Market Momentum: Your Weekly Financial Forecast & Market Prep

Issue 30 / What to expect Jan 27, 2025 thru Jan 31, 2025

In This Issue

Market-On-Close: All of last week’s market-moving news and macro context in under 5 minutes + futures-snapshots

Special Coverage: The Trump-Trade - Anticipated Policy Changes Under Donald Trump’s Presidency and Their Market Impacts

The Latest Investor Sentiment Readings

Institutional Support & Resistance Levels For Major Indices: Exactly where to look for support and resistance this week in SPY, QQQ, IWM & DIA

Institutional Activity By Sector: Institutional order flow by sector including the top institutionally-backed names in those sectors. We break it all down and provide the key insights and take-aways you need to navigate institutional positioning this week.

Top Institutional Order Flow In Individual Names: All of the largest sweeps and blocks on lit exchanges and hidden dark pools

Investments In Focus: Bull vs Bear arguments for QSR, CVX & LB

Top Institutionally-Backed Gainers & Losers: An explosive watchlist for day traders seeking high-volatility

Normalized Performance By Thematics YTD (Sector, Industry, Factor, Energy, Metals, Currencies, and more): which corners of the markets are beating benchmarks, which ones are overlooked and which ones are over-crowded

Key Econ Events and Earnings On-Deck For This Week

Market-On-Close

Markets, Policy, and Potential in 2025's Opening Act

With only a week left in the first month of 2025, the United States financial markets revealed a complex tapestry of economic signals, technological aspirations, and political recalibration. The stock market's performance painted a nuanced picture of resilience and challenge, with major indices experiencing modest declines yet holding near historical highs.

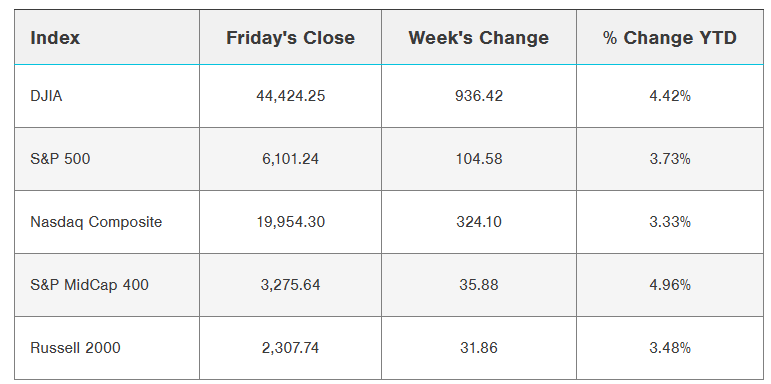

The S&P 500, despite closing down 0.29% for the week, achieved a remarkable milestone by establishing a new record high. This seemingly contradictory performance encapsulates the current market's intricate dynamics—a blend of cautious optimism and underlying strength. The Dow Jones Industrial Average and Nasdaq 100 followed similar trajectories, with respective declines of 0.32% and 0.58%, reflecting a market carefully navigating multiple economic crosscurrents.

At the heart of this week's market narrative was the ongoing quarterly earnings season, which emerged as a critical driver of investor sentiment. Analysts projected a robust 7.5% year-over-year earnings growth for S&P 500 companies—the most substantial increase since 2021. This projection suggests that corporate America continues to demonstrate remarkable adaptive capacity in an increasingly complex global environment.

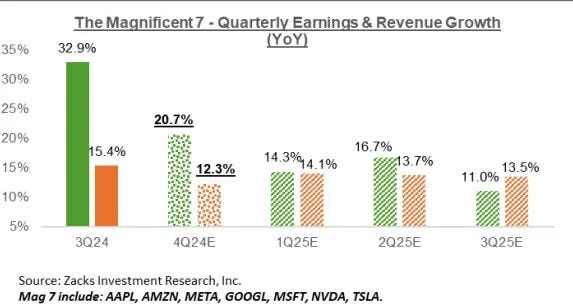

The technology sector, particularly the so-called "Magnificent Seven" stocks, remained a focal point of market attention. With impending earnings reports from industry titans like Microsoft, Tesla, Apple, and Meta Platforms, investors are keenly assessing the potential for continued technological momentum. The sector's performance carries significant weight, given that these companies have been primary engines of market growth, collectively driving nearly 65% of recent market gains.

