Thanks for taking a look at our second issue of “Fresh Prints”. Institutions have wasted no time positioning early this week and as we’ve watched these massive prints roll in each day, the conclusion drawn in the community Discord is: Will never had the right to place his hands on DJ Jazzy Jeff…man, this guy’s anger issues should’ve been apparent to everyone much earlier…oh, and something is brewing on a macro-level. We’ve picked out few tickers for you to mull-over ahead of tomorrow’s jobless-numbers.

On Monday, the #5 all-time-ranked trade rolled through. The ticker symbol FNGU represents the MicroSectors FANG+ Index 3X Leveraged ETN (Exchange-Traded Note). This ETN provides leveraged exposure to the performance of the FANG+ Index, which includes highly traded technology and tech-enabled companies. Here are some key details about FNGU:

Leveraged Exposure. FNGU offers 3x (300%) daily leveraged exposure to the performance of the FANG+ Index. This means that for every 1% move in the index, FNGU aims to move by 3% in the same direction on a daily basis.

Underlying Index. The FANG+ Index is a modified equal-weighted index that consists of ten highly traded growth stocks of next-generation technology and tech-enabled companies. These typically include companies like Facebook (now Meta Platforms), Amazon, Netflix, Google (now Alphabet), Apple, Baidu, NVIDIA, Tesla, Alibaba, and Twitter.

ETN Structure. As an ETN, FNGU is an unsecured debt obligation issued by Bank of Montreal (BMO). Unlike ETFs, ETNs do not hold the securities of the index but rely on the creditworthiness of the issuing institution.

Daily Reset. The leverage factor resets daily, which means the ETN is designed to achieve its leveraged investment objective on a daily basis. Holding FNGU for periods longer than one day can lead to compounding effects and may result in returns that differ significantly from 3x the return of the FANG+ Index over the same period.

Uses and Considerations:

Short-Term Trading. Due to its daily reset feature and leveraged nature, FNGU is primarily suitable for short-term trading and not for long-term investing. Traders use it to capitalize on short-term movements in the FANG+ Index.

High Risk and Volatility. Leveraged ETNs like FNGU are highly volatile and can experience significant fluctuations in value. They are inherently risky and not suitable for conservative investors or those with low risk tolerance.

Tracking Error. Over longer periods, the performance of FNGU may deviate from the expected 3x multiple of the FANG+ Index due to daily compounding and market volatility.

Credit Risk. As an ETN, FNGU carries the credit risk of the issuer, Bank of Montreal. If the issuer defaults or becomes insolvent, holders of FNGU could lose their investment.

Based on that information, the trade size and the trade location, could you confidently have taken a day trade? Yep. Due to the leveraged nature of the product, would you lean on this to hold longs against? Definitely not. Because this is meant to be traded short-term, ideally intra-day, the size does little to instill confidence because this is just plainly not a “buy and hold” product.

Another Monday monster, #7 all-time for TMF dropped. TMF is the Direxion Daily 20+ Year Treasury Bull 3X Shares ticker, an exchange-traded fund (ETF) that provides leveraged exposure to the performance of long-term U.S. Treasury bonds. Here are some key details about TMF:

Leveraged Exposure. TMF offers 3x (300%) daily leveraged exposure to the performance of the ICE U.S. Treasury 20+ Year Bond Index. This means that for every 1% move in the index, TMF aims to move by 3% in the same direction on a daily basis.

Underlying Index. The ICE U.S. Treasury 20+ Year Bond Index includes U.S. Treasury bonds with maturities greater than 20 years. The performance of the index is based on the price movements and interest payments of these long-term bonds.

ETF Structure. As an ETF, TMF holds a portfolio of long-term U.S. Treasury securities and uses derivatives such as futures, options, and swaps to achieve its leveraged exposure.

Daily Reset. The leverage factor resets daily, meaning that TMF is designed to achieve its leveraged investment objective on a daily basis. Holding TMF for periods longer than one day can lead to compounding effects and may result in returns that differ significantly from 3x the return of the underlying index over the same period.

