Market Momentum: Your Weekly Financial Forecast & Market Prep

Issue 16 / What to expect Oct 7, 2024 thru Oct 11, 2024

Weekly Wrap-Up

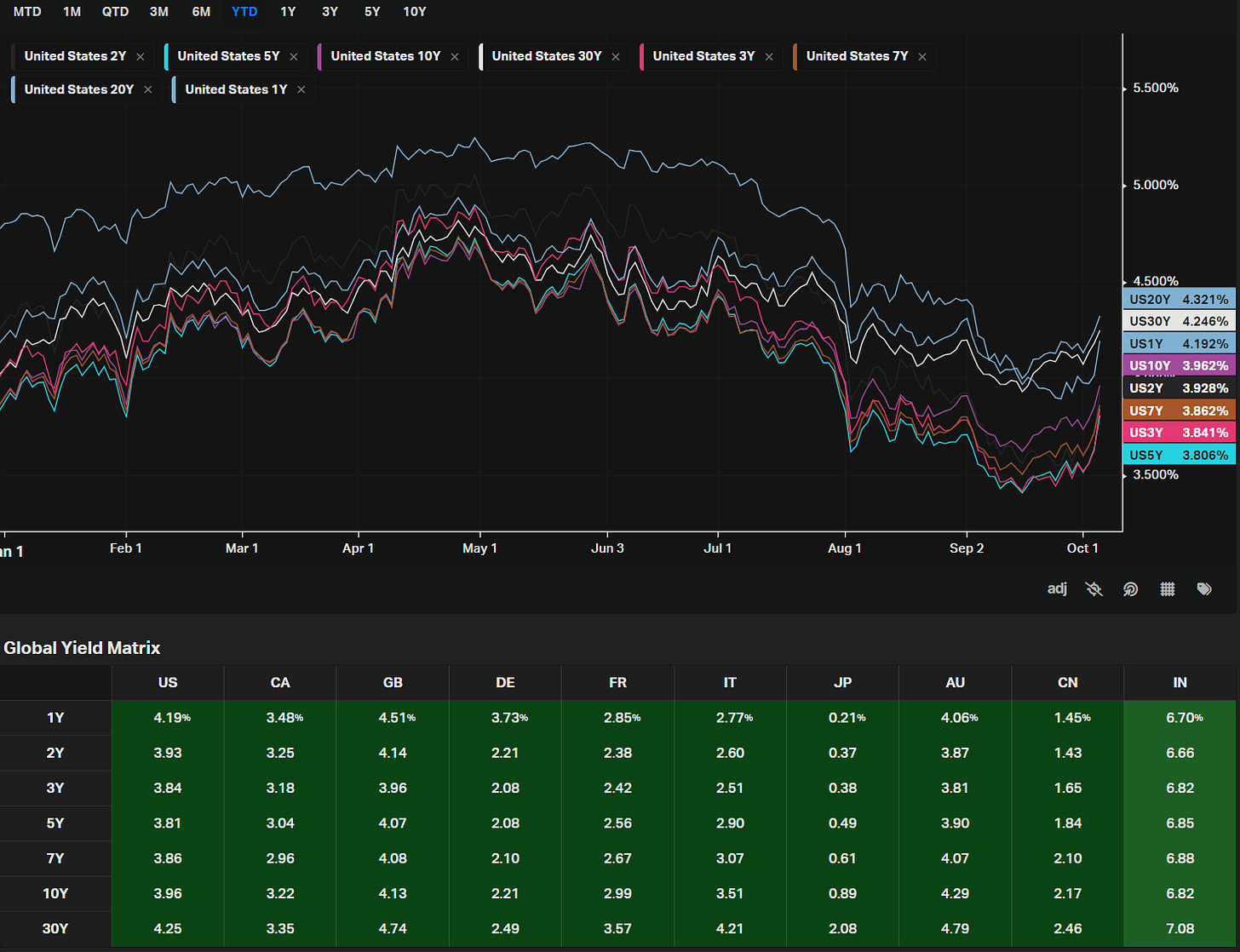

1. Yield Curve Dynamics and Its Recent Shift

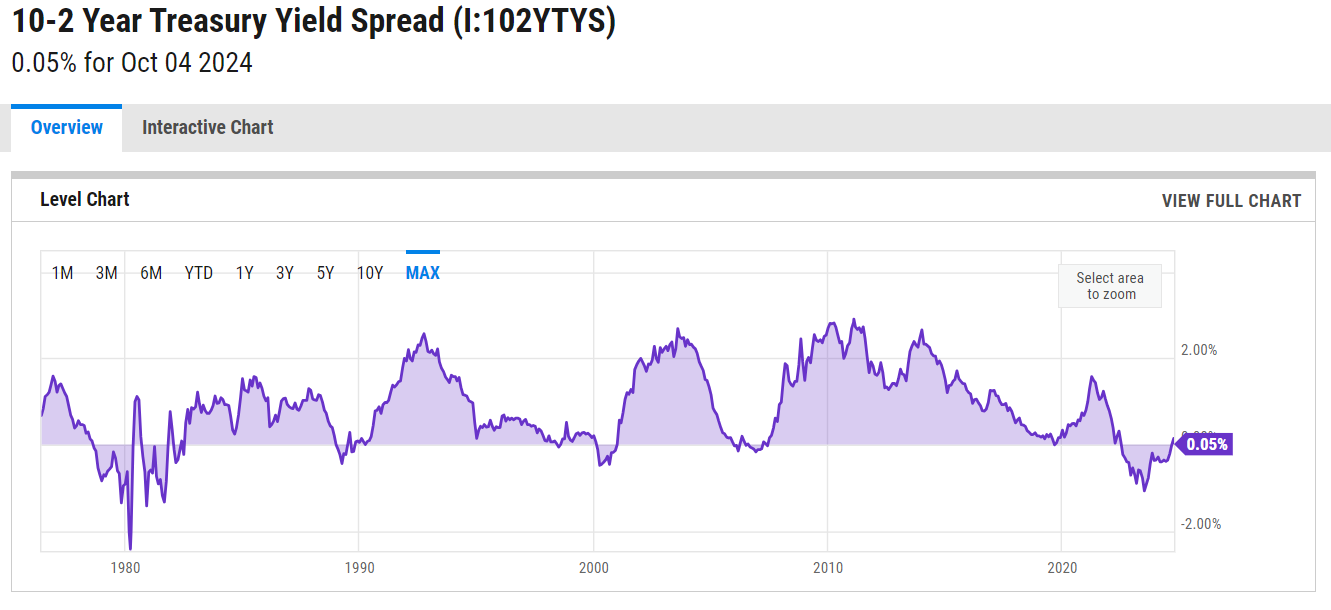

The yield curve, which plots the yields of Treasury securities across various maturities, is one of the most closely watched indicators in financial markets. It is often viewed as a reflection of the market's expectations for future economic conditions. Historically, an upward-sloping yield curve is considered the norm. This structure indicates that longer-term interest rates are higher than shorter-term rates, which makes sense because investors typically demand a higher yield for locking their money away for a longer period, especially in the face of potential inflation or economic uncertainty.

For 26 months, however, the yield curve had been inverted, meaning that shorter-term yields, such as those of the 2-year Treasury, were higher than longer-term yields like the 10-year. An inverted yield curve has traditionally been seen as a precursor to a recession, as it reflects expectations that future interest rates will fall, possibly because of an economic downturn. During this period of inversion, investors speculated that the Federal Reserve would cut interest rates to stimulate a slowing economy, leading to lower long-term yields relative to short-term ones.

Earlier this month, however, the yield curve reverted to its normal upward-sloping shape. This shift is referred to as bull steepening, meaning that short-term yields (specifically the 2-year yield) have fallen more quickly than long-term yields (the 10-year yield). Since the July Jobs report, this phenomenon has taken hold, and it was further accentuated by the Federal Reserve’s decision to cut rates by 50 basis points. The Fed’s cut helped push the 2-year yield lower, thus hastening the un-inversion of the yield curve.

It is important to note that while an inverted yield curve is a strong predictor of a recession, history suggests that it is actually the un-inversion of the yield curve that often precedes the actual downturn. This is a lesser-known but critical observation. In the past four U.S. recessions, the yield curve first inverted and then returned to its normal slope before the recession hit. However, the un-inversion itself is not the cause of the recession but rather an indication of shifting market expectations and economic conditions.

In this case, the normalization of the yield curve reflects a change in policy expectations and economic sentiment. The Federal Reserve’s recent actions and the ongoing developments in the U.S. economy have eased fears of an immediate slowdown. Although the 2-year yield has been falling, reflecting expectations of more dovish Fed policies, the 10-year yield has been rising slightly, suggesting that fears of a severe economic contraction have eased, and inflationary pressures are no longer seen as being as acute as before.

Nevertheless, despite the normalization of the 2-year and 10-year yield curve, another important part of the yield curve—the spread between the 3-month Treasury bill and the 10-year Treasury yield—remains inverted. The 3-month yield continues to offer a higher rate than the 10-year yield, which suggests that the market still expects further Federal Reserve rate cuts in the near future. This reflects ongoing concerns about economic growth and inflation, although the un-inversion of the longer-term part of the curve provides some relief.

2. The Federal Reserve’s Role and Policy Shifts

The Federal Reserve, as the central bank of the United States, plays a pivotal role in managing monetary policy to achieve its dual mandate: price stability (inflation control) and maximum employment. Interest rates are its primary tool for managing the economy, and the Fed adjusts rates based on prevailing economic conditions. Over the past several years, the Fed has been navigating a delicate balance between curbing inflationary pressures that emerged after the pandemic and supporting economic growth.

During the early stages of the pandemic, the Fed slashed interest rates to near-zero levels in order to stimulate the economy. However, as the economy began to recover and inflation surged, the Fed embarked on an aggressive rate-hiking cycle to rein in price increases. This led to the longest period of yield curve inversion seen in decades, as short-term interest rates rose sharply while long-term rates remained relatively subdued.

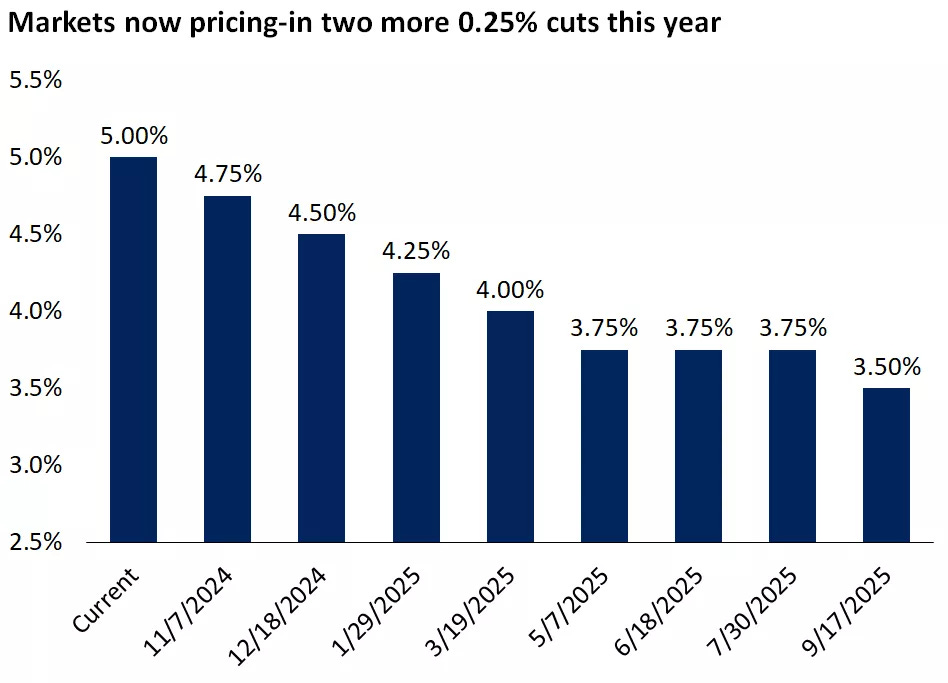

Recently, however, the Federal Reserve has taken a more dovish stance. The Fed’s decision to cut rates by 50 basis points is a significant policy move, indicating that the central bank is responding to a shifting economic landscape. The labor market, inflation data, and geopolitical risks all play into the Fed’s calculus.

Following the September FOMC meeting, the Fed has signaled that it may take a more measured approach to rate cuts moving forward. The 50 basis point cut helped accelerate the bull steepening of the yield curve, with the 2-year yield falling faster than the 10-year. However, in the weeks following the meeting, the 2-year yield continued to fall by an additional 6 basis points, while the 10-year yield rose slightly by 5 basis points. This suggests that market participants are now expecting fewer aggressive rate cuts in the near term, possibly due to easing concerns about a deep recession.

The Fed’s actions have been largely driven by incoming data. While inflation has shown signs of moderating, the labor market has remained strong. The September jobs report, in particular, was a positive surprise for markets, as it showed robust job growth and a decline in the unemployment rate. These developments suggest that the Fed’s aggressive tightening may be behind us, and that a more gradual pace of rate cuts could be on the horizon.

At the same time, wage growth remains elevated at around 4.0% year-over-year, which may keep the Fed cautious about inflation risks. While inflation has moderated from its peak, the Fed is likely to remain vigilant to prevent it from reaccelerating. This is why market expectations for rate cuts have shifted from 50 basis points to 25 basis points for the next few FOMC meetings. The Fed’s current focus seems to be on ensuring a soft landing for the economy—gradually reducing interest rates while keeping inflation in check and supporting employment growth.

3. Labor Market Surprises and Implications for Economic Growth

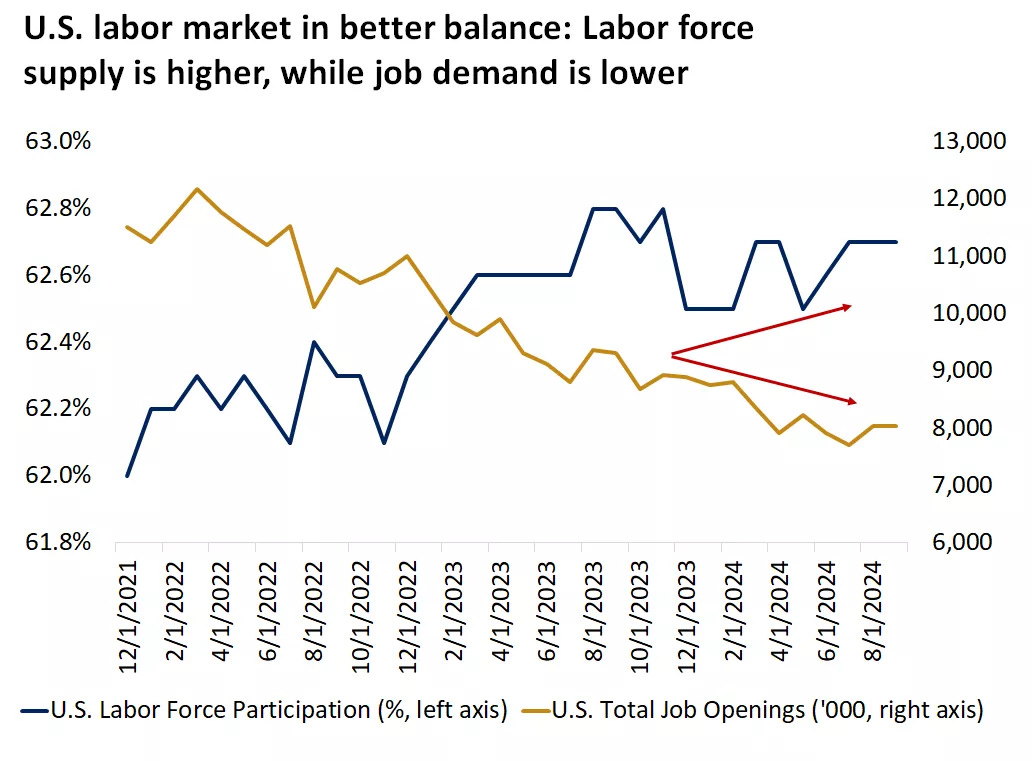

The U.S. labor market has been a critical driver of economic activity in recent years. Following the pandemic-induced recession in 2020, the labor market experienced a robust recovery, with millions of jobs being added and unemployment falling to historically low levels. However, in 2023 and early 2024, the pace of job growth began to slow, leading to concerns about a potential weakening of the economy.

In the months leading up to the September jobs report, labor market data had been somewhat disappointing. Jobs added in the summer months came in below expectations, and previous reports were revised downward. This had contributed to growing concerns about the resilience of the labor market and the overall economy. However, the September jobs report marked a sharp reversal in this trend.

The U.S. economy added 254,000 jobs in September, far exceeding economists’ expectations of around 150,000. In addition, the unemployment rate ticked lower from 4.2% to 4.1%. This strong jobs report was a welcome surprise for markets, as it indicated that the labor market remains resilient despite slowing economic growth in other areas.

Furthermore, the report included upward revisions to previous months’ data, with the total jobs added in July and August being revised higher by 72,000. This suggests that the labor market is stronger than previously thought, and that the earlier weakness may have been overstated. The labor force participation rate has also been rising, indicating that more people are returning to the workforce after having left during the pandemic.

This strong labor market data has important implications for Federal Reserve policy. In particular, the report has led to a shift in market expectations for future rate cuts. Prior to the report, markets had been pricing in the possibility of a 50 basis point rate cut at the November or December FOMC meeting. However, following the strong jobs data, those expectations were dialed back, with markets now pricing in a more measured 25 basis point cut.

The Federal Reserve’s decision-making process is highly data-dependent, and the strong jobs report suggests that the economy is not in immediate danger of a sharp slowdown. While inflation remains a concern, the Fed is likely to take a cautious approach to rate cuts in order to prevent the economy from overheating and reigniting inflationary pressures.

The labor market’s strength is also a key factor in supporting consumer spending, which is a critical driver of economic growth in the U.S. economy. With more people employed and wage growth remaining strong, consumer spending is likely to remain resilient in the coming months, helping to support overall economic growth.

4. Geopolitical Risks and Their Impact on Markets

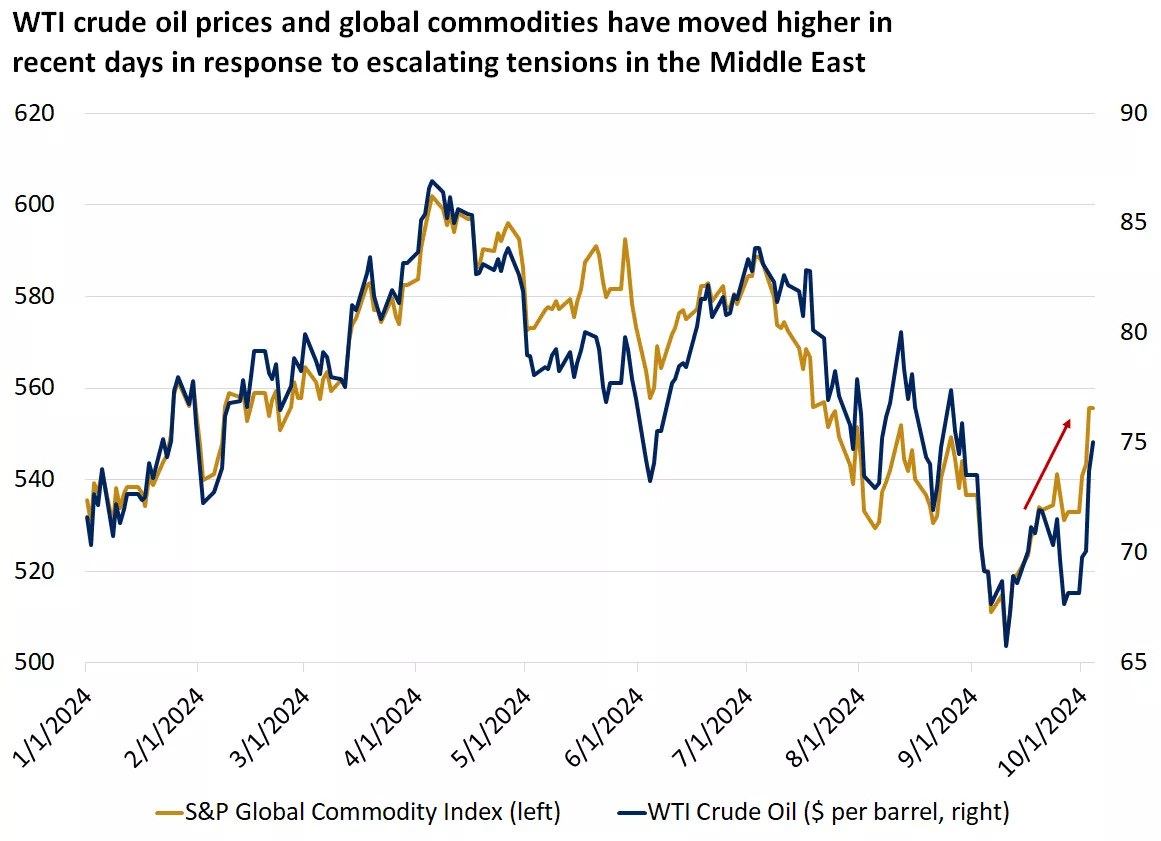

In addition to domestic economic factors, global geopolitical risks have played an increasingly important role in shaping market dynamics. In recent weeks, tensions in the Middle East have escalated, with Iran and Israel facing off in a series of missile strikes. These developments have raised concerns about the stability of the region and the potential for further disruptions to global oil and energy supplies.

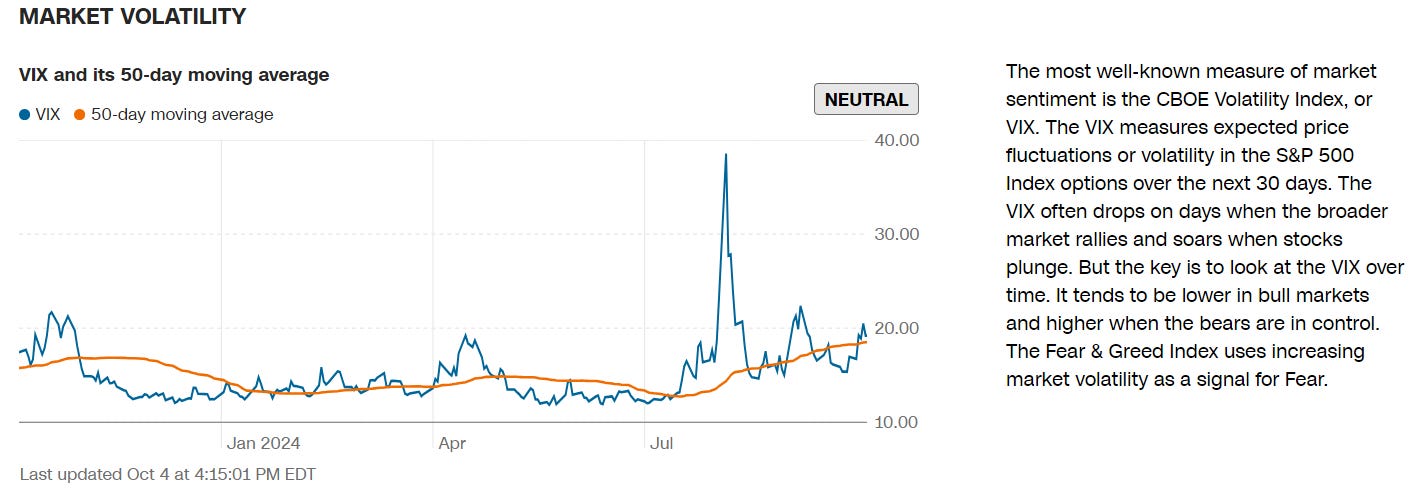

Geopolitical risks tend to have a significant impact on markets, particularly when they involve key regions like the Middle East, which is a major producer of oil. When tensions rise in the region, markets often respond by pushing up oil prices and increasing demand for safe-haven assets like gold and U.S. Treasury bonds. This was the case earlier in the week, when oil prices surged by over 10%, and the Cboe Volatility Index (VIX) spiked higher.

However, as the week progressed, some of these safe-haven trades unwound. Treasury yields and gold prices declined, and the VIX index moved lower, indicating that markets had become less concerned about an immediate escalation in the Middle East. Despite this, oil prices have remained elevated, as the risk of supply disruptions continues to loom large.

Oil prices are a critical driver of inflation, as higher energy costs tend to filter through to the broader economy, increasing the prices of goods and services. This, in turn, can put pressure on the Federal Reserve to keep interest rates higher for longer, as it seeks to prevent inflation from rising. The recent increase in oil prices, therefore, adds another layer of complexity to the Fed’s decision-making process.

In the longer term, geopolitical risks will continue to be an important factor for markets to monitor. While the risk of a major escalation in the Middle East remains a “tail risk” event for now, any further deterioration in the situation could have far-reaching implications for global markets. In particular, a significant disruption to oil supplies could send prices even higher, leading to a renewed inflationary surge and forcing central banks to adopt more hawkish policies.

At the same time, geopolitical tensions in other parts of the world, including Eastern Europe and Asia, also have the potential to impact markets. In an interconnected global economy, the risks of economic contagion from one region to another are high, and market participants will need to remain vigilant to these developments.

