Market Momentum: Your Weekly Financial Forecast & Market Prep

Issue 36 / What to expect March 10, 2025 thru March 14, 2025

In This Issue

Market-On-Close: All of last week’s market-moving news and macro context in under 5 minutes + futures-at-a-glance

The Latest Investor Sentiment Readings

Institutional Support & Resistance Levels For Major Indices: Exactly where to look for support and resistance this week in SPY, QQQ, IWM & DIA

Institutional Activity By Sector: Institutional order flow by sector including the top institutionally-backed names in those sectors. We break it all down and provide the key insights and take-aways you need to navigate institutional positioning this week.

Top Institutional Order Flow In Individual Names: All of the largest sweeps and blocks on lit exchanges and hidden dark pools

Moneyflow Charts for: SPY, QQQ, TSLA, NKE

Investments In Focus: Bull vs Bear arguments for CNX, RIO, PAYC

Top Institutionally-Backed Gainers & Losers: An explosive watchlist for day traders seeking high-volatility

Normalized Performance By Thematics YTD (Sector, Industry, Factor, Energy, Metals, Currencies, and more): which corners of the markets are beating benchmarks, which ones are overlooked and which ones are over-crowded

Key Econ Events and Earnings On-Deck For This Week

Market-On-Close

The first trading week of March 2025 presented a whirlwind of economic developments, policy shifts, and market movements that kept investors on edge. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all experienced significant declines over the week, with the S&P 500 falling 3.1%—its worst performance since September 2024. The tech-heavy Nasdaq fared even worse, dropping 3.5% as investors rotated away from riskier assets. The Dow Jones Industrial Average shed 2.4%, erasing much of its year-to-date gains. These losses were fueled by a confluence of trade policy uncertainty, evolving Federal Reserve expectations, and a mixed labor market report that painted a complex picture of the economy.

Early in the week, market sentiment soured following President Donald Trump’s announcement of sweeping tariffs on imports from Canada and Mexico, imposing a 25% duty on goods starting March 4. Additionally, the administration doubled tariffs on select Chinese imports, increasing them from 10% to 20%. The move was justified on grounds of national security and economic self-reliance, but it sent shockwaves through financial markets. Investors had hoped for a more measured approach, and the abrupt escalation in trade tensions raised concerns about global supply chains and corporate earnings. In response, both Canada and Mexico swiftly signaled plans for retaliatory tariffs, threatening further economic disruptions.

The uncertainty surrounding trade policy took a heavy toll on equities, particularly in sectors sensitive to global commerce. Technology stocks bore the brunt of the selloff, as fears of retaliatory measures from China and other trading partners cast a shadow over an industry deeply intertwined with international supply chains. The Nasdaq’s sharp decline reflected investor anxiety over the potential for increased costs and supply constraints. Even stalwarts like Apple and NVIDIA saw their stock prices slide, while semiconductor firms, heavily reliant on Chinese manufacturing, struggled to find footing.