Uses and Considerations:

Short-Term Trading. Due to its daily reset feature and leveraged nature, TMF is primarily suitable for short-term trading and not for long-term investing. Traders use it to capitalize on short-term movements in long-term U.S. Treasury bonds.

High Risk and Volatility. Leveraged ETFs like TMF are highly volatile and can experience significant fluctuations in value. They are inherently risky and not suitable for conservative investors or those with low risk tolerance.

Interest Rate Sensitivity. TMF is highly sensitive to changes in interest rates. When interest rates fall, the price of long-term bonds tends to rise, benefiting TMF. Conversely, when interest rates rise, the price of long-term bonds tends to fall, negatively impacting TMF.

Tracking Error. Over longer periods, the performance of TMF may deviate from the expected 3x multiple of the underlying index due to daily compounding and market volatility.

TMF is a leveraged ETF designed to provide 3x daily exposure to the performance of long-term U.S. Treasury bonds. It is suitable for experienced traders looking for short-term leveraged exposure to movements in long-term interest rates but carries significant risks due to its leverage, daily reset feature, volatility, and sensitivity to interest rate changes. It is not intended for long-term buy-and-hold investors due to the potential for significant tracking error and compounding effects over time.

It’s said that they don’t ring a bell at the top, but for a local high, that’s not bad. However, this probably says little about the longer-term performance of bonds here and could very well provide the dip many are looking for to climb aboard. Nice institutional support underneath price (blue-dashed trade levels)

IBIT is the ticker for iShares Bitcoin Trust, an exchange-traded product (ETP) that provides exposure to the price performance of Bitcoin. Here are some key details about IBIT:

Product Overview.

Name: iShares Bitcoin Trust

Ticker: IBIT

Issuer: BlackRock, one of the world's largest asset management firms.

Type: Exchange-Traded Product (ETP)

Objective. The iShares Bitcoin Trust seeks to provide investors with a simple, cost-effective way to gain exposure to the price performance of Bitcoin without the need to directly purchase, store, or manage Bitcoin.

Underlying Asset. The ETP holds Bitcoin as its underlying asset. The value of IBIT is directly tied to the price movements of Bitcoin, aiming to reflect the performance of the cryptocurrency.

Storage and Security. The Bitcoin held by the iShares Bitcoin Trust is typically stored in secure, institutional-grade custody solutions. These solutions employ advanced security measures to protect the digital assets from theft or loss.

Benefits and Uses:

Ease of Access. IBIT provides a convenient way for investors to gain exposure to Bitcoin through a traditional brokerage account, similar to buying and selling stocks or other ETFs.

Institutional Grade Security. Investors in IBIT benefit from the security measures put in place by professional custodians to safeguard the Bitcoin holdings, which can be more secure than managing Bitcoin directly.

Regulated Product. As an ETP offered by a reputable issuer like BlackRock, IBIT is subject to regulatory oversight, providing an additional layer of transparency and investor protection.

Risks and Considerations:

Volatility. Bitcoin is known for its high volatility, and the value of IBIT can fluctuate significantly in response to changes in the price of Bitcoin. Investors should be prepared for potential large swings in value.

Market Risk. The performance of IBIT is directly linked to the performance of Bitcoin. Factors affecting the price of Bitcoin, such as regulatory changes, market sentiment, technological developments, and macroeconomic conditions, will impact the value of IBIT.

Management Fees. As with most ETPs, IBIT charges management fees that cover the costs of administering the trust and securing the Bitcoin holdings. These fees can impact the overall returns for investors.

Regulatory Risk. The regulatory environment for cryptocurrencies is evolving. Changes in regulations or government policies towards Bitcoin could affect the price and, consequently, the performance of IBIT.