Semiconductor stocks experienced notable turbulence during the week. Texas Instruments' disappointing forward guidance sent ripples through the sector, with multiple chip manufacturers—including Nvidia, Microchip Technology, and Analog Devices—experiencing a good shake. This downturn highlighted the ongoing challenges in the semiconductor industry, particularly within automotive and consumer electronics markets.

The macroeconomic landscape presented an equally intricate tableau. The S&P Global economic activity report revealed nuanced indicators of economic health. The manufacturing sector, after months of contraction, showed signs of revival—returning to growth for the first time in six months. Meanwhile, service sector activity continued, albeit at a more measured pace, suggesting a cautious but resilient economic foundation.

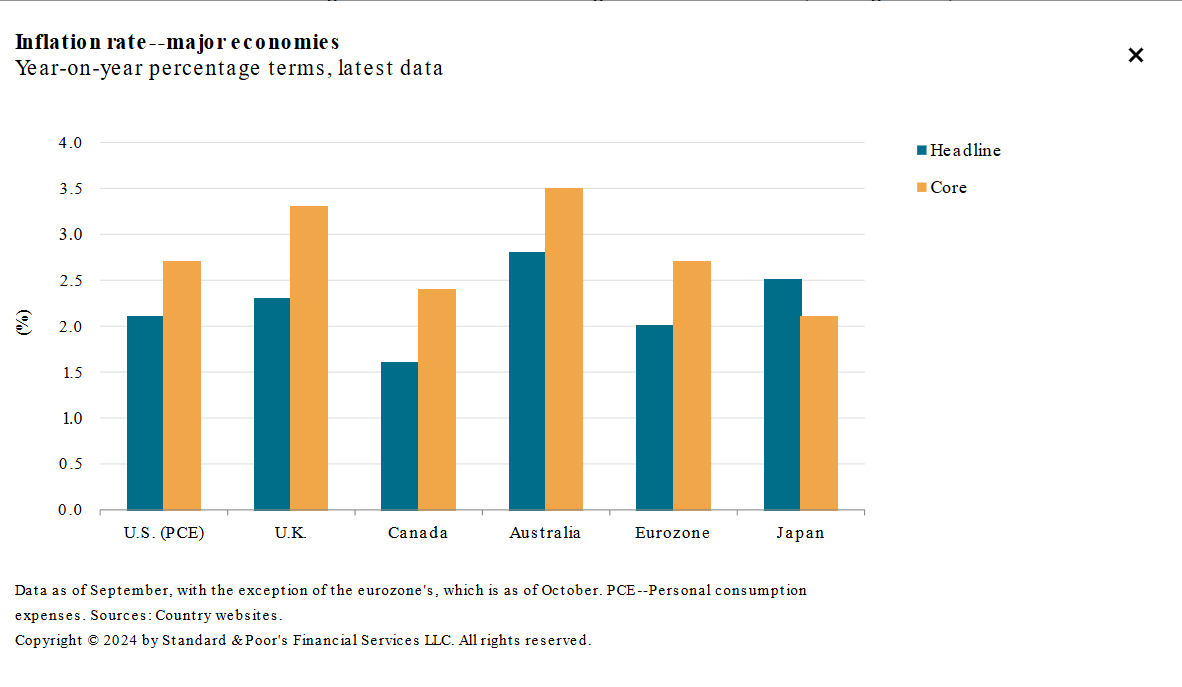

Consumer sentiment emerged as another critical barometer of economic mood. The University of Michigan's sentiment index unexpectedly declined, dropping to 71.1 from December's 74.0. This reduction was primarily driven by growing concerns about potential inflation and unemployment, reflecting the underlying economic anxieties that persist despite overall market strength.