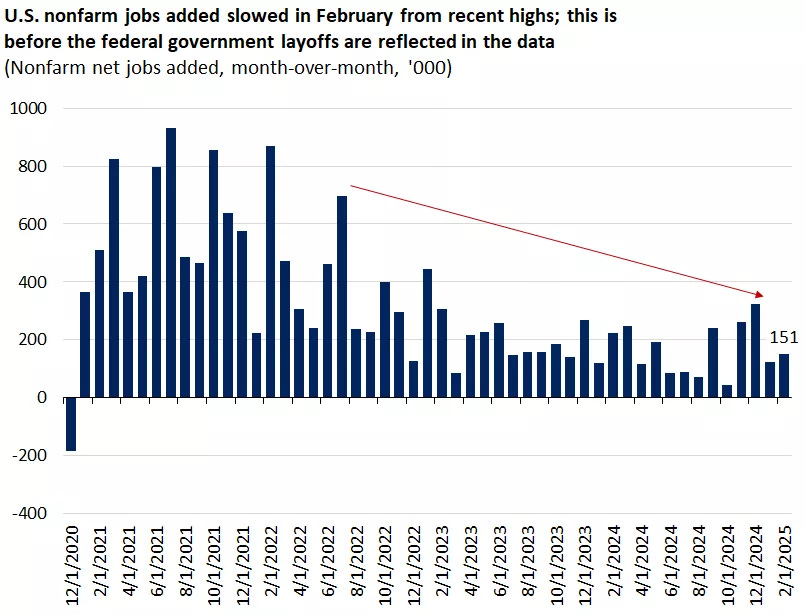

Meanwhile, economic data released throughout the week painted a mixed picture of the U.S. economy. The February nonfarm payrolls report showed that the U.S. added 151,000 jobs, slightly below expectations of 170,000. While employment gains in health care, financial activities, and transportation were encouraging, federal government payrolls shrank, a reflection of cost-cutting measures implemented earlier in the year. The unemployment rate ticked up to 4.1%, a modest increase that signaled some softening in labor market conditions. Wage growth, however, remained steady, rising 0.3% month over month, aligning with analyst projections. While the jobs report did not indicate a sudden economic downturn, it reinforced concerns that growth may be shifting into a lower gear.

The Federal Reserve’s stance on monetary policy remained a focal point for investors, with Fed Chair Jerome Powell offering measured comments that suggested the central bank would remain patient in adjusting interest rates. Powell reassured markets that while economic momentum had softened, the underlying fundamentals remained sound. His remarks provided a momentary boost to equities on Friday, with major indexes recovering from their intra-week lows.

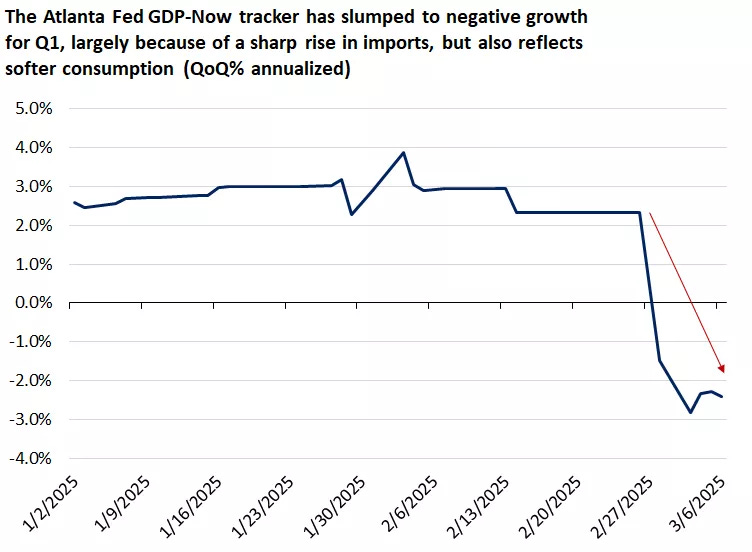

However, investors continued to grapple with uncertainty regarding the Fed’s next steps, particularly as inflation expectations remained elevated. While the bond market had initially priced in no rate cuts for 2025, shifting sentiment saw futures markets begin to factor in two to three quarter-point cuts later in the year, reflecting expectations of a more accommodative stance if economic growth continued to slow.

Beyond the U.S., international developments added to the unease. China’s latest trade data showed weaker-than-expected exports and a significant contraction in imports, signaling potential headwinds for global demand. European markets were similarly under pressure, with the Euro Stoxx 50 index declining nearly 1% amid concerns over slowing economic activity and persistent inflation. In Germany, factory orders posted their steepest decline in a year, fueling speculation that the European Central Bank may reconsider its timeline for potential interest rate cuts.

Despite the turmoil, there were pockets of strength in the markets. The energy sector provided a rare bright spot, bolstered by a 2% rise in crude oil prices. Supply constraints, coupled with geopolitical tensions in key oil-producing regions, lifted energy stocks even as broader equity markets struggled. Additionally, semiconductor giant Broadcom defied the market downturn, surging more than 8% after reporting better-than-expected quarterly earnings and issuing an optimistic outlook for AI-related demand. Broadcom’s performance highlighted the resilience of certain high-growth areas within the market, even amid broader volatility.

