Market Momentum: Your Weekly Financial Forecast & Market Prep

Issue 27 / What to expect Jan 06, 2025 thru Jan 10, 2025

In This Issue

Market-On-Close: All of last week’s market-moving news and macro context in under 5 minutes + futures-snapshots

Special Coverage: Anticipating Market Volatility in 2025

The Latest Investor Sentiment Readings

Institutional Support & Resistance Levels For Major Indices: Exactly where to look for support and resistance this week in SPY, QQQ, IWM & DIA

Institutional Activity By Sector: Institutional order flow by sector including the top institutionally-backed names in those sectors. We break it all down and provide the key insights and take-aways you need to navigate institutional positioning this week.

Top Institutional Orderflow In Individual Names: All of the largest sweeps and trade blocks on lit exchanges and dark pools

Investments In Focus: Bull vs Bear arguments for JPM, SFM, JNPR, ABNB, ZBRA, TRP, SCHP

Top Institutionally-Backed Gainers & Losers: An explosive watchlist for day traders seeking high-volatility

Normalized Performance By Thematics YTD (Sector, Industry, Factor, Energy, Metals, Currencies, and more): which corners of the markets are beating benchmarks, which ones are overlooked and which ones are over-crowded

Key Econ Events and Earnings On-Deck For This Week

Market-On-Close

Market Overview

The first trading week of 2025 presented a mixed picture for U.S. financial markets, as investors grappled with the transition from an exceptionally strong 2024 into the uncertainties of a new year. The major stock indices experienced modest declines through most of the week before staging a recovery on Friday, with the S&P 500, Nasdaq, and Dow each posting weekly losses of approximately 0.5%. Friday's session saw the S&P 500 rise 1.26%, the Dow Jones Industrial Average gain 0.80%, and the Nasdaq 100 advance 1.67%, helping to offset earlier weakness.

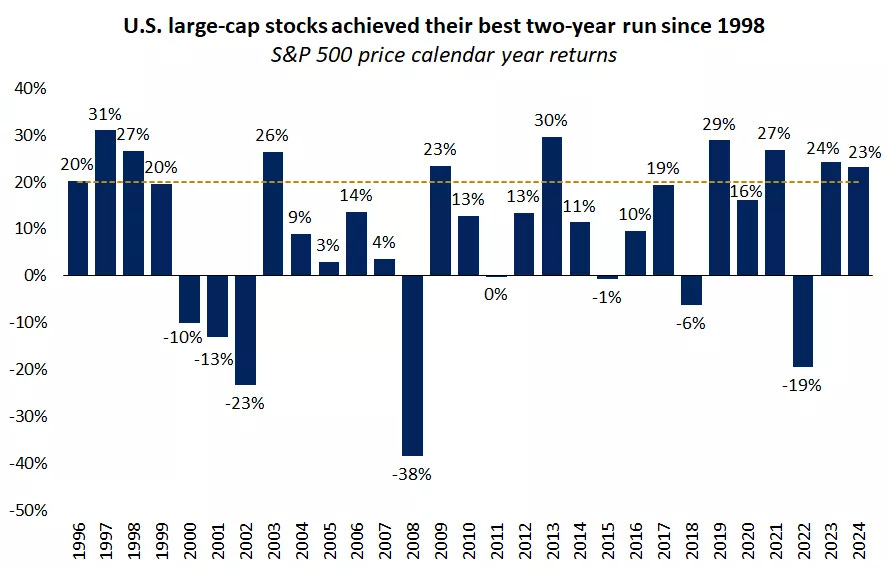

The week's trading pattern reflected both the remarkable achievements of the previous year and emerging concerns about the sustainability of the market's momentum. The S&P 500's stellar performance in 2024, which included setting 57 record highs and achieving back-to-back years of 20%-plus returns for the first time since 1998, has set a high bar for 2025. However, this impressive performance was notably concentrated, with just seven technology-oriented stocks accounting for more than 53% of the index's overall return.

Key Market Drivers

Technology Sector Leadership

The week's final trading session highlighted the continuing influence of technology stocks on market direction. Megacap tech companies provided significant support to the broader market, with TSLA 0.00%↑ leading the charge by surging more than 8%. Other tech giants, including AMZN 0.00%↑ , GOOG 0.00%↑ , MSFT 0.00%↑ , and META 0.00%↑ , each gained more than 1% on Friday. The semiconductor sector showed particular strength, with ARM 0.00%↑ Holdings rising over 10% and NVDA 0.00%↑ advancing more than 4%. Other chip manufacturers, including AMD 0.00%↑ , MRVL 0.00%↑ Technology, and AMAT 0.00%↑ , posted gains exceeding 3%.