The real estate sector offered its own complex narrative. December saw existing home sales rise 2.2% to 4.24 million units—a 10-month high. However, the broader 2024 landscape told a different story, with total sales reaching their lowest level since 1995. High interest rates and elevated home prices continued to challenge market dynamics, creating a significant headwind for residential real estate.

The week's most intriguing developments emerged from the political sphere, with the new administration signaling potentially transformative policy directions. Energy policy shifted towards increased fossil-fuel production, while simultaneously announcing a groundbreaking $500 billion initiative in artificial intelligence infrastructure. The Stargate project, a collaboration involving Softbank, OpenAI, Oracle, and MGX, signals a strategic commitment to technological leadership.

Trade policy appeared more nuanced than many had anticipated. Rather than implementing immediate, broad-based tariffs, the administration opted for a more measured approach—requesting comprehensive reviews of trade policies and indicating a preference for targeted, strategic interventions rather than sweeping economic disruptions.

Monetary policy remained a critical consideration. The Federal Reserve is expected to maintain current interest rates, with ongoing uncertainty surrounding potential future rate cuts. Internationally, the Bank of Japan's decision to raise its short-term policy rate to 0.50% represents a significant moment in global monetary policy.

For investors, these developments underscore the importance of a strategic, adaptable approach. The market's narrow rally, with only 62% of S&P 500 components trading above their 200-day moving average, suggests potential volatility. Diversification, attentive risk management, and a focus on fundamental economic indicators become paramount.

The technology sector, particularly artificial intelligence, represents a compelling narrative of potential future growth. The substantial investment signals not just a financial strategy but a broader commitment to maintaining technological leadership. For investors, this suggests looking beyond immediate market fluctuations and considering long-term transformative potential.

As we progress through 2025, the interplay between technological innovation, policy evolution, and global economic dynamics will continue to shape market opportunities. The current landscape demands both strategic patience and adaptive responsiveness.

The markets have entered a phase of sophisticated complexity—where traditional economic indicators intersect with technological revolution, where policy decisions carry immediate and long-term implications, and where global interconnectedness creates both challenges and unprecedented opportunities.