5. U.S. Elections and Their Impact on Market Volatility

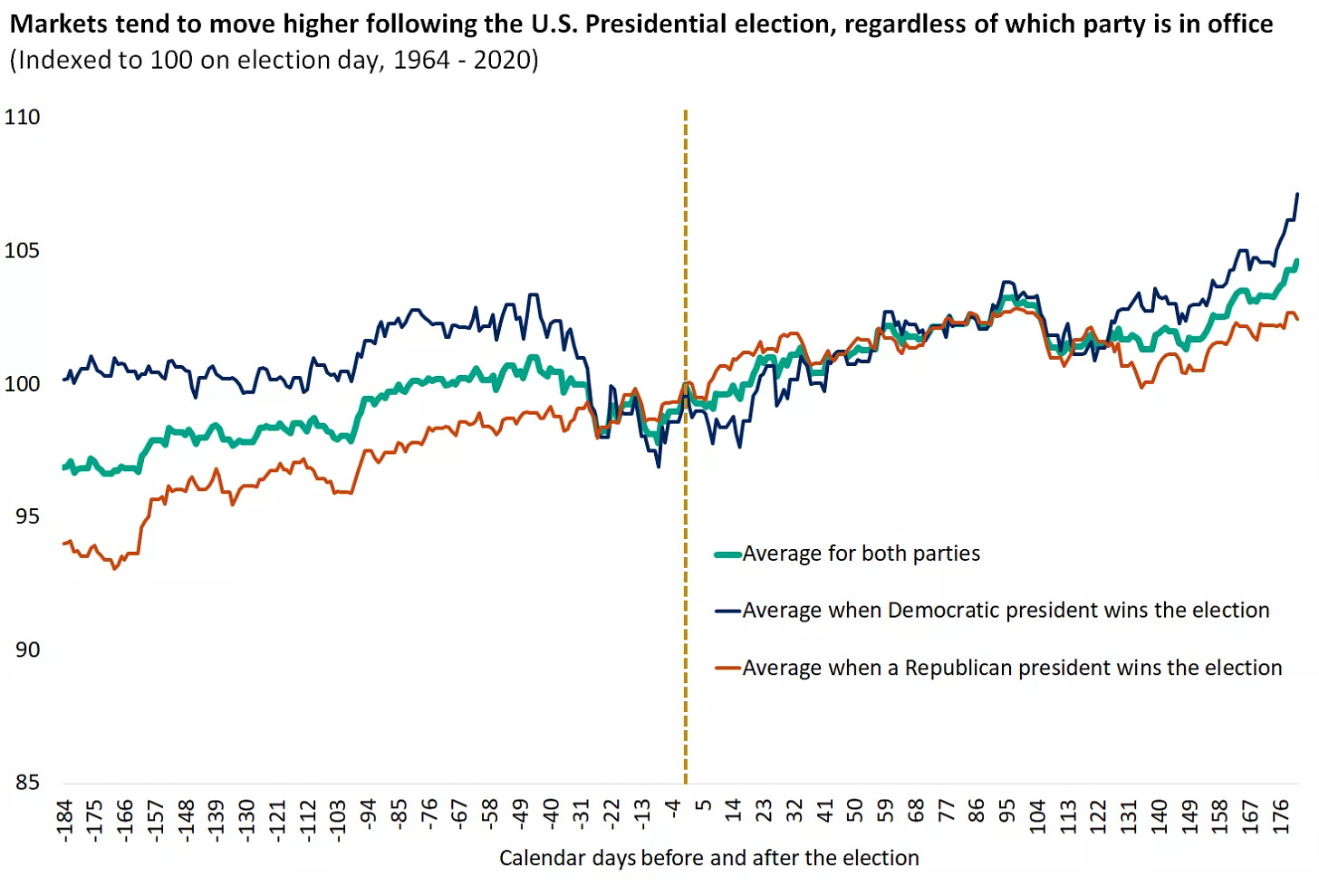

With less than five weeks remaining until the U.S. presidential election, markets are beginning to factor in the potential implications of the election outcome. Historically, U.S. stock markets have tended to experience increased volatility in the weeks leading up to an election, as uncertainty about the outcome creates anxiety among investors.

However, it is also worth noting that markets tend to recover after the election, regardless of which party wins. This is because once the uncertainty of the election is removed, investors can refocus on the fundamentals of the economy and markets. In the weeks following Election Day, stock markets often post gains as the political uncertainty subsides.

This year’s election is particularly important given the tight margins in key swing states and the potential for policy shifts depending on which party wins control of the White House and Congress. Key issues such as fiscal policy, tax rates, and regulation are all on the line, and the outcome of the election could have significant implications for sectors such as healthcare, energy, and technology.

In the run-up to the election, markets may continue to experience bouts of volatility, as polling data and political developments shift the perceived likelihood of different outcomes. For investors, this volatility presents both risks and opportunities. In times of heightened uncertainty, it is often wise to maintain a diversified portfolio and avoid making drastic moves based on short-term political developments.

6. Market Fundamentals: Earnings, Inflation, and Economic Growth

Despite the various risks and uncertainties facing markets, the underlying fundamentals of the U.S. economy remain solid. Earnings growth for companies in the S&P 500 has been strong, with analysts projecting year-over-year growth of 4.2% for the third quarter. This marks the fifth consecutive quarter of earnings growth, reflecting the resilience of corporate America despite the challenges posed by inflation and rising interest rates.

At the same time, inflation has begun to moderate after surging in the post-pandemic period. The Consumer Price Index (CPI) for August showed an annual inflation rate of 2.5%, down from its peak earlier in the year. This is the lowest inflation reading since February 2021, and it suggests that the Fed’s efforts to tame inflation are starting to bear fruit.

Looking ahead, the Federal Reserve is expected to continue lowering interest rates through 2025, which should provide further support to the economy. As rates come down, borrowing costs for consumers and businesses will decline, helping to stimulate spending and investment. This is particularly important for sectors such as housing and construction, which are highly sensitive to changes in interest rates.

Consumer spending, which accounts for nearly 70% of U.S. GDP, remains a key driver of economic growth. With wage growth remaining elevated and employment levels strong, consumers are likely to continue spending at healthy levels. This, in turn, should support trend-like economic growth through 2025, even as other parts of the economy, such as manufacturing and exports, face headwinds.

The risk of a recession remains low, as the cyclical sectors of the economy do not appear to be overextended, and there is little evidence of an economic bubble or external shock that could derail the current expansion. While geopolitical risks and the upcoming election present challenges, the fundamentals of the U.S. economy remain strong, and markets are well-positioned to climb past near-term uncertainties.

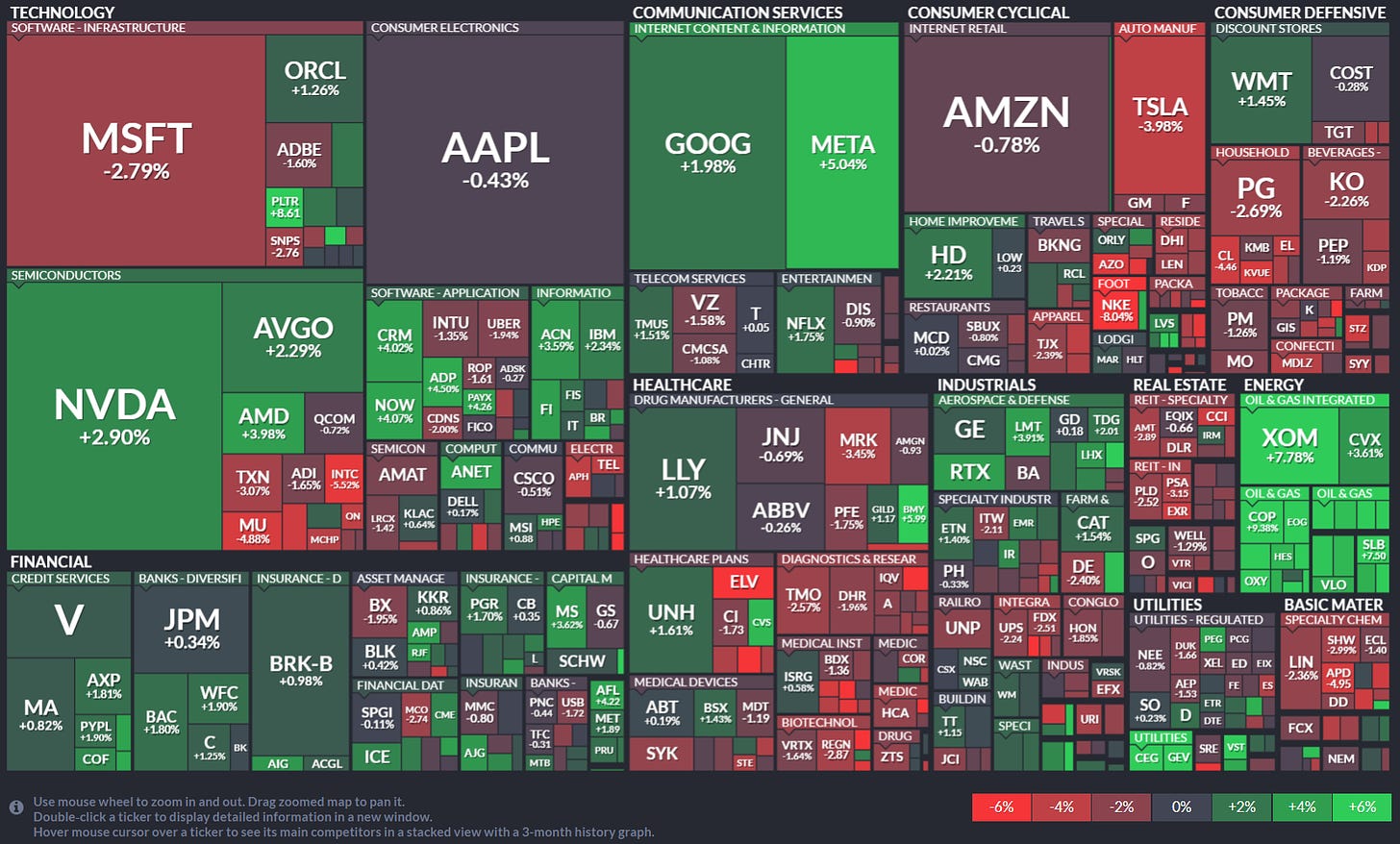

Last Week At A Glance

Week-Over-Week Snapshots

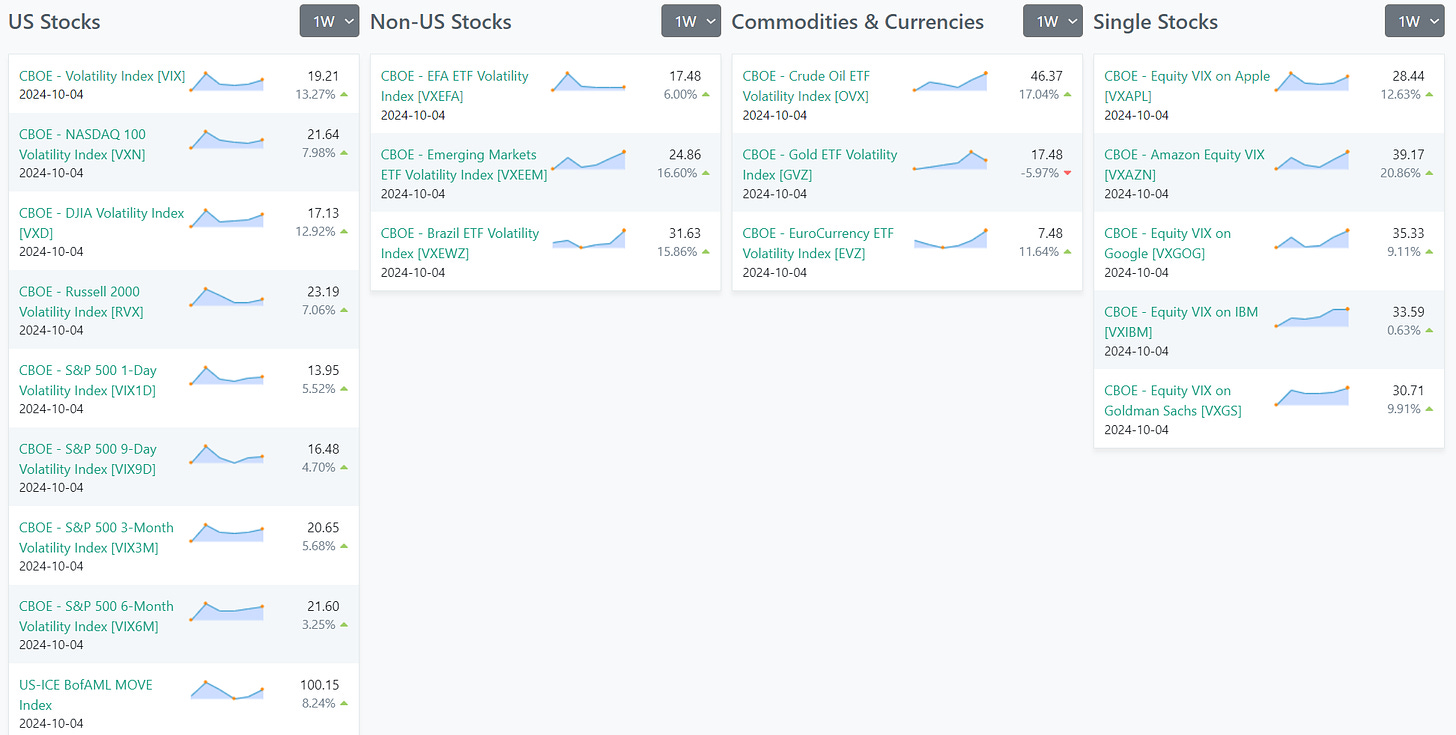

Volatility

US Stocks: Volatility indices for US stocks, such as the VIX (CBOE Volatility Index) and the volatility indices for major indices like the NASDAQ 100 (VXN), DJIA (VXD), and Russell 2000 (RVX), all show notable increases in volatility. The VIX is up by 13.27%, and other indices like the NASDAQ 100 and DJIA are also experiencing strong upward moves. This suggests rising uncertainty in US stock markets over the past week.

Non-US Stocks: There is also a notable increase in volatility for international equity ETFs like the EFA and emerging markets (VXEEM). The volatility in emerging markets stands out with a sharp increase of 16.60%, indicating higher perceived risks or market fluctuations in these regions.

Commodities & Currencies: Volatility in commodities and currencies is mixed. Crude oil (OVX) saw a significant rise in volatility (17.04%), while the gold volatility index (GVZ) dropped by 5.97%. This could reflect differing expectations around energy markets versus precious metals. The EuroCurrency volatility index (EVZ) also showed a moderate increase, possibly indicating higher currency market volatility.

Single Stocks: Individual stocks like Apple, Amazon, and Google have seen marked increases in their respective volatility indices, with Amazon showing the largest increase (20.86%). This suggests heightened uncertainty or market movement expectations around these major stocks.

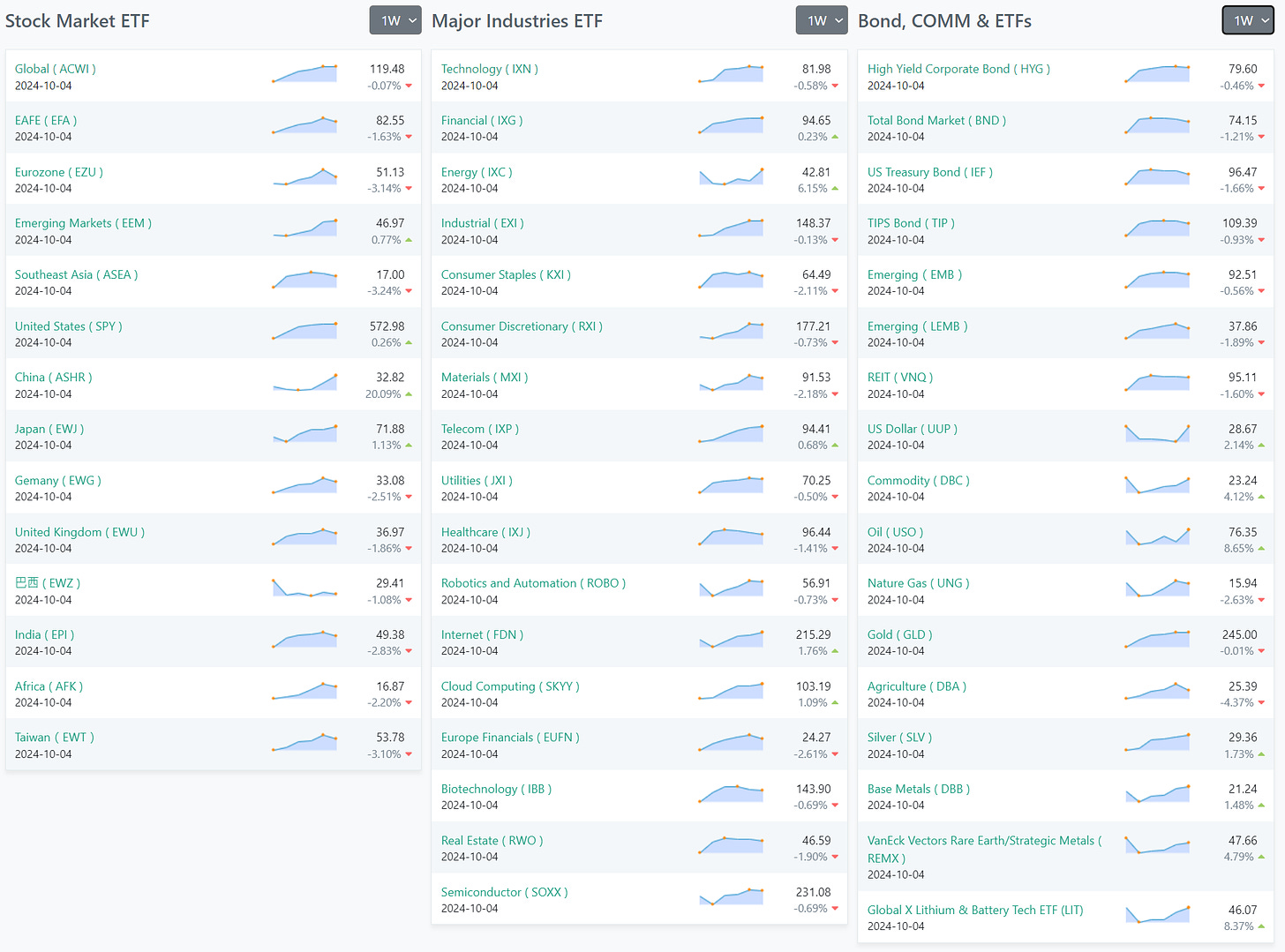

ETFs

This week’s performance in major ETFs shows a mix of gains and losses across global markets and sectors. China (ASHR) led the pack with a remarkable +20.99% rally, while other regions like India (-2.83%), Taiwan (-3.10%), and Germany (-2.51%) experienced notable declines. US markets (SPY) remained stable with a slight +0.26% gain. In major industries, Energy (+6.15%) stood out with strong gains, driven by rising oil prices, while sectors like Consumer Staples (-2.11%) and Materials (-2.18%) saw declines. Bond and commodity markets were mixed, with US Treasury bonds showing small gains, while commodities like Oil (+4.80%) rose and Agriculture (-4.37%) declined. Overall, market sentiment appears divided, with strength in Chinese equities and energy contrasted by broader weakness in defensive and emerging markets.

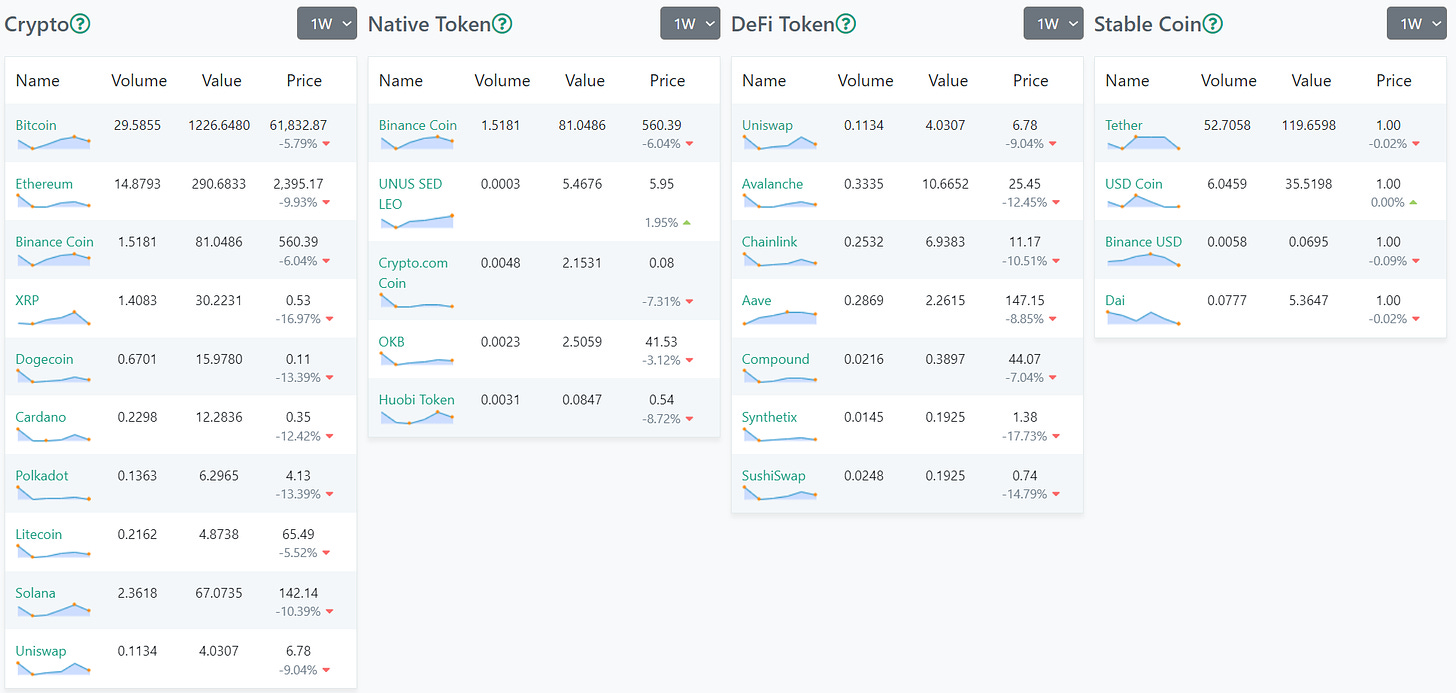

Crypto

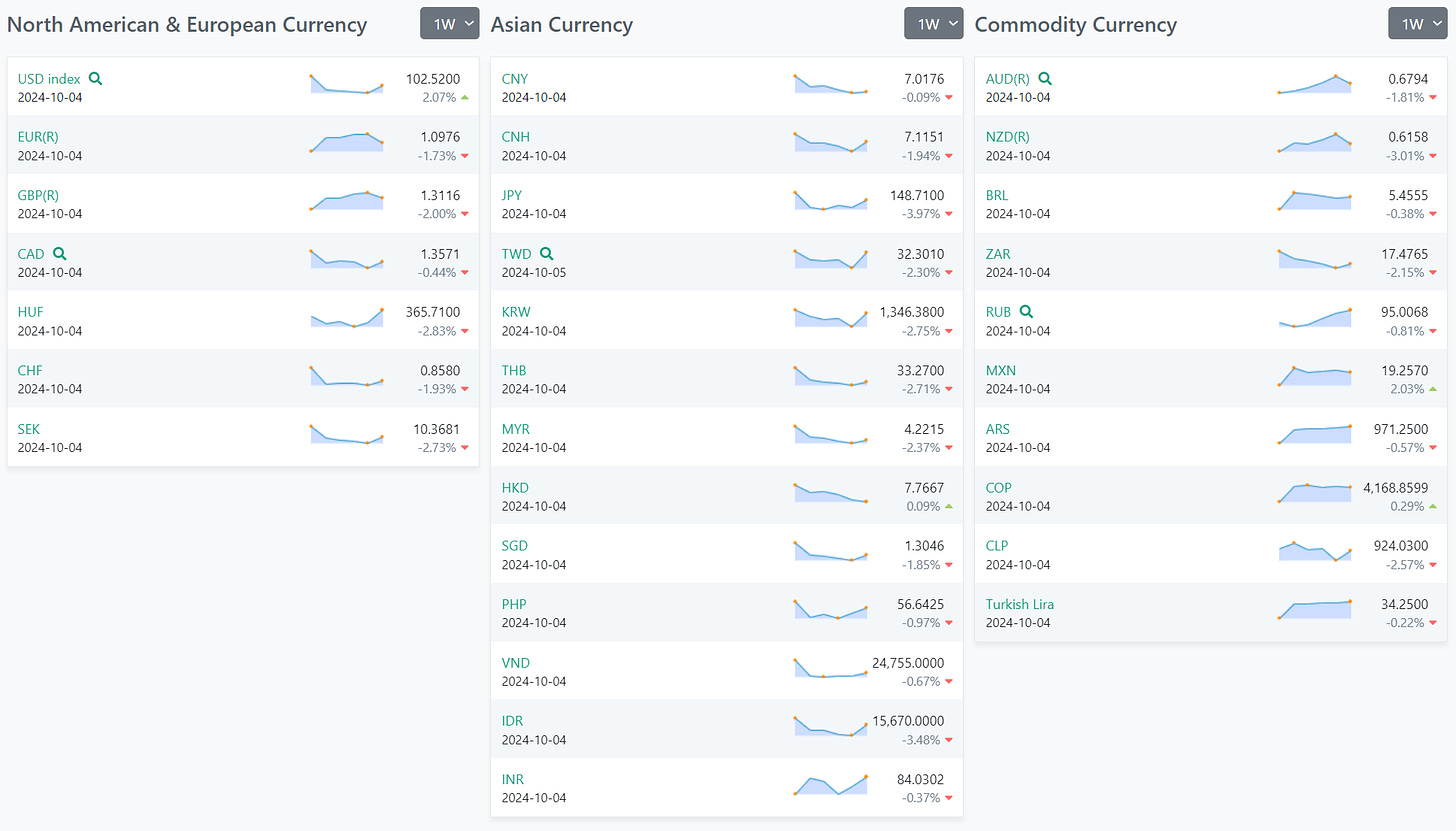

Forex

This week’s performance in Forex markets shows a broad strengthening of the US Dollar (+2.07%), which outperformed many global currencies, signaling a flight to safety or a reflection of central bank policy divergence. In Europe, the Euro (-1.73%) and British Pound (-2.00%) both weakened significantly, while the Swiss Franc (-1.93%) and Swedish Krona (-2.73%) also saw notable declines, likely driven by economic challenges in the region. Among Asian currencies, the Japanese Yen (-3.97%) experienced a sharp drop, reflecting Japan's ongoing monetary easing. The Chinese Yuan (CNY) was relatively stable (-0.09%), but the offshore CNH weakened more sharply (-1.94%). Other Asian currencies like the South Korean Won (-2.75%), Taiwan Dollar (-2.30%), and Thai Baht (-2.71%) also saw significant declines, indicating broader regional economic stress. In commodity-linked currencies, the Australian Dollar (-1.81%) and New Zealand Dollar (-3.01%) both weakened, while the Canadian Dollar was more resilient with only a slight drop (-0.44%). Overall, the strength of the US Dollar and weakness across Europe and Asia suggest heightened market caution and shifting economic dynamics.

