, with a current price of $446.77.

The chart displays significant price resistance at around $480-$485, where the price failed to sustain upward movement and instead fell to lower support levels.

Support and Resistance Levels:

Key Resistance Levels: Around $480.70, $481.30, and $475 as indicated by the chart. These levels had significant trade volumes and failed to hold, leading to the downtrend.

Key Support Levels: The lower support levels are marked at $438.90, $432.80, and $444.90, which could serve as the next zones where prices may consolidate or rebound.

The $460 region shows some interest and may serve as a minor resistance level should price rebound.

Large Trades:

The blue circles on the chart highlight large trades where a large volume of trading took place around August 10 to August 16. These represent potential pivot zones or areas of previous accumulation/distribution that acted as temporary support/resistance.

Trade Volumes and Relative Size (RS)

Notable Trades:

On September 4, 2024, a trade at $448.69 for $589M with an RS of 75.83x shows a significant amount of activity at this price level. It indicates that large investors may be positioning around this price, which could act as a near-term support level.

August 16, 2024, saw a massive trade at $472.50 with an RS of 186.80x, indicating a substantial institutional move at this price. This trade likely marked a pivotal resistance level as the price dropped sharply afterward.

August 13, 2024, had a trade at $462.58 with RS of 91.60x, which may have contributed to the price failing to sustain the upward movement and eventually leading to the continuation of the downtrend.

Trade Levels:

Key Support Zones:

$438.90: With $5.25B traded, it represents a strong support zone with 97.07% PCT of trades at this level. This is likely the next major support level QQQ may test.

$444.90 and $435.20 also have significant volume and could act as support levels, with 94.65% and 94.18% of trading activity, respectively.

Resistance Levels:

$480.70 and $481.30: Both levels have significant trading activity but have acted as resistance, with prices failing to break above. These levels may serve as future resistance if the price retraces upward.

Conclusion:

The downtrend continues for QQQ, with price failing to hold key levels around $480-$485. It may now be pulling into an area of support so eyes-up for some kind of response.

Key support levels to watch are $444.90, $438.90 and $432.80, where significant institutional activity is evident.