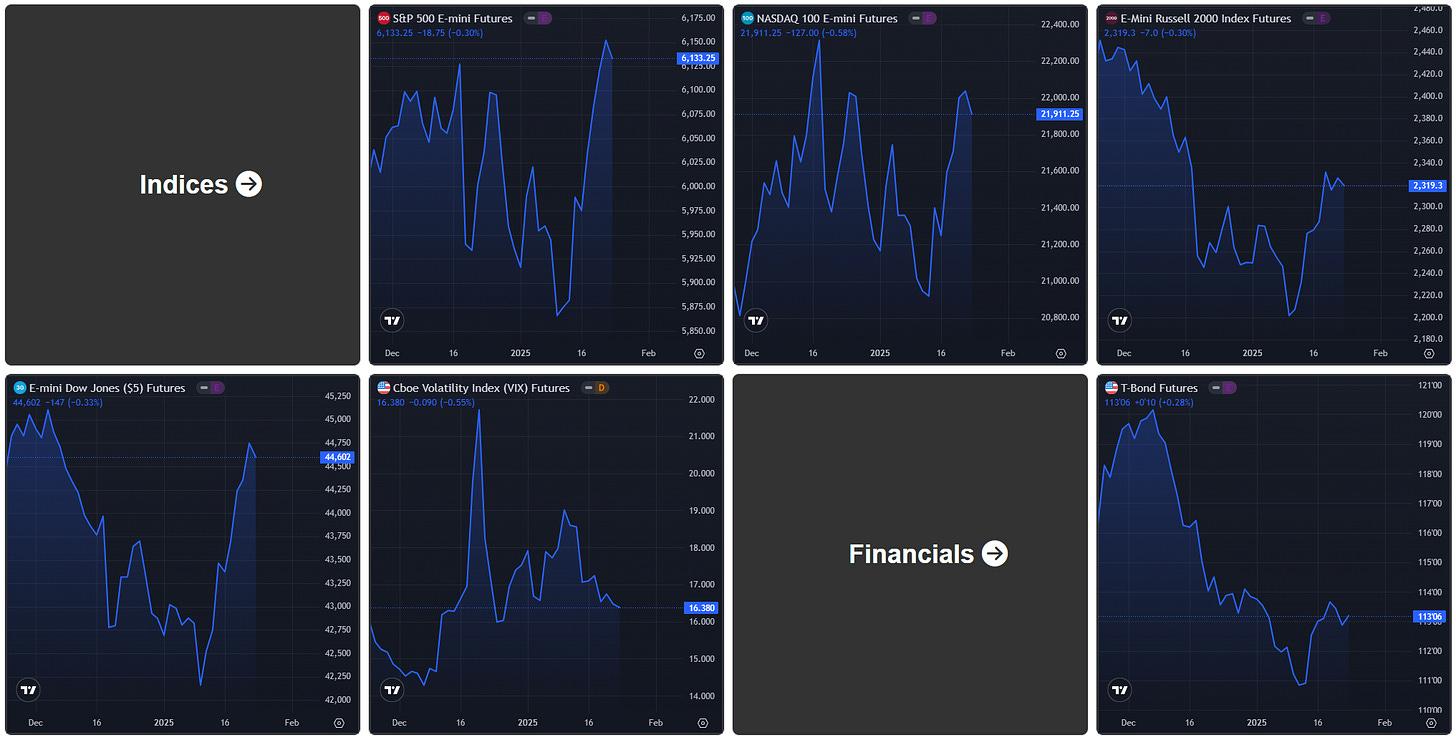

Futures Markets Snapshots

S&P 500: Sector Insights

The technology sector stood out as the top performer, with significant gains driven by AI momentum and strong earnings. Oracle ( ORCL 0.00%↑ ) soared over 15% following the announcement of the Stargate AI initiative, a government-backed collaboration with OpenAI and SoftBank to invest $500 billion in U.S. AI infrastructure over the next four years. Nvidia ( NVDA 0.00%↑ ) also climbed nearly 7% as ongoing demand for AI-related hardware reaffirmed its dominant position in the market. Meanwhile, Microsoft ( MSFT 0.00%↑ ) saw steady gains as investors responded positively to its continued success in cloud services and AI investments.

In the consumer discretionary sector, robust consumer spending and strong retail performance propelled gains. Amazon ( AMZN 0.00%↑ ) rose by over 6%, buoyed by analyst upgrades highlighting strength in its cloud computing and e-commerce divisions. Despite Tesla's ( TSLA 0.00%↑ ) slight decline, its launch of the Model Y in the U.S. and Europe generated optimism for future sales growth. Home Depot also contributed to the sector's strength, reflecting healthy demand for home improvement products.

The energy sector faced challenges, driven by a dip in oil prices following calls from President Trump for OPEC to reduce prices. As a result, ExxonMobil ( XOM 0.00%↑ ) and Chevron ( CVX 0.00%↑ ) both saw declines, underperforming the broader market. This contrasted with the industrials sector, where companies like General Electric ( GE 0.00%↑ ) outperformed due to robust demand in its aerospace division, with increased jet engine orders supporting growth. Financials also saw strong performance, with JPMorgan Chase ( JPM 0.00%↑ ) benefiting from rising net interest margins, leading analysts to raise price targets.