Political Developments

Market sentiment received a boost from political developments in Washington, as Louisiana Republican Mike Johnson won reelection as Speaker of the House of Representatives. This outcome was viewed positively by investors, who anticipate that Johnson's leadership could facilitate the passage of business-friendly deregulatory measures under the Trump administration. However, analysts note that policy uncertainty remains high, particularly regarding potential changes to tariffs, taxes, and regulatory frameworks.

Economic Indicators

The week brought mixed economic signals, with manufacturing data showing unexpected strength while concerns about global growth persisted. The U.S. December ISM manufacturing index surprised to the upside, rising 0.9 points to a 9-month high of 49.3, surpassing expectations of 48.2. While still in contractionary territory (below 50), the improvement suggests some resilience in the manufacturing sector.

However, the Chicago Purchasing Managers' Index painted a more concerning picture, plummeting to 36.9 in December from 40.2 in November, marking the 13th consecutive month of contracting activity. This represented the steepest month-over-month decline since May and fell well short of the expected 42.9 reading.

Labor Market Strength

The employment picture remained robust, with initial jobless claims falling to 211,000 for the week ended December 28, the lowest level in eight months. This decline from the previous week's 220,000 claims, coupled with continuing claims dropping to a three-month low of 1.84 million, suggests ongoing strength in the labor market despite broader economic uncertainties.

Interest Rates and Bond Markets

Treasury Market Dynamics

The bond market experienced notable volatility, with the 10-year Treasury yield rising 3.5 basis points to 4.594% by week's end. The movement in yields reflected various factors, including the stronger-than-expected ISM manufacturing data and comments from Richmond Fed President Barkin indicating ongoing concerns about inflation risks. Supply pressures also weighed on the Treasury market, with the Treasury scheduled to auction $119 billion of notes and bonds in the coming week.

Federal Reserve Outlook

Market participants continued to adjust their expectations for Federal Reserve policy in 2025. Current pricing suggests an 11% probability of a 25-basis-point rate cut at the January 28-29 FOMC meeting. Richmond Fed President Barkin's comments suggested a cautious approach to policy easing, noting that while inflation has moderated, there remain "upside risks to inflation and growth," supporting the case for maintaining restrictive rates for a longer period.