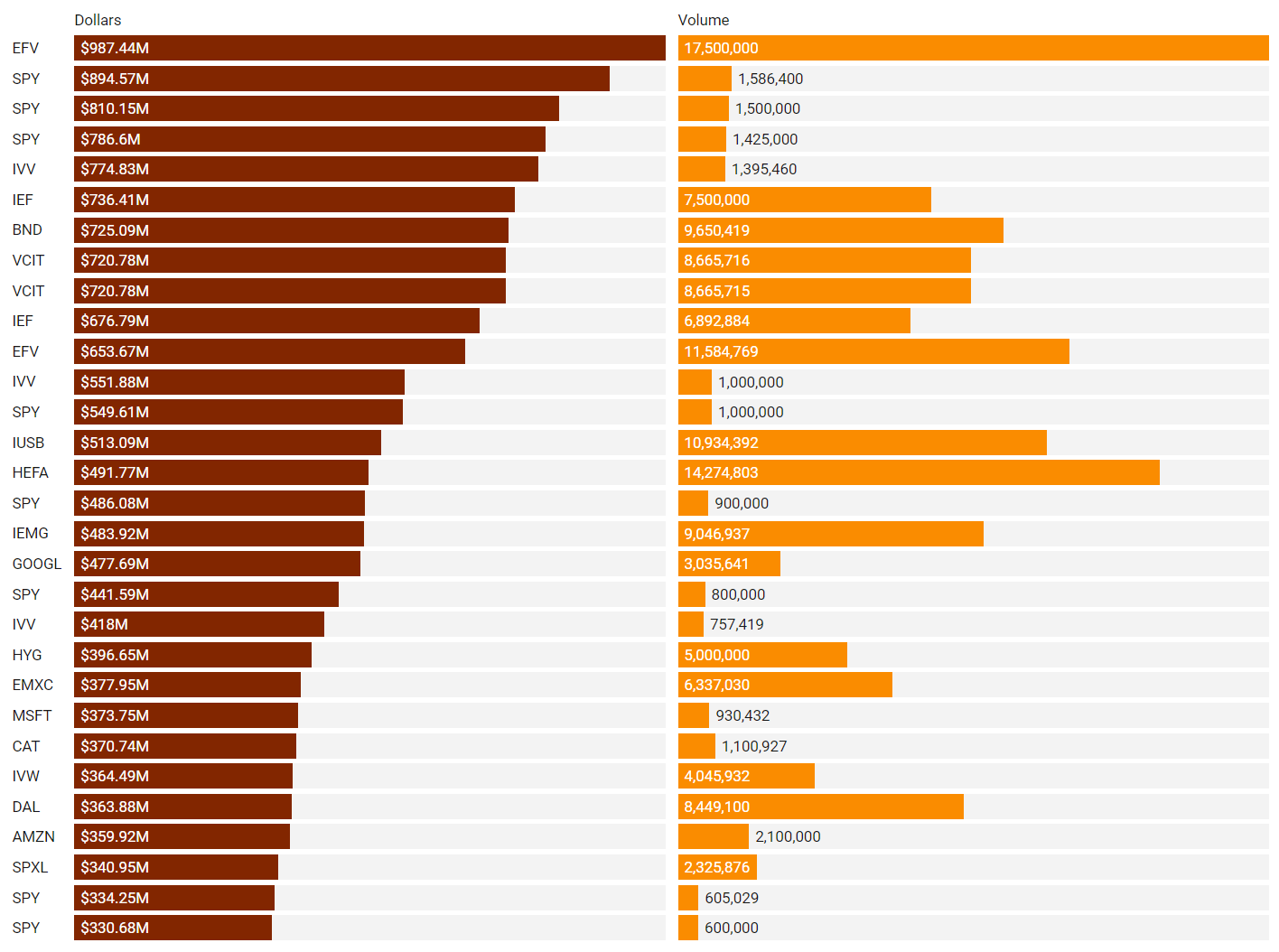

Top Institutional Order Flow

There are often great trades ideas or sources for inspiration in these prints. Only the top 30 of each group are shown but the full results are available in VL for you to browse at your leisure. Don’t forget to set up trade alerts inside the platform so you never miss institutional order flow that piques your interest or is otherwise important to you. Blue charts include all trade types including blocks on lit exchanges; red/orange charts are dark pool only trades; green charts are sweeps only.

Top Aggregate Dollars Transacted by Ticker

Largest Individual Trades by Dollars Transacted

Top Aggregate Dark Pool Activity by Ticker

Largest Individual Dark Pool Blocks by Dollars

Top Aggregate Sweeps by Ticker

Top Individual Sweeps by Dollars Transacted

Institutional S/R Levels for Individual Tickers

Please read “Institutional S/R Levels For Major Indices” at the top of this stack to understand the nature and importance of what we’re looking at here visually. Institutions leave footprints that VL can illustrate for you while providing context to assess things like institutional conviction and urgency.

The Vanguard Large-Cap ETF (ticker: VV) is a popular exchange-traded fund (ETF) that tracks the performance of the CRSP US Large Cap Index, which includes a broad selection of U.S. large-cap companies. It is designed to offer exposure to a diversified group of large U.S. firms across various sectors, making it a solid choice for investors looking for broad market exposure to large-cap equities.

Key Features:

Low Expense Ratio: One of its main advantages is its low-cost structure, with an expense ratio of just 0.04%, making it an attractive option for long-term investors who want to minimize fees.

Diversified Holdings: VV holds a wide range of large-cap stocks, typically covering about 85% of the U.S. equity market. Its holdings include blue-chip companies across industries like technology, healthcare, and financials.

Performance: The ETF has shown steady performance over the years, often reflecting the broader U.S. market's performance. Investors use it as a core holding in portfolios due to its stability and growth potential.

We’re now in an area of interest, with the descent of price slowing into this HVN around $248.00. However, that #5 trade came at the beginning of this week’s dump so someone knew to run for the exits. There also exists a significant amount of inventory hanging overhead. Should price lift from this area, we can expect significant resistance around the #5 trade and those with a short-bias will find a good spot to re-strike some positions from.