Healthcare saw mixed results, with managed care and pharmaceutical companies diverging. Eli Lilly ( LLY 0.00%↑ ) gained nearly 4%, supported by positive updates on its diabetes and obesity treatments, which also prompted analyst upgrades. In contrast, Merck ( MRK 0.00%↑ ) declined over 5%, reflecting concerns about competition in its oncology drug portfolio and weaker guidance from analysts.

Overall, while technology and consumer discretionary sectors led the rally, energy lagged behind due to oil price fluctuations, and healthcare exhibited a more nuanced performance.

ETF Insights

Over the past week, the performance of popular ETFs reflected a mix of optimism in growth sectors and lingering challenges in commodities and energy. Technology emerged as a clear leader, supported by easing bond yields and strong investor interest in AI and semiconductor demand, while energy and crude oil-related ETFs lagged due to declining oil prices and demand concerns. Other sectors, such as healthcare, financials, and consumer discretionary, also posted gains, underscoring the resilience of key areas of the economy.

Technology ETFs, such as XLK (+3.82%), led the rally, driven by favorable conditions for growth stocks as bond yields stabilized. Semiconductors played a major role, with SOXX (+3.18%) and the leveraged SOXL (+8.87%) benefiting from optimism around AI-related chip demand and improved supply chains. Conversely, the bearish SOXS (-9.23%) experienced significant losses, reflecting the sector's positive sentiment.

Healthcare ETFs had a strong week, with XBI (+5.20%) outpacing broader healthcare performance (XLV, +2.25%) as investors favored biotech companies following positive clinical trial updates and greater risk appetite. Meanwhile, financials also contributed to market gains, with XLF (+2.09%) and KRE (+1.92%) benefiting from higher interest rates that boosted net interest margins for banks. Regional banks, in particular, showed signs of stabilization after recent volatility.

The energy sector, however, struggled, with XLE (-2.07%) and XOP (-3.52%) declining in response to lower crude oil prices. Concerns over weakening global demand, coupled with rising inventories, weighed on oil prices and negatively impacted exploration and production companies. Meanwhile, gold ETFs such as GLD (+2.02%) gained on safe-haven demand and a weaker U.S. dollar, though silver ETFs like SLV (-0.46%) faced minor declines due to weaker industrial demand.

Consumer discretionary ETFs, including XLY (+1.75%), showed resilience as consumer spending trends remained positive. Homebuilder ETFs, like ITB (+0.03%), were flat despite easing mortgage rates, reflecting mixed housing market data. Industrial ETFs, such as XLI (+3.02%), gained from infrastructure spending and strong demand for aerospace and manufacturing goods.

International markets also performed well, with emerging market ETFs like EEM (+2.85%) rallying as the U.S. dollar weakened, making these economies more attractive to investors. Chinese ETFs, including FXI (+5.00%) and the leveraged YINN (+14.97%), led the way, bolstered by government stimulus measures and optimism about economic recovery efforts in China.

Cryptocurrency ETFs, such as BITO (+4.22%) and GBTC (+4.54%), saw significant gains as Bitcoin rallied on improved sentiment and growing regulatory clarity. Fixed income ETFs remained stable, with Treasury ETFs like TLT (+0.21%) and TMF (+0.13%) showing minor gains as bond yields eased, though overall demand remained subdued.

Overall, the week highlighted a shift toward growth and risk assets, with technology, healthcare, and consumer discretionary sectors leading gains. Meanwhile, energy faced headwinds from lower oil prices, and safe-haven assets like gold attracted interest. Emerging markets and cryptocurrencies also showed strength, reflecting improving sentiment and favorable macroeconomic trends. This performance underscores a market environment increasingly driven by optimism in growth sectors and selective risk-taking.