International Markets

Global Market Performance

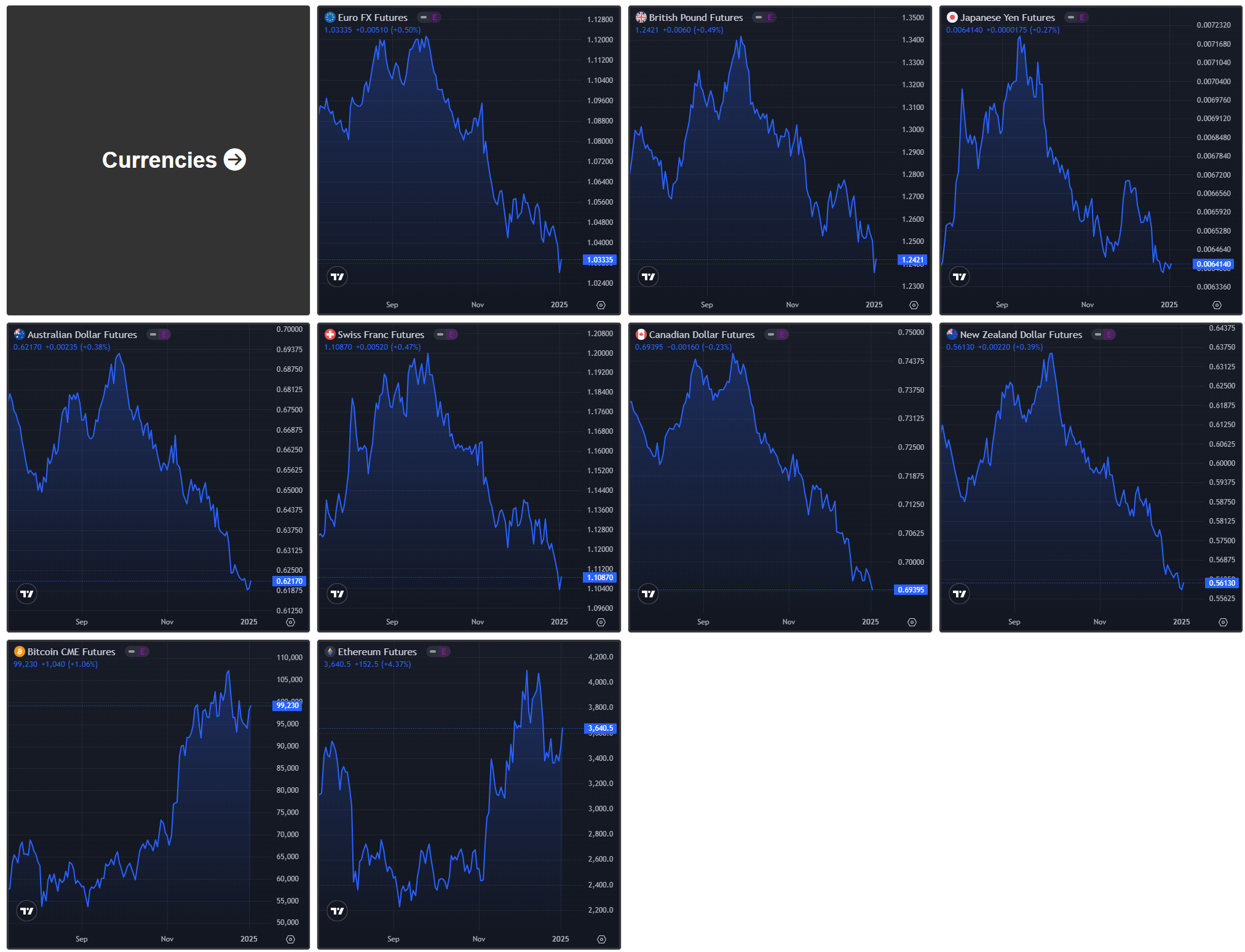

Overseas markets generally underperformed their U.S. counterparts during the week. The Euro Stoxx 50 declined 0.94%, while China's Shanghai Composite Index fell 1.57% to reach a 1½-month low. Japanese markets were closed for a bank holiday. The weakness in Chinese markets, coupled with the yuan's descent to a 14-month low against the dollar, raised concerns about global growth prospects.

European Economic Data

European economic indicators showed some resilience, with German unemployment data coming in better than expected. The December unemployment change showed an increase of 10,000 jobs, better than the anticipated 15,000 increase, while the unemployment rate held steady at 6.1%, defying expectations for an increase to 6.2%. Market participants are pricing in a 100% probability of a 25-basis-point rate cut by the European Central Bank at its January 30 policy meeting.

Sector Performance and Notable Moves

Individual Stock Highlights

Several companies saw significant stock movements based on analyst actions and corporate news:

SQ 0.00%↑ surged more than 6% following an upgrade to outperform by Raymond James

CHWY 0.00%↑ gained over 6% after receiving an outperform rating from Wolfe Research

JBL 0.00%↑ advanced more than 4% after announcing a warrant issuance to Amazon.com

US Steel ( X 0.00%↑ )declined more than 6% on reports of potential government intervention in its proposed sale to Nippon Steel

CVNA 0.00%↑ dropped more than 10% after Hindenburg Research announced a short position

Industry Trends

The alcohol beverage sector faced pressure following the U.S. Surgeon General's suggestion that product labels should include cancer warnings. This impacted stocks such as Molson Coors Beverage ( TAP 0.00%↑ -3%) and Brown-Forman Corp ( $BF.B -2%) and Boston Beer ( SAM 0.00%↑ ) . The automotive sector also saw movement, with Stellantis ( STLA 0.00%↑ ) declining on news that some of its electric vehicle models would lose eligibility for U.S. tax credits under stricter rules.

Looking Ahead to 2025

Economic Outlook

Analysts anticipate a year of moderate but positive economic growth in 2025, with GDP expected to maintain a pace near its long-term potential of around 2%. Consumer spending, supported by a healthy labor market and rising real wages, should continue to provide economic stability. The manufacturing sector may show signs of improvement after a period of weakness, while services spending could moderate following exceptional strength.