The iShares Bitcoin Trust (IBIT) is an exchange-traded product designed to provide investors with exposure to Bitcoin's price movements. It offers a convenient and secure way to invest in Bitcoin through a traditional brokerage account, leveraging the institutional-grade security measures of its issuer, BlackRock. However, investors should be aware of the high volatility associated with Bitcoin, the direct market risk tied to Bitcoin's price, and potential regulatory changes that could impact the investment.

Look at this hit-it-and-quit-it sequence: number 13 all-time at the lows, a follow-through #9 all-time and then a sweep (#16 all time) at the highs. Sweeps by their very nature imply urgency…so were they scrambling to buy more or closing the book on this trade after bagging-up 15% in relatively short order?

This index includes stocks from the S&P 500 Index that exhibit strong value characteristics, such as low price-to-earnings (P/E) ratios, low price-to-book (P/B) ratios, and high dividend yields. The ETF typically holds a diversified portfolio of large-cap U.S. companies that are considered to be undervalued according to the criteria of the S&P 500 Value Index. The holdings are rebalanced periodically to align with the index.

Look at the institutional activity in this range. Draw a box around that and play the break - it’s about to make a strong move. #7 and #42 all-time in the $48.90’s - that’s your LIS (line in the sand) if you’re looking for a tighter over/under to play.

19.5M Shares. An $876M bet. #1 all-time trade. If you’re a metal-head, pay attention. The iShares Gold Trust (IAU) is an ETF designed to provide investors with exposure to the price of gold. By holding physical gold bullion, IAU aims to reflect the daily price movements of gold. The ETF offers several benefits, including convenient gold exposure, an inflation hedge, portfolio diversification, and high liquidity. However, investors should be aware of the risks associated with gold price volatility, the impact of the expense ratio on returns, the lack of income generation from gold, and potential regulatory and tax considerations. Overall, IAU is a popular choice for investors looking to include gold in their investment portfolios.

Same box-setup as SPYV. You’ve got institutions getting busy in <$1-range. Bring up your higher timeframe charts and box-out this region as the spot to pay attention to right now for directional bias. Gold has had a strong performance in 2024, with prices up approximately 19% year-to-date. This makes gold one of the top-performing assets of the year, outpacing major indices like the S&P 500 and Nasdaq Composite, which have also seen significant gains.

There are several factors that could influence its performance for the remainder of 2024 though:

Central Bank Purchases. Central banks have been significant buyers of gold in 2024, particularly those in China, Turkey, and India. In the first quarter alone, global official gold reserves increased by 290 metric tons, the largest first-quarter increase since at least 2000. Continued strong demand from central banks could support gold prices.

Interest Rates. The direction of interest rates will be crucial. Lower interest rates generally boost gold prices by making alternative investments like bonds less attractive. A potential rate cut by the Federal Reserve later in the year could act as a catalyst for higher gold prices. Conversely, if rates remain high, it could deter some investors from gold.

Geopolitical Tensions. Geopolitical instability often drives investors to gold as a safe-haven asset. Ongoing geopolitical risks, including political polarization, conflicts, and economic nationalism, can increase demand for gold. Any significant geopolitical event could further elevate gold prices.

Inflation and Economic Uncertainty. Inflation concerns and the potential for an economic slowdown or recession also play a role. Gold is seen as a hedge against inflation and economic instability. If inflation remains above target and economic growth slows, gold could benefit as investors seek stability.

Investor Demand. Institutional and retail investor demand is also a key factor. North American investors, in particular, have increased their allocations to gold, viewing it as a valuable portfolio diversifier and hedge against market volatility and inflation.

Watch the reaction to that #1 trade in coming sessions!