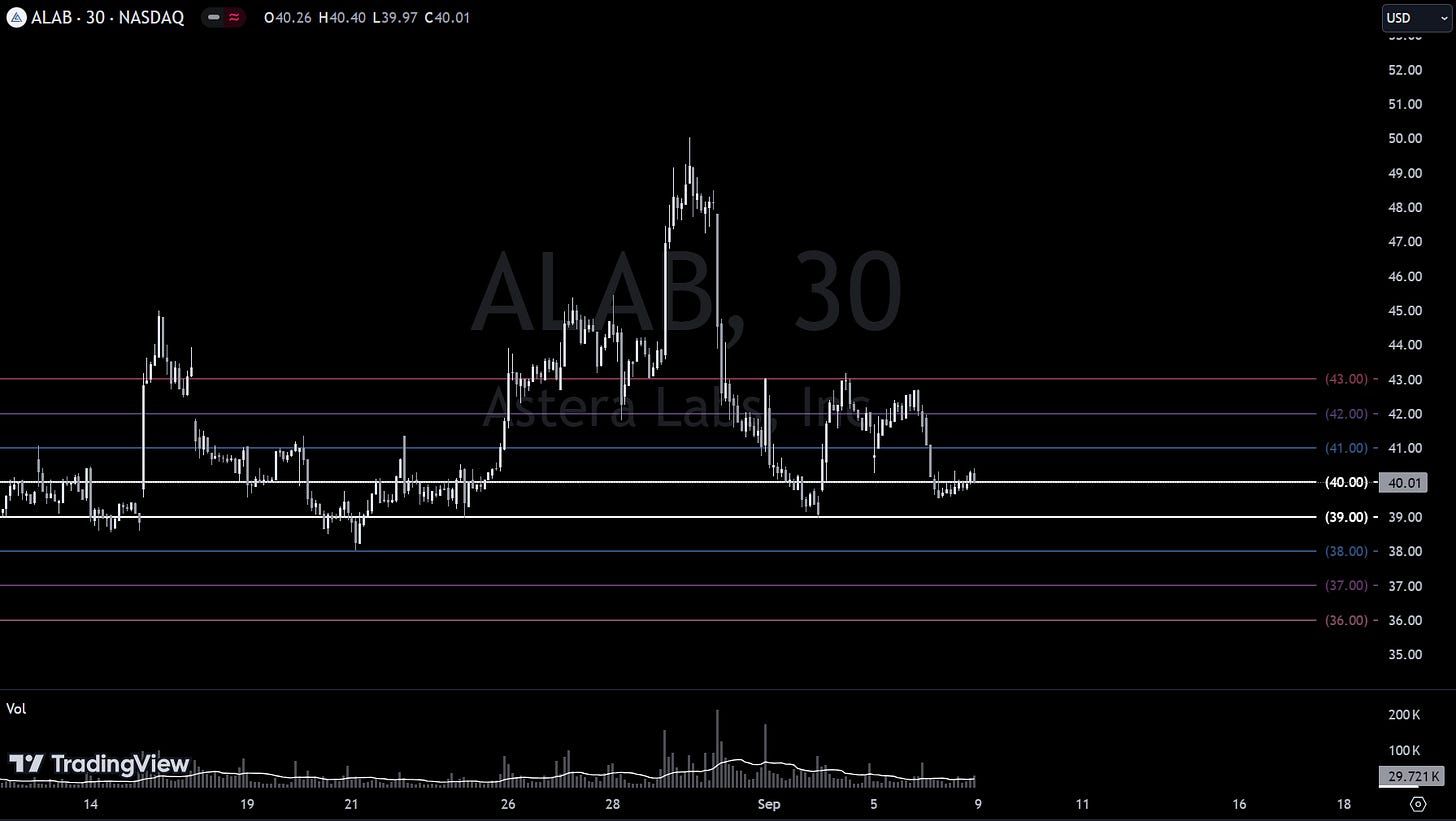

If there was ever an image that failed to inspire bullish confidence, this right now certainly fits the bill. We have a tremendous amount of institutional positioning above price and some very large trades to go with them. The one thing I can offer bulls here is that the 30-day profile is one of balance. If price starts looking buoyant around $400.00 I think we can revisit the highs. Successfully returning to the highs will confirm balance and traders can then use the edges of the balance box to define risk and monitor for the next big leg.

The Invesco S&P 500 Low Volatility ETF (SPLV) is an ETF designed to track the performance of the S&P 500 Low Volatility Index, which includes the 100 stocks from the S&P 500 with the lowest volatility over the past 12 months. This fund aims to provide investors with exposure to large-cap U.S. stocks, while focusing on minimizing risk by selecting stocks with historically stable price movements.