Market Expectations

While the sharp gains of 2024 may be difficult to replicate, several factors support continued market strength in 2025:

Expectations for corporate profit growth of 10-15%

Potential benefits from deregulation and pro-growth policies

Opportunities for broader market participation beyond mega-cap tech stocks

Favorable positioning for value-oriented sectors and dividend stocks

Investment Implications

Investors are advised to maintain a balanced approach while preparing for potentially increased volatility. Key considerations include:

Regular portfolio rebalancing to ensure proper diversification

Attention to opportunities in previously lagging market segments

Monitoring of policy developments and their potential market impact

Recognition that returns may moderate compared to the exceptional performance of 2024

Risks and Challenges

Policy Uncertainty

The implementation of new administration policies, particularly regarding trade and regulation, could create market volatility. The timing and scope of potential corporate tax changes and deregulatory measures remain uncertain, potentially affecting different market sectors asymmetrically.

Interest Rate Environment

While the Federal Reserve is expected to begin easing monetary policy, the pace and timing of rate cuts remain uncertain. The 10-year Treasury yield is anticipated to trade in a range of 4-4.5% throughout 2025, with various factors including deficit spending and inflation expectations influencing yield movements.

Global Economic Concerns

Weakness in Chinese economic growth and potential trade tensions present ongoing risks to global market stability. The strength of the U.S. dollar, which reached a two-year high, could impact multinational corporations' earnings and global trade dynamics.

Conclusion

As markets transition into 2025, the investment landscape presents both opportunities and challenges. While the exceptional returns of 2024 may be difficult to replicate, fundamental factors including economic growth, corporate earnings, and monetary policy normalization support continued market strength. However, investors should remain mindful of potential volatility arising from policy changes, global economic uncertainty, and the evolution of market leadership beyond the dominant technology sector.

Success in 2025 will likely require a more nuanced approach to portfolio management, with attention to diversification across sectors and investment styles. While technology and growth stocks may continue to play important roles, opportunities in value-oriented sectors and previously lagging market segments could provide additional sources of returns as the market environment evolves.

Futures Markets Snapshots

S&P 500: Sector Insights

Technology

MSFT (-3.37%): Declined as part of a broader selloff in mega-cap tech stocks due to renewed fears about extended monetary tightening.

AAPL (-6.05%): Apple was one of the biggest laggards, reflecting investor concerns over slower-than-expected iPhone 15 sales and reduced demand in China.

NVDA (+3.24%): Nvidia bucked the downward trend, supported by strong AI-related demand and continued dominance in the GPU market.

AVGO (-5.22%): Fell after weaker-than-expected guidance for the next quarter, particularly around its networking and wireless businesses.

Consumer Cyclical

TSLA (-9.62%): Tesla faced heavy losses following concerns about price cuts impacting margins and heightened competition in the EV market.

AMZN (-1.26%): Amazon saw modest declines, with investors digesting mixed retail sector data and uncertain consumer spending trends.

HD (-1.51%): Home Depot declined marginally amidst concerns about the broader housing market slowdown.

Communication Services

GOOGL (-1.95%): Alphabet slid as investors rotated away from tech-heavy names, despite strong performance in its cloud business.

META (+0.21%): Meta remained mostly flat, supported by optimism around its VR initiatives and strong engagement growth.

NFLX (-6.66%): Declined significantly as concerns over slowing subscriber growth and competitive pressures weighed on sentiment.

Healthcare

LLY (-1.53%): Eli Lilly dropped slightly, reflecting broader weakness in healthcare stocks amidst concerns over potential regulatory pressures on drug pricing.

ABBV (+1.13%): Outperformed, supported by strong sales figures for its immunology portfolio and positive clinical data.

Industrials

BA (-3.81%): Boeing declined after reports of continued supply chain constraints affecting its production targets.

GE (-0.11%): General Electric showed resilience, likely supported by strong performance in its aerospace division.

Energy

XOM (+1.29%) and CVX (+2.69%): Energy stocks rebounded, driven by a slight uptick in crude oil prices and better-than-expected earnings from key players.

Financials

V (-1.87%) and MA (-2.76%): Payment processors declined as higher bond yields raised concerns about slowing consumer spending.

BRK-B (-1.20%): Berkshire Hathaway saw a small decline, reflecting broader market weakness rather than company-specific news.

Consumer Staples

PG (-2.96%): Procter & Gamble declined as investors rotated out of defensive names into growth sectors amidst expectations of higher yields.