US Investor Sentiment

%Bull-Bear Spread

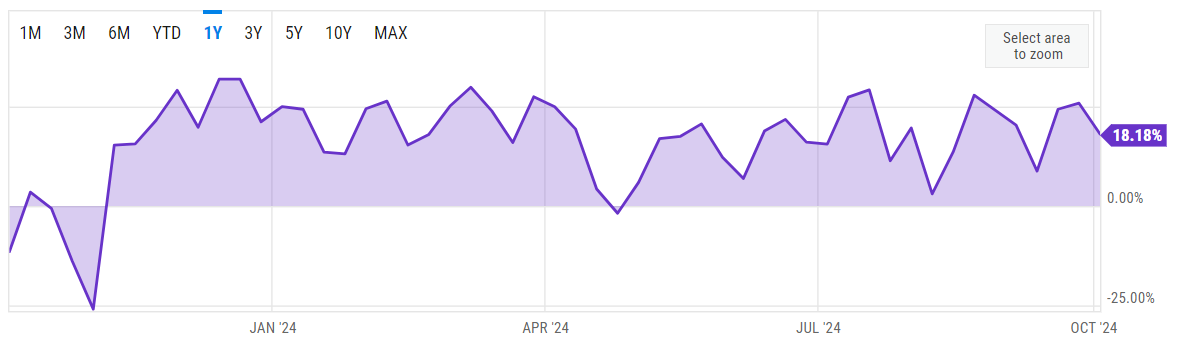

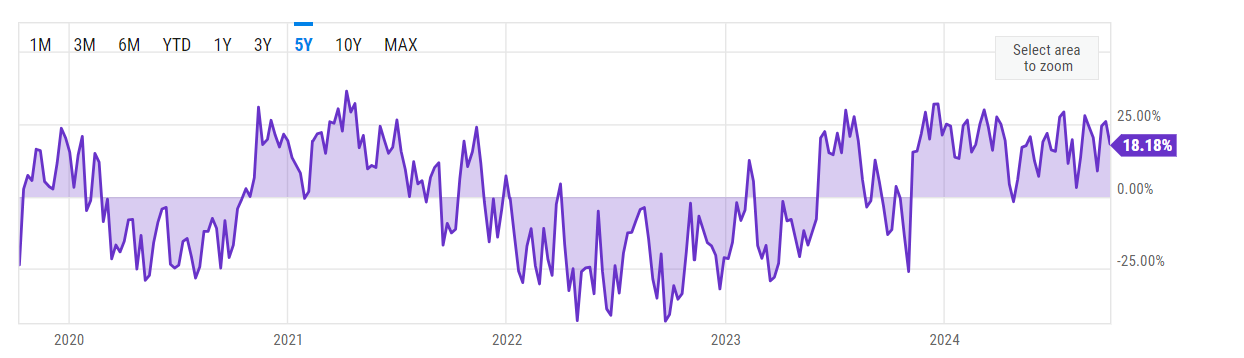

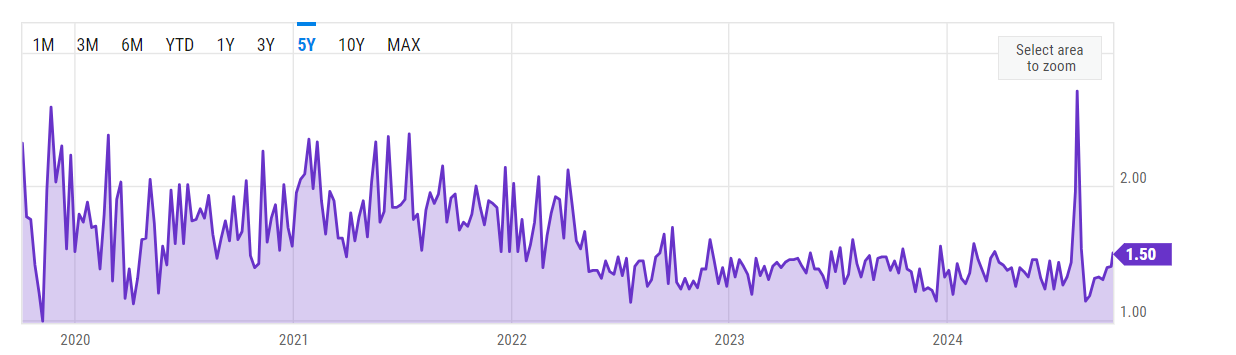

US Investor Sentiment, % Bull-Bear Spread is at 18.18%, compared to 25.94% last week and -13.15% last year. This is higher than the long-term average of 6.72%.

1-Year View

5-Year View

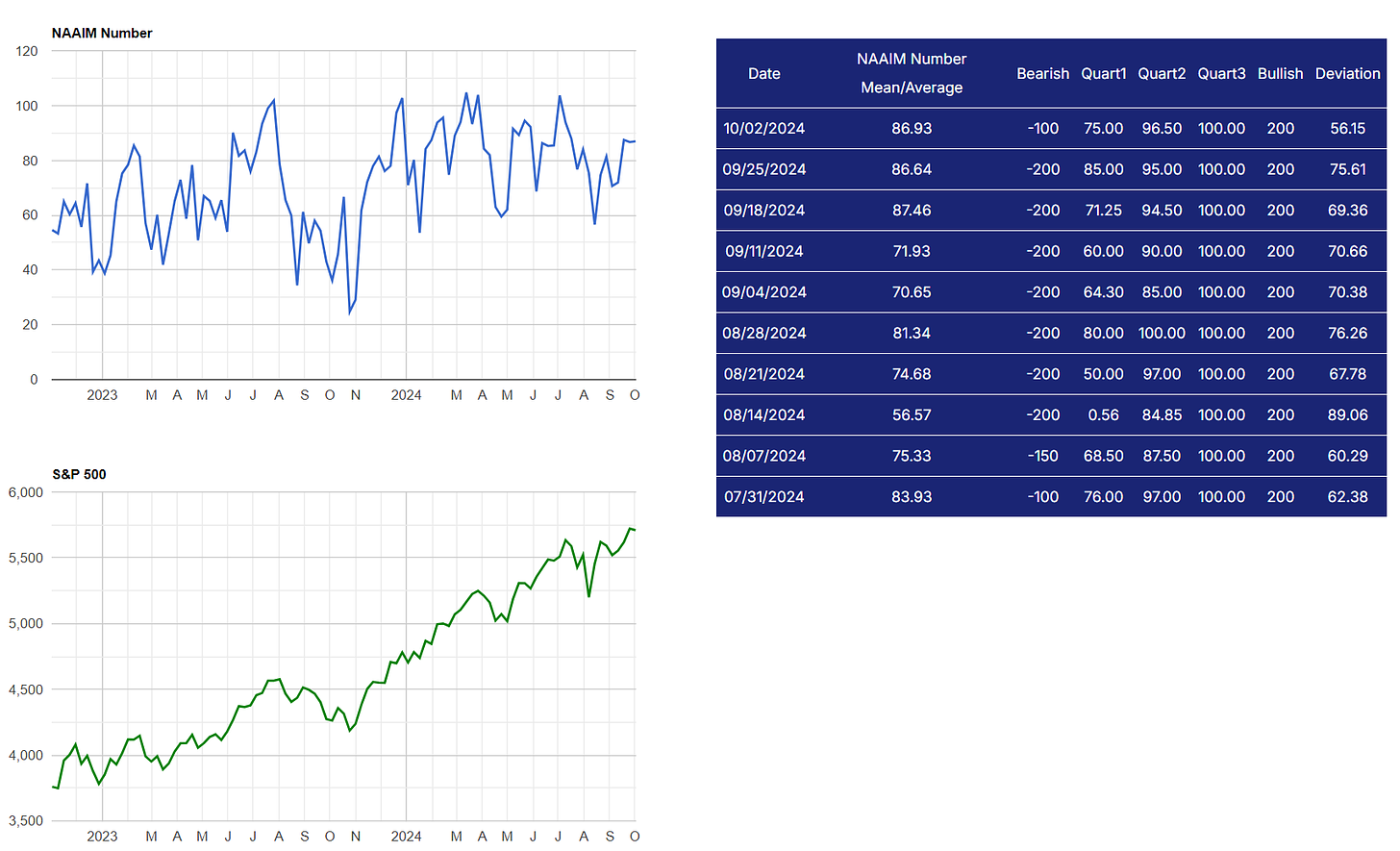

NAAIM Exposure Index

The NAAIM Exposure Index (National Association of Active Investment Managers Exposure Index) measures the average exposure to U.S. equity markets as reported by its member firms. These are typically active money managers who provide their equity exposure levels weekly. The index offers insight into how much these managers are investing in equities at any given time, ranging from being fully short (-100%) to leveraged long (up to +200%).

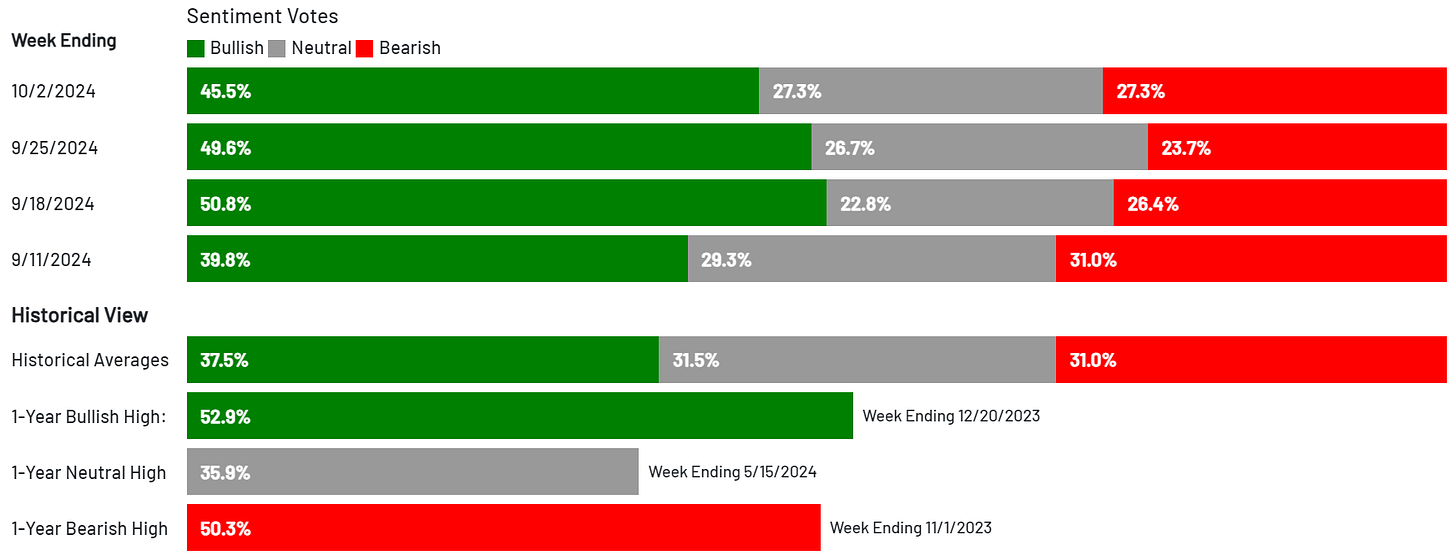

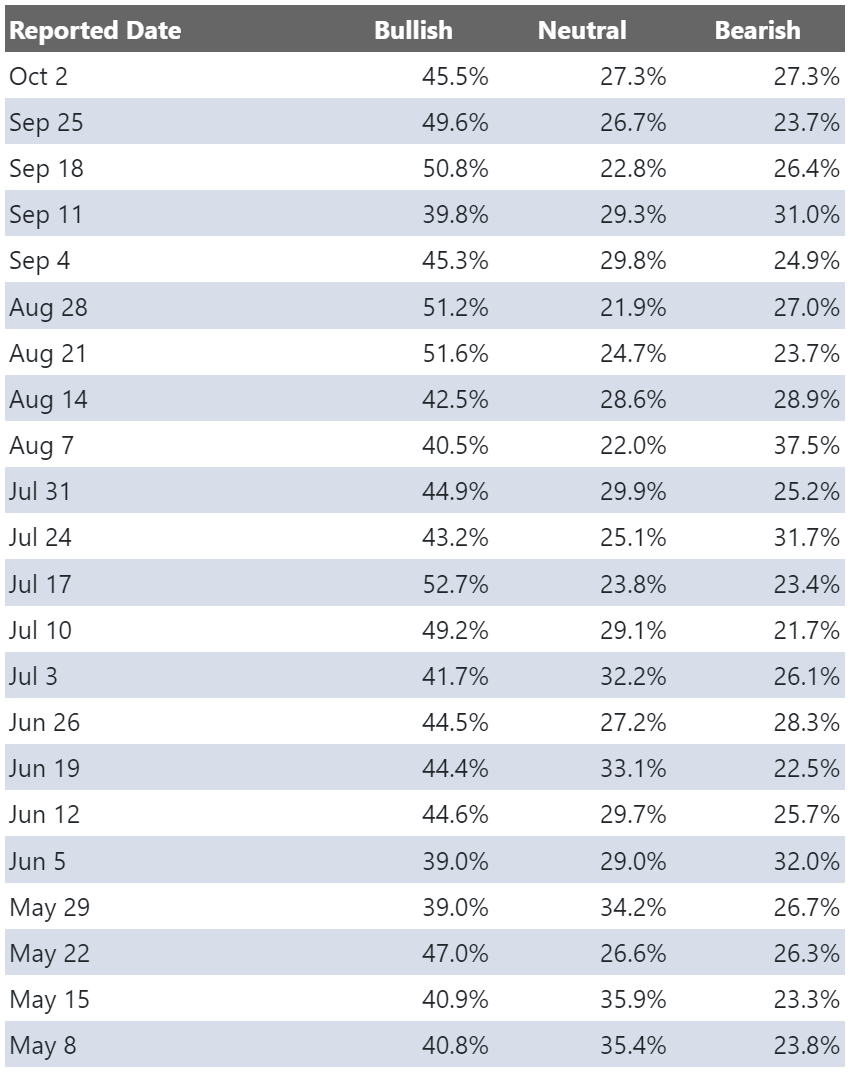

AAII Investor Sentiment Survey

The AAII Investor Sentiment Survey is a weekly survey conducted by the American Association of Individual Investors (AAII) to gauge the mood of individual investors regarding the direction of the stock market over the next six months. It provides insights into whether investors are feeling bullish (expecting the market to rise), bearish (expecting the market to fall), or neutral (expecting the market to stay about the same).

Key Points:

Bullish Sentiment: Reflects the percentage of investors who believe the stock market will rise in the next six months.

Bearish Sentiment: Represents those who expect a decline.

Neutral Sentiment: Reflects investors who anticipate little to no market movement.

The survey is widely followed as a contrarian indicator, meaning that extreme levels of bullishness or bearishness can sometimes signal market turning points. For example, when a large number of investors are overly optimistic (high bullish sentiment), it could suggest a market top, while excessive pessimism (high bearish sentiment) may indicate a market bottom is near.

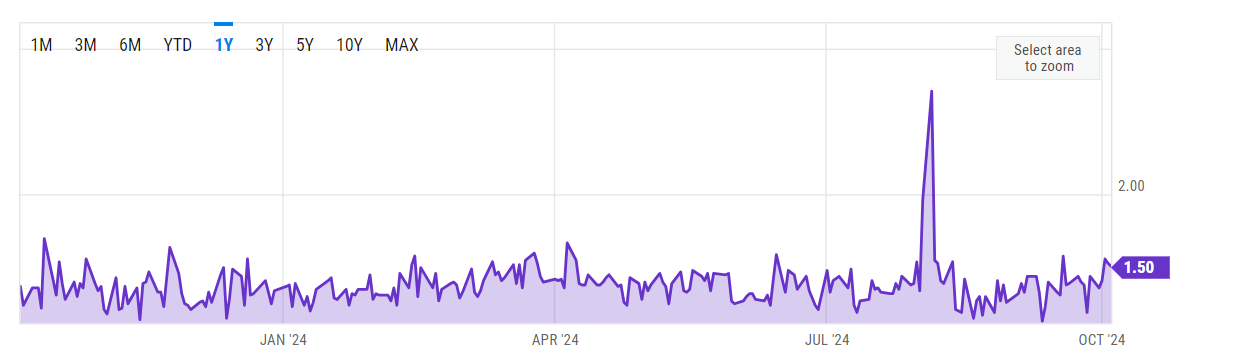

SPX Put/Call Ratio

The SPX Put/Call Ratio is an indicator that is used to gauge market sentiment. This is calculated as the ratio between trading S&P 500 put options and S&P call options. A high put/call ratio can indicate fear in the markets, while a low ratio indicates confidence. For example, in 2015, the Put-Call ratio was as high as 3.77 because of market fears stemming from various global economic issues like a GDP growth slowdown in China and a Greek debt default.

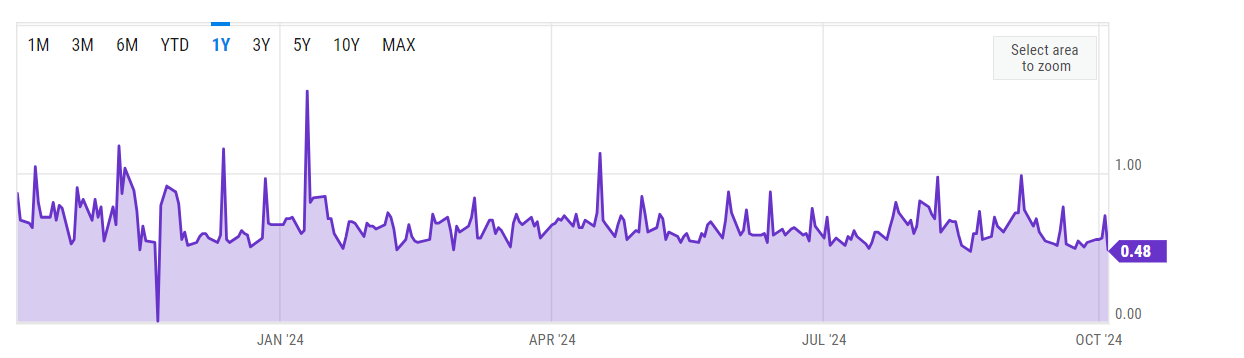

1-Year View

5-Year View

CBOE Equity Put/Call Ratio

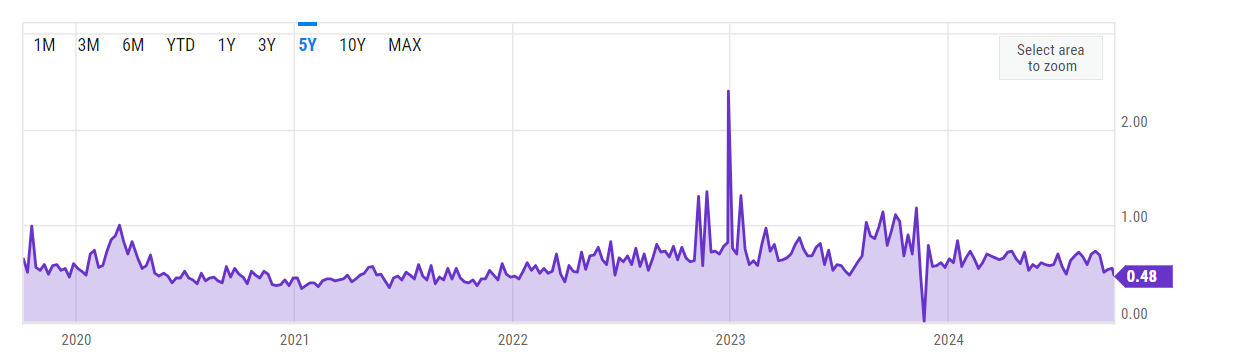

1-Year View

5-Year View

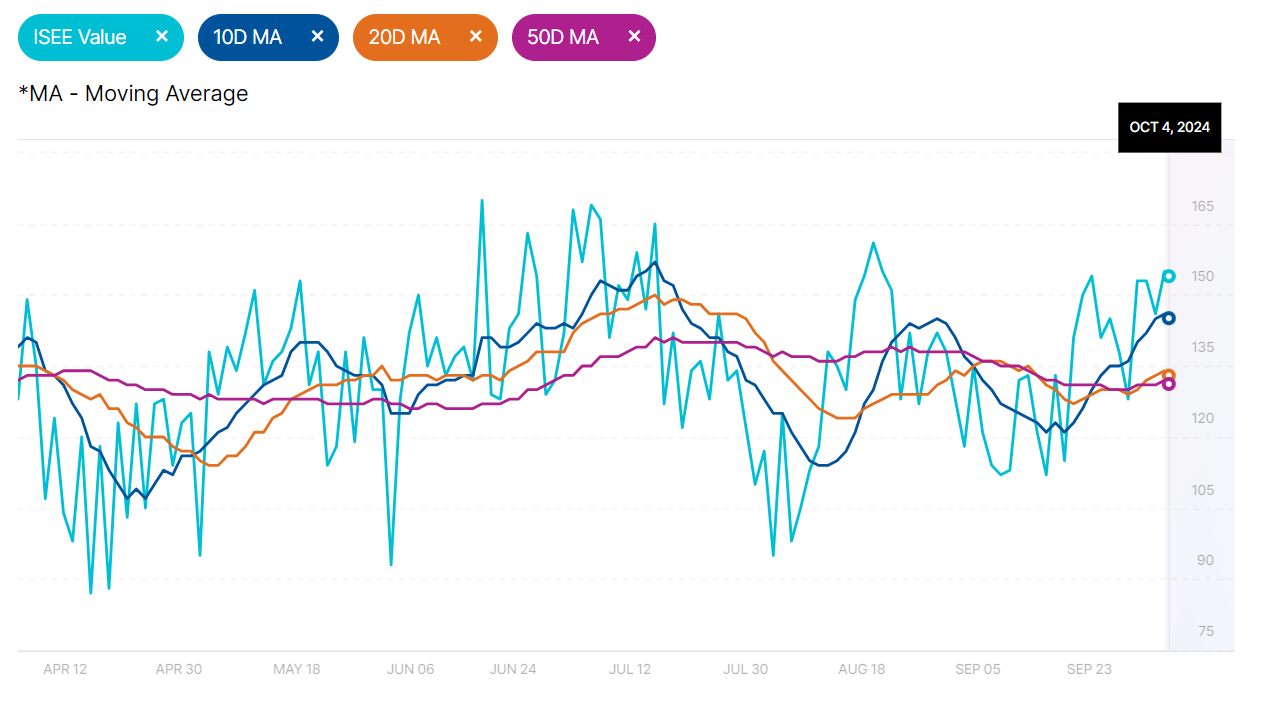

ISEE Sentiment Index

The ISEE (International Securities Exchange Sentiment) Index is a measure of investor sentiment derived from options trading. Unlike traditional put/call ratios, the ISEE Index focuses only on opening long customer transactions and is adjusted to remove market-maker and firm trades, providing a purer sentiment reading.

The ISEE Index typically ranges from 0 to 200, with readings above 100 indicating more call options being bought relative to put options, suggesting bullish sentiment. Conversely, readings below 100 suggest bearish sentiment, with more puts being purchased relative to calls.