Bonds are super-active this week. Yesterday the #1 all-time for this ticker hit. VMBS is a Vanguard product that is designed to provide investors with exposure to a diversified pool of mortgage-backed securities. It seeks to track the performance of the Bloomberg U.S. MBS Float Adjusted Index, investing primarily in high-quality, investment-grade MBS issued or guaranteed by U.S. government agencies or GSEs. VMBS offers benefits such as income generation, high credit quality, diversification, and a low expense ratio. However, investors should be aware of the risks associated with interest rate fluctuations, prepayment and extension risks, and general market conditions. Here’s a slightly zoomed-out 30-day view:

Just how significant is a number one trade in VMBS vs typical daily volume? Have a look for yourself:

iShares MSCI USA Min Vol Factor ETF (USMV) has achieved a year-to-date (YTD) return of approximately 10.62%. This performance highlights its ability to provide relatively stable returns in comparison to more volatile investments. Yesterday we got a #10 all-time ranked trade. Here’s a 90-day view of the ticker:

Investors might seek out USMV under various market conditions or when seeking certain portfolio characteristics:

Market Volatility: USMV is designed to provide exposure to U.S. equities with lower volatility characteristics. It is especially appealing during periods of high market uncertainty or volatility, as it aims to reduce the risk of large swings in portfolio value.

Risk Aversion: Investors looking to lower the overall risk in their portfolios might turn to USMV. By focusing on stocks with lower historical volatility, USMV aims to offer a more stable investment option compared to broader market indices.

Long-Term Stability: For those who prioritize steady, long-term growth over aggressive short-term gains, USMV provides a more conservative equity exposure. It is suitable for investors who seek to minimize potential drawdowns during market downturns.

Diversification: USMV can serve as a core holding in a diversified portfolio, providing balanced exposure to U.S. equities while mitigating some of the risks associated with more volatile stocks. This makes it a valuable component for building a well-rounded investment strategy.

By incorporating USMV into their portfolios, investors can potentially achieve a smoother investment experience with fewer dramatic ups and downs, making it an attractive option in times of market stress or for those with a lower risk tolerance. This product has seen tremendous inflows so far this year but the question we’re now asking: is someone planning on hiding out here to weather a storm or is money being reallocated somewhere else less crowded and with better returns into end of year?

Ah, one of the darlings from the financial corner of the market. A cool $2B bet was made yesterday.

That was followed up today by a #13. Visa Inc. (NYSE: V) has shown a strong performance in 2024. Year-to-date, Visa's stock has seen an increase of approximately 13.09%. The company's consistent performance is underpinned by robust financial results across its fiscal quarters.

Fiscal Q1 2024

Revenue: $8.6 billion, a 9% increase year-over-year.

Net Income: GAAP net income rose by 17% to $4.9 billion, or $2.39 per share.

Fiscal Q2 2024

Revenue: $8.8 billion, up 10% from the previous year.

Net Income: GAAP net income of $4.7 billion, or $2.29 per share, and non-GAAP net income of $5.1 billion, or $2.51 per share.

Fiscal Q3 2024

Visa continued its strong performance with further growth in revenue and net income, driven by stable growth in payment volumes and processed transactions.

Analysts and the company itself maintain a positive outlook for the remainder of 2024, expecting continued growth driven by increasing digital payment adoption, strategic partnerships, and innovation in payment technologies. The #3 ranked trade is certainly putting a stake in the ground for us to measure buyer or seller success from here into the end of the year.