As the week drew to a close, investor sentiment remained cautious. Defensive sectors, including health care and consumer staples, saw increased inflows as market participants sought safety. Meanwhile, U.S. Treasury bonds experienced heightened demand, with the 10-year yield dipping to 4.31% before stabilizing. The flight to safety underscored lingering concerns about economic growth and policy uncertainty.

Looking ahead, all eyes will be on upcoming inflation data and further developments in trade negotiations. While markets have adjusted to a more defensive posture, historical patterns suggest that pullbacks of this magnitude often create buying opportunities for patient investors. While risks remain—particularly around trade policy and potential government shutdown threats—the underlying strength of the economy, coupled with the possibility of Fed intervention if conditions deteriorate, provides a measure of reassurance. Investors will need to remain nimble, balancing caution with the potential for strategic positioning as new information emerges.

In sum, the first week of March 2025 was defined by heightened volatility and a reevaluation of market risks. The interplay of trade policy, monetary expectations, and economic data ensured that investors remained on high alert. While uncertainty persists, disciplined market participants may find opportunities amid the turbulence, as periods of volatility have historically led to long-term gains for those who remain steadfast in their investment approach.

5-Day Futures Performance Leaders

S&P 500 Sector Insights

Sector Overview With Individual Names By Market Cap

Technology Sector Hit Hard:

NVIDIA ( NVDA 0.00%↑ ) down 9.79%

Major tech names like AAPL 0.00%↑ (-1.15%), MSFT 0.00%↑ (-0.93%), AMZN 0.00%↑ (-6.14%), and META 0.00%↑ (-6.37%) all declining

Oracle ( ORCL 0.00%↑ ) down 6.56%

Financial Sector Under Pressure:

JPMorgan (JPM) down 8.45%

Visa (V) down 4.79%

Berkshire Hathaway (BRK-B) down 3.54%

Bank of America (BAC) down 10.20%

Consumer Cyclical Weakness:

Tesla ( TSLA 0.00%↑ ) among the worst performers at -10.35%

Home Depot ( HD 0.00%↑ ) down 4.99%

Walmart ( WMT 0.00%↑ ) down 6.99%

Costco ( COST 0.00%↑ ) down 8.04%

Relative Strength in Healthcare:

Several green boxes in healthcare including JNJ 0.00%↑ (+1.01%), ABBV 0.00%↑ (+2.52%), and MRK 0.00%↑ (+2.60%)

Selective Strength in Consumer Staples:

Procter & Gamble ( PG 0.00%↑ ) up 1.21%

Pepsi ( PEP 0.00%↑ ) up 0.63%

Coca-Cola ( KO 0.00%↑ ) up 0.31%

Energy and Industrials Mixed:

XOM 0.00%↑ down 0.26%

Some green in industrials like GE 0.00%↑ (+1.06%) and CAT 0.00%↑ (+1.85%)

Biggest Decliners:

TSLA 0.00%↑ : -10.35%

BAC 0.00%↑ : -10.20%

NVDA 0.00%↑ : -9.79%

AXP 0.00%↑ : -9.22%

JPM 0.00%↑ : -8.45%

COST 0.00%↑ : -8.04%

Notable Gainers:

Verizon ( VZ 0.00%↑ ): +16.87% (standout performer)

McDonald's ( MCD 0.00%↑ ): +4.20%

Gilead ( GILD 0.00%↑ ): +2.71%

Google ( GOOG 0.00%↑ ): +2.05%

Netflix ( NFLX 0.00%↑ ): +1.12%

The heatmap largely shows a defensive rotation with investors moving from growth/tech into:

Defensive consumer staples ( PG 0.00%↑ , KO 0.00%↑ , PEP 0.00%↑ )

Select healthcare names ( MRK 0.00%↑ , ABBV 0.00%↑ , JNJ 0.00%↑ )

Utilities

Telecom ( VZ 0.00%↑ as the standout winner)

This pattern suggests investors are seeking safety in dividend-paying stocks and traditionally defensive sectors amid broader market uncertainty.

5-Day Sector Leaderboard

5-Day Individual Performance Grouped By Sector (Size By Market Cap)

ETF Insights

Reviewing a heatmap like this weekly can be incredibly helpful for investors as it provides a quick and visual summary of market performance across various sectors, asset classes, and geographies.