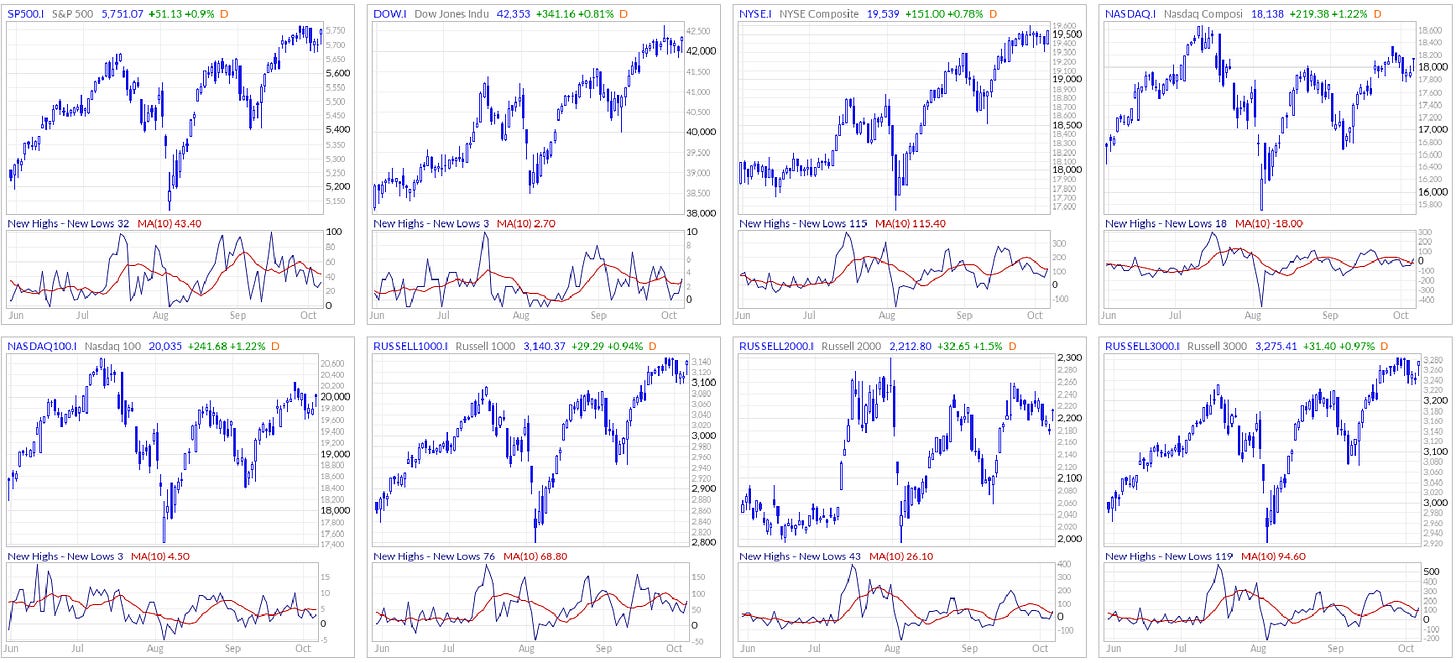

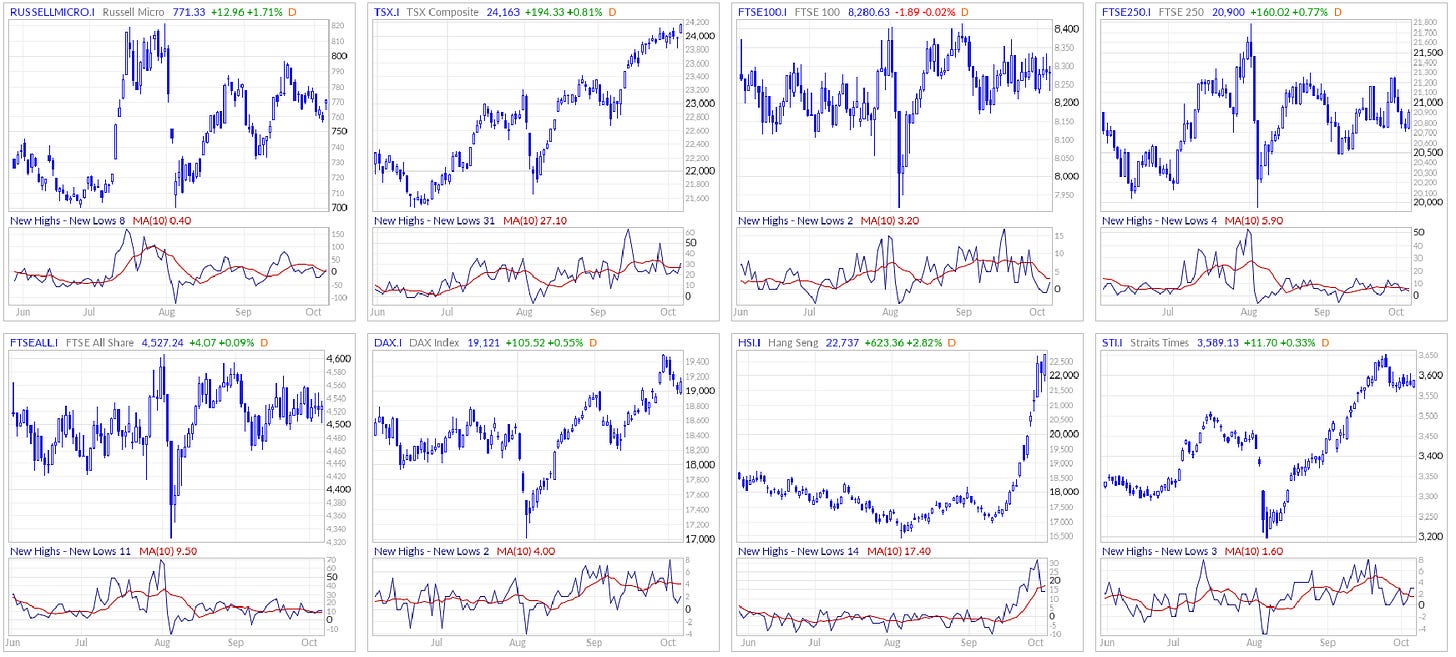

New Highs - New Lows

The New Highs - New Lows indicator (NH-NL) displays the daily difference between the number of stocks reaching new 52-week highs and the number of stocks reaching new 52-week lows. The NH-NL indicator generally reaches its extreme lows slightly before a major market bottom. As the market then turns up from the major bottom, the indicator jumps up rapidly. During this period, many new stocks are making new highs because it's easy to make a new high when prices have been depressed for a long time. The NH-NL indicator oscillates around zero. If the indicator is positive, the bulls are in control. If it is negative, the bears are in control. As the cycle matures, a divergence often occurs as fewer and fewer stocks are making new highs (the indicator falls), yet the market indices continue to reach new highs. This is a classic bearish divergence that indicates that the current upward trend is weak and may reverse.

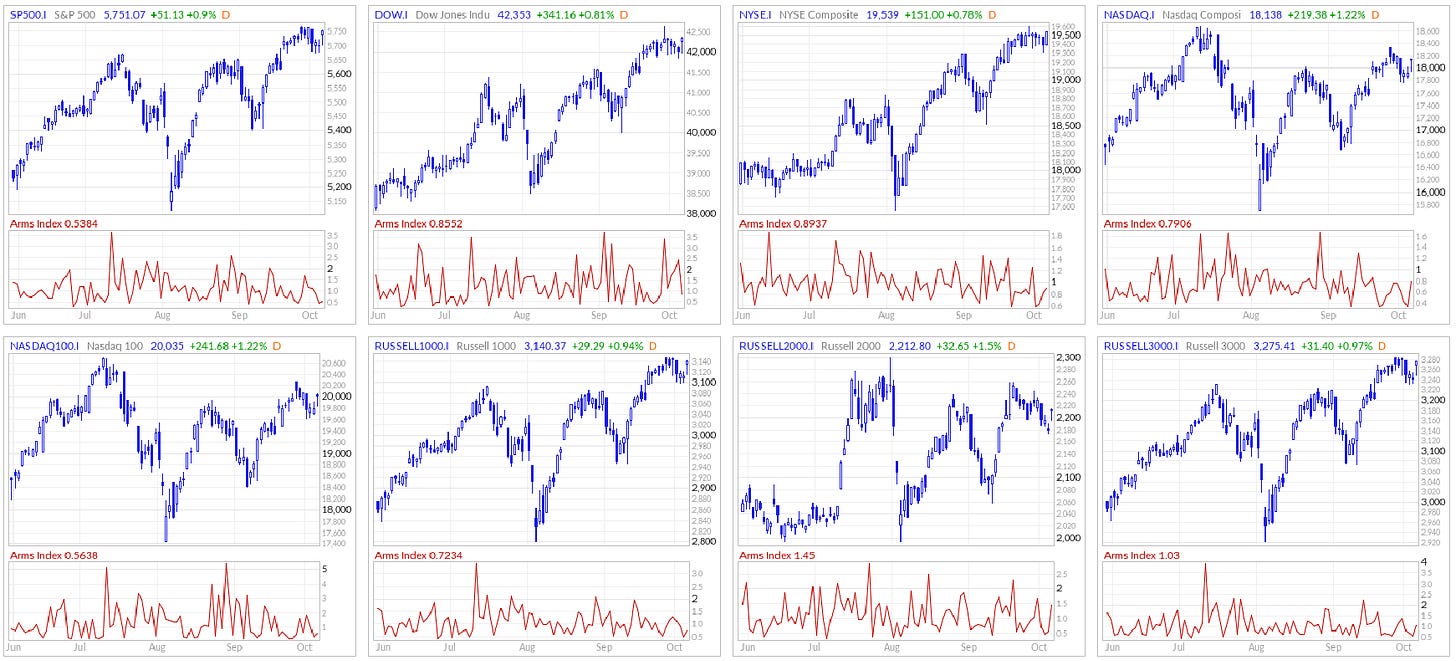

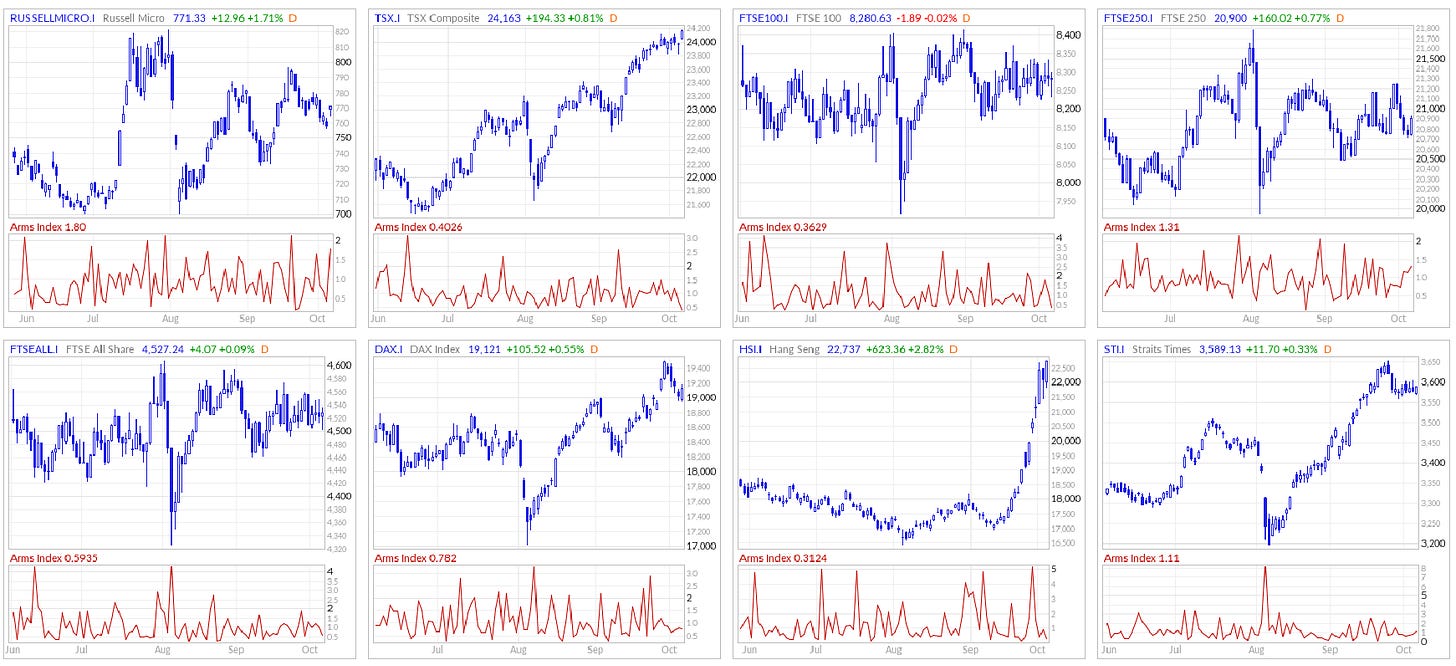

ARMS Index

The Arms Index, also known as the TRIN (Short-Term TRading INdex), was developed by Richard Arms in the 1960s. It is calculated by dividing the ratio of advancing stocks to declining stocks by the ratio of advancing volume to declining volume. Interpreting the Arms Index involves looking at its value in relation to certain thresholds. A value below "1" is considered bullish, indicating that advancing stocks and volume dominate the market. Conversely, a value above "1" is considered bearish, suggesting that declining stocks and volume are more prevalent. Extremely low values (below 0.5) or high values (above 2) are often seen as potential reversal signals.

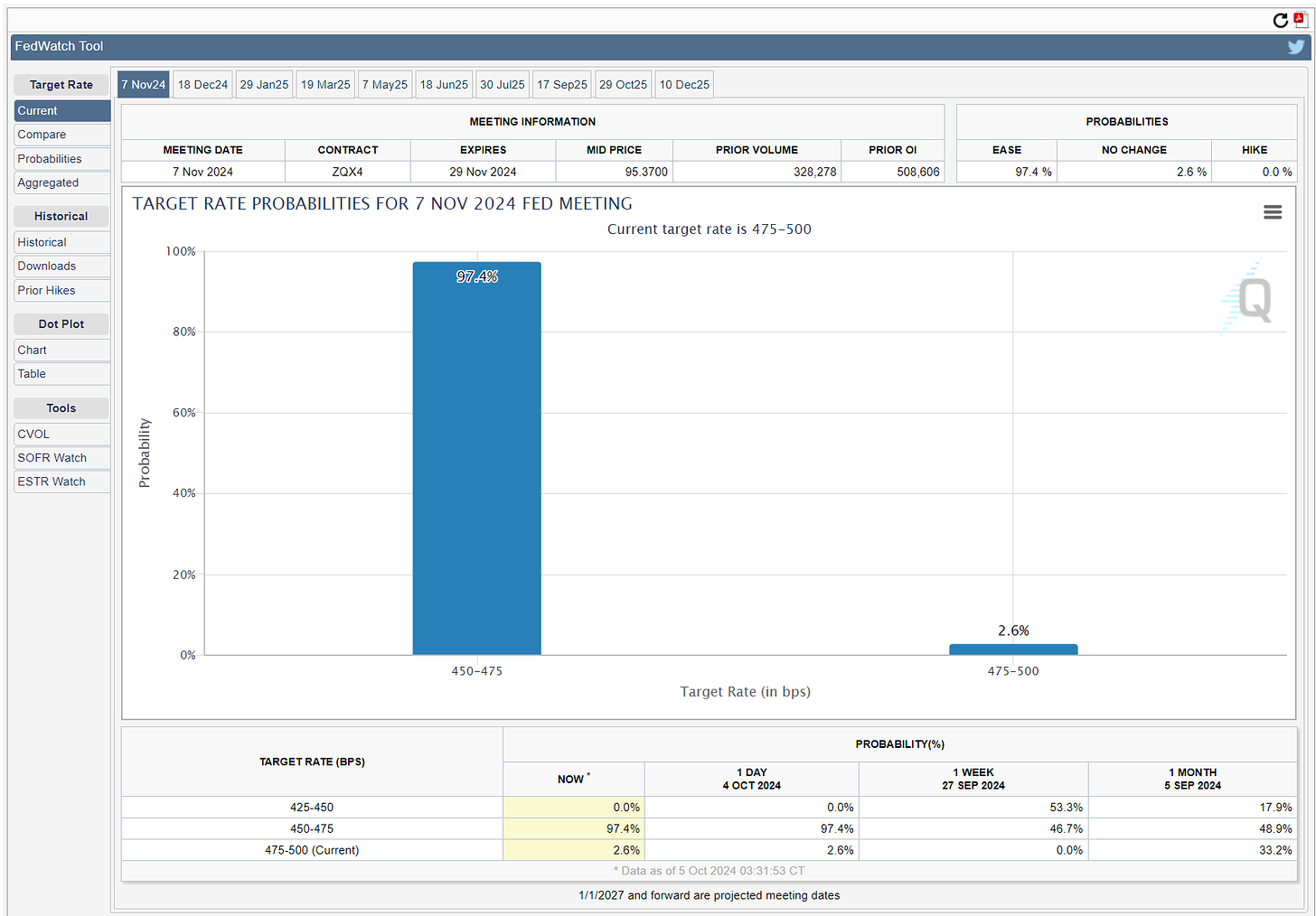

CME Fedwatch

What is the likelihood that the Fed will change the Federal target rate at upcoming FOMC meetings, according to interest rate traders? Use CME FedWatch to track the probabilities of changes to the Fed rate, as implied by 30-Day Fed Funds futures prices.