Utilities

Utilities showed mixed performance as rising bond yields continued to pressure this interest-sensitive sector. Defensive stocks lost some appeal.

Key Takeaways

Tech Weakness: The technology sector saw heavy losses, driven by concerns over high valuations, with Apple and Microsoft leading the declines.

Tesla Under Pressure: Tesla’s double-digit drop highlighted investor worries over profitability and competitive dynamics in the EV market.

Energy Gains: Energy was one of the few sectors with positive performance, as ExxonMobil and Chevron benefited from recovering oil prices.

Healthcare Resilience: While healthcare overall was weak, AbbVie stood out positively due to strong fundamentals.

ETF Insights

US Large Cap

SPY (-1.56%) and QQQ (-2.08%): Both broad-market ETFs declined this week, with technology-focused QQQ underperforming SPY as investors reacted to rising bond yields and concerns over stretched valuations in growth stocks.

RSP (-0.89%): The equal-weighted S&P 500 ETF outperformed SPY, reflecting slightly better performance in smaller names versus mega-caps.

US Sector ETFs

Technology (XLK, -2.05%): The technology sector continued to face pressure due to rising interest rates, which weigh on growth stock valuations.

Leveraged ETF SOXS (+1.34%), betting against semiconductor stocks, saw gains as some chipmakers showed weakness.

VGT (-1.96%): Broad tech sector ETFs followed the broader market's pullback.

Energy (XLE, +3.43%): Energy was the best-performing sector, driven by strong oil price recovery.

XOP (+5.63%): Outperformed within energy ETFs, reflecting strength in oil exploration and production stocks.

USO (+6.55%): Crude oil-linked ETFs gained due to supply concerns and geopolitical risks.

Consumer Discretionary (XLY, -3.31%): Consumer discretionary ETFs underperformed amid mixed retail earnings and concerns about high consumer debt.

XRT (-1.56%): Retail-focused ETFs showed resilience compared to broader discretionary names.

Healthcare (XLV, -0.46%): Healthcare held up relatively well, benefiting from its defensive nature, with biotech-focused XBI (-0.26%) outperforming.

Utilities (XLU, -1.15%): Utilities struggled as rising yields made their dividend yields less attractive to investors.

US Small and Mid-Cap

IJH (-0.51%) and IWM (-0.55%): Mid- and small-cap ETFs slightly outperformed their large-cap counterparts, showing relative resilience despite broader market weakness.

International and Emerging Markets

China (FXI, -2.35%): Chinese ETFs declined as weak economic data and geopolitical concerns weighed on sentiment.

Leveraged ETF YINN (-8.25%) was particularly hard-hit, reflecting bearish sentiment on China.

Emerging Markets (EEM, -0.80%): Emerging market ETFs were pressured by a stronger dollar and global growth concerns.

Japan (EWJ, +0.09%): Japanese ETFs were a rare bright spot, buoyed by a weaker yen and optimism around corporate reforms.

Fixed Income

TLT (-0.60%): Long-duration Treasury ETFs fell as yields continued to rise.

TMF (-2.11%): Leveraged long Treasury ETFs saw outsized losses due to their sensitivity to rising rates.

IEF (+0.03%): Shorter-duration Treasuries fared better as investors moved further out on the yield curve.

Commodities and Cryptocurrency

Gold (GLD, +0.17%) and Silver (SLV, -0.95%): Precious metals were mixed, with gold holding steady due to safe-haven demand, while silver fell on industrial demand concerns.

Oil (USO, +6.55%): Oil prices surged amid supply cuts and geopolitical risks, supporting energy-related ETFs.

Bitcoin ETFs (BITO, +2.87%) and GBTC (+2.98%): Crypto-linked ETFs rallied on renewed optimism in the cryptocurrency market, bolstered by increasing regulatory clarity and Bitcoin's recent strength.

Leverage and Inverse ETFs

TZA (+1.98%): Small-cap bear leveraged ETF gained, reflecting pressure on small-cap stocks this week.

SOXL (-2.45%): Leveraged bullish bets on semiconductors struggled as the tech sector weakened overall.

SOQQQ (+6.53%): Bearish bets on the Nasdaq performed strongly as tech-heavy ETFs sold off.

Key Takeaways

Energy Outperformance: Energy ETFs led the market, driven by strong oil prices and optimism around exploration and production stocks.