Key Features:

Risk Mitigation: SPLV is designed to reduce market volatility by focusing on low-volatility stocks, making it an appealing option for risk-averse investors or those looking for a more stable equity investment during turbulent market conditions.

Sector Allocation: The fund has high exposure to financials, consumer staples, and industrials, with lower allocations to more volatile sectors like information technology and communication services.

Expense Ratio: SPLV has a relatively low expense ratio of 0.25%, making it a cost-effective choice for those seeking long-term equity exposure with less volatility.

Rebalancing: The ETF is rebalanced quarterly to ensure that it continues to focus on the least volatile stocks, adjusting for any changes in the volatility of the underlying components.

Investment Use:

SPLV is suitable for investors who want equity exposure but are cautious about market swings, as it can provide smoother returns during periods of volatility. It’s particularly useful for those who seek to participate in the stock market while aiming to minimize drawdowns during market downturns.

We’re including this one because it has clearly been getting some attention from institutions. #64 came in at a critical area on the profile; price is basically sitting on a shelf that could lead to rapid liquidation underneath into lower support levels. Given recent weakness and an inflated VIX, it’s no surprise that this chart is quite top-heavy and even if the market sells-down further, sometimes institutions just need to be in something that will not hurt as much as the alternatives - a lesser of two evils, so to speak. Take a look at the thematics section below and note the lift in low vol names and large caps…money is looking for shelter to weather a storm.

To further complicate the bull thesis, we see these traditionally defensive sectors gaining ground against the S&P…like all things market-related, it doesn’t matter until it matters.