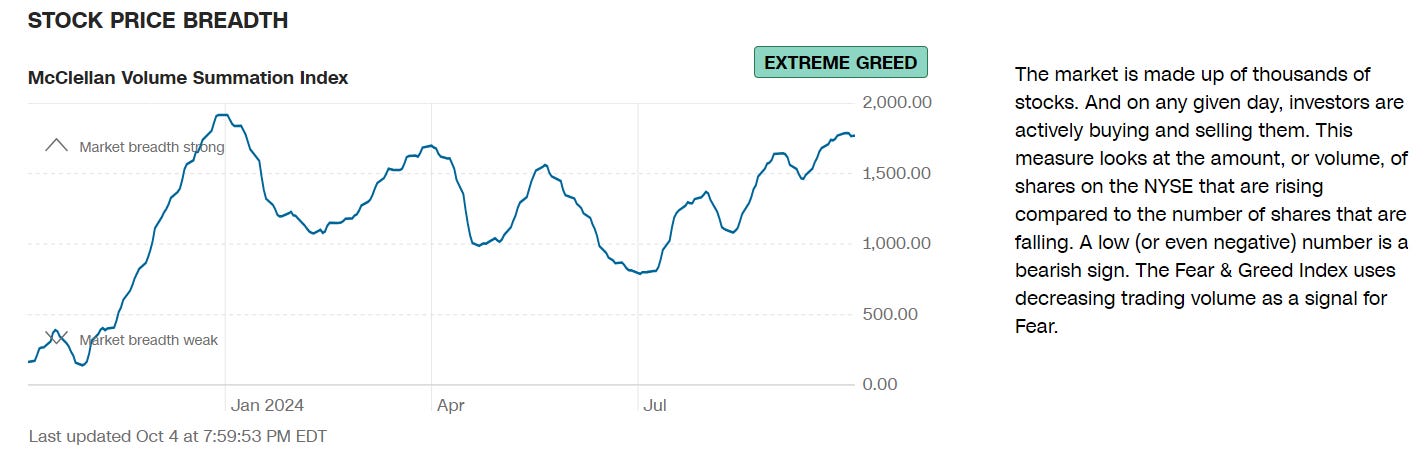

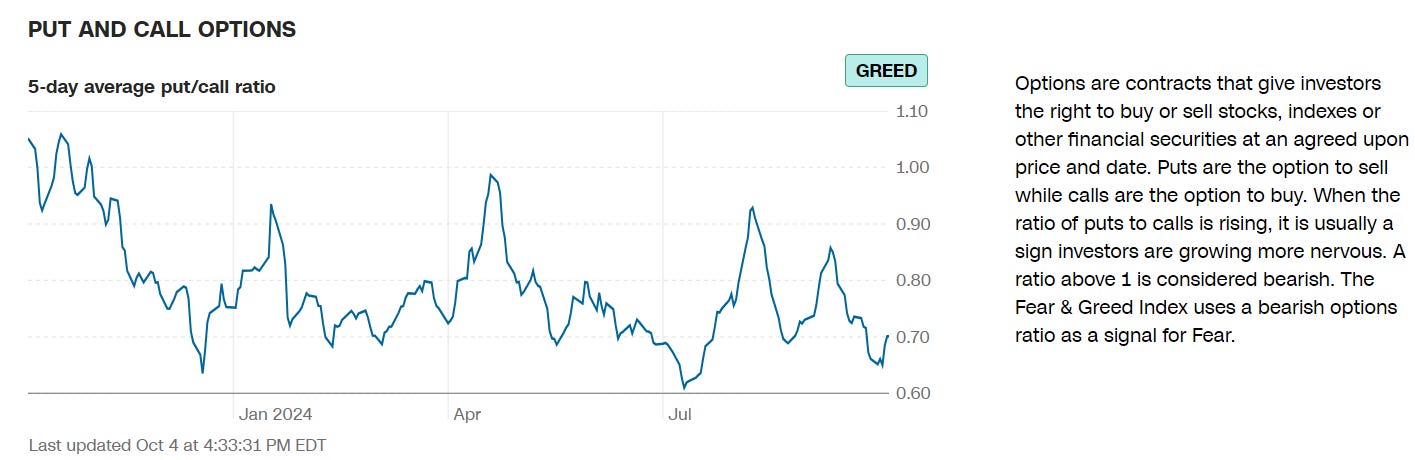

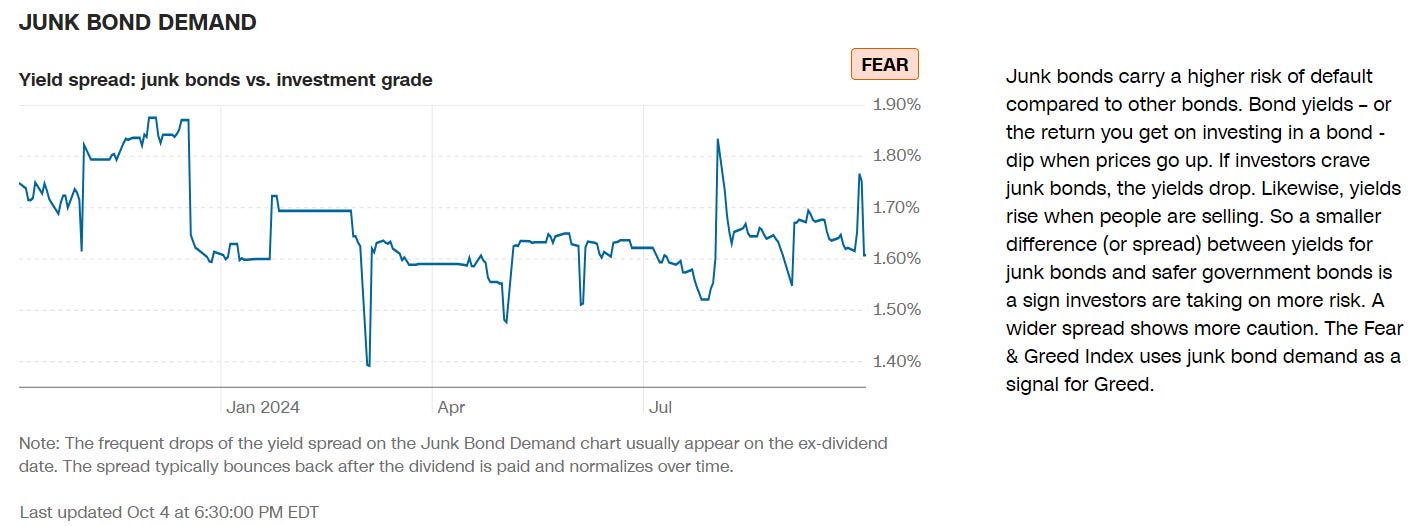

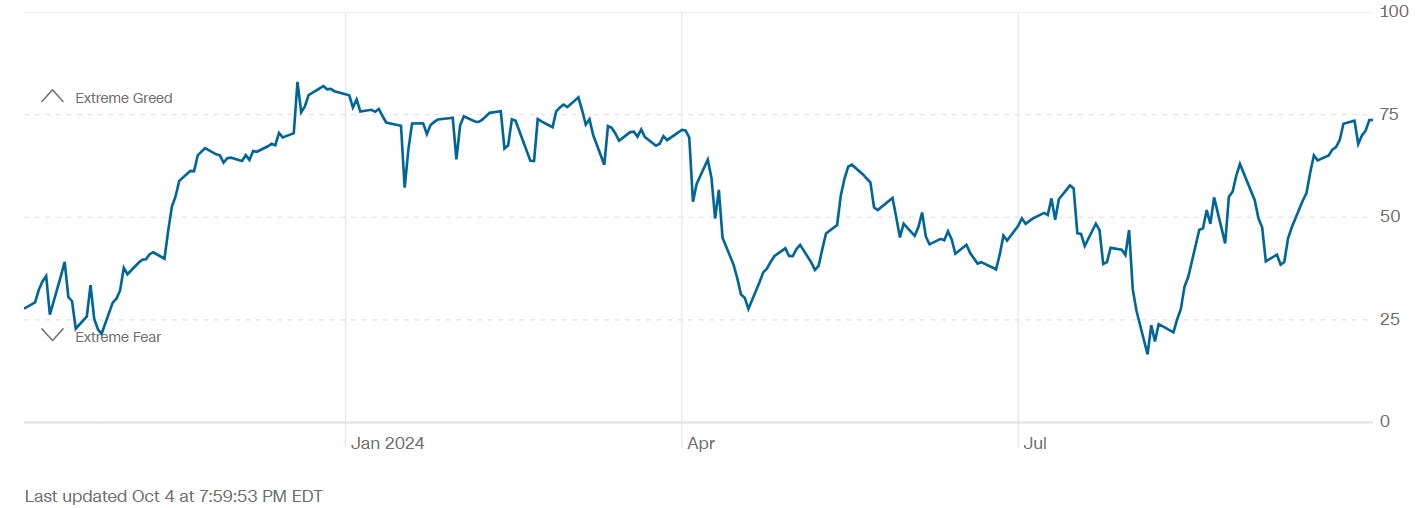

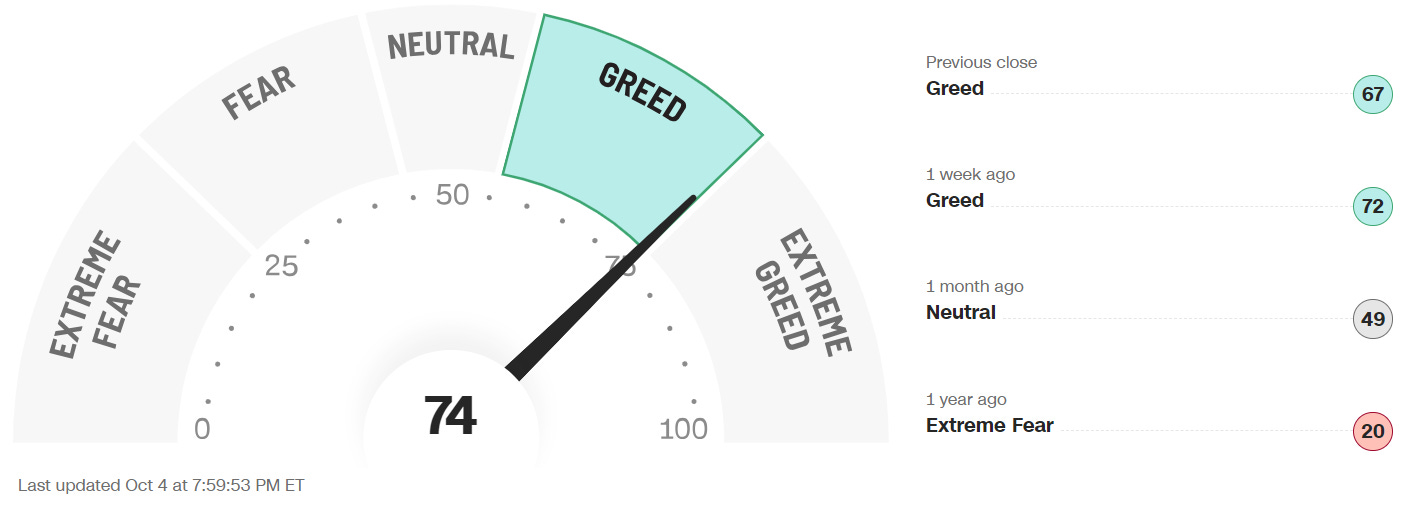

CNN 7 Fear & Greed Constituent Data Points + Composite Index

Final Composite Fear & Greed Index Reading

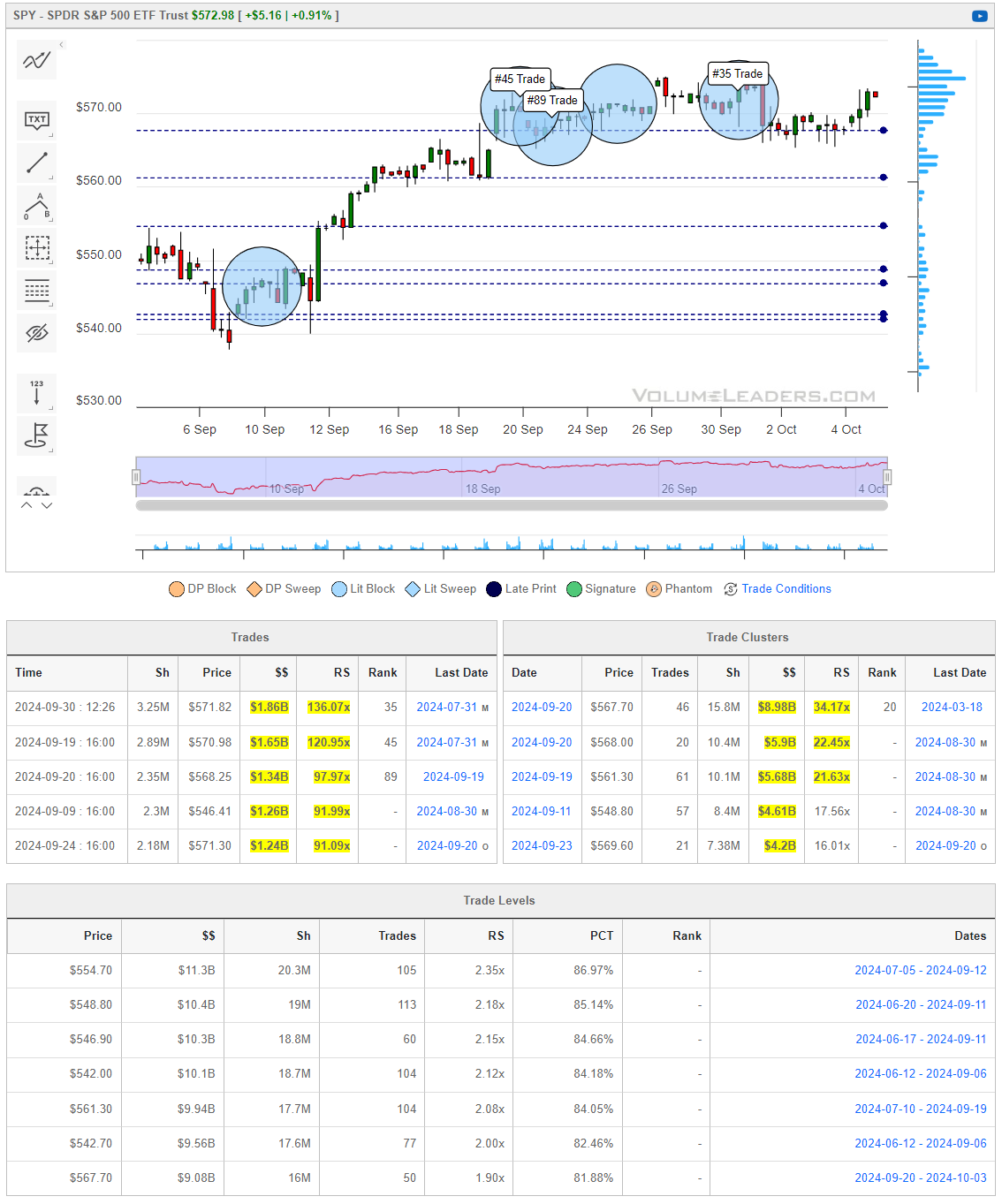

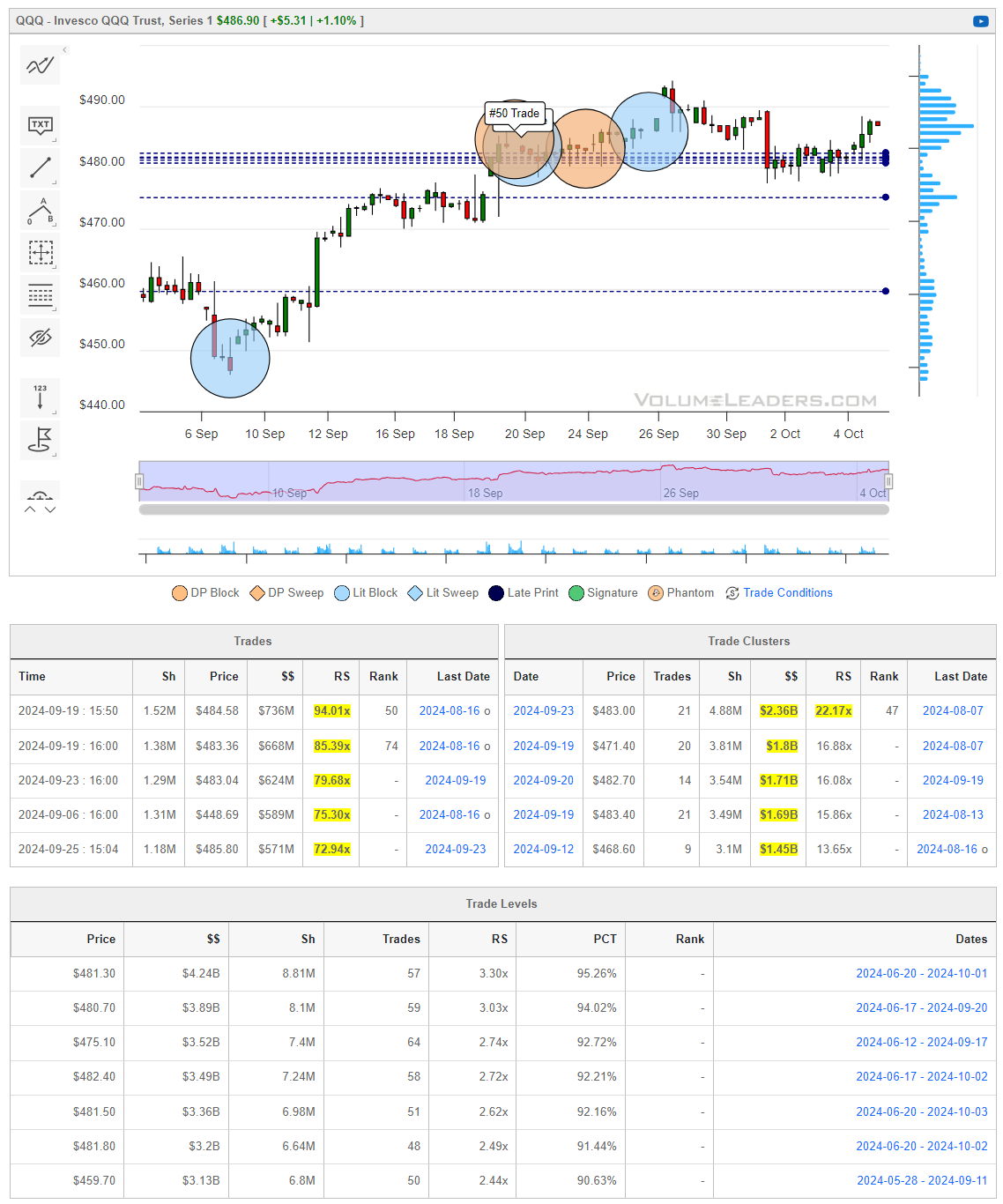

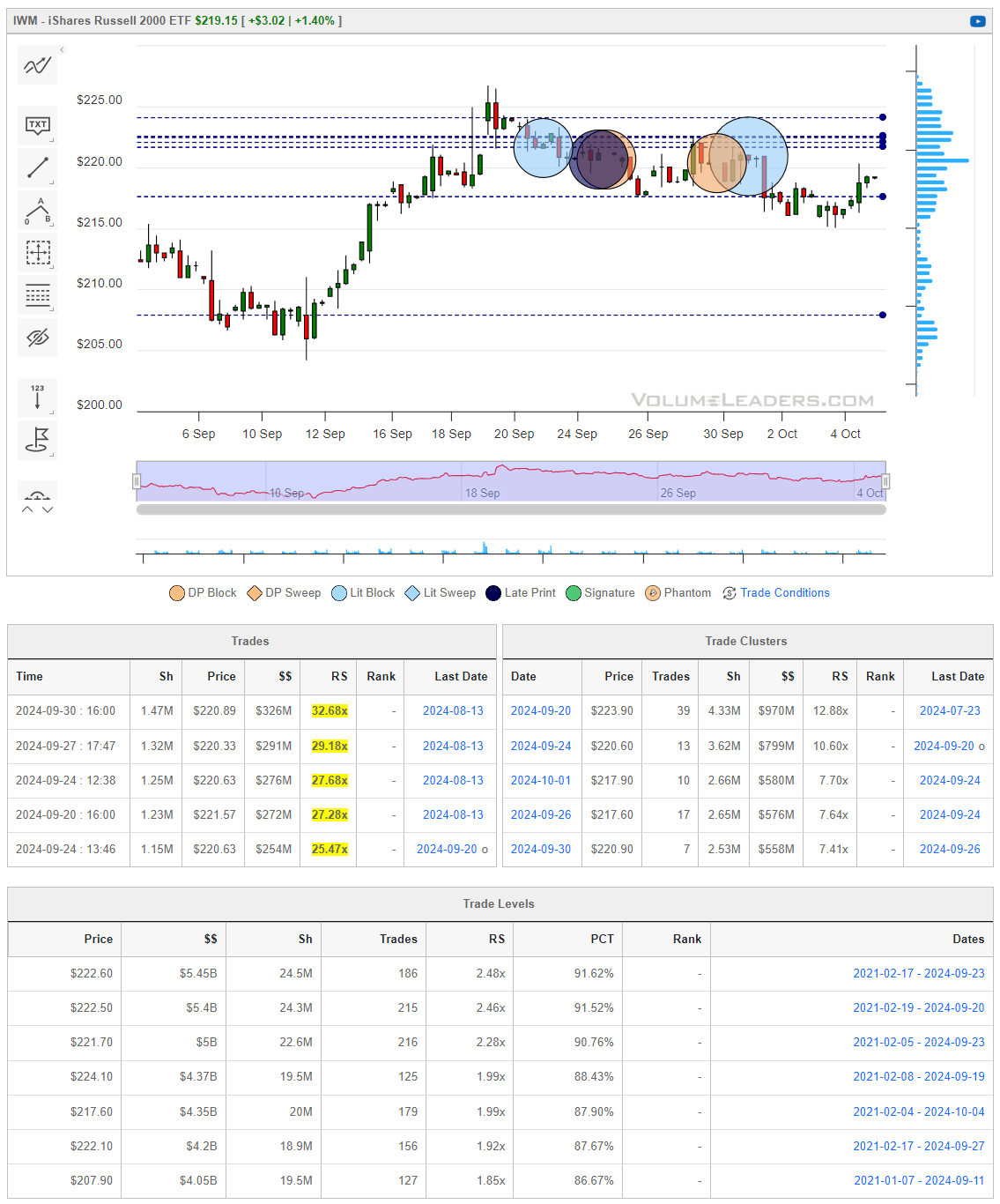

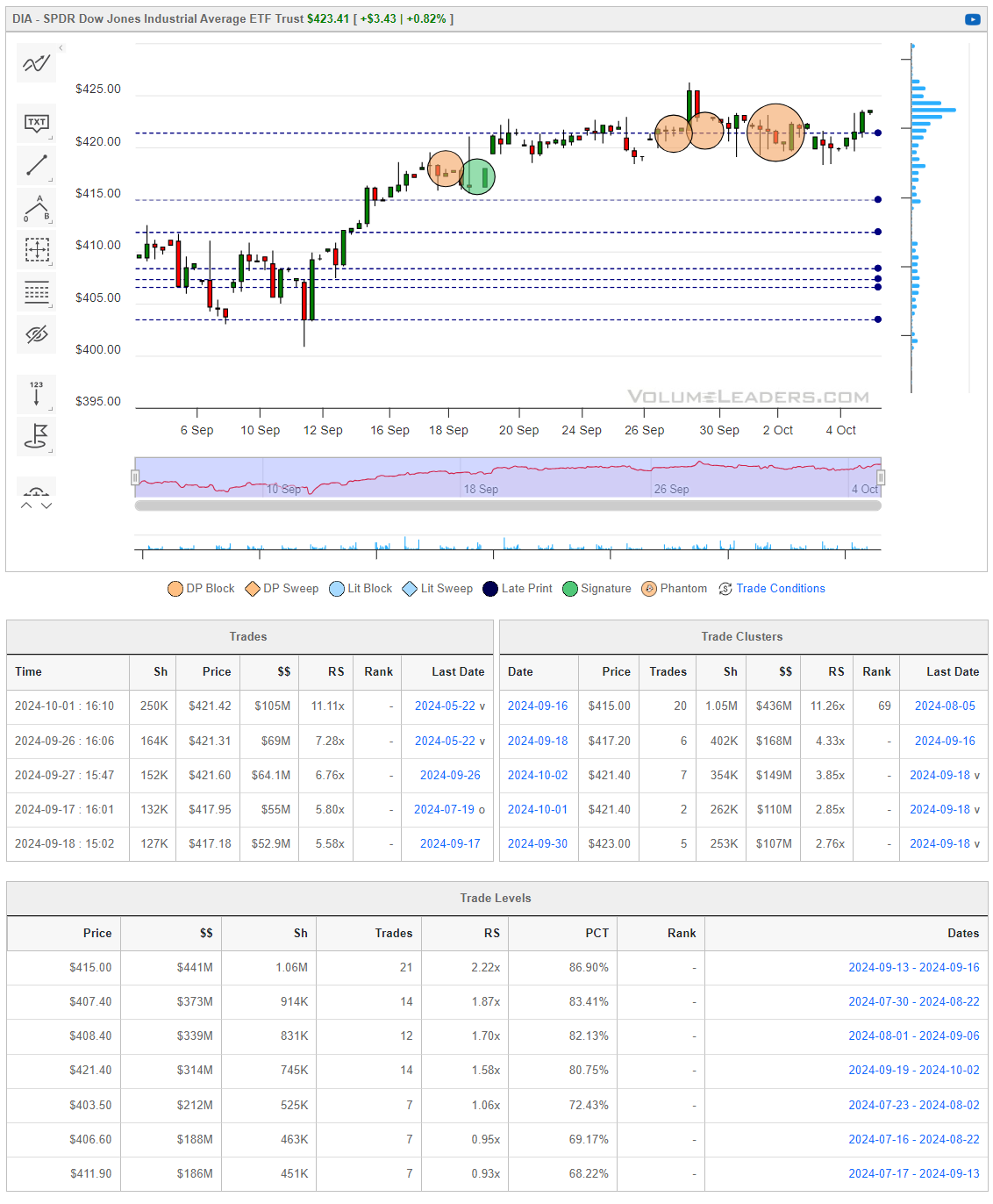

Institutional S/R Levels for Major Indices

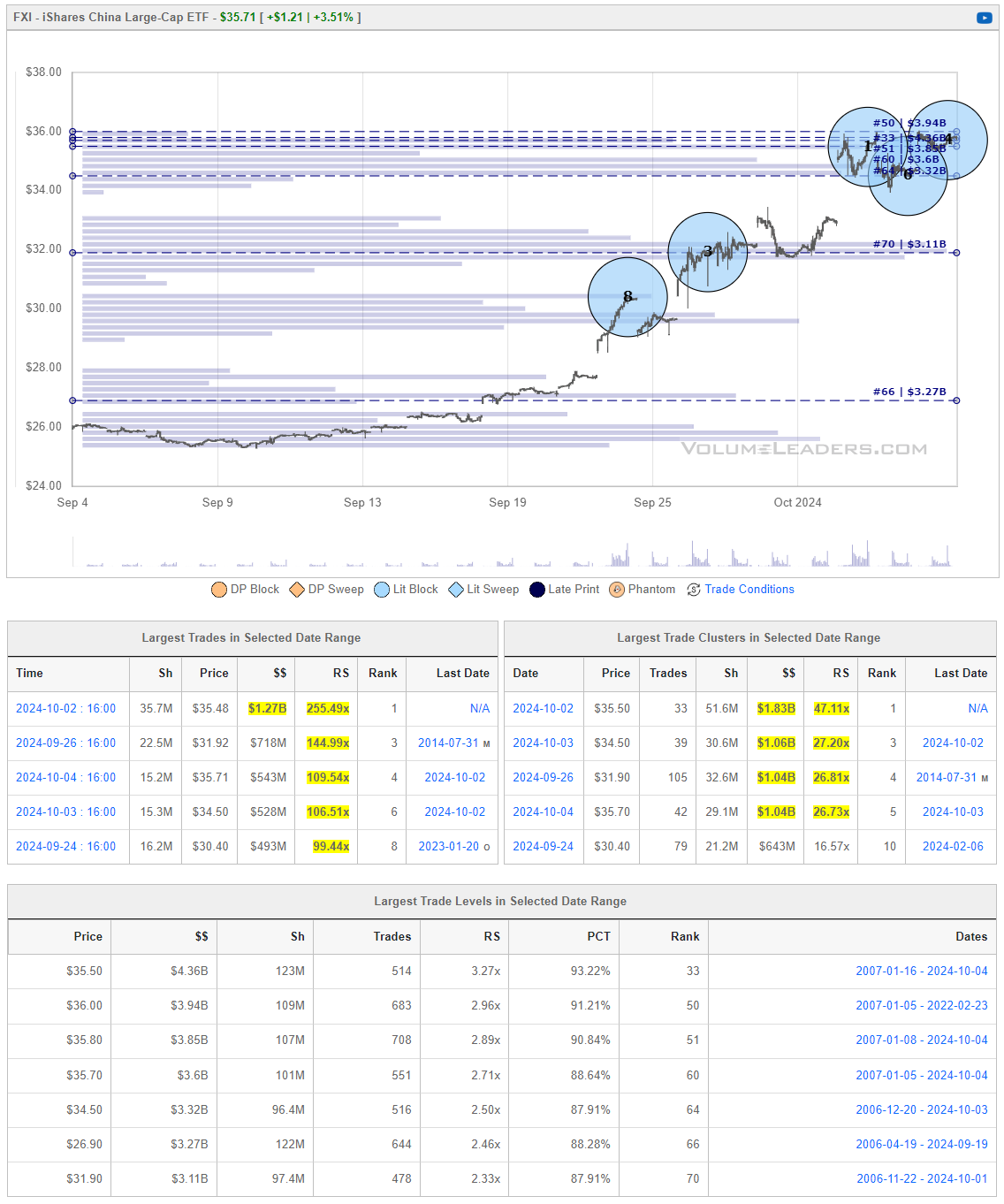

When you’re a large institutional player, your primary goal is to find liquidity - places to do a ton of business with the least amount of slippage possible. VolumeLeaders.com automatically identifies and visually plots the exact spots where institutions are doing business and where they are likely to return for more. It’s one of the primary reasons “support” and “resistance” concepts work and truly one of the reasons “price has memory”.

Levels from the VolumeLeaders.com platform can help you formulate trades theses about:

Where to add or take profit

Where to de-risk or hedge

What strikes to target for options

Where to expect support or resistance

And this is just a small sample; there are countless ways to leverage this information into trades that express your views on the market. The platform covers thousands of tickers on multiple timeframes to accommodate all types of traders. Observe for yourself how accurate the levels are by marking-up your charts with the information in the “Trade Levels” boxes I’m giving for free below and play-along in real-time this week. These charts cover recent sessions, but subs will get new levels as they develop, see the latest trades and institutional positioning, have access to levels from other time frames and so much more. When you watch these levels this week, I’m confident you’ll see how clear, intuitive and actionable this information is for yourself.