1. Sector and Asset Class Trends

Identify Strong and Weak Sectors: Investors can quickly spot which sectors (e.g., technology, energy, healthcare) are performing well or underperforming.

Asset Class Diversification: Seeing how commodities, fixed income, equities, and cryptocurrencies performed helps assess diversification.

2. Market Sentiment

Risk-On or Risk-Off: A green-dominated map suggests bullish sentiment, while red indicates bearish sentiment. Investors can align their strategies accordingly.

Volatility Indicators: Observing movements in volatility indices (e.g., VIX) can highlight changing market dynamics.

3. Regional Analysis

Global Insights: Performance in developed and emerging markets (e.g., Europe, China, Asia-Pacific) helps in gauging international investment opportunities or risks.

Currency Impacts: Movements in forex or country-specific ETFs can indicate currency-driven market trends.

4. Thematic Trends

Growth vs. Value: Comparing the performance of growth ETFs (e.g., VUG) versus value ETFs (e.g., VTV) reveals the prevailing market preference.

Industry Leadership: Highlighting leadership within industries (e.g., gold miners, semiconductors) can inform thematic plays.

5. Monitoring Investments

Portfolio Alignment: Investors can track how their existing investments or watchlist align with broader market trends.

Rotation Signals: Seeing week-over-week changes in sector dominance may signal sector rotation opportunities.

6. Risk Management

Recognizing Overbought/Oversold Conditions: Consistent underperformance or overperformance in specific areas may indicate potential mean-reversion trades.

Correlation Awareness: By observing how different asset classes move, investors can manage portfolio correlation and risk.

7. Decision Support

Identify Outperformers/Underperformers: ETFs, sectors, or indices that repeatedly outperform or underperform can help refine trading or investment strategies.

Macro Perspective: Weekly trends highlight macroeconomic or geopolitical influences affecting markets.

Regularly reviewing a heatmap like this is a strategic practice that supports data-driven decision-making while fostering a holistic understanding of market dynamics.

Broad Market & Sector Trends

Overall Market Weakness:

Major indices are down: SPY (-3.07%), QQQ (-3.22%), DIA (-2.81%)

Inverse ETFs Shining:

Significant outperformance of inverse ETFs: SDS (+6.46%), SQQQ (+17.71%), TZA (+12.84%)

Agile traders are profiting from the market declines and volatility

Sector Performance Breakdown:

Technology: XLK (-3.10%), SOXX (-2.24%) - continuing the tech weakness

Financials: XLF (-5.86%), KRE (-7.06%) - financial sector hit especially hard

Healthcare: XLV (+0.23%) - slight positive, confirming healthcare's relative strength

Energy: XLE (-3.92%), XOP (-4.55%) - energy sector underperforming

Consumer: XLY (-4.76%) for cyclicals, XLP (-0.27%) for staples - defensive staples holding up better

Real Estate: IYR (-1.46%) - moderate decline

Volatility Spike:

VIX-related products up significantly (VXX +16.80%, UVXY showing strong gains) indicating significant market fear and uncertainty

International Markets & Fixed Income

International Markets Mixed:

Emerging markets showing some resilience: EEM (-2.80%), VWO (-2.75%)

European markets: EZU (+2.15%), FEZ (+3.00%) - European markets outperforming US

Asian markets showing strength: EWJ (+1.85%), EWZ (+2.94%)

Fixed Income Under Pressure:

Most bond ETFs in red: TLT (-2.51%), BND (-0.90%)

Limited safe haven effect in traditional bond markets

Alternative Investments

Precious Metals Strong:

Gold and gold miners outperforming: GLD (+1.95%), GDX (+4.83%)

Silver even stronger: SLV (+4.52%)

Shows classic flight to precious metals during market uncertainty

Crypto Assets Mixed:

Bitcoin-related ETFs showing some strength: IBIT (+3.19%), FBTC (+3.35%)

Crypto performing better than equities in this pullback

Key Takeaways

Defensive Positioning:

Clear rotation from risk assets to defensive positions

Precious metals, inverse ETFs, and volatility products leading

Global Divergence:

US markets underperforming international markets, especially Europe and some Asian markets

Sector Rotation:

Movement from growth/tech/financial sectors toward defensive sectors

Healthcare holding up relatively well compared to other sectors

Leverage Magnifying Losses:

Leveraged ETFs showing outsized moves (both up and down)

TQQQ (-10.02%), UPRO (-9.42%) vs. inverse leveraged ETFs up significantly

This ETF heatmap confirms the defensive rotation we saw in individual stocks, with investors seeking safety in gold, volatility hedges, and inverse positions while reducing exposure to US equities, particularly in financials and technology.