Tech Weakness: Technology ETFs were hit hard, especially leveraged bullish tech ETFs, reflecting concerns about rising rates and valuations.

Crypto Strength: Cryptocurrency-linked ETFs continued to rebound, supported by Bitcoin's recent rally and broader market interest.

Resilience in Mid- and Small-Caps: Mid-cap and small-cap ETFs showed relative outperformance, highlighting interest in diversified equity exposure.

[Special Coverage] Anticipating Market Volatility in 2025

As we embark on 2025, investors are bracing for a year characterized by significant volatility in the U.S. financial markets. If the first few sessions are any indication of things to come, we could be in for some thrilling moves. The anticipated turbulence stems from a confluence of factors, including the Federal Reserve's monetary policy adjustments, persistent inflationary pressures, and the economic policies of the Trump administration. Recognizing these dynamics among the current backdrop of geopolitical uncertainty is crucial for investors seeking to navigate the complexities of the current financial landscape.

Federal Reserve's Monetary Policy: A Delicate Balancing Act

The Federal Reserve's approach to interest rates in 2025 is poised to play a pivotal role in shaping market conditions. In December 2024, the Fed reduced its key interest rate by a quarter-point to a target range of 4.25% to 4.5%, marking the third cut of the year. However, the central bank signaled a more gradual pace of rate reductions for 2025, projecting only two quarter-point cuts, a departure from the four cuts anticipated in September.

This cautious stance reflects the Fed's commitment to combating persistent inflation, which remains above its 2% target. Federal Reserve Chair Jerome Powell emphasized the need for a measured approach, stating that the current policy is "appropriately restrictive" to return inflation to the desired level. The Fed's projections indicate that the federal funds rate could remain higher for longer, with potential implications for borrowing costs and investment decisions.

Inflationary Pressures: A Persistent Challenge

Inflation continues to be a significant concern for policymakers and investors alike. Despite some moderation from the peaks observed in 2022, inflation rates have not fully aligned with the Federal Reserve's target. Factors contributing to sustained inflation include robust consumer spending, supply chain disruptions, and labor market tightness. The Fed's latest projections suggest that core inflation will decline to 2.5% in 2025, indicating a gradual easing of price pressures.

The potential implementation of new tariffs under the Trump administration could exacerbate inflationary trends. Tariffs on imports may lead to higher prices for goods, thereby increasing production costs and consumer prices. This scenario presents a complex challenge for the Federal Reserve as it seeks to balance economic growth with price stability.

Trump Administration's Economic Policies: Uncertainty and Market Implications

The return of President Donald Trump introduces a new layer of uncertainty to the economic outlook. His administration's policy agenda, including potential trade tariffs and fiscal measures, could have far-reaching effects on both domestic and global economies. For instance, proposed tariffs on imports aim to protect domestic industries but may also lead to retaliatory measures from trading partners, disrupting international trade dynamics.

Additionally, fiscal policies such as tax cuts and increased government spending could stimulate economic growth in the short term but may also contribute to higher inflation and increased federal debt. The interplay between these policies and the Federal Reserve's monetary stance will be critical in determining the trajectory of the economy and financial markets in 2025.

Market Volatility: Investor Sentiment and Strategic Considerations

Given these factors, financial advisors anticipate that the stock market's bull run may persist into 2025, albeit with increased volatility. A survey by InspereX revealed that over two-thirds of advisors expect the S&P 500 to rise by more than 10% in 2025, yet 80% foresee at least one market correction during the year. To mitigate potential risks, many advisors are incorporating downside protection strategies into client portfolios and adjusting asset allocations to favor sectors that may perform well in a volatile environment.

Sectors such as energy, utilities, and healthcare are expected to attract investor interest due to their defensive characteristics and potential for stable returns amid market fluctuations. Conversely, technology stocks, which have driven market gains in recent years, may experience heightened sensitivity to interest rate changes and policy shifts, warranting a more cautious approach.

Conclusion: Navigating Uncertainty with Informed Strategies

The confluence of the Federal Reserve's monetary policy, persistent inflation, and the Trump administration's economic agenda sets the stage for a complex and volatile financial environment in 2025. Investors are advised to stay informed, remain adaptable, and consider diversified investment strategies to navigate the uncertainties ahead. By closely monitoring policy developments and economic indicators, market participants can make informed decisions to safeguard their portfolios and capitalize on emerging opportunities in the evolving financial landscape.