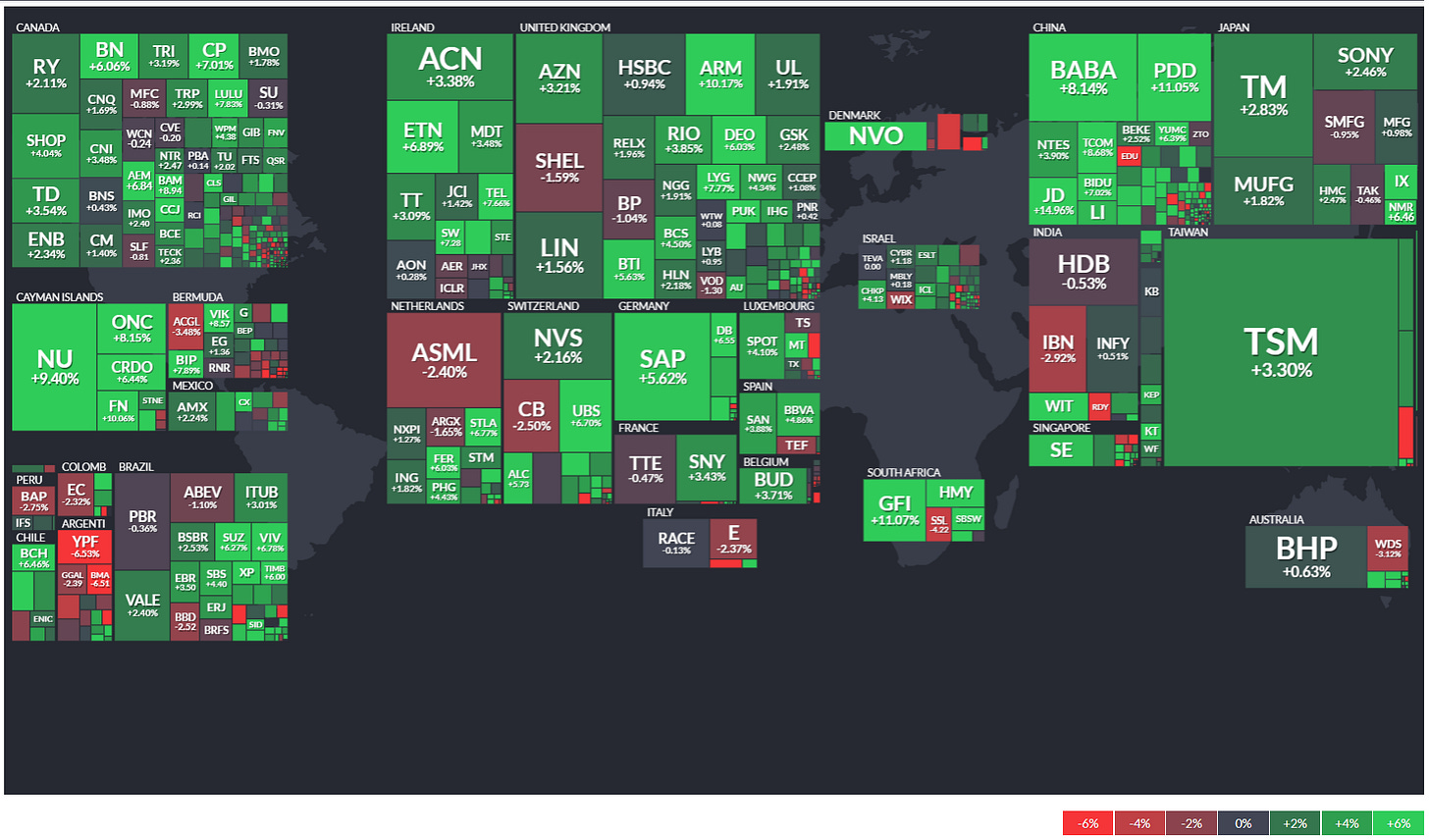

Global Overview

Special Coverage // The Trump-Trade: Anticipated Policy Changes Under Donald Trump’s Presidency and Their Market Impacts

Donald Trump’s presidency in 2025 brings a renewed focus on his well-known policy priorities, many of which stem from his previous administration and campaign promises. These policies are likely to impact various sectors of the market, creating opportunities and risks for investors. Below, we explore the anticipated policy changes and the sectors and specific companies that could be most affected, along with broader implications for the markets.