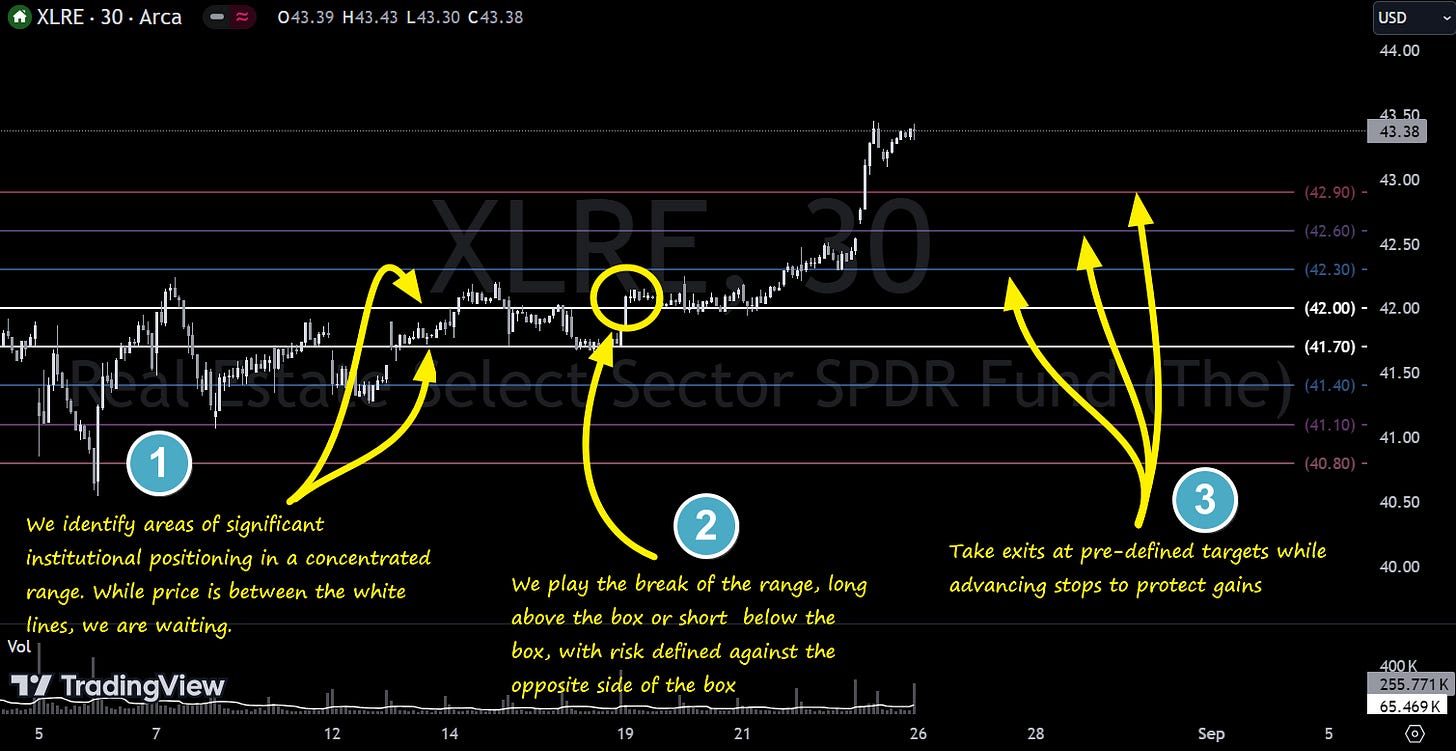

VL Precision Swings

This week we’re featuring additional screened trade ideas from one of our backtested proprietary signals for tactical swings called IBB - Institutional Breakout Boxes. The IBB Setup identifies an area of significant institutional positioning within a tight, concentrated price range, forming what we call a breakout box. This setup captures the potential energy built up as large players accumulate or distribute positions, creating a high-probability opportunity for explosive moves once the price breaks out of this zone. The precision of this setup allows traders to capitalize on the momentum generated by institutional forces, with clearly defined risk and reward parameters.

Note, these are shared for educational and entertainment purposes only and do not constitute financial advice.Here’s an example from XLRE:

Let’s see how last week’s setups played out. If you took any of these yourself, let us know in the comments!

ABNB: triggered short, +2.04%, no targets yet met

ASTS: triggered short, +10.84%, no targets yet met

⭐⭐BAX: triggered long, +2.58%, T1 + T2 met, holding runners for T3 with stop BE

⭐⭐CTVA: triggered short, + 2.39%, T1 + T2 met, holding runners for T3 with stop BE

⭐⭐DHR: triggered short, +1.57%, T1 + T2 met and just missed T3 by 20 cents or so, last partial stopped BE

⭐⭐EQT: triggered short, +2.45%, T1 + T2 met, holding runners for T3 with stops at BE

⭐ETSY: triggered short, +1.88%, first target met, holding runners for T2 + T3 with stops at BE

⭐⭐⭐IWM: triggered short, +3.5, all targets met

⭐NKE: triggered short, +2.36%, first target met, holding runners for T2 + T3 with stops at BE

⭐⭐⭐PEP: triggered long for +2%, all targets met

⭐⭐⭐SCHG: triggered short, +3.14%, all targets met.

⭐UPS: triggered short, .88%, first target met and stopped BE on the rest

⭐VIK: triggered short, +2.36%, first target met, holding runners for T2 + T3 with stops at BE

No losers and a lot of risk-free positions still on! If the market continues to exhibit weakness we should see some of these finish all targets early in the week. Here are some of the Precision Swings we’re watching this week:

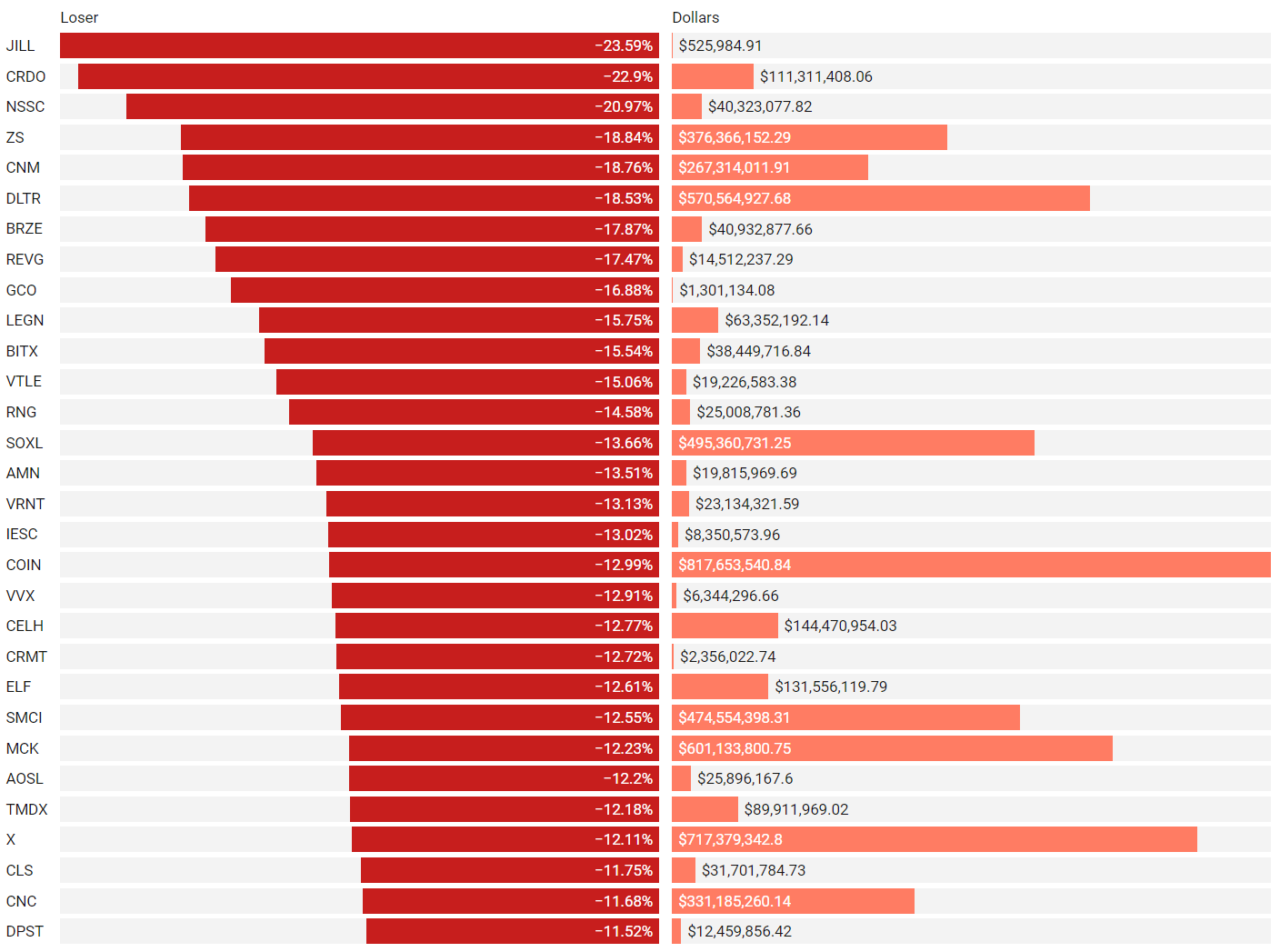

Institutionally-Backed Gainers & Losers

If you’re going to bet on a horse, consider one that is officially endorsed by an institution! These are the top percent gainers (green) and percent losers (red) from this week’s open-to-close that had a trade price greater than $20 and institutional involvement. Continue watching tickers from prior stacks as these frequently turn into multi-leg trades with a lot of movement!

Top Institutionally Backed Gainers

Top Institutionally Backed Losers

Billionaire Boys Club

Tickers that printed a trade worth at least $1B last week get a special shout-out… Welcome to the club. Subs should login to VL to get the exact trade price and relevant institutional levels around the trade - these are massive commitments by institutions that should not be ignored.

Summary Of Thematic Performance YTD

VL provides a lot of pre-built filters for thematics so that you can quickly dive into specific areas of the market. These performance overviews are provided here only for inspiration. Consider targeting leaders and/or laggards in the best and worst sectors, for example.

We’re now half-way through the year so we’re offering our semi-annual recap of what we’re seeing YTD in each theme. The next detailed wrap-up of thematics will come at the end of the year. If we missed something important, sound-off in the comments!

S&P By Sector

S&P By Industry

Energy

Metals

Agriculture

Country ETFs

Currencies

Yields

Factors: Size vs Value

Factors: Style

Social Media Favs

Most mentioned/discussed tickers on Reddit from some of the most active Subreddits for trading:

Events On Deck This Week

Here are key events happening this week that have the potential to cause outsized moves in the market or heightened short-term volatility.

Econ

Earnings

A Final Word

Thank you for reading this week's edition of Market Momentum. If you found value in this content, please consider sharing it with a friend or colleague, in a Discord or a Tweet. This small favor helps keep this stack free for you! Please check out VolumeLeaders.com for your own free trial of the platform that brings you the data powering this stack. Wishing you all a green week ahead filled with many bags ❤️💰.

Are Institutional Breakout Boxes lines in white?