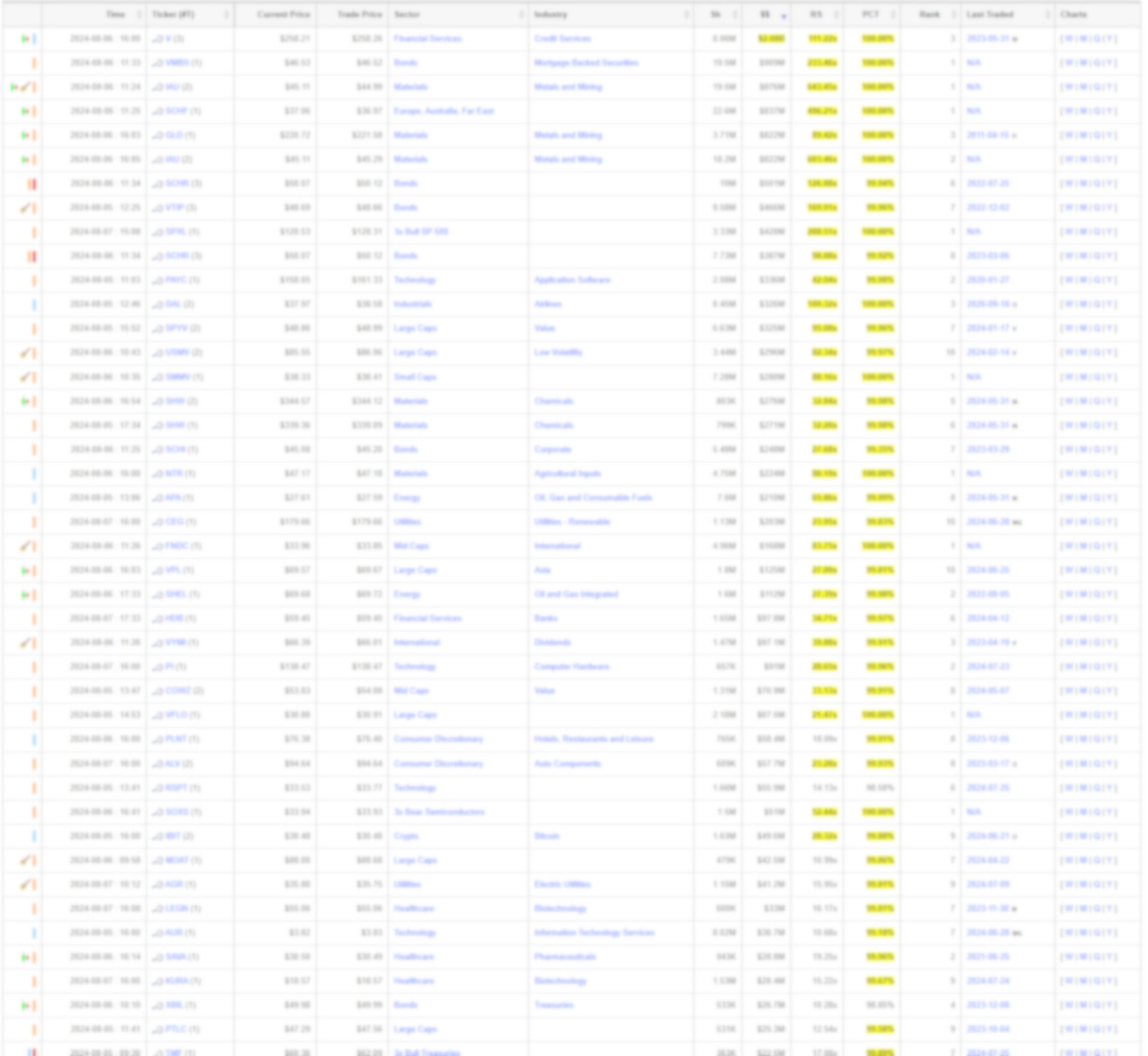

I wish I could cover all the massive trades the community has already seen and been discussing:

I wanted to share a couple of the gold and bond trades in particular, especially for those closely watching asset classes more broadly to assemble macro theses and trade higher timeframes.

One of the more subtle but vitally important takeaways from this issue is that institutions can trade size in places you don’t expect to look. We call these “proxy tickers”. They track the performance of other assets or asset classes but aren’t on your radar. Do you trade SPY? Did you know the institutions can put money to work in tickers like VOO, VONG, VTI, IVV or IVW and realize the same gains as SPY without alerting anyone to their presence?

There’s a ton more of everything but you’re just going to have to pay-up to see it all. I offer a month-to-month, no-commitment, no fine-print payment option that is criminally cheap. Try it for one month and see the data-driven difference.

VolumeLeaders.com publishes a weekly substack titled “Market Momentum” that is filled with screened trade ideas, loads of data on institutional positioning and a ton more; you can find the latest issue HERE. Have a look and please consider subscribing for more great content! Until next time, wishing you many bags!