Tax Policies

Sectors to Watch: Technology, Industrials, Financials, Consumer Discretionary.

Top Tickers to Watch: Apple ( AAPL 0.00%↑ ), Caterpillar ( CAT 0.00%↑ ), Walmart ( WMT 0.00%↑ ), Target ( TGT 0.00%↑ ), Delta Air Lines ( DAL 0.00%↑ ).

One of the cornerstones of Trump’s economic agenda has always been tax reform. His previous administration introduced significant corporate tax cuts, and further reductions are likely to stimulate investment and earnings growth. Sectors such as technology, industrials, financials, and consumer discretionary are positioned to benefit. Middle-class tax cuts could also boost consumer spending, leading to growth in retail, travel, and other consumer-focused industries. Companies like Apple, Caterpillar, Walmart, and Delta Air Lines could see significant gains as a result.

However, it’s important to note that tax changes are coming that may go beyond Trump’s earlier framework. While the election was not fought over tax policy, discussions around tax reforms will likely dominate the next few years. A potential “Rothification” of retirement savings—a shift to taxing retirement savings upfront rather than upon withdrawal—could alter how investors think about saving for retirement and significantly impact retirement-focused investment strategies.

Deregulation

Sectors to Watch: Energy, Financials, Technology.

Top Tickers to Watch: ExxonMobil ( XOM 0.00%↑ ), Halliburton ( HAL 0.00%↑ ), Bank of America ( BAC 0.00%↑ ), Coinbase ( COIN 0.00%↑ ).

Reducing regulatory burdens is expected to continue as a priority, particularly in the energy and financial sectors. Easing restrictions on fossil fuel extraction could bolster oil, gas, and coal industries, while financial deregulation may enhance profitability for banks and insurance companies. Firms such as ExxonMobil, Halliburton, Bank of America, and Goldman Sachs are likely to experience positive impacts from these changes.

Additionally, a theme of the upcoming Trump administration may be a “lighter touch” from regulators, especially around cryptocurrencies. Investors will need to exercise caution as scams and fraud in the crypto market remain prevalent. Congress may consider legislation for a regulatory framework. For now, the crypto market is likely to operate under a “buyer beware” philosophy, making due diligence and reliable exchanges critical for investors.

Trade Policies

Sectors to Watch: Agriculture, Manufacturing, Technology.

Top Tickers to Watch: Tesla ( TSLA 0.00%↑ ), Nike ( NKE 0.00%↑ ), Deere & Co. ( DE 0.00%↑ ), Boeing ( BA 0.00%↑ ).

Trump’s “America First” trade agenda could result in the reintroduction of tariffs on imports and a renegotiation of trade agreements. While protectionist measures may disrupt supply chains, sectors like agriculture and manufacturing could benefit from favorable terms in new trade deals. Companies such as Tesla, Nike, Deere & Co., and Boeing are worth watching as trade policies evolve.

Infrastructure Investment

Sectors to Watch: Construction, Materials, Industrials.

Top Tickers to Watch: United Rentals ( URI 0.00%↑ ), Vulcan Materials ( VMC 0.00%↑ ), Jacobs Engineering ( J 0.00%↑ ).

Trump has consistently emphasized the need for substantial infrastructure spending, a move that would drive growth in construction, materials, and industrial sectors. Increased demand for equipment rentals, aggregates, and engineering services could benefit companies like United Rentals, Vulcan Materials, and Jacobs Engineering.

Healthcare Reforms

Sectors to Watch: Healthcare Providers, Pharmaceuticals, Telehealth.

Top Tickers to Watch: UnitedHealth Group ( UNH 0.00%↑ ), Pfizer ( PFE 0.00%↑), Teladoc Health ( TDOC 0.00%↑ ).