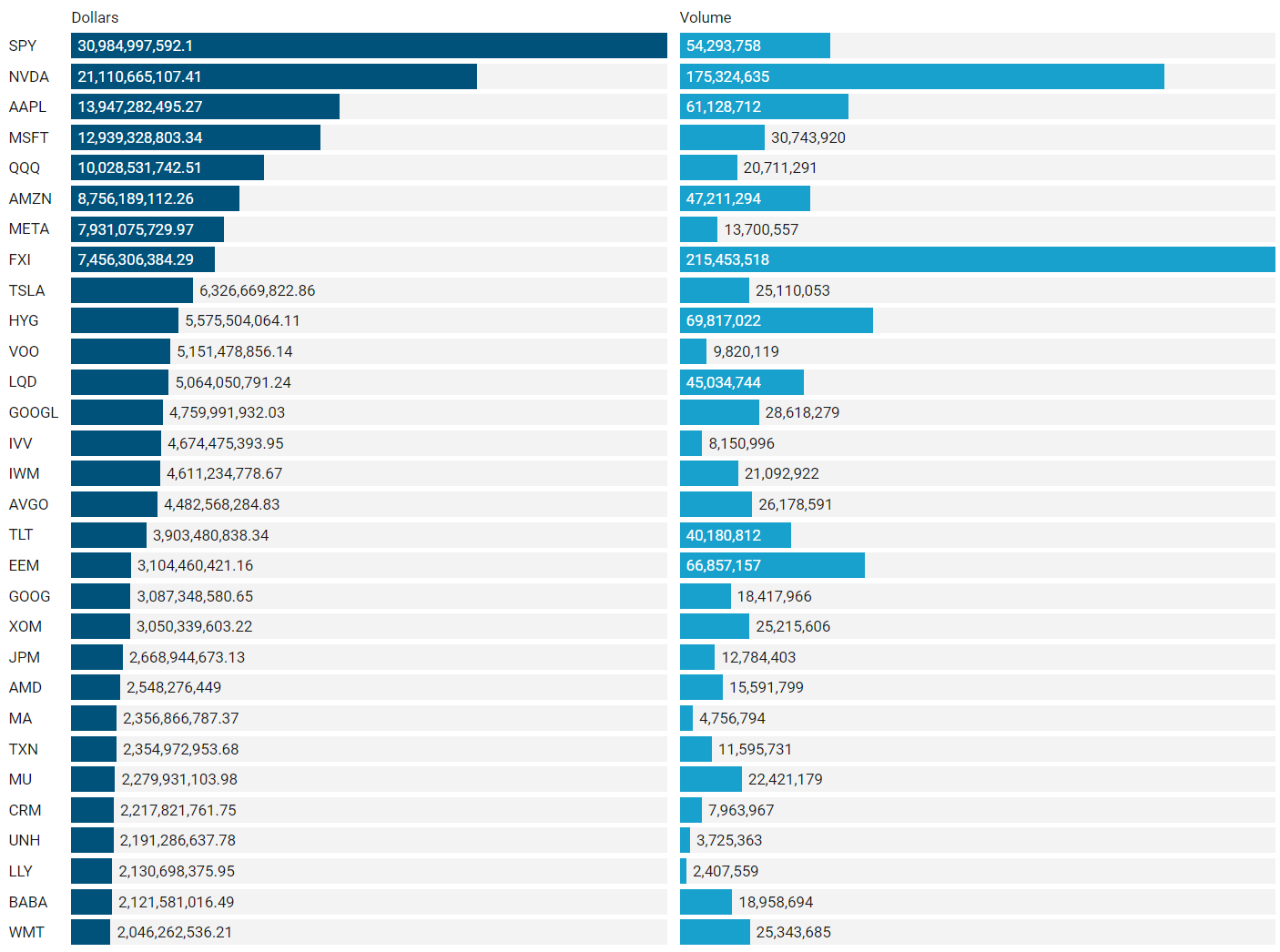

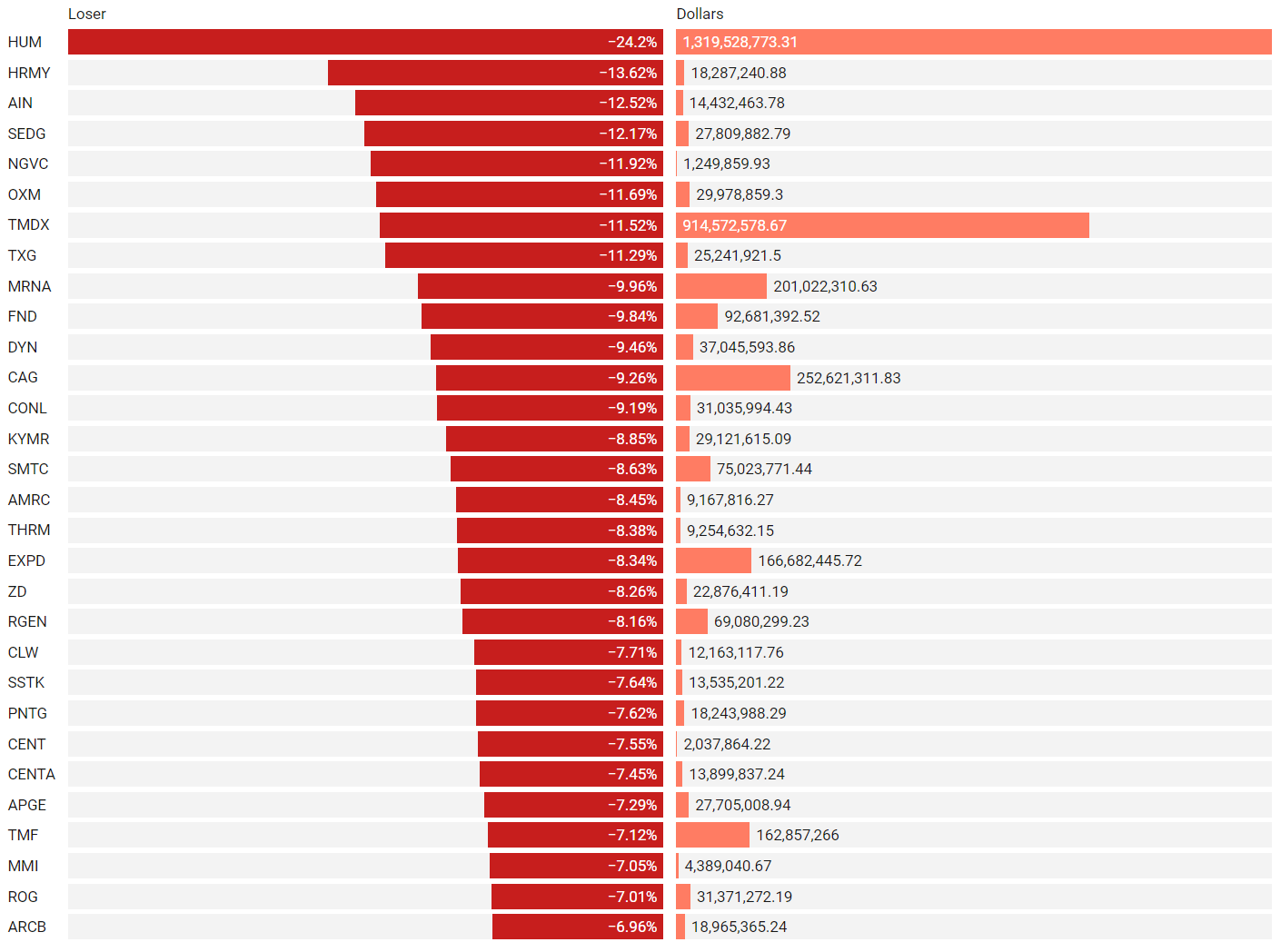

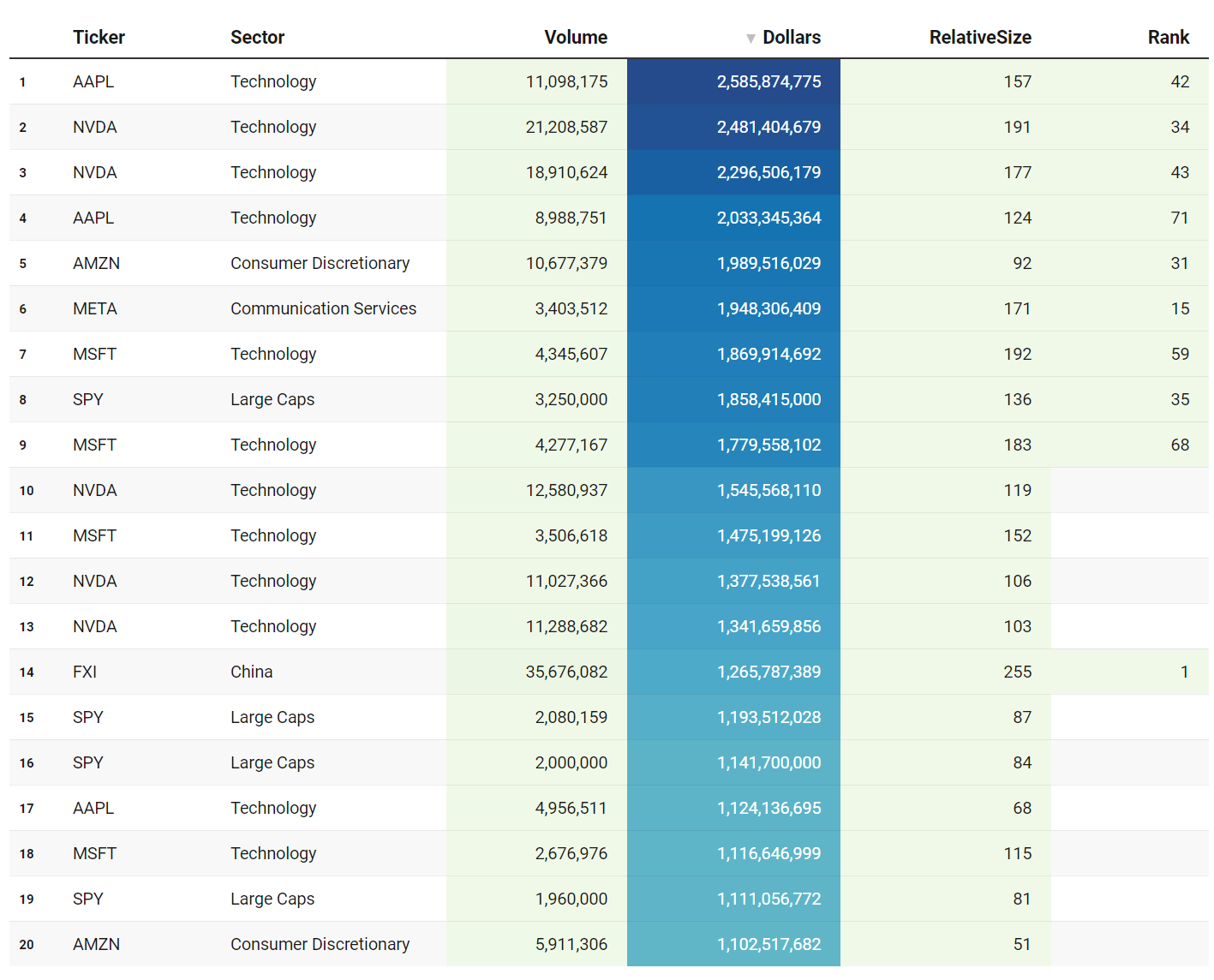

Top Institutional Order Flow

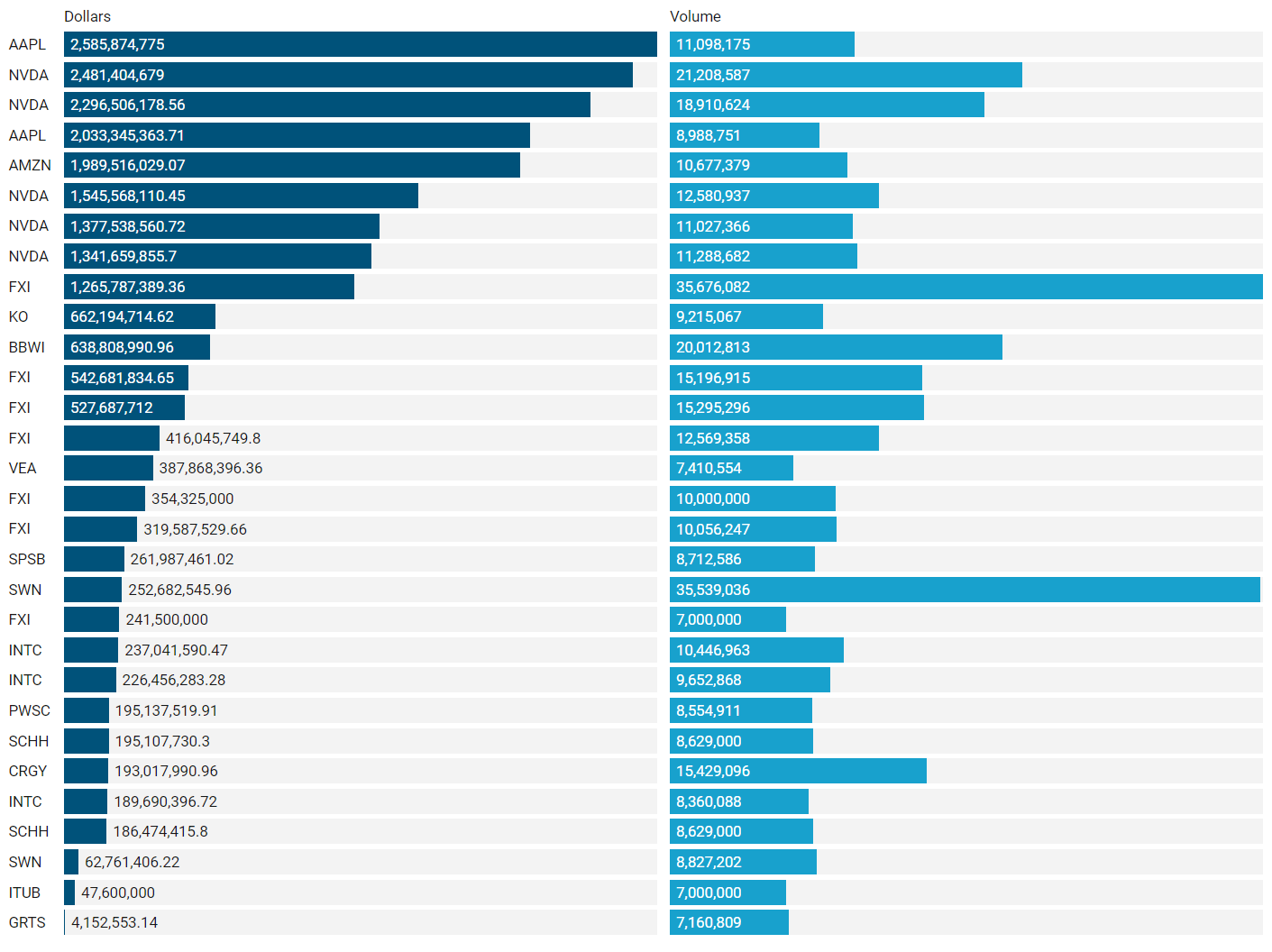

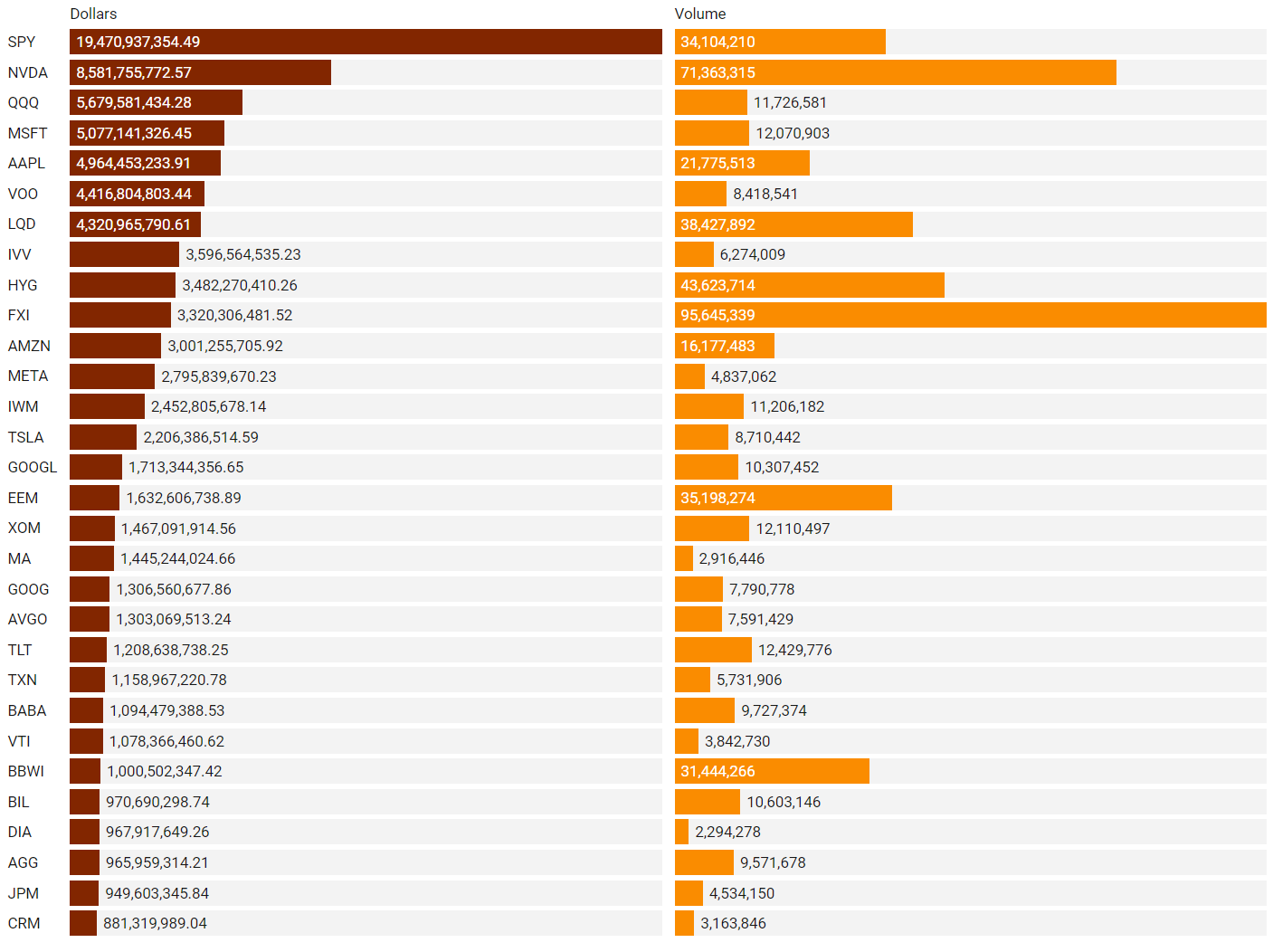

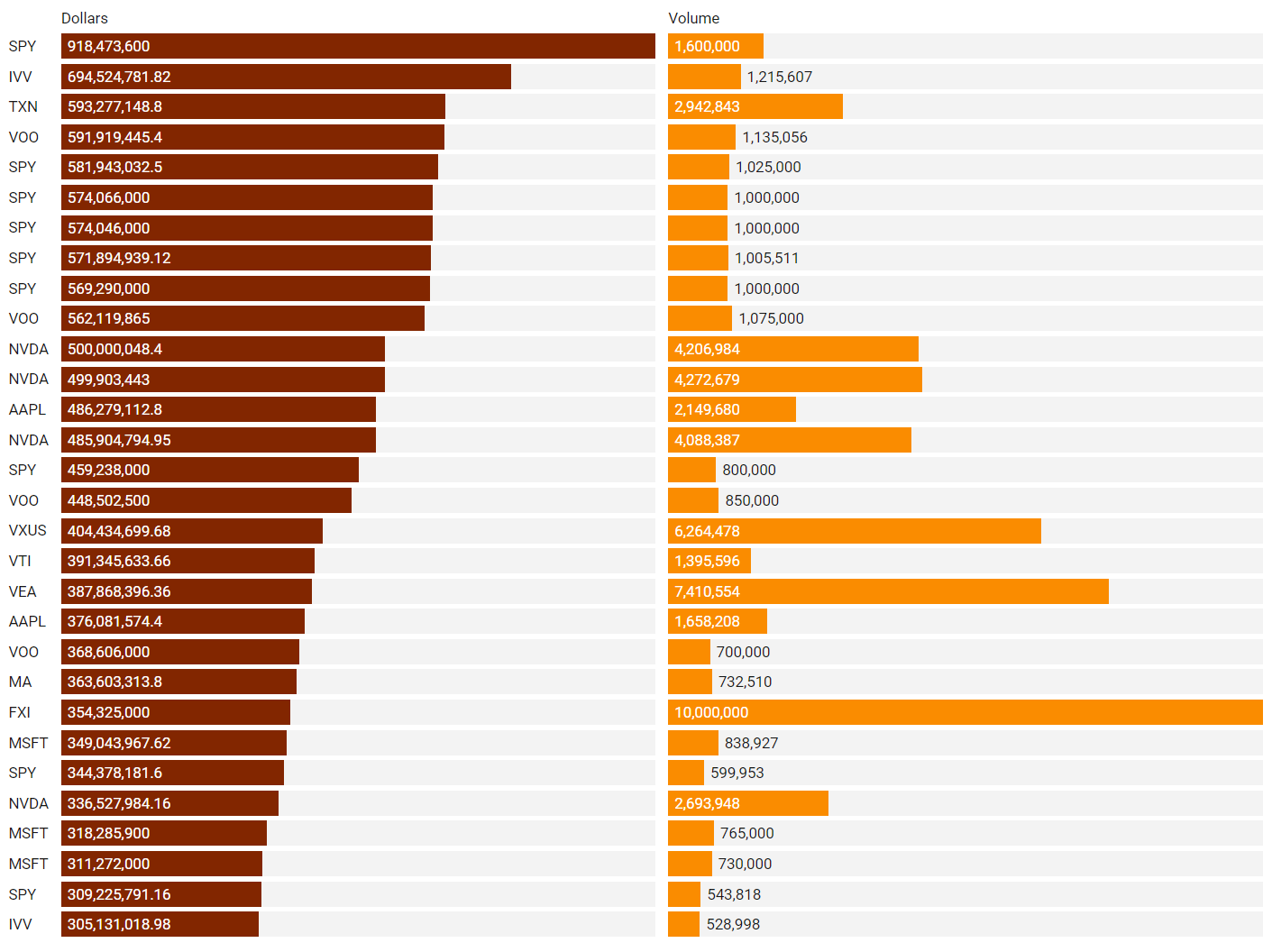

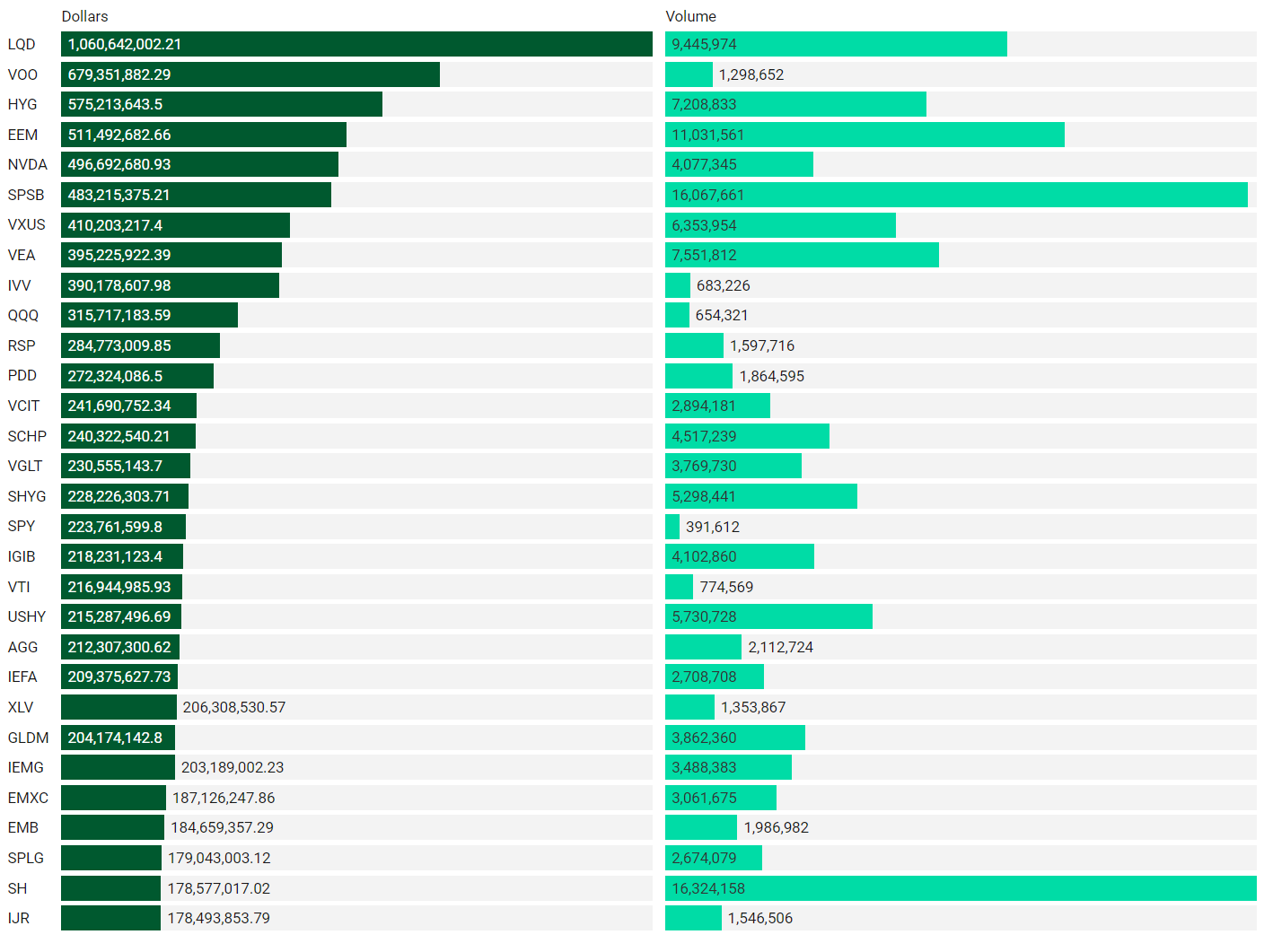

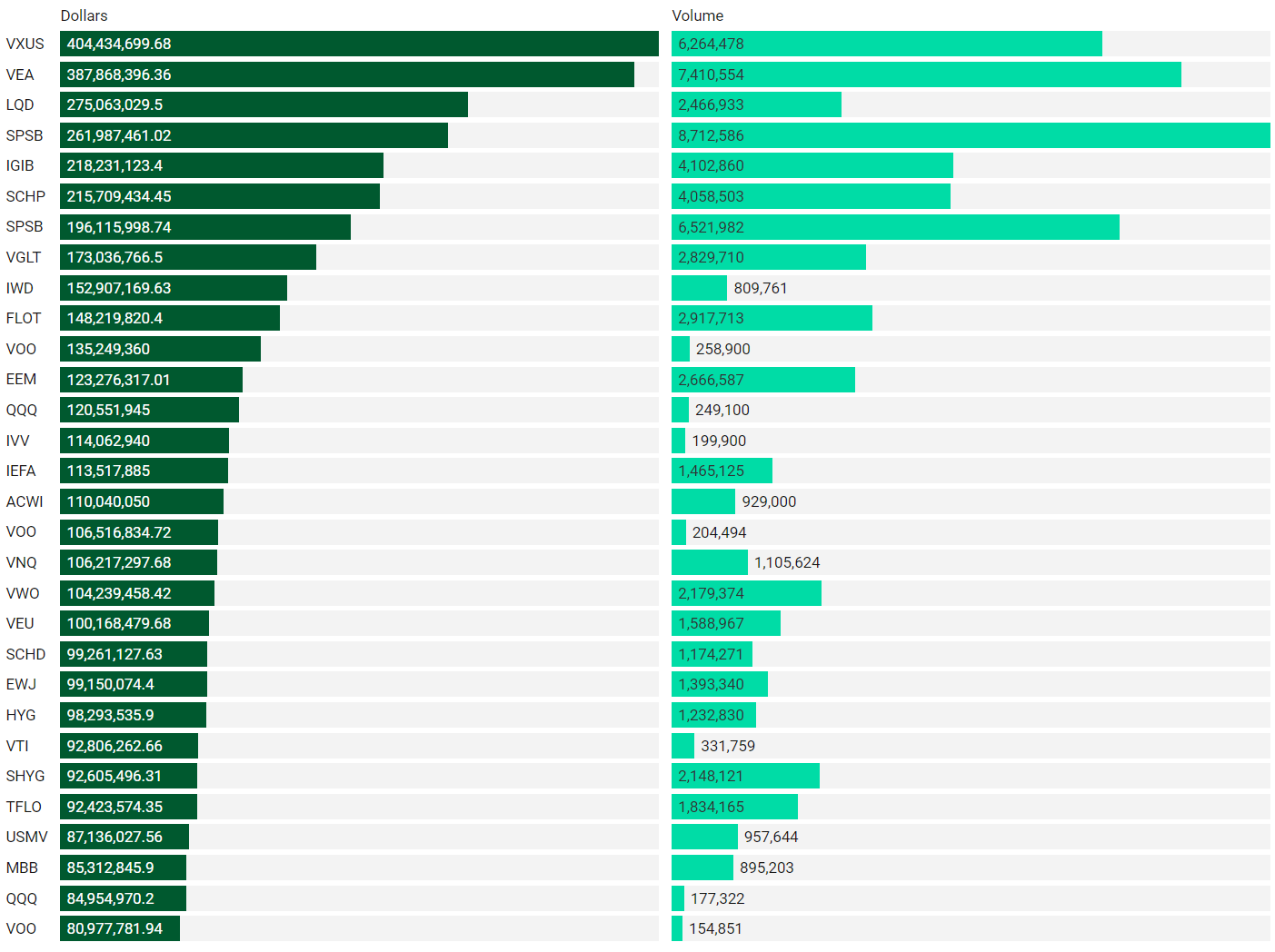

Many excellent trade ideas and sources of inspiration can be found in these prints. While only the top 30 from each group are displayed, the complete results are accessible in VolumeLeaders.com for your convenience to explore at any time. Remember to configure trade alerts within the platform to ensure you never overlook institutional order flows that capture your interest or are significant to you. The blue charts encompass all types of trades, including blocks on lit exchanges; the red/orange charts exclusively depict dark pool trades; and the green charts represent sweeps only.