Global Overview

Foreign ADR stocks listed on NYSE, NASDAQ & AMEX categorized by geographic location. Reviewing a global heatmap like this weekly is valuable for investors because it offers insights into international markets, helping to:

Identify Global Trends: Spot which regions or countries are performing well or underperforming.

Assess Sector and Regional Performance: Understand how industries are faring across different regions.

Diversify Portfolios: Uncover opportunities in emerging or developed markets for greater diversification.

Gauge Global Sentiment: Recognize the impact of macroeconomic events on specific regions.

Align with Global Strategies: Refine investment strategies based on regional strengths or weaknesses.

This overview ensures investors stay informed about global opportunities and risks, complementing their domestic market analysis.

Based on this global ADR heatmap, here are the key insights about international stock performance by region:

Regional Trends

Canada Under Pressure:

Significant weakness with Royal Bank (RY -2.62%), TD (-0.60%)

Bank of Nova Scotia (BN) particularly hard hit at -10.10%

Shopify (SHOP) down sharply at -10.60%

Energy names like Canadian Natural (CNQ) holding up better (+0.35%)

Europe Showing Strength:

Netherlands: ASML (+3.26%) - semiconductor equipment maker outperforming

Switzerland: Novartis (NVS +5.98%) - healthcare strength continues globally

United Kingdom: AstraZeneca (AZN +1.69%), Unilever (UL +4.65%) - defensive names performing well

Germany: SAP (+0.66%) showing modest gains

China Mixed but with Bright Spots:

Alibaba (BABA +6.12%) - significant outperformance

PDD Holdings (PDD +5.48%) - Chinese e-commerce showing strength

JD.com (JD) and others showing mixed performance

Japan Mixed:

Toyota (TM +4.79%) and MUFG (+2.28%) performing well

Sony (SONY -3.55%) underperforming

Taiwan Semiconductor (TSM -1.90%) - slight weakness in line with global chip sector

Brazil/Latin America Strong:

VALE (+4.98%) - mining giant outperforming

ABEV (+7.75%) - Brazilian beverage company showing strength

Sector Insights Across Regions

Global Banking Mixed:

Canadian banks weak (BN, RY)

European banks varied (HSBC -3.12%, UBS -0.41%)

Japanese banks stronger (MUFG +2.28%)

Healthcare/Pharma Strong Globally:

NVS (+5.98%), AZN (+1.69%), GSK (+6.54%)

Confirms the defensive healthcare trend seen in US markets

Technology Divergence:

European tech stronger (ASML +3.26%)

Asian tech mixed (BABA +6.12%, TSM -1.90%, SONY -3.55%)

Natural Resources Outperforming:

Mining and commodities companies showing strength globally

VALE (+4.98%), BHP (+3.46%), RIO (+2.89%)

Aligns with strength in gold and materials seen in US markets

Key Takeaways

Geographic Rotation:

Emerging markets (particularly China, Brazil) showing more strength than North America

European defensive names outperforming

Canadian Weakness:

Canadian market notably weaker, especially in financials and tech (SHOP)

Global Sector Consistency:

The healthcare and consumer staples strength seen in US markets is consistent globally

Mining and materials showing strength worldwide

Banking sector under pressure in multiple regions

Chinese Internet Rebound:

Chinese tech/internet names like BABA and PDD showing significant strength, bucking the global tech selloff

European Resilience:

European markets generally outperforming, with pharmaceutical and consumer staples names leading

This global heatmap confirms that the market uncertainty is worldwide but with notable geographic differences - with North American markets (US and Canada) experiencing more pressure while parts of Europe, China, and Brazil are showing relative strength. The sector rotation into defensives, healthcare, and precious metals/mining appears to be a global phenomenon.