Revisiting or repealing parts of the Affordable Care Act could create uncertainty but also opportunities in the healthcare sector. Insurance providers, pharmaceutical companies, and telehealth firms such as UnitedHealth Group, Pfizer, and Teladoc Health may experience significant impacts depending on the nature of the reforms.

Immigration Policies

Sectors to Watch: Agriculture, Construction, Hospitality.

Top Tickers to Watch: Marriott International ( MAR 0.00%↑ ), Archer-Daniels-Midland ( ADM 0.00%↑ ), Lennar Corporation ( LEN 0.00%↑ ).

Restrictive immigration policies could increase labor costs for industries reliant on immigrant workers, such as agriculture, construction, and hospitality. Companies like Marriott International, Archer-Daniels-Midland, and Lennar Corporation could face challenges in maintaining profitability under such policies.

Defense Spending

Sectors to Watch: Aerospace, Defense, Technology.

Top Tickers to Watch: Lockheed Martin ( LMT 0.00%↑ ), Northrop Grumman ( NOC 0.00%↑ ), Raytheon Technologies ( RTX 0.00%↑ ).

Increased defense budgets are likely to benefit the aerospace and defense sectors, with companies like Lockheed Martin, Northrop Grumman, and Raytheon Technologies poised to gain from expanded military contracts and investments in advanced technologies.

Federal Reserve and Interest Rates

Sectors to Watch: Financials, Real Estate, Consumer Staples.

Top Tickers to Watch: Wells Fargo ( WFC 0.00%↑ ), Realty Income ( O 0.00%↑ ), Procter & Gamble ( PG 0.00%↑ ).

Although Trump does not control the Federal Reserve, his administration may advocate for accommodative monetary policies to boost growth. This could influence financials, real estate, and consumer staples, with firms such as Wells Fargo, Realty Income, and Procter & Gamble which are particularly sensitive to interest rate changes.

Environmental, Social, and Governance (ESG) Investing

Sectors to Watch: ESG-focused Funds, Renewable Energy, Workplace Retirement Plans.

Top Tickers to Watch: iShares ESG Aware MSCI USA ETF ( ESGU 0.00%↑ ), First Solar ( FSLR 0.00%↑ ), NextEra Energy ( NEE 0.00%↑ ).

The Trump administration’s hostility toward ESG-focused investing is expected to have minimal impact on individual investors. Those who value ESG analysis can still incorporate it into their strategies, but workplace retirement accounts like 401(k)s may largely avoid ESG options due to regulatory challenges for plan sponsors. This could discourage employers from offering these options to their employees.

Convergence of Public and Private Markets

Sectors to Watch: Private Equity, Alternative Investments, Retail Investing Platforms.

Top Tickers to Watch: Blackstone ( BX 0.00%↑ ), KKR & Co. ( KKR 0.00%↑ ), Robinhood Markets ( HOOD 0.00%↑ ).

Private markets, historically accessible only to accredited and institutional investors, have gradually opened to retail investors. Regulators at the SEC and Department of Labor are expected to facilitate this trend by easing restrictions.

Market Sentiment and Volatility

Trump’s policy agenda and communication style are likely to contribute to market volatility. Monitoring indices like the CBOE Volatility Index ( $VIX ) and ETFs such as SPDR S&P 500 ( SPY 0.00%↑ ) and Invesco QQQ Trust ( QQQ 0.00%↑ ) can provide insights into market sentiment and sector-specific trends. As these policies unfold, they will create a dynamic environment for investors, offering both opportunities and risks.

As Donald Trump takes the helm in 2025, it is clear that his policies could have a profound impact on financial markets. From tax reforms and deregulation to shifts in trade policies and infrastructure investments, the effects will be felt across industries and sectors. In addition to the dynamics of new presidential leadership, the broader economic landscape will continue to be shaped by Federal Reserve policies and global geopolitical tensions. For investors, these changes bring both opportunities to capitalize on growth and risks to navigate carefully.