Top Aggregate Dollars Transacted by Ticker

Largest Individual Trades by Dollars Transacted

Top Aggregate Dark Pool Activity by Ticker

Largest Individual Dark Pool Blocks by Dollars

Top Aggregate Sweeps by Ticker

Top Individual Sweeps by Dollars Transacted

Institutional S/R Levels for Individual Tickers

Please read “Institutional S/R Levels For Major Indices” at the top of this stack to understand the nature and importance of what we’re looking at here visually. Institutions leave footprints that VolumeLeaders.com can illustrate for you while providing context to assess things like institutional conviction and urgency.

FXI tracks the performance of the largest and most liquid Chinese companies. It is designed to give investors exposure to the top 50 Chinese stocks traded on the Hong Kong Stock Exchange, covering sectors like financials, technology, and energy. This ETF is often used as a barometer for Chinese market performance and is a popular vehicle for investors looking to gain exposure to China's economic growth and key industries.

A lot of business is getting done in the $36-region. If price starts to sink from here, that can put a lot of pressure on late longs and create some supply, potentially leading to a rapid unwind. Bulls can still win this pivot and take inventory higher but, you’ll want to see $36’ish retest-and-hold from above

DTE Energy Company is a diversified energy company based in Detroit, Michigan. DTE primarily operates in the utility sector, providing electricity and natural gas to customers in Michigan. In addition to its utility operations, DTE also has non-utility businesses focused on energy infrastructure, renewable energy, and natural gas pipelines. It's commonly known for its focus on sustainability and efforts to transition to cleaner energy sources.

Price action has been strong in the back half of last month and price has tracked broader market sentiment so far in Oct. Price is now between 2 important groups of levels but winning either one of these pivots likely brings another $10-move to the victor.

PLTR is a U.S.-based company specializing in big data analytics and software solutions. Palantir provides platforms like Palantir Gotham and Palantir Foundry that are used by government agencies, corporations, and institutions to analyze large datasets for decision-making and operational insights. The company is known for its work with U.S. intelligence agencies and commercial clients in areas such as defense, healthcare, finance, and energy, helping to manage and analyze complex data.

I think the line-in-the-sand is clear here - $37.20. If you’re already on the train, keep riding as long as price holds above. If this has more to give on the upside, any pullbacks into that area should get bought up swiftly.

VL Precision Swings

This week we’re featuring additional screened trade ideas from one of our backtested proprietary signals for tactical swings called IBB - Institutional Breakout Boxes. The IBB Setup identifies an area of significant institutional positioning within a tight, concentrated price range, forming what we call a breakout box. This setup captures the potential energy built up as large players accumulate or distribute positions, creating a high-probability opportunity for explosive moves once the price breaks out of this zone. The precision of this setup allows traders to capitalize on the momentum generated by institutional forces, with clearly defined risk and reward parameters. These trades typically last from 2-days to 2-weeks and given targets are designed for tactical swings. Moreover, for longer-term swing traders, these ideas often provide excellent entries that can help get you into risk-free runners quickly. I highly encourage you to revisit prior recommendations - there aren’t just a few big winners that kept running, there are many, all due to the power of institutional positioning.

Note, these are shared for educational and entertainment purposes only and do not constitute financial advice.Here’s an example from XLRE:

Let’s see how last week’s setups played out. If you took any of these yourself, let us know in the comments!

TMF: +4.8%, T2 hit, runners still on for T3+

IVV: +.19%, no targets hit

AVGO: +1.77%, no targets hit, full position still on

CVX: +3.45%, all targets hit

X: 0%, triggered short but stopped B/E. Still inside the IBB and setup to move at any moment

SHOP: +2.86%, T1 hit, runners on for T2+T3

MMYT: +4.04%, T1 hit, stopped on the rest. Agile traders were able to capture another +4% on the topside breakout with runners in good position for higher targets

MKC: +2.19%, all targets hit.

CPB: +3.02%, all targets hit

CAH: +.97%, T1 hit, runners on for T2+T3

BLDR: +2.24%, T1 hit, runners on but looks like they’ll get stopped

A very nice haul this week for tactical swing traders.

Here are some of the Precision Swings we’re watching this week:

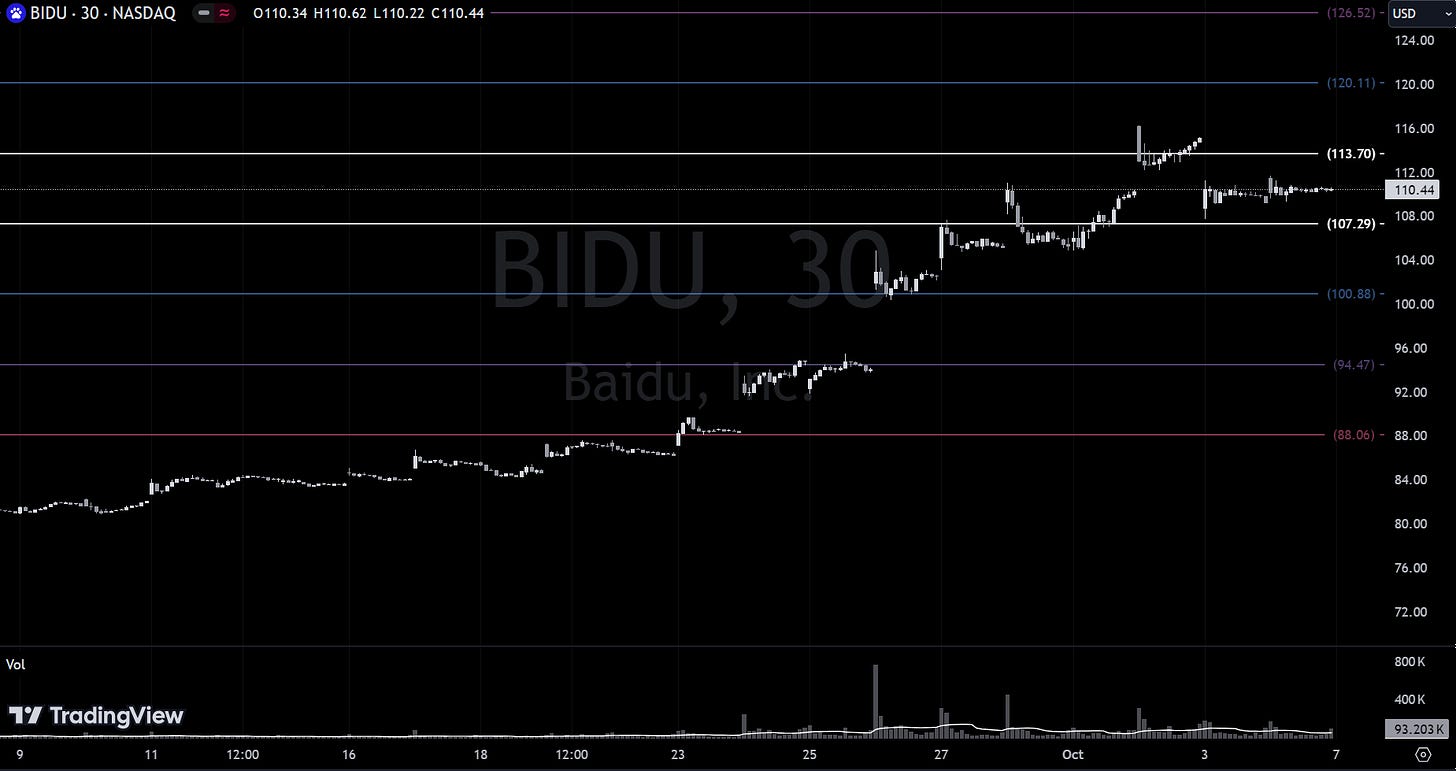

Given in a prior stack at $85. If you have runners leftover or want to get involved in China-related names, pay attention:

Given in a prior stack, it’s still in the same IBB building even more energy for a large directional move from the $266-$229 area

Given in a prior stack at $40, this has been a one-way train into the $50’s. It’s now built out yet another distribution that has caught our algo’s eye:

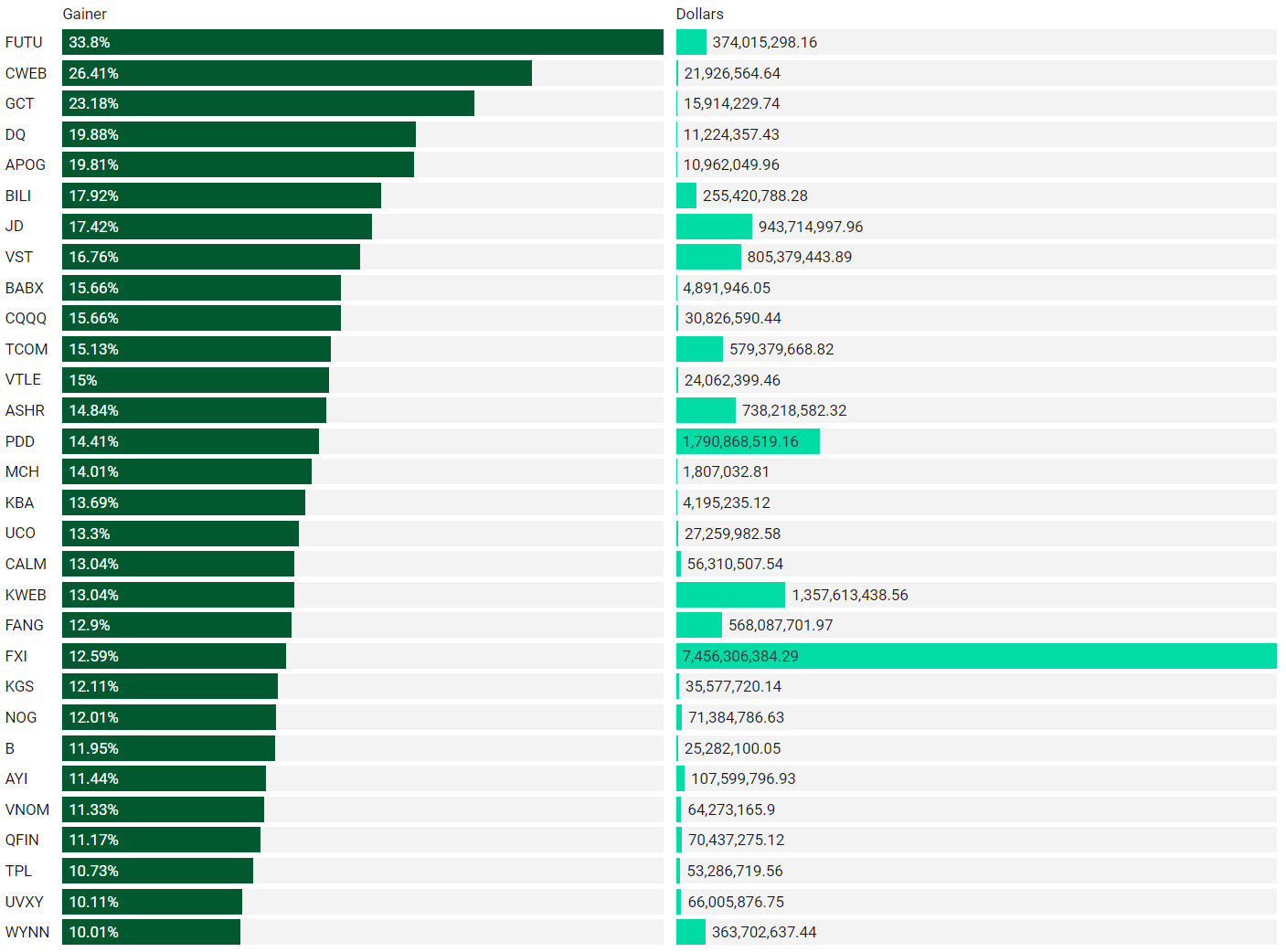

Institutionally-Backed Gainers & Losers

If you’re going to bet on a horse, consider one that is officially endorsed by an institution! These are the top percent gainers (green) and percent losers (red) from this week’s open-to-close that had a trade price greater than $20 and institutional involvement. Continue watching tickers from prior stacks as these frequently turn into multi-leg trades with a lot of movement!

Top Institutionally Backed Gainers

Top Institutionally Backed Losers

Billionaire Boys Club

Tickers that printed a trade worth at least $1B last week get a special shout-out… Welcome to the club. Subs should login to VolumeLeaders.com to get the exact trade price and relevant institutional levels around the trade - these are massive commitments by institutions that should not be ignored.

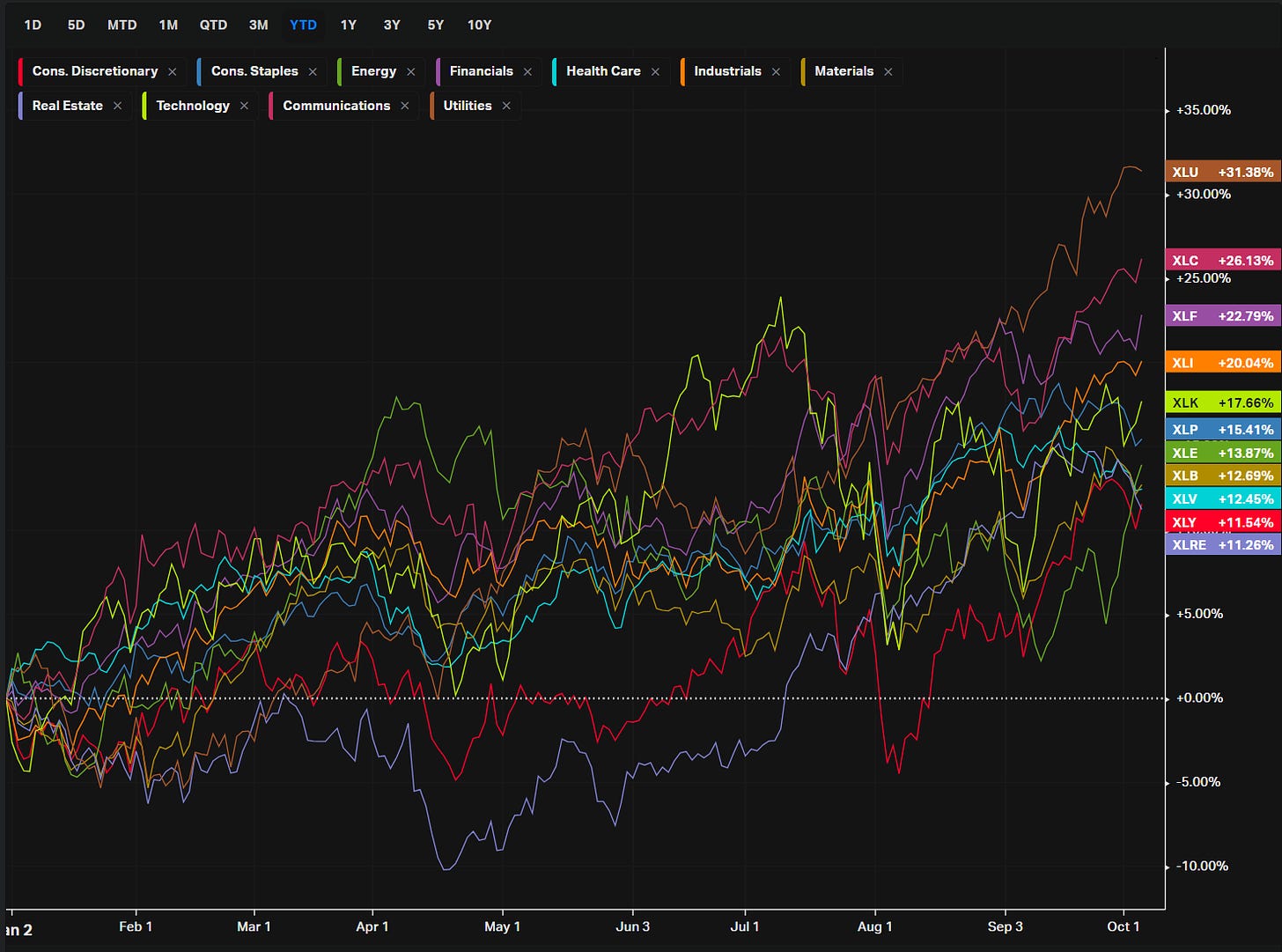

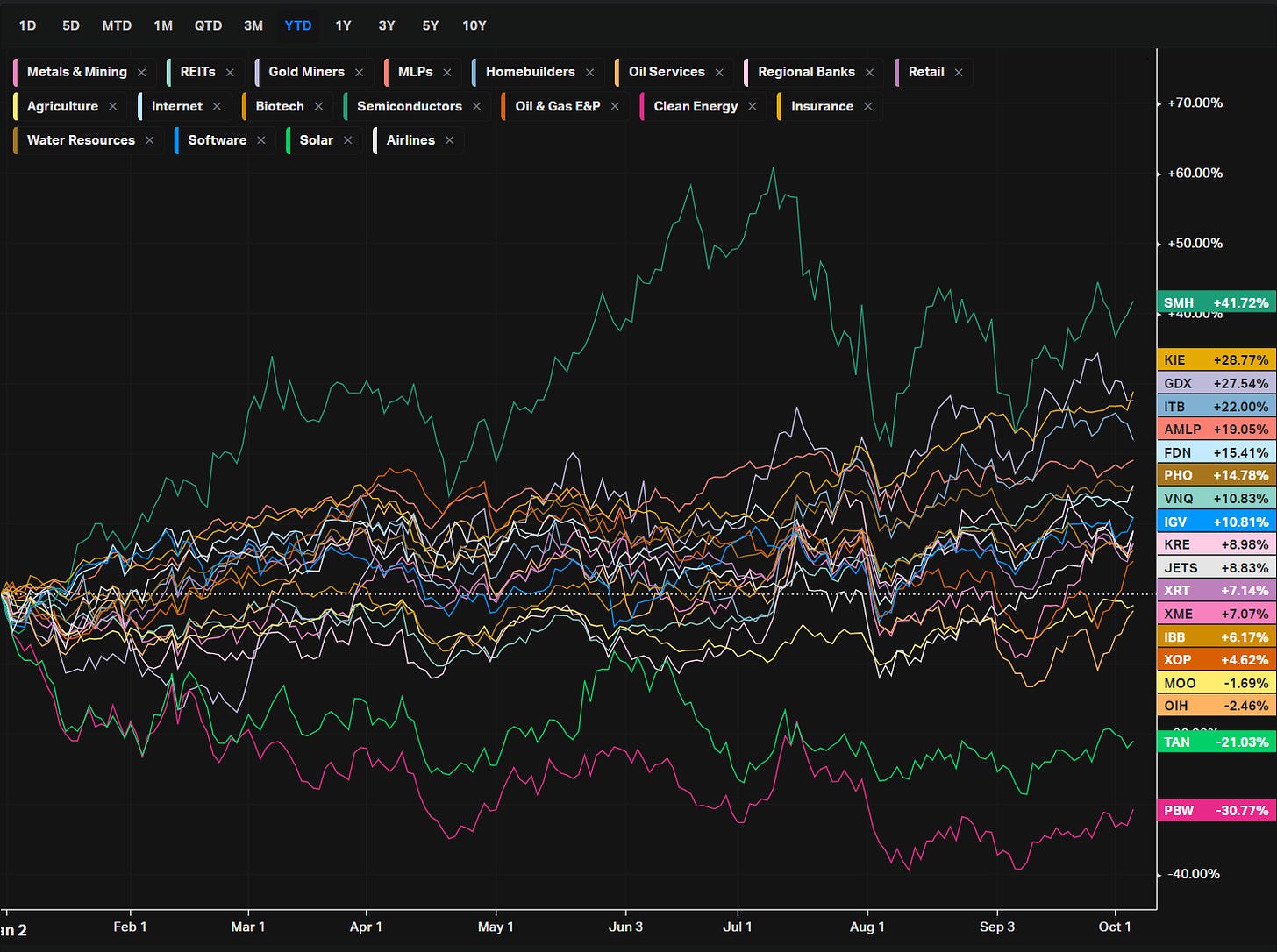

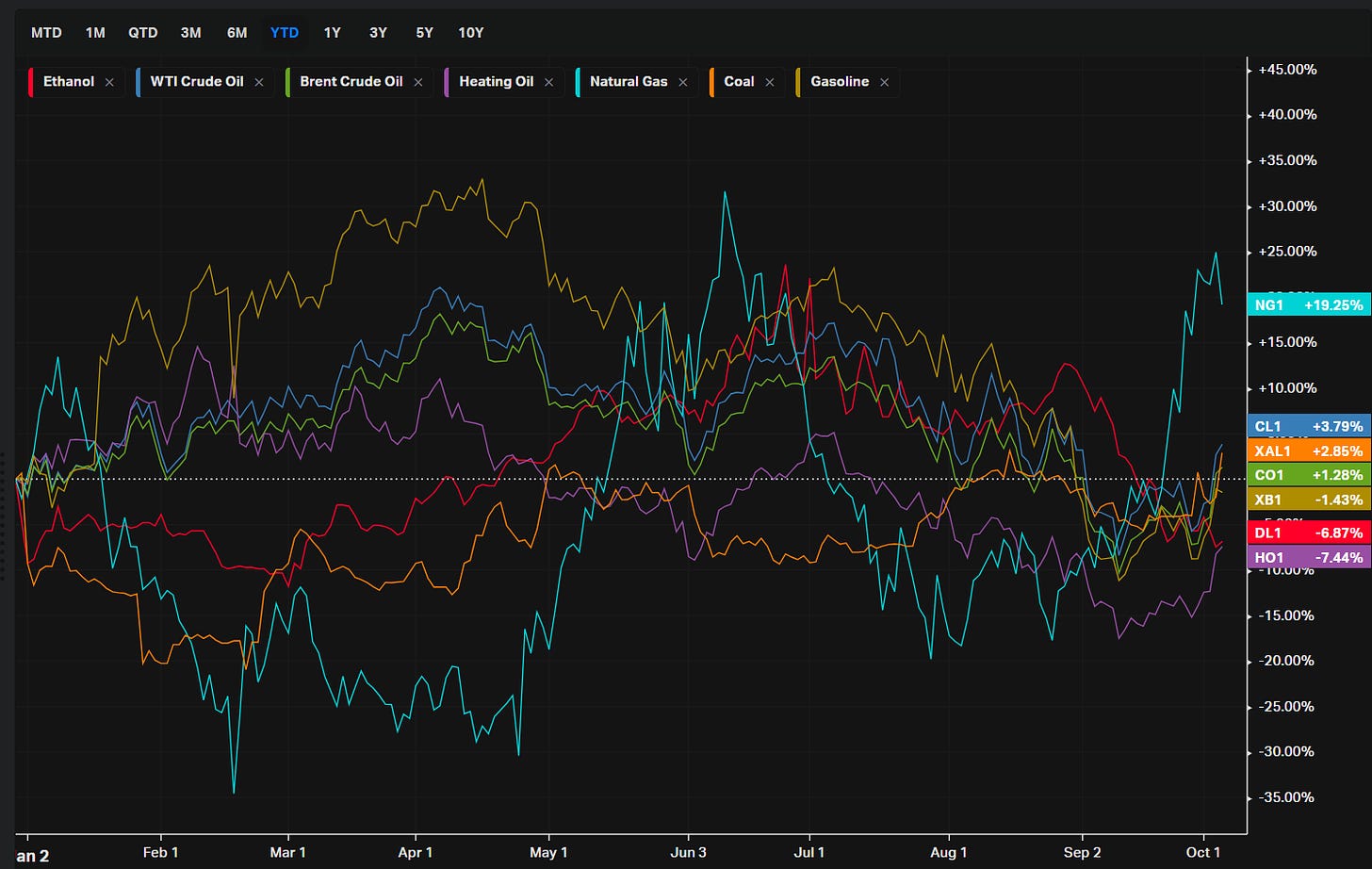

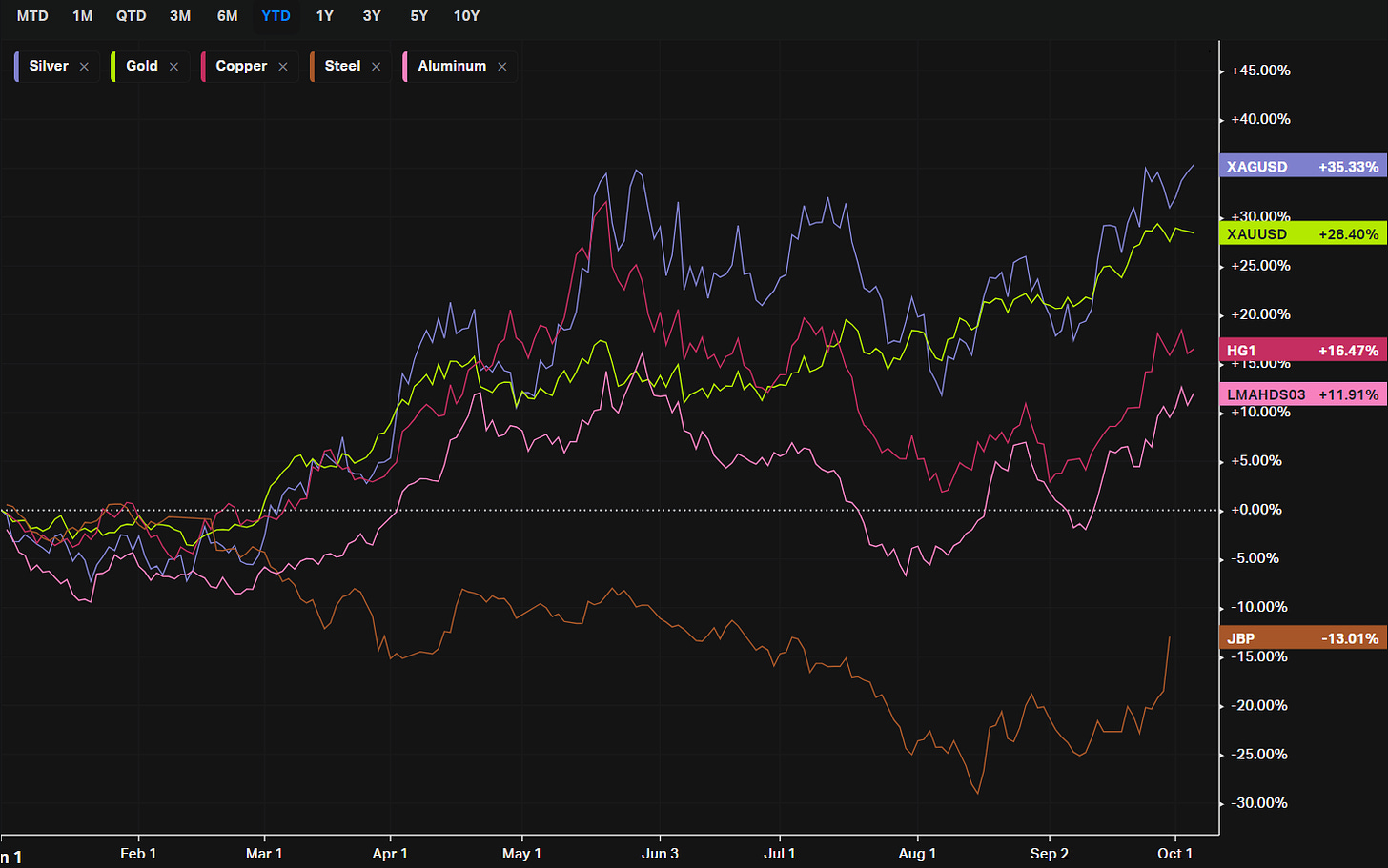

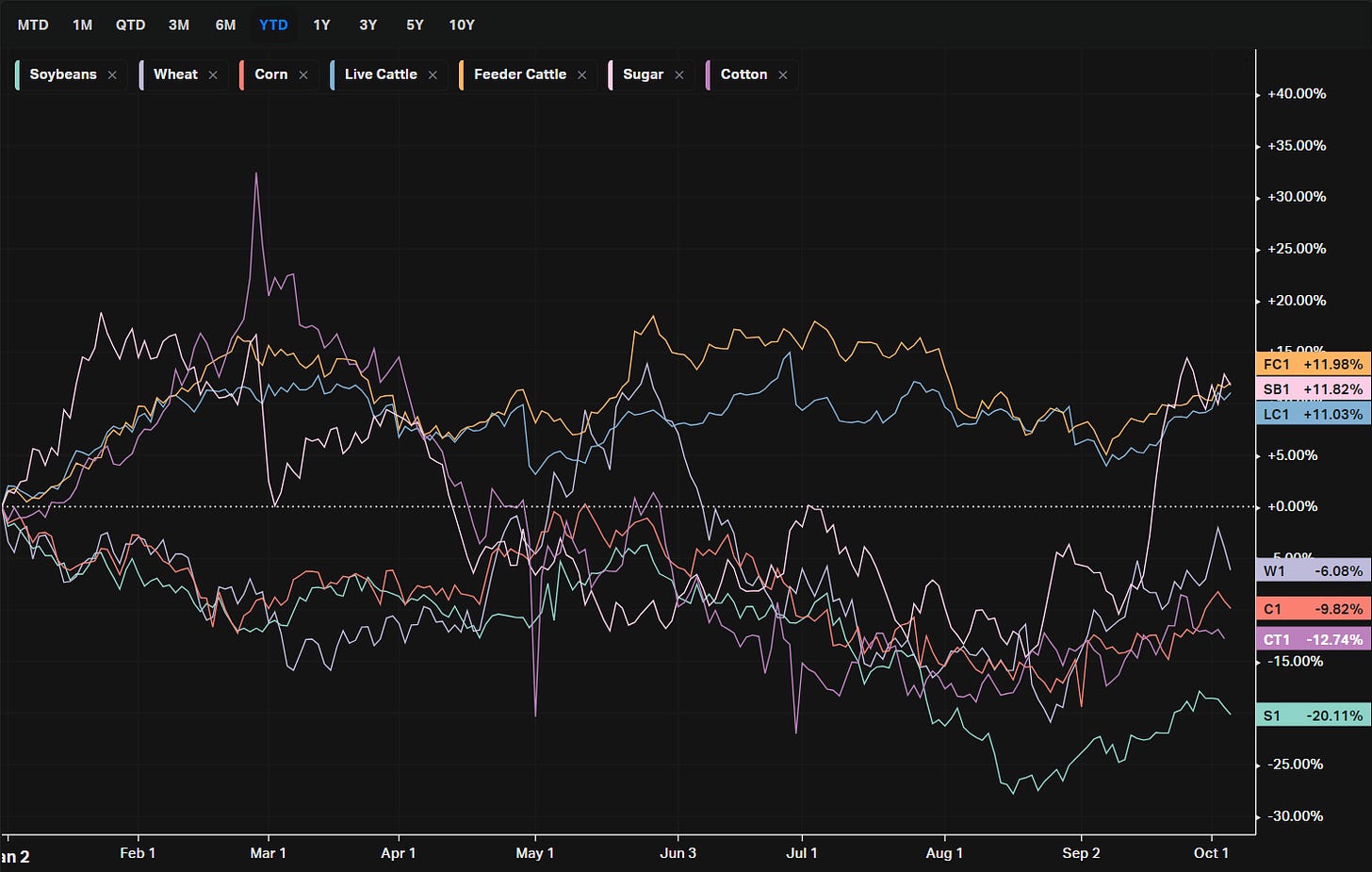

Summary Of Thematic Performance YTD

VolumeLeaders.com provides a lot of pre-built filters for thematics so that you can quickly dive into specific areas of the market. These performance overviews are provided here only for inspiration. Consider targeting leaders and/or laggards in the best and worst sectors, for example.

S&P By Sector

S&P By Industry

Energy

Metals

Agriculture

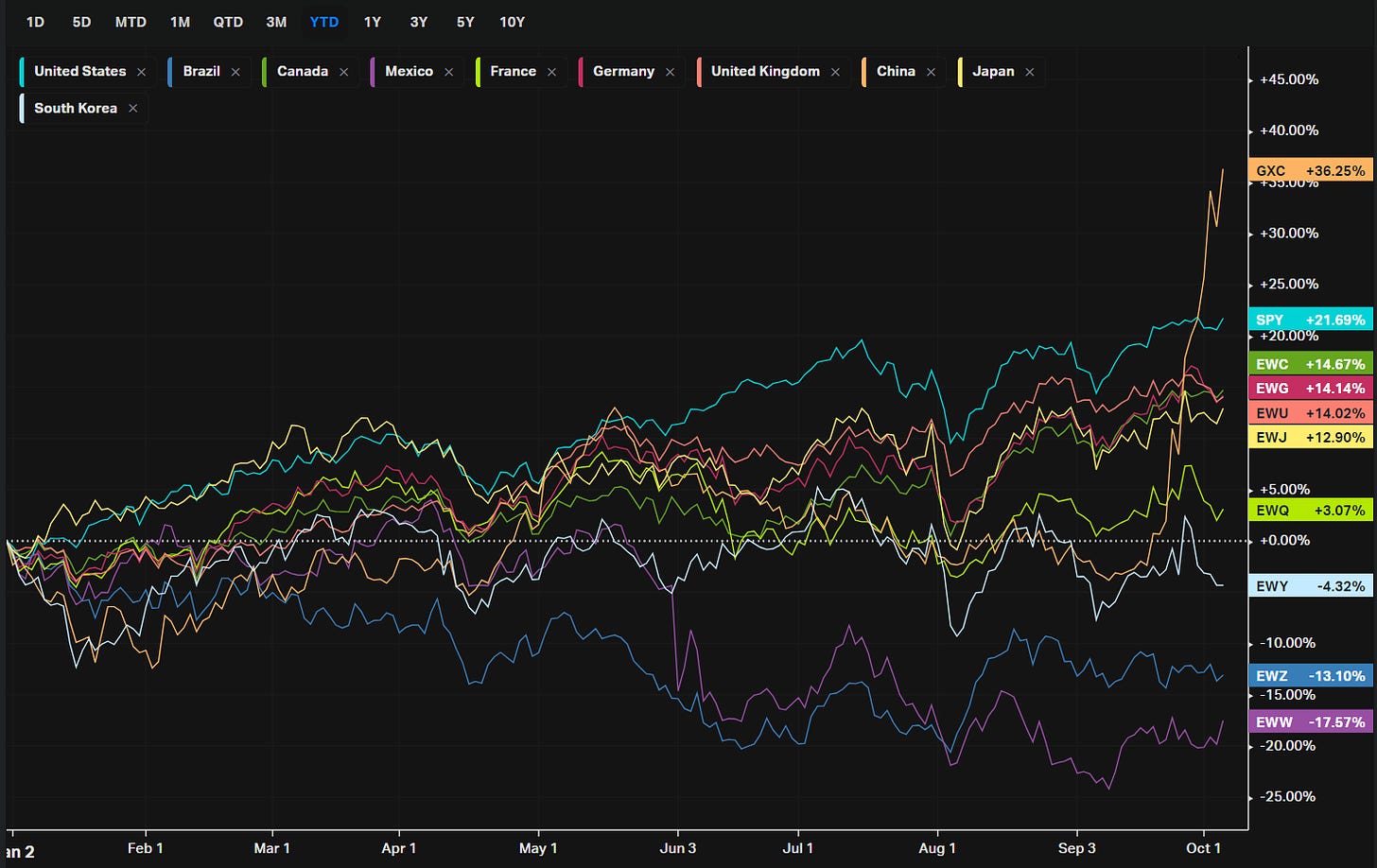

Country ETFs

Currencies

Yields

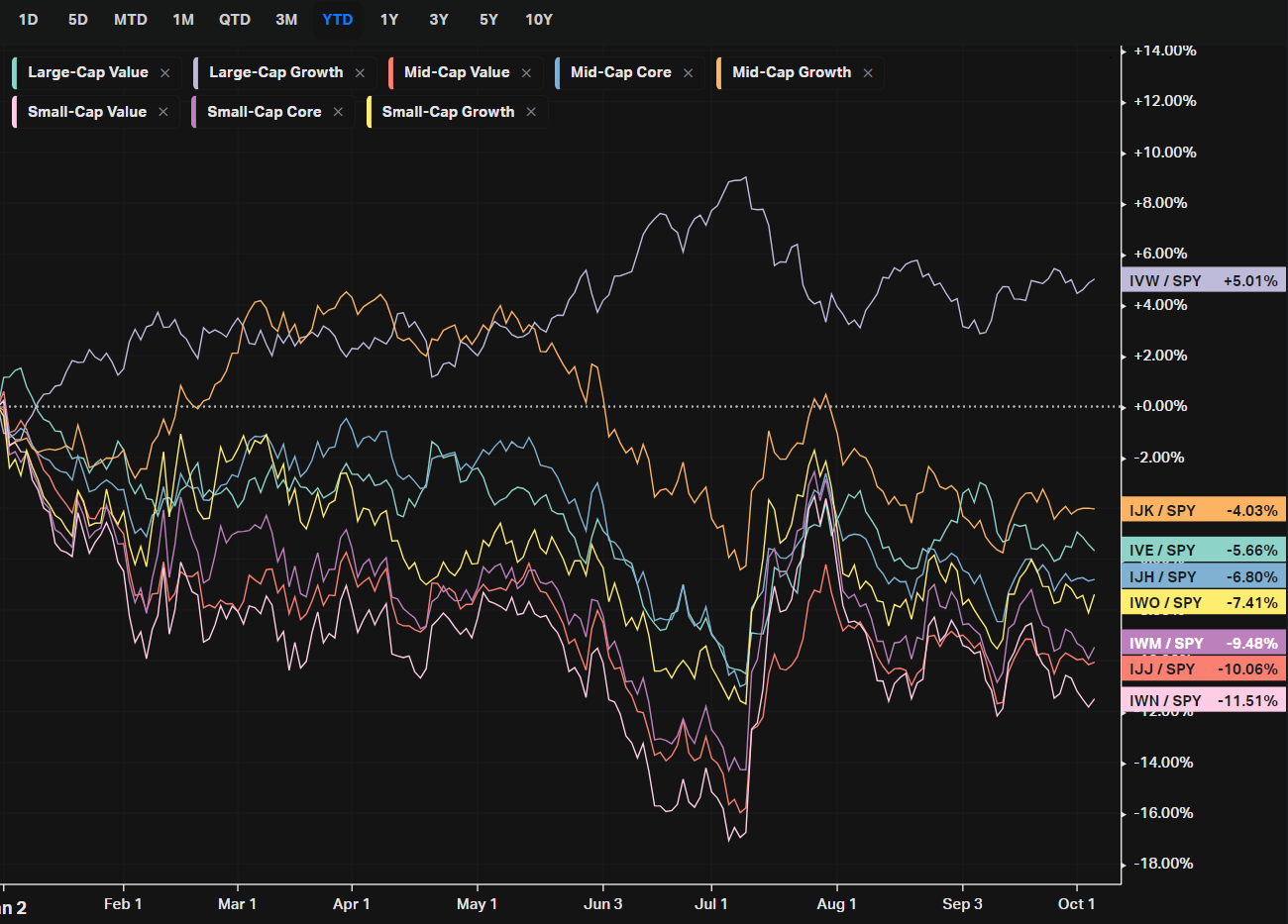

Factors: Size vs Value

Factors: Style

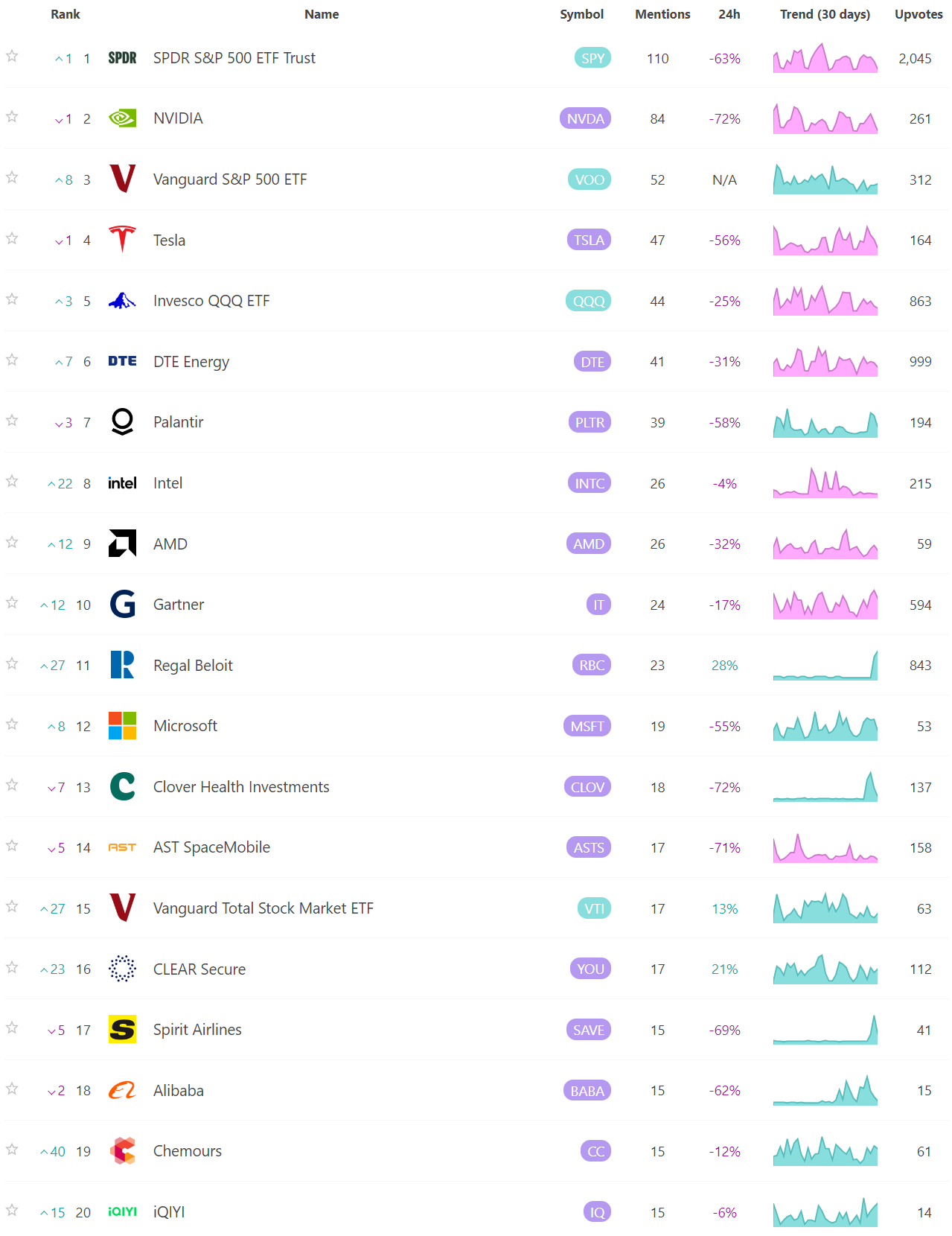

Social Media Favs

Most mentioned/discussed tickers on Reddit from some of the most active Subreddits for trading:

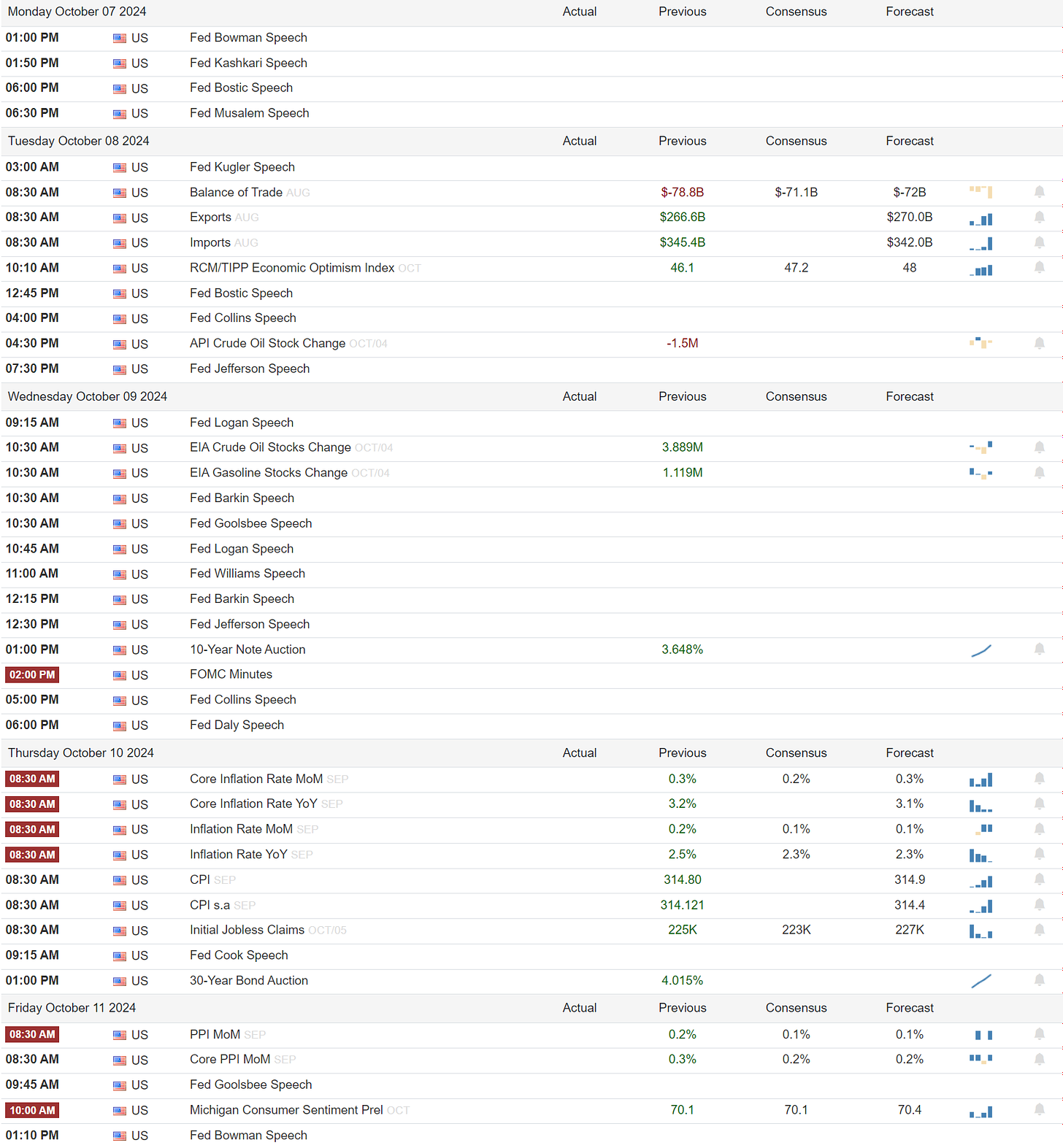

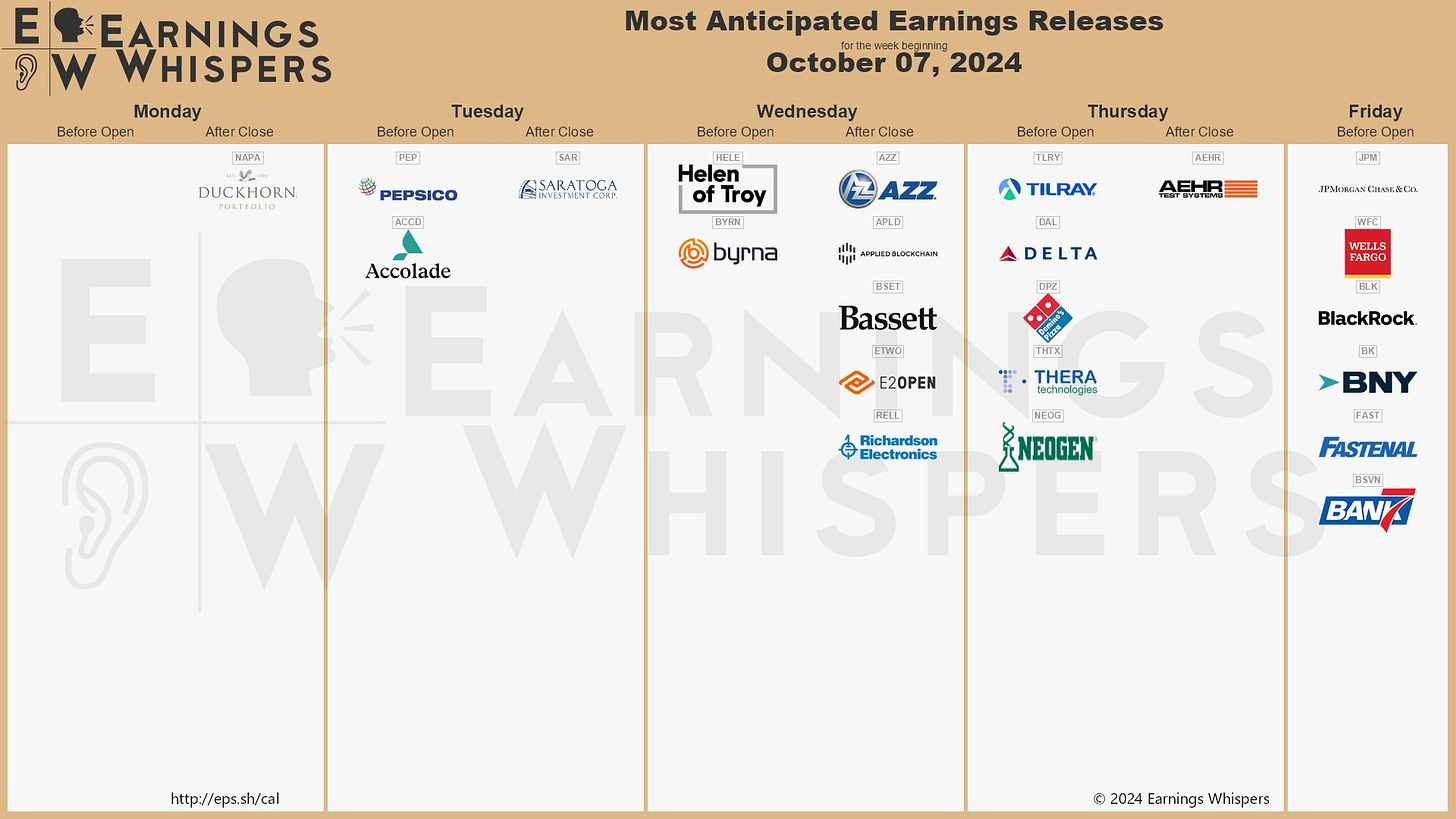

Events On Deck This Week

Here are key events happening this week that have the potential to cause outsized moves in the market or heightened short-term volatility.

Econ

Earnings

A Final Word

Thank you for reading this week's edition of Market Momentum. If you found value in this content, please consider sharing it with a friend or colleague, in a Discord or a Tweet. This small favor helps keep this stack free for you! Please check out VolumeLeaders.com for your own free trial of the platform that brings you the data powering this stack. Wishing you all a green week ahead filled with many bags ❤️💰.